by | ARTICLES, BLOG, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

With open enrollment for Obamacare beginning in a week, the Wall Street Journal outlines some of the major failures of this legislation to attract enrollees. Obamacare is severely behind target, which in turn affects costs for premiums for subscribers and costs to the government for subsidies. The Wall Street Journal suggests that within a year, by 2017, the need to overhaul and/or replace Obamacare will be necessary. Read their thoughts below:

ObamaCare’s image of invincibility is increasingly being exposed as a political illusion, at least for those with permission to be honest about the evidence. Witness the heretofore unknown phenomenon of a “free” entitlement that its beneficiaries can’t afford or don’t want.

This month the Health and Human Services Department dramatically discounted its internal estimate of how many people will join the state insurance exchanges in 2016. There are about 9.1 million enrollees today, and the consensus estimate—by the Congressional Budget Office, the Medicare actuary and independent analysts like Rand Corp.—was that participation would surge to some 20 million. But HHS now expects enrollment to grow to between merely 9.4 million and 11.4 million.

Recruitment for 2015 is roughly 70% of the original projection, but ObamaCare will be running at less than half its goal in 2016. HHS believes some 19 million Americans earn too much for Medicaid but qualify for ObamaCare subsidies and haven’t signed up. Some 8.5 million of that 19 million purchase off-exchange private coverage with their own money, while the other 10.5 million are still uninsured. In other words, for every person who’s allowed to join and has, two people haven’t.

Among this population of the uninsured, HHS reports that half are between the ages of 18 and 34 and nearly two-thirds are in excellent or very good health. The exchanges won’t survive actuarially unless they attract this prime demographic: ObamaCare’s individual mandate penalty and social-justice redistribution are supposed to force these low-cost consumers to buy overpriced policies to cross-subsidize everybody else. No wonder HHS Secretary Sylvia Mathews Burwell said meeting even the downgraded target is “probably pretty challenging.”

The HHS survey shows three of four ObamaCare-eligible uninsured people think having coverage is important—but four of five say they couldn’t fit their share of the premiums into their budgets even after the subsidies. They’re not poor; they tend to have jobs in industries like construction, retail and hospitality but feel insecure financially; and they prioritize items like paying down debt, car repairs or saving to buy a home over insurance.

The law’s failure to appeal to the young and rising middle class is already cascading through the insurance markets. Researchers at the Robert Wood Johnson Foundation and Urban Institute recently published a remarkable study of the industry barometer called medical loss ratios, or MLRs, and the pressure is building fast.

MLRs measure the share of premium revenue that flows to reimbursing medical claims. ObamaCare sets an MLR floor of 80% for patient care, with one-fifth left over for overhead like administration and profits, and the pre-ObamaCare 2010-13 historical trend for the individual market ranged from 79% to 86%.

The researchers found that in 2014—the first full year of claims experience in ObamaCare—average MLRs across all health plans sold on 16 state exchanges roamed from 90% to 99%. Average MLRs in 11 states climbed to 100% or more, reaching as high as 121% in Massachusetts. A business can’t stay solvent for long spending $1.21 for every $1 that comes in.

The 2014 MLRs are used to set rates for 2016 premiums, which are still under regulatory review. But the researchers estimate that to rebound to an MLR of 85%, premiums in the 11 money-losing states need to rise by 10% to 36% in the best estimate and 23% to 52% in the worst scenario. The familiar danger is that as rates rise, more people drop out, and thus rates must rise still higher, as the states that attempted ObamaCare-like regulatory schemes in the 1980s and 1990s discovered.

ObamaCare liberals pose as what-works-and-what-doesn’t technocrats. So perhaps they’d care to explain what it says about their creation that so many rational adults are willing to pay a fine of $695 or 2.5% of their earnings, whichever is higher, for the privilege of not buying an ObamaCare-compliant health plan.

***

ObamaCare will almost inevitably be reopened in 2017, whoever wins the election. The good news is the emerging consensus among Republican candidates about a credible, pragmatic and optimistic alternative. Jeb Bush was the latest to release a plan two weeks ago—and this is a debate that has always deserved to be litigated at the presidential level to create a mandate for reform.

The basic approach is to deregulate insurance and medical practice while replacing ObamaCare’s complex subsidy schedule with a refundable tax credit for individuals who lack job-based coverage. Unchained from benefit and redistribution mandates, insurance products and prices would come to reflect what consumers want. The credit would be sufficient to buy at least coverage for catastrophic expenses if people get sick, and the trade-offs of such skinnier plans might look better to voters priced out of ObamaCare.

GOP reformers also recognize that the Cadillac tax on high-cost employer-sponsored health plans is a heat shield that might let them solve some of the problems of the pre-2010 health finance status quo. Substituting a cap on the tax-code subsidy that helps drive medical inflation is more politically plausible with the Cadillac tax in place than without.

Mr. Bush was shrewd to frame his proposal with the vocabulary of innovation and aspiration. ObamaCare is built on a 20th-century chassis that is ever less relevant to modern medicine and consumer finance. If the law continues to underperform, voters may be open to a new model that puts their choices and needs ahead of the political class’s.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

From my friend, Michael Cannon:

It appears that Medicaid-expansion enrollees are going to cost states a lot more than they thought. According to a just-released “2014 Actuarial Report on the Financial Outlook for Medicaid” from the Department of Health and Human Services, ObamaCare’s Medicaid expansion is costing significantly more than projected:

“In 2014, the average benefit costs of newly eligible adult enrollees are expected to have been substantially greater than those for non-newly eligible adult enrollees in the program. Newly eligible adults are estimated to have had average benefit costs of $5,517 in 2014, 19 percent greater than non-newly eligible adults’ average benefit costs of $4,650. These estimates are significantly different from those in previous reports, in which average benefit costs for newly eligible adults in 2014 were estimated to be 1 percent lower than those of non-newly eligible adults.”

So the Obama administration had projected newly eligible Medicaid enrollees would cost about $50 less than other Medicaid-enrolled adults, but they actually cost nearly $1,000 more. Nice.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Yesterday it was reported that the Treasury Department paid $3 billion to cover Obamacare cost-sharing subsidies without Congressional approval. The heart of the dispute appears to be whether or not these subsidies were supposed to be funded via yearly appropriations or not. The House Ways and Means Chair, Paul Ryan, argues the former. Health and Human Services, via the Department of Justice, argues the latter.

In order to make sense of the funding dispute, it seemed necessary to dig around in the agency budgets to see how cost sharing was accounted for. Cost-sharing falls under the purview of the “Centers for Medicare & Medicaid Services (CMS)”. Yet, while comparing the budget requests for 2014 (for which the Treasury covered costs) and the ones for 2015 (current) & 2016 (future), it became clear that CMS changed the way it accounted for cost-sharing funding after 2014.

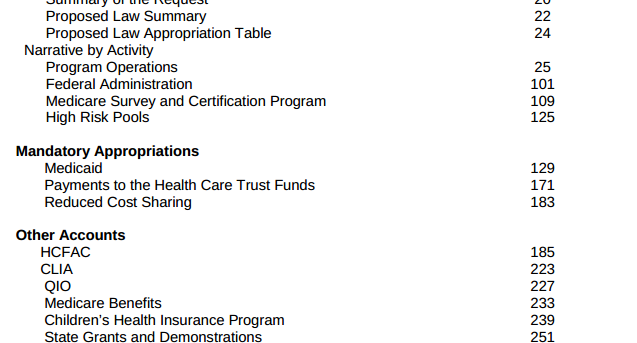

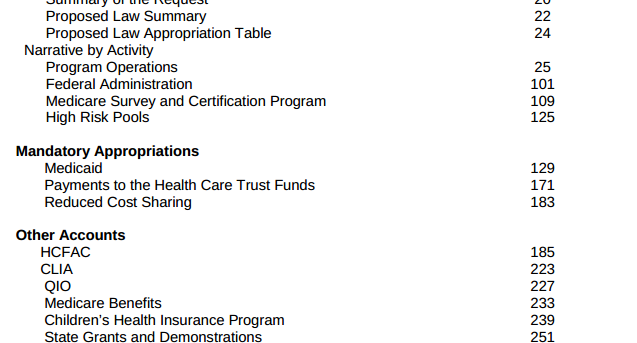

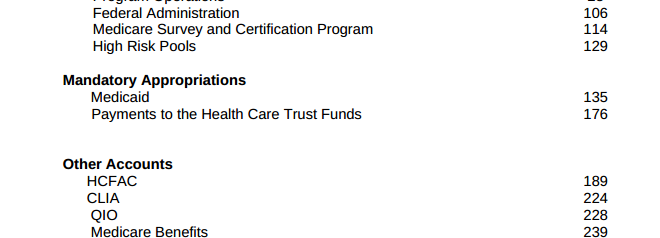

Looking at the 2014 Budget request, CMS had section called “Mandatory Appropriations”, which listed three items: 1) Medicaid 2) Payments to the Health Care Trust Funds 3) Reduced Cost Sharing.

Further in that budget, CMS wrote, “The FY 2014 request for Reduced Cost Sharing for Individuals Enrolled in Qualified Health Plans is $4.0 billion in the first year of operations for Health Insurance Marketplaces, also known as Exchanges. CMS also requests a $1.4 billion advance appropriation for the first quarter of FY 2015 in this budget to permit CMS to reimburse issuers who provided reduced cost-sharing in excess of the monthly advanced payments received in FY 2014 through the cost-sharing reduction reconciliation process.”

This position — that Obamacare cost-savings was to be funded by yearly appropriations– was reiterated by a “July 2013 letter to then Sen. Tom Coburn, Congressional Research Service wrote that, “unlike the refundable tax credits, these [cost-sharing] payments to the health plans do not appear to be funded through a permanent appropriation. Instead, it appears from the President’s FY2014 budget that funds for these payments are intended to be made available through annual appropriations.” (Remember, a 2014 budget would have been written also in 2013)

You can see a picture of the 2014 budget here:

However, Congress rejected those requested appropriations at the time so “the administration went ahead and made the payments anyway.” That is the mystery $3 billion paid for by the Treasury.

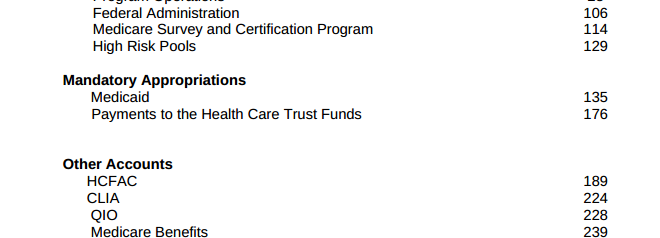

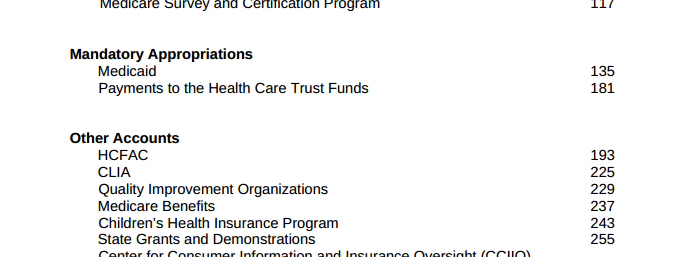

There is a noticeable change, however, with the CMS budget for 2015. The cost-sharing portion, which was originally listed as “Mandatory Payments” in 2014, is not listed at a “Mandatory Payment” anymore. Nor is it for 2016 either.

2015 Budget request:

CMS Budget 2015

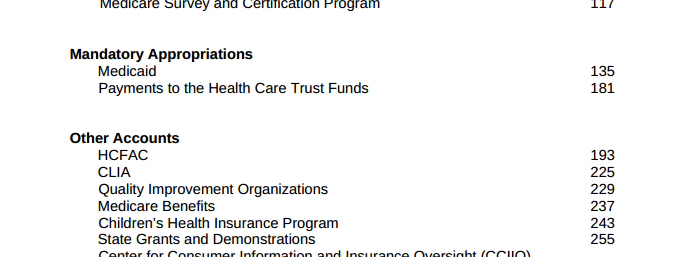

2016 Budget request:

CMS Budget 2016

Reading through the 2015 and 2016 budget documents, “cost sharing” appears in various areas, usually related to Medicaid, but not in one specific section — contrary to how it was accounted for in 2014, as a specific appropriation from the agency.

What’s equally interesting is that the DoJ argued about this specific matter in their recent brief dated January 26, 2015, saying that, “The House’s statutory arguments are incorrect. The cost sharing reduction payments are being made as part of a mandatory payment program that Congress has fully appropriated. See 42 U.S.C. § 18082. With respect to Section 4980H, Treasury exercised its rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute. See 26 U.S.C. § 7805(a).”

Yet, as shown above, the “mandatory program for cost-sharing”, that was submitted for funding (and rejected) in 2014, was removed entirely from the 2015 and 2016 budget requests. Now there is no way to even see the “cost-sharing” portion of the budget at all. And this appears to contract the statement by the DoJ that there is a “mandatory payment” program.

Cost sharing subsidies are an enormous part of Obamacare. “These payments come about because President Obama’s healthcare law forces insurers to limit out-of-pocket costs for certain low income individuals by capping consumer expenses, such as deductibles and co-payments, in insurance policies. In exchange for capping these charges, insurers are supposed to receive compensation.”

Cost sharing is expected to cost taxpayers roughly $150 billion over the next 10 years, according to estimates by the Congressional Budget Office.

But we now don’t know the specific funding amounts for the year 2015 or for 2016, and the costs for 2014 are in dispute, involving that $3 billion in funds from the Treasury (which came from somewhere and somehow).

The one thing we do know for certain: the Treasury Department is clearly exercising the power it perceives to have, as a “rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute.”

by | ARTICLES, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

A few weeks ago, I reported how Obama’s budget contained a $22 billion student loan bailout to cover a massive shortage of funds for the Department of Education Federal Student Loan program. Because the program is categorized as a “credit program”, due to a “quirk in the budget process for credit programs, the department can add the $21.8 billion to the deficit automatically, without seeking appropriations or even approval from Congress.”

Now it is being reported that the Treasury Department approved and paid for $3 billion in Obamacare costs without seeking Congressional approval. Have we uncovered another similar quirk in the federal budget process that allows for the Treasury to cover Obamacare costs that aren’t funded? We don’t actually know yet, because the letter from the Treasury which “revealed that $2.997 billion in such payments had been made in 2014”, “didn’t elaborate on where the money came from.”

Here’s what’s going on:

“At issue are payments to insurers known as cost-sharing subsidies. These payments come about because President Obama’s healthcare law forces insurers to limit out-of-pocket costs for certain low income individuals by capping consumer expenses, such as deductibles and co-payments, in insurance policies. In exchange for capping these charges, insurers are supposed to receive compensation.

What’s tricky is that Congress never authorized any money to make such payments to insurers in its annual appropriations, but the Department of Health and Human Services, with the cooperation of the U.S. Treasury, made them anyway.”

So here we have two agencies collaborating on funding for Obamacare without Congressional approval. When asked about the $3 billion by House Ways and Means Chairman Rep. Paul Ryan, he received a letter which merely described the what the cost-sharing program was, without explaining anything 1) regarding how the payments came to be made, or 2) where the money came from.

What’s more, because the cost-sharing payments from the Department of Homeland Security is part of a larger lawsuit against Obama’s Executive Actions, filed by John Boehner, the letter referred Rep. Ryan to the Department of Justice.

It turns out that Department of Justice recently argued this topic on January 26th. In this brief the Department of Justice argued that John Boehner’s position, that the cost-sharing program payments required annual appropriation, was incorrect, “The cost sharing reduction payments are being made as part of a mandatory payment program that Congress has fully appropriated.” So the Department of Justice and the Treasury Department and the Department of Health and Human Services maintain that the payment they made was licit and Congressionally approved as part of Congressional appropriations.

However, prior budget requests and negotiations tell a different story about how Obamacare cost-sharing is funded.

“For fiscal year 2014, the Centers for Medicare and Medicaid Services (the division of Health and Human Services that implements the program), asked Congress for an annual appropriation of $4 billion to finance the cost-sharing payments that year and another $1.4 billion “advance appropriation” for the first quarter of fiscal year 2015, “to permit CMS to reimburse issuers …”

In making the request, CMS was in effect acknowledging that it needed congressional appropriations to make the payments. But when Congress rejected the request, the administration went ahead and made the payments anyway.

The argument that annual appropriations are required to make payments is also backed up by a report from the Congressional Research Service, which has differentiated between the tax credit subsidies that Obamacare provides to individuals to help them purchase insurance, and the cost-sharing payments to insurers.

In a July 2013 letter to then Sen. Tom Coburn, Congressional Research Service wrote that, “unlike the refundable tax credits, these [cost-sharing] payments to the health plans do not appear to be funded through a permanent appropriation. Instead, it appears from the President’s FY2014 budget that funds for these payments are intended to be made available through annual appropriations.”

As we are likely to not receive any answers soon regarding the $3 billion in Obamacare funding, or the source, here are some things to think about and look for as we wait:

1) How will cost-sharing be funded in this year’s budget?

2) Where did the $3 billion come from? If the $3 billion came from another agency, does that mean we have agencies who have large enough slush funds to absorb a $3 billion transfer?

3) If the $3 billion was tacked onto the deficit (like the student loan “bailout”), what does this bode for future cost-sharing payments? The Congressional Budget Office has already estimated that cost-sharing payments to insurers are expected to cost about $150 billion over the next 10 years.