by | ARTICLES, BLOG, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

A piece from the Washington Times this week hammers out what most of us already know — that Obamacare is lagging severely behind its initial projections for participants. The lackluster enrollment in turns impacts the financial side of Obamacare because it has missed key targets that were counted on in budget planning.

The Obama Administration has tried all sorts of gimmicks so far to tout Obamacare as a success. First it was caught counting dental plans among enrollment figures to bolster numbers, and then it slashed last year’s CBO estimate for 2015 enrollees by more than three million down to 9.1 million in order to show success if it passed the target amount (hint: it did, at 9.9 million).

Additionally, the Obama Administration has delayed implementing various parts of the bill due to backlash from citizens and businesses alike over plan availability, and also as an effort to stave off sharp premium increases which we were told would never happen. Remember how Obamacare would save $2500/family?

The article is a good overview of the current state of Obamacare. It’s worth it to read in full below:

President Obama will need to more than double the number of Americans enrolled in Obamacare exchange plans to reach 21 million next year, the target set in budget projections, in what is shaping up as the next major test for the health care law.

As of June, the Department of Health and Human Services counted 9.9 million customers who have bought plans through the federal HealthCare.gov portal and a handful of state-run exchanges.

That puts the administration ahead of it’s own estimates for 2015, but is less than half what the Congressional Budget Office projected for 2016, showing just how much work officials have ahead of them as the next round of enrollment begins in less than two months.

That puts the administration ahead of it’s own estimates for 2015, but is less than half what the Congressional Budget Office projected for 2016, showing just how much work officials have ahead of them as the next round of enrollment begins in less than two months.

“It is definitely something that people pay attention to,” said Rachel Klein, director of organizational strategy at Families USA, a nonprofit that advocates for affordable health care.

The tax during the first year was $95 or 1 percent of income above the filing threshold — a relatively minor bite. This year, the penalty will be $325 or 2 percent of income, and by 2016 it will be $695 or 2.5 percent of income.

“The substantial increase in penalties under the individual mandate next year is a big wild card,” said Larry Levitt, a senior vice president at the Kaiser Family Foundation, a nonpartisan health policy organization. “We’re in unchartered territory here about how effective these bigger penalties will be in nudging people to get insured.”

“The marketplaces are working,” Mr. Levitt added, “but higher enrollment would both improve the insurance risk pool and reduce the number of Americans uninsured.”

The individual mandate was included in the Affordable Care Act of 2010 to make sure enough healthy Americans signed up, spreading out the costs for higher-risk customers.

A divided U.S. Supreme Court upheld the mandate in 2012 as an appropriate use of Congress’ taxing power.

But congressional Republicans are still intent on scrapping the health care law, and may use a fast-track budget procedure known as “reconciliation” to take a swing at it.

GOP leaders say they may not be able to eviscerate the law through the budget, but Brendan Buck, a spokesman for House Ways and Means Committee Chairman Rep. Paul Ryan, said repealing the individual mandate is “definitely on the table.”

“This law is only being held together by mandates and coercion, and that’s why we continue to look at ways to repeal the mandates and give people more freedom and choices,” Mr. Buck said.

Even as it struggles to meet the 2016 enrollment projection, the Obama administration is on track on other measures, including a CBO estimate that 17 million fewer people lack insurance this year because of the health care law.

But in setting lofty goals for the exchanges, the CBO estimated the effect of the individual mandate and other potential changes, including the belief that employers would shift workers onto the exchanges or that customers would enter the Obamacare marketplace ahead of late 2017, when they can no longer hold plans that do not comply with the law.

Under political duress, the White House let customers transition to compliant plans to keep Mr. Obama’s notorious promise that people who like their plans can keep them under his law.

Sizing up reality versus long-range estimates, Health and Human Services has begun to set its own, more modest goals for exchange enrollment, ignoring CBO’s guess of 12 million for 2015 and setting the mark at 9.1 million enrollees. So far, it’s besting its less ambitious goal.

The agency says it is doing its own evaluation of the marketplace and will likely announce its enrollment targets for 2016 before signups begin in November.

“At this point, the Congressional Budget Office’s projected enrollment total for 2016 seems overly optimistic,” Mr. Levitt said. “Enrollment may reach that level eventually, but I doubt it will happen by next year.”

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, POLITICS, TAXES

It is perfectly fine for an owner of a private business to decline to participate in an event or produce a product if it requires violating one’s religious beliefs. It’s another thing entirely for a person who works for the government — on behalf of the taxpayer and paid by taxpayer funds — to decline to do the job required of them.

Kim Davis is no hero. Her job is to process marriage licenses. If she felt she could no longer consciously do her job, she had an obligation to step aside. No only did she not do that, she barred the rest of her staff from executing their duties as well and ceased issuing all marriage licenses. A reasonable accommodation could have been made for Ms. Davis by allowing her other assistants to process that with which she disagreed. But she chose all-or-nothing, to stop doing her job entirely. For that, she should resign.

Ms. Davis was perfectly free to choose not to process the licenses with which she had disagreement, but in making that choice, the only logical and honorable conclusion was resignation — because she could no longer fulfill the oath she swore to when she was elected.

Not only is her judgment on the matter incorrect, but she is also mucking up the opportunity for those who deserve an honest day in court when they have faced persecution for their beliefs in the private sector.

As stated by Judge Andrew Napolitano, “The free exercise clause guarantees individuals the lawful ability to practice their religion free from government interference. It does not permit those in government to use their offices to deny the rights of others who reject their beliefs. That is the lesson for Kim Davis”.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, NEW YORK, POLITICS

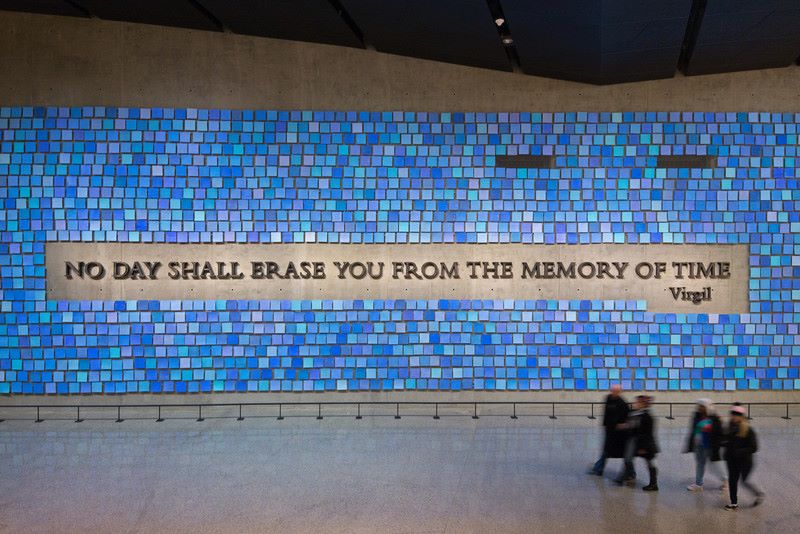

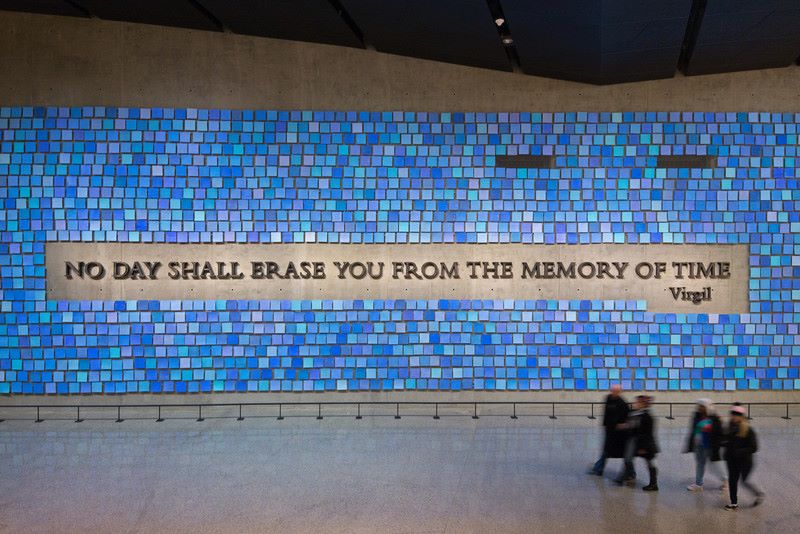

This quote from Virgil’s Aeneid sums it up:

God bless America.

by | ARTICLES, BLOG, ECONOMY, ELECTIONS, GOVERNMENT, OBAMA, TAXES

Kasich recently discussed the minimum wage while on the campaign trail Kasich was receptive to the possibility of raising the minimum wage 1) if the hike was “reasonable.” and 2) and when it made “sense” between management and labor.” Giving his answer in fairly broad terms allowed to Kasich to appear supportive of this policy at least in some circumstances, while also recognizing that such policy is not always beneficial, thereby satisfying potential voters on both sides of the aisle.

Kasich also went on to say that he favored state-level minimum wage policy over federal, because of the variation in economies and standards of living; his answer guarded him against outright supporting a blanket federal minimum wage rate hike — and it should. Even if Kasich were for state-level minimum wage increases, there is virtually no excuse for him to support a federal one. Anyone trying to argue that the minimum wage level should be the same in both New York and Arkansas is ludicrous. People may think that it helps, but when the minimum wage is way out of proportion for a jurisdiction in which it applies, the policy becomes especially harmful to businesses and workers.

Though Kasich’s answer was okay, he could have taken a better position. You can understand someone not wanting to take an absolute firm position on the minimum wage, considering that ⅔ of Americans favor it in some form or another. But it is also not honest to suggest that you are for it, without making it clear that your receptivity is merely to accommodate the will of the people, without trying to get the message out that the minimum wage, is in fact, a terrible thing.

What Kasich should say is that it is unfortunate that most people in the country do not understand that a minimum wage is a bad thing for the economy. It would have been preferable for him to explain that a minimum wage keeps people remaining in poverty — — but if that is what the people want, he won’t stand in the way. For his part, Kasich is not a full-throated advocate of a minimum wage, but he could have done a better job educating the voters on the pitfalls of such policy.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

The recently revived debate about birthright citizenship is both ridiculous and baffling. The language of the Constitution is quite clear: “All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside.” Commonly known as the “Citizenship Clause”, it is the first sentence of Section 1 of the 14th Amendment, passed in 1868.

This understanding of the 14th Amendment was codified four years later in 1871 in the case, Wong Kim Ark which granted citizenship “to at least some children born of foreigners because they were born on American soil (a concept known as jus soli)”. It is also worth noting that at the time of the Amendment, there was no such thing as illegal immigration, so the legal status of the parents was not an issue; the first law restricting immigration came in 1875.

The Constitution is clear, and there is no way to change it. There should be, and probably is in some way, a law against the budding practice known as “birth tourism”, which allows for a woman to come travel to this country — on a tourist visa — for the sole purpose of having a baby on American soil so that the child can be granted U.S. citizenship. Coming into the country with the intent to subvert the Constitution could be made a crime if it is not already so. For instance, the child will still be granted citizenship, but the parents become criminals — and can never come back to this country.

For those whose parents are here for some time, even if the parents are illegal, the law is clear: their birth in this country confers U.S. citizenship. But if you come here intentionally to subvert the law, the consequences should be so severe, that it makes people think twice about doing it. That should cut down on the amount of rogue circumstances for which people try to gain citizenship with no intent to reside in this country, while simultaneously protecting the 14th Amendment.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

A court ruling on Friday was a victory for those seeking information requests to the White House. A group called “Cause of Action” sued the IRS in 2013 trying to ascertain if the White House ever requested private taxpayer information, especially in light of the IRS scandal.

The requests, however, were declined by the IRS, who cited section 6103 of the tax code, which is the section governing taxpayer confidentiality laws. They argued that “the existence of those requests would be protected by confidentiality laws and couldn’t be released, so there was no reason to make the search.”

The judge however, Amy Berman Jackson, disagreed with their response, noting that “the agency couldn’t use the privacy protection ‘to shield the very misconduct it was enacted to prohibit.’” The IRS was subsequently ordered to turn over any and all recorded requests from the White House seeking taxpayer information. In December 2014, TIGTA acknowledged the existence of about 2500 documents that fit the FOIA request, from “Cause of Action”, asking for communication between the IRS and the White House. It will be interesting to see what these documents reveal.

There’s already been some hints at confidentiality impropriety. Remember that in August 2010, Austan Goolsbee spoke about the Koch Brothers’ tax structure in an anecdote to attack businesses and openly discussed tax information about their business structure that was not publicly available. Additionally, in October 2010, the agency sent a database on 501(c)(4) social-welfare groups containing confidential taxpayer information to the Federal Bureau of Investigation, according to documents obtained by a House panel.

It wouldn’t be a stretch, therefore, to imagine that the White House, the “most transparent administration ever”, also requested or received confidential taxpayer information in collusion with the IRS.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS, TAXES

Ron DeSantis (R., Fla.) chairman of the House Oversight and Government Reform Subcommittee on National Security and Jim Jordan (R., Ohio), chairman of the Subcommittee on Health Care, Benefits, and Administrative Rules, also recently called on President Obama to remove John Koskinen from the head of the IRS. Alternatively, they propose Congressional impeachment if Obama does not due his due diligence and remove Koskinen himself.

DeSantis and Jordan made their case in the pages of the Wall Street Journal and is reprinted below in its entirety, as it provided a thorough summation of Koskinen’s incompetence:

“Internal Revenue Service Commissioner John Koskinen needs to go.

When it was revealed in 2013 that the IRS had targeted conservative groups for exercising their First Amendment rights, President Obama correctly called the policy “inexcusable” and pledged accountability. He even fired the then-acting IRS commissioner because he said it was necessary to have “new leadership that can help restore confidence going forward.”

Unfortunately, Commissioner Koskinen, who took over in the wake of the IRS targeting scandal, has failed the American people by frustrating Congress’s attempts to ascertain the truth. A taxpayer would never get away with treating an IRS audit the way that IRS officials have treated the congressional investigation. Civil officers like Mr. Koskinen have historically been held to a higher standard than private citizens because they have fiduciary obligations to the public. The IRS and Mr. Koskinen have breached these basic fiduciary duties:

• Destruction of evidence. Lois Lerner, at the time the director of the IRS’s exempt-organizations unit, invoked the Fifth Amendment on May 22, 2013, when appearing before Congress; her refusal to testify put a premium on obtaining and reviewing her email communications. On the same day the IRS’s chief technology officer issued a preservation order that instructed IRS employees “not to destroy/wipe/reuse any of the existing backup tapes for email, or archiving of other information from IRS personal computers.”

Several weeks later, on Aug. 2, the House Oversight Committee issued its first subpoena for IRS documents, including all of Ms. Lerner’s emails. On Feb. 2, 2014, Kate Duval, the IRS commissioner’s counsel, identified a gap in the Lerner emails that were being collected. Days later, Ms. Duval learned that the gap had been caused in 2011 when the hard drive of Ms. Lerner’s computer crashed.

Despite all this—an internal IRS preservation order, a congressional subpoena, and knowledge about Ms. Lerner’s hard-drive and email problems—the Treasury inspector general for tax administration discovered that the agency on March 4, 2014, erased 422 backup tapes containing as many as 24,000 emails. (Congress learned of the discovery only last month.)

Ms. Duval has since left the IRS and now works at the State Department, where she is responsible for vetting Hillary Clinton’s emails sought by congressional investigations of the Benghazi attacks.

• Failure to inform Congress. Mr. Koskinen was made aware of the problems associated with Ms. Lerner’s emails the same month Ms. Duval discovered the gap. Yet the IRS withheld the information from Congress for four months, until June 13, 2014, when the agency used a Friday news dump to admit—on page seven of the third attachment to a letter sent to the Senate Finance Committee—that it had lost many of Ms. Lerner’s emails.

During that four-month delay, Mr. Koskinen testified before Congress under oath four times. On March 26, 2014, he appeared before the Oversight Committee and pledged that the IRS would produce all of Ms. Lerner’s emails, not mentioning that the IRS already knew of the problems with her emails and hard drive. Mr. Koskinen deliberately kept Congress in the dark. Based on testimony received by the committee, we now know that the IRS appears to have spent the four months working with the Obama administration to fine-tune talking points to mitigate the fallout.

• False testimony before Congress. Mr. Koskinen made statements to Congress that were categorically false. Of the more than 1,000 computer backup tapes discovered by the IRS inspector general, approximately 700 hadn’t been erased and contained relevant information. But Mr. Koskinen testified he had “confirmed” that all of the tapes were unrecoverable.

He also said: “We’ve gone to great lengths, spent a significant amount of money trying to make sure that there is no email that is required that has not been produced.” In reality, the inspector general found that Mr. Koskinen’s team failed to search several potential sources for Ms. Lerner’s emails, including the email server, her BlackBerry and the Martinsburg, W.Va., storage facility that housed the backup tapes.

The 700 intact backup tapes the inspector general recovered were found within 15 days of the IRS’s informing Congress that they were not recoverable. Employees from the inspector general’s office simply drove to Martinsburg and asked for the tapes. It turns out that the IRS had never even asked whether the tapes existed.

Three weeks after the 422 other backup tapes were destroyed by the IRS, Mr. Koskinen told the committee that he would produce “all” Lerner documents. This statement was clearly false—you can’t give Congress “all” of the material if you know that you have already destroyed some of it.

• Failure to correct the record. After his false statements to Congress under oath, Mr. Koskinen refused to amend them when given the opportunity at a public hearing earlier this year. If a lawyer makes a false statement to a court, he has a duty to correct it. Civil officers like Commissioner Koskinen have a duty to the American people to revise their testimony when it contains inaccuracies.

• Failure to reform the IRS to protect First Amendment rights. Mr. Koskinen hasn’t acted on the president’s May 2013 promise to “put in place new safeguards to make sure this kind of behavior cannot happen again.” A Government Accountability Office report released last week found that the IRS continues to lack the controls necessary to prevent unfair treatment of nonprofit groups on the basis of an “organization’s religious, educational, political, or other views.” In other words, the targeting of conservative groups may very well continue.

If the president doesn’t remove Mr. Koskinen from his post, then Congress should remove him through impeachment. The impeachment power is a political check that, as Alexander Hamilton wrote in Federalist No. 65 in 1788, protects the public against “the abuse or violation of some public trust.”

Supreme Court Justice Joseph Story echoed Hamilton in 1833 when he distinguished impeachable offenses from criminal offenses, noting that they “are aptly termed political offenses, growing out of personal misconduct or gross neglect, or usurpation, or habitual disregard for the public interests . . . They must be examined upon very broad and comprehensive principles of public policy and duty.”

John Koskinen has violated the public trust, breached his fiduciary obligations and demonstrated his unfitness to serve. Mr. President, it’s time for Commissioner Koskinen to go. If you don’t act, we will.”

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS, TAXES

Last month, Rep. Jason Chaffetz (R. Utah) wrote a letter regarding John Koskinen, the commissioner of the IRS, asking President Obama to remove him from his post. As the IRS is a part of the Department of the Treasury, it falls under the authority of Executive Branch.

Chaffetz rightly calls out Koskinen for “obstruction” with regard to the various congressional investigations, which have revealed bungled IRS responses to repeated inquiries. At the time of his letter in late July, it had recently been revealed that IRS workers destroyed Lerner’s backup tapes from 2010-2011, losing 24,000 emails in the processes.

Chaffetz has it right. Even now, a month after calling on Obama to dismiss Koskinen, there have been even more revelations of IRS misconduct. This include that fact that 10 groups have still yet to be approved for tax-exempt status — with some waiting as long as 5 years — due to a “backlog of cases”. Even more egregiously, the IRS only revealed last week during court proceedings that Lois Lerner used a second, private email account with the alias “Toby Miles” to conduct IRS business (on top of her IRS email and another private email account). The fact that after years into the investigations, only last week this information was disclosed to the public shows an unrepentant IRS.

If Obama is unwilling to actually dismiss Koskinen from his deplorable actions, it shows he lacks the fortitude to fix the critical problems at the IRS. In fact, it proves that he really is the root of the problem.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

The Washington Times has the story on this new information being admitted to by the IRS — Lois Lerner used another separate personal email account with an alias, “Toby Miles”, to conduct professional business. This now makes three email accounts used by Lerner, the other two being her work email and another personal email that was previously known.

After all this time, to only now come clean about a third email account is egregious. The IRS lawyer, Geoffrey Klimas, tried to deflect the situation by arguing “that the IRS had previously hinted there may be other personal email accounts, pointing back to a footnote in a letter attached to a June 27, 2014, brief that mentioned “documents located on her personal home computer and email on her personal email account.”

However, that wording was also altered on Monday — evidencing backtracking and cover-up — referring now to her ‘personal home computer and email on her personal email’ account(s).” So the IRS deliberately retained the information the Lerner had a second personal email account, by which she used an alias. The alias, by the way, is her dog’s name.

The Times also reports that “Curiously, the Ways and Means Committee criminal referral mentioned the Toby Miles email address, identified as tobomatic@msn.com. The address came to light because it was included on an email that also hadMs. Lerner’s official account on the chain of recipients….at the time of the referral in April 2014, the committee linked the Toby Miles address to Ms. Lerner’s husband, Michael R. Miles, but said, “The source of the name ‘Toby‘ is not known.”

At no time did Lerner, or anyone else at the IRS, admit that the “Toby Miles” email account belonged instead to Lois Lerner. Nor has that email address been searched.

Lerner, of course is not the first, or second, or third administration member to use extra or secret email accounts, with or without aliases. Former Secretary of State Hillary Rodham Clinton and her top aides, the White House’s top science adviser, top Environmental Protection Agency officials and now the IRS, have all done this. All part of the “most transparent administration ever.”

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, HYPOCRISY, OBAMA

As the Stock Market is swirling around today, I am reminded of an incident that began this day in 1982 and spanned several years; it involved illegal trading schemes, inside tips, and money. History.com has a good synopsis:

“Martin Siegel meets Ivan Boesky at the Harvard Club in New York City to discuss his mounting financial pressures. Arbitrageur Boesky offered Siegel, a mergers-and-acquisitions executive at Kidder, Peabody & Co., a job, but Siegel, who was looking for some kind of consulting arrangement, declined. Boesky then suggested that if Siegel would supply him with early inside information on upcoming mergers there would be something in it for him.

In January 1983, although little information had been exchanged, Boesky sent a courier with a secret code and a briefcase containing $150,000 in $100 bills to be delivered to Siegel at the Plaza Hotel.

Over the next couple of years, Siegel passed inside information to Boesky on several occasions. With Siegel’s inside tips, Boesky made $28 million dollars investing in Carnation stock before its takeover. But his success began to fuel investigative inquiries by both the press and the Securities and Exchange Commission. Rumors that Siegel and Kidder, Peabody & Co. were involved in illegal activities began floating around.

Despite the pressure, Siegel and Boesky met ata deliin January 1985, where Siegel demanded $400,000. This time, the cash drop-off was made at a phone booth. Siegel, who was apprehensive about his relationship with Boesky, decided to put an end to it after he had received his money. Still, he continued to trade inside information with other Wall Street executives.

In 1986, the illegal schemes, which by then included many of the biggest traders in the country, came crashing down. Arrests were made up and down Wall Street, and Boesky and Michael Milken, the junk bond king charged with violating federal securities laws, were no exception.

Siegel turned out to be one of the few cooperative witnesses for the government and virtually the only one who showed remorse for his role in the fraud, causing him to be ostracized on Wall Street. Nevertheless, he did fare better than the others: Milken received a 10-year sentence and Boesky received 3 years,but Siegel was only required to return the $9 million he had obtained illegally. The entire incident came to symbolize the era of unfettered greed on Wall Street in the mid-1980s.”

The big stock market crash, “Black Monday”, happened on October 19, 1987. Much of the Wall Street schemes noted above contributed greatly to the bull market which began in 1982, combined with low interest rates, mergers, and more. The fervor reached a crescendo in spectacular trading years of 1986-1987, before the stock market crashed. The Dow lost more than 22% of its value in the crash of 1987.