by | ARTICLES, ECONOMY

The tactics that the Democrats used in 2012 regarding the Bush tax cuts is the same strategy being deployed by the Republicans in 2013 and Obamacare. Yet this time around, the Republicans are getting vilified for it.

Let’s get this straight. In 2012, the Republicans wanted to permanently extend the “Bush tax cuts” for all. These cuts had been temporarily put in place in 2001 and 2003 and were renewed in Congress in 2010, making it the “law of the land” for roughly ten years.

However, the Democrats refused to have consider an across-the-board clean tax cut for all. Instead, they insisted on an exception. They demanded that Congress raise the rates on the high incomes earners by letting the tax cuts expire for them, and pushed for only extending the cuts on the lower earners. Their rationale? A revenue raiser. (Those high earners need to “pay their fair share”).

Then, the Democrats argued that if the Republicans did not agree to their request, all the tax cuts would lapse and it would be the Republicans who would be responsible for also raising the rates on the other 99%.

Fadst forward to late September 2013. The shoe is on the other foot and the Republicans make a demand about a law that has yet to go into effect (vs the decade-old tax cuts), using the same methodology as the Democrats did less than a year ago. And now the Republicans are the bad guys for insisting on a delay for one year on the healthcare law for which 100% are affected.

Now that the government is shut down, the Republicans are offering clean CRs areas by area. Yet the Democrats are refusing every bill. They insist that it be a Clean CR for everything — the same way the Republicans were lambasted for insisting that the tax cuts should be made cleanly and permanently for everyone.

What’s worse, the same argument that the Democrats made about raising the rates on the 1% (to raise revenue) is the exact same effect that a one-year Obamacare delay could give our economy. It has been estimated by the CBO the CBO that such a delay would have saved $35 billion in over ten years. How is this not a good thing this time around? Folks, a double standard is in effect.

Isn’t this current shutdown the epitome of hypocrisy? The Democrats insisted on shutting down the government to prove it could run healthcare. And they did so on the backs of you and me. The Republicans need to continue to follow the Democrat’s example and resolve in 2012 and hold their ground on this monumental issue.

by | ARTICLES, OBAMA, POLITICS

The Democrats (and some others) have been screaming for all the country to hear that the upcoming debt ceiling vote should not have to be. After all, once Congress passes a law that involves paying for something, and the President signs it, the country has an obligation to “pay its bills”, right?

The Democrats (and some others) have been screaming for all the country to hear that the upcoming debt ceiling vote should not have to be. After all, once Congress passes a law that involves paying for something, and the President signs it, the country has an obligation to “pay its bills”, right?

Wrong. This rationale is utter nonsense, as Congress has the sequence of events exactly backward. If Congress passes any law that would have the effect of increasing the country’s debt above the plainly existing (for all to see) debt limit, and has not first dealt with the obligation of how to get the debt ceiling increased so that the bills could be paid, Congress and all the members who have voted for those bills have abrogated their fiduciary responsibility.

For more than 100 years until WWI, Congress was obligated under law to approve each spending measure that resulted in accrued debt. Bonds were either approved or not approved, which kept spending and debt limits in check. That procedure is no longer in affect today. That is unfortunate.

For those who advocate for an unlimited debt ceiling, one should place their same arguments in an individual or business context. For instance, if a family only has $1,000 of available cash reserves, and for some reason commits itself to spend $1,200, where does the blame lie? And from where does the extra $200 come? And should that family have a continuous, open-ended stream of money to spend as it sees fit? Or look at it from a business perspective — every business wants to spend to succeed. However without the prudence and final decisions of the Chief Financial Officer obligated to operate under yearly and long-term budgets, the business runs the risk of swiftly becoming insolvent.

The same common sense should be applied to Congress as it once was. Do we spend before we know how we are going to pay for it, or do we know how we are going to pay for it before we spend? Let’s please get our sequence straight and financial house in order.

by | ARTICLES, BLOG

Hey folks —

Just remember, the very same Administration actively blocking your access to monuments, etc is the same Administration now in charge of your access to health care.

by | ARTICLES

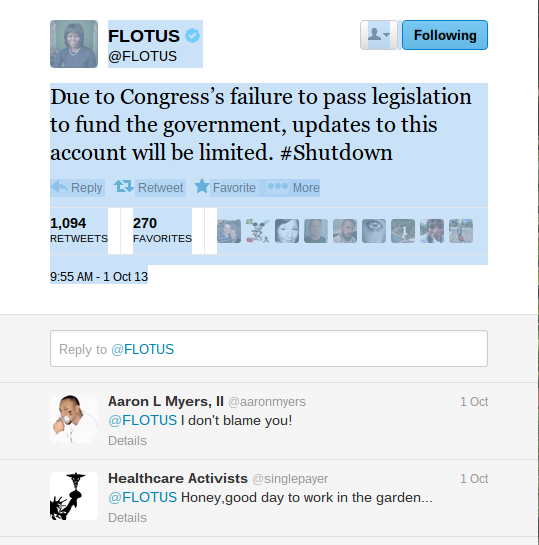

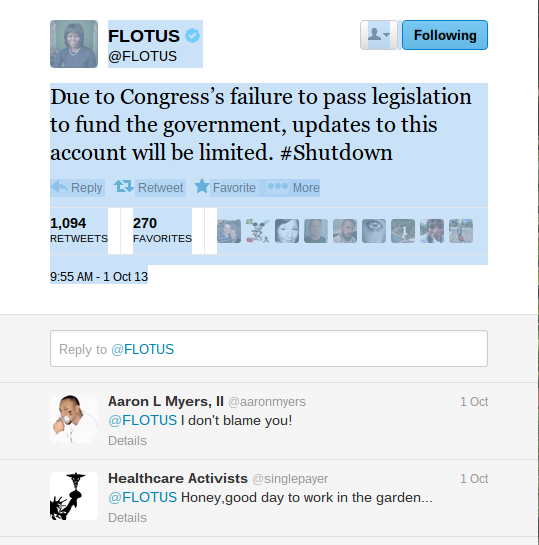

So, the FLOTUS account on Twitter posted this yesterday morning

So, a few questions come to mind:

1) Isn’t Twitter free?

2) If FLOTUS isn’t doing her own TWITTER (for free), can we assume the Twitter position for her is “non-essential” personnel?

3) Do we taxpayers need to be paying someone to Twitter for the FLOTUS, especially since 2 million (37%) of her followers are fake?

by | ARTICLES, BLOG, NEW YORK, OBAMA

Obama is lending NYC Mayor candidate his playbook to win — including his endorsement, his staff, and his rhetoric.

Obama is lending NYC Mayor candidate his playbook to win — including his endorsement, his staff, and his rhetoric.

Obama recently and heartily endorsed Mr. de Blasio, which comes a couple of weeks after his win in the Democrat primary against 8 other candidates.

De Blasio’s campaign released a statement noting Obama’s endorsement; Obama remarked, “Progressive change is the centerpiece of Bill de Blasio’s vision for New York City”, which would make him a “great mayor”. De Blasio spoke to this effect, describing how “On health care, tax fairness or the economy, the president is no stranger to addressing big problems with big ideas and big solutions. I will emulate the example he has set, and if elected I stand eager to work with him on an urban agenda that grows prosperity for all.”bb

According to the NYT, Obama is lending not only his name, but also his powerhouse consultants. “Several veterans of Mr. Obama’s 2008 and 2012 campaigns are now senior campaign advisers to Mr. de Blasio, including Mr. de Blasio’s campaign manager, Bill Hyers, and John Del Cecato, who has been most responsible for his commercials”. This will be a difficult obstacle for Joe Lhota to overcome along with the Obama endorsement — especially in light of the fact that Bloomberg, a marginal Republican and mayor for the past 12 years — as refused to endorse anyone in the race.

Most notably, De Blasio is using language that echos much of the phrases preferred by President Obama. De Blasio describes himself as ““a consistent progressive with a very strong activist worldview and someone who wants to make substantial change in this city.”. (sounds a lot like community organizer, eh?).

He has also spoken of his plans regarding “fighting inequality and economic injustice.” Sounds very much like “pay their fair share” policies.

So if New Yorkers want NYC to be a microcosm of our current government style and economy, De Blasio is their candidate. He is very open about modeling himself after Obama.

by | ARTICLES, ECONOMY, OBAMA, POLITICS

Supporters of President Obama continually try to rationalize his decisions on the basis of some philosophical and moral philosophy. In fact, it does seem clear to most rational thinkers that, in fact, the President chooses the most politically expedient position at the moment. Nothing makes this clearer than Obama’s all-over-the-lot positions on the debt ceiling.

CNS News released an excerpt” from President Obama’s speech given on September 18 at the Business Roundtable in D.C. During his discussion, Obama remarked,

“Now, this debt ceiling — I just want to remind people in case you haven’t been keeping up — raising the debt ceiling, which has been done over a hundred times, does not increase our debt; it does not somehow promote profligacy. All it does is it says you got to pay the bills that you’ve already racked up, Congress. It’s a basic function of making sure that the full faith and credit of the United States is preserved.”

However a speech given in 2006 by then-Senator Obama on the occasion of raising the debt ceiling under President George Bush paints a completely different picture. Back then, Obama actually laments that that Federal spending has not been reduced, which he in turn blames for an increase in deficits, therefore resulting in more money borrowing and a need to raise the debt ceiling:

“Tax breaks have not been paid for by reductions in Federal spending, and thus the only way to pay for them has been to increase our deficit to historically high levels and borrow more and more money. Now we have to pay for those tax breaks plus the cost of borrowing for them”

What else did Senator Obama say? He also described Bush’s increase of federal debt by $ 3.5 trillion over 5 years to be “reckless fiscal policies”, and a sign of “leadership failure”.

“The fact that we are here today to debate raising America’s debt limit is a sign of leadership failure. It is a sign that the U.S. Government can’t pay its own bills. It is a sign that we now depend on ongoing financial assistance from foreign countries to finance our Government’s reckless fiscal policies. Over the past 5 years, our federal debt has increased by $3.5 trillion to $8.6 trillion. That is ‘‘trillion’’ with a ‘‘T.’’ That is money that we have borrowed from the Social Security trust fund, borrowed from China and Japan, borrowed from American taxpayers. And over the next 5 years, between now and 2011, the President’s budget will increase the debt by almost another $3.5 trillion”

Yet in merely three years of Obama’s Administration, from 09/30/09 – 09/30/12 (the last year for which figures were available), the debt increased $ $4.1 Trillion, from $1,909,829,003,511.75 to $16,066,241,407,385.89. These numbers were taken from Treasurydirect.gov. Obama’s own fiscal policies have proven to be worse.

So because we are in so much more debt, we need to raise the debt ceiling yet again. And we find Obama at his recent speech rationalizing the need to raise the debt ceiling in order to preserve the full faith and credit of the United States for the future:

“And I have responsibilities at this point not just to the current generation but to future generations, and we’re not ‘going to set up a situation where the full faith and credit of the United States is put on the table every year or every year and a half, and we go through some sort of terrifying financial brinksmanship because of some ideological arguments that people are having about some particular issue of the day. We’re not going to do that.”

But what was did Obama think about his responsibilities to current and future generations and the full faith and credit of the United States back in 2006? As a Senator, Obama used that same argument against raising the debt ceiling

“Increasing America’s debt weakens us domestically and internationally. Leadership means that ‘‘the buck stops here.’’ Instead, Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren. America has a debt problem and a failure of leadership. Americans deserve better. I therefore intend to oppose the effort to increase America’s debt limit.”

It’s quite clear: What Obama said and thought as a Senator during the Bush administration in 2006 versus what Obama says and thinks as the President in 2013 regarding the very same topic, the debt ceiling, yields two very different sets of conclusions. When Obama argued against the debt ceiling as a Senator, we were at $8.5 Trillion in federal debt created in a span of 200+ years. A mere 7 years later, we have managed to double that number, with 5 of those 7 years under Obama’s watch. The explosive growth of federal debt under President Obama is gross fiduciary negligence.

The full text of Obama’s 2006 speech is here.

An interesting thing to note about Obama’s 2006 speech against the debt ceiling. The original text of the speech should be in the Senate archives online, but it was removed months ago after an NRO article drew attention to it in January 2013. Shortly after that article ran, the link to the speech came back as an “error”.

Unsurprisingly, the link has yet to be fixed as of this morning. When the link originially disappeared, the Heritage Foundation was able to get a copy of the text from the Government Printing Office (gpo.gov). They dug it up there because the online Senate file was scrubbed.

And after the NRO article ran, I reproduced it here in its entirety. It almost sounds…..conservative. Obama-the-President wouldn’t like that.

by | ARTICLES, ECONOMY, OBAMA, POLITICS

Today we have reached 1600 days without an operating budget for our country. But who’s actually counting right now? And why should we care?

Today we have reached 1600 days without an operating budget for our country. But who’s actually counting right now? And why should we care?

Currently, we have Syria at the forefront of discussion, which has put any substantive monetary debates on the back burner. Besides the question of whether or not to authorize and spend money on Syria, Congress also faces both if and how to fund the government past September 30 in the form of a CR, whether or not to defund Obamacare, and what to do with the impending debt ceiling limit.

So here’s a little primer on the fiscal State of the Union.

According to the US Debt Clock, we are $16,970,000,000 in debt. The US Debt Clock is an unofficial tally of our excessive spending.

The federal deficit increased by $146 billion in August, as reported by the CBO four days ago. Yet this conflicts with reports from the Treasury Department.

Yet as reported by CNSnews, “According to the Daily Treasury Statements that the Treasury publishes at 4:00 p.m. on each business day, the debt subject to the legal limit has remained at exactly $16,699,396,000,000–or about $25 million below the legal limit–every day since May 17.”

This makes 118 days, with the September 12 report being the most current, that the debt has stayed at $16,699,396,000,000.

Why is this important? The current debt ceiling limit is $16,699,421,095,673.60. According to the debt clock, however, and if CBO reports for June, July, and August were added to the Treasury statements amount since May 17th, we would be way past the debt ceiling limit. In fact, August alone would have crossed the threshold. So what is our current debt?

Incidentally, the reason why Congress even has to consider the question of funding the government or shutting it down past September 30 (the last day of the fiscal year) is that there is no operating budget. The last time the Senate passed a budget was April 29, 2009. Nearly the entirety of Obama’s time as President has been this way. For the Senate to abrogate its basic fiduciary responsibilities in such a major way is unconscionable.

Today also marksthe five year anniversary of the Lehman Brothers Chapter 11 bankruptcy filing on September 15, 2008, the largest in U.S. history. This event triggered the instability of the stock market and marks the starting point for the economic stress and downturn that has plagued the nation for the last five years.

Obama has been at the helm for the duration of this financial crisis. Yet his fiscal policies have failed to relieve the nation of high unemployment:

“The unemployment rate in September 2008 was 6.1 percent—up from a relatively stable 5 percent that had been the peak unemployment for the 30 months preceding December 2007. The unemployment rate steadily rose throughout 2008 and the beginning of 2009, spiking at 10.2 percent in October 2009. We still haven’t gotten back to the prerecession levels of unemployment. We haven’t even gotten back to the mid-recession unemployment of five years ago. The employment picture for this August was particularly bleak, with an Obama-presidency-low unemployment rate of 7.3 percent masking sharp downward revisions to the previous months’ jobs gains. At August’s rate of job growth, it’d take nearly two years for the economy to get back to 5 percent unemployment.

”

Our fiscal health is poor today. Is the current state of our Republic how it was meant to be when our Founding Fathers created it? Thomas Jefferson wisely observed, “I place economy among the first and most important of republican virtues, and public debt as the greatest of the dangers to be feared”.

The CBO confirms the massive deficit spending that has characterized this administration. The Treasury reports reveal unexplainable debt data that don’t square up to with the CBO and may be masking a debt amount that has surpassed the statutory limit. And Obama’s Democrat-led Senate has failed to pass a budget in 1600 days, forcing an impending showdown for Congress and its excitable politicians who can’t decide whether to fund our government past another 15 days.

These are the fiscal realities facing the nation from the man behind the curtain at 1600 Pennsylvania Avenue.

by | ARTICLES, ECONOMY, NEW YORK

The recent ruling in finding NYC’s prevailing wage unconstitutional was the correct decision. Bloomberg understands the fundamental economic premise regarding paying a wage what the market dictates the worker is worth. Those that support the prevailing wage policies do not. It is both unfortunate and dangerous, because implementing a prevailing wage has two effects: 1) it devastates the very people its proponents think they are helping and 2) it erodes NYC’s economy by creating more barriers for businesses.

When a government takes taxpayer money, it takes it as a fiduciary; that is, it implies a relationship — legal, ethical, and economical — between “trustee” (government) and beneficiary (taxpayer).Therefore, the government has a moral, if not legal, obligation not to spend more money or pay anything more than the market demands.

The very act of paying $10 for something that costs $8, under the notion of “prevailing wage”, would put any other private businessman in trouble. Prevailing wage theory is not the government acting out of the kindness of heart, like its proponents would have you think. It raises the cost of goods to all constituents, increases the cost of living, and slows down the local economy.

The judge, although he ruled correctly, did so reluctantly — seemingly only under the technicality that the “law contravened state law”. He described how, “this court believes that the prevailing wage law could benefit the people of New York and does not see wisdom in the mayor’s zeal for the possibility of welcoming to New York City a business that would pay its building service employees less than the prevailing wage”. Bloomberg, however, hit the nail on the head when he countered that “legislation like this makes it harder for companies to invest in New York City.”

Here’s what the prevailing wage campaigners fail to discuss or flat out don’t understand from fundamental economics. The extra money being paid in a prevailing wage only benefits people that you can see. You do not see the hidden costs that add up to the employer, which create a net loss to the economy (deadhead costs). When you pay $10 for $8 worth of labor, it is identical to imposing a tax from an accounting point-of-view. What you see is the extra $2 going into the employee’s pocket. What you don’t see is the effects of the price increase on the business owner or the economy — how he absorbs the cost, offsets the cost, changes or slows production, cuts back hours or product, and so forth. That is the unspoken deadhead cost, a loss which has a ripple effect on the rest of the economy.

Prevailing wage is a scourge that must be stopped in its entirety, or else it will continue to grow. It doesn’t matter that one judge in open court halted the process. The people pushing for its policy must come to understand the basic economic premise — that when you artificially raise the price of something, you get less of it. Ergo, if you artificially raise the price of wages, you get less of that too — because many companies cannot afford the additional costs (or they would have to pass on the higher costs, but at the higher price there would be fewer buyers).

Artificial wage prices impede a business’ ability to grow and invest. There are many arguments against a “prevailing wage”, chief among them the burden on businesses — which are already struggling. The failure to understand the true effect of artificial wage control on the economy-at-large is frustrating. Such faulty logic is representative of the current trend to focus on feel-good rules rather than economic well-being for all. At least Mayor Bloomberg, who has been a successful businessman, (despite all his other faults) was willing to fight against measures like a “prevailing wage” that would keep NYC’s economy both depressed and sluggish.

by | ARTICLES, BLOG, FREEDOM, HYPOCRISY, OBAMA

The idea of “disparate impact” is a poisonous cancer that has taken root as an important concept in the business world. If we do not end it soon, it will continue to grow, extorting huge sums from innocent companies, creating an enormous economic burden on society, and allowing the tort bar to run amok.

Under disparate impact, there are many areas in business where charges of “discrimination”, often regarding race, could and are being made every day. Employment and mortgage origination are two of the most prevalent. The law requires – as it should -that for a company to be guilty of such discrimination, there must be an intent to discriminate.But government agencies have found a way to overrule that requirement by developing the concept of “disparate impact”. Disparate impact is the concept that allows for a showing that if a protected class of citizens has a statistically lesser representation with respect to a business (hiring, mortgages originated, etc.) it may be implied that the business has intentionally discriminated. This is clearly irrational, since there may be many economic, societal, and local reasons for the statistic. But disparate impact puts the burden to show lack of discrimination on the employer – guilty until proven innocent. In fact, in order for an employer to defend himself against such a charge, he would have to show that the “offending rule or practice” was a “business necessity”.

Though I find this concept outrageous, the federal and state governments and their agencies seem to love it. I therefore believe that they should be equally adamant in applying the concept in the public sector.

The IRS scandal has shown the clear practice of targeting conservative groups applying for 501c4 status. Under disparate impact theory, the charge of intentional discrimination would apply because there is no “business necessity” in the clearly statistically significant discrimination policy the IRS has employed. The Obama administration, having complete control and responsibility for the Department of the Treasury and its Internal Revenue Service.is therefore guilty of intentional discrimination. In particular, President Obama’s specific response, that there has been no evidence that anyone directed anyone to intentionally target conservatives, does not insulate him from being actually guilty.

The current administration has been keen on applying disparate impact theory to a number of private companies, and appears intent on ramping up the practice. For example, Obama’s labor secretary nominee, Thomas Perez, has been particularly lucrative in this regard. In June, National Review Online (NRO) covered some of Perez’s more recent cases, noting that Perez “has applied that theory vigorously to force large settlements from financial companies even in cases where there was no evidence of actual racial discrimination”. In other words, employers can be sought after for violating the law whether or not they intended to do wrong.

The White House in general, and Perez in particular, like disparate impact theory because it, as NRO notes, it “sets a very low bar for proving discrimination. Under it, prosecutors need not prove intent, merely that minorities have suffered a disparate impact from some action”. And this is a person Obama intends to add to his Presidential Cabinet.

If disparate impact can be applied to the private sector, it should also — in the spirit of fairness and equality, of course — be applied to the IRS. Numbers have been abused, and particular groups have been adversely singled out and subject to excessive, burdensome, and overreaching scrutiny; of this we are certain. The targeting of conservatives was a concerted effort to slow down or dissuade the creation of their tax-exempt groups. Even if the White House did not give a direct order (which remains to be seen), it doesn’t really matter anyway under disparate impact theory. Intent needs not to be proved in court; merely the act of discrimination is enough.

Based on the White House’s unmitigated belief of their ability to use disparate impact against companies for questionable practices, the rule should be applied to the IRS for its questionable practices as well. Since the IRS falls directly under the purview of the Executive Branch, why is the President of the United States therefore not directly responsible and culpable for the IRS abuse?

by | ARTICLES, BLOG

The Chicago Tribune has published a Sunday editorial calling for Obamacare to be re-written. The Chicago Tribune.

The Tribune goes through the myriad of delays that the Administration has announced in the last few months, contrary to the actual written law, and then they go further. They question the ability of Obama to actual ignore parts of the law he deems inconvenient or difficult to implement under the dates created by Congress — and signed into law by Obama himself.

“The administration asserts that it can make these changes under the president’s broad executive authority. Yet critics make a compelling argument that the president is stretching the limits. Former federal appellate Judge Michael McConnell, director of the Constitutional Law Center at Stanford Law School, writes in The Wall Street Journal about a different sort of mandate: the mandate in Article II of the Constitution that the president “‘shall take Care that the Laws be faithfully executed.’ This is a duty, not a discretionary power. … As the Supreme Court wrote long ago (Kendall v. United States, 1838), allowing the president to refuse to enforce statutes ‘would be clothing the president with a power to control the legislation of Congress, and paralyze the administration of justice.'”

Like most issues of presidential authority, this isn’t cut and dried. Presidents do have broad discretion on how laws are enforced. But they’re on shaky ground when they decide whether to enforce a law. It’s not hard to understand why: Imagine the outcry if President Mitt Romney refused to enforce, say, Obamacare”

Yes, imagine that. Imagine Romney (or Bush?) trying to do what Obama has done. What’s more, The Chicago Tribune calls into credibility Obama’s excuse to circumvent Congress and administer his changes by fiat. Obama blames a toxic environment in Congress, but the Tribune isn’t even buying it.

“Tweaks? Obama isn’t making tweaks. He’s trying to circumvent major flaws that began flaring when the law was enacted. Hence the many carve-outs, delays and special deals that have been piling up since he added his signature to Obamacare on March 23, 2010.

The president crusaded for this law and has embraced its nickname. But he did not write the law. Congress did. Major changes are necessary — he has stipulated by his actions that this law as constituted cannot work — and Congress should legislate them for his review.”

The Chicago Tribune sums up the sloppy, slippery implementation of Obamacare by calling for it to be rewritten. The fact that the one of the most adament cheerleaders of Obama has 1) turned its back on this signature piece of legislation and 2) questioned Obama’s tactics, is quite alarming. When such a major ally discovers that our Emperor indeed has no clothes, it reinforces the need for Obamacare critics to press on in their fight to repeal this monstrosity of a law.