by | ARTICLES, ECONOMY, ELECTIONS, FED, GOVERNMENT, OBAMA, POLITICS, POTUS, SOCIAL SECURITY, TAXES, TRUMP

Are we past the tipping point for economic reform? I would argue that Obama’s budgets and spending accelerated the deficits beyond repair. Some people will go back to Reagan and say that the deficit and the debt ballooned during the Reagan Administration and they will blame it on his tax cuts. But what is actually true is that the tax cuts generated a large increase in revenue, and the only reason why he had deficits was that the Democrat-led Congress increased spending even over the increased revenue. The same thing happened with the Bush tax cuts which were very pro-growth; the revenue went up sharply, but spending went up even faster. But at this point the debt was still manageable.

Then you come to Obama. At the beginning of his administration, we had the deep recession -which arguably could have benefited by one year of stimulus. The concept of a stimulus is supposed to be a one-off event. In other words, you engage in big one-time expenditures to get the economy on track and then spending goes back to previous levels as the recovery occurs. The problem is that Obama didn’t put things in for just one year. He did long term things, like food stamps, teacher’s compensation, etc., knowing full well that once put into effect they could not easily be withdrawn. And it was pretty clearly his intent all along, for political reasons, to bake them into the budget. So now when we started to have a recovery, you had ballooning deficits — even with a growing economy. Then by the time Trump was elected, the locked-in recurring spending with its locked-in annual increases made the deficit – and the debt – almost impossible to rein in.

Now we have the pandemic and we have no place to go. There’s no surplus to go to the deficit. Millions of Americans are unexpectedly unemployed, which means they’re not paying into Social Security. At the same time, we see older workers who have lost their jobs choose to draw their benefits as soon as they become eligible. This will speed up the insolvency train. But then Trump did something that was very stupid (though his political motivation is clear). He said that entitlements are off the table. If entitlement reform is off the table at this point, we’re headed to bankruptcy.

We’ve been talking about the coming insolvency of the Social Security and Medicare programs for many, many years now and Congress has done nothing to stave off the inevitable. Couple that with Obama budgets, Trump’s lack of action, and the pandemic, and the deficits are even larger now. Anyone seriously looking at the situation knows that absent a major change to entitlements, the mandated annual increases, both because of cost of living adjustments and demographics, will bankrupt both programs in the next ten to fifteen years. It’s very safe to say that absent major entitlement reform, we’re basically past the tipping point.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

During a speech at UNLV this week, Hillary Clinton discussed higher education and her opinion that “more needs to be done to assure young people can achieve their dreams and free students from debt.”

While making higher education more affordable is certainly a worthwhile endeavor, the means by which the Democrats have made changes — and continue to push for more change — to the student loan system will cause even higher tuition costs, unsustainable taxpayer debt, and create another rail of entitlement.

The first wave of detrimental change came in 2010 with the Pay-As-You-Earn Program implemented in 2010. Essentially, PAYE has repayment options based on 10% of discretionary income. However, if the payment doesn’t cover the accruing interest, the government pays your unpaid accruing interested for up to three years from when you begin paying back your loan under the PAYE program.” That means the taxpayer.

Obama expanded that 10% income cap this past June with an Executive Order. Its purpose is to extend “such relief to an estimated five million people with older loans who are currently ineligible”, according to the New York Times.

Though this Executive Order — and its 2010 law counterpart — may sound well and good, financially it is a disaster. The 10% income repayment does not help any young person get off on a solid financial footing. Likewise, because some sectors allow for loan forgiveness after a period of time, that amount gets written off by the federal government, thereby substantially adding to the federal debt.

And what of the federal debt? Earlier this summer, CNS News compared the current cumulative outstanding balance on federal student loans to the balance owed in January 2009, and found it had skyrocketed 517.4 percent:

“The balance owed as of the end of May was $739,641,000,000.00. That is an increase of $619,838,000,000.00 from the balance that was owed as of the end of January 2009, when it was $119,803,000,000.00, according to the Monthly Treasury Statement”.

They then compared it to George Bush’s tenure:

“During President George W. Bush’s time in office, the amount of outstanding loans increased from $67,979,000,000.00 in January of 2001 to $119,803,000,000 in January of 2009, an increase of 76.2%. This means that under President Obama, the amount of federal direct student loans increased 579% more than under President Bush.”

The most influential factor in this rapid rise of student loan debt is the PAYE program repayment terms. Besides the 10% option, students also have two other possibilities of loan help, known as “forgiveness:”

1) The balance of your loan can be forgiven after 20 years if you meet certain criteria, OR 2) Your loan can be forgiven after 10 years if you go to work for a public service organization (known as Public Service Loan Forgiveness, or PSLF).

The Wall Street Journal recently discussed the impact of “loan forgiveness” when it highlighted a report from the New America Foundation, which analyzed the PLSF impact. The WSJ noted that the report found “it will not be a small population of borrowers standing in line for this gift from taxpayers. The federal government estimates that a quarter of all jobs may qualify”.

Furthermore, the study concluded that:

“it could become common for the government to pay for a student’s entire graduate education via loan forgiveness” if those kids take jobs at a nonprofit or in government. The new payment terms for such borrowers “are unlikely to cause many graduate and professional students to fully repay their loans—even if they earn a competitive salary in their chosen careers or a salary that places them among upper-income Americans.”

and also,

“This will likely provide an incentive for graduate and professional students to borrow more rather than less, particularly for some professions. It should also make graduate students less sensitive to the price of a graduate or professional degree, allowing institutions to charge higher tuitions, especially for certain programs like healthcare, social work, education, and government, where borrowers would go on to qualify for PSLF.”

The government meddling in higher education and loan programs has perpetuated more crises, which in turn has created more government “fixes”, and hence, a new-tier of entitlements — this time, for education. And that’s not all. Senator Elizabeth Warren proposed a bill earlier this year allowing student loan holders to refinance their loans at a lower rate. How? You guessed it: a bailout to be paid for by yet another tax on the wealthy. President Obama, of course, has endorsed this legislation, but it has yet to pass Congress.

The long-term effect of such an education policy is that a new generation of youth will be raised to pursue careers in the public and non-profit sectors by the dangling carrot of free education money — instead of slugging it out in the private sector.

Do we need more regulators and bureaucrats? Where is the encouragement for innovation, for entrepreneurship, for capitalism? Where is the risk-taking? Why risk-take when you can get your education paid for by taxpayer-funded loan forgiveness and a comfortable government or non-profit job?

Small businesses have been the backbone of America. Our country was built upon those who were willing to invest their time and money to become great. This approach to education is undeniably detrimental to our future by saddling taxpayers with unseemly debt while discouraging our young people from seeking private enterprise. That is not the American Dream.

by | ARTICLES, ECONOMY, GOVERNMENT, OBAMA, TAX TIPS, TAXES

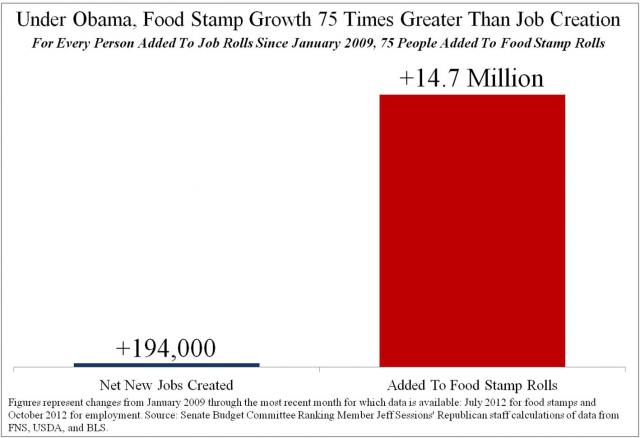

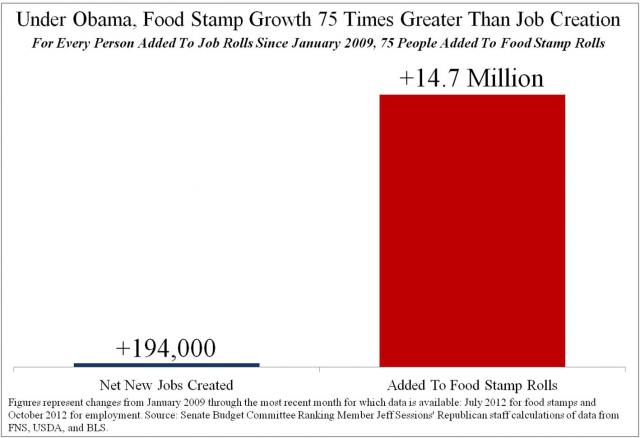

The Weekly Standard does a great analysis of the growth of food stamps in comparison to the growth of jobs during the Obama Administration. Using FNS, BLS and USDA data, they calculated that food stamp enrollment was 75 times faster than job creation. This visual puts it into perspective:

I have written on this trend before in the last few months; as unemployment has remained high, we recently passed the point where more people have been added to the dependency rolls than payrolls. This has a high impact on our crushing deficit and is directly attributable to Obama’s legacy. The article sums it up:

Welfare spending is projected to remain permanently elevated; for instance, at no point in the next 10 years will fewer than 1 in 9 Americans be on food stamps. In fact, the Administration has actively sought to boost food stamp spending and enrollment, including through a partnership with the Mexican government to advertise benefits to foreign nationals, as well as materials that teach outreach workers how to “overcome the word ‘No.’” USDA even goes so far as to argue that the program is “the most direct stimulus you can get.”

Overall, in the last four years, the United States’ gross federal debt has increased 53 percent, food stamp enrollment has increased 46 percent, and the number of employed persons has increased just 0.15 percent. This picture, however, is even more ominous than it looks. While only 194,000 net jobs have been created since 2009, the working age population has increased by approximately 5 million—almost 25 times that amount. In other words, a shrinking share of working age adults have or are even looking for a job. The real unemployment number (U-6), therefore, is 14.6 percent.

To put this month’s job creation in historical perspective, in October of 1984, 286,000 jobs were created—67 percent more—at a time when the U.S. working age population was 26 percent smaller than it is today.

Over time, these trends, if not reversed, spell economic disaster for the United States and its citizens.

Be sure to read the article in its entirety.

by | ARTICLES, POLITICS

Catching up on the WSJ, I came across an opinion piece by Ben Wattenberg, who surmised that the current entitlement crisis is one of demographics; that is, our fertility rates are not able to sustain payment obligations. Though generally the WSJ and the American Enterprise Institute — of which Mr. Wattenberg is a senior fellow — are good in their analyses, this argument is patently untrue.

A few days later, the WSJ ran a letter to the editor by a Mr. Walsh, who well summed up the problem with Wattenberg assertion.

Ben J. Wattenberg’s suggestion that the funding problems with Social Security are due to demographics is demonstrably false. A properly funded program of benefits works regardless of demographics if benefit amounts are not increased above what payments can support, and accumulated funds and related investment earnings are invested wisely and not diverted to other uses.

These basic conditions are at work in the private retirement sector, governed by Erisa, where demographics have had a relatively negligible effect on current funding levels. In the case of Social Security, the former condition has been routinely violated by politicians pandering for votes, while elimination of the latter condition was seen to by Lyndon Johnson (Mr. Wattenberg’s old boss) and the Democratic House and Senate at the time. Current entitlement practices lack basic and proper accounting for costs.

In short, we’ll have deficits in 2020 not because only because spending is too much, but also because their accounting methods allow them to record the costs incurred years prior (for instance in 2003) as expenses in 2020.

What Mr. Wattenberg is really saying is that the current shift in demographics has made it more difficult to tax current earners sufficiently to pay for the overpromised benefits of current beneficiaries and to compensate for government mismanagement.

I have written before on the crisis of Social Security and its lack of basic and valid accounting practices. Entitlement reform must consist of both fiscal restraint and acceptable and professional accounting.