by | ARTICLES, BLOG, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

With Bernie Sanders doing well against Hillary Clinton for the Democrat nomination, it’s a great time to look at some of the specifics of his tax plan. The Tax Foundation studied the affects of the major changes (listed below). Their analysis found that Sander’s plan will reduce typical income by more than 15% while simultaneously hiking taxes by the trillions and shrinking the GDP by nearly 10% over the next decade.

First, Sander’s plan highlights:

Individual Income Tax Changes

–Adds four new income tax brackets for high-income households, with rates of 37 percent, 43 percent, 48 percent, and 52 percent.

–Taxes capital gains and dividends at ordinary income rates for households with income over $250,000.

–Creates a new 2.2 percent “income-based [health care] premium paid by households.” This is equivalent to increasing all tax bracket rates by 2.2 percentage points, and would raise the top marginal income tax rate to 54.2 percent.

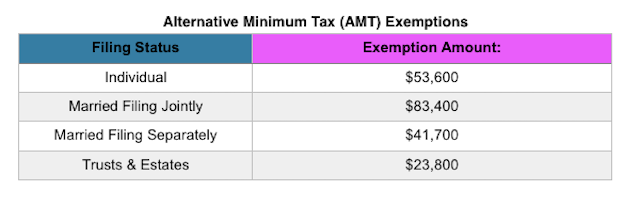

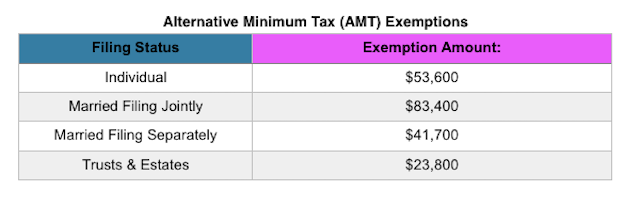

–Eliminates the alternative minimum tax.

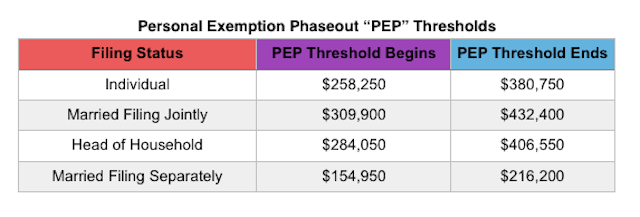

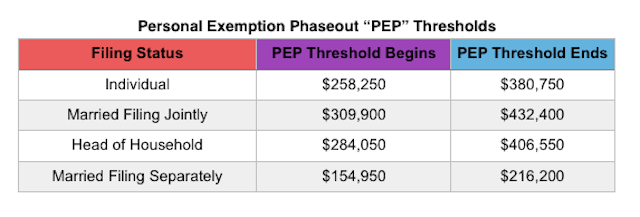

–Eliminates the personal exemption phase-out (PEP) and the Pease limitation on itemized deductions.

–Limits the value of additional itemized deductions to 28 percent for households with income over $250,000.

Payroll Tax Changes

–Creates a new 6.2 percent employer-side payroll tax on all wages and salaries. This is referred to by the campaign as an “income-based health care premium paid by employers.”

–Creates a 0.2 percent employer-side payroll tax and 0.2 percent employee-side payroll tax, to fund a new family and medical leave trust fund.

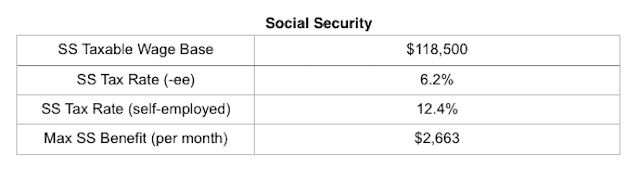

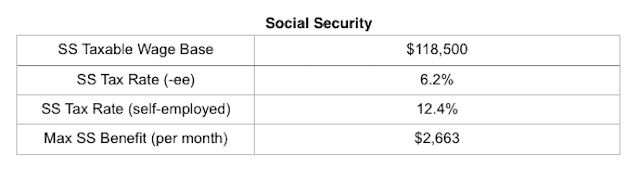

–Applies the Social Security payroll tax to earnings over $250,000, a threshold which is not indexed for wage inflation.

Business Income Tax Changes

–Eliminates several business tax provisions involving oil, gas, and coal companies.

–Ends the deferral of income from controlled foreign subsidiaries.*

–Changes several international tax rules to curb corporate inversions and limit use of the foreign tax credit.*

Estate Tax Changes

–Decreases the estate tax exclusion from $5.4 million to $3.5 million.

–Raises the estate tax rate from 40 percent to a set of rates ranging between 45 percent and 65 percent.

–Changes several estate tax rules involving asset valuation, family trusts, gift taxes, and farmland and conservation easements.*

Other Changes

–Creates a financial transactions tax on the value of stocks, bonds, derivatives, and other financial assets traded by U.S. persons. The rate of the tax ranges from 0.005 percent to 0.5 percent, depending on the type of asset.*

–Limits like-kind exchanges of property to $1 million per taxpayer per year and prohibits the use of like-kind exchanges for art and collectibles.*

Now, The Weekly Standard analysis:

Now that Bernie Sanders has routed Hillary Clinton by 22 points in New Hampshire, the American people might be curious to learn more about some of his specific policy proposals, starting with his tax plan. The nonpartisan Tax Foundation has scored Sanders’s plan and has found it would cause the after-tax incomes of those in the middle of the income spectrum—those with incomes between the 40th and 60th percentiles—to drop by between 16.3 and 17 percent. In other words, Sanders’s tax plan would reduce the typical American’s income by a sixth.

This would result partly from Sanders’s raising of taxes on the middle class (and on everyone else), and partly from the ill-effects that his myriad tax hikes would have on the economy. In terms of tax increases for the middle class, Sanders would add a new 6.2 percent employer-side payroll tax that his campaign calls an “income-based health care premium paid by employers,” which would be passed on to employees in the form of lower wages. He would also add a new 2.2 percent “income-based [health-care] premium paid by households,” which the Tax Foundation writes “is equivalent to increasing all tax bracket rates by 2.2 percentage points.” It turns out that government-run “single payer” health care requires a whole lot of payers.

In all, the Tax Foundation finds that Sanders’s tax plan would be a $13.6 trillion tax hike—27 times as large as Hillary Clinton’s proposed $498 billion tax hike.

Sanders’s plan would also shrink the U.S. gross domestic product by 9.5 percent over ten years in relation to what it otherwise would have been, according to the scoring. That means it would decrease the size of the economy by about $2.6 trillion—or about $8,000 for every American, or $32,000 per family of four. If a rising tide lifts all boats, Sanders’s plan seems designed to sink the whole American fleet.

While middle-class Americans’ incomes would fall by a sixth under Sanders’s plan, the incomes of the top one percent would fall even more, dropping by a quarter. That might provide some solace for Sanders supports—if everyone is less prosperous, everyone should at least be more equal.

If you’d like to read the full Tax Foundation study, go here.

by | ARTICLES, BLOG, BUSINESS, FREEDOM, GOVERNMENT, POLITICS, TAX TIPS, TAXES

The IRS announced this morning that a hardware failure occurred sometime yesterday afternoon; because of this, tax processing systems are not currently not functioning correctly.

As a result of the failure, the IRS is unable to accept tax returns filed electronically, and may also have difficultly processing refunds; however, they do not believe that “major disruptions” will occur long-term. By-and-large, 90% of taxpayers should still be able to get their refunds within 21 days.

If you visit IRS.gov, the website is up and running by some features are unavailable, such as “Where’s My Refund?” The outage will likely continue throughout the day today. Taxpayers who use services and companies that file their electronic return will see their return filing on hold until the system is properly restored.

UPDATE:

E-filing had been restored but the cause remains unknown. The IRS has assured taxpayers that hackers don’t appear to be involved; an IRS spokesman said it looked to be a “power or electrical issue” but did not provide any more substance on the matter.

According to Bloomberg, “The system failure occurred at a center in West Virginia, according to the person with knowledge off the matter. Agency officials were trying to determine if any other facilities were affected.

The IRS website lists several facilities in West Virginia; it wasn’t clear which might have been affected. IRS sites there include at least two “enterprise computing centers” in Martinsburg and Kearneysville and the Beckley Finance Center in Beckley. The finance center, part of the IRS’s chief financial office, processes payments for manual transactions and electronic payment files and helps handle the agency’s general ledger, according to the website.”

The IRS is sure to argue that budget cuts are the reason why such an episode occurred, as basic taxpayer functions have eroded over the past few years. Of course, the IRS scandals that continue to plague the agency don’t help improve its image.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

The article written by Josh Zumbrun of the Wall Street Journal on December 31, entitled, “Tax Rate for Top 400 Taxpayers Climbed in 2013,” should have been fairly straightforward with interesting data on that particular tax demographic. Unfortunately, the author distorts some aspects of the tax code, which makes the article a bit suspect and disappointing.

Zumbrun begins by gleefully announcing that “Tax rates on the 400 wealthiest Americans in 2013 rose to their highest average since the 1990s, after policy changes that boosted levies on capital gains and dividends.”

Here’s the first major problem. Tax rates may have risen in 2013 — but not because of rate increases on capital gains and dividends; several other tax changes also affecting the wealthy happened due to the Fiscal Cliff negotiations. Some of these include 1) The top marginal rate increased from 35 percent to 39.6 percent; 2) a phase out of personal exemptions; 3) a phase down of itemized deductions; 4) an increase in the death tax.

However, the author fails to mention those in an attempt to focus solely on capital gains.

This is especially evident in his next section. “Over the years, these taxpayers have devised strategies to collect more of their income as capital gains—profits from the sale of property or an investment—and dividends.” Unfortunately, the author has a total lack of understanding of capital gains. He erroneously, like many others, writes as though capital gains are income and thus lumps capital gains discussions together with income discussions. But that distorts the tax picture and tax strategy.

Capital gains are unusual in that the taxpayer has the ultimate decision as to whether and when to sell his asset (stock, his business, a work of art, etc.) The higher the tax rate, the LESS likely he is to sell, seeing as he will only be able to enjoy or reinvest what is left of the proceeds AFTER TAX. History has borne this out – capital gains tax collections go down in the periods after increases, and go up in the years after decreases.

The actual impact of raising the capital gains rate is also devastating to the economy. By discouraging the sale of assets, there is reduced capital available for new projects and opportunities, reducing job creation and wages, and resulting in lower revenue collection.

Furthermore, with higher capital gain rates, the expected after tax rate of return on new projects will go down, assuring that fewer of them will go forward.

But none of this seems to matter to the author. By alluding to “strategies to collect more income as capital gain profits” and describing how, with impending rate increases, “many of the highest earners sold assets before the deadline to avoid higher taxes, leading to a huge surge in income in late 2012,” the author is subtly suggesting that these actions are somehow wrong, underhanded, or unfair.

Juxtaposing that with his opening statement about how tax rates rose on the wealthiest Americans in 2013, the author seems to be dipping his toes into the class warfare playbook of “taxing higher income earners more is a good.”

This becomes readily apparent in the second half of the article, where the author brings up how the “capital-gains rate has become a prominent feature of 2016 presidential candidates’ tax proposals” — pointing out that top Republican candidates such as Cruz or Rubio would seek to lower the rates.

He also helpfully includes quotes about the wealthy and capital gains, and all the tax revenue they bring in. ““It’s not chump change,” said Len Burman, director of the Tax Policy Center, a nonpartisan think tank. Capital-gains taxes bring in more than $100 billion in some years “and almost all of it is realized by people with very high incomes,” he said. In 2013, the 400 households earned 5.3% of all dividend income and 11.2% of all income from sales of capital assets.”

Thus, using 2013 as a bellweather year for higher tax rates for the wealthy, the author tries to correlate it with capital gains — in order to suggest to the reader that higher capital gains taxes on the wealthy is an economic good. This is where he is woefully incorrect. What could have been an interesting article was sprinkled economic ignorance and a subtle agenda.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

The IRS is involved in another “erased hard drive” event — and it’s not a part of the IRS scandal of 2013. It is apparent that there is a pattern of destruction at the agency.

This time, the hard drive that was erased belonged to “Samuel Maruca, former director of transfer pricing operations at the IRS Large Business and International Division.” Maruca was also a top level employee at the IRS, and was also involved in a controversy; this time, the scrutiny involved the IRS’s decision to hire an inexperienced yet elite law firm to handle tax data.

In this particular incident, “although there was a court preservation order on all documents related to the IRS hiring of the outside firm, the hard drive was erased anyway. The order was borne of a Freedom of Information Act (FOIA) request submitted by Microsoft.

Even though the white shoe law firm has zero experience handling sensitive tax data, taxpayers have been footing bills of over $1,000 per hour for its services.”

And more:

“Despite its complete inexperience handling audits or taxpayer data, Quinn Emanuel was hired under an initial $2.2 million contract.

This unusual decision prompted a probe by Finance Committee Chairman Orrin Hatch (R-Utah), based on concerns that the decision to hire outside contractors was expensive and entirely unnecessary.

As Sen. Hatch pointed out in his letter to the IRS, the agency already has access to around 40,000 employees responsible for enforcement. The IRS can also turn to the office of Chief Counsel or a Department of Justice attorney, both of which have the expertise to conduct this kind of work, without risking sensitive information.

The fact that another important hard drive is permanently gone can only lead to two conclusions: 1) that the IRS is still thoroughly incompetent or 2) the IRS is exceedingly corrupt. Neither of these are good for the taxpayer. The only immediately remedy should be to remove IRS Commissioner John Koskinen.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, TAX TIPS, TAXES

Tax season has begun. Normally, the deadline for filing your federal tax return is April 15. But because the Washington D.C. Emancipation Day holiday falls on April 15 this year, Tax Day is the Monday after, April 18th.

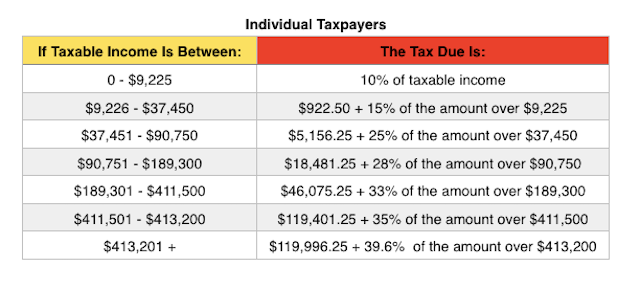

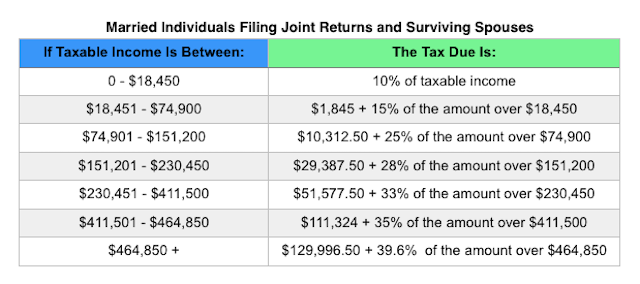

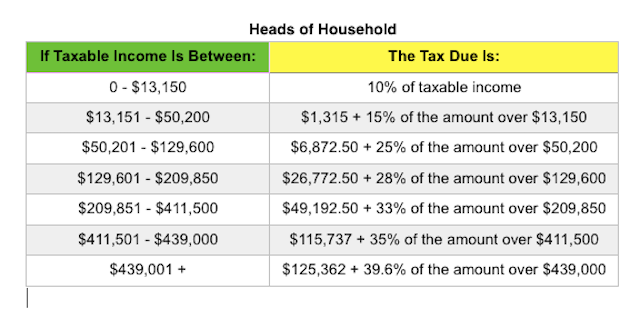

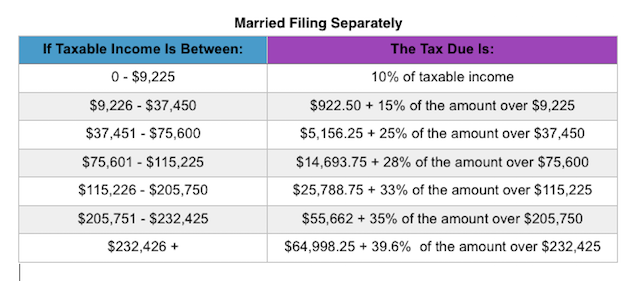

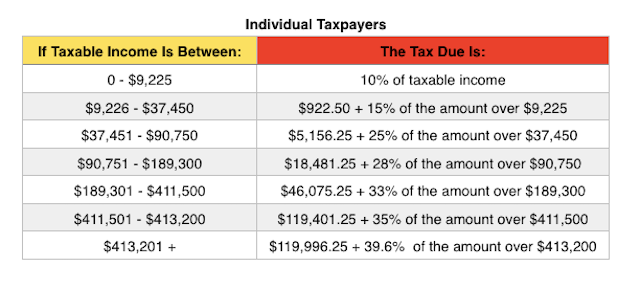

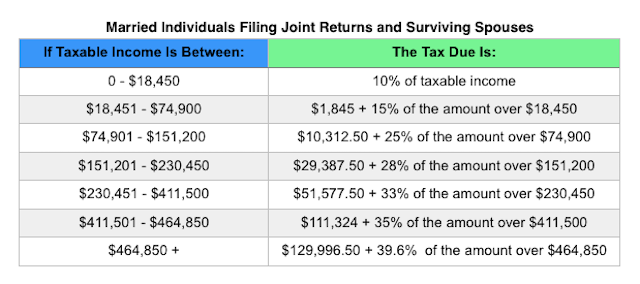

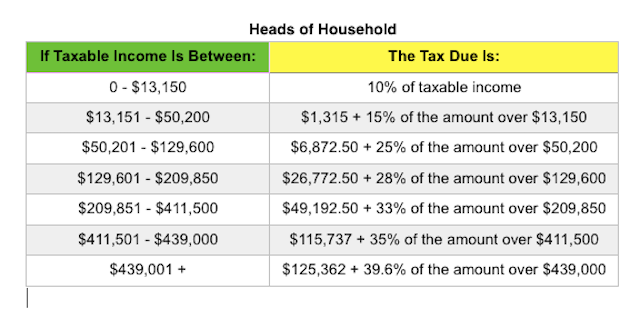

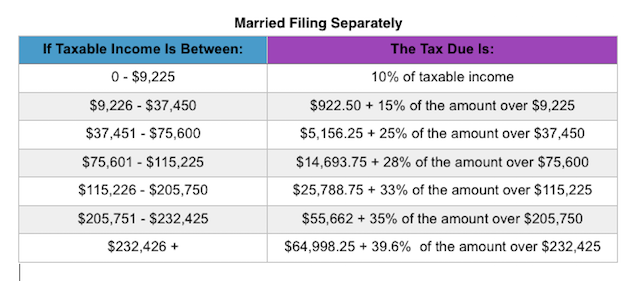

Last spring, Forbes put together a nice, extensive list of all the tax rates and adjustments for 2015. I have posted below some of the most pertinent information. For an all-inclusive list, you should check out the article in its entirety.

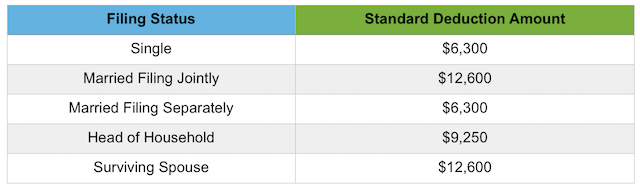

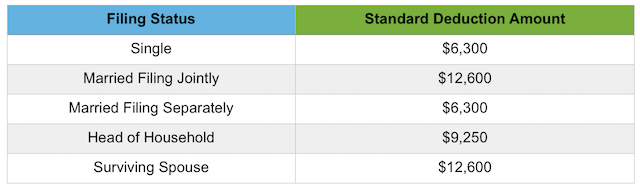

The standard deduction amounts are:

Some tax credits are also adjusted for 2015. Some of the most common tax credits are:

Earned Income Tax Credit (EITC). For 2015, the maximum EITC amount available is $3,359 for taxpayers filing jointly with one child; $5,548 for two children; $6,242 for three or more children (up from $6,143 in 2014) and $503 for no children. Phaseouts are based on filing status and number of children and begin at $8,240 for single taxpayers with no children and $18,110 for single taxpayers with one or more children.

Child & Dependent Care Credit. For 2015, the value used to determine the amount of credit that may be refundable is $3,000 (the credit amount has not changed). Keep in mind that this is the value of the expenses used to determine the credit and not the actual amount of the credit.

Hope Scholarship Credit. The Hope Scholarship Credit for 2015 is an amount equal to 100% of qualified tuition and related expenses not in excess of $2,000 plus 25% of those expenses in excess of $2,000 but not in excess of $4,000. That means that the maximum Hope Scholarship Credit allowable for 2015 is $2,500. Income restrictions do apply and for 2015, those kick in for taxpayers with modified adjusted gross income (MAGI) in excess of $80,000 ($160,000 for a joint return).

Lifetime Learning Credit. As with the Hope Scholarship Credit, income restrictions apply to the Lifetime Learning Credit. For 2015, those restrictions begin with taxpayers with modified adjusted gross income (MAGI) in excess of $55,000 ($110,000 for a joint return).

Changes were also made to certain tax Deductions, deferrals & exclusions for 2015. You’ll find some of the most common here:

Student Loan Interest Deduction. For 2015, the maximum amount that you can take as a deduction for interest paid on student loans remains at $2,500. Phaseouts apply for taxpayers with modified adjusted gross income (MAGI) in excess of $65,000 ($130,000 for joint returns), and is completely phased out for taxpayers with modified adjusted gross income (MAGI) of $80,000 or more ($160,000 or more for joint returns).

Flexible Spending Accounts. The annual dollar limit on employee contributions to employer-sponsored healthcare flexible spending accounts (FSA) edges up to $2,550 for 2015 (up from $2,500).

IRA Contributions. The limit on annual contributions to an Individual Retirement Arrangement (IRA) remains unchanged at $5,500. The additional catch-up contribution limit for individuals aged 50 and over remains at $1,000.

Also note that the floor for medical expenses remains 10% of adjusted gross incocome (AGI) for most taxpayers. Taxpayers over the age of 65 may still use the 7.5% through 2016.

For a more complete list of tables and rates, check out the Forbes article or visit the official IRS website.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

Government wage increases vastly outpaced the public sector, and the number of government jobs have soared. For the federal government alone, there are 2.1 million workers, “costing over $260 billion in wages and benefits this year.” according to recent data analysed by the US Bureau of Economic Analysis (BEA).

There is no justification for government workers to earn more than the private sector. What was once a noble profession — the idea of ‘public service’ — has been replaced by as system that allows for and encourages the economic imbalance because the government is not market-driven. Structures such as arbitration and non-firing allow public service employees to continue to receive their benefits and artificial pay raises regardless of the outside economic conditions.

Because of this, public sector wages eventually exceed the normal market-based wages. Negotiations in the public sector should never be “how much of an increase will I receive from before”, but rather, “can we justify these wages and benefits at all?” We should not be paying more than the private sector, which responds and adjusts to the mitigating economic factors; the government does not, and the result is what we see today: sprawling wages, busted pensions, and bloated budgets.

In essence, government workers have stronger job security because they are not dependent on the economy to keep them going. What’s even more sobering is the fact that the private sector marketplace is beginning to lose the best and brightest people, because the government is paying more, and providing employment with better benefits. This will have long-lasting detrimental effects. It was never intended for the government to compete with the private sector. This phenomenon has turned the entire system on its head.

by | ARTICLES, BLOG, BUSINESS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

My friend, Nina Olson, has been the long-time Taxpayer Advocate (TA) for the IRS, an independent office within the IRS. The job of the TA is to ensure that every taxpayer is treated fairly and that every taxpayer knows and understand his or her rights. Each year, the TA issues two different reports to Congress. Today, the TA released her 2015 Annual Report to Congress, with a list of the twenty most serious problems facing the IRS today.

Think reaching a human at the Internal Revenue Service last tax filing season was tough? Olson anticipates even less telephone and face-to-face customer service in future years. A planned expansion of IRS online offerings will leave taxpayers who seek help the old-fashioned way “up a creek,” listing it as the No. 1 problem in a report to Congress released Wednesday.”

An overview from Bloomberg noted another serious problem: transparency. “Since 2014 the IRS has spent “several million dollars” working with management consultants to develop a plan for how it will operate over the next five years. The details in the report haven’t been made public or shared with Congress, and the IRS hasn’t solicited comments from a broad pool of constituents, the advocate’s report notes.

Additionally, the IRS has never asserted so many times that data and documents the Taxpayer Advocate planned to include were for “official use only” and couldn’t be made public. That made this year’s report difficult to write, Olson says, “because while the intent to reduce telephone and face-to-face service has been a central assumption in the five-year ‘Future State’ planning process, little about service reductions has been committed to writing.”

Olson is calling for congressional hearings on the IRS plan over the next few months, and will solicit comments at public hearings held across the country. Among groups she plans to invite are those with the greatest need for free help, including the elderly, the disabled, small businesses, low-income taxpayers, and people with limited English proficiency.

The impression the Taxpayer Advocate’s office has, based on discussions with IRS officials, is that the agency’s ultimate goal is “to get out of the business of talking with taxpayers.” It would do that in part by creating online accounts for filers, which Olson sees as a good way to supplement, not replace, existing service—as long as data security concerns are addressed.

While far more people file electronically now, and the IRS has taken many steps to limit the need for taxpayers to phone the IRS, the demand for personal service hasn’t decreased. In fact, over the past decade the number of calls the IRS received on its Accounts Management lines rose from about 64 million for fiscal year 2006 to about 102 million for fiscal year 2015. That’s almost a 60 percent jump. Automating customer service even more, the report says, “will mean only those with the means to pay for it can receive help with their taxes.”

Here are Nina’s Top Twenty Problems:

TAXPAYER SERVICE: The IRS Has Developed a Comprehensive “Future State” Plan That Aims to Transform the Way It Interacts With Taxpayers, But Its Plan May Leave Critical Taxpayer Needs and Preferences Unmet

IRS USER FEES: The IRS May Adopt User Fees to Fill Funding Gaps Without Fully Considering Taxpayer Burden and the Impact on Voluntary Compliance

FORM 1023-EZ: Recognition As a Tax-Exempt Organization Is Now Virtually Automatic for Most Applicants, Which Invites Noncompliance, Diverts Tax Dollars and Taxpayer Donations, and Harms Organizations Later Determined to be Taxable

REVENUE PROTECTION: Hundreds of Thousands of Taxpayers File Legitimate Tax Returns That Are Incorrectly Flagged and Experience Substantial Delays in Receiving Their Refunds Because of an Increasing Rate of “False Positives” Within the IRS’s Pre-Refund Wage Verification Program

TAXPAYER ACCESS TO ONLINE ACCOUNT SYSTEM: As the IRS Develops an Online Account System, It May Do Less to Address the Service Needs of Taxpayers Who Wish to Speak with an IRS Employee Due to Preference or Lack of Internet Access or Who Have Issues That Are Not Conducive to Resolution Online

PREPARER ACCESS TO ONLINE ACCOUNTS: Granting Uncredentialed Preparers Access to an Online Taxpayer Account System Could Create Security Risks and Harm Taxpayers

INTERNATIONAL TAXPAYER SERVICE: The IRS’s Strategy for Service on Demand Fails to Compensate for the Closure of International Tax Attaché Offices and Does Not Sufficiently Address the Unique Needs of International Taxpayers

APPEALS: The Appeals Judicial Approach and Culture Project Is Reducing the Quality and Extent of Substantive Administrative Appeals Available to Taxpayers

COLLECTION APPEALS PROGRAM (CAP): The CAP Provides Inadequate Review and Insufficient Protections for Taxpayers Facing Collection Actions

LEVIES ON ASSETS IN RETIREMENT ACCOUNTS: Current IRS Guidance Regarding the Levy of Retirement Accounts Does Not Adequately Protect Taxpayer Rights and Conflicts with Retirement Security Public Policy

NOTICES OF FEDERAL TAX LIEN (NFTL): The IRS Files Most NFTLs Based on Arbitrary Dollar Thresholds Rather Than on a Thorough Analysis of a Taxpayer’s Financial Circumstances and the Impact on Future Compliance and Overall Revenue Collection

THIRD PARTY CONTACTS: IRS Third Party Contact Procedures Do Not Follow the Law and May Unnecessarily Damage Taxpayers’ Businesses and Reputations

WHISTLEBLOWER PROGRAM: The IRS Whistleblower Program Does Not Meet Whistleblowers’ Need for Information During Lengthy Processing Times and Does Not Sufficiently Protect Taxpayers’ Confidential Information From Re-Disclosure by Whistleblowers

AFFORDABLE CARE ACT (ACA) – BUSINESS: The IRS Faces Challenges in Implementing the Employer Provisions of the ACA While Protecting Taxpayer Rights and Minimizing Burden

AFFORDABLE CARE ACT (ACA) – INDIVIDUALS: The IRS Is Compromising Taxpayer Rights As It Continues to Administer the Premium Tax Credit and Individual Shared Responsibility Payment Provisions

IDENTITY THEFT (IDT): The IRS’s Procedures for Assisting Victims of IDT, While Improved, Still Impose Excessive Burden and Delay Refunds for Too Long

AUTOMATED SUBSTITUTE FOR RETURN (ASFR) PROGRAM: Current Selection Criteria for Cases in the ASFR Program Create Rework and Impose Undue Taxpayer Burden

INDIVIDUAL TAXPAYER IDENTIFICATION NUMBERS (ITINs): IRS Processes Create Barriers to Filing and Paying for Taxpayers Who Cannot Obtain Social Security Numbers

PRACTITIONER SERVICES: Reductions in the Practitioner Priority Service Phone Line Staffing and Other Services Burden Practitioners and the IRS

IRS COLLECTION EFFECTIVENESS: The IRS’s Failure to Accurately Input Designated Payment Codes for All Payments Compromises Its Ability to Evaluate Which Actions Are Most Effective in Generating Payments

EXEMPT ORGANIZATIONS (EOs): The IRS’s Delay in Updating Publicly Available Lists of EOs Harms Reinstated Organizations and Misleads Taxpayers

EARNED INCOME TAX CREDIT (EITC): The IRS Does Not Do Enough Taxpayer Education in the Pre-Filing Environment to Improve EITC Compliance and Should Establish a Telephone Helpline Dedicated to Answering Pre-Filing Questions From Low Income Taxpayers About Their EITC Eligibility

EARNED INCOME TAX CREDIT (EITC): The IRS Is Not Adequately Using the EITC Examination Process As an Educational Tool and Is Not Auditing Returns With the Greatest Indirect Potential for Improving EITC Compliance

EARNED INCOME TAX CREDIT (EITC): The IRS’s EITC Return Preparer Strategy Does Not Adequately Address the Role of Preparers in EITC Noncompliance.

You can read the report in full by going here.

by | ARTICLES, BLOG, BUSINESS, CONSTITUTION, ECONOMY, OBAMA, OBAMACARE, POLITICS, TAX TIPS, TAXES

The Wall Street Journal put together an excellent editorial yesterday on the intersection of Obamacare and immigration.

First, starting in 2016, employers with 50 or more full time employees are required to offer health insurance for each of their workers, or else pay a penalty of $3,000 per each person who fails to receive proper Obamacare coverage.

So what happens with the undocumented immigrants allowed to stay under President Obama’s Executive Action? The numbers are estimated to be upwards of 5 million people.

“The government’s petition says that the executive action intended to provide ‘work authorizations’ so that undocumented immigrants could find jobs in the U.S. without working illegally for less than market wages, which might harm American workers. But wait: Employers aren’t required to offer ObamaCare coverage or subsidies to these immigrants. The statutory language in the Affordable Care Act says that only ‘lawful residents’ are eligible, and the government’s petition specifically notes that the immigration action does not ‘confer any form of legal status in this country.'”

Therefore, the immigrants (with deferred deportation), are exempt from Obamacare. While that may be good for the taxpayer, it is not necessarily good news for the worker. From a purely financial perspective, companies could easily save the $3000 penalty cost per worker if they hire and employ an Obamacare-exempt immigrant instead of a citizen/resident subject to the Obamacare rules.

The Wall Street Journal sums up the scenario nicely:

“Suppose businesses subject to ObamaCare employ only 40%, or two million, of the up to five million immigrants covered by the president’s executive action. At $3,000 an employee, businesses would save about $6 billion a year. Companies already dealing with the added expense of operating in the Obama economy — burdened by regulations, high taxes and other barnacles — would find those savings hard to pass up.”

Exempting employers who hire these immigrants from the law’s penalties gives the immigrants a distinct market advantage over U.S. citizens. That flies in the face of the president’s statement that his executive action would not “stick it to the middle class” by allowing these individuals to “take our jobs.” It is also contrary to the government’s statement that the executive action would make it less likely that these undocumented immigrants hurt American workers by “illegally” working “for below market rates.” They could still work at below-market rates, only it would be legal.

All of this was inevitable. The root problem with ObamaCare is that one party rammed it through Congress without a single Republican vote, while the law’s supporters didn’t even read it, let alone vet it through congressional committees. As a result, ObamaCare as written was unworkable, and the administration has had to repeatedly amend it by constitutionally dubious executive fiat.

Now this flawed law is clashing with yet another constitutionally dubious executive action that the administration couldn’t be bothered to pass through the legislature.”

The Obama Administration may yet decide to grant Obamacare to these immigrants currently exempted. But for the time being, since their status presents a situation may wreak havoc in the business world, leaving the current court injunction against the immigration order in place is the only suitable solution until the Obamacare-immigration situation is sorted out. Otherwise, expect the economy to continue to weaken from this latest threat.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAX TIPS, TAXES

A few days ago, UnitedHealthcare announced that the possibility of withdrawing from the Obamacare health insurance exchanges. This is a significant announcement, as UnitedHealthcare is one of the biggest insurers in the country. The impact of withdrawl would affect hundreds of thousands of people with regard to their healthplans; the timing — right before 2016 elections — would be critical.

A few days ago, UnitedHealthcare announced that the possibility of withdrawing from the Obamacare health insurance exchanges. This is a significant announcement, as UnitedHealthcare is one of the biggest insurers in the country. The impact of withdrawl would affect hundreds of thousands of people with regard to their healthplans; the timing — right before 2016 elections — would be critical.

HHS is predicting 10 million enrollees in 2016, which is half of what was originally projected when Obamacare was passed. It’s unlikely that enrollment will suddenly surge this year, which means that the financial instability of the entire model will continue.

If UnitedHealthcare decides to discontinue next year, those with their coverage will have to — yet again — choose another plan, but this time from a smaller list of coverage providers. Since Open Enrollment begins in the fall, right around Election time, such a move could wreak havoc on the final stretch.

One economist suggests that prices will increase even more.

“The year 2017 is significant for insurers, because that’s the year when several programs designed to mitigate risk for insurers through federal backstops go away. The hope was that those programs would act as training wheels for Obamacare in its first few years of implementation, but after that, the insurers were supposed to be able to thrive on their own. UnitedHealth’s statement suggests otherwise.

If UnitedHealth and other insurers decide to exit, remaining insurers will be forced to take on even more high-risk enrollees, prompting them to either raise rates further or exit themselves. That in turn would deprive individuals of choices and remove competition, a key purpose of the exchanges.”

So don’t expect United to suddenly see a reason to get back into the 2017 market, not without hefty risk-corridor subsidies — which under any other circumstances would be called “corporate welfare.” Given that Congress isn’t likely to reverse course and underwrite ObamaCare losses, the path to the exit remains the likely course for United, and perhaps some of its competitors, too.

United says it will remain committed to its Medicaid and Medicare businesses, and of course it will stick with its employer-based group coverage, where the issues of ObamaCare regulation have less impact.”

“But UnitedHealth and other insurers need more Americans to come into the public exchanges because the patients that are signing up for coverage are sicker, making a “higher overall risk pool,” insurance executives say. It’s a key reason many Americans are seeing rate increases of 10 percent or more across the country on public exchanges.

United has discovered that the trade-offs in mandates and forced coverage don’t pay off. It’s a bait-and-switch for insurers by the Obama administration, but it’s even worse of a bait-and-switch for consumers.

Subsidies do not mitigate the fact that consumers have to pay both the premium and then thousands of dollars for care out of their own pocket before insurance takes effect, except in rare and catastrophic circumstances.

Consumers used to have an option for that kind of health insurance – catastrophic coverage, used to indemnify against unforeseen major health events. Those policies featured low premiums and left routine care for consumers to negotiate directly with providers on a cash basis. Combined with health-savings accounts (HSAs), those plans offered a rational approach to balancing health and economic requirements, especially for younger consumers who rarely need more than one or two clinic visits a year, which would cost far less than either comprehensive-coverage premiums or deductibles even in the pre-ACA era.

Instead of “affordable care” promised by President Obama and Democrats, consumers have instead discovered they have effectively been forced to pay for catastrophic health insurance at comprehensive-plan prices. They have become victims of a bait-and-switch scheme that the government would vigorously prosecute – if it wasn’t masterminding the scheme itself.”

by | ARTICLES, BLOG, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAX TIPS, TAXES

A must read from the Washington Examiner today on the subject of Obamacare, insurance companies, and bailouts. I republished the article in full.

The Department of Health and Human Services attempted to reassure private insurers on Thursday that they’ll be able to recover losses from participating in Obamacare by claiming it was an “obligation” of the U.S. government to bail them out.

At issue is a provision within the law known as the risk corridors program. Under the program, which runs from 2014 through 2016, the federal government is to collect money from health insurers doing better than expected and use those funds to provide a federal backstop to other insurers who incur larger than expected losses from rising medical claims. The idea was to provide training wheels to insurers in the first years of Obamacare’s implementation, and to take away any incentive for insurers to cherry pick only the healthiest customers.

Republicans, fearing that this could turn into an open-ended government bailout in the event of industry-wide losses, included a provision in last year’s spending bill that limited the program, requiring HHS to pay out only from the pool of money collected, rather than supplementing it with other sources of government funding. President Obama signed that bill.

Now that insurers have been able to look at medical claims, what they’ve found is that enrollees in Obamacare are disproportionately sicker, and losses are piling up. For the 2014 benefit year, insurers losing more than expected asked for $2.87 billion in government payments through the risk corridors program, but HHS only collected $362 million from insurers performing better than expected. Thus, the funds available to the federal government only amounts to 12.6 percent of what insurers argue that they’re owed.

So insurers are not happy. And now the industry lobbying group America’s Health Insurance Plans — which happens to be helmed by Marilyn Tavenner, who previously oversaw the implementation of Obamacare as head of the Centers for Medicare and Medicaid Services — is aggressively fighting for more money.

In a statement issued Thursday, the same day that the nation’s largest insurer, UnitedHealth announced it may exit Obamacare due to mounting losses, Tavenner said, “We’ve been very clear with the administration about the serious challenges facing consumers and health plans in this Exchange market. Most recently, nearly 800,000 Americans have faced coverage disruptions as a result of the significant and unexpected shortfall with the risk corridors program. When health plans cannot rely on the government to meet its obligations, individuals and families are harmed as a result. The administration must act to ensure this program works as intended and consumers are protected.”

In an effort to reassure the industry, CMS, the HHS agency Tavenner previously led, issued guidance reiterating that HHS would use money collected from insurers in 2015 and possibly 2016 to make up the $2.5 billion shortfall that exists in 2014.

But what happens if there still isn’t enough money, and after 2016, the program is taking in less than the money sought by insurers?

HHS said it, would “explore other sources of funding for risk corridors payments, subject to the availability of appropriations. This includes working with Congress on the necessary funding for outstanding risk corridors payments.”

The agency further added: “HHS recognizes that the Affordable Care Act requires the Secretary to make full payments to issuers, and HHS is recording those amounts that remain unpaid following our 12.6 percent payment this winter as fiscal year 2015 obligation of the United States government for which full payment is required.”

In reality, this doesn’t mean much at all. Risk corridor payments for 2016 won’t be due until mid-2017, and by that point, it will be an issue for a future Congress and future president. Nothing that a previous administration’s HHS said in 2015 will really matter.

That said, this is another demonstration that for all of Obama’s sanctimonious rhetoric about taking on insurance companies. In reality, his signature legislative achievement was to put government in bed with private insurers. And now that his pet project backfired, he wants taxpayers to take care of those very insurance companies he spent years railing against.