by | ARTICLES, BLOG, BUSINESS, CONSTITUTION, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, QUICKLY NOTED, TAXES

Bernie Sanders recently advocated for President Obama to raise $100 billion in taxes by the old “closing corporate loopholes” schtick. The difference this time, is that Obama is actively exploring his abilities to do so via Executive Order. Townhall has the scoop:

“White House Press Secretary Josh Earnest confirmed Monday that President Obama is “very interested” in the idea of raising taxes through unitlateral executive action.

“The president certainly has not indicated any reticence in using his executive authority to try and advance an agenda that benefits middle class Americans,” Earnest said in response to a question about Sen. Bernie Sanders (I-VT) calling on Obama to raise more than $100 billion in taxes through IRS executive action.

“Now I don’t want to leave you with the impression that there is some imminent announcement, there is not, at least that I know of,” Earnest continued. “But the president has asked his team to examine the array of executive authorities that are available to him to try to make progress on his goals. So I am not in a position to talk in any detail at this point, but the president is very interested in this avenue generally,” Earnest finished.

Sanders sent a letter to Treasury Secretary Jack Lew Friday identifying a number of executive actions he believes the IRS could take, without any input from Congress, that would close loopholes currently used by corporations. In the past, IRS lawyers have been hesitant to use executive actions to raise significant amounts of revenue, but that same calculation has change in other federal agencies since Obama became president.

Obama’s preferred option would be for Congress to pass a corporate tax hike that would fund liberal infrastructure projects like mass transit. But if Congress fails to do as Obama wishes, just as Congress has failed to pass the immigration reforms that Obama prefers, Obama could take actions unilaterally instead. This past November, for example, Obama gave work permits, Social Security Numbers, and drivers licenses to approximately 4 million illegal immigrants.

Those immigration actions, according to the Congressional Budget Office, will raise federal deficits by $8.8 billion over the next ten years.”

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Yesterday it was reported that the Treasury Department paid $3 billion to cover Obamacare cost-sharing subsidies without Congressional approval. The heart of the dispute appears to be whether or not these subsidies were supposed to be funded via yearly appropriations or not. The House Ways and Means Chair, Paul Ryan, argues the former. Health and Human Services, via the Department of Justice, argues the latter.

In order to make sense of the funding dispute, it seemed necessary to dig around in the agency budgets to see how cost sharing was accounted for. Cost-sharing falls under the purview of the “Centers for Medicare & Medicaid Services (CMS)”. Yet, while comparing the budget requests for 2014 (for which the Treasury covered costs) and the ones for 2015 (current) & 2016 (future), it became clear that CMS changed the way it accounted for cost-sharing funding after 2014.

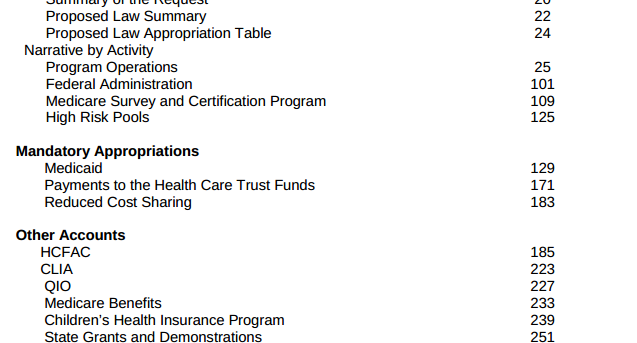

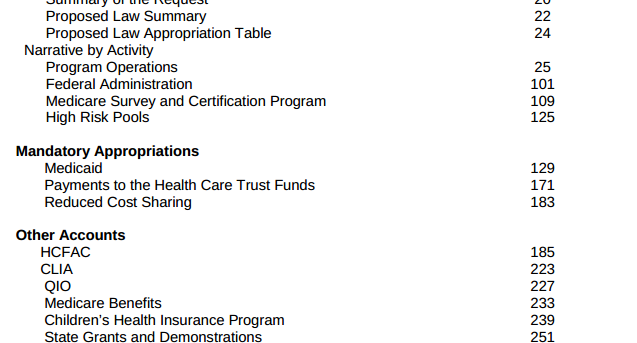

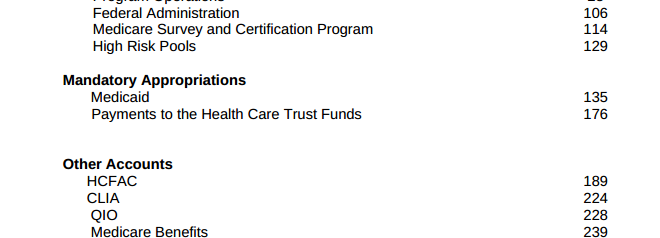

Looking at the 2014 Budget request, CMS had section called “Mandatory Appropriations”, which listed three items: 1) Medicaid 2) Payments to the Health Care Trust Funds 3) Reduced Cost Sharing.

Further in that budget, CMS wrote, “The FY 2014 request for Reduced Cost Sharing for Individuals Enrolled in Qualified Health Plans is $4.0 billion in the first year of operations for Health Insurance Marketplaces, also known as Exchanges. CMS also requests a $1.4 billion advance appropriation for the first quarter of FY 2015 in this budget to permit CMS to reimburse issuers who provided reduced cost-sharing in excess of the monthly advanced payments received in FY 2014 through the cost-sharing reduction reconciliation process.”

This position — that Obamacare cost-savings was to be funded by yearly appropriations– was reiterated by a “July 2013 letter to then Sen. Tom Coburn, Congressional Research Service wrote that, “unlike the refundable tax credits, these [cost-sharing] payments to the health plans do not appear to be funded through a permanent appropriation. Instead, it appears from the President’s FY2014 budget that funds for these payments are intended to be made available through annual appropriations.” (Remember, a 2014 budget would have been written also in 2013)

You can see a picture of the 2014 budget here:

However, Congress rejected those requested appropriations at the time so “the administration went ahead and made the payments anyway.” That is the mystery $3 billion paid for by the Treasury.

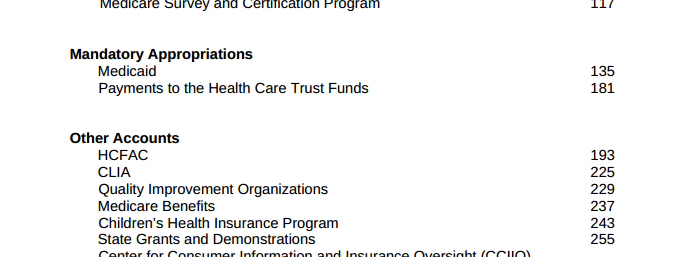

There is a noticeable change, however, with the CMS budget for 2015. The cost-sharing portion, which was originally listed as “Mandatory Payments” in 2014, is not listed at a “Mandatory Payment” anymore. Nor is it for 2016 either.

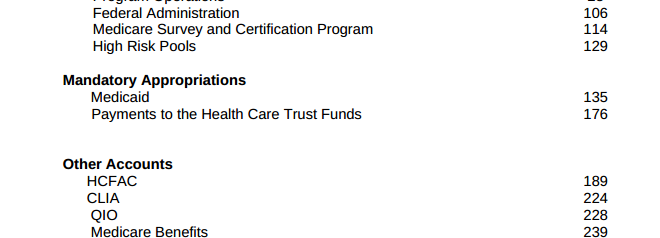

2015 Budget request:

CMS Budget 2015

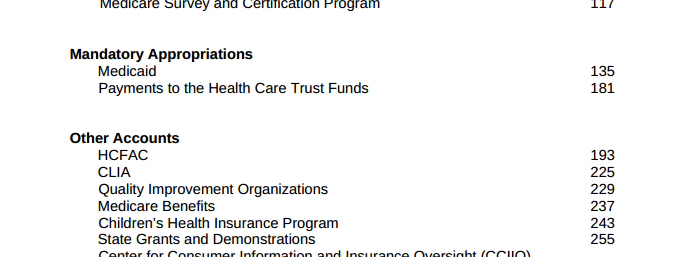

2016 Budget request:

CMS Budget 2016

Reading through the 2015 and 2016 budget documents, “cost sharing” appears in various areas, usually related to Medicaid, but not in one specific section — contrary to how it was accounted for in 2014, as a specific appropriation from the agency.

What’s equally interesting is that the DoJ argued about this specific matter in their recent brief dated January 26, 2015, saying that, “The House’s statutory arguments are incorrect. The cost sharing reduction payments are being made as part of a mandatory payment program that Congress has fully appropriated. See 42 U.S.C. § 18082. With respect to Section 4980H, Treasury exercised its rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute. See 26 U.S.C. § 7805(a).”

Yet, as shown above, the “mandatory program for cost-sharing”, that was submitted for funding (and rejected) in 2014, was removed entirely from the 2015 and 2016 budget requests. Now there is no way to even see the “cost-sharing” portion of the budget at all. And this appears to contract the statement by the DoJ that there is a “mandatory payment” program.

Cost sharing subsidies are an enormous part of Obamacare. “These payments come about because President Obama’s healthcare law forces insurers to limit out-of-pocket costs for certain low income individuals by capping consumer expenses, such as deductibles and co-payments, in insurance policies. In exchange for capping these charges, insurers are supposed to receive compensation.”

Cost sharing is expected to cost taxpayers roughly $150 billion over the next 10 years, according to estimates by the Congressional Budget Office.

But we now don’t know the specific funding amounts for the year 2015 or for 2016, and the costs for 2014 are in dispute, involving that $3 billion in funds from the Treasury (which came from somewhere and somehow).

The one thing we do know for certain: the Treasury Department is clearly exercising the power it perceives to have, as a “rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute.”