by | ARTICLES, ECONOMY, GOVERNMENT, TAXES

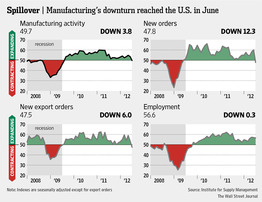

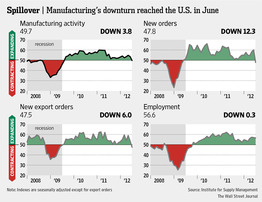

Signaling a slow down in the global economy is affecting U.S. manufacturers, June numbers showed production was down.

The trade group of purchasing managers said its index of manufacturing activity fell to 49.7. That’s down from 53.5 in May. And it’s the lowest reading since July 2009, a month after the Great Recession officially ended. Readings below 50 indicate contraction.

Though growth rates are already sluggish — 1.9% in January-March — the latest manufacturing numbers indicate growth is closer now to a mere annual rate of 1.5%.

Manufacturing Downturn — WSJ July2, 2012

This is not good economic news, which could worsen depending on the unemployment figures due out this week.

by | ARTICLES, BUSINESS, ECONOMY, FREEDOM

The sage Don Boudreaux share the following quote this morning on his website, Cafe Hayek:

“[S]ince profits and losses reflect the success or failure of the entrepreneur in adjusting production to consumer demand, the profits of a competitive (in the Austrian sense) industry can never be “too high” or “too low.”

Followed by his spot on commentary:

Right. To disparage profits earned in competitive markets is to disparage success at arranging for resources to serve consumers well; and to disparage unusually high profits is to disparage success at arranging for resources to serve consumers unusually well.

Put differently, to disparage unusually high profits is to imply that society is harmed whenever entrepreneurs and businesses rescue it from uses of resources that are especially wasteful compared to new, highly profitable uses.

Sadly, though, because such disparagement scores political points with many who are economically unaware – or who embrace envy as a sound justification for public policy – there’s always an abundance of politicians willing to issue such disparagements.

Not much more needs to be said. Boudreaux succinctly captures the essence of free-market enterprise and the benefits of profit to society, the individual, and businesses. To punish success, as our government seeks to do, does irreparable harm to the economy and stifles creativity, investment, growth.

by | ARTICLES, ECONOMY, HYPOCRISY, TAXES

Politico is reporting the quiet release of the White House’s annual salaries report.

Obama is doing his part to grow the economy and add jobs, because the numbers are UP:

A quick review found the White House payroll appears to have grown since last year, going from $37.1 million in 2011 to $37.8 million in 2012. The number of employees listed also grew — from 454 last year to 468 in 2012.

White House officials did not immediately respond to a message seeking explanation of the growth. Overall, the payroll has shrunk since 2009, when it totaled $39.1 million.

You can see the full report here:

The lowest paid positions (3), are $41,000, just slightly below the average median income for the U.S. This excludes (2) positions listed at $0.00, because it is unclear of the nature of the position (intern, etc).

The highest paid positions (20) are $172,200, and are all assistants to the President

There are 139 positions at or above $100,000, out of 466 — which is roughly 29%

There are 3 Calligraphers, who make between $85.9K and $96.7K

There are 2 Ethics Advisors, who make $136K and $140K

Jay Carney is paid $172,200 to lie to the American people as the Press Secretary.

Your tax dollars at work!

by | ARTICLES, OBAMA, OBAMACARE, POLITICS, TAXES

So, the Supreme Court ruled yesterday that ObamaCare is constitutional because it is a tax. That settles it, right?

Not so fast.

On Friday, the day after the ObamaCare ruling, White House Press Secretary Jay Carney insisted the fine is still just a “penalty”.

Carney went on to say Friday that the “penalty” will affect only about 1 percent of Americans, those who refuse to get health insurance. He said the penalty was modeled after the one put in place in Massachusetts when Mitt Romney was governor.

“It’s a penalty, because you have a choice. You don’t have a choice to pay your taxes, right?” Carney said.

Carney was initially reluctant to assign a label to the fine when pressed repeatedly by reporters Friday. “Call it what you want,” he said.

and more:

“You can call it what you want,” he said. “If you read the opinion, it is not a broad-based tax. It affects one percent, by CBO estimates, of the population. It is not something that you assess like an income tax.”

It was unclear which Congressional Budget Office estimate Carney was referring to. Despite being pressed on the issue, though, the spokesman would not relent.

It didn’t even take 24 hours for the games and backtracking by the White House to begin. Don’t forget, they insisted to the American people — in order to get the bill passed — that it was not a tax. Clearly, they are worried about the tax narrative shaping the rest of the election season rhetoric.

by | ARTICLES, CONSTITUTION, HYPOCRISY, OBAMACARE, POLITICS, TAXES

The WSJ editorial this morning, The Roberts Rules, was excellent — as it dissects the inconsistencies within the ObamaCare decision. Read it through, but here are some highlights:

The remarkable decision upholding the Affordable Care Act is shot through with confusion—the mandate that’s really a tax, except when it isn’t, and the government whose powers are limited and enumerated, except when they aren’t.

and this:

The Chief Justice ruled that ObamaCare’s mandate violated the Commerce Clause, joined by the Court’s conservative bloc, but he also said that the mandate fell within Congress’s power to tax, joined by the Court’s liberal bloc. In practice this is a restraint on federal power without real restraint—and, worse, the Chief Justice had to rewrite the statute Congress passed in order to salvage it. The ruling will stand as one of the great what-might-have-beens of American constitutional law.

more:

According to Chief Justice Roberts, the penalty is merely a tax on not owning health insurance, no different from “buying gasoline or earning income,” and it thus complies with the Constitution. This a large loophole.

and this:

But if the mandate is really a tax, why doesn’t the law known as the Anti-Injunction Act apply, which says that taxes can’t be challenged legally until they’ve been collected? The Chief Justice actually rules that the mandate is a tax under the Constitution and a mandate for the purposes of tax law.

Additionally, the WSJ lent some more credence to the assertion that Chief Justice Roberts was actually in agreement with Scalia, Thomas, Kennedy, and Alito (giving a 5-4 strikedown), but at the last minute changed his mind. “One telling note is that the dissent refers repeatedly to “Justice Ginsburg’s dissent” and “the dissent” on the mandate, but of course they should be referring to Ruth Bader Ginsburg’s concurrence. This wording and other sources suggest that there was originally a 5-4 majority striking down at least part of ObamaCare, but then the Chief Justice changed his mind”. This theory was floated yesterday first by Paul Campos and Brad Delong who noticed language confusion and tone changes in the opinion. Their ideas are examined more in depth here.

Now that we have a both a scrutiny of the dissonance and a peek at some silver linings, where do we go from here? It is clear that November must be our top priority — both at the Presidential level and Congress, especially the Senate. And then, we’ll see whether American can be preserved.

Update #1:…and the White House (Jay Carney) is already insisting today that it is NOT A TAX

by | ARTICLES, OBAMACARE, TAXES

21 New Tax Increases

My View From Inside the Court room – More Good than Bad in the Obamacare Decision

Stocks Tumble After Ruling

I am Not Down on John Roberts

Cantor: House Will Vote on Repeal on July 11

VA Attorney General Cuccinelli: “Dark Day for American Liberty”

Is Roberts Outfoxing Us All? Roberts Steals A Move From John Marshall’s Playbook

Weekly Standard: Marshalling Precedent: With Nod to Predecessor, Roberts Affirms Mandate

Limbaugh: ObamaCare is the Largest Tax Increase in the History of the World

Fornier: Roberts Labels Obama a Tax Raiser

NRO: Chief Justice Robert’s Folly

George Will: Conservative’s Consolation Prize

Breitbart: Did Justice Roberts Give in to Bullying?

by | ARTICLES, ECONOMY, POLITICS

Poverty spending is up 41% since the start of the Obama administration, according to a recent study by the Cato Institute. The poverty rate remains at 15.1%, which is the same rate it was in 1965, when LBJ declared his “War on Poverty”.

The poverty rate since then has hovered in the 11-15% range since then; the only time it fell below 11% was a short time in the 1970s. In FY2008, federal anti-poverty spending totaled $475 billion dollars. For FY2011, spending was $668 billion in 126 anti-poverty programs.

According to Cato,

The study faults the way poverty programs are designed, saying that the increase in spending and largely unchanged poverty rate showed that the issue is not a matter of money, but a matter of what the programs aim to achieve.

“The vast majority of current programs are focused on making poverty more comfortable – giving poor people more food, better shelter, health care, and so forth – rather than giving people the tools that will help them escape poverty.”

Instead, the study recommends refocusing anti-poverty efforts on keeping people in school, discouraging out-of-wedlock births, and encouraging people to get a job – even if that job is a low-wage one.

Trillions in debt. Nearly 50% of taxpayers don’t pay federal taxes. Uptick in anti-poverty spending with no tangible results. What will Obama do next?

by | ARTICLES, ECONOMY, POLITICS, TAXES

Food stamps cost taxpayers $80 billion a year, but how those funds are spent by the recipient remains largely unknown

Food stamps can be spent on goods ranging from candy to steak and are accepted at retailers from gas stations that primarily sell potato chips to fried-chicken restaurants. And as the amount spent on food stamps has more than doubled in recent years, the amount of food stamps laundered into cash has increased dramatically, government statistics show.

Information regarding how and where the funds are distributed apparently can’t be released due to federal rules.

When a FOIA attempt was made to state officials in Maryland — the request was denied: “the information belonged to the federal government, which instructed states not to release it”. Furthermore, when the Washington Times inquired about how and where the food stamps funds are disbursed, the Times was offered the information — for $125,ooo. The USDA also keeps the program under tight wraps, and would not disclose any information.

The Washington Times concluded,

As a result, fraud is hard to track and the efficacy of the massive program is impossible to evaluate.

So there you have it — your tax dollars, unaccounted for. Surprised?

UPDATE: “>The USDA suggests Food Stamp Parties and games to increase participation

by | ARTICLES, ECONOMY, POLITICS, TAXES

From the WSJ:

U.S. stocks posted their biggest losses of the year following another disappointing employment report.

The Dow industrials sank 274.88 points, or 2.2%, to 12118.57, turning negative for the year. The Nasdaq composite lost 79.86, or 2.8%, to 2747.48. The S&P 500 fell 32.29, or 2.5%, to 1278.04.

Gold prices shot up 3.7% to $1,620.50 a troy ounce. The yield on the 10-year Treasury note fell to 1.467%, its first time ever below 1.5%. Crude-oil slumped 3.8%. The dollar retreated against the euro and yen.

However, want some really sobering numbers?

Go down to International Stock Markets and start looking at their 1-yr % change.

Spain? 41.34% of their stock value GONE.

Italy? 36.84% of their stock value GONE.

France? 25.58% of their stock value GONE.

Britain? 11.27% of their stock value GONE.

Canada? 16.02% of their stock value GONE.

Argentina? 28.95% of their stock value GONE. (remember them? Right now they are denying devaluation speculation)

Hong Kong? 21.45% of their stock value GONE.

China? 13.49% of their stock value GONE.

Japan? 13.16% of their stock value GONE.

Israel? 15.03 of their stock value GONE.

Egypt? 15.15% of their stock value GONE. (didn’t they just have a revolution? On par with Israel…)

The U.S. Dow Jones? Down a mere 3.14%

I don’t think we’ve seen numbers such as these since the Great Depression or the fall of Rome. Worse, this is all being done on speculation on the Greek market’s impact on the Euro.

Two things:

(1) The world markets are tanking and that “full faith and credit of the United States” on your money is what’s keeping America afloat.

(2) You should be investing in precious metals if we don’t get a budget out of Congress by the end of the year. Not gold and silver, either… but copper and lead.

Between the federal statutory debt limit and the November Presidential elections, Autumn 2012 is certain to be just as volatile.

by | ARTICLES, ECONOMY, TAXES

Reports coming in this morning show the unemployment rate rising a tenth of a point, as only 69K jobs were added in May. If you count “discouraged workers”, their numbers went up as well — to 14.8%. Workforce participation continues to hover at 30 year lows.

Last month, analysts boasted hopeful spin numbers that the unemployment rate was 8.1% — forgetting to mention the part that it was because 341K had left the workforce. Now, what about the month of April, again?

The report comes a month after the government reported that just 115,000 new jobs were added in April, a number that helped contribute to a general malaise about economic growth.

Even that number was worse than thought: The BLS revised the April number down to 77,000.

Additionally, stocks were down their worst week since 2010. A quick look at pre-market data shows that they are spooked by the report as well this morning. Let’s see what Friday brings. At least for President Obama, he has six fundraiser to attend today!

Other opinions:

White House Blames Bush

Is a second recession on the way?

Jobs Slowdown Adds to Global Fears