by | ARTICLES, ECONOMY, FREEDOM, QUICKLY NOTED, TAXES

“We must make our election between economy and liberty, or profusion and servitude. If we run into such debts as that we must be taxed in our meat and in our drink, in our necessities and our comforts, in our labors and our amusements,… our people … must come to labor sixteen hours in the twenty-four, give our earnings of fifteen of these to the government,… have no time to think, no means of calling our mis-managers to account; but be glad to obtain sustenance by hiring ourselves out to rivet their chains on the necks of our fellow-sufferers…. And this is the tendency of all human governments … till the bulk of society is reduced to be mere automatons of misery…. And the forehorse of this frightful team is public debt. Taxation follows that, and in its train wretchedness and oppression”.

Thomas Jefferson, 1816

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, BLOG, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS

As we get into blame season surrounding the extension of the debt ceiling, let’s make sure we remember – and remind anyone who will listen — what actually caused the government to shut down just a few short months ago.

The Democrats insisted that the Republicans accept a pure Continuing Resolution (CR) as a first and final offer with no negotiation along the way.

In contrast, the Republicans (after a number of initial offers were rebuffed and ignored with no discussion), made a final offer of 1) simply delaying the individual mandate for one year (which is effectively now happening) and 2) subjecting Congress to ObamaCare as the existing law actually requires anyway.

The Democrats refused even this more than reasonable –and in hindsight quite astute — offer causing the Government to shut down.

In what possible world can the shutdown be blamed directly on the Republicans?!

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ECONOMY, OBAMA, OBAMACARE

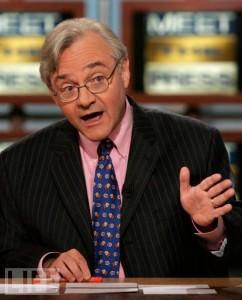

Last week’s Meet the Press roundtable featured, among others, E.J. Dionne — a columnist with the Washington Post. Mr. Dionne’s discussion on Obama and Obamacare was so incredibly inaccurate, it is quite obvious that he is a person who just likes to make up facts as he goes along. And with moderators like David Gregory, who do little to nothing to question the commentary coming from his guests, viewers are left with severely wrong or misinterpreted information.

Some highlights from the show:

>>“Look, I think there is something crazy when people say where government can’t deliver health care. Ever heard of Medicare? Ever heard of Medicaid?”

The fact is that Medicare is actuarially and actually bankrupt, and Medicaid is virtually bankrupting large numbers of states as we speak. Why do people have a positive view of Medicare – simply because they are getting $3 of medical care for each $1 they spend (and hiding from them the fact that the $2 difference will be paid by their children and grandchildren). An SEC investigation would have everyone associated with such a program behind bars. I suppose technically the government does “deliver healthcare” via Medicare and Medicaid but they are so egregiously flawed and mismanaged that it can hardly be considered successful.

> >”President Obama chose to go for a model that is a market-oriented model that Republicans favor, of helping people buy private health insurance”.

A blatant lie. Republicans do favor a market oriented model, but ObamaCare is certainly not anything like one. Can anyone list all the names of the House Republicans who supported and voted for Obamacare in Congress? None? That’s right. In addition, Obamacare is no more a market-oriented model when it renders obsolete millions of plans already freely chosen by Americans and replaces them with fewer and more expensive options — while bullying insurance companies to alter dates and plans according to the whim of any number of government agencies.

>>But what you’re seeing already is there is an enormous appetite among all the Americans who don’t have health insurance to buy it. And that’s what’s going to save Obamacare. This is filling a real need in the society”.

The actual enrollment figures for Obamacare are way off and lower-than-expected. It is so dismal that the White House is counting among the totals for the media the number of people who have “put a plan in their shopping cart” but haven’t paid for it yet in order to bolster totals. Likewise, a lack of “appetite” for Obamacare has resulted in the Obama Administration panicking and paying hundreds of millions of taxpayer money to run commercials and partner with organizations, groups, and non-profits in order to push citizens to sign up before the deadlines (that keep shifting).

>>Every rich democracy in the world uses government to deliver healthcare. You had Christine Lagarde on. France spends less per capita in government spending to cover everybody than we spend for just Medicare and Medicaid. So this thing can work. It needs fixes. And I think the next move by the president is to tell Republicans, do you want to fix this or do you just want to get rid of it?

First of all, the United States is a Republic, not a democracy. Second, the emphasis on the word “rich” is telling because it reeks of the same class warfare-equality policies that have been quintessential to Obama’s presidency. Obamacare is exactly that. It is a wealth transfer that forces the healthy and/or wealthy to subsidize the plans of the uninsured, sicker, or poorer through government fiat — an “individual mandate”. And while Mr. Dionne wishes to hold up France as the pinnacle of Western governing, the French just passed a 75% tax on the wealthy in order to pay for the Socialist policies of Francois Hollande.

E.J.Dionne is representative of the typical progressive pundit who has no framework of reality, and frankly, doesn’t seem to care. He repeats whatever talking points are suitable for the day and the Obama Administration, and its a damn shame that the actual moderators of Meet the Press lack the knowledge or fortitude to call into question their information.

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ELECTIONS, OBAMA, OBAMACARE, POLITICS

With all the talk abuzz about an inevitable Hillary Clinton candidacy, I wager that her platform might quite likely include repealing Obamacare. Hillary is certain to declare late in the spring so that she can positively impact the midterm elections to benefit the Democrats.

What would Hillary gain from a repeal-Obamacare platform? Here’s three things:

First, a “repeal-Obamacare” position would effectively neuter the Republican narratives of anyone running in 2014 (and possibly beyond). All the hand-wringing and fundraising, all the sob-stories and alarm bells about Obamacare would be utterly weakened if Hillary was out there saying the exact same thing.

Think about it: any Republican candidate on the same policy page as Hillary Clinton would be disastrous for that candidate. The Republicans are hoping for strong gains in 2014 — possibly even taking the Senate — and are banking on a fledgling Obamacare to do it. This objective could not be achieved with Hillary added to the mix arguing that Obamacare is not good legislation.

Second, a “repeal-Obamacare” position from Hillary would give vulnerable Democrats a free pass to sever close ties and loyalty to Obama. Obama is toxic right now; his popularity is in the mid ‘30s and his signature legislation is overwhelmingly disliked across the country. With Hillary jumping in, Democrats would be able to rally around a more popular and likeable Democrat (what Democrat doesn’t like the Clintons?). They could distance themselves from Obama and Obamacare without hurting the Democrat brand for the elections; Hillary enhances that brand right now much better than Obama can.

Finally, Hillary herself was intimately involved in health care reform after Clinton’s election in 1992. The legislation she helped champion via the Taskforce For Health Care Reform was aptly dubbed “Hillarycare”.

Twenty years later — in comparison to what we’ve seen of Obamacare, does Hillarycare looks so bad? Maybe not to some people. Is this the alternative solution and finally Hillary’s day in the sun? Possibly, but not likely.

It is much more plausible that Hillary would take healthcare reform even further than Obamacare. Knowing the growing disdain for mandates and the insurance system that seems helplessly broken right now, Hillary would likely lobby instead for a single-payer system.

This is a dream of many progressives and Democrats. It would be presented as a “simplified” alternative solution to the byzantine problem that is Obamacare, at a time when the Republicans lack their own, strong Obamacare alternative.

Whatever the case, running on repealing Obamacare is a win-win for Hillary. She gets to directly impact and help the midterm elections for the Democrats. 6 years after her primary defeat against Obama, Hillary will emerge as the better, wiser, and more likeable Democrat (revenge is a dish best served cold?). And finally, Hillary will have the unprecedented opportunity to finish the healthcare reform she started two decades ago, since practically anything will be seen as better than Obamacare now.

by | ARTICLES, ECONOMY, QUICKLY NOTED

“To advocate any clear-cut principles of social order is today an almost certain way to incur the stigma of being an unpractical doctrinaire. It has come to be regarded as the sign of the judicious mind that in social matters one does not adhere to fixed principles but decides each question “on its merits”; that one is generally guided by expediency and is ready to compromise between opposed views. Principles, however, have a way of asserting themselves even if they are not explicitly recognized but are only implied in particular decisions, or if they are present only as vague ideas of what is or is not being done. Thus has it come about that under the sign of “neither individualism nor socialism” we are in fact rapidly moving from a society of free individuals toward one of a completely collectivist character.”

This is the beginning of F.A. Hayek’s lecture “Individualism: True and False,” given in 1945. The lecture comprises the first chapter of Hayek’s 1948 work, “Individualism and Economic Order”. Thanks to Mises.org, you can read it online; however, it is a fine book to own for your collection.

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ECONOMY, NEW YORK, TAXES

The NYTimes ran an article yesterday talking about the curious population shift from NY to FL. The biggest thing missing from the article’s conclusions, however, is the affect of taxes on New York’s population (re)location.

A CNSnews report last year discussed a study by the Tax Foundation found a net loss of 1.3 million New Yorkers who left the state over the 10 year period from 2000-2010.

3.4 million total moved out of state, but another 2.1 moved in, so the change was -1.3 million — which totaled a loss of $45.6 billion in income.

Although many factors determine one’s decision to move to or from a locality, taxes are typically part of the process. As such, the Tax Foundation noted many high tax facts that are unique to New York:

According to the group, New York ranked second among the states for the highest state and local tax burden in 2009. The Empire State was ranked highest for tax burden every year from 1977 until 2006, except in 1984 when it was ranked second.

New York State has a progressive personal income tax rate ranging from 6.45 percent to 8.82 percent for those earning over $2 million. Sales varies by county, and is between seven and eight percent. In Manhattan, the sales tax is 8.875 percent.

According to the Retirement Living Center, which examines tax burdens by state for those nearing retirement, New York also levies a gasoline tax at 49.0 cents per gallon and a cigarette tax of $4.35 per pack, along with an additional $1.50 per pack in New York City.

New York is also one of 17 states plus the District of Columbia that collects an estate tax, with a $1 million exemption and a progressive rate from 0.8 percent to 16 percent.

In 2007, New York State collected $1.1 billion from its estate and gift taxes, the highest of any of the states, according to the Tax Foundation.

I have mentioned these points before. Back in 2009, Rush Limbaugh fled the state due to the crushing taxes. And an Op-Ed in the NY Post last year discussed the implications of a shrinking population — loss of revenue, House of Representative seats, and policy power.

High taxes have devastating consequences. Thomas Sowell once quipped, “Elections should be held on April 16th- the day after we pay our income taxes. That is one of the few things that might discourage politicians from being big spenders”.

With the recent election of De Blasio as Mayor of NYC, you can expect even more flight. De Blasio has vowed to raise taxes both as a means of pushing his economic equality agenda and rewarding the unions for the patience with contract negotiations over the last 4+ years.

The state of NY is on the brink of fiscal insolvency and more and more people are waking up to that reality — and leaving the state in droves.

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ECONOMY, FREEDOM, POLITICS

As a Jewish guy, I hardly pay attention to the leaders of other religions, but Pope Francis has won my admiration since his election this past spring. So it was somewhat dismayed when I read his recent Papal Exhortation published last month. In one section, Pope Francis seems to very nearly reject the idea of “trickle down economics”, a position that, if indeed true, would be devastating to the world.

Being in finance and business for decades, it has become abundantly clear that free markets are the best path to prosperity. So what to make of Francis’s thoughts?

My Catholic friends tell me that Francis’s discussion follows the the same path of Catholic Social Teaching — under which economics loosely falls — from the last several Popes, and therefore he hasn’t said anything new or different on the topic. This sentiment was echoed in Peggy Noonan’s piece published in the WSJ regarding Francis’s publication. Noonan was cautiously optimistic that Francis wasn’t rejecting free markets and she welcomed the conversation he has created.

On the other side of the aisle, Francis was blasted by some fiscal conservatives over a particularly thorny paragraph:

“In this context, some people continue to defend trickle-down theories which assume that economic growth, encouraged by a free market, will inevitably succeed in bringing about greater justice and inclusiveness in the world. This opinion, which has never been confirmed by the facts, expresses a crude and naïve trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system. Meanwhile, the excluded are still waiting. To sustain a lifestyle which excludes others, or to sustain enthusiasm for that selfish ideal, a globalization of indifference has developed. Almost without being aware of it, we end up being incapable of feeling compassion at the outcry of the poor, weeping for other people’s pain, and feeling a need to help them, as though all this were someone else’s responsibility and not our own. The culture of prosperity deadens us; we are thrilled if the market offers us something new to purchase; and in the meantime all those lives stunted for lack of opportunity seem a mere spectacle; they fail to move us.”

Here, it’s easy to see on the surface that the language Pope Francis employs — that trickle-down theories “have never been confirmed by the facts” of being successful — can be confusing. This is a very valid criticism. Certainly, the world has seen economic gains in numerous places where trickle-down economics has been practiced, including Pope Francis’s Argentina, but he seems not to discuss them.

A second reading suggests that “Free markets aren’t what Francis is criticizing here, but rather the lazy idea that “trickle down” economics somehow lifts people from poverty by its own volition, much as a sale at Wal-Mart somehow lifts people from poverty. Does it?

Francis — as well as any causal observer of any video showing Wal-Mart shoppers fight over $500 televisions — would disagree. Francis condemns a consumerist culture that is merely keeping up with the Joneses as it were (or in Francis’ words, “ we are thrilled if the market offers us something new to purchase; and in the meantime all those lives stunted for lack of opportunity seem a mere spectacle”) and simply views human beings as participants in the spectacle of consumerism as something abhorrent… “they fail to move us” as Pope Francis rightly mentions.

So what do the leaders of conservative finance and economics do about Pope Francis? Obviously he will be writing more during his pontificate. Clearly, the world is watching and his remarks and actions speak volumes not just to Catholics any more.

It’s worth it to remember that Pope Francis is not an economist first and foremost. That being said the sweeping generalities seen in his exhortation were ripe for wide interpretation. Don’t forget, the liberal media is always waiting in the wings for a statement or a sentence (this time paragraph 54) that “shows” the Pope is on their (liberal) side — in this case the issue was economics.

Pope Francis is a speaker of freedom, and in that should be included economic freedom. We have a potential opportunity to educate the Pope and ally with him about the truth about economics and the free market. Will the world listen?

by | ARTICLES, BLOG, HYPOCRISY, OBAMA, OBAMACARE, POLITICS

Today, the architect of Obamacare, Zeke Emanuel, modified another one of Obama’s promises. This time, he explained the “if you like your doctor, you can keep your doctor” now actually means “if you want to, you can pay for it,”.

During Fox News Sunday, Chris Wallace pressed Emanuel to whether the promise would be upheld. Here’s the exchange, courtesy of The Weekly Standard.

“The president never said you were going to have unlimited choice of any doctor in the country you want to go to,” said the Obamacare architect.

“No. He asked a question. If you like your doctor, you can keep your doctor. Did he not say that, sir?”

“He didn’t say you could have unlimited choice.”

“It’s a simple yes or no question. Did he say if you like your doctor, you can keep your doctor?”

“Yes. But look, if you want to pay more for an insurance company that covers your doctor, you can do that. This is a matter of choice. We know in all sorts of places you pay more for certain — for a wider range of choices or wider range of benefits….“

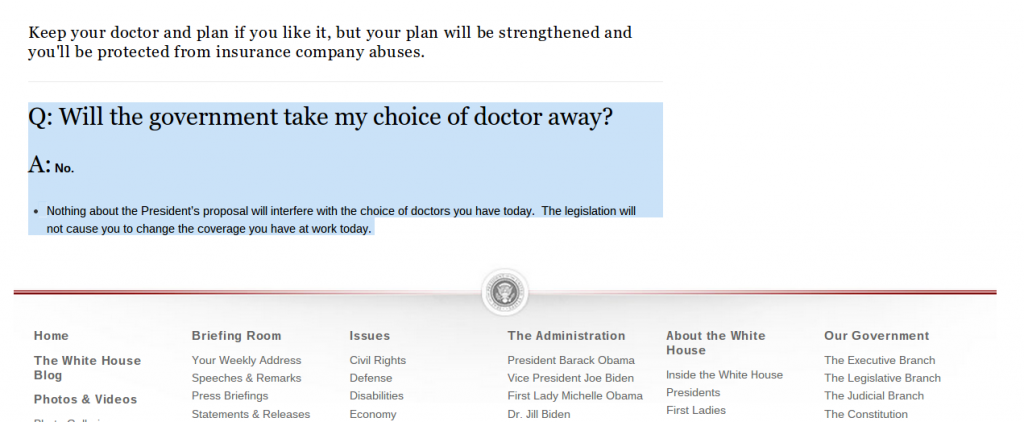

Here’s the problem. Right on the White House website, there is a document called “Health Insurance Reform Reality Check”. . There it states: “It’s never been more important to dispel these outlandish rumors and myths. Learn the facts and share them with your friends, family and neighbors.”

Then it has a “Reality Check” list. The very first bullet item says this:

“You Can Keep Your Own Insurance

Reform isn’t about putting government in charge of your health insurance; it’s about putting you in charge of your health insurance. If you like your doctor, you can keep your doctor. If you like your health care plan, you can keep your health care plan”.

Notice that it doesn’t say, “if you like your doctor, you might have to pay more”

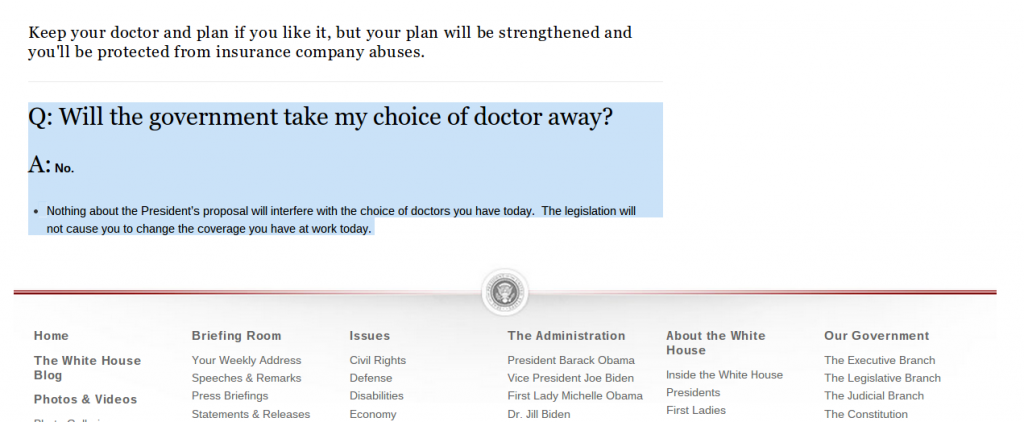

This isn’t the only place on whitehouse.gov that has the Doctor Promise. On the FAQ page entitled “Putting Americans In Charge of their Health Care”, it says:

“Q

: Will the government take my choice of doctor away?

A: No.

Nothing about the President’s proposal will interfere with the choice of doctors you have today. The legislation will not cause you to change the coverage you have at work today”

Here’s the screencap:

In fact, the Doctor Promise goes all the way back to at least 2009. On whitehouse.gov, you can find Obama’s weekly address from August 8th, 2009, where he states,

“So, let me explain what reform will mean for you. And let me start by dispelling the outlandish rumors that reform will promote euthanasia, cut Medicaid, or bring about a government takeover of health care. That’s simply not true. This isn’t about putting government in charge of your health insurance; it’s about putting you in charge of your health insurance. Under the reforms we seek, if you like your doctor, you can keep your doctor. If you like your health care plan, you can keep your health care plan.

So, since at least 2009, we’ve been hearing the simple promise, “if you like your doctor, you can keep your doctor”. Yet today we hear a modified version of that Promise, much like the recent caveat to the “If you like your plan, you can keep your plan” promise”.

Now we find out the caveat to the Doctor Promise. Here’s the rest of the interview with Emanuel from earlier today. The exchange with Wallace finishes up:

“The president guaranteed me I could keep my doctor,” said Wallace.

“And if you want to, you can pay for it,” said Emanuel.

Caveat emptor, indeed.

by | ARTICLES, OBAMA, OBAMACARE, POLITICS, QUICKLY NOTED

“It will be of little avail to the people, that the laws are made by men of their own choice, if the laws be so voluminous that they cannot be read, or so incoherent that they cannot be understood; if they be repealed or revised before they are promulgated, or undergo such incessant changes that no man, who knows what the law is to-day, can guess what it will be tomorrow. Law is defined to be a rule of action; but how can that be a rule, which is little known, and less fixed?” ~

~Federalist #62

by | ARTICLES, ECONOMY, POLITICS

The NY Post had a good piece today by William McGurn on the state of the union (pension system) in Detroit, making the case for Detroit to switch to defined contribution plans for their union workers. McGurn is right on the mark that the such a move is critical for the city’s revitalization. Dispensing with this one particularly enormous financial burden which has added greatly to the city’s fiscal insolvency would change the city’s finances for the better going forward. However, he seems skeptical that such a radical change could ever be achieved.

There is a way to implement a change to a defined contribution system. Even though the city of Detroit is billions of dollars in debt, the emergency manager, Kevyn Orr, has the opportunity to make to make it happen.

Orr is currently at odds with the unions over the total amount that union’s two pension system are underfunded. Using the actuarial projections provided by the unions, the funds are only short by $650 million, while Orr’s calculations show that the underfunding is a good $3.5 billion. Who is right? Orr believes he is correct and some independent studies seem to back his assertions. In actuality, it doesn’t necessarily matter who is correct, because the conflict actually provides a solution for the city.

If the unions wish to argue that their pension liability is merely $650 million, the city should wholeheartedly agree to fully fund their request — with one important condition. The unions must either a) agree to a fixed annual contribution to the defined benefit plans going forward, or b) (the better solution) cease using a defined benefit plan and move to a defined contribution plan going forward for all of their employees. In either case they must take full ownership, responsibility, and management, from here on out.

Once the unions pensions are fully paid up with the $650 million from the city, they will be in a position to take over the management of their funds. Let the unions use their expertise and earn the 8% that they maintain should be readily achievable. If they can do it, their members will continue to thrive-as-usual, ultimately collecting the pensions that have been promised to them for work up to this point. If they can only earn 3-4 or 6%, it will be on them to explain to their own members why their numbers are suddenly now off.

Even though $650 million sounds like a large number to pay off and fully fund the union pensions, it is a small amount to pay for the fiduciary freedom that comes with not having to manage an incredibly complex, risky, and fiscally unsound system. Such a move will contribute greatly to the long term health of the city of Detroit.