by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS, TAXES

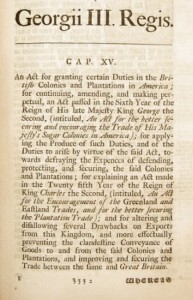

On April 5, 1764, Parliament passed something called “The Sugar Act”, which, interestingly, had another name: “The American Revenue Act”. It was a modification of the 1733 Molasses Act, and it also affected other goods, such as wine and coffee.

The Preamble to this Act states: “it is expedient that new provisions and regulations should be established for improving the revenue of this Kingdom … and … it is just and necessary that a revenue should be raised … for defraying the expenses of defending, protecting, and securing the same.”

The Sugar Act/American Revenue Act, therefore, was a revenue raising measure (and not just a regulation measure), whose revenue was intended to help defray the costs of defending the colonies during the 7 Years War which ended in 1763. Instead, it wreaked havoc in the colonies:

“The situation disrupted the colonial economy by reducing the markets to which the colonies could sell, and the amount of currency available to them for the purchase of British manufactured goods. This act, and the Currency Act, set the stage for the revolt at the imposition of the Stamp Act.”

Fast forward to 2014. A new measure was introduced by Rep. Rosa deLauro called the SWEET Act, also known as the “Sugar-Sweetened Beverages Tax” — a proposed tax of “one cent per teaspoon – 4.2 grams – of sugar, high fructose corn syrup or caloric sweetener”.

The Act sounds eerily like a revenue-raiser, much like its ancestor, the Sugar Act. From the text of the SWEET Act:

“This Act is intended to discourage excessive consumption of sugar-sweetened beverages by increasing the price of these products and by creating a dedicated revenue source for programs and research designed to reduce the human and economic costs of diabetes, obesity, dental caries, and other diet-related health conditions in priority populations”

Let’s compare:

Sugar Act: “improving the revenue of this Kingdom”… “just and necessary that a revenue should be raised”… “for defraying the expenses of defending, protecting, and securing the same.”

SWEET Act: “dedicated revenue source for programs and research”… “to reduce the human and economic costs of diabetes, obesity, dental caries, and other diet-related health conditions”.

Same over-reaching thinking, different government.

As a response to the Sugar Act in May 1764, Samuel Adams drafted a report on the Sugar Act for the Massachusetts assembly, in which he denounced the act as an infringement of the rights of the colonists as British subjects:

For if our Trade may be taxed why not our Lands? Why not the Produce of our Lands & every thing we possess or make use of?

”

Will there also be a similar rebuke over the Sweet Act of 2014? The Sugar Act was subsequently repealed in 1766 because it was such a disastrous piece of legislation. Let’s hope history doesn’t repeat itself and the SWEET Act never comes to fruition.

by | ARTICLES, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

Earlier this week, the business world was chattering about the news that Kinder Morgan, pioneer of the Master Limited Partnership (MLP) business model, was surrendering the MLP structure in favor of a more traditional corporation. This happened last Sunday.

While many questioned what this meant for the MLP model in general, the more pressing questions began to emerge when, the following day, the Treasury Department came out with a statement regarding MLPs: “We at the Treasury are looking into the effects of these transactions on future tax revenues. Instances where the tax base may be eroded serve as a reminder of why we need Congress to enact business tax reform that broadens the tax base and lowers tax rates.”

Much like that false crusade on inversions, here we have another instance of anti-business sentiment coming out of the Executive Branch. Obama’s abuse of the law is clearly now seeping down to his cabinet underlings who also think now they have the authority to rewrite the law as well — especially under the cloak of getting more tax revenue.

Starting this past April, the government issued a temporary pause in the formation of new MLPs. The way the process works is that the IRS would issue what’s known as “private letter rulings” that examine qualifying income, and then therefore allow an MLP to be formed. However, the Treasury Department decided to examine the standards being used, meaning that the creation of new MLPs have been on hold for a few months.

The internal committee has been tasked with evaluating the “aggressive” rulings regarding qualifying income of MLPs issued in recent years. The internal committee may determine that such rulings are too expansive and recommend stricter interpretations of what types of natural resources income constitute qualifying income.

Most folks in the business world fully expected the formation of MLPs to resume after rules were reviewed. Barrons noted that, “They went through a similar review process for REITs in 2013 and concluded that the approvals were in line with the law. The same results were expected for MLPs and that private letter rulings would resume. But Treasury seems to say they are looking at issues larger than the IRS which would seem like another attempt to jawbone companies in the future from seeking MLP approvals.”

This sudden interest in MLPs sounds eerily similar to the recent interest the government has taken in business “inversions”; the government claims (erroneously) that inversions also deprive the government of supposed-entitled tax revenue, the same flimsy justification for looking more closely at, and ceasing the formation of, MLPs.

The worst part about this new anti-business targeting is that it is completely unfounded. The Treasury Department makes it sound like MLPs somehow are avoiding paying tax revenue by the way the company is structured and calls on the need for “Congress to enact business tax reform”. Except that MLPs ARE a perfect example of a type of reformed business tax structure that Congress should be welcoming.

With MLPs, the business is only taxed once, (the way most business structures around the world already operate.) In the United States, however, corporations face an abominable problem in our tax code known as “double taxation”. Basically if a corporation pays its corporate taxes and then reinvests its profits, there is no extra tax. But if its profit earnings are given to the owner(shareholders), they are taxed again on that amount — hence the double taxation.

Contrast that with MLPs, which “does not incur income taxes. Its income is allocated among all partners in proportion to their ownership interest.” Hence, the taxation only occurs once. This singular taxation of businesses is what real broad-based tax reform should aim for.

The real inequality in the tax code is not the MLP structure, which only taxes businesses one time; it is the double taxation that major corporations face. If Obama is truly for tax reform — like he says he is when he talks about inversions — the MLP structure for businesses is one way to achieve that reform. (Another would be to lower the corporate tax rate.)

Going after MLPs now and reducing the number of them in existence is the opposite of tax reform. Allowing the Treasury Department to play with business rules willy-nilly is egregious. This MLP attack is just another example of how anti-business the Obama Administration really is.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

Obama has called “for an end to a corporate loophole that allows companies to avoid federal taxes by shifting their tax domiciles overseas in deals known as ‘inversions’.” Such as statement shows the utter ineptitude that Obama has for understanding a) what inversion actually is and b) how his policies are the cause.

Inversion is not a “corporate loophole” and companies who do so are not “avoiding federal taxes”.

Currently, only the United States taxes American companies on foreign profits as well as domestic. No other major country does this. This policy is non-competitive, stupid, and a major reason why inversion occurs. An American company is being taxed in two jurisdictions.

For instance, if Honda is making cars in the United States, it pays the same taxes as General Motors. But if an American company is in Japan, it has to pay both Japanese taxes and American taxes and therefore has to make an even larger profit just to stay competitive and survive.

If foreign sales grow substantially, a company will find itself paying increased U.S. taxes because it is still incorporated in this country and we tax both foreign and domestic profits. Eventually, a U.S. company may find by moving its incorporation to a different country, it can cease paying U.S. taxes on income that is not generated in the United States — the way every other advanced nation, except for the United States, operates. That extra savings in taxes can be reinvested in the company itself.

Couple this ridiculous tax law with the fact that we also have the highest corporate tax rate in the world as well as a substantial number of stifling regulatory agencies, and it’s small wonder why some companies choose to move abroad eventually.

To call this a “corporate loophole” is exceedingly disingenuous. For some companies to survive, they may have no choice but to move its legal status elsewhere. American companies are in business to make and do things, not to comply with exhaustive tax policy and burdensome bureaucracy. However, the business climate in this country is difficult and to call a company a “deserter” or “unpatriotic” casts the blame squarely in the wrong place — which is a government that over-taxes and over-regulates. That is the problem, and inversion is a symptom of an anti-business environment.

To insinuate that companies who go through the process of inversion are “avoiding federal taxes” entirely omits the reality that this country is the only country who taxes companies both on domestic and foreign profits. Just because we can tax them this way, doesn’t mean we ought to. Reforming the tax code is a better solution.

“Needing to reform inversion” is merely creating another tax grab for Obama — masquerading as fighting against “bad corporations” in order to pander to the rhetoric of the left. The government continues to run chronic deficits and is considering this measure in order to fleece businesses for extra tax revenue. They already face oppressive taxation and burdensome regulation. Attacking them for doing what they might need to do, in order to stay in business, is repugnant.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, OBAMA, POLITICS, TAXES

State and local governments have been forbidden from taxing Internet access — apparently forever — according to a bill passed in the House on July 15. This measure was a response to updating the Internet Tax Freedom Act of 1996, which had a extension passed in 2007 and was on the verge of expiration.

House Judiciary Chairman Rep. Bob Goodlatte explained that the bill “prevents a surprise tax hike on Americans’ critical services this fall. It also maintains unfettered access to one of the most unique gateways to knowledge and engine of self-improvement in all of human history.

Unfortunately, it is expected to be joined with the Marketplace Fairness Act when it heads to the Senate. That abominable piece of legislation was passed in May 2013; it’s merely a back-door way for states to add additional levies on their citizens under the guise of leveling the playing field, while simultaneously adding undo burden to businesses by expecting compliance with multiple tax jurisdictions. Read more about the Marketplace Fairness Act here.

As for the Internet Tax, it’s a bill to keep track of as it moves through Congress

by | ARTICLES, ECONOMY, FREEDOM, GOVERNMENT, POLITICS, TAXES

The Teachers Union in Pennsylvania is putting self-interest ahead of the schools.

A recent article in the WSJ highlights the problems of the Philadelphia school system trying to navigate the process of staff reduction. The unions claim that seniority is the only criteria for cuts, while school administration wants other choices. Pennsylvania is one of a few states that grants teachers a right to strike, so this fight is one which is sure to be long-suffering.

The schools point out to the unions that since “a 2001 state takeover spurred in part by major financial problems and woeful test scores, the system has been governed by the School Reform Commission, a five-member board jointly appointed by the governor and mayor. State law permits the commission to suspend some parts of the school law, including seniority protections for employees”. This is the point of contention with the unions.

While the article is decent, it misses a very important part related to contracts and negotiations. The teacher contracts expired in 2013. Therefore, those teachers who are complaining that there is no right other than seniority — because that right exists in their contract — are operating as if the contract is still valid. It certainly is not. Despite the fact that their contracts expired nearly a year ago, they still claim rights under that contract. This is patently false; when a contract is over, it is over -they have the right to nothing unless it is negotiated in a new contract.

If the school administration is struggling financially, there is nothing to stop them from say, offering teachers 15% – 25% lower pay than what they made in previous contracts in order to get back on their feet, but even more importantly, to get them in line with what similarly qualified individuals are earning in the private sector. There is no inherent right to a higher salary or even the same benefits as they had previously earned. The private sector does not operate this way. The public sector cannot either, if it is to remain solvent.

Teachers don’t automatically deserve work rules, pensions, and pay other than what the private sector pays, especially in a down economy. A teacher strike shouldn’t be over a 10-15% assumed increase based on past contracts and situations. The harsh reality is that the schools simply cannot afford the current teacher pay and pension/benefits packages. And it should not have to pay those salaries and benefits – the realities of life, the job market, and the economy have set compensation levels for similarly qualified individuals at substantially lower than Philly teacher levels. It is only teacher union and political cronyism that has allowed this fiasco to exist.

The Pennsylvania school system would do well to be reminded that, because teacher contracts are expired, they are not bound to continue them on previous, overgenerous terms. Their obligation is to provide their services in return for certain compensation and benefits during that time. But that’s it — they are only covered for the period of the current contract.

This point is important because there really can be no part of a negotiated contract that promises any compensation or benefits for services rendered after the end of the contract period; otherwise, a locality (Philadelphia in this case) runs the risk of continuing runaway financial obligations for which it cannot properly budget and it hamstrings future body politics not even in office yet.

Financial difficulties have already plagued the system once, in 2001. Unfortunately, the wake-up call seems to have been missed. Slapping down a $2 cigarette tax for the schools is not going to save the system. It’s merely a band-aid when a tourniquet is needed.

Overhauling the pay and compensation packages of Philadelphia teachers would be thoroughly beneficial. Even though it may be politically difficult and unpalatable, budget reform and deficit reduction will naturally follow once compensation levels have been stabilized and brought in line with their private counterparts.

by | ARTICLES, ECONOMY, GOVERNMENT, POLITICS, TAXES

Even with record federal revenue, the government has a running deficit of $385 billion though the first nine months of fiscal 2014.

According to CNSNews, “The White House Office of Management and Budget has estimated that in the full fiscal 2014, the federal government will collect $3.001721 trillion in taxes and spend $3.650526 trillion, while running a deficit of $648.805 billion.

The OMB has also estimated that, while running that deficit, the federal government will collect a record amount in inflation-adjusted tax revenues.”

All this confirms is that the government is not short on money (record tax revenue receipts) but is short on cutting spending.

As I noted last fall how irregular circumstances contributed to reducing the deficit last year, it is likely that there will be a similar explanation for the tiny surplus as well.

by | BLOG, BUSINESS, CONSTITUTION, ECONOMY, OBAMA, OBAMACARE, POLITICS, TAXES

The next big case related to Obamacare, Halbig v. Burwell, is sitting in the U.S. Court of Appeals for the D.C. Circuit. The verdict should be announced soon. The crux of the case lies in the wording of the actual bill of Obamacare, which specifically lists state exchanges as a source of subsidies.

There is no mention of federal exchanges in Obamacare. This was created merely by an IRS rule authorizing the subsidies in federal exchanges.

Regardless of the outcome of the case (for a primer, click here), here’s the salient point to take away.

When you look at the plain wording of the actual bill, it really doesn’t make any sense (common sense). Here we have a perfect example of the Democrats trying — and ultimately succeeding — to push something through without looking at it or even carefully thinking through the implications of the words and provisions.

Obamacare was drafted badly, and they couldn’t even get it corrected the proper way because of the crookedness by which it was passed. Now we have a stupid mistake that the judiciary is being asked to fix. And that’s the problem.

What the government is asking the courts to do is to ignore the literal wording of the law. On the other hand, if the literal wording is indeed upheld, the immediate effect of a reversal is going to be extremely terrible.

Think about it. The IRS will have to go after people for refunds of tax credits. That will be a messy and slow and heated endeavor. Many people, especially poor people, are going to argue that they wouldn’t have used Obamacare insurance if it wasn’t for the subsidies. Not sure if that scenario is ultimately good for conservative or libertarians either, because it certainly sets up the sound-byte narratives that conservatives and libertarians want to “take away your health care”, “they hate the poor, etc”. Is it worth it?

My heart of hearts wants literal side to win, but at the same time, I’m not entirely convinced that its the best thing in the long run. Yet, if the government wins, it reinforces the precedent we’ve been seeing that it is okay to ignore the actual wording of the law, much in the same fashion that the wording of the Constitution is being ignored in some instances.

This case perfectly highlights the stupidity and utter disdain for which the Democrats have of procedure and law.

by | ARTICLES, BUSINESS, ECONOMY, OBAMA, POLITICS, TAXES

What’s going on with oil and energy these days?

Last week, SNL Financial noted that,

“Canada’s crude oil producers are looking to markets other than the U.S. to sell increased output amid delays in pipeline expansions, according to the president of the Canadian Association of Petroleum Producers.

“In terms of growth potential, Keystone is obviously bogged down and everything behind Keystone in the queue is bogged down because the regulatory process won’t engage on those other projects until Keystone clears its hurdles one way or another,” Collyer said. “The primary focus for Canadian producers, Canadian governments and Canadian pipeline companies is to look east and to look west.”

Canada is tired of waiting. What else?

Besides the current frustration with our Canadian friends, there is another overlooked consequence stemming from the delays with the Keystone XL Pipeline project: high gas prices.

Although the pipeline (and ANWR, and other major oil projects) have multi-year lead times, when a project of this magnitude has the green light to move ahead, it has an immediate effect on the markets by changing the traders’ expectations of future supply. Having more oil available in the marketplace contributes to lower prices for consumers. So when Keystone was delayed — multiple times — the markets have reacted accordingly.

In fact, it was noted last week that July 4th marked a record 1290 days of gas prices above $3.00/gallon. Gas prices climbed above $3.00/gallon on Dec. 23, 2010, and that streak has continued since then.

Of course, don’t forget what Secretary Chu said back in 2012 about the price of gas: Chu “admitted to a House committee that the administration is not interested in lowering gas prices.

Chu, along with the Obama administration, regards the spike in gas prices as a feature rather than a bug. High gas prices provide an incentive for alternate energy technology, a priority for the White House, and a decrease in reliance on oil for energy”.

This helped to explain why Keystone was delayed. While the White House continues to “figure out” how to balance two of his major constituencies (labor is pro-pipeline and environmental is anti-pipeline), Americans are feeling the price at the pump. But it doesn’t have to be this way.

According to Gordon Ritchie, vice chairman of RBC Capital Markets, Ritchie noted,

“I’m at a loss to understand why the Americans wouldn’t approve the pipeline going down south because of the difference between the Brent price of oil — world price — and the North American combined price of WTI (West Texas Intermediate). “That $5 a barrel is really a subsidy by Canada to American consumers of gasoline and it works out to about $20 billion a year.”

To add insult to injury, a new report is out that shows the highway trust fund is losing money due to to more fuel efficient cars, which Obama had repeatedly championed. Additionally, the high prices have kept Americans from traveling as much. The highway trust fund will go from a budgeted $50 billion to around $34 billion. The Highway Trust Fund receives roughly 18 cents on every gallon of gasoline sold in this country.

Meanwhile, Canada gets antsy, gas prices are high, the Highway Trust fund is being depleted. Will the Obama Administration finally move forward with Keystone?

by | ARTICLES, ECONOMY, FREEDOM, GOVERNMENT

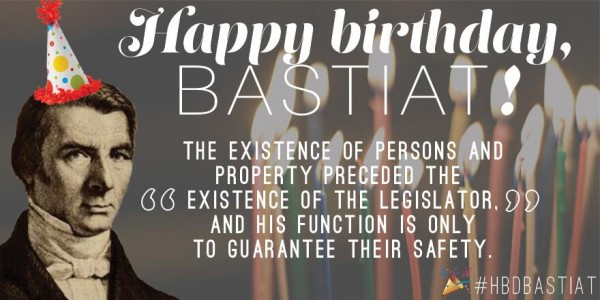

One of my favorite economists, thinkers, writers…Frederic Bastiat should be read by all.

Get started by reading “The Law”. It was originally published as a pamphlet in 1850. The Foundation for Economic Freedom (FEE), has many works available for free on its website.

Here’s a link to “The Law”, where Bastiat gave his famous definition of “legal plunder”.

So, happy birthday to Bastiat — and get started reading some fantastic writing about a free society.

by | ARTICLES, ECONOMY, OBAMA, TAXES

We first heard that the GDP contraction of 1% was an anomaly. Now, the Commerce Department has revised its report from the Bureau of Economic Analysis, stating the the GDP fell -2.9% in the first quarter.

Here’s the summary:

“Real GDP declined 2.9 percent in the first quarter, after increasing 2.6 percent in the fourth. This downturn in the percent change in real GDP primarily reflected a downturn in exports, a larger decrease in private inventory investment, a deceleration in PCE, and downturns in nonresidential fixed investment and in state and local government spending that were partly offset by an upturn in federal government spending”.

Exports dropped 8.9%

Real final sales of domestic product dropped 1.3%

Real nonresidential fixed investment decreased 1.2%

Nonresidential structures decreased 7.7%

Equipment decreased 2.8%

Real residential fixed investment decreased 4.2%

The one bright spot? Intellectual property products increased 6.3%

You can read the highlights of the report here, along with the May durable-goods report and business investment outlook.

If we see a negative GDP after the second quarter, we’ll be in recession territory again.