by | ARTICLES, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS

It was certainly no surprise to most of us the the CBO report showed Obamacare was costing the economy countless jobs. White House and congressional Democrats could have put a rational spin on it – that this was a necessary price to pay in order to get his signature health care proposal implemented, – but they didn’t do that.

Instead, they chose a response which showed them to be the disingenuous hypocrites that they truly are. It also showed that the true intention is simply political — in other words, they wantonly come up with whatever excuse will lose them the least number of votes.

The White House and congressional Democrats have explained the CBO’s job loss outlook to actually be a good thing. The job losses merely reflect the fact that individuals will, going forward, have choices. Such examples include the option to retire before one might have otherwise done so, or perhaps stay at home as a single parent because the government is providing for them (health care) what otherwise only a job could.

But this “logic” is ridiculous. Electing the option to not work when one could do so will certainly prevent many people from getting ahead along the economic chain. And in combination with an extension of food stamp benefits, an extension of unemployment benefits, an extension of other welfare programs, and raising the minimum wage, all are acting in tandem to prevent the upward mobility that the President has said he so sorely wants and unequivocally demands.

He can’t have it both ways. The President cannot be both against economic inequality and simultaneously for policies that maintain prolonged dependence. The preposterous idea that work is now a “lifestyle” choice reveals the shallowness of his commitment to economic success.

by | ARTICLES, HYPOCRISY, OBAMA, OBAMACARE

Obama has lied to this country. Most recently and most memorably, he lied to when he told “you can keep your health plan” and “you can keep your doctor”. But charging that someone “lied” implies that they knew it was untrue when they said it, so how can anyone be sure?

Records dating back to 2010 discussed the fallout from ObamaCare implementation that would render most plans obsolete and doctor choices restricted. If Obama truly believed that individuals could keep their health plan and doctor under ObamaCare, this belief had to come from being lied to or intentionally misled by one or more advisors.

However, if he was lied to or misled by his advisor(s), the individual(s) responsible would have been immediately fired by President Obama. The President of the United States can never tolerate the Office having its integrity undermined by lesser staff.

Therefore there are no explanations for the President not firing a lying advisor on the spot other than 1) these individuals had information regarding what the President knew and when he knew it, which would be exposed if they were fired; or 2) in fact, the truth had been conveyed to the President (and the President lied to us anyway).

On the other hand, you can contrast Obama’s behavior with Chris Christie. Say what you will about Chris Christie, but consider this: upon learning that he had been misled in the George Washington Bridge lane closing matter, Christie immediately fired the several individuals involved. He did not tolerate his office being denigrated by staffers who were not forthcoming to their governor.

How could it be, then, that President Obama did not have the necessity or integrity to fire anybody because for lying about ObamaCare? Because they probably didn’t lie.

It is not a new thing for our President to intentionally misrepresent the truth on many issues regarding ObamaCare — he does so on almost a daily basis now because ObamaCare was his signature legislation and it is an unmitigated disaster.

One of the most oft-repeated distortions is his recurring theme that ObamaCare will result in a net reduction in the federal debt. At a Clinton Global Initiative recently, the President said “It is a net reduction of our deficit. The irony of those who are talking about repealing Obamacare because of, it’s so wildly expensive, is if they actually repealed the law, it would add to the deficit.” What a joke.

Everyone – including the President – full well knows that the original concept of reducing the deficit was based on underestimating costs and overstating revenues. On top of that, fiscal changes made both by Congress (such as repealing the 1099 initiative) and the President (implementation delays) have guaranteed that ObamaCare will seriously add to the National Debt. So, clearly, at the time of the Clinton Global Initiative, the President knew his comment was a lie.

What’s worse, the pathetic, anemic enrollment numbers (yet another item being played with loose and fast by the Administration) means that ObamaCare costs will soar in this country because not nearly enough people have wanted to enroll. ObamaCare, and President Obama, are rife with — not inconsistencies, not misstatements, but intentional lies.

The President certainly knows it. And we know it too.

by | ARTICLES, OBAMACARE, TAX TIPS, TAXES

Do you make above $250,000 (married joint filer) or $200,000 (individual filer)? For 2013 filers, you get to pay an additional tax starting this year.

Prior to tax year 2013, the Medicare Payroll tax was 2.9%. Self-employed taxpaxers pay the entire 2.9% themselves. Non self-employed taxpayers pay this tax split evenly between employer and employee, each paying 1.45%

The new surtax that starts this year was implemented as part of paying for Obamacare. It tacks on an additional 0.9% tax for filers above the aforementioned thresholds. Additionally, if you are married filing separately, the threshold is $125,000. See below:

Previous Law:

Employer/Employee 1.45%/1.45%

Self-employed 2.9%

Obamacare Tax Hike, 0.9% Surtax

Individual: First $200,000 (same as old law)

Married/Joint: First $250,000 (same as old law)

Married/Separately: First $125,000 (same as old law)

Individual: Above $200,000

Married/Joint: Above $250,000

Married/Separately: Above $125,000

Employer/Employee 1.45%/2.35%

Self-employed 3.8%

This additional tax is found on pages 2000-2003 of the PPACA.

If you think you may owe the new 0.9% tax, you should fill out the “Additional Medicare Tax” Form, which is also called Form 8959

by | ARTICLES, BLOG, OBAMACARE, TAX TIPS, TAXES

New Changes to the Itemized Medical Deduction

For years, taxpayers have been able to claim an itemized deduction on their taxes for medical expenses. That deduction still exists, but the threshold has been increased starting this years, as part of the implemenation of Obamacare taxes.

When a taxpayer, spouse, and/or dependents accumulate large medical bills in a given year, the ability to deduct them comes as a welcome relief to many family. The rule-of-thumb was that the sum of medical expenses totalled 7.5% or more of the Adjusted Gross Income (AGI). So for instance, if a family’s AGI was $50,000, they could claim an itemized deduction of medical expenses if it was at least $3,500 (not including insurance premiums, etc).

Now beginning this year and beyond, the threshold has been raised to 10% AGI. That same family making $50,000 AGI needs to have accumulated $5,000 worth of qualifying medical expenses before they can claim that deduction on their tax return.

There is one group for which the floor is still 7.5%; that is persons who are age 65 and above. The 7.5% AGI calculation will remain as such for another 4 years until 2017.

For data through 2009 from the IRS, 10 million families used this tax deduction. Raising the threshold was a means to limit the amount of deductions taxpayers would claim starting this year, thereby raising more tax revenue to pay for Obamacare.

This change is found of found on pages 1,994-1,995 of the PPACA.

——————————-

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ECONOMY, OBAMA, OBAMACARE

Last week’s Meet the Press roundtable featured, among others, E.J. Dionne — a columnist with the Washington Post. Mr. Dionne’s discussion on Obama and Obamacare was so incredibly inaccurate, it is quite obvious that he is a person who just likes to make up facts as he goes along. And with moderators like David Gregory, who do little to nothing to question the commentary coming from his guests, viewers are left with severely wrong or misinterpreted information.

Some highlights from the show:

>>“Look, I think there is something crazy when people say where government can’t deliver health care. Ever heard of Medicare? Ever heard of Medicaid?”

The fact is that Medicare is actuarially and actually bankrupt, and Medicaid is virtually bankrupting large numbers of states as we speak. Why do people have a positive view of Medicare – simply because they are getting $3 of medical care for each $1 they spend (and hiding from them the fact that the $2 difference will be paid by their children and grandchildren). An SEC investigation would have everyone associated with such a program behind bars. I suppose technically the government does “deliver healthcare” via Medicare and Medicaid but they are so egregiously flawed and mismanaged that it can hardly be considered successful.

> >”President Obama chose to go for a model that is a market-oriented model that Republicans favor, of helping people buy private health insurance”.

A blatant lie. Republicans do favor a market oriented model, but ObamaCare is certainly not anything like one. Can anyone list all the names of the House Republicans who supported and voted for Obamacare in Congress? None? That’s right. In addition, Obamacare is no more a market-oriented model when it renders obsolete millions of plans already freely chosen by Americans and replaces them with fewer and more expensive options — while bullying insurance companies to alter dates and plans according to the whim of any number of government agencies.

>>But what you’re seeing already is there is an enormous appetite among all the Americans who don’t have health insurance to buy it. And that’s what’s going to save Obamacare. This is filling a real need in the society”.

The actual enrollment figures for Obamacare are way off and lower-than-expected. It is so dismal that the White House is counting among the totals for the media the number of people who have “put a plan in their shopping cart” but haven’t paid for it yet in order to bolster totals. Likewise, a lack of “appetite” for Obamacare has resulted in the Obama Administration panicking and paying hundreds of millions of taxpayer money to run commercials and partner with organizations, groups, and non-profits in order to push citizens to sign up before the deadlines (that keep shifting).

>>Every rich democracy in the world uses government to deliver healthcare. You had Christine Lagarde on. France spends less per capita in government spending to cover everybody than we spend for just Medicare and Medicaid. So this thing can work. It needs fixes. And I think the next move by the president is to tell Republicans, do you want to fix this or do you just want to get rid of it?

First of all, the United States is a Republic, not a democracy. Second, the emphasis on the word “rich” is telling because it reeks of the same class warfare-equality policies that have been quintessential to Obama’s presidency. Obamacare is exactly that. It is a wealth transfer that forces the healthy and/or wealthy to subsidize the plans of the uninsured, sicker, or poorer through government fiat — an “individual mandate”. And while Mr. Dionne wishes to hold up France as the pinnacle of Western governing, the French just passed a 75% tax on the wealthy in order to pay for the Socialist policies of Francois Hollande.

E.J.Dionne is representative of the typical progressive pundit who has no framework of reality, and frankly, doesn’t seem to care. He repeats whatever talking points are suitable for the day and the Obama Administration, and its a damn shame that the actual moderators of Meet the Press lack the knowledge or fortitude to call into question their information.

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ELECTIONS, OBAMA, OBAMACARE, POLITICS

With all the talk abuzz about an inevitable Hillary Clinton candidacy, I wager that her platform might quite likely include repealing Obamacare. Hillary is certain to declare late in the spring so that she can positively impact the midterm elections to benefit the Democrats.

What would Hillary gain from a repeal-Obamacare platform? Here’s three things:

First, a “repeal-Obamacare” position would effectively neuter the Republican narratives of anyone running in 2014 (and possibly beyond). All the hand-wringing and fundraising, all the sob-stories and alarm bells about Obamacare would be utterly weakened if Hillary was out there saying the exact same thing.

Think about it: any Republican candidate on the same policy page as Hillary Clinton would be disastrous for that candidate. The Republicans are hoping for strong gains in 2014 — possibly even taking the Senate — and are banking on a fledgling Obamacare to do it. This objective could not be achieved with Hillary added to the mix arguing that Obamacare is not good legislation.

Second, a “repeal-Obamacare” position from Hillary would give vulnerable Democrats a free pass to sever close ties and loyalty to Obama. Obama is toxic right now; his popularity is in the mid ‘30s and his signature legislation is overwhelmingly disliked across the country. With Hillary jumping in, Democrats would be able to rally around a more popular and likeable Democrat (what Democrat doesn’t like the Clintons?). They could distance themselves from Obama and Obamacare without hurting the Democrat brand for the elections; Hillary enhances that brand right now much better than Obama can.

Finally, Hillary herself was intimately involved in health care reform after Clinton’s election in 1992. The legislation she helped champion via the Taskforce For Health Care Reform was aptly dubbed “Hillarycare”.

Twenty years later — in comparison to what we’ve seen of Obamacare, does Hillarycare looks so bad? Maybe not to some people. Is this the alternative solution and finally Hillary’s day in the sun? Possibly, but not likely.

It is much more plausible that Hillary would take healthcare reform even further than Obamacare. Knowing the growing disdain for mandates and the insurance system that seems helplessly broken right now, Hillary would likely lobby instead for a single-payer system.

This is a dream of many progressives and Democrats. It would be presented as a “simplified” alternative solution to the byzantine problem that is Obamacare, at a time when the Republicans lack their own, strong Obamacare alternative.

Whatever the case, running on repealing Obamacare is a win-win for Hillary. She gets to directly impact and help the midterm elections for the Democrats. 6 years after her primary defeat against Obama, Hillary will emerge as the better, wiser, and more likeable Democrat (revenge is a dish best served cold?). And finally, Hillary will have the unprecedented opportunity to finish the healthcare reform she started two decades ago, since practically anything will be seen as better than Obamacare now.

by | ARTICLES, BLOG, HYPOCRISY, OBAMA, OBAMACARE, POLITICS

Today, the architect of Obamacare, Zeke Emanuel, modified another one of Obama’s promises. This time, he explained the “if you like your doctor, you can keep your doctor” now actually means “if you want to, you can pay for it,”.

During Fox News Sunday, Chris Wallace pressed Emanuel to whether the promise would be upheld. Here’s the exchange, courtesy of The Weekly Standard.

“The president never said you were going to have unlimited choice of any doctor in the country you want to go to,” said the Obamacare architect.

“No. He asked a question. If you like your doctor, you can keep your doctor. Did he not say that, sir?”

“He didn’t say you could have unlimited choice.”

“It’s a simple yes or no question. Did he say if you like your doctor, you can keep your doctor?”

“Yes. But look, if you want to pay more for an insurance company that covers your doctor, you can do that. This is a matter of choice. We know in all sorts of places you pay more for certain — for a wider range of choices or wider range of benefits….“

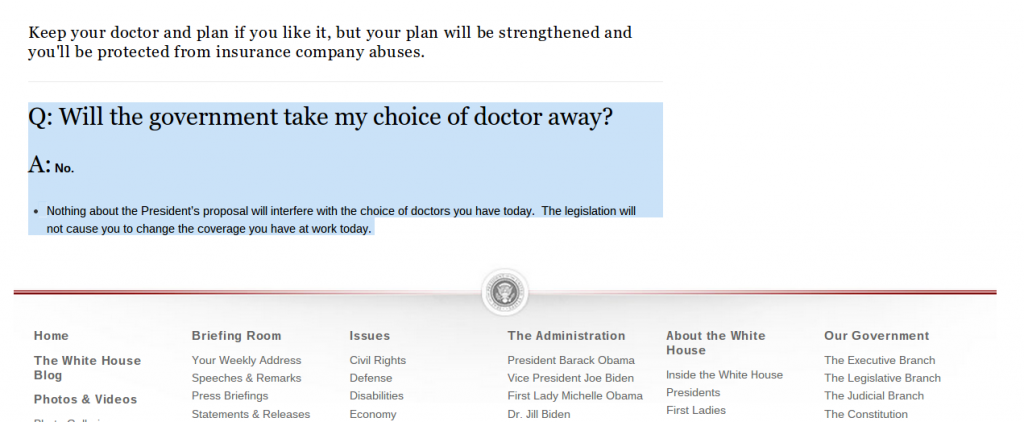

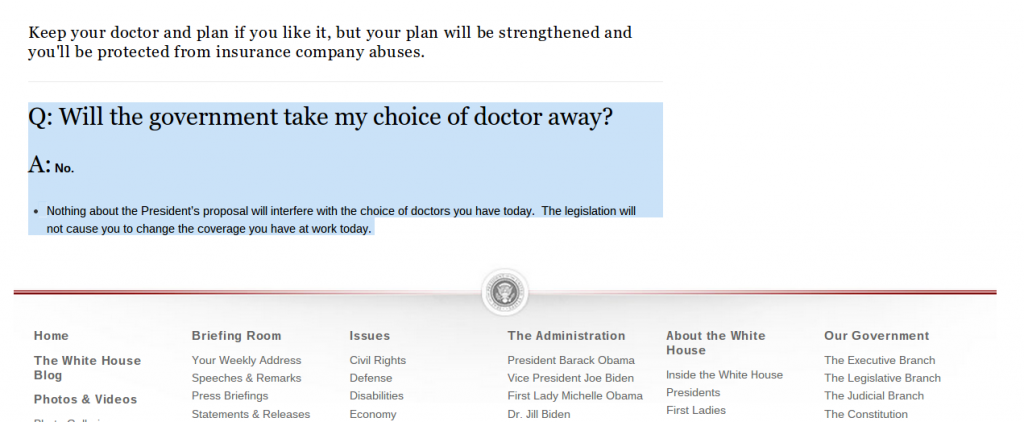

Here’s the problem. Right on the White House website, there is a document called “Health Insurance Reform Reality Check”. . There it states: “It’s never been more important to dispel these outlandish rumors and myths. Learn the facts and share them with your friends, family and neighbors.”

Then it has a “Reality Check” list. The very first bullet item says this:

“You Can Keep Your Own Insurance

Reform isn’t about putting government in charge of your health insurance; it’s about putting you in charge of your health insurance. If you like your doctor, you can keep your doctor. If you like your health care plan, you can keep your health care plan”.

Notice that it doesn’t say, “if you like your doctor, you might have to pay more”

This isn’t the only place on whitehouse.gov that has the Doctor Promise. On the FAQ page entitled “Putting Americans In Charge of their Health Care”, it says:

“Q

: Will the government take my choice of doctor away?

A: No.

Nothing about the President’s proposal will interfere with the choice of doctors you have today. The legislation will not cause you to change the coverage you have at work today”

Here’s the screencap:

In fact, the Doctor Promise goes all the way back to at least 2009. On whitehouse.gov, you can find Obama’s weekly address from August 8th, 2009, where he states,

“So, let me explain what reform will mean for you. And let me start by dispelling the outlandish rumors that reform will promote euthanasia, cut Medicaid, or bring about a government takeover of health care. That’s simply not true. This isn’t about putting government in charge of your health insurance; it’s about putting you in charge of your health insurance. Under the reforms we seek, if you like your doctor, you can keep your doctor. If you like your health care plan, you can keep your health care plan.

So, since at least 2009, we’ve been hearing the simple promise, “if you like your doctor, you can keep your doctor”. Yet today we hear a modified version of that Promise, much like the recent caveat to the “If you like your plan, you can keep your plan” promise”.

Now we find out the caveat to the Doctor Promise. Here’s the rest of the interview with Emanuel from earlier today. The exchange with Wallace finishes up:

“The president guaranteed me I could keep my doctor,” said Wallace.

“And if you want to, you can pay for it,” said Emanuel.

Caveat emptor, indeed.

by | ARTICLES, OBAMA, OBAMACARE, POLITICS, QUICKLY NOTED

“It will be of little avail to the people, that the laws are made by men of their own choice, if the laws be so voluminous that they cannot be read, or so incoherent that they cannot be understood; if they be repealed or revised before they are promulgated, or undergo such incessant changes that no man, who knows what the law is to-day, can guess what it will be tomorrow. Law is defined to be a rule of action; but how can that be a rule, which is little known, and less fixed?” ~

~Federalist #62

by | FREEDOM, HYPOCRISY, OBAMA, OBAMACARE, POLITICS

The great bait-and-switch of Obamacare (“you can keep your plan and your doctor”) was intentionally orchestrated by the architects of the legislation. There were thousands of policies offered nationwide that were good and even very good but now they can’t be sustained under the new Obamacare policy requirements. These regulations are so narrow that it intentionally made obsolete or non-compliant the vast majority of health care policies in that were currently in existence, thereby requiring the insurers to cancel those offerings.

There are 10 essential benefits to Obamacare that every policy now must have. Most of them are routine and were likely found in some form on the vast majority of plans pre-Obamacare. Forbes recently compiled a list of these required items:

1) Ambulatory patient services – Care you receive without being admitted to a hospital, such as at a doctor’s office, clinic or same-day (“outpatient”) surgery center. Also included in this category are home health services and hospice care (note: some plans may limit coverage to no more than 45 days).

2) Emergency services – Care you receive for conditions that could lead to serious disability or death if not immediately treated, such as accidents or sudden illness. Typically, this is a trip to the emergency room, and includes transport by ambulance. You cannot be penalized for going out-of-network or for not having prior authorization.

3) Hospitalization – Care you receive as a hospital patient, including care from doctors, nurses and other hospital staff, laboratory and other tests, medications you receive during your hospital stay, and room and board. Hospitalization coverage also includes surgeries, transplants and care received in a skilled nursing facility, such as a nursing home that specializes in the care of the elderly (note: some plans may limit skilled nursing facility coverage to no more than 45 days).

4) Laboratory services – Testing provided to help a doctor diagnose an injury, illness or condition, or to monitor the effectiveness of a particular treatment. Some preventive screenings, such as breast cancer screenings and prostrate exams, are provided free of charge.

5) Maternity and newborn care – Care that women receive during pregnancy (prenatal care), throughout labor, delivery and post-delivery, and care for newborn babies.

6) Mental health services and addiction treatment – Inpatient and outpatient care provided to evaluate, diagnose and treat a mental health condition or substance abuse disorder (note: some plans may limit coverage to 20 days each year).

7) Rehabilitative Services and devices – Rehabilitative and habilitative services and devices to help you gain or recover mental and physical skills lost to injury, disability or a chronic condition. Plans have to provide 30 visits each year for either physical or occupational therapy, or visits to the chiropractor. Plans must also cover 30 visits for speech therapy as well as 30 visits for cardiac or pulmonary rehab.

8) Pediatric Services – Care provided to infants and children, including well-child visits and recommended vaccines and immunizations. Dental and vision care must be offered to children younger than 19. This includes two routine dental exams, an eye exam and corrective lenses each year.

9) Prescription drugs – Medications that are prescribed by a doctor to treat an illness or condition. Examples include prescription antibiotics to treat an infection or medication used to treat an ongoing condition, such as high cholesterol. At least one prescription drug must be covered for each category and classification of federally approved drugs.

10) Preventive and wellness services and chronic disease treatment – Preventive care, such as physicals, immunizations and cancer screenings designed to prevent or detect certain medical conditions. Also, care for chronic conditions, such as asthma and diabetes.

The bulk of this list consists of items that were not necessarily mandatory on any insurance plan, but were fairly common in some form or another. For instance, maternity care might have been an add-on some plans, included on others, but was relatively common in the industry. However, there are two items in particular on this list which are recent healthcare innovations not widely found. Therefore, their inclusion as criteria for assessing whether a health plan was “good” or “not good” rendered most current insurance plans incomplete — and therefore obsolete — for Obamacare. They are 1) “rehabilitative and habilitative care” and 2) “pediatric services”.

On the matter of rehabilitative and habilitative services, the new Obamacare essential makes a distinction between Rehabilitative Services (which help to recover lost capacities) and Habilitative Services (which “help people acquire, maintain, or improve skills and functioning for daily living”). Statereforum.org, a site devoted to health reform implementation, concurs that Habilitative services — a word not readily familiar to many people — are “a set of benefits not traditionally covered by private health insurance”.

When Health and Human Services made their final decisions this past November on the 10 Essentials for health plans, it “recognized that many health plans across the country do not recognize habilitative services as a distinct group of services. HHS proposed a flexible policy that allows states to define habilitative services if their benchmark plan fails to do so”. In the Federal Register published on November 26, 2013, it was specifically noted that this flexibility “will provide a valuable opportunity for states to lead the development of policy in this area and welcome comments on this proposed approach to providing habilitative services”. In other words, HHS created an benefit requirement that most insurance plans didn’t cover and isn’t even uniformly defined in the industry. Because nearly all plans lacked this “essential item”, most existing health insurance plans have been declared non-compliant.

With regard to pediatric services, it has typically been a matter in the healthcare industry that dental and vision coverage — particularly for children — are not to be included as part of a health insurance policy. Those that do have almost always have it as an add-on where you get services elsewhere, and only a few of the largest companies even bothered to offer it. This “must have” was never a part of a normal healthcare environment, and by making this one of the compliance items, it too has rendered nearly all plans incompatible with Obamacare regulations.

It has become clear that few existing health insurance policies pass the Obamacare litmus test. This carefully engineered attack on the “bad apple” health care industry was to induce a large-scale shift of citizens onto the exchanges (to pay for Obamacare) after their insurance was inevitably canceled. “If you like your plan you can keep it”, was a hollow promise all along. With the website calamity, Obamacare has utterly backfired — but the citizens are left holding the bag of higher costs, canceled plans, and an uncertain future. There is a sense of irony that the Obamacare “benefits” have done nothing to benefit anyone.

by | ARTICLES, OBAMA, OBAMACARE, POLITICS

Are you a genetic lottery winner? Too bad.

The legislative name for Obamacare is the Affordable Care Act. This name was chosen precisely to appeal to Americans to consider buying a health insurance plan from a government-run exchange. Who doesn’t like the idea of something that is “affordable”? By using that term, it suggested that the current system of health care was the opposite –“unafforable”. But the Affordable Care Act was merely a red herring for what the government really thought about the healthcare system — that it was discriminatory, and could be used as another vessel for wealth transfer.

Yesterday’s interview transcript between Chuck Todd and the Architect of Obamacare, Mr. Jonathan Gruber, M.I.T. should be screaming from every newspaper this morning. But there was hardly a blip on the radar screen. Real Clear Politics has the video. Mr. Gruber revealed the singular truth about the real reason our government created and passed Obamacare — it was not about an “affordable” new system; it was about a “discriminatory” old system, and the government “fix”. Here’s what Gruber described:

“We currently have a highly discriminatory system where if you’re sick, if you’ve been sick or [if] you’re going to get sick, you cannot get health insurance. The only way to end that discriminatory system is to bring everyone into the system and pay one fair price.

That means that the genetic winners, the lottery winners who’ve been paying an artificially low price because of this discrimination now will have to pay more in return. And that, by my estimate, is about four million people. In return, we’ll have a fixed system where over 30 million people will now for the first time be able to access fairly price and guaranteed health insurance“.

Where to start?

The most glaring and insulting concept in his statement is the idea that someone is a “genetic winner” and “a lottery winner” that has been “paying an artificially low price because of this discrimination”.

The idea of a “genetic winner” is incredibly chilling. Brave New world-ish even. It completely removes the idea of personal responsibility in the health equation. We are somehow only and entirely healthy or not because of superior genetics, and therefore those who are should be financially punished for it due to a government-imposed standard of “fairness”.

The next absurity goes hand-in-hand with that — the idea that people who “won” the “genetic lottery” are paying artificially low prices for insurance. By what standard is something “artificially low” (or not)? The government standard! Not the insurance market. The government tells us something is artificially low and therefore needs to be corrected. It is their justification to punish the “winners”, a form of reparation of to those who the government considers “genetic lottery losers”. Pay up! It’s not fair you have been paying too low of a price!

Gruber also describes in detail how the government has decided the system is discriminatory: “where if you’re sick, if you’ve been sick or [if] you’re going to get sick, you cannot get health insurance. At every point in time — present, past, and future — the system discriminates. If you might get sick in the future, you cannot have insurance now! Such a statement defies all logic. But it doesn’t matter. The groundwork is laid bare: our health care discriminates.

What is the solution? Gruber explains that the only way to level the playing field and be fair is to force the “genetic winners” to pay their fair share (sound familiar?).And finally, finally, Gruber tells us, “In return, we’ll have a fixed system where over 30 million people will now for the first time be able to access fairly price and guaranteed health insurance”.

A fixed system now. Because the government decided the system was “broken”. It was the fault of the genetic lottery winners and the artifically low prices who discriminated against those who did not have insurance. Are you a genetic lottery winner? The government finds you contemptible.

Of course, there was no distinction of the uninsured between those who could not get insurance or who chose not to have insurance either. The Uninsured were discriminated against. And that needed to be fixed — by the government. We’re here to help.

The Affordable Care Act is only about being affordable to some. It is revealed to be another giant wealth transfer. Take the genetic lottery winners, kick them off their freely chosen policies, put them on the more expensive Obamacare government exchanges, and subsidize those who have been discriminated against to make it fair for all.

Fairness is yet again the objective of, and gift from, the government — no matter the cost to our wallets or our dignity.