by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, POLITICS, TAX TIPS, TAXES

We’re coming up on three years since the IRS scandal broke in May 2013. Most Americans have certainly forgotten about it, especially since the former head, Lois Lerner, went wholly unpunished. But some targeted groups have not forgotten about it, and continue to fight for transparency with the entire affair.

Earlier this week, a federal appeals court “ordered the IRS to quickly turn over the full list of groups it targeted so that a class-action lawsuit, filed by the NorCal Tea Party Patriots, can proceed. The judges also accused the Justice Department lawyers, who are representing the IRS in the case, of acting in bad faith — compounding the initial targeting — by fighting the disclosure.”

The IRS, of course, claimed that no targeting happened — that it was merely an issue of poorly trained employees. Of course, we all know better. A vast majority of the targets were conservative or tea-party groups, there were secret buzz words to identify them, and some of the groups still have not attained 501c3 status after 5 years!

According to the Washington Times, Tea Party groups have been trying for years to get a full list of nonprofit groups that were targeted by the IRS, but the IRS had refused, saying that even the names of those who applied or were approved are considered secret taxpayer information. The IRS said section 6103 of the tax code prevented it from releasing that information.

Judge Kethledge, however, said that turned the law on its head. ‘Section 6103 was enacted to protect taxpayers from the IRS, not the IRS from taxpayers,’ he wrote.”

This particular ruling certified the NorCal case as a class-action lawsuit. Others who were targeted may be permitted to join the case, but until that list is revealed, it is unknown who exactly among the 200 or so groups involved were actually targeted.

Now, “the case moves to the discovery stage, where the tea party groups’ lawyers will ask for all of the agency’s documents related to the targeting and will depose IRS employees about their actions.”

As a CPA intimately involved with the IRS for many years, I have been following this case since the beginning and have continued to report on updates. The actions of the IRS were particularly egregious and overreaching, and no one was appropriately punished for it. It’s good that some of the groups remain dedicated to getting more answers that what has been divulged by the Department of Justice to date.

by | ARTICLES, BLOG, CONSTITUTION, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Obama weighed in on the current Apple-government dispute, saying that access should be made necessary.

From Reuters:

U.S. President Barack Obama on Friday made a passionate case for mobile devices to be built in such a way as to allow government to gain access to personal data if needed to prevent a terrorist attack or enforce tax laws.

Speaking at the South by Southwest festival in Texas, Obama said he could not comment on the legal case in which the FBI is trying to force Apple Inc. to allow access to an iPhone linked to San Bernardino, California, shooter Rizwan Farook.

But he made clear that, despite his commitment to Americans’ privacy and civil liberties, a balance was needed to allow some intrusion when needed.

“The question we now have to ask is: If technologically it is possible to make an impenetrable device or system where the encryption is so strong that there is no key, there’s no door at all, then how do we apprehend the child pornographer, how do we solve or disrupt a terrorist plot?” he said.

“What mechanisms do we have available to even do simple things like tax enforcement because if in fact you can’t crack that at all, government can’t get in, then everybody is walking around with a Swiss bank account in their pocket.”

The Justice Department has sought to frame the Apple case as one not about undermining encryption. A U.S. Federal Bureau of Investigation court order issued to Apple targets a non-encryption barrier on one iPhone.

The FBI says Farook and his wife were inspired by Islamist militants when they shot and killed 14 people on Dec. 2 at a holiday party in California. The couple later died in a shootout with police.

“Setting aside the specific case between the FBI and Apple, … we’re going to have to make some decisions about how do we balance these respective risks,” Obama said.

“My conclusion so far is you cannot take an absolutist view.”

Obama was speaking at the South by Southwest festival in Austin about how government and technology companies can work together to solve problems including making it easier for people to vote.

by | ARTICLES, BUSINESS, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

I have written numerous articles over the year about the onerous, destructive practice of IRS asset forfeiture cases. Basically, the IRS has been leveraging laws intended to target money launderers and criminals in order to seize the bank accounts of business owners who make one or more deposits of $10,000 cash. Time after time, these cases showed the circumstances were not criminal, and yet citizens spent months and even years trying to get their hard-earned money back.

In 2014, after a series of high-profile cases outlined the outrageous behavior, the IRS announced it would restrict its practice to situations in which the person is suspected of criminal activity; subsequently, the DoJ issued a change as well, saying that they would devote themselves only to the “most serious illegal banking transactions.”

While these changes are a step in the right direction, they still left behind a trail of cases that severely disrupted the work and lives of many Americans. Remember, money was seized time after time for years — usally without any charges ever brought forth, only the suspicion of possible “illegal activity” for merely depositing large sums of money.

Some of the tactics involved in the practice of asset seizure involve the government offering a “settlement” to the business owners, returning to them only a portion of their hard-earned money, which keeping the rest for their coffers. Many people — for fear of government or lack of funds for representation — chose the path of settlement to be able to move on with their lives and have some money back in their accounts.

Two asset forfeiture cases have emerged recently where both parties are requesting restitution. The first cases involves trying to recover the portion of the money that the government kept as part of the settlement; the second cases requests the full portion that was seized after the party involved unknowingly signed away his account when visited by IRS agents.

In the first case, due to “a prior settlement with the government, Randy and Karen Sowers, who own South Mountain Creamery in Middletown, Maryland, got back a portion of the seized money, around $33,500. Now in a new letter filed this week to the Justice Department, a nonprofit organization that has has been working with the farmers is helping in the fight to get back the rest of the couple’s money — $29,500 — despite the prior settlement.

Randy Sowers said his bank teller initially suggested that his wife keep deposits under $10,000 to avoid time-consuming paperwork at the bank. “We thought it was very legitimate,” he said. Karen Sowers initially wanted to deposit $12,000 earned from a weekend farmer’s market. “If I wanted to hide it, I would have put it in a can. We have trouble paying our bills and don’t need the government coming and taking money from us.”

Despite settling previously with the government, the Sowerses and Johnson say they are owed all of the assets, and initially had to settle for fear of losing the full amount seized and potentially more assets.

Congress has even gotten into the fray. The House Ways and Means Subcommittee on Oversight took up the Sowers case, and asked the Treasury Department to review similar cases.”

The related cases include Khalid “Ken” Quran, who owns a convenience store in Greenville, North Carolina. He had more than $150,000 seized in June 2014 after he unknowingly agreed to forfeit his bank account when IRS agents visited his store, accusing him of skirting reporting laws. Quran denies the charges.

“He said, ‘You need to sign a paper,’ and I told him my English is not right,” said Quran, an immigrant from the Middle East. “Then he read it to me like you would read the newspaper and said you need to sign it.” Quran said he did nothing wrong. “No bank told me that. No bookkeeper told me that,” he said.

He has not received any of his money back, and the Institute for Justice has also filed a petition on Quran’s behalf. On Tuesday, the legal nonprofit send a letter to the IRS, asking for his petition to be reviewed.”

The IRS and Department of Justice should work immediately to make these cases, and possibly others, correct again. The seizures, as they were practiced prior to the changes made in 2014, were egregious and improper.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

The IRS is involved in another “erased hard drive” event — and it’s not a part of the IRS scandal of 2013. It is apparent that there is a pattern of destruction at the agency.

This time, the hard drive that was erased belonged to “Samuel Maruca, former director of transfer pricing operations at the IRS Large Business and International Division.” Maruca was also a top level employee at the IRS, and was also involved in a controversy; this time, the scrutiny involved the IRS’s decision to hire an inexperienced yet elite law firm to handle tax data.

In this particular incident, “although there was a court preservation order on all documents related to the IRS hiring of the outside firm, the hard drive was erased anyway. The order was borne of a Freedom of Information Act (FOIA) request submitted by Microsoft.

Even though the white shoe law firm has zero experience handling sensitive tax data, taxpayers have been footing bills of over $1,000 per hour for its services.”

And more:

“Despite its complete inexperience handling audits or taxpayer data, Quinn Emanuel was hired under an initial $2.2 million contract.

This unusual decision prompted a probe by Finance Committee Chairman Orrin Hatch (R-Utah), based on concerns that the decision to hire outside contractors was expensive and entirely unnecessary.

As Sen. Hatch pointed out in his letter to the IRS, the agency already has access to around 40,000 employees responsible for enforcement. The IRS can also turn to the office of Chief Counsel or a Department of Justice attorney, both of which have the expertise to conduct this kind of work, without risking sensitive information.

The fact that another important hard drive is permanently gone can only lead to two conclusions: 1) that the IRS is still thoroughly incompetent or 2) the IRS is exceedingly corrupt. Neither of these are good for the taxpayer. The only immediately remedy should be to remove IRS Commissioner John Koskinen.

by | ARTICLES, BLOG, CONSTITUTION, ELECTIONS, FREEDOM, OBAMA, POLITICS, TAXES

Earlier this week, the Supreme Court heard arguments about the constitutionality of union fees. The case involves an Orange County teacher who has sued to strike down the mandatory fees which pay for both collective bargaining and union activities.

The current law is governed by a 1977 SCOTUS ruling which stated that “public employees can be required to pay a “fair share” fee to reflect the benefits all workers receive from collective bargaining. But at the same time, employees who object cannot be forced to pay for a union’s political activities.” Teachers must pay $650/year for collective bargaining, but can opt out of the nearly $350/year that funds political lobbying and spending by the union — by requesting a refund.

This arrangement is being reexamined, with Justice Kennedy describing ” the mandatory fees as ‘coerced speech’ that violates the 1st Amendment.” The fundamental question, “according to Chief Justice John G. Roberts Jr., is ‘whether or not individuals can be compelled to support political views that they disagree with.'”

A ruling is expected in June. If the mandatory fees are struck down, the unions will undoubtedly face financial difficulty, as it can no longer compel citizens to pay up. How this plays out in a Presidential election year will be even more interesting.

by | ARTICLES, BLOG, BUSINESS, CONSTITUTION, ECONOMY, OBAMA, OBAMACARE, POLITICS, TAX TIPS, TAXES

The Wall Street Journal put together an excellent editorial yesterday on the intersection of Obamacare and immigration.

First, starting in 2016, employers with 50 or more full time employees are required to offer health insurance for each of their workers, or else pay a penalty of $3,000 per each person who fails to receive proper Obamacare coverage.

So what happens with the undocumented immigrants allowed to stay under President Obama’s Executive Action? The numbers are estimated to be upwards of 5 million people.

“The government’s petition says that the executive action intended to provide ‘work authorizations’ so that undocumented immigrants could find jobs in the U.S. without working illegally for less than market wages, which might harm American workers. But wait: Employers aren’t required to offer ObamaCare coverage or subsidies to these immigrants. The statutory language in the Affordable Care Act says that only ‘lawful residents’ are eligible, and the government’s petition specifically notes that the immigration action does not ‘confer any form of legal status in this country.'”

Therefore, the immigrants (with deferred deportation), are exempt from Obamacare. While that may be good for the taxpayer, it is not necessarily good news for the worker. From a purely financial perspective, companies could easily save the $3000 penalty cost per worker if they hire and employ an Obamacare-exempt immigrant instead of a citizen/resident subject to the Obamacare rules.

The Wall Street Journal sums up the scenario nicely:

“Suppose businesses subject to ObamaCare employ only 40%, or two million, of the up to five million immigrants covered by the president’s executive action. At $3,000 an employee, businesses would save about $6 billion a year. Companies already dealing with the added expense of operating in the Obama economy — burdened by regulations, high taxes and other barnacles — would find those savings hard to pass up.”

Exempting employers who hire these immigrants from the law’s penalties gives the immigrants a distinct market advantage over U.S. citizens. That flies in the face of the president’s statement that his executive action would not “stick it to the middle class” by allowing these individuals to “take our jobs.” It is also contrary to the government’s statement that the executive action would make it less likely that these undocumented immigrants hurt American workers by “illegally” working “for below market rates.” They could still work at below-market rates, only it would be legal.

All of this was inevitable. The root problem with ObamaCare is that one party rammed it through Congress without a single Republican vote, while the law’s supporters didn’t even read it, let alone vet it through congressional committees. As a result, ObamaCare as written was unworkable, and the administration has had to repeatedly amend it by constitutionally dubious executive fiat.

Now this flawed law is clashing with yet another constitutionally dubious executive action that the administration couldn’t be bothered to pass through the legislature.”

The Obama Administration may yet decide to grant Obamacare to these immigrants currently exempted. But for the time being, since their status presents a situation may wreak havoc in the business world, leaving the current court injunction against the immigration order in place is the only suitable solution until the Obamacare-immigration situation is sorted out. Otherwise, expect the economy to continue to weaken from this latest threat.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Now this is pretty interesting. Last week, a federal district judge ruled in favor of the House of Representatives against the Obama Administration with regarding to Obamacare payments and Congressional appropriations. Specifically, the ruling allow for House to continue their lawsuit which claims that the Executive Branch (via Health and Human Services and the Treasury Department) has overstepped its authority by overspending on Obamacare beyond what was appropriated to them by Congress.

Rollcall has a great overview of what is at stake, how difficult the question it, how it affects the Constitution, and what it says about the Separation of Powers. You should take a few minutes and read it in full, as this type of lawsuit is fairly rare.

The House can pursue some constitutional claims in a lawsuit against the Obama administration over appropriations and implementing the health care overhaul law, a federal district judge ruled Wednesday.

The ruling means Congress has cleared a high procedural hurdle in the separation of powers case, one that usually stops the judiciary from stepping into fights between lawmakers and the executive branch.

The House has legal standing to pursue allegations that the secretaries of Health and Human Services and Treasury are spending $175 billion over the next 10 fiscal years that was not appropriated by Congress, Judge Rosemary M. Collyer of the U.S. District Court in Washington, D.C., wrote in the 43-page ruling.

The House lawsuit asks the court to declare the president acted unconstitutionally in making payments to insurance companies under Section 1402 of the health care overhaul law (PL 111-148, PL 111-152) and to stop the payments.

House Speaker John A. Boehner said the court’s ruling showed that the administration’s “historic overreach can be challenged by the coequal branch of government with the sole power to create or change the law. The House will continue our effort to ensure the separation of powers in our democratic system remains clear, as the Framers intended.”

Wednesday’s ruling does not address the merits of the claims. Collyer acknowledged that the court was taking a rare step, but doing so carefully into a high-profile dispute, so that it wouldn’t give the House standing to file other similar lawsuits.

“Despite its potential political ramifications, this suit remains a plain dispute over a constitutional command, of which the judiciary has long been the ultimate interpreter,” Collyer wrote. “The court is also assured that this decision will open no floodgates, as it is inherently limited by the extraordinary facts of which it was born.”

The dispute focuses on two sections of the health care overhaul law. The administration felt it could make Section 1402 Offset Program payments from the same account as Section 1401 Refundable Tax Credit Program payments. House Republicans say the health care law doesn’t permit that.

The Obama administration, during the fiscal 2014 appropriations process, initially asked Congress for a separate line item for 1402 payments. Congress did not include money for such a line item. During oral arguments in the case in May, Collyer questioned government lawyers about why the administration could ignore Congress and then argue that the House couldn’t sue them.

The administration argued that the House has other options, such as political remedies or passing other legislation, they said.

Jonathan Turley, the attorney for the House, said in a statement that the ruling means that the House “now will be heard on an issue that drives to the very heart of our constitutional system: the control of the legislative branch over the ‘power of the purse.’ We are eager to present the House’s merits arguments to the Court and remain confident that our position will ultimately prevail in establishing the unconstitutional conduct alleged in this lawsuit.”

Turley said the administration had argued that Congress couldn’t seek judicial enforcement of its constitutional status. “The position would have sharply curtailed both the legislative and judicial branches. The Court has now answered that question with a resounding rejection of this extreme position,” he said.

The case at the U.S. District Court for the District of Columbia is U.S. House of Representatives v. Burwell, No. 14-cv-1967.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, POLITICS, TAXES

It is perfectly fine for an owner of a private business to decline to participate in an event or produce a product if it requires violating one’s religious beliefs. It’s another thing entirely for a person who works for the government — on behalf of the taxpayer and paid by taxpayer funds — to decline to do the job required of them.

Kim Davis is no hero. Her job is to process marriage licenses. If she felt she could no longer consciously do her job, she had an obligation to step aside. No only did she not do that, she barred the rest of her staff from executing their duties as well and ceased issuing all marriage licenses. A reasonable accommodation could have been made for Ms. Davis by allowing her other assistants to process that with which she disagreed. But she chose all-or-nothing, to stop doing her job entirely. For that, she should resign.

Ms. Davis was perfectly free to choose not to process the licenses with which she had disagreement, but in making that choice, the only logical and honorable conclusion was resignation — because she could no longer fulfill the oath she swore to when she was elected.

Not only is her judgment on the matter incorrect, but she is also mucking up the opportunity for those who deserve an honest day in court when they have faced persecution for their beliefs in the private sector.

As stated by Judge Andrew Napolitano, “The free exercise clause guarantees individuals the lawful ability to practice their religion free from government interference. It does not permit those in government to use their offices to deny the rights of others who reject their beliefs. That is the lesson for Kim Davis”.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, NEW YORK, POLITICS

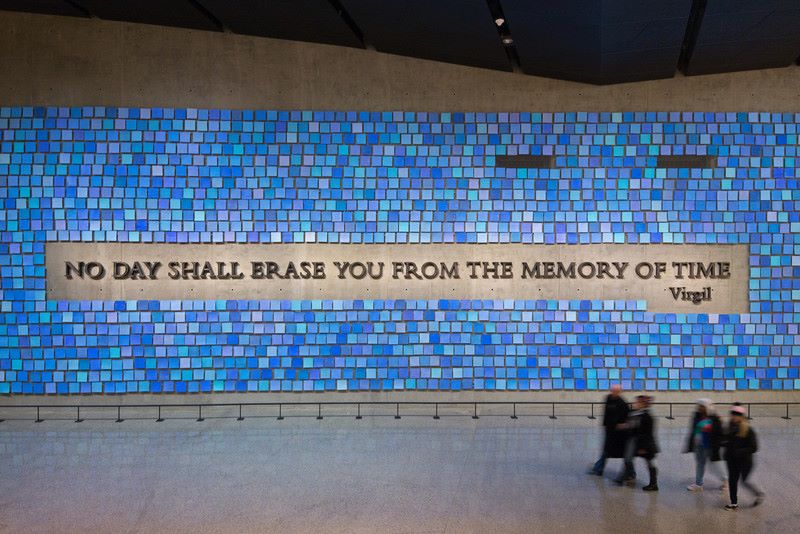

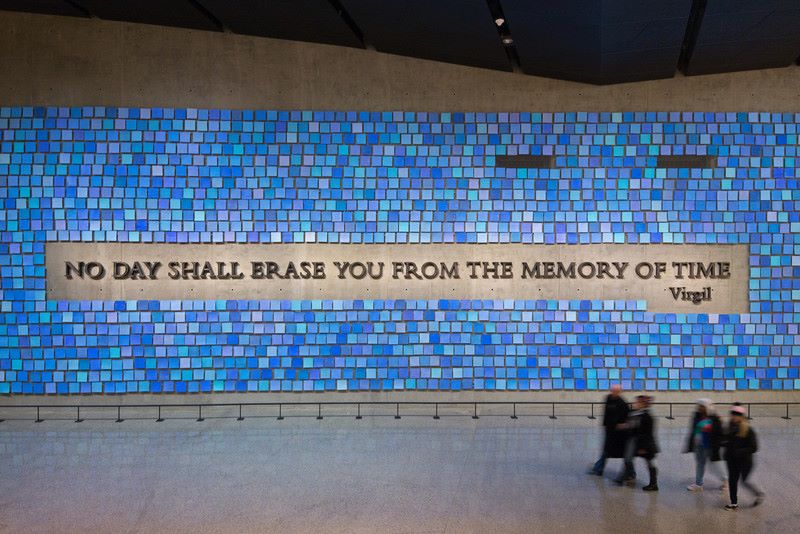

This quote from Virgil’s Aeneid sums it up:

God bless America.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

The recently revived debate about birthright citizenship is both ridiculous and baffling. The language of the Constitution is quite clear: “All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside.” Commonly known as the “Citizenship Clause”, it is the first sentence of Section 1 of the 14th Amendment, passed in 1868.

This understanding of the 14th Amendment was codified four years later in 1871 in the case, Wong Kim Ark which granted citizenship “to at least some children born of foreigners because they were born on American soil (a concept known as jus soli)”. It is also worth noting that at the time of the Amendment, there was no such thing as illegal immigration, so the legal status of the parents was not an issue; the first law restricting immigration came in 1875.

The Constitution is clear, and there is no way to change it. There should be, and probably is in some way, a law against the budding practice known as “birth tourism”, which allows for a woman to come travel to this country — on a tourist visa — for the sole purpose of having a baby on American soil so that the child can be granted U.S. citizenship. Coming into the country with the intent to subvert the Constitution could be made a crime if it is not already so. For instance, the child will still be granted citizenship, but the parents become criminals — and can never come back to this country.

For those whose parents are here for some time, even if the parents are illegal, the law is clear: their birth in this country confers U.S. citizenship. But if you come here intentionally to subvert the law, the consequences should be so severe, that it makes people think twice about doing it. That should cut down on the amount of rogue circumstances for which people try to gain citizenship with no intent to reside in this country, while simultaneously protecting the 14th Amendment.