by | ARTICLES, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, NEW YORK, OBAMA, POLITICS, TAXES

What is Wall Street, anyway? I would be willing to bet that 90% of the protesters from Occupy Wall Street and of self-styled liberals have absolutely no idea what Wall Street is, what it does, and how important it is.

If not for Wall Street, there wouldn’t be any Main Street, certainly not as we know it today.

In order for any business to be successful, it must run on capital. Capital can be funded by an owner’s personal investment or through funds from outside investors. The ability to grow from the Mom and Pop store to the bigger corporation model is dependent upon the business owner’s ability to get risk capital.

This risk capital is necessary to rent the space, hire the employees, grow the inventory,and buy the equipment to get the business going. There is no guarantee that this money could ever be paid back. But the investors are willing to risk their hard-earned money in the hope that the venture is successful enough to 1) repay the money borrowed and 2) to give back a reasonable profit for the risk taken.

So where does that money typically come, that risk capital? Wall Street. Look around the house at what you have. Your lights? From the utility company. Where did that capital come from to build the utility plants, to lay the distribution networks, to expand them? Risk capital. Wall Street. Where did Macy’s get its start? Or Google, or IBM? Or any of the energy, pharmaceutical, or chemical companies? Or virtually any large corporation you can think of today — where did it get its funds to really get going and continue to grow? Wall Street.

And the people on Wall Street, people sometimes described (invariably by clueless politicians and populists who know nothing about what it takes to run a business or create jobs) as paper-pushers who make unconscionable amounts of money, what do they do?

They must be able to analyze how businesses (Main Street) work, and which ones (out of the many thousands out there all claiming to be worthy) are likely to be successful. They must develop the confidence of potential investors, and convince them to invest in these projects. They must bring the companies and investors together to agree on how much of the company the investors would get for the amount of capital that is being invested. Should the money invested be equity (ownership in the company) or bonds (loans to the company), and if bonds, what interest rate? Most importantly, more than in any other business, pay day never comes to Wall Street unless the capital is successfully raised. And if Main Street is not successful with its new capital, good luck for that Wall Street company in trying to raise money for its next project.

There have been abuses on Wall street, certainly. But there is absolutely no reason to believe that there are any more abuses than in any other business. And those abuses almost always are paid for with serious financial pain to those companies.

But none of these abuses can compare with the financial abuses and mismanagement that we endure daily from our government. Our government has us at the brink of bankruptcy, with a $17 trillion dollar debt (more than 100% of our GDP) which balloons to more than $100 trillion if our entitlement obligations are included.

We have President Obama and the Democratic leaders of the Senate (Harry Reid) and the House (Nancy Pelosi) saying that this is not a current problem (clearly not the truth) and spending money they don’t have to get votes for the next election. A short trip through YouTube (circa 2004-2005) clearly show that Barney Frank (Democratic House…), Chris Dodd (Democratic Senate ….) and Maxine Waters (Democratic House ….), among other Democrats, were principally responsible for the recent economic meltdown. The videos of Congressional Hearings demonstrate unquestionably that Fannie Mae and Freddie Mac were cooking their own books and lending to dangerously unqualified borrowers, but the Democrats prevented any remedial action to be taken.

And taxpayers and Main Street have borne the heavy burden of their negligence during this sluggish, anemic economic recovery.

Wall Street is an invisible backbone of our economy — providing the money and investments that are necessary to continue America’s upward mobility in all facets of our lives. Focusing only on trumped up Wall Street problems or buying into the class warfare hatred of the rich is misguided — especially while giving our government a free pass to use and abuse our taxpayer money each day.

by | ARTICLES, BUSINESS, ECONOMY, GOVERNMENT, NEW YORK, OBAMA, POLITICS

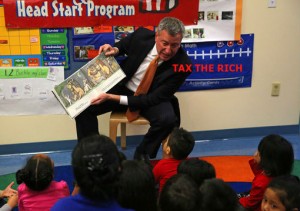

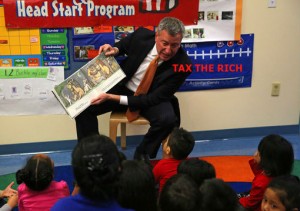

The new pre-school plan presented by Mayor de Blasio reveals just how politically disingenuous he really is.

In his effort to push the progressive agenda he put forth during his campaign, de Blasio has vowed to have universal pre-school in New York State to be paid for only by the wealthiest New Yorkers.

Here’s the logical inconsistancy: If universal pre-school is the all-important and necessary step for all children in their educational development (the merits of which is fodder for another article entirely), then the only logical conclusion is that the cost should also be borne by all taxpayers the way K-12 already is — not just a select few. If “everyone” is not willing to pay his or her fair share of this “necessary” project, then maybe that tells us that it should not be done.

This line of thinking clearly echoes the Obama Administration’s sentiment that the rich “pay just a little bit more”, and it is not welcome in New York.

by | ARTICLES, ECONOMY, NEW YORK, TAXES

The NYTimes ran an article yesterday talking about the curious population shift from NY to FL. The biggest thing missing from the article’s conclusions, however, is the affect of taxes on New York’s population (re)location.

A CNSnews report last year discussed a study by the Tax Foundation found a net loss of 1.3 million New Yorkers who left the state over the 10 year period from 2000-2010.

3.4 million total moved out of state, but another 2.1 moved in, so the change was -1.3 million — which totaled a loss of $45.6 billion in income.

Although many factors determine one’s decision to move to or from a locality, taxes are typically part of the process. As such, the Tax Foundation noted many high tax facts that are unique to New York:

According to the group, New York ranked second among the states for the highest state and local tax burden in 2009. The Empire State was ranked highest for tax burden every year from 1977 until 2006, except in 1984 when it was ranked second.

New York State has a progressive personal income tax rate ranging from 6.45 percent to 8.82 percent for those earning over $2 million. Sales varies by county, and is between seven and eight percent. In Manhattan, the sales tax is 8.875 percent.

According to the Retirement Living Center, which examines tax burdens by state for those nearing retirement, New York also levies a gasoline tax at 49.0 cents per gallon and a cigarette tax of $4.35 per pack, along with an additional $1.50 per pack in New York City.

New York is also one of 17 states plus the District of Columbia that collects an estate tax, with a $1 million exemption and a progressive rate from 0.8 percent to 16 percent.

In 2007, New York State collected $1.1 billion from its estate and gift taxes, the highest of any of the states, according to the Tax Foundation.

I have mentioned these points before. Back in 2009, Rush Limbaugh fled the state due to the crushing taxes. And an Op-Ed in the NY Post last year discussed the implications of a shrinking population — loss of revenue, House of Representative seats, and policy power.

High taxes have devastating consequences. Thomas Sowell once quipped, “Elections should be held on April 16th- the day after we pay our income taxes. That is one of the few things that might discourage politicians from being big spenders”.

With the recent election of De Blasio as Mayor of NYC, you can expect even more flight. De Blasio has vowed to raise taxes both as a means of pushing his economic equality agenda and rewarding the unions for the patience with contract negotiations over the last 4+ years.

The state of NY is on the brink of fiscal insolvency and more and more people are waking up to that reality — and leaving the state in droves.

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ECONOMY, NEW YORK, POLITICS

De Blasio’s recent mayoral victory was a sad day for New Yorkers. Electing him was proof that the constituency in NYC is morally, philosophically, and educationally bankrupt. And if the mayor sticks to his positions that he declared as candidate De Blasio, NYC will be financially bankrupt as well.

A strong argument can be made that the entire election was a public service union push. For four years now, the public service unions have waiting to negotiate their contracts until Bloomberg was out of office. The time has come for the unions. De Blasio, from a position of patronage, will roll over and give the unions huge back-end and retroactive pay increases and benefits both undeserved and unaffordable. New York City could easily find itself in the same fiscal categories as Detroit and Chicago.

Why have the unions been willing to work without a contract for virtually all of the Bloomberg tenure? A little known clause of the anti-strike Taylor Law is the Triborough Amendment.This provision mandates that if a contract expires before a new contract is in place, the benefits of the expired contract continue, unchanged, until the new contract is finally negotiated. NYC is the only place in the country that has such a clause, which renders it difficult to negotiate anything from a position of austerity.

Bloomberg understood the ever-expanding costs of public service union wages and benefits, and sought to restrain them during the economic downturn. Over the past four years, the unions have steadfastly refused to engage in contract negotiations that would bring their costs in line.Why should they? They could continue to accrue the unaffordable and unreasonable benefits of the expired contract that they could have no hope of getting with Bloomberg under a new contract. Then they could help elect a new mayor who is philosophically aligned, financially naive, and seemingly irresponsible enough to give them what they could only dream of in a new contract.

De Blasio won the election by a huge majority, despite the fact that he is so far left as to be an avowed supporter of the likes of Cuba and the Sandinistas. He clearly espouses policies — such as higher taxes, more spending and regulation, attempts at government imposed income redistribution, and curtailment of police activity — which will ultimately hurt the poor and economically disadvantaged more than anyone. And if he tops it off with crony contracts with the public service unions, New Yorkers will have dug themselves a hole virtually impossible to get out of.

by | ARTICLES, BLOG, NEW YORK, OBAMA

Obama is lending NYC Mayor candidate his playbook to win — including his endorsement, his staff, and his rhetoric.

Obama is lending NYC Mayor candidate his playbook to win — including his endorsement, his staff, and his rhetoric.

Obama recently and heartily endorsed Mr. de Blasio, which comes a couple of weeks after his win in the Democrat primary against 8 other candidates.

De Blasio’s campaign released a statement noting Obama’s endorsement; Obama remarked, “Progressive change is the centerpiece of Bill de Blasio’s vision for New York City”, which would make him a “great mayor”. De Blasio spoke to this effect, describing how “On health care, tax fairness or the economy, the president is no stranger to addressing big problems with big ideas and big solutions. I will emulate the example he has set, and if elected I stand eager to work with him on an urban agenda that grows prosperity for all.”bb

According to the NYT, Obama is lending not only his name, but also his powerhouse consultants. “Several veterans of Mr. Obama’s 2008 and 2012 campaigns are now senior campaign advisers to Mr. de Blasio, including Mr. de Blasio’s campaign manager, Bill Hyers, and John Del Cecato, who has been most responsible for his commercials”. This will be a difficult obstacle for Joe Lhota to overcome along with the Obama endorsement — especially in light of the fact that Bloomberg, a marginal Republican and mayor for the past 12 years — as refused to endorse anyone in the race.

Most notably, De Blasio is using language that echos much of the phrases preferred by President Obama. De Blasio describes himself as ““a consistent progressive with a very strong activist worldview and someone who wants to make substantial change in this city.”. (sounds a lot like community organizer, eh?).

He has also spoken of his plans regarding “fighting inequality and economic injustice.” Sounds very much like “pay their fair share” policies.

So if New Yorkers want NYC to be a microcosm of our current government style and economy, De Blasio is their candidate. He is very open about modeling himself after Obama.

by | ARTICLES, ECONOMY, NEW YORK

The recent ruling in finding NYC’s prevailing wage unconstitutional was the correct decision. Bloomberg understands the fundamental economic premise regarding paying a wage what the market dictates the worker is worth. Those that support the prevailing wage policies do not. It is both unfortunate and dangerous, because implementing a prevailing wage has two effects: 1) it devastates the very people its proponents think they are helping and 2) it erodes NYC’s economy by creating more barriers for businesses.

When a government takes taxpayer money, it takes it as a fiduciary; that is, it implies a relationship — legal, ethical, and economical — between “trustee” (government) and beneficiary (taxpayer).Therefore, the government has a moral, if not legal, obligation not to spend more money or pay anything more than the market demands.

The very act of paying $10 for something that costs $8, under the notion of “prevailing wage”, would put any other private businessman in trouble. Prevailing wage theory is not the government acting out of the kindness of heart, like its proponents would have you think. It raises the cost of goods to all constituents, increases the cost of living, and slows down the local economy.

The judge, although he ruled correctly, did so reluctantly — seemingly only under the technicality that the “law contravened state law”. He described how, “this court believes that the prevailing wage law could benefit the people of New York and does not see wisdom in the mayor’s zeal for the possibility of welcoming to New York City a business that would pay its building service employees less than the prevailing wage”. Bloomberg, however, hit the nail on the head when he countered that “legislation like this makes it harder for companies to invest in New York City.”

Here’s what the prevailing wage campaigners fail to discuss or flat out don’t understand from fundamental economics. The extra money being paid in a prevailing wage only benefits people that you can see. You do not see the hidden costs that add up to the employer, which create a net loss to the economy (deadhead costs). When you pay $10 for $8 worth of labor, it is identical to imposing a tax from an accounting point-of-view. What you see is the extra $2 going into the employee’s pocket. What you don’t see is the effects of the price increase on the business owner or the economy — how he absorbs the cost, offsets the cost, changes or slows production, cuts back hours or product, and so forth. That is the unspoken deadhead cost, a loss which has a ripple effect on the rest of the economy.

Prevailing wage is a scourge that must be stopped in its entirety, or else it will continue to grow. It doesn’t matter that one judge in open court halted the process. The people pushing for its policy must come to understand the basic economic premise — that when you artificially raise the price of something, you get less of it. Ergo, if you artificially raise the price of wages, you get less of that too — because many companies cannot afford the additional costs (or they would have to pass on the higher costs, but at the higher price there would be fewer buyers).

Artificial wage prices impede a business’ ability to grow and invest. There are many arguments against a “prevailing wage”, chief among them the burden on businesses — which are already struggling. The failure to understand the true effect of artificial wage control on the economy-at-large is frustrating. Such faulty logic is representative of the current trend to focus on feel-good rules rather than economic well-being for all. At least Mayor Bloomberg, who has been a successful businessman, (despite all his other faults) was willing to fight against measures like a “prevailing wage” that would keep NYC’s economy both depressed and sluggish.

by | ARTICLES, BUSINESS, NEW YORK, POLITICS

Governor Cuomo is on the list of presidential potentials for 2016. His positions on state and federal taxes need to be elucidated in case he becomes a major candidate in the next couple of years.

For instance, Governor Cuomo lashed out against the recent federal proposal to eliminate the Federal tax deductions for state and local taxes. He calls this “double taxation” because it forces individuals to pay two separate taxes – federal and NY State – on the same income- without giving any relief against the federal tax in recognition of the tax paid to the State. Without the deduction, Cuomo warns that tax bills will rise substantially for New Yorkers.

However, the truth is that Cuomo’s attacks are nothing more than an attempt to shift the focus away from New York State failing its fiduciary responsibility to its taxpayers. It currently levies a very high level of taxation upon its citizens. The deduction is simply a subsidy that masks the egregious overspending of the state which creates the situation in which high taxation is necessary to feed the body politic.

Why should the federal government have to subsidize New York at all? If the residents of New York State think that high (some would say ludicrously wasteful) government spending paid for by very high taxes is the right way to run a state, it is certainly their right. But these residents also have no right to ask taxpayers of other states to subsidize them. And that is exactly what happens when the federal tax code enables New Yorkers to reduce their federal tax simply because they pay high taxes to their state.

Furthermore, Governor Cuomo’s outrage over this “tax increase” is blatantly hypocritical. Where was his outrage when the federal government raised tax rates which fall so overwhelmingly on his NY constituents? Where was his outrage when the federal government’s Alternative Minimum Tax (“AMT”) kept exploding the tax liability of New Yorkers (mostly because the AMT does not allow the deductions for state and local taxes)? And where was his outrage against himself when he broke his clear promise and substantially raised NY income taxes on the most productive New Yorkers?

So yes, although the proposal will seriously hurt all New Yorkers, it is essentially and simply a reform that puts all taxpayers around the country on a level playing field. If Cuomo is so concerned with New York’s taxpayers, he should aim to reduce the scope and size of government and the wildly out of control spending that created it, instead of adding to the budget deficit by his latest spending schemes.

by | BLOG, BUSINESS, ECONOMY, NEW YORK

I Love NY (money)

Knowing that Gov. Cuomo’s is considered a possible contender for 2016, his use of taxpayer funds in this regard is appalling. My latest on Canada Free Press this morning:

It is an outrage that Gov. Andrew Cuomo is spending up to $140 million of taxpayer money and funds received for disaster relief, to publicize the advantages of conducting business in New York. New York is indisputably one of the most unfriendly business states, with a Legislature that piles huge administrative burdens onto businesses and a Department of Taxation that is among the most aggressive in the country.

Thanks to the NY Legislature, the state demands a payment of an LLC fee every Jan. 30, causing large administrative burdens disproportionate to a small amount of additional tax revenue. It also requires a high minimum-wage, creating an unnecessary and expensive burden on small businesses.

The state also introduced a brand new “MTA” tax with new forms to fill out as a separate levy, simply because they did not want to take the heat for raising existing rates. When a huge outcry against this ridiculous tax was made, the state’s “fix” was to exempt some lower income businesses while making the complications for the remaining businesses even worse.

New York State recently created a new burden on all employers requiring every employer to make specific annual reports to each of its employees in significant detail, a provision clearly intended more to provide fodder for employer lawsuits than to protect the rights of workers. As long as Sheldon Silver continues as Speaker of the NYS Assembly (and a current partner in an anti-business civil litigation law firm), the legislature will continue to make it inordinately difficult to carry on with business in New York. It should be noted that some well known restaurant organizations have sworn never to open any new facilities in New York State, specifically due to its impossible and litigation-friendly business environment.

The Legislature continues to add the latest nanny state employment regulations each year, making New York a gold mine for lawyers to sue employers over technicalities. Its insistence on giving enormous amounts to its public-service unions guarantees that the tax burden will keep growing in the years ahead. And New York has the “only one in the world” statute (called the Triborough Amendment) — that requires the state to continue paying its public service employees on the items contained within an expired contract — making it impossible to negotiate any austerity.

The New York Department of Taxation is no better, as it ruthlessly goes after extra New York City taxes paid by state residents and New York state taxes paid by non-New York state residents. It demands huge and automatic penalties built into tax law on each assessment, penalties that are used as levers to get the New York taxpayer or business owner to agree to compromises that they often don’t really owe.

One anecdote that encapsulates this mentality is the individual who lived with his family out-of-state. He bought a home for his elderly parents in Staten Island and was successfully taxed as a NY City resident. The state’s determination? He had a key to the front door, and a few items of clothing in the closet!

Clearly, for the average person in New York, it is an onerous state in which to do business. If Mr. Cuomo wants to create a better business image, he must make the state a better and more business-friendly place from the ground up. Instead of trying to deceive people with taxpayer funded propaganda into thinking that New York has a healthy business climate, use that $140 million to reform his deplorable Legislature and Department of Taxation. Any non-NY business that falls for Gov. Cuomo’s propaganda campaign gets what it deserves.

by | BLOG, ECONOMY, NEW YORK, POLITICS

That’s me!

Senator Kirsten Gillibrand’s website proudly proclaims “as the mother of two young children, Senator Gillibrand knows that working families are struggling in this difficult economy.” But Sen. Gillibrand’s positions regarding the economy don’t support such a statement.

When Gillibrand appeared on Meet The Press on April 21, she stated that she refuses to support even the trivial chain “CPI” adjustment of Social Security benefits “because it is not significantly affecting the current deficit”. This reform (backed even by President Obama in his April 7 budget) changes the formula for calculating cost-of-living increases in Social Security, thereby reducing future raises slightly. Gillibrand’s extreme position, on the other hand, flatly spurns any changes that will reduce the looming catastrophe of Social Security.

Gillibrand is well aware that the reason that the current deficit is not being significantly affected is that her children’s future retirement payments are being confiscated, being used to pay for current retirees (whose retirement payments were similarly confiscated). This is the well known Ponzi method of entitlements – taking money from current workers who think — and are being told by Ms. Gillibrand – that they are paying for their own retirement, when in fact the money is being stolen to pay for others whose money was similarly taken under false pretenses.

The current total Social Security liabilities, per the Annual Trustees Report, has ballooned to $20.5 trillion. The liabilities are the promised future payments to workers currently paying into the system. Gillibrand is aware that each year that goes by significantly increases the burden to her own children – and ours, which weakens the economy. For her staunch advocacy of this position, she should be granted the well-earned title of PONZI MOM.

by | ARTICLES, ECONOMY, NEW YORK, POLITICS

In a twist of irony, “Big Government” Bloomberg has admitted that NYC is at the edge of a fiscal precipice.

In a twist of irony, “Big Government” Bloomberg has admitted that NYC is at the edge of a fiscal precipice.

“There is no practical ways to pay our workforce given the current environment, current tax structure, current other obligations we have more than what we have been doing, with the possible exception of dramatically raising taxes”.

Bloomberg points to public service unions as being among the biggest roadblocks to any meaningful fiscal health in the city.

Currently in NYC, most of the unions are refusing to negotiate contracts right now. This is completely legal. If the contract is not re-negotiated, the current terms continue. The unions are trying to hold out for more money until a new mayor is elected, in the hopes that a new mayor will cave to their demands. One thing Bloomberg wants — which is met with hostility — is to “force union workers to pay part of the health care costs”. Imagine that! “Unless we do something those expenses will bankrupt us,” Bloomberg said.

Additionally, when Bloomberg mentions “obligations”, he’s talking largely about the pension system.

Living in NYC, I am no fan of Bloomberg’s at all. I do want to give him a little (tiny) credit — he’s been sounding the alarm about this for the past few years. Even back in 2010, Bloomberg told CrainsNY that

“city pension funds have set unrealistically high assumed rates of return on investments, at 8%, which may require spending more than has been budgeted for retirement benefits…The pension system itself provides defined benefits that can’t be reduced under guarantees the Legislature has placed in the state constitution. While it permits new, less-expensive benefit tiers for future employees, savings wouldn’t be realized for 10 or 15 years”

The New York pension system is out of control. In addition to the extravagant, irresponsible and under-reported negotiated levels of benefits, there is an additional characteristic of the system that is never talked about. There is a huge break that goes to New York retirees; anyone who gets a retirement pension from New York State, or any locality or agency (teacher, firefighter, etc) pays no city or state income tax on that pension money. This hearkens back to the days when New York workers were so underpaid that this benefit was warranted.

It should be noted that nearly a decade ago, that provision of New York state law was declared federally unconstitutional. It was determined that New York state could not exclude federal retirees from the tax exemption. The courts gave New York two options: make New York government pensions taxable, or add federal workers to the list of non-taxable agencies. Of course, New York chose the latter, thereby adding to the state budget deficits.

Even though historically, public sector employees earned less than what those skills would command in the private sector, that is clearly not the case today. Study after study has shown that public sector compensation – which includes retirement pensions – has steadily outpaced its private sector counterparts in recent years. New York is among the worst offenders.

This state of affairs must be reversed. Allowing the exempted retiree pensions to be taxed the same way other retiree pensions would accomplish two goals: 1) lessen the compensation disparity with private sector employees, and 2) severely reduce the New York budget deficit by providing additional revenue to the state.

But it won’t happen. Too many people are entangled in the system as it is and don’t want to give up their tax-free benefit. And with the unions unwilling to budge on anything with Bloomberg, the likelihood that any real reform will take place — be it pension reform, benefit reform, or anything where the public service union employee might have to pay a little more — is very remote.

How is NYC going to afford all the tsunami it has created? Bloomberg warns that taxes could go up 50% if the unions are given what they want once a new Democrat mayor is elected. For high income earners, federal/state/local taxes combined already total 54%! More than half of your income going to the government. This is legal plunder.

Frederic Bastiat characterized “legal plunder” as a “fatal idea” in “The Law”. He wrote, “Imagine that this fatal principle has been introduced: Under the pretense of organization, regulation, protection, or encouragement, the law takes property from one person and gives it to another; the law takes the wealth of all and gives it to a few”

and also this:

“Now, legal plunder can be committed in an infinite number of ways. Thus we have an infinite number of plans for organizing it: tariffs, protection, benefits, subsidies, encouragements, progressive taxation, public schools, guaranteed jobs, guaranteed profits, minimum wages, a right to relief, a right to the tools of labor, free credit, and so on, and so on. All these plans as a whole — with their common aim of legal plunder — constitute socialism”.

Sounds a lot like NYC. It is running out of other people’s money. Of course, Bloomberg never mentions cutting govenment spending and waste as a dent in the abyss, but that’s a whole other matter. The current fiscal trajectory is unsustainable. Higher taxes are unsustainable too. What happens when a Democrat once again gets elected as mayor, and what happens when the union negotiations begin in earnest again? The people of New York City have no idea about the financial mess that will inevitably hit them.