by | ARTICLES, ECONOMY, HYPOCRISY, OBAMA, TAXES

The NY Times is reporting the following tidbits about Obama’s campaign :

1) President Obama has spent more campaign cash more quickly than any incumbent in recent history

2) The price tag: about $400 million from the beginning of last year to June 30 this year, according to a New York Times analysis of Federal Election Commission records, including $86 million on advertising.

3) With less than a month to go before the national party conventions begin, the president’s once commanding cash advantage has evaporated, leaving Mitt Romney and the Republican National Committee with about $25 million more cash on hand than the Democrats as of the beginning of July

Let’s couple these points with a recent report from the Hill:

The president spent $58.1 million in June despite bringing in just $45.9 million, meaning his reelection effort ran a deficit of more than $12 million dollars for the month. And the president spent an whopping $32.2 million in television ads, along with $4.5 million in online ads, over the 30-day period. The Romney campaign, by contrast, spent $10.4 million over that period on advertisements.

The total national debt is $15.8 trillion, increasing nearly 50% from the $10.6 trillion in debt when Obama took office. Additionally, the debt held by the public is up to $11 trillion from $6.3 trillion when Obama began his presidency, which is a 75% increase. Though it is commonly cited that Obama accumulated more public debt than all the other prior presidents combined, he falls $1.7 trillion short right now — though that is not too far off.

Another interesting statistic is that calculating the federal spending debt as a percentage of the GDP yields that Obama is higher than the last five presidents. The Office of Management and Budget statistics show that the debt percentage increases were: Reagan, up 14.9%; Bush 41, up 7.1%; Clinton, down 13.4%; George W. Bush 43, up 5.6%; and Obama, up 21.9%. Thus, Obama’s spending debt increases exceeded that of the last five presidents.

So right now, Obama’s campaign spending is the highest in recent history, and his campaign posted deficit spending last month. We know that his campaign is sending out multiple donation pleas daily to his supporters, just as Obama is talking about raising the tax margins in order to generate more government revenue. The most ironic part is that Obama is more than happy to attend and accept $35,000+ a-plate fundraising dinners, but then at the same time excoriates “millionaires and billionaires” and the “top 2%” for the sake of election class warfare rhetoric.

I guess these expensive campaign fundraisers is Obama’s interpretation of making sure the wealthy “pay their fair share” (to him).

UPDATE 8/6: The Washington Times is reporting Obama is hitting up Hollywood for cash again. Aren’t they the top 2%?

UPDATE x2: This on top of reports that Romney and the GOP raised $100 million in July, while Obama raised only $75 million

by | ARTICLES, ECONOMY, HYPOCRISY, OBAMA, POLITICS, TAXES

After being caught by surprise on Tuesday at a press conference, Jay Carney admitted he did not know that Ohio military base — to which President Obama would be flying and landing — on August 1, would be closed due to defense cuts.

So how does the Obama crowd spin cover this gaffe? Well, they whip out their “blame the GOP” and “blame the wealthy” playbooks, of course! (AKA “paying their fair share”)

“What is holding us up right now is the Republican refusal to have the top two percent [of earners] pay their fair share,” Zients said in response to a question from Rep. Randy Forbes (R., Va.).”

At least one lawmaker rightfully called out Jeffrey Zients, director of OMB who made the remark. Rep. Mike Turner of Ohio responded in kind,

“We’re not usually in the habit of hearing such partisan comments in what is really a bipartisan committee,” Turner said. “We don’t usually hear people throw around ‘Republican’ and ‘Democrat,’ but you have, very, very well. I want to commend you on your broken record of partisanship.”

“Zients’ comments are pretty brazen in light of the $800 billion in wasted taxpayer dollars that was supposed to (but didn’t) stimulate the economy and which were, in effect, paid for by $800 billion in defense cuts,” said Gary Schmitt, resident scholar at the American Enterprise Institute. “And is he really suggesting the country’s national security be put at risk because the administration want to raise taxes (on more than the top 2 percent) in order to save PBS, Amtrak, and the Education Department?”

The possible military cuts (sequestration) would cut troops at several levels, affect medical benefits, military housing, and more. This would happen if $1.2 trillion in budget cuts are not found. As part of the “automatic trigger” put in place from the failed Super Committee last year, President Obama endorsed and signed the sequester plan.

But instead of offering alternative solutions to avoid this from happening on January 2nd, unlike the Republicans and the Ryan Plan, Obama and the Democrats have not offered another option. Resorting to the same old tired class warfare rhetoric doesn’t solve any real problems; it only makes the White House look more desperate as the campaign season limps along.

by | ARTICLES, POLITICS

Catching up on the WSJ, I came across an opinion piece by Ben Wattenberg, who surmised that the current entitlement crisis is one of demographics; that is, our fertility rates are not able to sustain payment obligations. Though generally the WSJ and the American Enterprise Institute — of which Mr. Wattenberg is a senior fellow — are good in their analyses, this argument is patently untrue.

A few days later, the WSJ ran a letter to the editor by a Mr. Walsh, who well summed up the problem with Wattenberg assertion.

Ben J. Wattenberg’s suggestion that the funding problems with Social Security are due to demographics is demonstrably false. A properly funded program of benefits works regardless of demographics if benefit amounts are not increased above what payments can support, and accumulated funds and related investment earnings are invested wisely and not diverted to other uses.

These basic conditions are at work in the private retirement sector, governed by Erisa, where demographics have had a relatively negligible effect on current funding levels. In the case of Social Security, the former condition has been routinely violated by politicians pandering for votes, while elimination of the latter condition was seen to by Lyndon Johnson (Mr. Wattenberg’s old boss) and the Democratic House and Senate at the time. Current entitlement practices lack basic and proper accounting for costs.

In short, we’ll have deficits in 2020 not because only because spending is too much, but also because their accounting methods allow them to record the costs incurred years prior (for instance in 2003) as expenses in 2020.

What Mr. Wattenberg is really saying is that the current shift in demographics has made it more difficult to tax current earners sufficiently to pay for the overpromised benefits of current beneficiaries and to compensate for government mismanagement.

I have written before on the crisis of Social Security and its lack of basic and valid accounting practices. Entitlement reform must consist of both fiscal restraint and acceptable and professional accounting.

by | ARTICLES, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, POLITICS

Our taxes built that.

If you were successful, somebody along the line gave you some help. There was a great teacher somewhere in your life. Somebody helped to create this unbelievable American system that we have that allowed you to thrive. Somebody invested in roads and bridges. If you’ve got a business — you didn’t build that. Somebody else made that happen. The Internet didn’t get invented on its own. Government research created the Internet so that all the companies could make money off the Internet.

Roads and bridges? Internet? Built by capital revenue provided by taxpayers and business owners, not the faceless “government”

Without the hard work and innovation by our citizens, wealth could not have been created. That wealth provides the thriving economy and tax revenue to pay for all the functions of government (necessary and unnecessary) — be it it infrastructure, education, or technology.

Obama seems to have forgotten that part…until he needs more taxes for his deficit spending and expansive government programs. Only a self-absorbed government bureaucrat could argue that their existence justifies everyone else’s existence.

Facts are stubborn things. Yes, we built that.

by | ARTICLES, HYPOCRISY, POLITICS, TAXES

From Thomas Sowell comes a great column:

Anyone who wants to study the tricks of propaganda rhetoric has a rich source of examples in the statements of President Barack Obama. On Monday, July 9th, for example, he said that Republicans “believe that prosperity comes from the top down, so that if we spend trillions more on tax cuts for the wealthiest Americans, that that will somehow unleash jobs and economic growth.”

and this gem:

People over 65 years of age have far more wealth than people in their thirties and forties — but lower incomes. If Obama wants to talk about raising income taxes, let him talk about it, but claiming that he wants to tax “the wealthiest Americans” is a lie and an emotional distraction for propaganda purposes.

Sowell really dissects Obama’s distortion of wealth vs income, and how it plays right into class warfare tactics. He also points out the fallacy of the notion that raising taxes will result in higher government revenue. He is absolutely correct, and the most recent example of such a failed policy is England. Last week, I wrote about the reports which showed that upping the taxes rates this past spring in England yielded lower-than-expected revenue, which boggled the minds of such politicians who don’t understand the Laffer Curve.

And Sowell reminds us, JFK staunchly believed that higher tax rates drives money into tax shelters. This point was proven in the time leading up to the Internal Revenue Code (IRC) overhaul of 1986 — when some tax rates were more than 70%. When the IRC lowered rates to 28%, the money flowed, because it was too much work to hide the money, so to speak. I have written about this before when I picked apart Obama’s “millionaires and billionaires” rhetoric.

Obama’s only tactic is to continue to use class warfare speak in order to win. As much of the electorate is simply uninformed about the nuances of economics and with a media content to perpetuate his distortions, we must steadfastly refute his claims, as Sowell has done so well.

by | ARTICLES, ECONOMY, GOVERNMENT, HYPOCRISY, TAXES

From Investor’s Business Daily:

The economy created just 80,000 jobs in June, the Bureau of Labor Statistics reported Friday. But that same month, 85,000 workers left the workforce entirely to enroll in the Social Security Disability Insurance program, according to the Social Security Administration.

and more:

In addition, while job growth has been very weak during the recovery, the total number of people who’ve dropped out of the labor force entirely has exploded, climbing 7.3 million since June 2009, and IBD analysis of BLS data show. Some of them aged into retirement, but most either signed up for disability, stayed in school, moved back in with parents, or just quit looking for a job.

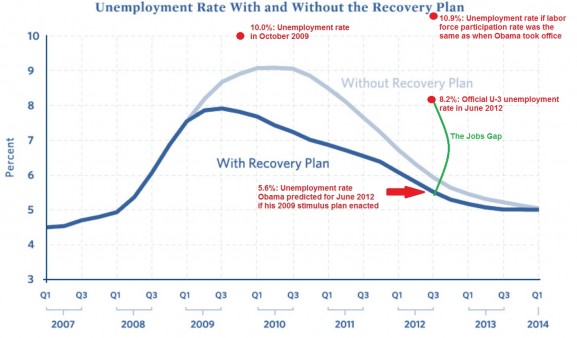

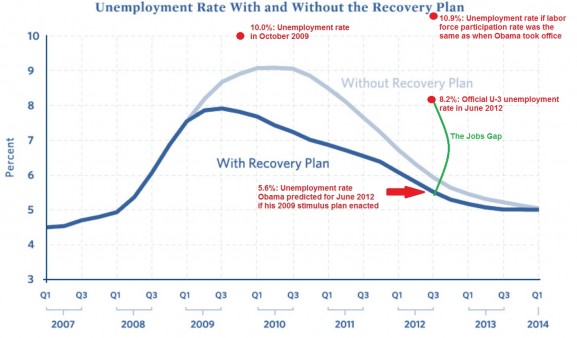

But, don’t forget, Obama predicted 5.6% unemployment by this time with the stimulus

AEI Obama Stimulus

There’s not much else to say here….add your commentary below!

by | ARTICLES, ECONOMY, HYPOCRISY, OBAMA, POLITICS, TAXES

Alan Krueger, Chairman Of the Council of Economic Advisors, soothed Americans on his White House blog post regarding the unemployment numbers released today.

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and employment estimates can be subject to substantial revision. Therefore, it is important not to read too much into any one monthly report and it is informative to consider each report in the context of other data that are becoming available

Did you know that the White House said something similar the month before?

June 2012: “Therefore, it is important not to read too much into any one monthly report and it is informative to consider each report in the context of other data that are becoming available.”

And the month before?

May 2012: “Therefore, it is important not to read too much into any one monthly report and it is helpful to consider each report in the context of other data that are becoming available.”

April 2012: “Therefore, it is important not to read too much into any one monthly report and it is helpful to consider each report in the context of other data that are becoming available.”

And so forth. Like a parrot.

March 2012: “Therefore, it is important not to read too much into any one monthly report, and it is helpful to consider each report in the

context of other data that are becoming available.”

February 2012: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report; nevertheless, the trend in job market indicators over recent months is an encouraging sign.”

January 2012: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report; nevertheless, the trend in job market indicators over recent months is an encouraging sign.”

December 2011: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

November 2011: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

October 2011: “The monthly employment and unemployment numbers are volatile and employment estimates are subject to substantial revision. There is no better example than August’s jobs figure, which was initially reported at zero and in the latest revision increased to 104,000. This illustrates why the Administration always stresses it is important not to read too much into any one monthly report.”

September 2011: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

August 2011: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

July 2011: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

June 2011: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

May 2011: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

April 2011: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

March 2011: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

February 2011: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

January 2011: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

December 2010: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

November 2010: “Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.”

October 2010: “Given the volatility in monthly employment and unemployment data, it is important not to read too much into any one monthly report.”

September 2010: “Given the volatility in the monthly employment and unemployment data, it is important not to read too much into any one monthly report.”

August 2010: “Therefore, it is important not to read too much into any one monthly report, positive or negative.”

July 2010: “Therefore, it is important not to read too much into any one monthly report, positive or negative. It is essential that we continue our efforts to move in the right direction and replace job losses with robust job gains.”

June 2010: “As always, it is important not to read too much into any one monthly report, positive or negative.”

May 2010: “As always, it is important not to read too much into any one monthly report, positive or negative.”

April 2010: “Therefore, it is important not to read too much into any one monthly report, positive or negative.”

March 2010: “Therefore, it is important not to read too much into any one monthly report, positive or negative.”

January 2010: “Therefore, it is important not to read too much into any one monthly report, positive or negative.”

November 2009: “Therefore, it is important not to read too much into any one monthly report, positive or negative.”

Parrots repeat the same thing over and over ad nauseum. But they can’t read. Maybe the White House figures that people won’t really read their blog too closely either. Isn’t the definition of insanity is to do the same thing over and over and expecting different results?

by | ARTICLES, FREEDOM, HYPOCRISY, OBAMA, TAXES

A great piece by John Nolte on Tuesday documents the coordinated attack on Romney’s wealth in an attempt to insinuate some sort of financial impropriety.

Nevermind the fact that Romney has unequivocally been squeaky clean in releasing and documenting every bit of his finances.

Nolte goes on to discuss how both the Washington Post and Politico coordinated with Obama’s campaign to hint at potential indiscretions with Romney’s money while covering a pro-Occupy article in Vanity Fair.

Though both Politico and the Post lie through the act of omission by not telling their readers Romney has complied 100% with financial disclosure requirements, what both are doing here (and you can expect the rest of the media to pile on) is laying the foundation for a media-narrative that will demand more disclosure from Romney. The tactic is an old one, for the media knows that the simple act of demanding this kind of information is in and of itself a way of making Romney look slippery and dishonest — you know, like a rich jerk with something to hide — which is exactly how the Obama campaign (and therefore Politico and the Washington Post) intend to define Romney.

Not only is this an attempt to discredit Romney, it is also part of a larger Obama anti-rich campaign narrative. We’ve heard them before: “the rich need to pay their fair share”, “millionaires and billionaires“, “Buffett Rules” and other class-warfare rhetoric. Painting Romney as a rich shyster allows the campaign to continue to push the idea that Obama is one of us…not a big-bad-rich-guy.

Yet, back in January, when Romney disclosed his taxes, the media story then was similar too; Romney paid only about a 15% tax rate — which means (according to their playbook) he didn’t pay enough. Interestingly however, was one aspect of the tax return that went wholly unreported by many news outlets, and not just the overtly liberal ones either (remember in January, Romney was one of several potential GOP candidates). Having reviewed Romney’s returns, I noted that he paid taxes on more than $1 million worth of income that existed on paper only, due to the nature of hedge funds, IRS deduction rules, etc. You can read that report here. Yet no less than five news agencies — liberal and conservative — chose not to cover and discuss a story that had Romney paying “more than his fair share of taxes”. That wouldn’t sell. That didn’t fit the rhetoric. Would have it been different if the returns came out now, now that he is our nominee — and therefore we are more unified against Obama?

Reflecting on that, one thing is certain: we can expect more of these baseless, factless attacks on Romney from the leftist media as the summer marches on. Thankfully, articles like Nolte’s help to expose and dispel the bias and campaign mouthpieces that are indeed active.

by | ARTICLES, OBAMACARE, POLITICS, TAXES

Just to quickly note — a thoughtful piece by Sean Trende offering an interesting take on the Robert’s decision. The article is highly recommended in its entirety. However, here’s just a taste:

The simple fact is that almost all of us pay higher taxes each year than we otherwise would on the basis of things we forgo: whether it is not buying an electric car, not installing energy-efficient windows in our house, or not having that third kid. There’s no new ground being broken here

Robert’s ruling will be dissected for years to come. Looking at it from Trende’s angle is worthwhile.

by | ARTICLES, ECONOMY

Daniel Mitchell had a spot-on piece over at Cato, showcasing the punitive effects of raising income tax rates too high in England. The lower-than-expected revenue receipts have stymied certain politicians and economists — those who don’t understand or believe in the Laffer Curve.

The documented results of higher-tax policy will also be seen in the United States should the Bush tax cuts expire and government spending continue unrestrained. Below is the summary of England’s money debacle:

let’s now take a closer look at David Cameron’s tax increases. They’ve been in place for a while, so we can look at some real-world data. Allister Heath of City AM has the details.

Something very worrying is happening to the UK’s public finances. Income tax and capital gains tax receipts fell by 7.3 per cent in May compared with a year ago, according to official figures. Over the first two months of the fiscal year, they are down by 0.5 per cent. This is merely the confirmation of a hugely important but largely overlooked trend: income and capital gains tax (CGT) receipts were stagnant in 2011-12, edging up by just £414m to £151.7bn, from £151.3bn, a rise of under 0.3 per cent. By contrast, overall tax receipts rose 3.9 per cent.

Is this because the United Kingdom is cutting tax rates? Nope. As we mentioned in the introduction, Cameron is doing just the opposite.

…overall taxes on labour and capital have been hiked: the 50p tax was introduced from April 2010 (and will fall to a still high 45p in April 2013), those earning above £150,000 have lost their personal allowance, CGT has risen to 28 per cent, many workers have been dragged into higher tax thresholds, and so on. In theory, if one were to believe the traditional static model of tax, beloved of establishment economists, this should have meant higher receipts, not lower revenues.

So what’s the problem? Well, it seems that there’s thing called the Laffer Curve.

…there is a revenue-maximising rate of tax – and that if you set rates too high, you raise less because people work less, find ways of avoiding tax or quit the country. The world isn’t static, it is dynamic; people respond to tax rates, just as they respond to other prices. Laffer told a gathering at the Institute of Economic Affairs that this is definitely true in the UK today – and the struggling tax take revealed in the official numbers suggest that he is right. Tax rates and levels are so high as to be counterproductive: slashing capital gains tax would undoubtedly increase its yield, for example. Many self-employed workers are delaying incomes as much as possible until the new, lower top rate of tax kicks in.

Allister’s column also makes the critical point that not all taxes are created equal.

…higher VAT is also damaging growth, though it is still yielding more. Some taxes can still raise more – but try doing that with income tax, CGT or corporation tax and the result is now clearly counter-productive. These taxes are maxed out; they have been pushed beyond their ability to raise revenues.

Last but not least, he makes an essential point about the role of bad spending policy.

The problem is that spending is too high – central government current expenditure is up by 3.7 per cent year on year in April-May – not that taxes are too low. The result is that the April-May budget deficit reached £30.7bn, some £6.2bn higher than a year ago.

While imposing higher taxes on the “wealthy”, “millionaires and billionaires” or “top 2%” makes for good presidential election season rhetoric in the US, England has proven the folly of such policy. Additionally, government spending must be reigned in, not expanded with more “programs”.

Why take additional money from those taxpayers who have been able to create wealth and employment successfully and give it to the government and politicians who have proven their ability to mismanage and squander income?