by | ARTICLES, GOVERNMENT, TAX TIPS, TAXES

Military Members: Get Free Tax Help

The IRS offers free tax help to members of the military and their families through the Volunteer Income Tax Assistance program. VITA is available both on and off base including sites for military members overseas. Here are five tips to know about free tax help for the military:

1. Armed Forces Tax Council. The Armed Forces Tax Council oversees the military tax programs offered worldwide.

2. Certified Staff. Military VITA certified employees staff their sites. They receive training on military tax issues, like tax benefits for service in a combat zone. They can help you with special extensions of time to file your tax return and to pay your taxes or with special rules that apply to the Earned Income Tax Credit.

3. What to Bring. Take the following records with you to your military VITA site:

- Valid photo identification.

- Social Security numbers for you, your spouse and dependents; or individual taxpayer identification numbers (ITINs) or adoption taxpayer identification numbers (ATINs) for those who don’t have Social Security numbers.

- Birth dates for you, your spouse and dependents.

- Your wage and earning forms, such as Forms W-2, W-2G, and 1099-R.

- Interest and dividend statements (Forms 1099).

- Health coverage information forms such as Form 1095-A, 1095-B or 1095-C.

- Exemption Certificate Number for exemptions that you obtained through the Marketplace.

- A copy of your last year’s federal and state tax returns, if available.

- Routing and account numbers for direct deposit of your tax refund.

- Total amount you paid for day care and the day care provider’s identifying number. This is usually an Employer Identification Number or Social Security number.

- Other relevant information about your income and expenses.

4. Joint Returns. If you are married filing a joint return, generally both you and your spouse need to sign. If you both can’t be present to sign the return, you should bring a valid power of attorney form unless you are eligible for an exception. Publication 501, Exemptions, Standard Deduction, and Filing Information, has more details.

5. Health Care Tax Law Help. IRS Free File can help with tax provisions of the health care law. The software will walk you through the lines on the tax forms that relate to the Health Care Law. If your income was $62,000 or less, you qualify for Free File software. If you made more than $62,000, you can use Free File Fillable Forms.

Each and every taxpayer has a set of fundamental rights they should be aware of when dealing with the IRS. These are your Taxpayer Bill of Rights. Explore your rights and our obligations to protect them on IRS.gov.

Additional IRS Resources:

Military Pay Exclusion – Combat Zone Service

Publication 4940, Tax Information for Active Duty Military and Reserve Personnel

Publication 3, Armed Forces’ Tax Guide

Gathering Your Health Coverage Documentation

IRS YouTube Videos:

Military Tax Tips – English | Spanish

by | ARTICLES, BUSINESS, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

I have written numerous articles over the year about the onerous, destructive practice of IRS asset forfeiture cases. Basically, the IRS has been leveraging laws intended to target money launderers and criminals in order to seize the bank accounts of business owners who make one or more deposits of $10,000 cash. Time after time, these cases showed the circumstances were not criminal, and yet citizens spent months and even years trying to get their hard-earned money back.

In 2014, after a series of high-profile cases outlined the outrageous behavior, the IRS announced it would restrict its practice to situations in which the person is suspected of criminal activity; subsequently, the DoJ issued a change as well, saying that they would devote themselves only to the “most serious illegal banking transactions.”

While these changes are a step in the right direction, they still left behind a trail of cases that severely disrupted the work and lives of many Americans. Remember, money was seized time after time for years — usally without any charges ever brought forth, only the suspicion of possible “illegal activity” for merely depositing large sums of money.

Some of the tactics involved in the practice of asset seizure involve the government offering a “settlement” to the business owners, returning to them only a portion of their hard-earned money, which keeping the rest for their coffers. Many people — for fear of government or lack of funds for representation — chose the path of settlement to be able to move on with their lives and have some money back in their accounts.

Two asset forfeiture cases have emerged recently where both parties are requesting restitution. The first cases involves trying to recover the portion of the money that the government kept as part of the settlement; the second cases requests the full portion that was seized after the party involved unknowingly signed away his account when visited by IRS agents.

In the first case, due to “a prior settlement with the government, Randy and Karen Sowers, who own South Mountain Creamery in Middletown, Maryland, got back a portion of the seized money, around $33,500. Now in a new letter filed this week to the Justice Department, a nonprofit organization that has has been working with the farmers is helping in the fight to get back the rest of the couple’s money — $29,500 — despite the prior settlement.

Randy Sowers said his bank teller initially suggested that his wife keep deposits under $10,000 to avoid time-consuming paperwork at the bank. “We thought it was very legitimate,” he said. Karen Sowers initially wanted to deposit $12,000 earned from a weekend farmer’s market. “If I wanted to hide it, I would have put it in a can. We have trouble paying our bills and don’t need the government coming and taking money from us.”

Despite settling previously with the government, the Sowerses and Johnson say they are owed all of the assets, and initially had to settle for fear of losing the full amount seized and potentially more assets.

Congress has even gotten into the fray. The House Ways and Means Subcommittee on Oversight took up the Sowers case, and asked the Treasury Department to review similar cases.”

The related cases include Khalid “Ken” Quran, who owns a convenience store in Greenville, North Carolina. He had more than $150,000 seized in June 2014 after he unknowingly agreed to forfeit his bank account when IRS agents visited his store, accusing him of skirting reporting laws. Quran denies the charges.

“He said, ‘You need to sign a paper,’ and I told him my English is not right,” said Quran, an immigrant from the Middle East. “Then he read it to me like you would read the newspaper and said you need to sign it.” Quran said he did nothing wrong. “No bank told me that. No bookkeeper told me that,” he said.

He has not received any of his money back, and the Institute for Justice has also filed a petition on Quran’s behalf. On Tuesday, the legal nonprofit send a letter to the IRS, asking for his petition to be reviewed.”

The IRS and Department of Justice should work immediately to make these cases, and possibly others, correct again. The seizures, as they were practiced prior to the changes made in 2014, were egregious and improper.

by | ARTICLES, BLOG, BUSINESS, FREEDOM, GOVERNMENT, POLITICS, TAX TIPS, TAXES

The IRS announced this morning that a hardware failure occurred sometime yesterday afternoon; because of this, tax processing systems are not currently not functioning correctly.

As a result of the failure, the IRS is unable to accept tax returns filed electronically, and may also have difficultly processing refunds; however, they do not believe that “major disruptions” will occur long-term. By-and-large, 90% of taxpayers should still be able to get their refunds within 21 days.

If you visit IRS.gov, the website is up and running by some features are unavailable, such as “Where’s My Refund?” The outage will likely continue throughout the day today. Taxpayers who use services and companies that file their electronic return will see their return filing on hold until the system is properly restored.

UPDATE:

E-filing had been restored but the cause remains unknown. The IRS has assured taxpayers that hackers don’t appear to be involved; an IRS spokesman said it looked to be a “power or electrical issue” but did not provide any more substance on the matter.

According to Bloomberg, “The system failure occurred at a center in West Virginia, according to the person with knowledge off the matter. Agency officials were trying to determine if any other facilities were affected.

The IRS website lists several facilities in West Virginia; it wasn’t clear which might have been affected. IRS sites there include at least two “enterprise computing centers” in Martinsburg and Kearneysville and the Beckley Finance Center in Beckley. The finance center, part of the IRS’s chief financial office, processes payments for manual transactions and electronic payment files and helps handle the agency’s general ledger, according to the website.”

The IRS is sure to argue that budget cuts are the reason why such an episode occurred, as basic taxpayer functions have eroded over the past few years. Of course, the IRS scandals that continue to plague the agency don’t help improve its image.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

The IRS is involved in another “erased hard drive” event — and it’s not a part of the IRS scandal of 2013. It is apparent that there is a pattern of destruction at the agency.

This time, the hard drive that was erased belonged to “Samuel Maruca, former director of transfer pricing operations at the IRS Large Business and International Division.” Maruca was also a top level employee at the IRS, and was also involved in a controversy; this time, the scrutiny involved the IRS’s decision to hire an inexperienced yet elite law firm to handle tax data.

In this particular incident, “although there was a court preservation order on all documents related to the IRS hiring of the outside firm, the hard drive was erased anyway. The order was borne of a Freedom of Information Act (FOIA) request submitted by Microsoft.

Even though the white shoe law firm has zero experience handling sensitive tax data, taxpayers have been footing bills of over $1,000 per hour for its services.”

And more:

“Despite its complete inexperience handling audits or taxpayer data, Quinn Emanuel was hired under an initial $2.2 million contract.

This unusual decision prompted a probe by Finance Committee Chairman Orrin Hatch (R-Utah), based on concerns that the decision to hire outside contractors was expensive and entirely unnecessary.

As Sen. Hatch pointed out in his letter to the IRS, the agency already has access to around 40,000 employees responsible for enforcement. The IRS can also turn to the office of Chief Counsel or a Department of Justice attorney, both of which have the expertise to conduct this kind of work, without risking sensitive information.

The fact that another important hard drive is permanently gone can only lead to two conclusions: 1) that the IRS is still thoroughly incompetent or 2) the IRS is exceedingly corrupt. Neither of these are good for the taxpayer. The only immediately remedy should be to remove IRS Commissioner John Koskinen.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, TAX TIPS, TAXES

Tax season has begun. Normally, the deadline for filing your federal tax return is April 15. But because the Washington D.C. Emancipation Day holiday falls on April 15 this year, Tax Day is the Monday after, April 18th.

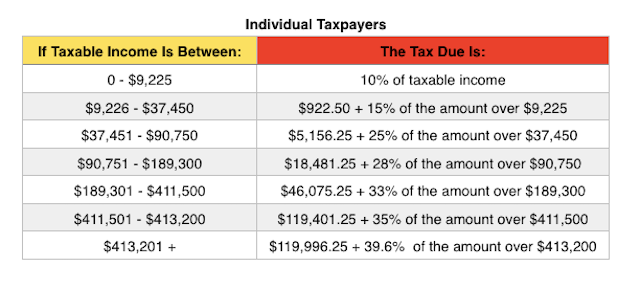

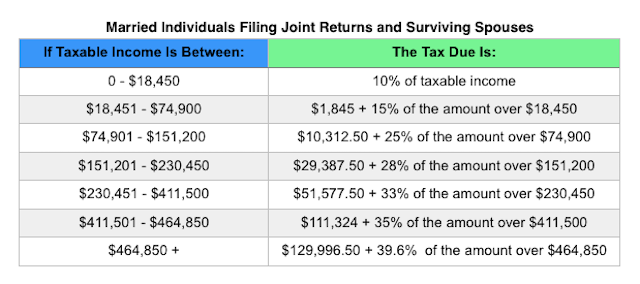

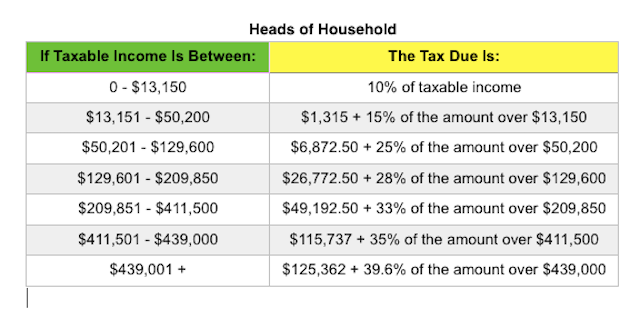

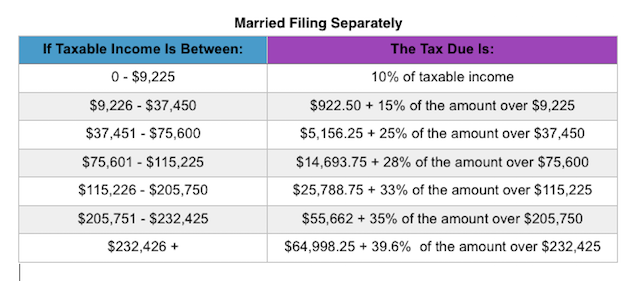

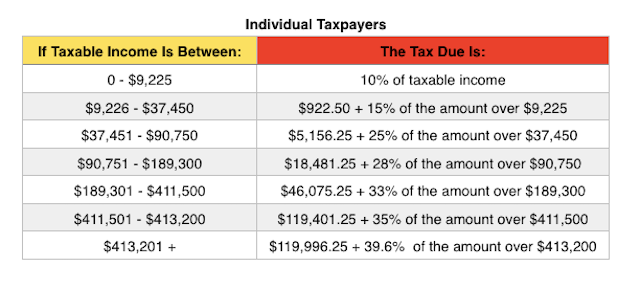

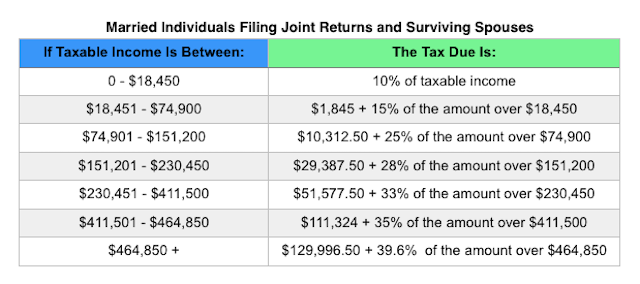

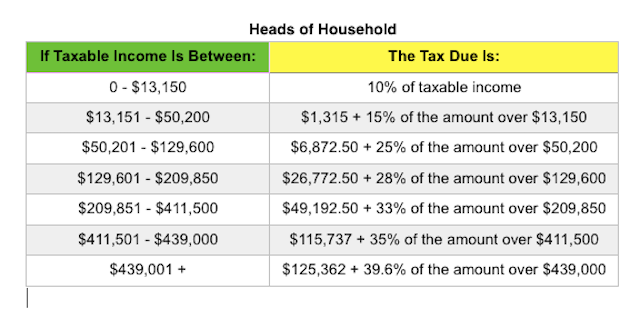

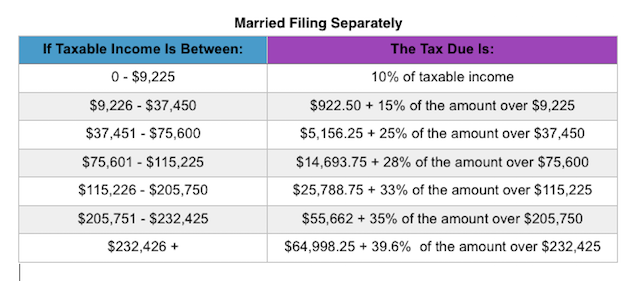

Last spring, Forbes put together a nice, extensive list of all the tax rates and adjustments for 2015. I have posted below some of the most pertinent information. For an all-inclusive list, you should check out the article in its entirety.

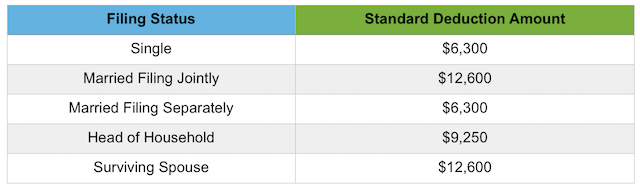

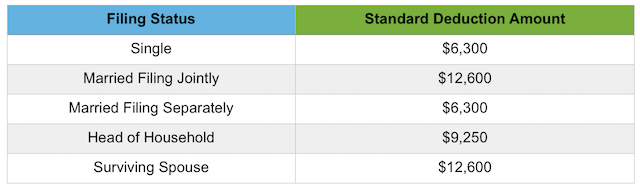

The standard deduction amounts are:

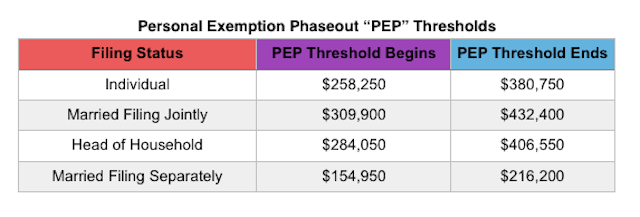

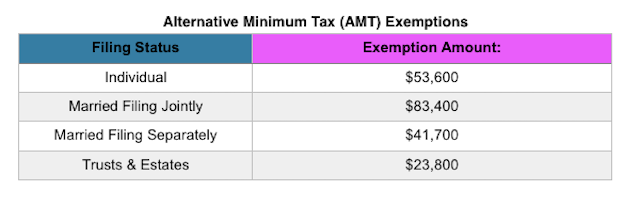

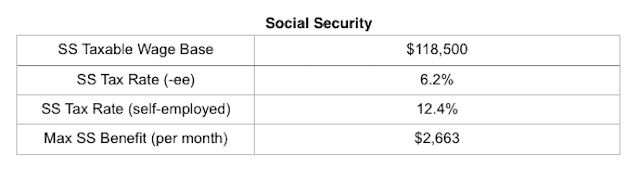

Some tax credits are also adjusted for 2015. Some of the most common tax credits are:

Earned Income Tax Credit (EITC). For 2015, the maximum EITC amount available is $3,359 for taxpayers filing jointly with one child; $5,548 for two children; $6,242 for three or more children (up from $6,143 in 2014) and $503 for no children. Phaseouts are based on filing status and number of children and begin at $8,240 for single taxpayers with no children and $18,110 for single taxpayers with one or more children.

Child & Dependent Care Credit. For 2015, the value used to determine the amount of credit that may be refundable is $3,000 (the credit amount has not changed). Keep in mind that this is the value of the expenses used to determine the credit and not the actual amount of the credit.

Hope Scholarship Credit. The Hope Scholarship Credit for 2015 is an amount equal to 100% of qualified tuition and related expenses not in excess of $2,000 plus 25% of those expenses in excess of $2,000 but not in excess of $4,000. That means that the maximum Hope Scholarship Credit allowable for 2015 is $2,500. Income restrictions do apply and for 2015, those kick in for taxpayers with modified adjusted gross income (MAGI) in excess of $80,000 ($160,000 for a joint return).

Lifetime Learning Credit. As with the Hope Scholarship Credit, income restrictions apply to the Lifetime Learning Credit. For 2015, those restrictions begin with taxpayers with modified adjusted gross income (MAGI) in excess of $55,000 ($110,000 for a joint return).

Changes were also made to certain tax Deductions, deferrals & exclusions for 2015. You’ll find some of the most common here:

Student Loan Interest Deduction. For 2015, the maximum amount that you can take as a deduction for interest paid on student loans remains at $2,500. Phaseouts apply for taxpayers with modified adjusted gross income (MAGI) in excess of $65,000 ($130,000 for joint returns), and is completely phased out for taxpayers with modified adjusted gross income (MAGI) of $80,000 or more ($160,000 or more for joint returns).

Flexible Spending Accounts. The annual dollar limit on employee contributions to employer-sponsored healthcare flexible spending accounts (FSA) edges up to $2,550 for 2015 (up from $2,500).

IRA Contributions. The limit on annual contributions to an Individual Retirement Arrangement (IRA) remains unchanged at $5,500. The additional catch-up contribution limit for individuals aged 50 and over remains at $1,000.

Also note that the floor for medical expenses remains 10% of adjusted gross incocome (AGI) for most taxpayers. Taxpayers over the age of 65 may still use the 7.5% through 2016.

For a more complete list of tables and rates, check out the Forbes article or visit the official IRS website.