by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

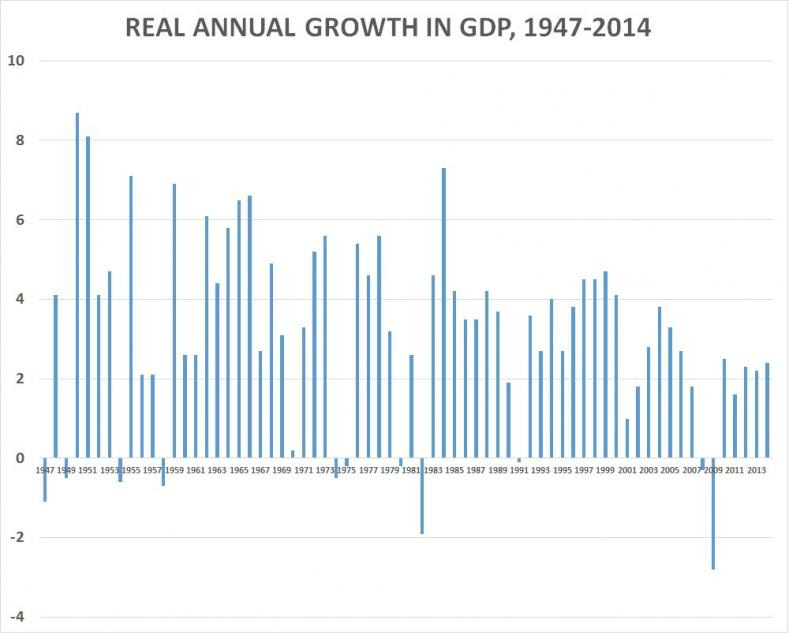

Marketwatch is reporting dismal numbers related to economic growth in the first three months of 2016; expansion is “the slowest pace in two years as business slashed investment by the steepest amount since the Great Recession.”

GDP growth was significantly reduced as well — recording a .5% annual growth rate. The prior three quarters were 1.4%, 2% and 3.9% in the preceeding year, per quarter.

Marketwatch suggests that some economists contend this sluggishness is an anomaly and will bounce back this spring, estimating a 200,000 job growth for April numbers, which will be released on the first Friday in May. Those with this sentiment predict that “the economy will speed up to a 2.6% annual clip in the spring, typically the fastest growing quarter of the year. The same pattern occurred in both 2015 and 2014.”

On the other hand, I tend to side with economists who are a little bit leery about a robust-growth outlook. “A tepid global economic scene and a tumultuous U.S. presidential election marked by heavy anti-corporate rhetoric appears to have made business executives more cautious.”

Business investment is certainly anemic, and we’ve recently crossed the threshold of more businesses closing than opening. None of this is a sign of a healthy economy, and I doubt very much that the April numbers will be so rosy.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

In lieu of the recent news that the GDP actually contracted during the 1st Quarter, some folks at the White House seem fit to blame both the winter and the actual process and algorithms by which 1st Quarter numbers are analyzed.

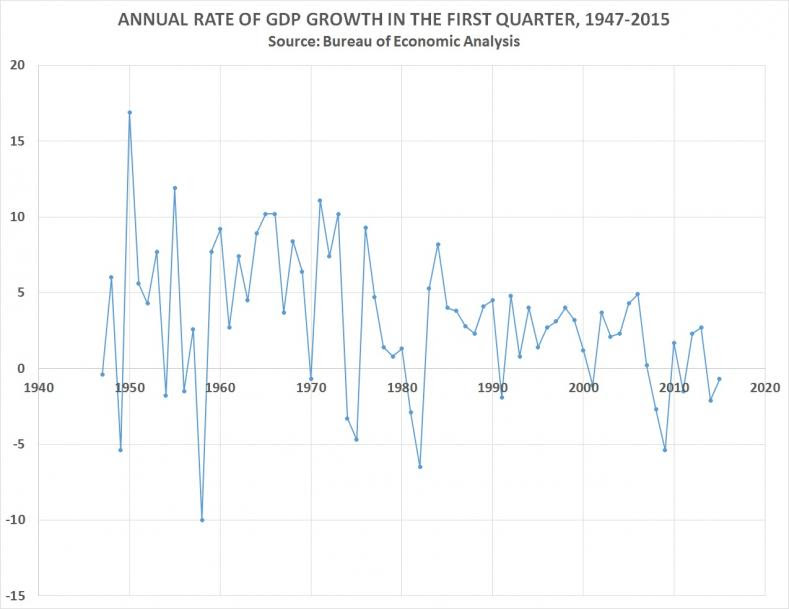

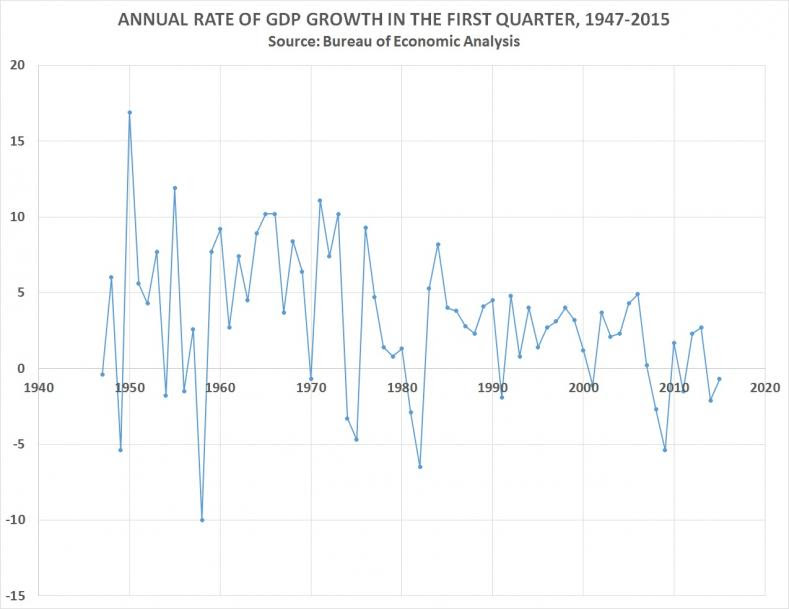

CNS News decided to take a look at Obama’s 1st Quarter numbers and compare them to previous presidents all the way back to 1947, which is the earliest data offered by the Bureau of Economic Analysis. The result shows that Obama has the lowest 1st Quarter numbers of all Presidents. I reproduced the article below, because it had some great graphs which shows the comparison data nicely. This just reaffirms what we know and what I wrote about the other day: the economy is still not that strong.

——–

Even if you leave out the first quarter of 2009—when the recession that started in December 2007 was still ongoing–President Barack Obama has presided over the lowest average first-quarter GDP growth of any president who has served since 1947, which is the earliest year for which the Bureau of Economic Analysis has calculated quarterly GDP growth.

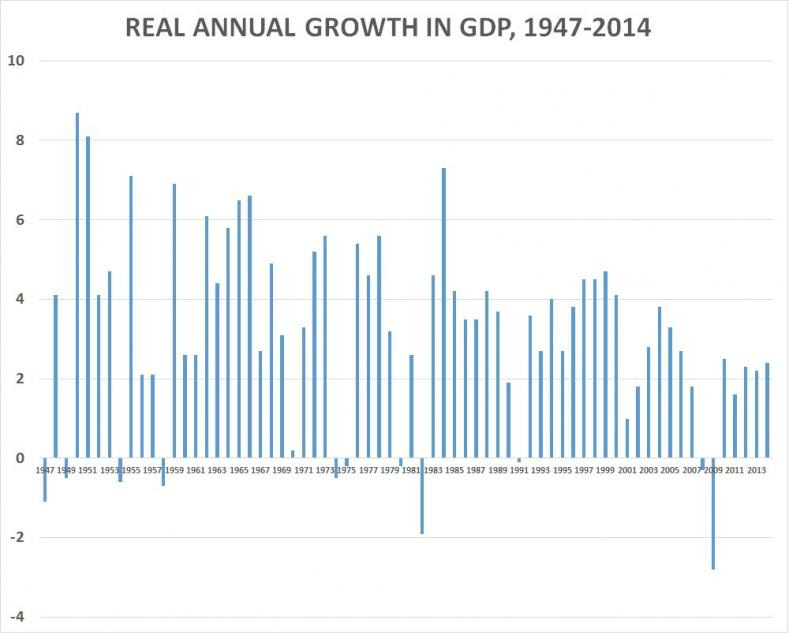

In all first quarters since 1947, the real annual rate of growth of GDP has averaged 4.0 percent.

In the seven first quarters during Obama’s presidency, it has declined by an average of -0.43 percent. And if you leave out the first quarter of 2009 and look only at the first quarters of the six years since the recession ended, it has averaged only 0.4 percent.

In the six years of Harry Truman’s presidency for which the BEA has calculated quarterly GDP, the annual rate of growth in GDP in the first quarter averaged 4.5 percent.

During President Eisenhower’s eight years, it averaged 3.2 percent. During Kennedy’s three years, it averaged 4.9 percent. During Johnson’s five years, it averaged 8.3 percent. During Nixon’s six years, it averaged 5.3 percent. During Ford’s two years, it averaged 2.3 percent. During Carter’s four years, it average 2.4 percent. During Reagan’s eight years, it average 2.1 percent. During George H.W. Bush’s four years, it average 2.9 percent. During Clinton’s eight years, it averaged 2.6 percent. And during George W. Bush’s eight years, it averaged 1.7 percent.

President Obama took office on Jan. 20, 2009. In the first quarter of 2009, GDP declined at an annual rate of -5.4 percent. In the first quarter of 2010, it grew by 1.7 percent. In the first quarter of 2011, it declined -1.5 percent. In the first quarter of 2012, it grew 2.3 percent. In the first quarter of 2013, it grew 2.7 percent. In the first quarter of 2014, it declined -2.1 percent. And in the first quarter of 2015, it declined -0.7 percent.

In these seven first quarters that Obama has been president (2009 through 2015), the annual rate of growth in GDP has declined at an average rate of -0.43 percent.

But the National Bureau of Economic Research says the last recession, which began on December 2007 did not end until June 2009. If you leave out the first quarter of 2009, and only count the six years (2010-2015) since the recession ended in June 2009, real annual rate of growth of GDP in the post-recession first quarters of Obama’s presidency has averaged 0.4 percent.

When GDP declined at -1.5 percent in the first quarter of 2011—which was after the recession and two full years into Obama’s presidency—some blamed it at least partly on the weather.

“Some of the slowdown in growth was linked to bad weather in early 2011 and an 11.7 percent decline in defense spending,” said a Reuters story of May 27, 2011.

When real GDP declined at a rate of -2.1 percent in the first quarter of 2014, a May 30, 2014 New York Times story said: “Most economists on Wall Street and at the Federal Reserve blame a very cold winter for much of the slowdown.”

When real GDP declined at a rate of -0.7 percent in the first quarter of this year, the top paragraph of an Associated Press story said: “The U.S. economy shrank at a 0.7 percent annual rate in the first three months of the year, depressed by a severe winter and a widening trade deficit.”

But there seems something more at work here than climate patterns–or the Obama presidency.

Under previous presidents, real GDP sometimes grew massively during the first quarter. In 1950, under Truman, for example, GDP grew at an annual rate of 16.9 percent in the first quarter. In 1955, under Eisenhower, it grew at a rate of 11.9 percent.

Under Johnson, in the first quarters of both 1965 and 1966, it grew at a rate of 10.2 percent. Under Nixon, it grew at 11.1 percent in the first quarter of 1971, and 10.2 percent in the first quarter of 1973, it grew at 10.2 percent.

Under Ford, in the first quarter of 1976, it grew at 9.3 percent. Under Reagan, in the first quarter of 1984, real GDP grew at a rate of 8.2 percent.

But since 1984—more than three decades ago–there has been no first quarter, in any year, under any president, when real GDP grew even as fast as 5.0 percent. The closest it came was in the first quarter of 2006, when George W. Bush was president, and it hit 4.9 percent.

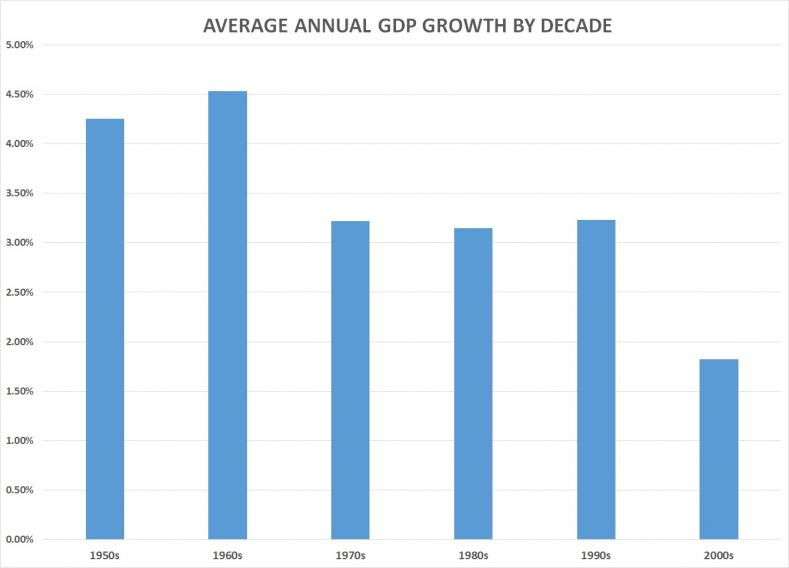

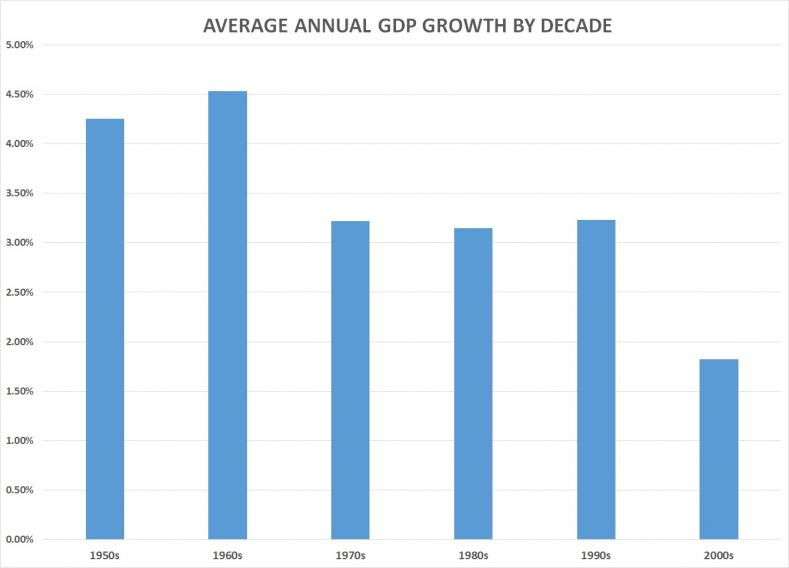

In the decades starting after World War II, average annual growth in GDP peaked in the 1960s.

In the 1950s, annual growth in GDP averaged 4.25 percent. In the 1960s, it climbed to 4.5 percent. But it dropped to 3.22 percent in the 1970s, then 3.15 percent in the 1980s, before ticking up to 3.23 percent in 1990s. In the 2000s, it averaged only 1.82 percent.

In the first five years of this decade (2010-2014), annual growth in GDP has averaged 2.2 percent. But that is less than the 2.7 percent it averaged in the first five years of the last decade (2000-2004) which was before the recession hit at the end of 2007 and brought the decade’s average down to 1.82 percent.

If it were to maintain an average annual rate of 2.2 percent for the next five years, the American economy of this decade would still be growing at less than half the rate of the 1960s.

Should the long-term decline in U.S. economic growth be attributed to cold weather? Or should people in Washington, D.C., start looking around them for an anthropogenic cause.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, OBAMA, POLITICS, TAXES

I came across this little piece in the NYPost discussing the sluggish economy and the arbitrary numbers that come out of the Labor Department. It starts off discussing the 1st Quarter GDP contraction, which stumped many “economists”, and even went so far as to possibly blame the algorithms themselves by which the government analyzes 1st Quarter numbers. Because it certainly couldn’t be domestic policies, could it?

This writer posits that we could indeed be on the bring of a recession, the definition of which is 2 straight quarters of economic contraction, and points out something fairly obvious. People just don’t have a lot of money to spend. I concur this is a major part of assessing the health of an economy, although I would argue that investment spending spurs economic growth even more than consumptive spending, which is this writers argument. Putting that aside, however, he does a decent job pointing out the concerns about the economy that we should all be paying attention to. Here’s the article and food for thought below:

“Anyone with even a quarter of a brain now understands that the US economy got off to a bad start this year.

There was an economic contraction in the first three months — when the nation’s gross domestic product fell at an annualized rate of 0.7 percent — that some quarter-brainers are still blaming on the cold weather, strikes at ports, the strong dollar, solar flares, Martian landings and (insert your own poor excuse here).

The truth: Most of these excuses are part of the problem, although I didn’t personally see or not see the Martians.

But the biggest part is that people don’t have enough money to spend. Interest from savings is down to zero, people don’t liquidate stock gains to make purchases, and job and income growth has been sketchy.

The economy isn’t doing much better in the current quarter either. The Federal Reserve Bank of Atlanta, an independent observer if ever there was one, measures growth so far in the second quarter at an annual rate of just 1.1 percent. That means growth — un-annualized — is a paltry 0.275 percent with less than four weeks left in the quarter.

It’s quite possible that we will eventually be told, after all revisions are made, that the economy met the official definition of a recession in the first half of 2015, which is two straight quarters of contractions.

But the quarter-brainers will probably get something to cheer about when Friday’s employment numbers come out. And, if they don’t strain their quarter-brains looking too deeply into the numbers, they could come away with a smile that can only happen because ignorance is bliss.

Wall Street expects the Labor Department to report that 235,000 new jobs were created in May. That would be higher than the 223,000 new jobs that — before any revisions are made — were created in April.

I’ve written before about the so-called birth/death model, which is the government’s fist-on-the-scale way of adding jobs they assume but can’t prove exist when new companies suddenly come into business in springtime.

The only problem is, entrepreneurs — especially those just starting out and risking their own capital — aren’t very daring when it’s clear to everyone that the economy isn’t doing well. So maybe, just maybe, there are more companies dying this spring than being born.

Labor must be having some second thoughts about the validity of that model since it guessed that only 213,000 phantom jobs were created by newly born companies in April. That’s way down from the 263,000-phantom-job guesstimate in April 2014.

The guesstimate for May should still be substantial. In May of 2014, Labor’s phantom jobs guesstimate added 204,000 jobs. Even if that’s been adjusted downward, this will still give a nice boost to the job growth that will be reported Friday.

There’s no guarantee, of course, that Friday’s number will be good. Any number of things could go wrong. Seasonal adjustments could hurt Friday’s number. And, of course, companies could have actually cut jobs in April. There were plenty of announcements of such cuts.

So, will Wall Street get the 235,000-job growth it expects? I say there’s a 60 percent chance Friday’s number meets or exceeds that guess.

But even if you guess right on Friday’s jobs figure, the prize could be elusive. Most folks don’t know how Wall Street will react to a better-than-expected number. If the figure is too strong, it’ll causes interest rates to rise and bond prices to fall in anticipation that the Federal Reserve’s interest rate hike is back on the table. If the number is weaker than expected, even the quarter-brainers will start worrying the economy is tanking.”