by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

A few days ago, Politico revealed a little gem hidden in the Obama budget:

“In obscure data tables buried deep in its 2016 budget proposal, the Obama administration revealed this week that its student loan program had a $21.8 billion shortfall last year, apparently the largest ever recorded for any government credit program.”

That’s a nearly $22 billion loss — for one program, for one year. Politico described how that the amount is greater than the budgets of the EPA and Interior Department combined, or the NASA program’s budget. But it will be covered entirely by the taxpayer anyway.

How did the federal student loan program rack up such massive debt so quickly? Let’s take a look at Obama’s recent reform efforts and programs to help provide relief to student borrowers.

A 2010 law allowed for repayment caps at 10% of a borrower’s income, though some loan holders were initially ineligible. This was called “Pay As You Earn” (PAYE). There were also some other portions of PAYE that were less talked about by the media, including:

1) If the payment doesn’t cover the accruing interest, the government pays your unpaid accruing interested for up to three years from when you begin paying back your loan under the PAYE program.

2) The balance of your loan can be forgiven after 20 years if you meet certain criteria

3) Your loan can be forgiven after 10 years if you go to work for a public service organization

Obama then expanded the PAYE program in June 2014 via Executive Order. The NYTimes reported that this “extend such relief to an estimated five million people with older loans who are currently ineligible — those who got loans before October 2007 or stopped borrowing by October 2011. But the relief would not be available until December 2015, officials said, given the time needed for the Education Department to propose and put new regulations into effect”.

That recent expansion helped to figure into the staggering re-estimation listed in Obama’s FY 2016 budget. As far as the terms of the costs for just the PAYE program, those have “ballooned from $1.7 billion in 2010 to $3.5 billion in 2013 to an estimated $7.6 billion for 2014.”

What’s more, last June, CNS News reported a huge increase in overall student loan debt by comparing the balanced owed when Obama took office to the balance owed in May 2014:

“Since President Barack Obama took office in January 2009, the cumulative outstanding balance on federal direct student loans has jumped 517.4 percent. The balance owed as of the end of May was $739,641,000,000.00. That is an increase of $619,838,000,000.00 from the balance that was owed as of the end of January 2009, when it was $119,803,000,000.00, according to the Monthly Treasury Statement.”

Comparing that amount to his predecessor, under George W. Bush, “the amount of outstanding loans increased from $67,979,000,000.00 in January of 2001 to $119,803,000,000 in January of 2009, an increase of 76.2%.” That was over 8 years. Obama’s jumped the 517.4% in 5.5 years.

So how does this particularly enormous budget shortfall get resolved? Why, it simply gets tacked directly onto the federal deficit. Since the federal student loan program is considered a credit program, “because of a quirk in the budget process for credit programs, the department can add the $21.8 billion to the deficit automatically, without seeking appropriations or even approval from Congress.” This whopper adds nearly 5% to the deficit itself.

Apparently, this sort of bailout is not entirely uncommon either. According to a report last month on the U.S. Government credit-loan system,

“these unregulated and virtually unsupervised federal credit programs are now the fastest-growing chunk of the United States government, ballooning over the past decade from about $1.3 trillion in outstanding loans to nearly $3.2 trillion today. That’s largely because the financial crisis sparked explosive growth of student loans and Federal Housing Administration mortgage guarantees, which together compose two-thirds.“

The FHA itself has added $75 billion to the deficit in this manner over the last twenty years. Though that is a ridiculous sum itself, it makes the one year, $21.8 billion chunk for the federal student loan program bailout contained in Obama’s FY2016 budget especially egregious and alarming.

Like the ballooning student loan debt, the act of loan forbearance, which is a temporary pause in repayment of your federal student loan, has also seen an upswing. Forbearance can be granted for up to three years. According to the Wall Street Journal, “loan balances in forbearance were about 12.5% of those in repayment in 2006. In 2013, they were 13.3%. Today they are 16%, or $125 billion of the $778 billion in repayment.”

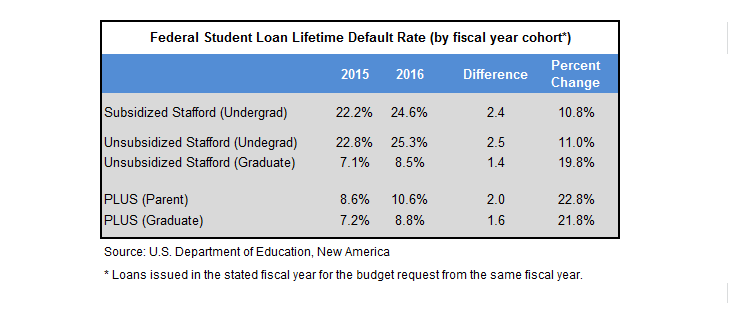

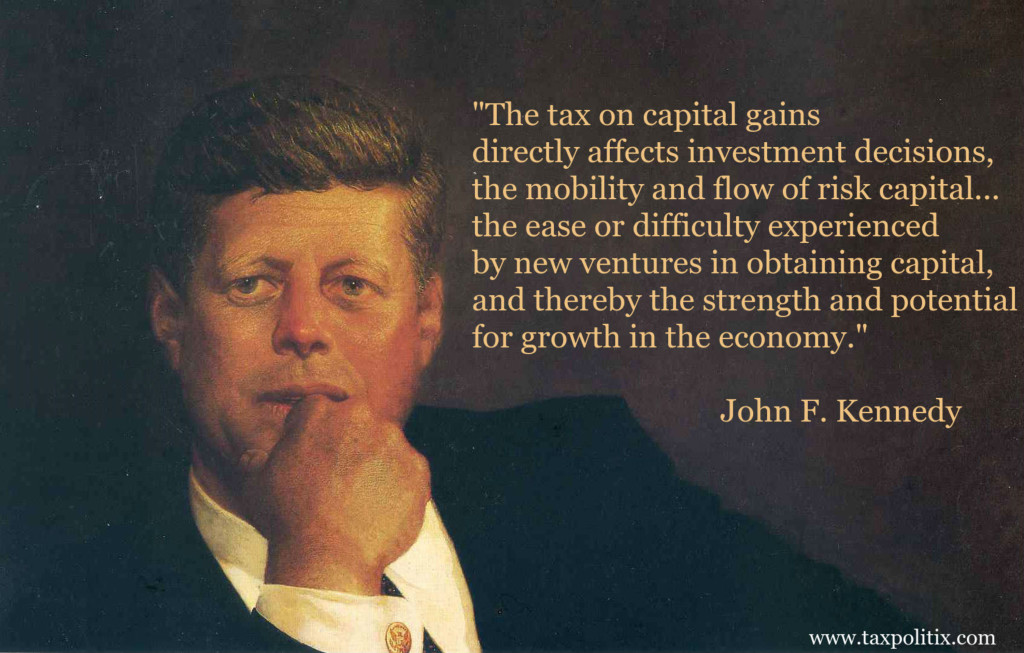

As for defaulting entirely, Forbes recently noted that, “the Department of Education’s budget documents project that 25.3 percent of undergraduate Stafford loans (measured by dollars, not numbers of loans) issued next year will default at some point during the borrower’s repayment term. That is up a full 2.5 percentage points from what the agency projected last year for the previous cohort of loans.” All categories of loans, according to the DoE projection, will see an increase in default.

These figures reinforce a WSJ opinion piece in late December covering the “student debt bomb”. The author, Jason Delisle, director of the Federal Education Budget Project at the New America Foundation, detailed how the current rate of default “now stands at 19.8% of borrowers whose loans have come due — some 7.1 million borrowers with $103 billion in outstanding balances.”

Trying to discern whether or not this $21.8 billion shortfall contained in Obama’s budget is a one-time anomaly or not remains to be seen. The sharp uptick of federal student loan debt and defaults in the past few years would suggest it is not. And there seems to be little incentive just yet to reign in Obama’s repayment reforms, since, at the end of the day, any loss will just be added onto the federal deficit for the taxpayer to pick up the tab — while the Feds continue to tout to young people how much Obama is helping them.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, TAX TIPS, TAXES

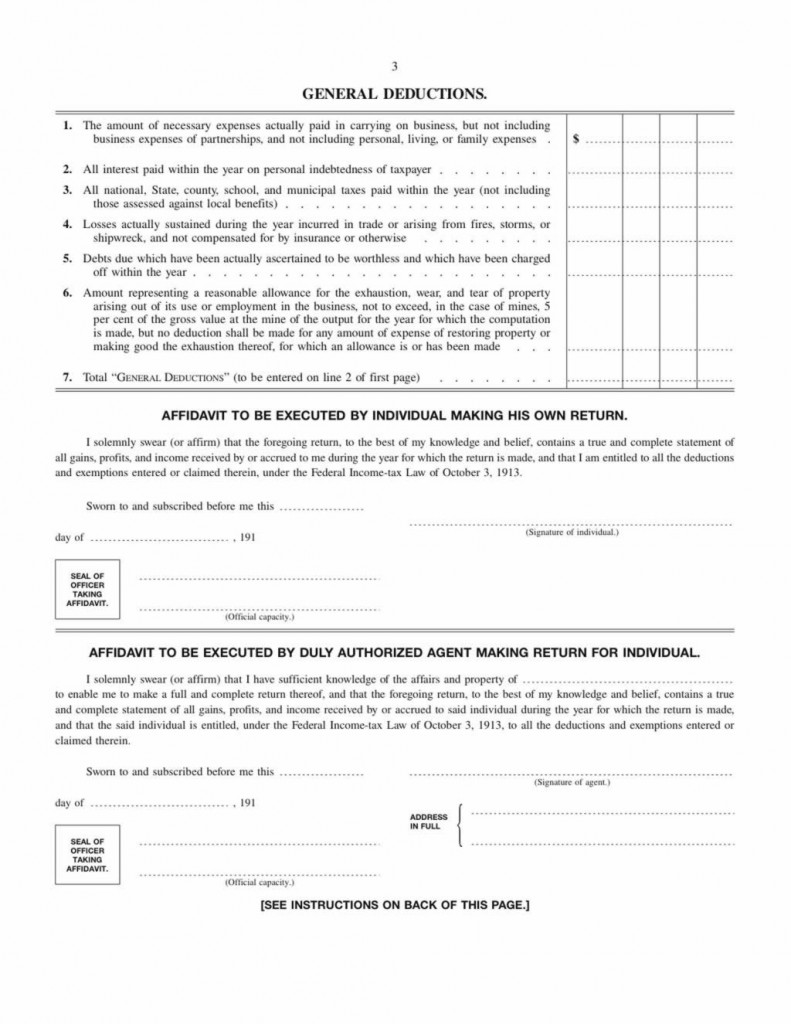

He’s a pretty smart guy….

by | ARTICLES, BLOG, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Obama’s budget for FY2016 claimed $1.8 trillion in deficit savings over a ten year period, 2016-2025. He used PAYGO (pay-as-you-go) rules to determine this figure, which basically means paring tax increases and spending reductions on one side to pay for new spending programs and tax credits on the other side, with anything left over going to the deficit.

However, his numbers for overall deficit reduction appear to be overstated, according to an analysis by the Committee For a Responsible Federal Budget (CRFB), by “using a baseline which effectively ignores the costs of extending or repealing certain policies and assuming a large increase in spending in the future to claim savings from extending spending limits after 2021.”

The Chicago Sun-Times did a decent summary of the CRFB report. Essentially, Obama makes a series of assumptions about future budget items to achieve his number for deficit reduction ($1.8 trillion), so that it comes close to the amount of tax hikes in the budget ($2 trillion), making it somewhat politically palatable — at least for his side. Here are the major points:

“MANDATORY AUTOMATIC CUTS

In the budget table summarizing the $1.8 trillion in deficit cuts, there’s a line that adds back funds to replace the automatic, across-the-board cuts to a variety of mandatory programs, including a 2 percentage point cut in payments to doctors who treat Medicare patients.

That’s a major assumption on Obama’s part about the fate of the automatic cuts, part of the deal he struck with Congress in August 2011.

Cost: $185 billion over 10 years.

MEDICARE FEES

There’s a proposal to permanently fix a flawed Medicare formula that threatens doctors with an even bigger 21 percent fee cut. Lawmakers typically “patch” the formula for a year or two but hope for a long-term solution this year.

Cost: $108 billion.

REFUNDABLE TAX CREDITS

A set of refundable tax credits — tax refunds that go out to low-income people who don’t owe federal income tax — expire in 2017. So does a maximum $2,500 tax credit for the cost of college. Obama’s budget simply assumes they get extended.

Cost: $166 billion.

INFLATED SPENDING BASELINE

This one’s tricky and requires background. Under budget rules, official scorekeepers at the Congressional Budget Office are supposed to set an arbitrary baseline for annual agency budgets passed by Congress each year that rises each year with inflation at a relatively generous pace.

The 2011 Budget Control Act slashed this spending increase by $900 billion by setting spending “caps” well below this baseline. Well, the caps are lifted after 2021, but Obama’s 10-year budget covers four more years. The White House assumes the baseline would jump to inflated levels that pretend the 2011 law never happened. Then it claims huge savings when cutting them back in 2022-25 to more realistic levels.

Questionable savings: about $310 billion.

DEBT SERVICE

Additional debt would have to be issued to cover the above policies, and interest costs on that debt are considerable. Cost: about $105 billion

GRAND TOTAL: $874 BILLION

In summary, Obama’s budget claims $1.809 trillion in deficit savings. Take away $874 billion accruing from accounting tricks and there’s about $935 billion left.”

There you have it. $935 billion is vastly different than $1.8 trillion — essentially saving only half of what Obama claims. For those who want to get into the nitty-gritty, you can read the full CRFB analysis here.

The government is always playing around with numbers and accounting tricks. Here are past examples of fuzzy math for Social Security gimmicks, Obamacare deficit scoring, and boosting Obamacare enrollment numbers. So this latest one is anything but surprising.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Obama proposed his FY2016 budget on Monday. The budget is filled tax hikes — more than 20 — which are expected to fund more spending schemes cooked up by the President. The tax hikes total about $2 trillion in additional revenue over the next decade. “The administration contends that various spending cuts and tax increases would trim the deficits by about $1.8 trillion over the next decade, leaving the red ink at manageable levels.”

So, just like his yearly spending, so to with his decade budget outlook: despite record tax revenue, Obama’s proposals still don’t balance out. We continue to have deficit spending.

What is in this budget proposal? It’s chock-full of ambitious taxes aimed mainly at the wealthy and businesses. Most of his budget items will likely not pass Congress — and he knows this. At this point in his Presidency, it doesn’t matter anyway what he proposes, or really, what actually passes. And Obama knows this. He’s not running again.

Obama has merely given the Democrats a list of initiatives for them to push, so that they can create anti-Republican narratives using his ideas for litmus tests and sound bytes over the next year to two years heading into the 2016 elections. It’s not about solutions; it’s about creating more divide. Charles Krauthammer got it right when he said, ““Look, I don’t mind if the President sends a budget which he knows is not going to achieve anything. But when he prefaces his remarks as we just saw by saying we have to put politics aside, posing again as the one person in the country who rises above partisanship and party, speaks for the national interest, it’s really grating.”

Here’s the rundown of the list of budget tax hikes. I’ll do some follow up posts about a couple of particularly odious policies contained therein, but for the time being, you can read the entire list of tax increases here. The amounts of revenue noted below are calculated to be collected from the tax increases over the next decade, from 2016 – 2025.

“Limit deductions for top earners to 28 percent rate, even if income is taxed at 39.6 percent: $603.2 billion

Impose a 14 percent one-time tax on previously untaxed foreign income: $268.1 billion

Impose a 19 percent minimum tax on foreign income: $206 billion

Modify estate and gift tax provisions: $214.4 billion

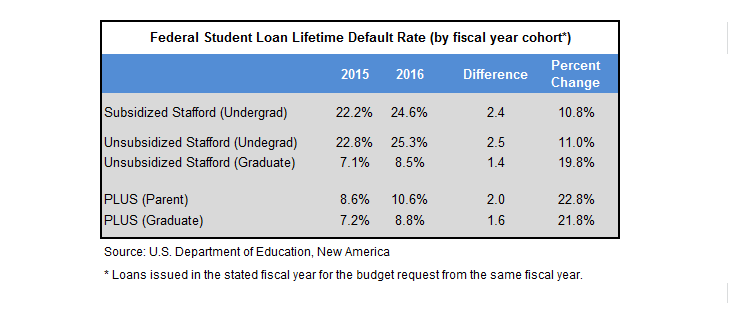

Change the taxation of capital income: $207.9 billion

Other increases from reform of U.S. international tax system: $135.8 billion

Impose a financial fee on large financial companies: $111.8 billion

Increase tobacco taxes and index for inflation: $95.1 billion

Repeal LIFO (Last In First Out) method of accounting for inventories: $76.1 billion

Conform SECA (Self Employed Contributions Act) taxes for professional service businesses: $74.6 billion

Other revenue changes and loophole closers: $47.9 billion

Eliminate oil and natural gas preferences: $45.5 billion

Implement the Buffett Rule by imposing a new “Fair Share Tax” (making millionaires pay at least 30 percent tax rate): $35.2 billion

Reform the treatment of financial and insurance industry products: $34.4 billion

Limit the total accrual of tax-favored retirement benefits: $26.0 billion

Other loophole closers: $24.3 billion

Reinstate Superfund taxes: $21.2 billion

Tax carried interests as ordinary income: $17.7 billion

Make unemployment insurance surtax permanent: $15.7 billion

Eliminate coal preferences: $4.3 billion

Reauthorize special assessment from domestic nuclear utilities: $2.3 billion

Increase and modify Oil Spill Liability Trust Fund financing: $1.6 billion

Repeal tax-exempt bond financing of professional sports facilities: $542.0 million”

by | BLOG, POLITICS, QUICKLY NOTED, TAXES

As we begin tax season, here’s something to ponder.

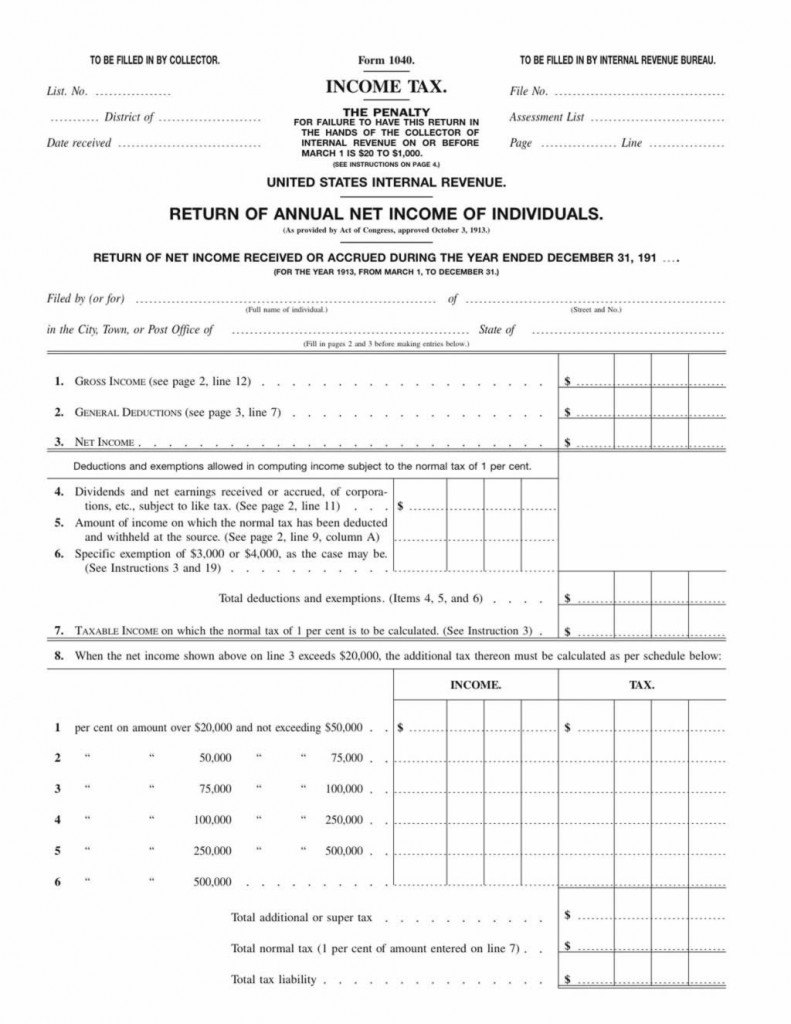

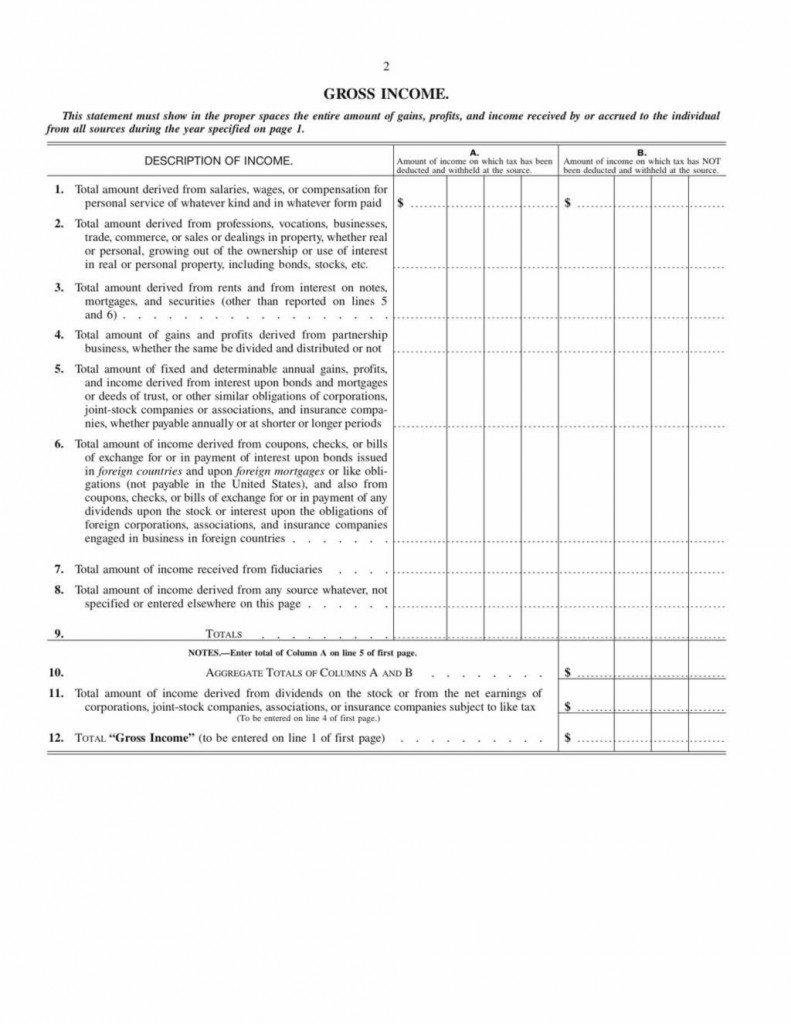

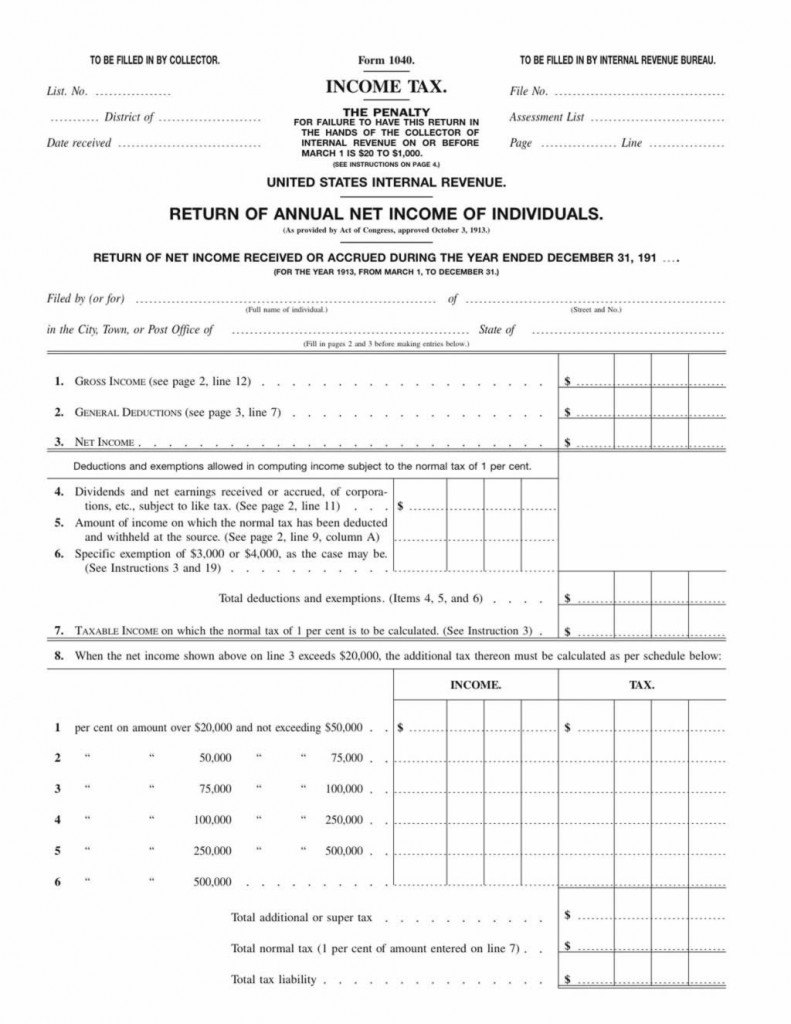

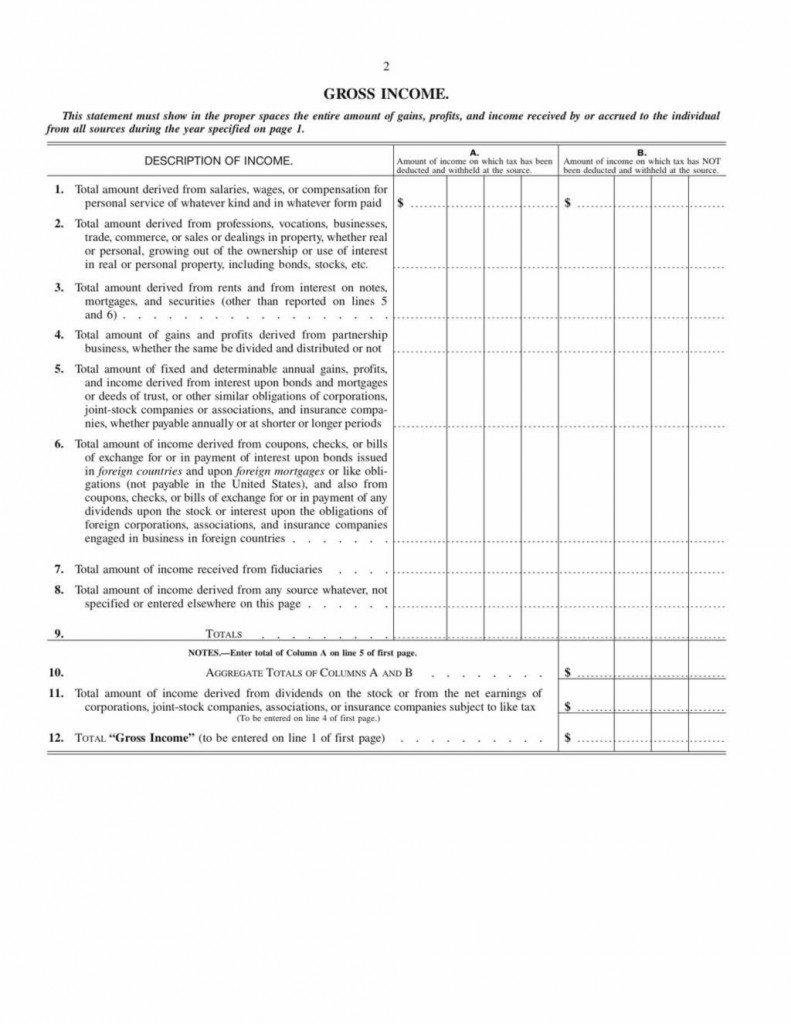

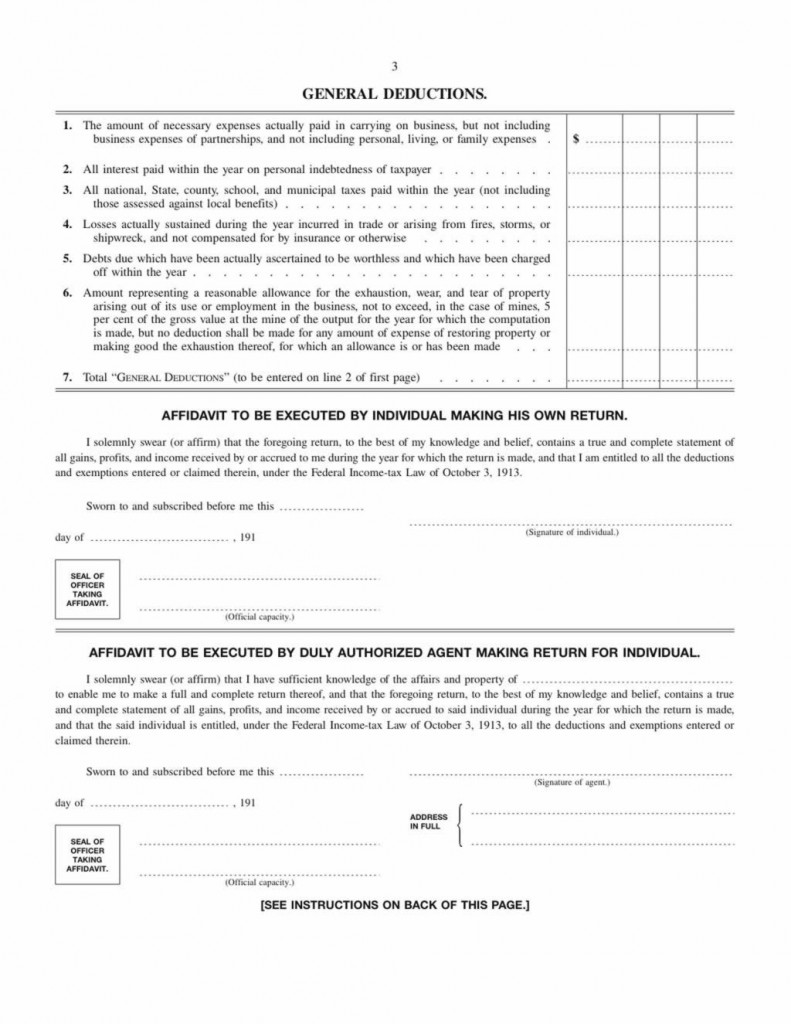

1n 1913, the 16th Amendment was ratified which granted Congress the ability to levy a personal income tax. Below is a scan of the tax form from 100 years ago:

That is the first page of the 1913 1040. It is FOUR pages in its entirety — 3 pages of calculations and 1 page of instructions. The rest of the pages are at the end.

The income tax for that year was a 1% tax on net income greater than $3,000. It also included a 6% surtax on incomes of more than $500,000.

There are some charming provisions on here, such as how farmers can calulate income on wool and hides of slaughtered animals, or how to deal with “losses occurred during shipwreck”.

What this document shows, however, is that it took merely 100 years to go from 4 pages to 1000s of pages just for Americans to calculate their tax burdens and tax compliance to the government.

There is something incredibly wrong with that. The 1913 tax form is a good argument for the need for comprehensive tax reform.

——————————-

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, QUICKLY NOTED, TAX TIPS, TAXES

Since there seems to be increased interest, and confusion, regarding tax filing and Obamacare this year, it is worth it add some more information to help navigate the process.

The IRS Tax Form 1095a is officially known as the “Health Insurance Marketplace Statement”. If a household member or members enrolled in a healthcare plan through a state or federal exchange, you will receive a 1095a in the mail by early February. You cannot file your taxes without it. It contains information regarding your coverage, such as the number of people enrolled in a marketplace plan, and the dates of effective coverage.

Please note: you will not receive a Form 1095a if you have health coverage through a job or through programs such as Medicaid, Medicare, or the Children’s Health Insurance Program (CHIP).

What you will see on a Form 1095a?

–The form will have information about every member of your household who received Obamacare coverage in 2014. Each person will be listed separately.

–The form will list month-by-month, the amount you paid for your health insurance premium. Each person will be listed separately.

–The form will provide the amount of the “premium tax credits” you received in 2014. They are also called “advanced payments”. This amount is what lowered your monthly premiums, and was calculated based upon income information you provided when you enrolled.

–The form will list the cost of a “benchmark” premium that your premium tax credit is based on. This was the second-lowest cost silver plan, and was considered the “benchmark” to determine subsidies for lower- and moderate-income earners who enrolled in Obamacare.

Why is the 1095a necessary?

The 1095a is your PROOF OF INSURANCE. It contains all the information you need to fill out your form 8965, which is the Premium Tax Credit form. The 8962 Form is a worksheet, whose calculation gets recorded on your 2014 Tax Return.

The main point of all of these forms is really the Premium Tax Credit portion. Remember, 85% of Obamacare enrollees received some sort of subsidy, which is properly known to the IRS as a “Premium Tax Credit”. But most people opted not to receive their tax credit at tax filing time (now). They received it in advance, during 2014, in the form of monthly amounts that were credited against the monthly healthcare premium costs. These advance payments lowered the monthly cost of insurance.

The credit was tabulated based on estimated income information furnished during the application process. But because income situations can change over the course of a year (remember you enrolled at the beginning of 2014), the IRS requires you to re-calculate your income again at tax time (now), and match it against the amount and information you provided when you enrolled.

Since your Premium Tax Credit was based upon estimated income amounts, the amount you were eligible to receive as a tax credit may be higher or lower than what you actually did receive. So, using the information you receive on your 1095a about your household and your payments and your subsidies, you then fill out the Form 8962 to calculate the ACTUAL amount of tax credit you were eligible for in 2014, and check it against what you received as an advance payment applied to your monthly premium costs. Any differences will be resolved either by either reducing or increasing your tax credit amount, which will then affect the final amount of taxes due or taxes returned to you.

Also note — if you enrolled in Obamacare, you must fill out Form 8925, which means you cannot file a 1040EZ. You must file a traditional 1040 tax return.

All the information listed above that you will see on the 1095a is important. If there are any errors, it is imperative that you contact the Obamacare marketplace immediately to resolve the inconsistencies before you file your taxes.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Since we’ve been discussing it recently.