by | ARTICLES, BUSINESS, ECONOMY, OBAMACARE, POLITICS

When Chuck Rocha, from the Center for National Policy, was a guest on Bulls and Bears last past weekend, he continued to spew out statistics that touted the economic benefits of Obamacare. His assertions were based on a Price Waterhouse report that indicated health care cost had come down 4%.

Of course, health care costs have not come down. If Mr. Rocha was referring to the fact that the rate of growth of health care spending has slowed (by a not really significant 4%), this trend started long before Obamacare. In fact, the Price Waterhouse Study lays out the reasons for the slowing growth, including individuals delaying treatments, individuals using the internet to find lower pricing, large employers finding ways to get cheaper alternatives for their employees – all specifically NOT RELATED to ObamaCare.

What’s worse, although Mr. Rocha acknowledges that this country does have a debt problem, he insists that it does not need to be dealt with currently. He espouses the clearly dangerous and uneducated view that unfunded costs of future promises are not a real liability.

He also claims that incentives to manufacturing are necessary to keep employment in this country, totally ignorant of its effect on free trade, which is really what is necessary to get the economy moving.

The frustrating part of the entire segment was that nobody on the show thought to contradict any of these assertions, which were patently and demonstrably false.

by | ARTICLES, BUSINESS, ECONOMY, OBAMACARE, POLITICS

Rick Ungar, the “Token Lefty”, usually comes very well prepared for his appearances on Forbes on Fox. But it is disappointing to watch when he regurgitates the same absolutely misleading statistics, despite the fact that he’s been corrected so many times before.

Mr. Ungar argues that the changes which President Obama continues to make to Obamacare are not a significantly harmful to the economy, since “the Obamacare mandate excludes 96% of businesses”.

One might ask: if Obamacare only affected 4% of businesses, how could it be such a major program? The answer is simple. Those 4% of businesses include the vast majority of employees in this country. Most businesses have zero to very few employees, with the total number of employees for all businesses that have 100 or fewer employees making up a relatively small number of the total employees in this country.

This statistic-fib is reminiscent of the exact same tactic that the Democrats were using when pushing to raise the income tax margins of the highest earners making above $250,000. Democrats continuously argued that “only 3% of all small businesses made above $250,000”, a seemingly low percentage.

What they purposely failed to disclose, however, is that that figure accounted for more than 50% of all small business income — most of which would be taxed at individual rates due to the structure of the company. So when the Democrats raised taxes on those upper income brackets, through the process of letting the tax cuts expire, they willfully and quietly were raising taxes on small businesses. Now, high earning non-corporate entities pay more in taxes (39.6%) than even their corporate counterparts (35%).

We have the same chicanery going on here. Nothing could be more intentionally misleading, for those who don’t know better, than Mr. Ungar’s statement that only 4% of businesses are affected by Obamacare. “It’s the number of employees, stupid”.

by | ARTICLES, BUSINESS, ECONOMY, POLITICS, TAXES

Democrat politicians and “economists” have found a wonderful populist issue for the the current election cycle – raising the minimum wage. The economists (including Krugman, Goolsbee, etc) make the argument that the most obvious, serious problem — loss of entry level jobs and non-hiring at new entry level positions — is not a significant factor, and they have even been able to marshal some studies to support this.

They then argue that the higher minimum wage puts more money into needy families and therefore strengthens the economy. This argument just happens to have a wonderful political effect for these Democrats: it makes them seem sensitive to the plight of the needy, while making Republicans look like shills for those greedy Republican businessmen who are only trying to squeeze every last dollar out of their poor employees.

Just one problem — the Democratic position is baloney, and the economists know it, because it is simple economics 101. No businessman would be willing to pay an employee more than the economic value of the employee.

Let’s assume that the rise in the minimum wage puts the cost of employee in excess of the value of that employee. The employer may then 1) terminate the employee (saving the excess of cost over productivity) or 2) buy equipment which, at that price, becomes cheaper than the employee.

But let’s say the employer keeps the employee, just paying him more for the same work he did before. The employer will then either a) earn a smaller return on his investment, reducing the amount he will be able to invest in the business in the future; b) he will raise his prices, which will maintain his profit margin, but will reduce his sales volume, or c) some combination of a) and b). In either case, economic growth of the economy will be hurt.

By citing narrow studies where short-term noise could easily hide the effects of small changes in the minimum wage, these political “faux-economists” are abusing economic appearances to serve a political end.

Furthermore having a national minimum wage when price and wage levels vary so markedly across the country is truly nonsensical.

The country will be better off when economists remain true to their profession.

by | ARTICLES, BUSINESS, ECONOMY, GOVERNMENT, NEW YORK

The newest calls to raise the minimum wage in NYC to $11/hour are a frustrating reminder that the city’s own Comptroller, Scott Stringer, has a total lack of understanding about how economics work.

Scott Stringer makes the argument that raising the minimum wage to $11/hour would provide an additional $2 billion in annual income to working families. While that might sound good to taxpayers — to get more money in their pockets — he completely fails to explain the other side of the equation: from where does that $2 billion come?

Stringer seemingly takes that $2 billion figure out of thin air, as there is no documented basis from which he arrived at this number. If Stringer is not utterly incompetent, then he should certainly have available his complete analysis of the financial pluses and minuses that are likely to occur as the result of the minimum wage hike; after all, that is his job.

Here’s the problem. Minimum wage hikes mean that all employers in New York City – both in the government and in the private sector – will pay more for its labor than it currently does pay, in order to produce the exact same product or services. Looked at it another way, in order to keep to the operating budget, NYC will get less goods and services than it now receives. Or, to keep its present level of operations would result in a budget deficit — because of having to spend more overall to maintain the current goods and services.

Therefore, the thought that minimum wage increases — especially a substantial one — will not have a negative effect on the city economy, is ludicrous.

The standard justification goes that the higher minimum wage puts more money into needy families and therefore strengthens the economy. This argument just happens to have a wonderful political effect for Democrats: it makes them seem sensitive to the plight of the needy, while making Republicans look like shills for those greedy Republican businessmen who are only trying to squeeze every last dollar out of their poor employees.

Just one problem —the Democratic position is nonsense, and economists know it, because of simple Economics 101: no businessman would be willing to pay an employee more than the economic value of the employee for him to perform his work.

Let’s assume that the rise in the minimum wage puts the cost of employee in excess of the value of that employee. The employer may then 1) terminate the employee (saving the excess of cost over productivity) or 2) buy equipment which, at that price, becomes cheaper than the employee.

But let’s say the employer keeps the employee, just paying him more for the same work he did before. The employer will then either a) earn a smaller return on his investment, reducing the amount he will be able to invest in the business in the future; b) he will raise his prices, which will maintain his profit margin, but will reduce his sales via you, or c) some combination of a) and b). In either case, growth of the NY economy will be hurt.

Here in New York City, a minimum wage hike would mean that New York City will pay more for its labor than it currently has calculated to pay, in order to produce the exact same product or services. Looked at it another way, to then keep to the operating budget, NYC will get less goods and services for the taxes it receives. This would result in a budget deficit — because of having to spend more overall to maintain the current goods and services.

Therefore, the thought that minimum wage increases — especially a substantial one — will not have a negative effect on the city economy, is ludicrous.

What the city is demanding with the minimum wage increase will have two effects. First, businesses in the city will have to pay their labor more, thereby raising the price of their goods to cover the wage increase. This ultimately will render New York City businesses less competitive than other businesses not located in the city. The result? Our businesses will lose business to those outside of New York City. That is not positive for the economy.

Secondly, New York City is often required to buy from the lowest bidder for many of its goods and services. Therefore, the city would likely have end up buying from outside of the city in order to get those cheaper prices — thereby not supporting the city’s own businesses.

The net effect of a minimum wage hike from $8 to $11 (a 37.5% increase) will take its toll on businesses in New York City and the economy. Stringer has publicly admitted that “the budgetary path we are on is still not sustainable.” Instead of cutting spending, his solution is to make the businesses cough up extra funds via a wage increase so that those wages can subsequently be taxed for more revenue for the city and the city’s budget — even at the expense of NYC businesses. Taxpayers too, will be affected, because their tax dollars will have less purchasing power in the city.

The minimum wage is already set to rise incrementally through 2015 to $9.00 for New York. Pushing through a faster and higher minimum wage increase will handicap New York City businesses in an already sluggish economy, and punish those companies who already endure high taxes and unending bureaucracy under the heavy hand of government.

by | ARTICLES, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, NEW YORK, OBAMA, POLITICS, TAXES

What is Wall Street, anyway? I would be willing to bet that 90% of the protesters from Occupy Wall Street and of self-styled liberals have absolutely no idea what Wall Street is, what it does, and how important it is.

If not for Wall Street, there wouldn’t be any Main Street, certainly not as we know it today.

In order for any business to be successful, it must run on capital. Capital can be funded by an owner’s personal investment or through funds from outside investors. The ability to grow from the Mom and Pop store to the bigger corporation model is dependent upon the business owner’s ability to get risk capital.

This risk capital is necessary to rent the space, hire the employees, grow the inventory,and buy the equipment to get the business going. There is no guarantee that this money could ever be paid back. But the investors are willing to risk their hard-earned money in the hope that the venture is successful enough to 1) repay the money borrowed and 2) to give back a reasonable profit for the risk taken.

So where does that money typically come, that risk capital? Wall Street. Look around the house at what you have. Your lights? From the utility company. Where did that capital come from to build the utility plants, to lay the distribution networks, to expand them? Risk capital. Wall Street. Where did Macy’s get its start? Or Google, or IBM? Or any of the energy, pharmaceutical, or chemical companies? Or virtually any large corporation you can think of today — where did it get its funds to really get going and continue to grow? Wall Street.

And the people on Wall Street, people sometimes described (invariably by clueless politicians and populists who know nothing about what it takes to run a business or create jobs) as paper-pushers who make unconscionable amounts of money, what do they do?

They must be able to analyze how businesses (Main Street) work, and which ones (out of the many thousands out there all claiming to be worthy) are likely to be successful. They must develop the confidence of potential investors, and convince them to invest in these projects. They must bring the companies and investors together to agree on how much of the company the investors would get for the amount of capital that is being invested. Should the money invested be equity (ownership in the company) or bonds (loans to the company), and if bonds, what interest rate? Most importantly, more than in any other business, pay day never comes to Wall Street unless the capital is successfully raised. And if Main Street is not successful with its new capital, good luck for that Wall Street company in trying to raise money for its next project.

There have been abuses on Wall street, certainly. But there is absolutely no reason to believe that there are any more abuses than in any other business. And those abuses almost always are paid for with serious financial pain to those companies.

But none of these abuses can compare with the financial abuses and mismanagement that we endure daily from our government. Our government has us at the brink of bankruptcy, with a $17 trillion dollar debt (more than 100% of our GDP) which balloons to more than $100 trillion if our entitlement obligations are included.

We have President Obama and the Democratic leaders of the Senate (Harry Reid) and the House (Nancy Pelosi) saying that this is not a current problem (clearly not the truth) and spending money they don’t have to get votes for the next election. A short trip through YouTube (circa 2004-2005) clearly show that Barney Frank (Democratic House…), Chris Dodd (Democratic Senate ….) and Maxine Waters (Democratic House ….), among other Democrats, were principally responsible for the recent economic meltdown. The videos of Congressional Hearings demonstrate unquestionably that Fannie Mae and Freddie Mac were cooking their own books and lending to dangerously unqualified borrowers, but the Democrats prevented any remedial action to be taken.

And taxpayers and Main Street have borne the heavy burden of their negligence during this sluggish, anemic economic recovery.

Wall Street is an invisible backbone of our economy — providing the money and investments that are necessary to continue America’s upward mobility in all facets of our lives. Focusing only on trumped up Wall Street problems or buying into the class warfare hatred of the rich is misguided — especially while giving our government a free pass to use and abuse our taxpayer money each day.

by | ARTICLES, BUSINESS, ECONOMY, GOVERNMENT, NEW YORK, OBAMA, POLITICS

The new pre-school plan presented by Mayor de Blasio reveals just how politically disingenuous he really is.

In his effort to push the progressive agenda he put forth during his campaign, de Blasio has vowed to have universal pre-school in New York State to be paid for only by the wealthiest New Yorkers.

Here’s the logical inconsistancy: If universal pre-school is the all-important and necessary step for all children in their educational development (the merits of which is fodder for another article entirely), then the only logical conclusion is that the cost should also be borne by all taxpayers the way K-12 already is — not just a select few. If “everyone” is not willing to pay his or her fair share of this “necessary” project, then maybe that tells us that it should not be done.

This line of thinking clearly echoes the Obama Administration’s sentiment that the rich “pay just a little bit more”, and it is not welcome in New York.

by | ARTICLES, BUSINESS, ECONOMY, OBAMA, QUICKLY NOTED

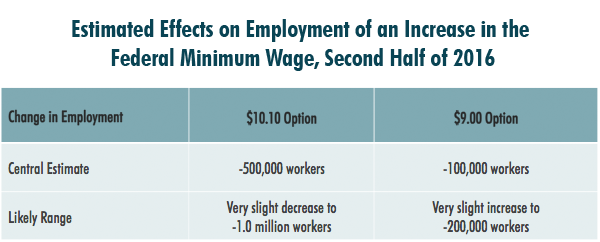

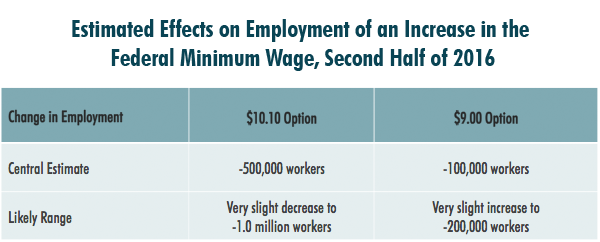

The CBO considered two different possibilities to raise the minimum wage, as a Democrat bill is set to be introduced in the Senate in a few weeks.

From the CBO report:

“Increasing the minimum wage would have two principal effects on low-wage workers. Most of them would receive higher pay that would increase their family’s income, and some of those families would see their income rise above the federal poverty threshold. But some jobs for low-wage workers would probably be eliminated, the income of most workers who became jobless would fall substantially, and the share of low-wage workers who were employed would probably fall slightly”

What Options for Increasing the Minimum Wage Did CBO Examine?

For this report, CBO examined the effects on employment and family income of two options for increasing the federal minimum wage:

1) A “$10.10 option”

A “$10.10 option would increase the federal minimum wage from its current rate of $7.25 per hour to $10.10 per hour in three steps—in 2014, 2015, and 2016. After reaching $10.10 in 2016, the minimum wage would be adjusted annually for inflation as measured by the consumer price index.

2) A “$9.00 option”

A “$9.00 option” would raise the federal minimum wage from $7.25 per hour to $9.00 per hour in two steps—in 2015 and 2016. After reaching $9.00 in 2016, the minimum wage would not be subsequently adjusted for inflation.

Read the full report here

by | ARTICLES, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT

The story of “I, Pencil” is rightfully regarded as one of the most important economic essays of the 20th century. Known for both its brevity and simplicity, “I, Pencil” conveys the truth about the correlation between free people and economic freedom.

The brilliance of “I, Pencil” is that the lesson is told from the most unexpected perspective — that of the lowly pencil. Yet the very humbleness of the pencil is perfectly juxtaposed by the complexity through which the pencil itself comes into being.

Told through the eyes of the pencil, the pencil delightfully describes human ingenuity, cooperation, and connectedness — all necessary parts to bring the pencil to fruition. The pencil explains that it is a people free and unfettered, who have each learned and exchanged a skill, that ultimately will create a good — be it a pencil like him, or otherwise.

Ultimately, using the perspective of the pencil is a metaphor for Read’s salient point: for us all to look introspectively and understand ourselves, our potential, and the world in which we live and can contribute. That it is ultimately people, not some government, who can organize, work, and create a thing of beauty and of necessity.

In that regard, the recent movie adaptation of “I, Pencil”, produced by Competitive Enterprise Institute, fell short of its potential. To be sure, the film most certainly has beautiful and simple graphics to convey the story and show the complexity of markets. However, the message itself is narrated from an outside perspective explaining the process of creative industry using a pencil as an example, which is not how “I, Pencil” is written.

By choosing to retell “I, Pencil”, with a replacement narrator looking in instead of the pencil looking out, the film loses the charm of the story and the central message about individuals, their potential, and freedom to create. The story needs that foundation in order to powerfully and properly explain that people, not government, are the true source of economic freedom.

Though the film is good, it is not great, and misses a wonderful opportunity to really bring to life the message of “I Pencil”, and convey its truths about individual freedom and free markets. Start with the essay and then watch the movie — and be uplifted about the ingenuity of free people.

by | ARTICLES, BUSINESS, FREEDOM, GOVERNMENT, POLITICS

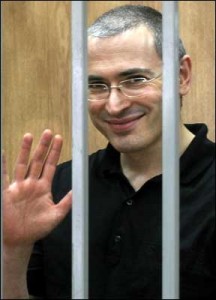

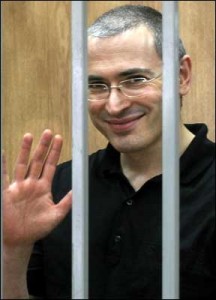

Mikhail Khodorkovsky, the former Yukos CEO and Russian billionaire, has just recently been released from jail. If I were him, my first act of new-found freedom would be to sue Goldman Sachs for billions of dollars. Watch out, Goldman Sachs investors!

I am a liberty-loving free market individual, which means I am generally pro-business. But as I have indicated so many times before, crony-capitalism is not free market, and thus it should be called out. Unfortunately, that cronyism does not entirely escape the upper echelons of the finance world and a horrific lack of integrity sometimes seeps into Wall Street. The story of Mikhail Khordorkovsky and Goldman Sachs is such an example.

First, a parallel story: in the late 1980’s, the State of Washington issued Washington Power Public Service bonds (commonly called “WPPSS”) to finance a number of nuclear power plants. The bonds were considered very high quality as they were guaranteed 1) not only by the project, but 2) also unconditionally by the State of Washington, and 3) even regardless of whether the plants ever actually got constructed.

First Boston was a lead underwriter of this issue.

When oil and gas prices dropped sharply a few years later, the State of Washington decided to renege on its guarantee and default to the tune of $2.25 billion. It argued (incredibly) that they didn’t have the right to make such a guarantee. The Washington Courts upheld this point of view (naturally), and the Supreme Court (ridiculously) claimed that it was a state matter, despite the fact that many little old ladies — like my mother — pension funds, and other investors from all around the country were devastated by this “fraud”. This was undeniably gross negligence.

The most frustrating part of the matter, however, happened after the decision was issued. The State of Washington needed to raise money by issuing new bonds. And who do you think was the lead underwriter this time around, despite the scam that had cost their customers hundreds of millions of dollars….

You guessed it — First Boston again, a stunning lack of integrity from world of government and finance. But this fraud pales in comparison to that of Mikhail Kordorkovsky and Vladmir Putin.

I was reminded of the WPPSS affair (also known as “Whoops”) when in 2003, in a brazen act of thievery, Vladimir Putin “confiscated” the controlling interest in shares of the Yukos Oil Company held by Mikhail Khodorkovsky.

Khordorkovsky built a company that grew in wealth and stature upon the collapse of the Soviet Union. Shortly after Kordorkovsky was named “Person of the Year” by the Russian business magazine “Expert”, he was arrested.

There were laughable “criminal” and “tax cheating” charges leveled against Khodorkovsky, for which he has been in jail for a decade until just last month.

As Khordorkovsky’s popularity grew while in prison, Putin suddenly and obviously made a public relations decision in connection with the Olympics to release the famed Khordorkovsky. (Indeed, just in the last week, Khordorkovsky’s business partner was also released from his prison sentence.)

Everyone knew that the criminal charges were just a very thinly veiled justification for President (Dictator) Putin to steal the company for himself and the Russian people. I get it – that is his nature. But what has this to do with integrity, finance, or even WPPSS?

Underwriters.

Just as First Boston underwrote the first WPPSS project that fraudulently defaulted and was able to (incredibly) underwrite for the State of Washington again, Putin was able to perform his grand confiscation with the help of a major underwriter.

Upon restructuring the oil company following the arrest of Khodorkovsky, that fact that Vladmir Putin could then go to Goldman Sachs, who would gladly orchestrate the largest underwriting of stolen goods and fraud the world has ever seen, is utterly staggering.

Just as incredible, First Boston — later known as Credit Suisse during the time of the confiscating and beyond — also got in on the action (among others).

But the coziness between Putin and Goldman doesn’t end there. Just last winter, Goldman Sachs renewed its relationship with Putin by signing a three-year agreement with Russia’s Economy Ministry and the Russian Direct Investment Fund.

During that time, Goldman Sachs will be paid $500,000 to help Putin attract foreign investors. This latest partnership has been slammed by the Human Rights Foundation.

Now that Khodorkovsky is a free man once again, it wouldn’t take much for him to highlight the close relationship between Vladmir Putin and Goldman Sachs. I’m not a lawyer, but one would think that Goldman might have reason to be concerned about a potential lawsuit from Mr. Khodorkovsky for aiding and abetting the confiscation of his company.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, GOVERNMENT, HYPOCRISY

Right before the government shutdown, Detroit received a pledge for a $320 million federal “aid package”. The Obama Administration wants to make it perfectly clear: this is not a bailout. That word is too toxic during this time of fiscal instability in Washington. This is relief. A stimulus. It is a hand-up, not a hand-out, and, as the NY Times reports, this will not be the only federal infusion that Detroit receives to get back on its feet.

Some questions immediately come to mind:

1) Various news agencies reported that the funds are being scraped together mainly from agencies such as TARP, FEMA, Homeland Security, and HUD. Who authorized this aid package?

2) Much of the funds are for projects that are similar to projects already funded by alternative sources, such as the Ford, Kresge, and Knight Foundations. The funds will not be used in anyway with regard to debt structuring. Why are federal funds duplicating projects already in motion?

3) Detroit already receives 71 federal grants for operation and it still couldn’t manage to avoid bankruptcy. Clearly, Detroit has been malfunctioning for years even with government intervention, so Why are we propping up this city even more?

4) What is to prevent other cities who are struggling financially for reasons to call for aid? After the aid to Detroit was announced, at least one Congressman, Jerry McNerney, went on the offensive. He wrote to the White House asking why aid was not extended to Stockton, California, a city which declared bankruptcy last year, “and suffers from many of the same problems as Detroit”. Will this type of federal aid package for cities become a slippery slope? Will it be a pick-and-chose/reward scenario? How about a carrot dangled to cities?

A recent WSJ article on the aid noted that with federal money comes strings. “Grants from the Transportation and Housing and Urban Development Departments will require the city to pay prevailing union wages, which will jack up costs. Prevailing wage is an economic compensation theory that requires municipalities to pay more-than-market wages. The end result of paying prevailing wages means that Detroit will get less with their our money. Even now, prevailing wage theory is hotly contested in NYC, a form of unionism for those workers who are non-unionized. Isn’t this type of overpayment what helped get Detroit into the mess it is in in the first place?

Furthermore, this cash fund may impact pension reforms that city manager Kevyn Orr is trying to accomplish. The pension managers insist that pensions are only underfunded by $634 million, while Orr is arguing closer to $3 billion. Part of pension restructuring and cost savings proposed by Orr were expected to be re-diverted toward blight abatement. With the arrival of this federal aid package — much of which is supposedly for the blight problem — you can expect that pensioners will argue that their pensions do not need, or need less of, the chopping block. That is a pity, as it undermines real pension reform so badly needed in Detroit.

What Kevyn Orr really needs to do to forge a path of prosperity in Detroit is to completely fund the pension system according to what the pension managers say they need ($634 million vs $3 billion), in exchange for complete government removal from the pension system; Impose a switch from a defined benefit model to a defined contribution model and be done with it. Let the pension heads grapple and manage their own funds now. Such a bold fiscal move would give Detriot a much more solid path to economic revitalization than any aid package can do.

There was no emergency that necessitated the use of federal funds being injected into the city of Detroit. No Katrina. No Sandy — only decades of fiscal irresponsibility, corruption, mismanagement. This “non-bailout” only undermines the task of this city, and potentially others, to make hard decisions about money, taxes, pensions, and budgets. It is a band-aid where a tourniquet (or maybe an amputation?) is needed. In a city rife with every kind of unimaginable fiduciary irresponsibility, the idea that the city of Detroit should be entitled to receive any more federal tax dollars is wholeheartedly repugnant.