by | ARTICLES, BLOG, GOVERNMENT, IRS, LAW, POLITICS, TAXES

The Democrats have continuously claimed that they are looking out for America’s middle class by keeping the tax rates the same for them while seeking to raise rates on the wealthiest Americans who need to “pay their fair share”. This assertions serves to deflect attention away from the one policy that is already the mechanism for ensuring that the wealthiest pay more. What is it? The AMT.

The Alternative Minimum Tax (AMT) currently serves virtually no useful purpose, other than the raising of an ever-increasing amount of tax revenue. The AMT was instituted in its present form when the prior “add on” Minimum Tax was transformed into the AMT in the early 1980’s. Its stated purpose was to require that all taxpayers paid at least a “fair share of tax”. Yet it has become very clear in recent years that this AMT tax revenue is not coming from just the taxpayers who were the intended targets of this tax.

The AMT was developed to identify “loophole” type deductions, also known as “preferences”. There would then be an alternative calculation using lower tax rates applied against this taxable income as increased by the preferences. Whichever of the taxes is higher is the one the taxpayer must pay.

However the AMT was seriously flawed from the outset. Instead of focusing on these loophole type preferences (which would have limited the tax to a very small number of tax law abusers), the law that was passed included items that were not loopholes at all. A convoluted formula is used to calculate and compare the differences between income and deductions in order to determine who falls under the guidelines. Interestingly, a very substantial majority of all current AMT paid by taxpayers results from the following factors: 1) treating state and local taxes as a preference; 2) treating miscellaneous deductions as a preference; 3) allowing lower exemptions than the regular tax.

These factors have flaws. For instance, state and local taxes are hardly a loophole because taxes exacted by state and local governments are hardly “voluntarily” paid by taxpayers in an attempt to avoid paying federal taxes. Likewise, “Miscellaneous Deductions” is the category of deductions that consists primarily of expenses incurred to earn income. It often includes unreimbursed employee expenses, investment expenses, etc. This is the most basic and important deduction necessary to have a truly fair income tax system and should not be considered a loophole. Furthermore, the exemption available under the AMT is a fixed dollar amount which, unlike exemptions and standard deductions under the regular tax system, is not indexed for inflation; it is also phased out entirely over certain income levels.

During AMT discussions over the years, Congress used to posture and point to the AMT patch as some major revenue loss (had the AMT been applied to those families) as an excuse to raise to raise taxes in order to offset this “potential missing tax revenue”. Once the “patch” became permanent and the higher exemption level kept many taxpayers from being hit with the AMT, Congress stopped talking about the AMT altogether. But the fact still remains that there is a parallel tax system already that goes after the highest income-earners; they already pay “their fair share” — and then some

by | ARTICLES, BLOG, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

After nearly 8 years of listening to Obama talk incessantly about the need for the wealthy to “pay their fair share,” Hillary Clinton has picked up the mantle in her new tax proposal unveiled this week.

Clinton spoke about the need for “an additional 4 percent tax on people making more than $5 million per year, calling the tax a “fair share surcharge.” It is reminiscent of the failed “Buffet Rule” proposal put forth by Obama a few years back.

According to a Clinton staffer, “This surcharge is a direct way to ensure that effective rates rise for taxpayers who are avoiding paying their fair share, and that the richest Americans pay an effective rate higher than middle-class families.”

The tax proposal is calculated to bring in $150 billion on revenue over a ten-year span. Nowhere does it calculate the cost of implementing such a plan, additional paperwork, hours spent on compliance and enforcement, and so forth. As a revenue raiser, it amounts to $15 billion a year for the federal government, pocket change really — something that could be more easily attained by cutting the size and scope of many federal budgets.

It’s not really about revenue anyway. It’s more about pandering to a segment of voters, vilifying the high income earners and stirring up class warfare. It was the one message that resonated most with Obama supporters in 2012; he continuously and intentionally railed against “millionaires and billionaires”, and talked about “the wealthy paying their fair share” in order to create a divide and separate that particular fiscal population from the rest of “mainstream America”. Hillary is merely following the leftist playbook and recycling stale ideas as her candidacy flounders.

by | ARTICLES, ECONOMY, FREEDOM

I just read Stephen Moore’s new book “Who’s the Fairest of Them All? The Truth About Opportunity, Taxes, and Wealth in America“. Thomas Sowell gave it a nod last week when he wryly observed,

If everyone in America had read Stephen Moore’s new book, “Who’s The Fairest of Them All?”, Barack Obama would have lost the election in a landslide. The point here is not to say, “Where was Stephen Moore when we needed him?” A more apt question might be, “Where was the whole economics profession when we needed them?” Where were the media? For that matter, where were the Republicans?

Indeed. This book does a great job in a little over 100 pages of expelling the myth that “the rich need to pay their fair share” by showing with quantitative data that cutting taxes spurs economic growth, and that tax cuts increase tax revenue collection. These are some of the very topics I’ve written about before on this site.

We need to let the “Bush tax cuts” continue. Except that they really aren’t the Bush tax cuts anymore — they’ve been the law for 10 years. Let’s stop pretending they are “very temporary” and either extend them again long term or else make them permanent.

We also need to overhaul the tax code. With the IRC reforms of 1986, Reagan reduced the tax rates to 28% in exchange for getting rid of the tax shelters. As a result, the amount of federal income collected was more at 28% and a clean tax code than at 91% and tax shelters, because at 28%, it really wasn’t worth the time, cost, and effort to hide money.

We need comprehensive tax reform, but not the type that Obama is pushing. His policies of more “tax credits” (which is government spending run through the tax code) and marginal rate increases hampers our recovery. If the federal tax rates are going to rise again – and they will, unfortunately, if Obama has his way – in addition to state and local tax hikes, the tax burden in this country will be staggering. People will do one of two things: 1) start finding ways not to pay it like they did when the rates were outrageous or 2) stop working and investing so much because it’s just going to get taken away from them. When that happens, the economy worsens — and it is already suffering enough. We need to simplify the tax code.

Back to the book — I would heartily recommend it, and also check out Sowell’s overview of it.

by | ECONOMY, FREEDOM, OBAMA, POLITICS, TAXES

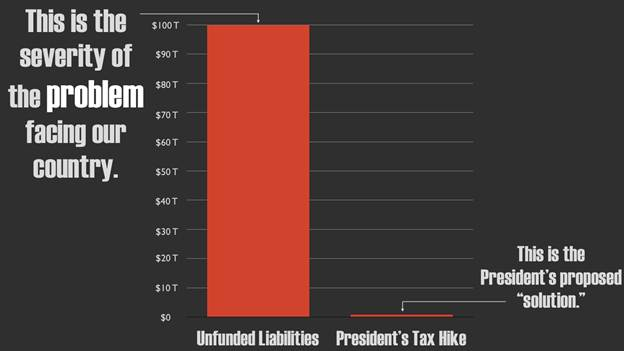

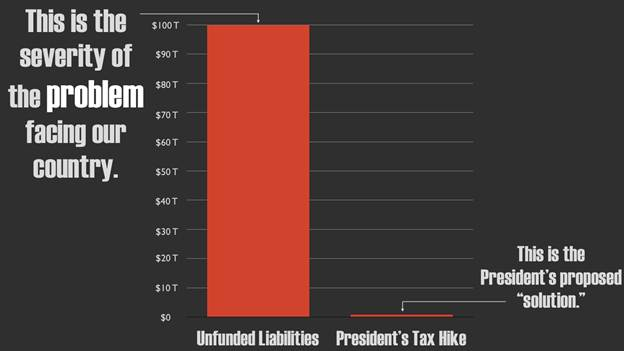

This is fairly self-explanatory

Obama’s plan to tax the rich would have very little impact on the crushing debt — even if you were to tax the top income-earners at 100%…but he doesn’t want to tell you that.

by | ECONOMY, OBAMA, POLITICS, TAXES

In an interview a week before Election Day, President Obama declared that if he won again, it would be mandate for making cuts, but also for raising taxes on the highest income earners.

Reviewing Election Day exit poll data, however, tells a different story.

Looking at the voting patterns broken down by income earning amounts (based on 2011 total family income), there are only TWO categories out of six that Obama won more than 50% of the vote. Those are:

Under $30,000: Obama 63% Romney 35%

$30,000 – $49,999: Obama 57% Romney 42%

The other four out of the six categories had Romney with over 50% of the vote. Those are:

$50,000 – $99,999: Obama 46% Romney 52%

$100,000 – $199,999: Obama 44% Romney 54%

$200,000 – $249,999: Obama 47% Romney 52%

$250,000 or more: Obama 42% Romney 55%

The electorate that voted from Obama – voters whose households earned under $50,000 – are also the same citizens who pay the least amount of taxes. The voters who already pay the most in taxes voted for Romney.

The only “mandate to raise taxes”, therefore, comes from the population of taxpayers who prefer others to pay more in tax so they can continue to pay less. The only clear lesson from the election is that President Obama has created class warfare as it has never been seen before.

(crossposted at redstate.com/alanjoelny)