by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAX TIPS, TAXES

March 23, 2010: Obamacare was signed into law by President Obama. How have we fared since then? Sally Pipes over at NYDailyNews gives a good overview of how Obamacare has failed to live up to its expectations.

“Obamacare turns five years old today. But there’s little to celebrate.

When he signed his signature piece of legislation into law, President Obama guaranteed lower health-care costs, universal coverage and higher-quality care. Americans wouldn’t have to change their doctors if they didn’t want to. Five years later, the health law has failed to fulfill those grandiose promises.

“In the Obama administration,” candidate Obama boasted in 2008, “we’ll lower premiums by up to $2,500 for a typical family in a year.”

Not quite. A recent report from the National Bureau of Economic Research examined the non-group marketplace, where families and individuals who don’t get coverage through work shop for insurance. The report concluded that 2014 premiums were 24.4% higher than they would have been without Obamacare.

On Obamacare’s third birthday, the White House reassured Americans the law would protect vulnerable patient populations from increases in drug prices.

“Preventing them from being charged more because of a pre-existing condition or getting fewer benefits like mental health services or prescription drugs,” was a key purpose of the law, explained the White House.

Instead, drug costs for these patients have skyrocketed. The majority of health plans on the exchanges have shifted costs for expensive medications onto patients.

In 2015, more than 40% of all “silver” exchange plans — the most commonly purchased — are charging patients 30% or more of the total cost of their specialty drugs. Only 27% of silver plans did so last year.

Part of the problem is that Obamacare has quashed competition.

The president promised in 2013 that “this law means more choice, more competition, lower costs for millions of Americans.” But that hasn’t turned out to be true. According to the Heritage Foundation, the number of insurers selling to individual consumers in the exchanges this year is 21.5% less than the number on the market in 2013 — the year before the law took effect.

The Government Accountability Office reports that insurers have left the market in droves. In 2013, 1,232 carriers offered insurance coverage in the individual market. By 2015, that number had shrunk to 310.

A man looks over the Affordable Care Act (commonly known as Obamacare) signup page on the HealthCare.gov website in New York in this October 2, 2013 photo illustration.

As competition in the exchanges declines, so does quality — just like Obama inadvertently predicted in 2013, when he said: “without competition, the price of insurance goes up and the quality goes down.”

Consumers who purchase insurance on the law’s exchanges have fewer options than they had pre-Obamacare. McKinsey & Co. noted that roughly two-thirds of the hospital networks available on the exchanges were either “narrow” or “ultra-narrow.” That means that these insurance plans refuse to partner with at least 30% of the area’s hospitals. Other plans exclude more than 70%.

Patients may also have fewer doctors to pick from. More than 60% of doctors plan to retire earlier than anticipated — by 2016 or sooner, according to Deloitte. The Physicians Foundation reported in the fall that nearly half of the 20,000 doctors who responded to their survey — especially those with more experience — considered Obamacare’s reforms a failure.

The Obama administration claims the health-care law has been a success because millions have gained insurance coverage. But that coverage is worthless if they can’t find a doctor or hospital who will see them.

Further, as many as 89% of the Americans who signed up for Obamacare when the exchanges opened in 2013 already had insurance. In other words, many exchange enrollees simply switched from one plan to another.

And the law is set to cover far fewer people than initially promised. In March 2011, the Congressional Budget Office forecast that 34 million uninsured would gain insurance thanks to Obamacare by 2021. But this month, the agency revised that estimate to 25 million obtaining coverage by 2025.

Covering those people isn’t cheap. This month, the CBO estimated the law’s 10-year cost will reach $1.2 trillion — a far cry from the President’s initial promise of $940 billion.

So much for President Obama’s five-year-old declaration that he would not sign a plan that “adds one dime to our deficits — either now or in the future.”

Time and again, Obama has been proven wrong about what his health law would accomplish. Quality hasn’t improved, and costs continue to grow out of control. So far at least, that’s Obamacare’s legacy.”

by | ARTICLES, BLOG, CONSTITUTION, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

In Obama’s Keystone recent veto message to Congress, our President cited the ongoing State Department review as the basis for his decision. He stated, “And because this act of Congress conflicts with established executive branch procedures and cuts short thorough consideration of issues that could bear on our national interest — including our security, safety, and environment — it has earned my veto.”

How incredibly obnoxious and incompetent is the President to say that after SIX years, the State Department has failed to complete its review. Nothing else at all needs to be said as to why the economy is still deplorable. The Keystone saga encapsulates the entire failure of the “shovel ready jobs” schtick, if it takes six years and counting for the federal government to make a decision on one pipeline project.

by | ARTICLES, BLOG, BUSINESS, CONSTITUTION, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, QUICKLY NOTED, TAXES

Bernie Sanders recently advocated for President Obama to raise $100 billion in taxes by the old “closing corporate loopholes” schtick. The difference this time, is that Obama is actively exploring his abilities to do so via Executive Order. Townhall has the scoop:

“White House Press Secretary Josh Earnest confirmed Monday that President Obama is “very interested” in the idea of raising taxes through unitlateral executive action.

“The president certainly has not indicated any reticence in using his executive authority to try and advance an agenda that benefits middle class Americans,” Earnest said in response to a question about Sen. Bernie Sanders (I-VT) calling on Obama to raise more than $100 billion in taxes through IRS executive action.

“Now I don’t want to leave you with the impression that there is some imminent announcement, there is not, at least that I know of,” Earnest continued. “But the president has asked his team to examine the array of executive authorities that are available to him to try to make progress on his goals. So I am not in a position to talk in any detail at this point, but the president is very interested in this avenue generally,” Earnest finished.

Sanders sent a letter to Treasury Secretary Jack Lew Friday identifying a number of executive actions he believes the IRS could take, without any input from Congress, that would close loopholes currently used by corporations. In the past, IRS lawyers have been hesitant to use executive actions to raise significant amounts of revenue, but that same calculation has change in other federal agencies since Obama became president.

Obama’s preferred option would be for Congress to pass a corporate tax hike that would fund liberal infrastructure projects like mass transit. But if Congress fails to do as Obama wishes, just as Congress has failed to pass the immigration reforms that Obama prefers, Obama could take actions unilaterally instead. This past November, for example, Obama gave work permits, Social Security Numbers, and drivers licenses to approximately 4 million illegal immigrants.

Those immigration actions, according to the Congressional Budget Office, will raise federal deficits by $8.8 billion over the next ten years.”

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Yesterday it was reported that the Treasury Department paid $3 billion to cover Obamacare cost-sharing subsidies without Congressional approval. The heart of the dispute appears to be whether or not these subsidies were supposed to be funded via yearly appropriations or not. The House Ways and Means Chair, Paul Ryan, argues the former. Health and Human Services, via the Department of Justice, argues the latter.

In order to make sense of the funding dispute, it seemed necessary to dig around in the agency budgets to see how cost sharing was accounted for. Cost-sharing falls under the purview of the “Centers for Medicare & Medicaid Services (CMS)”. Yet, while comparing the budget requests for 2014 (for which the Treasury covered costs) and the ones for 2015 (current) & 2016 (future), it became clear that CMS changed the way it accounted for cost-sharing funding after 2014.

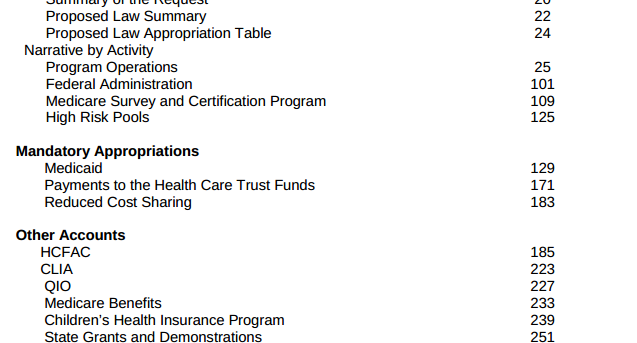

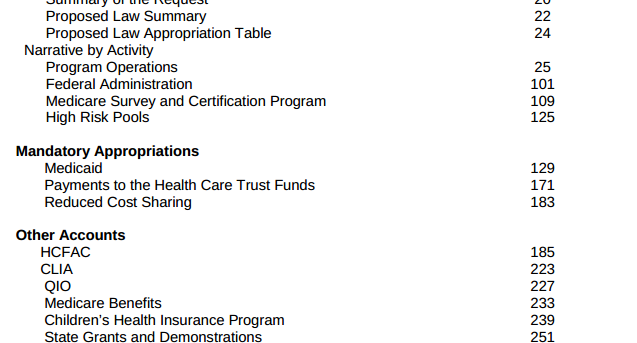

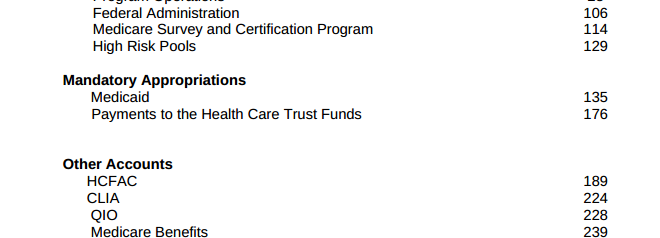

Looking at the 2014 Budget request, CMS had section called “Mandatory Appropriations”, which listed three items: 1) Medicaid 2) Payments to the Health Care Trust Funds 3) Reduced Cost Sharing.

Further in that budget, CMS wrote, “The FY 2014 request for Reduced Cost Sharing for Individuals Enrolled in Qualified Health Plans is $4.0 billion in the first year of operations for Health Insurance Marketplaces, also known as Exchanges. CMS also requests a $1.4 billion advance appropriation for the first quarter of FY 2015 in this budget to permit CMS to reimburse issuers who provided reduced cost-sharing in excess of the monthly advanced payments received in FY 2014 through the cost-sharing reduction reconciliation process.”

This position — that Obamacare cost-savings was to be funded by yearly appropriations– was reiterated by a “July 2013 letter to then Sen. Tom Coburn, Congressional Research Service wrote that, “unlike the refundable tax credits, these [cost-sharing] payments to the health plans do not appear to be funded through a permanent appropriation. Instead, it appears from the President’s FY2014 budget that funds for these payments are intended to be made available through annual appropriations.” (Remember, a 2014 budget would have been written also in 2013)

You can see a picture of the 2014 budget here:

However, Congress rejected those requested appropriations at the time so “the administration went ahead and made the payments anyway.” That is the mystery $3 billion paid for by the Treasury.

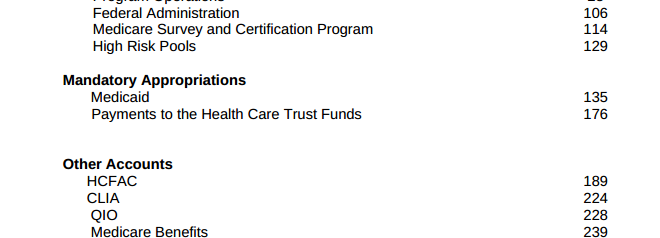

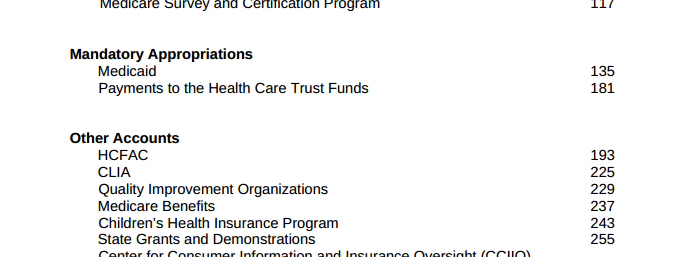

There is a noticeable change, however, with the CMS budget for 2015. The cost-sharing portion, which was originally listed as “Mandatory Payments” in 2014, is not listed at a “Mandatory Payment” anymore. Nor is it for 2016 either.

2015 Budget request:

CMS Budget 2015

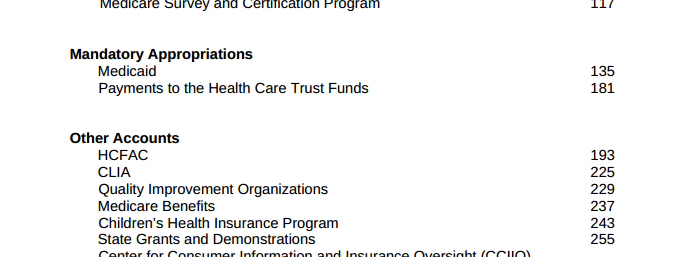

2016 Budget request:

CMS Budget 2016

Reading through the 2015 and 2016 budget documents, “cost sharing” appears in various areas, usually related to Medicaid, but not in one specific section — contrary to how it was accounted for in 2014, as a specific appropriation from the agency.

What’s equally interesting is that the DoJ argued about this specific matter in their recent brief dated January 26, 2015, saying that, “The House’s statutory arguments are incorrect. The cost sharing reduction payments are being made as part of a mandatory payment program that Congress has fully appropriated. See 42 U.S.C. § 18082. With respect to Section 4980H, Treasury exercised its rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute. See 26 U.S.C. § 7805(a).”

Yet, as shown above, the “mandatory program for cost-sharing”, that was submitted for funding (and rejected) in 2014, was removed entirely from the 2015 and 2016 budget requests. Now there is no way to even see the “cost-sharing” portion of the budget at all. And this appears to contract the statement by the DoJ that there is a “mandatory payment” program.

Cost sharing subsidies are an enormous part of Obamacare. “These payments come about because President Obama’s healthcare law forces insurers to limit out-of-pocket costs for certain low income individuals by capping consumer expenses, such as deductibles and co-payments, in insurance policies. In exchange for capping these charges, insurers are supposed to receive compensation.”

Cost sharing is expected to cost taxpayers roughly $150 billion over the next 10 years, according to estimates by the Congressional Budget Office.

But we now don’t know the specific funding amounts for the year 2015 or for 2016, and the costs for 2014 are in dispute, involving that $3 billion in funds from the Treasury (which came from somewhere and somehow).

The one thing we do know for certain: the Treasury Department is clearly exercising the power it perceives to have, as a “rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute.”

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Obama proposed his FY2016 budget on Monday. The budget is filled tax hikes — more than 20 — which are expected to fund more spending schemes cooked up by the President. The tax hikes total about $2 trillion in additional revenue over the next decade. “The administration contends that various spending cuts and tax increases would trim the deficits by about $1.8 trillion over the next decade, leaving the red ink at manageable levels.”

So, just like his yearly spending, so to with his decade budget outlook: despite record tax revenue, Obama’s proposals still don’t balance out. We continue to have deficit spending.

What is in this budget proposal? It’s chock-full of ambitious taxes aimed mainly at the wealthy and businesses. Most of his budget items will likely not pass Congress — and he knows this. At this point in his Presidency, it doesn’t matter anyway what he proposes, or really, what actually passes. And Obama knows this. He’s not running again.

Obama has merely given the Democrats a list of initiatives for them to push, so that they can create anti-Republican narratives using his ideas for litmus tests and sound bytes over the next year to two years heading into the 2016 elections. It’s not about solutions; it’s about creating more divide. Charles Krauthammer got it right when he said, ““Look, I don’t mind if the President sends a budget which he knows is not going to achieve anything. But when he prefaces his remarks as we just saw by saying we have to put politics aside, posing again as the one person in the country who rises above partisanship and party, speaks for the national interest, it’s really grating.”

Here’s the rundown of the list of budget tax hikes. I’ll do some follow up posts about a couple of particularly odious policies contained therein, but for the time being, you can read the entire list of tax increases here. The amounts of revenue noted below are calculated to be collected from the tax increases over the next decade, from 2016 – 2025.

“Limit deductions for top earners to 28 percent rate, even if income is taxed at 39.6 percent: $603.2 billion

Impose a 14 percent one-time tax on previously untaxed foreign income: $268.1 billion

Impose a 19 percent minimum tax on foreign income: $206 billion

Modify estate and gift tax provisions: $214.4 billion

Change the taxation of capital income: $207.9 billion

Other increases from reform of U.S. international tax system: $135.8 billion

Impose a financial fee on large financial companies: $111.8 billion

Increase tobacco taxes and index for inflation: $95.1 billion

Repeal LIFO (Last In First Out) method of accounting for inventories: $76.1 billion

Conform SECA (Self Employed Contributions Act) taxes for professional service businesses: $74.6 billion

Other revenue changes and loophole closers: $47.9 billion

Eliminate oil and natural gas preferences: $45.5 billion

Implement the Buffett Rule by imposing a new “Fair Share Tax” (making millionaires pay at least 30 percent tax rate): $35.2 billion

Reform the treatment of financial and insurance industry products: $34.4 billion

Limit the total accrual of tax-favored retirement benefits: $26.0 billion

Other loophole closers: $24.3 billion

Reinstate Superfund taxes: $21.2 billion

Tax carried interests as ordinary income: $17.7 billion

Make unemployment insurance surtax permanent: $15.7 billion

Eliminate coal preferences: $4.3 billion

Reauthorize special assessment from domestic nuclear utilities: $2.3 billion

Increase and modify Oil Spill Liability Trust Fund financing: $1.6 billion

Repeal tax-exempt bond financing of professional sports facilities: $542.0 million”