As we begin tax season, here’s something to ponder.

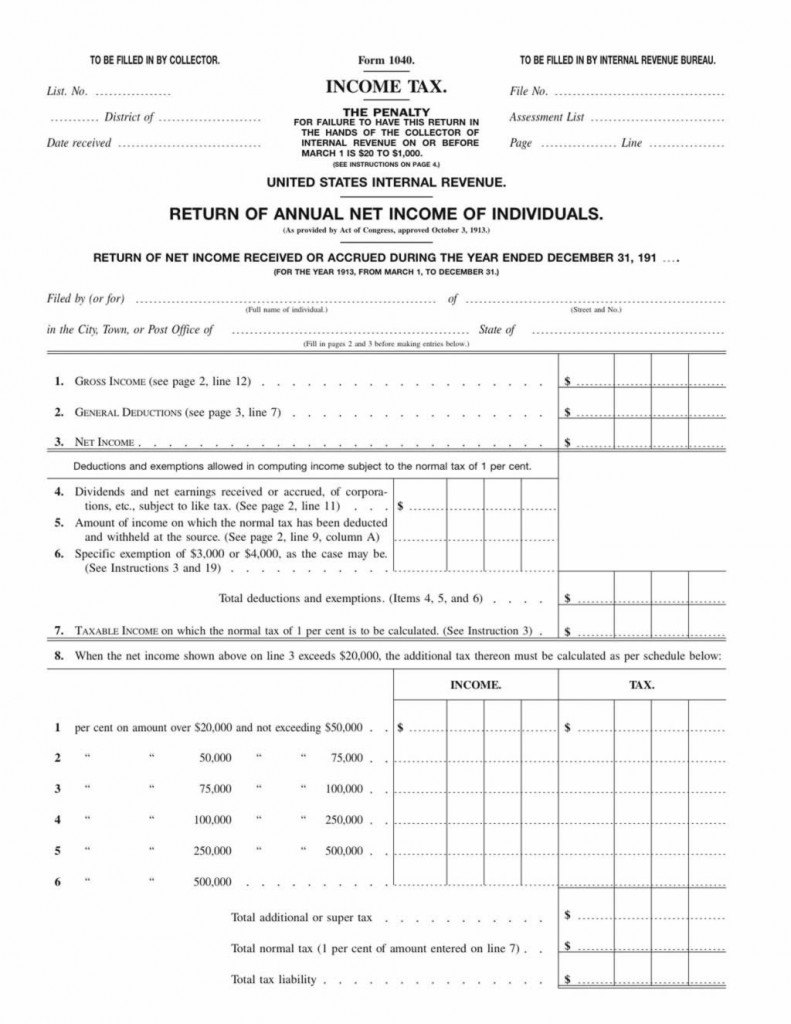

1n 1913, the 16th Amendment was ratified which granted Congress the ability to levy a personal income tax. Below is a scan of the tax form from 100 years ago:

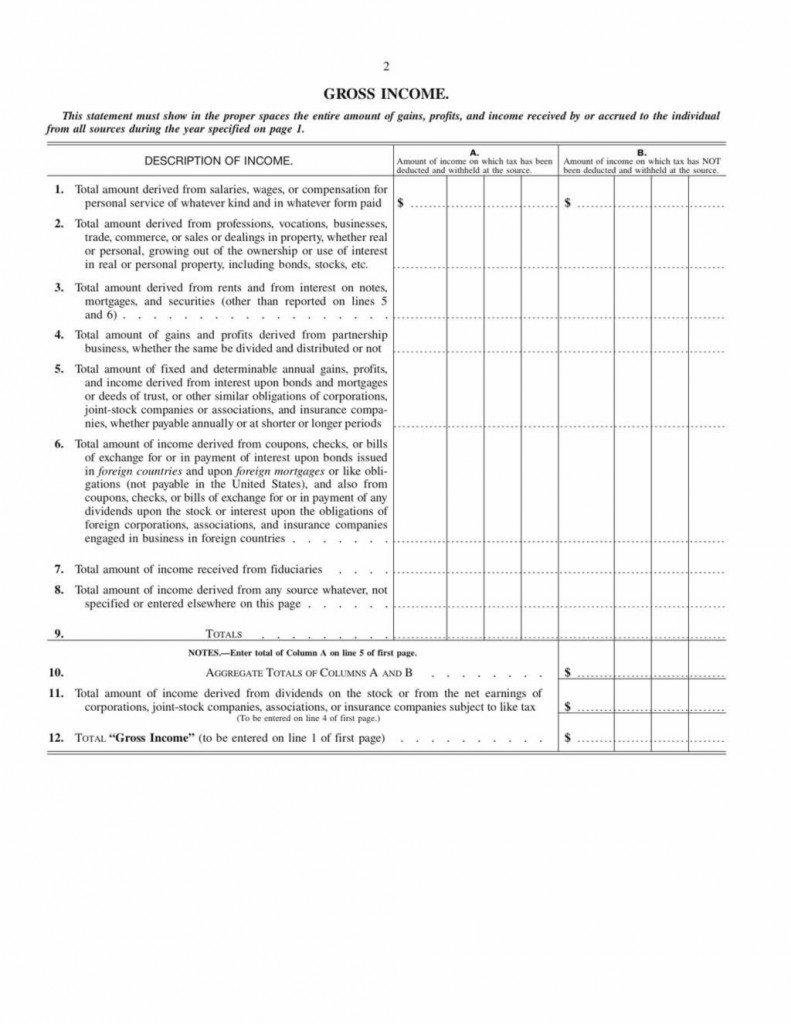

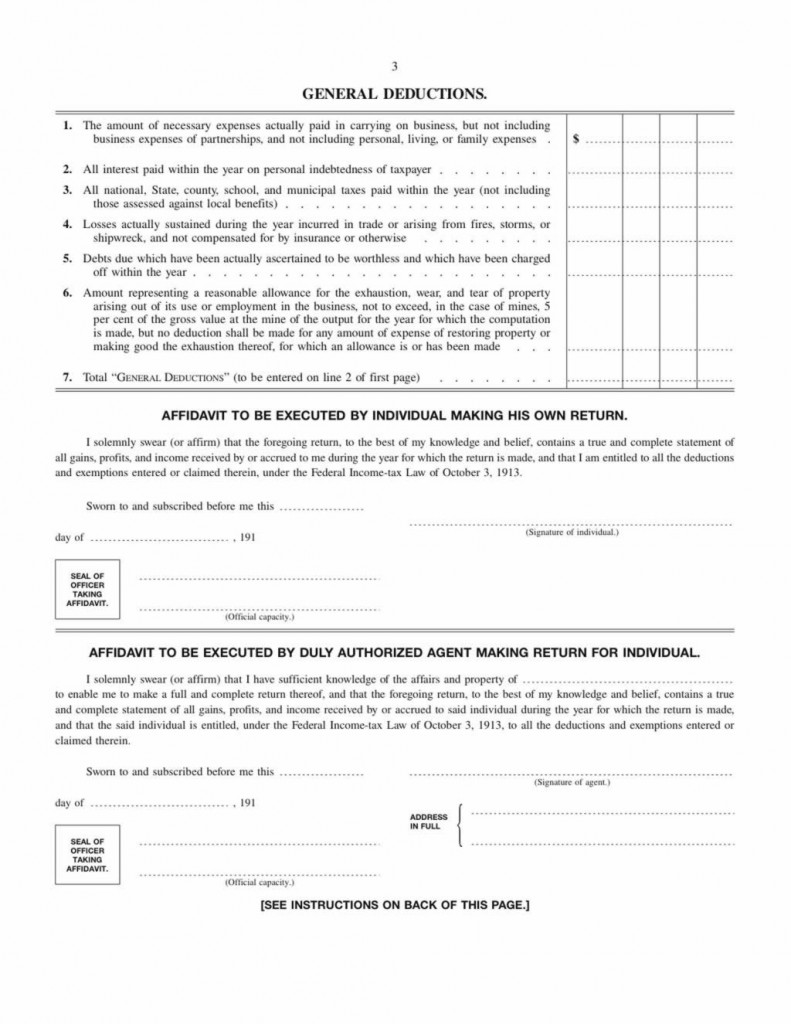

That is the first page of the 1913 1040. It is FOUR pages in its entirety — 3 pages of calculations and 1 page of instructions. The rest of the pages are at the end.

The income tax for that year was a 1% tax on net income greater than $3,000. It also included a 6% surtax on incomes of more than $500,000.

There are some charming provisions on here, such as how farmers can calulate income on wool and hides of slaughtered animals, or how to deal with “losses occurred during shipwreck”.

What this document shows, however, is that it took merely 100 years to go from 4 pages to 1000s of pages just for Americans to calculate their tax burdens and tax compliance to the government.

There is something incredibly wrong with that. The 1913 tax form is a good argument for the need for comprehensive tax reform.

——————————-

The problem is that regular taxpayers, like you, are missing out on legal and safe deductions, to the tune of hundreds of millions of dollars in unclaimed refunds every year! As a tax professional, it truly breaks my heart, knowing that just a few thousand, or even a few hundred bucks for us “regular guys” out of that vast pool of overcharging could make a world of difference–and they are just sitting there, unclaimed! And with the economy we’re facing now…it’s essential that the “right” professional handles your taxes, books, or other financial matters.

Thanks Alan Joel for that walk down memory lane. It is incredible to see how a simple tax return in 1913 has morphed into a totally incomprehensible (for the average taxpayer) multi page stressful document to file. I would recommend that the legislatures that actually pass these complex tax laws be required to prepare their own tax returns without professional help. If they are unable to do so then they must simplify the code until that level of simplicity is attained. What you have demonstrated is a strong argument why a flat tax should be adopted.