by | ARTICLES, BLOG, CONSTITUTION, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

From Scotusblog:

Decision of the Fourth Circuit is affirmed in King v. Burwell. 6-3.

This means that individuals who get their health insurance through an exchange established by the federal government will be eligible for tax subsidies.

Chief Justice writes for the Court. Six are the Chief, Kennedy, Ginsburg, Breyer, Sotomayor, and Kagan.

Dissent by Scalia, joined by Alito and Thomas.

Court refused to apply Chevron deference — that is, to find that the statute is ambiguous and that the federal government’s interpretation was reasonable.

From Scalia’s dissent: “We should start calling this law SCOTUScare.” From the intro to Scalia’s dissent: the majority’s reading of the text “is of course quite absurd, and the Court’s 21 pages of explanation make it no less so.”

From the majority opinion: “Congress passed the Affordable Care Act to improve health insurance markets, not to destroy them.”

The majority also acknowledges that the challengers’ “arguments about the plain meaning . . . are strong.”

‘In this instance, the context and structure of the Act compel us to depart from what would otherwise be the most natural reading of the pertinent statutory phrase’…

The opinion is here

Justice Scalia’s dissent, via the WSJ:

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA

In the past couple of months, I drew attention to a case that would be decided by the Supreme Court this term, which I felt was probably the biggest property-rights case since the Kelo decision 10 years ago. You can read the background here. In sum, the property in question this time is not land, but raisins. A couple, the Hornes, who were raisin farmers in California were fined for declining to participate in a government sponsored raisin regulatory group in existence since the Truman Administration.

Writing a letter to the Agriculture Department, they called the program “a tool for grower bankruptcy, poverty, and involuntary servitude.” The raisin police were not amused. The Raisin Administrative Committee sent a truck to seize raisins off their farm and, when that failed, it demanded that the family pay the government the dollar value of the raisins instead.”

This morning, SCOTUS ruled 8-1 in favor of the raisin growers, the Hornes. The majority opinion found “that the Agriculture Department program, which seizes excess raisins from producers in order to prop up market prices during bumper crop years, amounted to an unconstitutional government “taking.”

But they limited their verdict to raisins, lest they simultaneously overturn other government programs that limit production of goods without actually seizing private property.

The 8-1 decision was written by Chief Justice John Roberts, with the court’s more conservative justices in agreement. Roberts said the government violates citizens’ rights when it seizes personal property — say, a car — as well as real property such as a house.

While the government can regulate production in order to keep goods off the market, the chief justice said it cannot seize that property without compensation.”

Only Sotomayor dissented. She did not recognize the government’s fines a form of taking, saying that the rule “only applies where all property rights have been destroyed by governmental action.” In saying so, she indicated that the Hornes did retain some of their property rights, a logic that mirrored the ridiculousness of the Ninth’s Circuits’ opinion.

You can read the full court ruling here. The best quote goes to Justice Clarence Thomas who noted in his concurrence to the majority opinion, that “having the Court of Appeals calculate “just compensation” in this case would be a fruitless exercise.“

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, POLITICS, TAXES

One of the major sticking points regarding the free trade talks is a portion known as TAA, or “Trade Adjustment Assistance”. “The Trade Adjustment Assistance (TAA) Program is a federal program that provides a path for employment growth and opportunity through aid to US workers who have lost their jobs as a result of foreign trade,” and this program is slated to expire at the end of September, unless Congress reauthorizes is. The funding source for the new TAA bill, as passed by the Senate last month, is a $700 million reduction to Medicare funding. But the vote neared, the pressure to change the funding source and spare Medicare reached a crescendo.

An alternative funding solution was prepared, one that is particularly odious. TAA, if passed, will be financed by “raising the penalties for misfiled taxes”.

Here’s how it would work. As it stands now, small businesses who pay independent contractor/freelancers are supposed to report that income to the IRS using a 1099 form. Another copy of that form goes to the contractor/freelancer. If a small business files all their forms past the deadline or not at all, it receives a fine. The new proposal, “would double and triple these fines.”

This merely serves to empower the IRS, who frankly, is the last arm of the government who deserves increased power right now. Because this measure specifically creates an incentive to raise revenue for the express purpose of funding another government program, you can be sure the IRS will be incentivized to pay closer attention to our small businesses and pounce on paperwork error.

This proposal is reminiscent of the program that was approved as a revenue raiser for Obamacare a few years ago. Congress initially voted to increase the fines meted out for small businesses who did not file a 1099 for anyone paid a mere $600 or more in a calendar year, but the backlash was so great, that Congress appealed it before the law took effect. Though this new gimmick is not quite the same, it is equally abhorrent.

The underlying assumption is that there are enough businesses who don’t file, or misfile all their forms, so they deserved to be penalized even more by substantially increasing compliance fines – all for the express purpose of funding something else by the government. Instead of the government making spending cuts to existing programs in order the TAA program alive, it chooses to target the private sector again for more money.

Congress has a deadline of July 30th to re-vote on the TAA bill. If it plans to re-authorize the program, perhaps it will find a better way to fund it than off of the backs of small businesses.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

Daniel Mitchell, a libertarian economist and Senior Fellow at the CATO Institute, offered an overall positive review of Rand Paul’s tax plan that was released today. He had three minor quibbles and one major concern with the proposal. It his his evaluation of Paul’s 14.5% business activity tax that is the interesting point for discussion — Mitchell asserts is a Value-Added Tax (VAT) for all intents and purposes.

Paul’s argues that he “would also apply this uniform 14.5% business-activity tax on all companies…. This tax would be levied on revenues minus allowable expenses, such as the purchase of parts, computers and office equipment. All capital purchases would be immediately expensed, ending complicated depreciation schedules.”

As Mitchell points out, the high corporate tax rate (35%) would be reduced down to 14.5% which is obviously a great thing. His bone of contention is the “business-activity tax doesn’t allow a deduction for wages and salaries” and therefore, “he is turning the corporate income tax into a value-added tax (VAT).” In theory, he argues, a VAT would not be a terrible thing because “is a consumption-based tax which does far less damage to the economy, on a per-dollar-collected basis, than the corporate income tax.”

However, the VAT’s place in other economies have proven to be, as Mitchell suggests, “a money machine for big government”, and therefore Mitchell cautions against its implementation in the United States.

Mitchell contends,

“The VAT helped finance the giant expansion of the welfare state in Europe. And the VAT is now being used to enable ever-bigger government in Japan. Heck, even the IMF has provided evidence (albeit inadvertently) that the VAT is a money machine. All of which helps to explain why it would be a big mistake to give politicians this new source of revenue.

Indeed, this is why I was critical of Herman Cain’s 9-9-9 plan four years ago. It’s why I’ve been leery of Congressman Ryan’s otherwise very admirable Roadmap plan. And it’s one of the reasons why I feared Mitt Romney’s policies would have facilitated a larger burden of government.

These politicians may have had their hearts in the right place and wanted to use the VAT to finance pro-growth tax reforms. But I can’t stop worrying about what happens when politicians with bad motives get control. Particularly when there are safer ways of achieving the same objectives.”

Mitchell gives an alternative suggestion for reforming the corporate part of the tax code. He calls for “an incremental reform”, consisting of the following:

–Lower the corporate tax rate

–Replace depreciation with expensing

–Replace worldwide taxation with territorial taxation

His suggestion is that if there is enough support within Congress to potentially reform the corporate income tax (and replace it with a VAT), there should also be support for an alternative reform done incrementally, which would be far better in the long run than introducing a VAT for good.

So are Mitchell’s concerns about Paul’s “business activity tax” valid? Is it essentially a VAT? Pretty much. The VAT gets added to products along the way in the process of production and distribution, and is ultimately passed on to the consumer in the form of the final price.

One could certainly argue that the VAT is not a positive solution for reasons such as the fact that European economies which have the VAT are also in shambles. Also, though many of the VATs started out small, most VATs average nearly 20%. That would likely happen here too — while we still continue to collect an income tax. What’s more, it also tends to disproportionately affect small businesses because they often can’t pass along the cost increases associated with the VAT, and compliance will be burdensome and expensive.

Overall, though, Mitchell was pleased with Rand Paul’s plan, which is to be expected from a fellow libertarian economist. His points about the business activity tax are fair, but Paul’s roadmap is overall a decent one. As more contenders for 2016 release their tax plans, we’ll evaluate them here. Thoughts?

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

The number of new businesses has been on the decline since 2008, with more businesses closing than opening. The US Census Bureau confirmed the statistics, which was reported on by Gallup earlier this year. This startling trend also reaffirms a study released last year by the Brookings Institute, which noted that 2009, 2010, and 2011 saw the collapse of businesses faster than their creation.

The annoying thing about the Brookings Institute’s study is that they do not attribute the decline to anything in particular, saying that they need “a more complete knowledge about what drives dynamism, and especially entrepreneurship, than currently exists.” This is utter nonsense, and reinforces why I typically don’t pay attention to what the Brookings Institute says. They are providing political cover for the Obama Administration with their non-conclusive conclusion about the decline of new business.

The most suffocating factor is the sharp rise of federal regulations, which now cost the American economy nearly $1.9 trillion every year — more than 10% of our nation’s GDP. Add in state and local regulations, and that total is even higher.

Not surprisingly, the rates of business start-ups and deaths have changed for the worse as regulatory costs have grown. No wonder: Anyone who wants to stay in business has to keep finding more money to pay for higher costs, while anyone who wants to start a new business has to clear financial and legal barriers that get taller every year. The founder of Subway recently remarked that his company “would not exist” if today’s regulatory burden had existed when he started it in the 1960s.

Simply look at the past few years to see how the regulatory state has grown. Between 2009 and 2013, the federal government added $494 billion in regulatory costs to the American economy. The highlight was 2012, when President Obama and his executive agencies published over $236 billion in new costs. As for 2014, the federal government announced over 79,000 pages of new regulations, costing a total of $181.5 billion.

That’s equivalent to 3.5 million median family incomes. But it isn’t flowing to families through new jobs and higher wages — it’s lost on lawyers, paperwork and other compliance costs.

I was curious what some of the largest wealth managers had to say about the economy. Was anyone talking about the recovery (or lack thereof)? High taxes? Regulation? I took a sampling of the CEOs of Citigroup, JP Morgan Chase, Goldman Sachs, and Morgan Stanley to see what, if anything, they’ve publicly discussed in the last 6 months to a year. The only one that has spoken on the subject is Jamie Dimon of Chase, who stated earlier this year that “the U.S. economy is doing well” but he blamed poor government and regulatory policies for hurting growth. “We’re growing at 2.5 percent. We should be doing better. “I blame them all,” Dimon said of politicians. “To me, they waste a lot of time pointing fingers and not collaborating.”

But they do spend time regulating. This is the canary in the coalmine which impacts new and potential entrepreneurs. Many see the start up costs and the regulatory headaches as too burdensome a barrier to even begin, thus deciding it’s not worth it. Small businesses have been the backbone of America, the pathway to our greatness, and this recent, rapid decline in American business is most alarming.

by | ARTICLES, BLOG, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, RETIREMENT, SOCIAL SECURITY, TAXES

I recently read a letter to the editor about Social Security in the Wall Street Journal that irritated me. Not the letter writer per se, but more by the Wall Street Journal choosing to print a letter that perpetuates a widely perceived myth about Social Security.

The letter was simply this: “Oh, please don’t blame older Americans for “eating up the budget” through payments of Social Security and Medicare benefits. It is the federal government that raided the Social Security Trust Fund. Older Americans have contributed to this for years. Where is the money now?”

The problem with this letter writer is that they really just don’t understand the truth that people who have paid into Social Security are getting many, many more times the actuarial value than what they put into it. It’s not a simple misunderstanding on this. It really, truly is just a flat-out lie that people who put 30-40 years worth of payments are merely getting back just what they put in.

The politicians need this lie to survive because they risk alienating a large voting bloc of older Americans if they merely even suggest that Social Security needs reform. But it does; the egregious state that Social Security is hidden by the way the federal government accounts for it. They even have a special name for it. Social Security is repeatedly described as a pay-as-you-go (“PAYGO”) system, which gives credence to something that is terribly incorrect. PAYGO is not a system at all; rather it is a method of reporting that hides earned realities, making it totally unacceptable to accounting professions, the SEC, and virtually everybody outside the government.

Calling it PAYGO helps to perpetuate the fallacy that beneficiaries are merely receiving what they paid into to. I don’t want to pick on the poor letter writer, as she doesn’t seem to really know how Social Security works (or hasn’t worked). But the Wall Street Journal should know better.

I suppose it is fitting that the 1936 Bulletin announcing Social Security ends like this: “What you get from the Government plan will always be more than you have paid in taxes and usually more than you can get for yourself by putting away the same amount of money each week in some other way.”

This is why we have accrued trillions in unfunded liabilities such as Social Security. If it sounds too good to be true, it probably is.

by | ARTICLES, BLOG, BUSINESS, FREEDOM, GOVERNMENT, OBAMA, POLITICS

On Monday, the Department of Education announced student loan debt forgiveness for students at the now-closed Corinthian College system in California. At the end of April, the Department of Education slapped the for-profit college group with $30 million in fines for allegedly misrepresenting post-graduation job prospects and/or placement rates to some 900 students in 12 schools since 2007. Read the letter here.

Never mind that in 2010 (a year for which I have numbers), 110,000 students were enrolled in 100 schools in their system. That means the total transgressions represent less than 1% of the entire school population. And yet, the DoE decided that 40,000 students in the shuttered college system were eligible for immediate loan forgiveness for Corinthian’s misdeeds; all the students need to do is fill out a form, and their loan will be covered. By taxpayers, to the tune of an estimated $500 million dollars.

But why? That’s where it gets interesting.

Enter Kamala Harris. She’s the current Attorney General in California and she’s running for retiring Senator Barbara Boxer’s seat. Harris worked in conjunction with the Department of Education specifically targeting the Corinthian College system. According to the Wall Street Journal, “Last summer the Education Department began to drive Corinthian out of business by choking off federal student aid for supposedly stonewalling exhaustive document requests. The Department claimed to be investigating whether Corinthian misrepresented job placement rates as California Attorney General Kamala Harris alleged in a lawsuit.”

Corinthian agreed to turn over their education centers to other non-profits, but Kamala Harris refused to release any buyer of potential future liability, meaning anyone purchasing would be under constant threat of a lawsuit. Last November, “the nonprofit Education Credit Management Corporation (ECMC) “agreed to buy more than 50 Corinthian campuses for $24 million plus $17.25 million in protection money to the feds for a release from liability. But ECMC passed up Corinthian’s 23 schools in California because Ms. Harris wouldn’t quit.” The alternative to having no buyer for these particular schools would ultimately be to shut them down.

It was in April 2015 that Corinthian was slapped with the $30 million fine, which effectively drove the final nail in the coffin of the remaining schools because no one in their right mind would shoulder the liability. As for the hefty penalty, “The Department assessed the maximum fine of $35,000 per regulatory violation, which its bureaucrats count as each student that was improperly counted.” By the end of the month, all the rest of the schools indeed closed, throwing out of employment and school, thousands of people.

For those affected, “to mitigate the political damage, DoE [deputized] financial aid counselors to help Corinthian’s student refugees. Yet most community colleges don’t offer Corinthian’s vocational programs and flexible schedules, and many for-profits don’t accept Corinthian’s credits. Ms. Harris and the feds have also made clear they intend to continue their persecution of for-profits, so students could enroll in another political target.” How generous of them.

What makes this whole affair particularly odious is that that “the federal government doesn’t specify how for-profits calculate their job placement rates. States and accrediting agencies have disparate and often vague rules, which notably don’t apply to nonprofit and public colleges.” Thus, Corinthian Colleges was really just a part of the larger assault on for-profit colleges by the Obama Administration, all tied to his new “Gainful Employment” rules. You can read the regulations released last October.

Part of this new regulation change deals with colleges and federal aid. “In particular, Obama intends to change the parameters of what’s known as the “90-10 Rule”—a federal law that bars these schools from receiving more than 90 percent of their revenues through federal student aid, including loans and grants.” The affect of these changes on the for-profit college system has been noted by Forbes. Though the regulations don’t actually take affect until July 1, 2015, it appears Corinthian was a ripe target. What’s more, the Department of Education found a ready and willing partner in Kamala Harris, who just happens to be running for a very important Senate seat in California.

On can debate the merits of the for-profit college system, but that would be fodder for another post. The fact remains that certainly, the generous student loan forgiveness/bailout will resonate with these 40,000 young, impressionable voters who suddenly got their college costs covered by someone else, even if they weren’t an actual victim of alleged “misrepresentation”. Will there soon be another for-profit college chain shut down and subsequent loan bailout by the Feds in another important election state?

by | ARTICLES, BLOG, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

The upcoming Presidential Election Cycle is beginning to get crowded already. Since I’m undecided right now, I’ve chosen to do a scorecard of sorts of each of the major candidates in four policy areas:

*Taxes

*Immigration

*Free Trade

*Entitlement Reform

These issues are among the most crucial for me. Over the next couple of weeks, I’ll be posting about what I believe is the best, most optimal policy in each of these four areas, and then I’ll score the candidates on their positions.

I’ll also post when I have decided to eliminate a candidate, and why. I welcome your thoughts on these particular issues too. The scorecard will be up soon.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

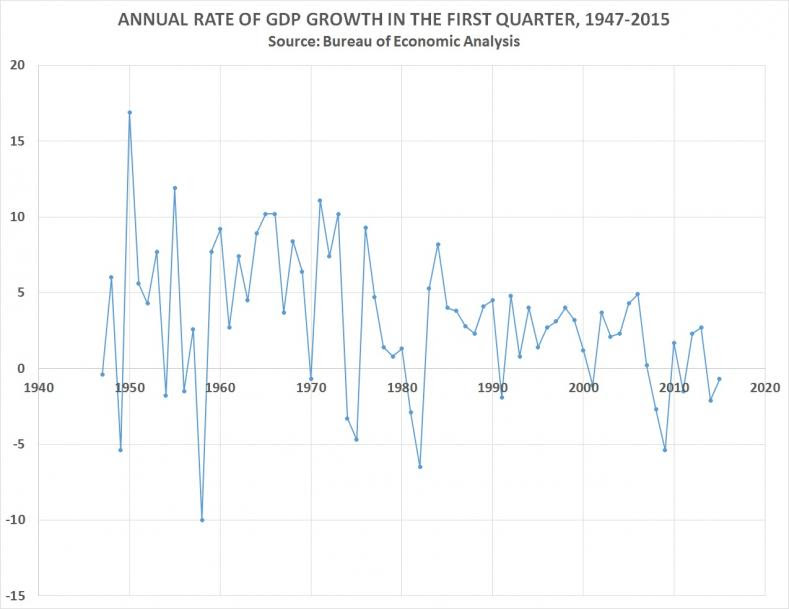

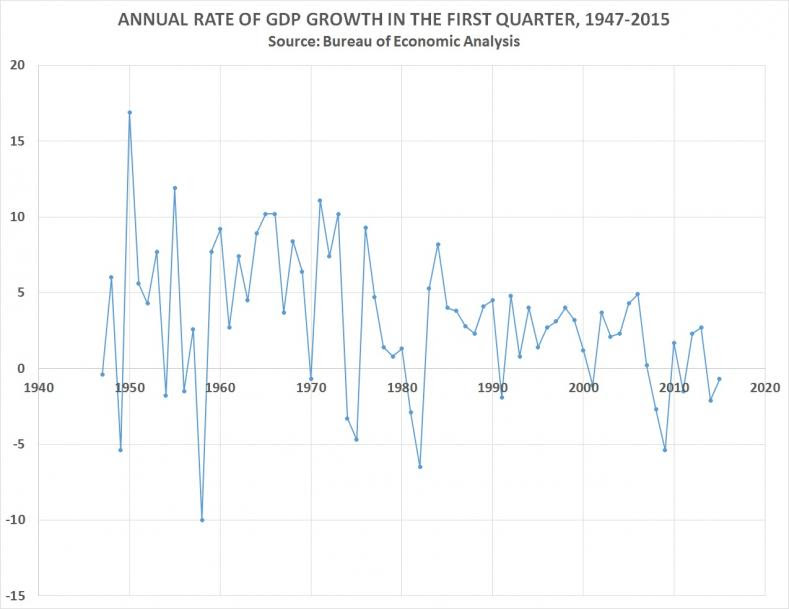

In lieu of the recent news that the GDP actually contracted during the 1st Quarter, some folks at the White House seem fit to blame both the winter and the actual process and algorithms by which 1st Quarter numbers are analyzed.

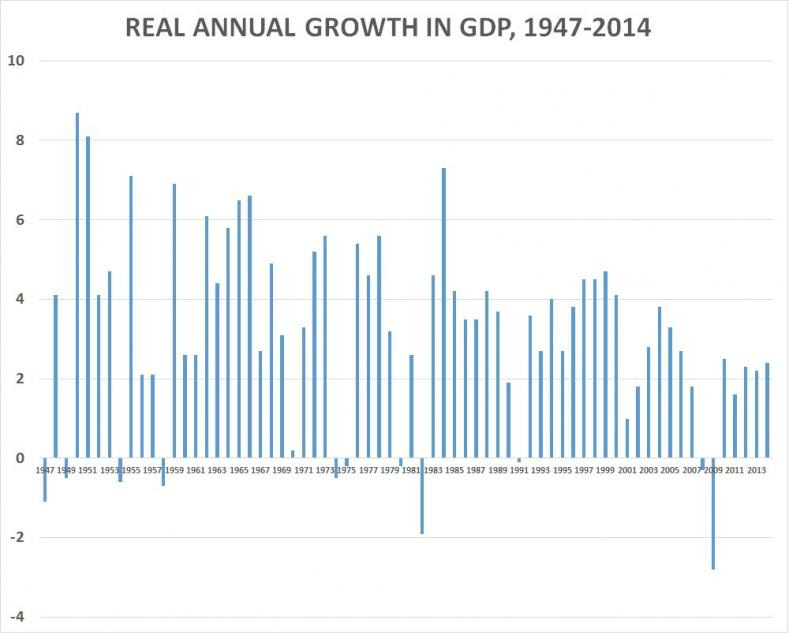

CNS News decided to take a look at Obama’s 1st Quarter numbers and compare them to previous presidents all the way back to 1947, which is the earliest data offered by the Bureau of Economic Analysis. The result shows that Obama has the lowest 1st Quarter numbers of all Presidents. I reproduced the article below, because it had some great graphs which shows the comparison data nicely. This just reaffirms what we know and what I wrote about the other day: the economy is still not that strong.

——–

Even if you leave out the first quarter of 2009—when the recession that started in December 2007 was still ongoing–President Barack Obama has presided over the lowest average first-quarter GDP growth of any president who has served since 1947, which is the earliest year for which the Bureau of Economic Analysis has calculated quarterly GDP growth.

In all first quarters since 1947, the real annual rate of growth of GDP has averaged 4.0 percent.

In the seven first quarters during Obama’s presidency, it has declined by an average of -0.43 percent. And if you leave out the first quarter of 2009 and look only at the first quarters of the six years since the recession ended, it has averaged only 0.4 percent.

In the six years of Harry Truman’s presidency for which the BEA has calculated quarterly GDP, the annual rate of growth in GDP in the first quarter averaged 4.5 percent.

During President Eisenhower’s eight years, it averaged 3.2 percent. During Kennedy’s three years, it averaged 4.9 percent. During Johnson’s five years, it averaged 8.3 percent. During Nixon’s six years, it averaged 5.3 percent. During Ford’s two years, it averaged 2.3 percent. During Carter’s four years, it average 2.4 percent. During Reagan’s eight years, it average 2.1 percent. During George H.W. Bush’s four years, it average 2.9 percent. During Clinton’s eight years, it averaged 2.6 percent. And during George W. Bush’s eight years, it averaged 1.7 percent.

President Obama took office on Jan. 20, 2009. In the first quarter of 2009, GDP declined at an annual rate of -5.4 percent. In the first quarter of 2010, it grew by 1.7 percent. In the first quarter of 2011, it declined -1.5 percent. In the first quarter of 2012, it grew 2.3 percent. In the first quarter of 2013, it grew 2.7 percent. In the first quarter of 2014, it declined -2.1 percent. And in the first quarter of 2015, it declined -0.7 percent.

In these seven first quarters that Obama has been president (2009 through 2015), the annual rate of growth in GDP has declined at an average rate of -0.43 percent.

But the National Bureau of Economic Research says the last recession, which began on December 2007 did not end until June 2009. If you leave out the first quarter of 2009, and only count the six years (2010-2015) since the recession ended in June 2009, real annual rate of growth of GDP in the post-recession first quarters of Obama’s presidency has averaged 0.4 percent.

When GDP declined at -1.5 percent in the first quarter of 2011—which was after the recession and two full years into Obama’s presidency—some blamed it at least partly on the weather.

“Some of the slowdown in growth was linked to bad weather in early 2011 and an 11.7 percent decline in defense spending,” said a Reuters story of May 27, 2011.

When real GDP declined at a rate of -2.1 percent in the first quarter of 2014, a May 30, 2014 New York Times story said: “Most economists on Wall Street and at the Federal Reserve blame a very cold winter for much of the slowdown.”

When real GDP declined at a rate of -0.7 percent in the first quarter of this year, the top paragraph of an Associated Press story said: “The U.S. economy shrank at a 0.7 percent annual rate in the first three months of the year, depressed by a severe winter and a widening trade deficit.”

But there seems something more at work here than climate patterns–or the Obama presidency.

Under previous presidents, real GDP sometimes grew massively during the first quarter. In 1950, under Truman, for example, GDP grew at an annual rate of 16.9 percent in the first quarter. In 1955, under Eisenhower, it grew at a rate of 11.9 percent.

Under Johnson, in the first quarters of both 1965 and 1966, it grew at a rate of 10.2 percent. Under Nixon, it grew at 11.1 percent in the first quarter of 1971, and 10.2 percent in the first quarter of 1973, it grew at 10.2 percent.

Under Ford, in the first quarter of 1976, it grew at 9.3 percent. Under Reagan, in the first quarter of 1984, real GDP grew at a rate of 8.2 percent.

But since 1984—more than three decades ago–there has been no first quarter, in any year, under any president, when real GDP grew even as fast as 5.0 percent. The closest it came was in the first quarter of 2006, when George W. Bush was president, and it hit 4.9 percent.

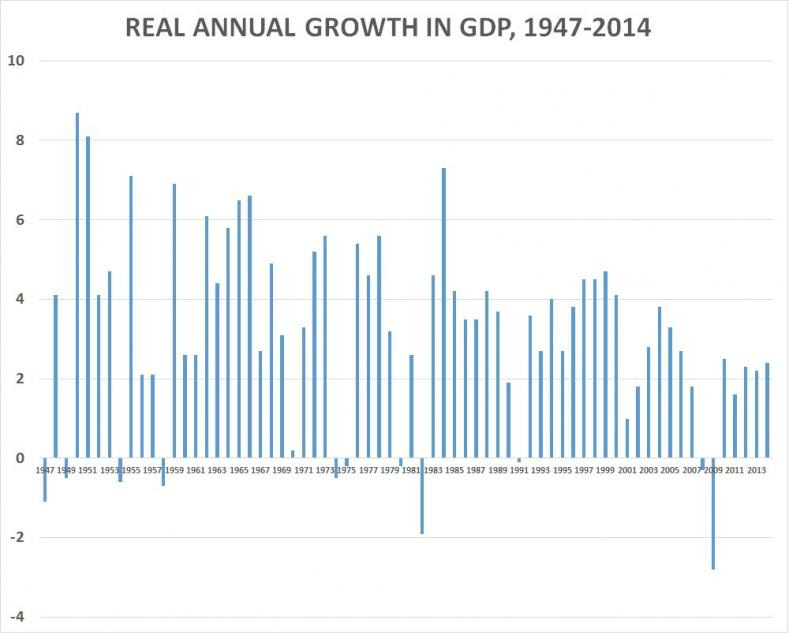

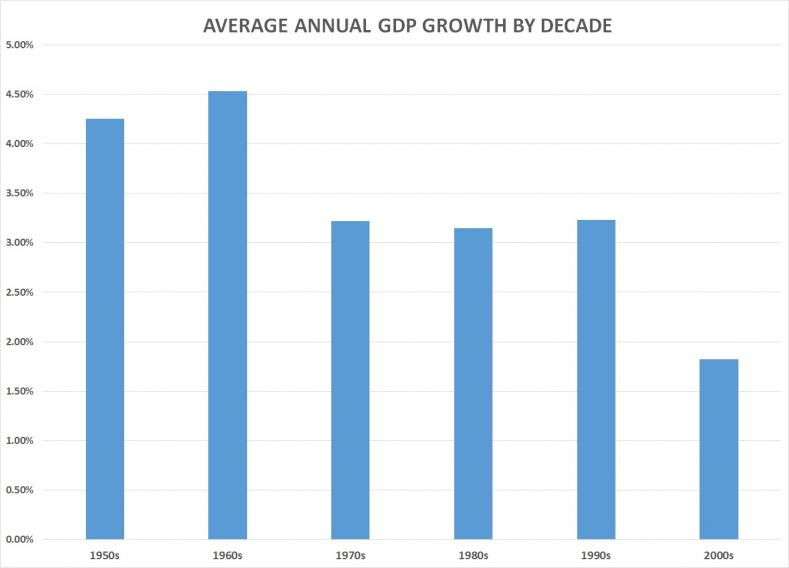

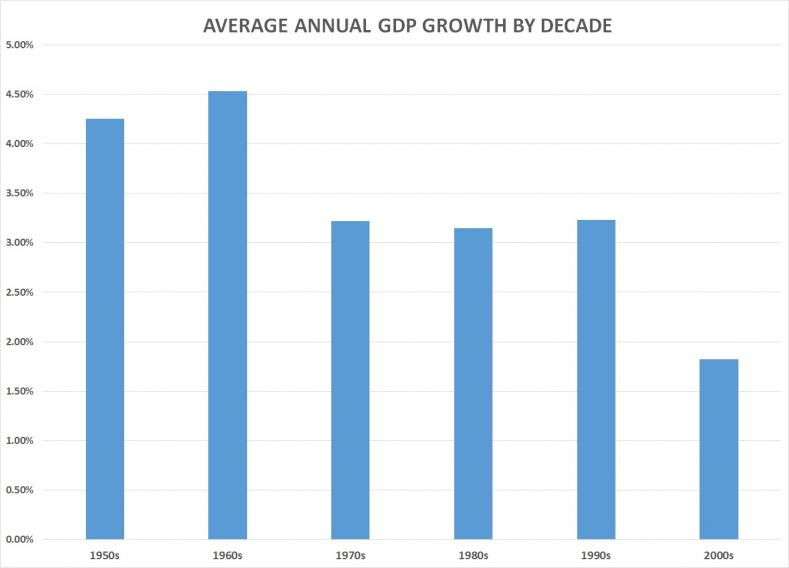

In the decades starting after World War II, average annual growth in GDP peaked in the 1960s.

In the 1950s, annual growth in GDP averaged 4.25 percent. In the 1960s, it climbed to 4.5 percent. But it dropped to 3.22 percent in the 1970s, then 3.15 percent in the 1980s, before ticking up to 3.23 percent in 1990s. In the 2000s, it averaged only 1.82 percent.

In the first five years of this decade (2010-2014), annual growth in GDP has averaged 2.2 percent. But that is less than the 2.7 percent it averaged in the first five years of the last decade (2000-2004) which was before the recession hit at the end of 2007 and brought the decade’s average down to 1.82 percent.

If it were to maintain an average annual rate of 2.2 percent for the next five years, the American economy of this decade would still be growing at less than half the rate of the 1960s.

Should the long-term decline in U.S. economic growth be attributed to cold weather? Or should people in Washington, D.C., start looking around them for an anthropogenic cause.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS, TAXES

We have entered the Twilight Zone. Because there is virtually no other explanation of the latest crusade by labor leaders in Los Angeles. Union leaders are lobbying Los Angeles city council members to be EXEMPT from paying a $15 minimum wage in workplaces where unions exist. Tim Worstall from Forbes got it right in his opening salvo on the matter: “This is really quite glorious as a display of sheer naked chutzpah.”

The unions themselves have been some of the biggest supporters of the wage increase, not just in Los Angeles, but around the country. Now when it comes to actually paying that wage in Los Angeles, which is poised to be approved by city council, the unions want to retain their right to collective bargaining — which means paying a lower wage if they want. Here is the sheer hypocrisy:

“Rusty Hicks, who heads the county Federation of Labor and helps lead the Raise the Wage coalition, said Tuesday night that companies with workers represented by unions should have leeway to negotiate a wage below that mandated by the law.

“With a collective bargaining agreement, a business owner and the employees negotiate an agreement that works for them both. The agreement allows each party to prioritize what is important to them,” Hicks said in a statement. “This provision gives the parties the option, the freedom, to negotiate that agreement. And that is a good thing.”

You can’t make this up. Currently, businesses are not mandated to pay a $15/hour minimum wage and therefore really, truly, actually have, right now, what Mr. Union Rusty Hicks is asking for: “the option, the freedom, to negotiate” an agreement between a business owner and an employee for their wages, allowing “each party to prioritize what is important to them”. That’s what exists now. No mandated wage. Unions seem to be following the “Do as I say, not as I do” playbook.

What is really happening is that the unions want to be able to retain exclusivity on certain contracts. The exemption they are seeking is in places where unions exist in the workplace. By being exempt, this will give the unions the upper hand on contracts. If you were an employer who now will have to pay a $15/hour minimum wage, and the unions can come in and undercut that wage amount by negotiating $13/hour, which do you think an employer will pay? The $15/hour mandated wage for non unions, or the $13/hour union contract? The unions are fearful that leveling the playing field by mandating a $15/hour minimum wage for all will mean that they will lose some (or many) contract — meaning less money in the union’s pockets.

Now I’m not a fan of the proposed $15/hour minimum wage hike, ironically for some of the same reasons that the unions are pleading — a business owner and an employee ought to have the right to agree on wages without an artificial, arbitrary price floor. However, I’m even less of a fan of the idea that unions, or any other group, should be able to claim an exemption. If the city of Los Angeles is going to pass this legislation, then it should be binding for all. Either $15/hour is good for everyone, or no one. Shame on the unions for their brazen hypocrisy.