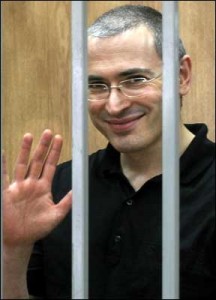

Mikhail Khodorkovsky, the former Yukos CEO and Russian billionaire, has just recently been released from jail. If I were him, my first act of new-found freedom would be to sue Goldman Sachs for billions of dollars. Watch out, Goldman Sachs investors!

I am a liberty-loving free market individual, which means I am generally pro-business. But as I have indicated so many times before, crony-capitalism is not free market, and thus it should be called out. Unfortunately, that cronyism does not entirely escape the upper echelons of the finance world and a horrific lack of integrity sometimes seeps into Wall Street. The story of Mikhail Khordorkovsky and Goldman Sachs is such an example.

First, a parallel story: in the late 1980’s, the State of Washington issued Washington Power Public Service bonds (commonly called “WPPSS”) to finance a number of nuclear power plants. The bonds were considered very high quality as they were guaranteed 1) not only by the project, but 2) also unconditionally by the State of Washington, and 3) even regardless of whether the plants ever actually got constructed.

First Boston was a lead underwriter of this issue.

When oil and gas prices dropped sharply a few years later, the State of Washington decided to renege on its guarantee and default to the tune of $2.25 billion. It argued (incredibly) that they didn’t have the right to make such a guarantee. The Washington Courts upheld this point of view (naturally), and the Supreme Court (ridiculously) claimed that it was a state matter, despite the fact that many little old ladies — like my mother — pension funds, and other investors from all around the country were devastated by this “fraud”. This was undeniably gross negligence.

The most frustrating part of the matter, however, happened after the decision was issued. The State of Washington needed to raise money by issuing new bonds. And who do you think was the lead underwriter this time around, despite the scam that had cost their customers hundreds of millions of dollars….

You guessed it — First Boston again, a stunning lack of integrity from world of government and finance. But this fraud pales in comparison to that of Mikhail Kordorkovsky and Vladmir Putin.

I was reminded of the WPPSS affair (also known as “Whoops”) when in 2003, in a brazen act of thievery, Vladimir Putin “confiscated” the controlling interest in shares of the Yukos Oil Company held by Mikhail Khodorkovsky.

Khordorkovsky built a company that grew in wealth and stature upon the collapse of the Soviet Union. Shortly after Kordorkovsky was named “Person of the Year” by the Russian business magazine “Expert”, he was arrested.

There were laughable “criminal” and “tax cheating” charges leveled against Khodorkovsky, for which he has been in jail for a decade until just last month.

As Khordorkovsky’s popularity grew while in prison, Putin suddenly and obviously made a public relations decision in connection with the Olympics to release the famed Khordorkovsky. (Indeed, just in the last week, Khordorkovsky’s business partner was also released from his prison sentence.)

Everyone knew that the criminal charges were just a very thinly veiled justification for President (Dictator) Putin to steal the company for himself and the Russian people. I get it – that is his nature. But what has this to do with integrity, finance, or even WPPSS?

Underwriters.

Just as First Boston underwrote the first WPPSS project that fraudulently defaulted and was able to (incredibly) underwrite for the State of Washington again, Putin was able to perform his grand confiscation with the help of a major underwriter.

Upon restructuring the oil company following the arrest of Khodorkovsky, that fact that Vladmir Putin could then go to Goldman Sachs, who would gladly orchestrate the largest underwriting of stolen goods and fraud the world has ever seen, is utterly staggering.

Just as incredible, First Boston — later known as Credit Suisse during the time of the confiscating and beyond — also got in on the action (among others).

But the coziness between Putin and Goldman doesn’t end there. Just last winter, Goldman Sachs renewed its relationship with Putin by signing a three-year agreement with Russia’s Economy Ministry and the Russian Direct Investment Fund.

During that time, Goldman Sachs will be paid $500,000 to help Putin attract foreign investors. This latest partnership has been slammed by the Human Rights Foundation.

Now that Khodorkovsky is a free man once again, it wouldn’t take much for him to highlight the close relationship between Vladmir Putin and Goldman Sachs. I’m not a lawyer, but one would think that Goldman might have reason to be concerned about a potential lawsuit from Mr. Khodorkovsky for aiding and abetting the confiscation of his company.