by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS, TAXES

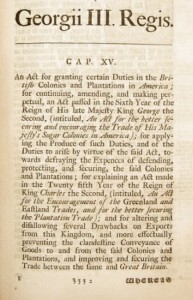

On April 5, 1764, Parliament passed something called “The Sugar Act”, which, interestingly, had another name: “The American Revenue Act”. It was a modification of the 1733 Molasses Act, and it also affected other goods, such as wine and coffee.

The Preamble to this Act states: “it is expedient that new provisions and regulations should be established for improving the revenue of this Kingdom … and … it is just and necessary that a revenue should be raised … for defraying the expenses of defending, protecting, and securing the same.”

The Sugar Act/American Revenue Act, therefore, was a revenue raising measure (and not just a regulation measure), whose revenue was intended to help defray the costs of defending the colonies during the 7 Years War which ended in 1763. Instead, it wreaked havoc in the colonies:

“The situation disrupted the colonial economy by reducing the markets to which the colonies could sell, and the amount of currency available to them for the purchase of British manufactured goods. This act, and the Currency Act, set the stage for the revolt at the imposition of the Stamp Act.”

Fast forward to 2014. A new measure was introduced by Rep. Rosa deLauro called the SWEET Act, also known as the “Sugar-Sweetened Beverages Tax” — a proposed tax of “one cent per teaspoon – 4.2 grams – of sugar, high fructose corn syrup or caloric sweetener”.

The Act sounds eerily like a revenue-raiser, much like its ancestor, the Sugar Act. From the text of the SWEET Act:

“This Act is intended to discourage excessive consumption of sugar-sweetened beverages by increasing the price of these products and by creating a dedicated revenue source for programs and research designed to reduce the human and economic costs of diabetes, obesity, dental caries, and other diet-related health conditions in priority populations”

Let’s compare:

Sugar Act: “improving the revenue of this Kingdom”… “just and necessary that a revenue should be raised”… “for defraying the expenses of defending, protecting, and securing the same.”

SWEET Act: “dedicated revenue source for programs and research”… “to reduce the human and economic costs of diabetes, obesity, dental caries, and other diet-related health conditions”.

Same over-reaching thinking, different government.

As a response to the Sugar Act in May 1764, Samuel Adams drafted a report on the Sugar Act for the Massachusetts assembly, in which he denounced the act as an infringement of the rights of the colonists as British subjects:

For if our Trade may be taxed why not our Lands? Why not the Produce of our Lands & every thing we possess or make use of?

”

Will there also be a similar rebuke over the Sweet Act of 2014? The Sugar Act was subsequently repealed in 1766 because it was such a disastrous piece of legislation. Let’s hope history doesn’t repeat itself and the SWEET Act never comes to fruition.

by | ARTICLES, BUSINESS, GOVERNMENT, OBAMA, POLITICS, RETIREMENT, TAXES

A study was released today that showed more than a third of Americans, (36%)a have saved nothing for retirement. That got me thinking about the idea of retirement and the state of retiring in this country.

Everyone thinks they can retire at age 65. It’s an American ideal born in the last century with the rise of unions, the defined benefit plan, and generous pension systems. In reality, especially due to advances in health, medicine, and nutrition, many people have great capability to continue to work and contribute to society and themselves until 80. And they should — because they need to.

There is a crisis of affordability looming. Besides the enormously wealthy, for the most part no average person can afford to retire at 65. It is simply not possible, living a normal lifestyle, for anyone to put enough toward retirement that will enable him to live another 20-30 years. A life span of 85-95 is swiftly becoming the new norm. The only workers today who are the exception to this reality, and have any hope of a lengthy retirement with comfort, are public service employees.

Taxpayers have been long bamboozled into making generous commitments to the retirement systems of public service workers. All over the country, in all levels of federal and state governments, these defined benefit plan pension funds have proven to be vastly untenable. Yet to sustain the plans in their current arrangements and cover the obligations that have already been promised, the rest of society will be duty-bound/compelled to contribute to the retirement of those public service workers via higher taxes. This is turn makes the rest of the populace poorer — because their hard-earned money is being levied to the promised public pensioner, and not for able to be saved for themselves.

The grand scheme is becoming unhinged. One must realize that the more people continue to buy into the idea that they are supposed to “retire at 65”, the more they are suckered into continuing make their retirement years poorer and subsequently make the retirement years of public service employees richer. People see a public service worker being able to retire at that age and they think “I should be able to also do so”. This idea needs to change.

There are two reasons why most people think that such pension programs are still sustainable and normal: their troubles are largely masked because they encompass the larger budget process of federal/state/local governments (and how many people pay attention?) and the costs to keep the programs afloat are borne by all the rest of society — the taxpayers. This arrangement enables a small group of people to be paid a sizeable and continuous pension for until death. It is not out of the ordinary anymore for a person to receive $65K- $100K for the rest of their life. But the actuarial cost to provide that promised benefit is astronomical.

With the lifespan of Americans growing longer, retiring at 65 is no longer viable; the systems are badly strained. And it is certainly not rational for the longevity of Social Security and Medicare either. Yet the steadfast refusal of most of government to overhaul retirement systems or make age and formula adjustments to entitlement programs — in order to maintain this retirement facade — only compounds the problem. (See the latest regarding the annual Social Security report here)

Another one of the biggest detriments of being able to retire at 65 is investment return. Interest rates have been historically low for the last five years and there is a strong likelihood of them staying low for another few. As a result, peoples’ retirement portfolios have lagged in their anticipated growth and goals. The low rates mean less money overall for retirement time, a problem which can be offset by continuing to work and contribute to a retirement fund past the basic age.

Likewise, inflation is not just the issue that everyone thinks it is. The cost of “modern living”, the “keeping up with the Jones”, is a form of lifestyle inflation that adds to the problem. For example, newer models of everything due to technology constantly changing — upgrading TVs, cell phones, etc. are raising the bar for how much pensioners want to comfortably live on and live with.

In sum, with living longer, low rates of return, and the “cost of Jones’s increase”, people must begin to realize that the timespan between 65 – 80 can be, and should be, a healthy and productive time of life. Working, staying active, and continuing to save will be beneficial in the long run. The mindset of older citizens needs to change and they need to understand that they can should aim to be productive until they are 80. At 65 they can certainly slow down, but the concept of retiring and not working anymore at that age is unrealistic and unaffordable.

by | ARTICLES, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

Earlier this week, the business world was chattering about the news that Kinder Morgan, pioneer of the Master Limited Partnership (MLP) business model, was surrendering the MLP structure in favor of a more traditional corporation. This happened last Sunday.

While many questioned what this meant for the MLP model in general, the more pressing questions began to emerge when, the following day, the Treasury Department came out with a statement regarding MLPs: “We at the Treasury are looking into the effects of these transactions on future tax revenues. Instances where the tax base may be eroded serve as a reminder of why we need Congress to enact business tax reform that broadens the tax base and lowers tax rates.”

Much like that false crusade on inversions, here we have another instance of anti-business sentiment coming out of the Executive Branch. Obama’s abuse of the law is clearly now seeping down to his cabinet underlings who also think now they have the authority to rewrite the law as well — especially under the cloak of getting more tax revenue.

Starting this past April, the government issued a temporary pause in the formation of new MLPs. The way the process works is that the IRS would issue what’s known as “private letter rulings” that examine qualifying income, and then therefore allow an MLP to be formed. However, the Treasury Department decided to examine the standards being used, meaning that the creation of new MLPs have been on hold for a few months.

The internal committee has been tasked with evaluating the “aggressive” rulings regarding qualifying income of MLPs issued in recent years. The internal committee may determine that such rulings are too expansive and recommend stricter interpretations of what types of natural resources income constitute qualifying income.

Most folks in the business world fully expected the formation of MLPs to resume after rules were reviewed. Barrons noted that, “They went through a similar review process for REITs in 2013 and concluded that the approvals were in line with the law. The same results were expected for MLPs and that private letter rulings would resume. But Treasury seems to say they are looking at issues larger than the IRS which would seem like another attempt to jawbone companies in the future from seeking MLP approvals.”

This sudden interest in MLPs sounds eerily similar to the recent interest the government has taken in business “inversions”; the government claims (erroneously) that inversions also deprive the government of supposed-entitled tax revenue, the same flimsy justification for looking more closely at, and ceasing the formation of, MLPs.

The worst part about this new anti-business targeting is that it is completely unfounded. The Treasury Department makes it sound like MLPs somehow are avoiding paying tax revenue by the way the company is structured and calls on the need for “Congress to enact business tax reform”. Except that MLPs ARE a perfect example of a type of reformed business tax structure that Congress should be welcoming.

With MLPs, the business is only taxed once, (the way most business structures around the world already operate.) In the United States, however, corporations face an abominable problem in our tax code known as “double taxation”. Basically if a corporation pays its corporate taxes and then reinvests its profits, there is no extra tax. But if its profit earnings are given to the owner(shareholders), they are taxed again on that amount — hence the double taxation.

Contrast that with MLPs, which “does not incur income taxes. Its income is allocated among all partners in proportion to their ownership interest.” Hence, the taxation only occurs once. This singular taxation of businesses is what real broad-based tax reform should aim for.

The real inequality in the tax code is not the MLP structure, which only taxes businesses one time; it is the double taxation that major corporations face. If Obama is truly for tax reform — like he says he is when he talks about inversions — the MLP structure for businesses is one way to achieve that reform. (Another would be to lower the corporate tax rate.)

Going after MLPs now and reducing the number of them in existence is the opposite of tax reform. Allowing the Treasury Department to play with business rules willy-nilly is egregious. This MLP attack is just another example of how anti-business the Obama Administration really is.

by | ARTICLES, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, POLITICS

Lately there have been recent discussion about whether or not Congress can sue the President. We have had several occurrences, in fact, where the President has violated the Constitution by overreaching his authority with regard to Congress. In these instances, Congress should have the standing to sue the President.

When Congress has acted in its authority as the Legislative branch, that institution as a whole has been compromised when the President, acting as the Executive branch, has ignored the actions of Congress and acted unilaterally in a manner other than that which was decided by Congress.

For instance, Congress voted for Obamacare. It contained some 2000 pages of laws, rules, and regulations. And yet dozens of times since the implementation of the law (March 2010), parts of the law been ignored, delayed, or changed by the President or some of his agencies — directly contrary to the actions of Congress crafting and passing a law.

In an even more obtuse example, Obama passed the Dream Act on his own. Though the president wanted it, Congress did its institutional job and it did not pass. Instead of letting the matter end there, as proscribed by the Constitution, the president implemented it anyway.

The crux here lies in understanding the will of the people. Indeed, Thomas Jefferson aptly remarked that, “The will of the people is the only legitimate foundation of any government, and to protect its free expression should be our first object.”

Remember, Congress (composed of elected representatives) is the Legislative Branch. Under the Constitution, the Executive Branch has no direct power to pass legislation. That power lies solely with Congress. Therefore, if Congress does not create and pass a particular law, it is because the people don’t will it. That is the free expression of their Constitutional power.

When the President says, “I have to act because Congress does not”, he violates the will of the people with a gross overreach of Executive authority.

Part of the current problem lies in the fact that Obama’s actions are allowed to stand because no one fights it. If this continues without a challenge, then future successors in the Executive branch can — and will — point to Obama and say “Obama did it, so now we can too”.

So let’s get this clarified once and for all that the constitutionality of some of Obama’s actions are not correct. When Obama has acted directly contrary to a decision made by the institution of Congress — creating a law after Congress has declined to do so, or changing a law passed by Congress — he threatens the institution of the Legislative Branch itself and the will of the people as a whole. We have the will of the people through Congress, not the majority of the people’s opinion as defined by the latest poll question.

The three branches of government, and their checks and balances, must be meticulously maintained. A lawsuit on behalf of the institution of Congress to the President regarding powers specifically granted and not granted (including the lawmaking powers), is a necessary safeguard for our Constitutional Republic.

by | ARTICLES, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, POLITICS

As if the recent letter from the Inspectors General to Congress wasn’t enough, there’s a new story about apparent interference from the Feds into an Inspector General report.

The Washington Post reports today about an incident in which an Inspector General for the Commerce department received a “filtered” version that watered down telework abuse incidents in the U.S. Patent Office.

The original report, seen here described “‘fundamental issues’ with the business model of the patent office”, and that oversight was “Oversight of the telework program — and of examiners based at the Alexandria headquarters — was “completely ineffective,”.

The final report was only 16 pages, compared to the original one, which was twice the size.

The report confirmed the fears allayed in the aforementioned letter to Congress: The post reports that “Investigators recommended “unmitigated access” to records when abuse is suspected.

The version supplied to the inspector general, though, explained that managers did not provide full access to computer records that could substantiate allegations of fraud because officials did not want to be seen as “big brother” through electronic surveillance.”

This is in direct violation to the Inspector General Act of 1978, which mandates that each Inspector General is to “have access to all records, reports, audits, reviews, documents, papers, recommendations, or other material available”. And yet, this tactic is growing all-too-common with regard to Inspectors General and their ability to audit the federal government for waste, fraud, and mismanagement.

by | ARTICLES, CONSTITUTION, FREEDOM, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS, TAXES

Inspectors General (yes, that’s the plural) are considered watchdogs for the government. Their jobs primarily focus on “uncovering waste, fraud, and mismanagement”, which is an important function to keep government programs and agencies in check.

A serious breach of trust is evident, therefore, when 47 of 73 Inspectors General pen a letter to Congress describing “serious limitations on access to records.” That’s 64% of the total watchdogs who express such concerns. You can read the letter here:

The letter takes aim at primarily three agencies: the General at the Peace Corps, the Environmental Protection Agency, and the Department of Justice. These Inspectors General “recently faced restrictions on their access to certain records available to their agencies that were needed to perform their oversight work in critical areas.” The restrictions were not limited to just those Inspectors General; hence the overwhelming need to pen a letter to Congress. The Inspectors General described how other

“Inspectors General have, from time to time, faced similar obstacles to their work, whether on a claim that some other law or principle trumped the clear mandate of the IG Act or by the agency’s imposition of unnecessarily burdensome administrative conditions on access. Even when we are ultimately able toresolve these issues with senior agency leadership, the process is often lengthy, delays our work, and diverts time and attention from substantive oversight activities. This plainly is not what Congress intended when it passed the IG Act.

The Inspector General Act of 1978 is clear. The pertinent statute that relates to access is Section §6: Authority of Inspector General; information and assistance from Federal agencies; unreasonable refusal; office space and equipment. It patently states:

(a) In addition to the authority otherwise provided by this Act, each Inspector General, in

carrying out the provisions of this Act, is authorized—

(1) to have access to all records, reports, audits, reviews, documents, papers, recommendations,

or other material available to the applicable establishment which relate to programs and

operations with respect to which that Inspector General has responsibilities under this Act

The full text of the law can be found here:

The letter to Congress was addressed to the Honorable Darrell Issa, the Honorable Thomas R. Carper, The Honorable Elijah Cummings, and The Honorable Tom Coburn. What made the letter particularly notable, however, was its size and scope.

Darrell Issa described, “I’ve never seen a letter like this, and my folks have checked — there has never been a letter even with a dozen IGs complaining. This is the majority of all inspectors general saying not just in the examples they gave, but government wide, they see a pattern that is making them unable to do their job.”

Reading the official website for Inspectors General, one can see they pride themselves on service, “whose primary responsibilities, to the American public, are to detect and prevent fraud, waste, abuse, and violations of law and to promote economy, efficiency and effectiveness in the operations of the Federal Government.”

The fact that the majority of the Inspectors General find themselves unable to perform their duties to audit the federal government is quite troubling, because it is another example of the “most transparent administration” choosing to willfully cloak themselves in secrecy. Stonewalling the very agents — who have a duty to the American people to keep government in check — is another tactical abuse of power.

by | ARTICLES, BLOG, BUSINESS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

When the resident or his advisers talk about inversions these days, they are truly talking about intentional and virulent discrimination of our American companies compared to foreign companies.

In the present environment, U.S. companies are at a severe financial disadvantage compared to foreign companies. Inversions have nothing to do with taxes that the US or foreign companies pay on income they earn within the United States. It all has to do with foreign-earned income, which the United States government lays claim to — and is the only major country to do so. Under U.S. tax law, U.S. companies are forced to pay higher tax rates than other foreign companies on the income they make in foreign countries.

All inversions are, therefore, are a way for U.S. companies to change their HQ from the U.S. to a foreign country, for the sole purpose of allowing themselves the express privilege of being on par with foreign companies and eliminate the severe disadvantage that the U.S. puts on its own businesses!

It is outrageous that the government applies such discrimination. It is outrageous that American companies have to chose to move their headquarters elsewhere simply to survive and compete globally, because they are taxed on their profits in two jurisdictions — both domestic and foreign.

If the government truly abhors the thought of American companies moving their incorporation abroad, then they should drop this tax policy immediately. Make no mistake — every politician who favors this recent, artificial attack on “unpatriotic inversions” shows they are hostile and antagonistic to American companies as well.

For more on what inversions actually are, you can read this earlier article

by | ARTICLES, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, POLITICS

The Washington Post reports that a vote to sue President Obama for overreach of powers passed in the House. No Democrats supported the measure as well as 5 Republicans who also voted no.

Here’s where the mess begins. Most Americans are unaware of how the government actually works. Here’s all the nuances pertaining to Congressional and Executive power.

The Legislative branch, Congress, has the power to pass laws.

The Constitution does not grant specific permission for the Executive branch to issue executive orders.

Presidents have used Executive Orders to assist the officers of the Executive Branch (federal agencies) to carry out their duties.

In a court case in 1952, Youngstown Sheet & Tube Co. v. Sawyer, 343 US 579 the Supreme Court ruled that an Executive Order issued by President Truman, which placed all steel mills in the country under federal authority, was “not valid because it attempted to make law, rather than clarify or act to further a law put forth by the Congress or the Constitution”.

And more:

“The Youngstown decision was critical because it established a standard for the exercise of executive power. In his concurring opinion, Justice Robert H. Jackson described three different situations and three corresponding levels of presidential authority:

The president acts with the most authority when he has the “express or implied” consent of Congress

The president has uncertain authority in situations where Congress has not imposed its authority — either by inaction or indifference — and the president takes advantage of this “zone of twilight” to make an executive decision

The president acts with the least authority when he issues an executive order that is “incompatible” with the expressed or implied will of Congress. Such an act, wrote Justice Jackson, threatens the “equilibrium established by our Constitutional system” [source: Contrubis]”

Executive Orders are not meant to create new laws. Nevertheless, Presidents have, in recent years, pushed the envelope in this matter, using “the executive order as an increasingly powerful political weapon, pushing through programs and regulations — often controversial in nature — without Congressional or judicial oversight [source: Savage]. Executive orders can be overruled by the courts or nullified by legislators after the fact, but until then they carry the full weight of federal and state law [source: Contrubis]”

Obama’s response to the lawsuit vote was this:

“They’re going to sue me for taking executive actions to help people. So they’re mad I’m doing my job. And by the way, I’ve told them I’d be happy to do it with you. The only reason I’m doing it on my own is because you’re [Congress] not doing anything,”

One could argue that Obama’s response magnifies the problem. Obama’s job is not to take “executive actions to help people”. His job, per the Constitution, is to “take care that the laws be faithfully executed”. If Congress isn’t doing anything, that doesn’t mean the power to make laws, the Legislative Branch, is abrogated to the Executive Branch.

If Congress does not create and pass a particular law, it is because the people don’t will it. That is a free expression of Congress’s Constitutional power.

When the President says, “I have to act because Congress does not”, it can be argued that he violates the will of the people with a gross overreach of Executive authority.

Legal scholars have weighed in, suggesting that if Congress acts as one body with this lawsuit — in this case, the House passing the measure to sue — they will have decent Congressional standing from a legal perspective. Here’s more on how that works

Because this really has not been done before, it will likely take a long time to settle the matter. Stay tuned.

by | ARTICLES, BLOG, BUSINESS, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Reason does a good job (un)covering some clips from 2012, which feature the Chief Architect for Obamacare, Jonathan Gruber. They come at an awkward time just as a Circuit Court judge panel ruled that Obamacare was limited to only providing subsidies in state exchanges, not federal, per the text of the law. The government unsuccessfully argued that everyone meant both federal and state exchanges, and the text was akin to a typo.

Back to the clips and the article. Apparently, in 2012, Jonathan Gruber described precisely the opposite of the government’s recent argument — that Obamacare was limited to state run exchanges and the threat was that, if states did not set up exchanges, the residents of those states would lose out on millions and billions in tax subsidies. Oops.

After being presented with the video, Gruber denied that position and suggested the bill really just contained a typo. And then, a second video was found, also from 2012, which Gruber again argues the same point — that Obamacare only meant to have state-run exchanges. Remember, Gruber was the “chief architect of Obamacare”. Oops again.

The government did not anticipate that a majority of governors would reject the carrot of tax subsidies dangled in front of them when presented implementing Obamacare in their states. They simply did not comprehend that most states would find Obamacare too expensive or too bureaucratic. That is why the bill never said “federal exchanges”. The allure of tons of tax subsides was supposed to woo all the governors to be enticed by this poorly-crafted-bill-that-was-rammed-through-Congress.

When the embarrassment emerged that only a handful of states chose to participate, they scrambled to create federal exchanges, even though that was never intended in the first place. Now the courts have to fight it out. Now we have courts who are split between the language and the spirit of the law.

That is why this unearthing of video footage of the handpicked Obamacare crafter is particularly awkward for the government’s defense.

From the Reason article: (also worthwhile to go there and check out the videos)

“Obamacare’s defenders have responded by saying that this is obviously ridiculous. It doesn’t make any sense in the larger context of the law, and what’s more, no one who supported the law or voted for it ever talked about this. It’s a theory concocted entirely by the law’s opponents, the health law’s backers argue, and never once mentioned by people who crafted or backed the law.

It’s not. One of the law’s architects—at the same time that he was a paid consultant to states deciding whether or not to build their own exchanges—was espousing exactly this interpretation as far back in early 2012, and long before the Halbig suit—the one that was decided this week against the administration—was filed. (A related suit, Pruitt v. Sebelius, had been filed earlier, but did not challenge tax credits within the federal exchanges until an amended version which was filed in late 2012.) It was also several months before the first publication of the paper by Case Western Law Professor Jonathan Adler and Cato Institute Health Policy Director Michael Cannon which detailed the case against the IRS rule.

Jonathan Gruber, a Massachusetts Institute of Technology economist who helped design the Massachusetts health law that was the model for Obamacare, was a key influence on the creation of the federal health law. He was widely quoted in the media. During the crafting of the law, the Obama administration brought him on for consultation because of his expertise. He was paid almost $400,000 to consult with the administration on the law. And he has claimed to have written part of the legislation, the section dealing with small business tax credits.

After the law passed, in 2011 and throughout 2012, multiple states sought his expertise to help them understand their options regarding the choice to set up their own exchanges. During that period of time, in January of 2012, Gruber told an audience at Noblis, a technical management support organization, that tax credits—the subsidies available for health insurance—were only available in states that set up their own exchanges.

A video of the presentation, posted on YouTube, was unearthed tonight by Ryan Radia at the Competitive Enterprise Institute, a libertarian think tank which has participated in the legal challenge to the IRS rule allowing subsidies in federal exchanges. Here’s what Gruber says.

What’s important to remember politically about this is if you’re a state and you don’t set up an exchange, that means your citizens don’t get their tax credits—but your citizens still pay the taxes that support this bill. So you’re essentially saying [to] your citizens you’re going to pay all the taxes to help all the other states in the country. I hope that that’s a blatant enough political reality that states will get their act together and realize there are billions of dollars at stake here in setting up these exchanges. But, you know, once again the politics can get ugly around this. [emphasis added]

There can be no doubt, based on his record, that Gruber is a supporter of the law. He says so in the presentation. “I’m biased, I’m in favor of this type of law, I won’t hide that,” he says. He also explains early on that his entire presentation is made of “verifiable objective facts.”

And what he says is exactly what challengers to the administration’s implementation of the law have been arguing—that if a state chooses not to establish its own exchange, then residents of those states will not be able to access Obamacare’s health insurance tax credits. He says this in response to a question asking whether the federal government will step in if a state chooses not to build its own exchange. Gruber describes the possibility that states won’t enact their own exchanges as one of the potential “threats” to the law. He says this with confidence and certainty, and at no other point in the presentation does he contradict the statement in question.

In early 2013, Gruber told the liberal magazine Mother Jones that the theory advanced by the challengers in this case was “nutty.” Gruber also signed an amicus brief in defense of the administration and the IRS rule. But judging by the video it is quite clear that in 2012 he accepted the essence of the interpretation advanced by the challengers.

Unless this video is a fraud or there are relevant details missing, there are only two options here: Either Gruber, a key influence on the legislation who wrote part of the law and who consulted with multiple states on setting up their own exchanges, was correct, and the law explicitly limits subsidies to state-run exchanges.

Or he was wrong in a way that perfectly aligns with both the clear text of the legislation and the argument later made by the challengers to the IRS rule allowing susbidies in federal exchanges.

Update: Earlier this week, Gruber was on MNSBC to address the Halbig ruling. He was asked if the language limiting subsidies to state-run exchanges was a typo. His response: “It is unambiguous this is a typo. Literally every single person involved in the crafting of this law has said that it’s a typo, that they had no intention of excluding the federal states.”

Update 2: The Cato Institute’s Michael Cannon, who was instrumental in developing the arguments that laid the groundwork for the legal challenge in Halbig, responds to the video at Forbes:

I don’t mean to overstate the importance of this revelation. Gruber acknowledging this feature of the law is not direct evidence of congressional intent. But Gruber is probably the most influential private citizen/government contractor involved in that legislative process. He was in the room with the people who crafted this bill.

Update 3: Gruber says the statement in the video was “a mistake.” Jonathan Cohn of The New Republic got a response from Gruber this morning. Here are a few snippets:

I honestly don’t remember why I said that. I was speaking off-the-cuff. It was just a mistake. People make mistakes. Congress made a mistake drafting the law and I made a mistake talking about it.

During this era, at this time, the federal government was trying to encourage as many states as possible to set up their exchanges. …

At this time, there was also substantial uncertainty about whether the federal backstop would be ready on time for 2014. I might have been thinking that if the federal backstop wasn’t ready by 2014, and states hadn’t set up their own exchange, there was a risk that citizens couldn’t get the tax credits right away. …

But there was never any intention to literally withhold money, to withhold tax credits, from the states that didn’t take that step. That’s clear in the intent of the law and if you talk to anybody who worked on the law. My subsequent statement was just a speak-o—you know, like a typo.

Update 4: Gruber appears to have made a second “speak-o.” In a separate speech, he spoke of the “threat” posed by states declining to build their own exchanges. And he once again explicitly ties the creation of state-based exchanges to the law’s tax credits (its subsidies for private health insurance insurance).

On January 10, 2012, in a speech at the Jewish Community Center of San Francisco, Gruber said that “by not setting up an exchange, the politicians of a state are costing state residents hundreds and millions and billions of dollars….That is really the ultimate threat, is, will people understand that, gee, if your governor doesn’t set up an exchange, you’re losing hundreds of millions of dollars of tax credits to be delivered to your citizens.”

by | ARTICLES, BLOG, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

Obama has called “for an end to a corporate loophole that allows companies to avoid federal taxes by shifting their tax domiciles overseas in deals known as ‘inversions’.” Such as statement shows the utter ineptitude that Obama has for understanding a) what inversion actually is and b) how his policies are the cause.

Inversion is not a “corporate loophole” and companies who do so are not “avoiding federal taxes”.

Currently, only the United States taxes American companies on foreign profits as well as domestic. No other major country does this. This policy is non-competitive, stupid, and a major reason why inversion occurs. An American company is being taxed in two jurisdictions.

For instance, if Honda is making cars in the United States, it pays the same taxes as General Motors. But if an American company is in Japan, it has to pay both Japanese taxes and American taxes and therefore has to make an even larger profit just to stay competitive and survive.

If foreign sales grow substantially, a company will find itself paying increased U.S. taxes because it is still incorporated in this country and we tax both foreign and domestic profits. Eventually, a U.S. company may find by moving its incorporation to a different country, it can cease paying U.S. taxes on income that is not generated in the United States — the way every other advanced nation, except for the United States, operates. That extra savings in taxes can be reinvested in the company itself.

Couple this ridiculous tax law with the fact that we also have the highest corporate tax rate in the world as well as a substantial number of stifling regulatory agencies, and it’s small wonder why some companies choose to move abroad eventually.

To call this a “corporate loophole” is exceedingly disingenuous. For some companies to survive, they may have no choice but to move its legal status elsewhere. American companies are in business to make and do things, not to comply with exhaustive tax policy and burdensome bureaucracy. However, the business climate in this country is difficult and to call a company a “deserter” or “unpatriotic” casts the blame squarely in the wrong place — which is a government that over-taxes and over-regulates. That is the problem, and inversion is a symptom of an anti-business environment.

To insinuate that companies who go through the process of inversion are “avoiding federal taxes” entirely omits the reality that this country is the only country who taxes companies both on domestic and foreign profits. Just because we can tax them this way, doesn’t mean we ought to. Reforming the tax code is a better solution.

“Needing to reform inversion” is merely creating another tax grab for Obama — masquerading as fighting against “bad corporations” in order to pander to the rhetoric of the left. The government continues to run chronic deficits and is considering this measure in order to fleece businesses for extra tax revenue. They already face oppressive taxation and burdensome regulation. Attacking them for doing what they might need to do, in order to stay in business, is repugnant.