by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

A short but informative article by the Washington Free Beacon describes how the Government Accountability Office (GAO) has calculated that within a few years, the federal government will owe more money that the sum of what is produced by the economy. That, my friends, is an egregious amount of debt.

“Gene Dodaro, the comptroller general for the Government Accountability Office, testified at the Senate Budget Committee to provide the results of its audit on the government’s financial books.

“We’re very heavily leveraged in debt,” Dodaro said. “The historical average post-World War II of how much debt we held as a percent of gross domestic product was 43 percent on average; right now we’re at 74 percent.”

Dodaro says that under current law, debt held by the public will hit a historic high.

“The highest in the United States government’s history of debt held by the public as a percent of gross domestic product was 1946, right after World War II,” he said. “We’re on mark to hit that in the next 15 to 25 years.”

Another economic projection which assumes that cost controls for Medicare don’t hold and that healthcare costs continue to increase, shows debt rising even further.

“These projections go to 200, 300 percent, and even higher of debt held by the public as a percent of gross domestic product,” said Dodaro. “We’re going to owe more than our entire economy is producing and by definition this is not sustainable.”

Additionally, the audit found fault with the number of improper payments that should not have been made or were the incorrect amount. The audit found that in fiscal year 2015 there were $136.7 billion improper payments, which was up by $12 billion from the year prior.

The audit also called into question the reliability of the government’s financial statements. According to the report, if a federal entity purchases a good or service, that cost should match the revenue recorded by the federal entity that sold the good or service. The report found that this was not always the case and found hundreds of billions of dollars in differences between transactions between federal entities.

“The government-wide financial statements that the GAO audits tell us what came into the government’s coffers and what went out, what the government owns and what it owes, and if the operations are financially sustainable,” said Sen. Mike Enzi (R., Wyo.). “But can we trust the information in the statements?”

“GAO’s audit calls into question the reliability of the underlying financial data,” he said. “The sketchiness is such that GAO remains unable to even issue an audit opinion on the government’s books.”

According to the audit, these weaknesses will eventually harm the government’s ability to reliably report their assets, liabilities, and costs, and this will prevent the government from having the information to operate in an efficient and effective manner.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, RETIREMENT, TAXES

The Financial Times reviewed data recently that suggested that the US public pension system is in dire straits; the funding shortage is likely 3 times as large as what is being reported. The estimated deficit is $3.4 trillion.

The solutions for the funding shortfalls are grim: either raise taxes or cut spending; unfortunately the “cut spending” approach always goes to the essential services first, so that taxpayers feel the heat and will consider a tax hike instead.

US Congressman Devin Nunes recently noted that, “It has been clear for years that many cities and states are critically underfunding their pension programmes and hiding the fiscal holes with accounting tricks.” Nunes has “put forward a bill to the House of Representatives last month to overhaul how public pension plans report their figures.” He added: “When these pension funds go insolvent, they will create problems so disastrous that the fund officials assume the federal government will have to bail them out.”

Insolvency has already been observed in San Bernardino, California and Detroit, Michigan, largely due to mismanagement of pension funding and budget shortfalls. The Financial Times noted that “Chicago, Dallas, Houston and El Paso have the largest pension holes compared with their own revenues”, as well as the states of Illinois, Arizona, Ohio, and Nevada.

Research done by Stanford paints a difficult future: “Currently, states and local governments contribute 7.3 per cent of revenues to public pension plans, but this would need to increase to an average of 17.5 per cent of revenues to stop any further rises in the funding gap.”

And more: “Several cities and states, including California, Illinois, New Jersey, Chicago and Austin, would need to put at least 20 per cent of their revenues into their pension plans to prevent a rise in their deficits, while Nevada would have to contribute almost 40 per cent.”

Much of the problem lies in the fact that retirement costs and liabilities have consistently been calculated on a 7%-8% return , which is not particularly realistic, as has been demonstrated in recent years during the economic downturn.

There is no way this silent funding crisis will get any better — and until localities recognize and admit their crisis and make ardent changes to their pension systems, it will only continue to worsen egregiously.

by | ARTICLES, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

The Fix the Debt Campaign Steering Committee is a bipartisan group of prominent leaders and experts, including luminaries such as Erskine Bowles and Alan Simpson, the co-chairs of the White House Fiscal Commission. The Fix the Debt group put together some decent graphics regarding federal spending.

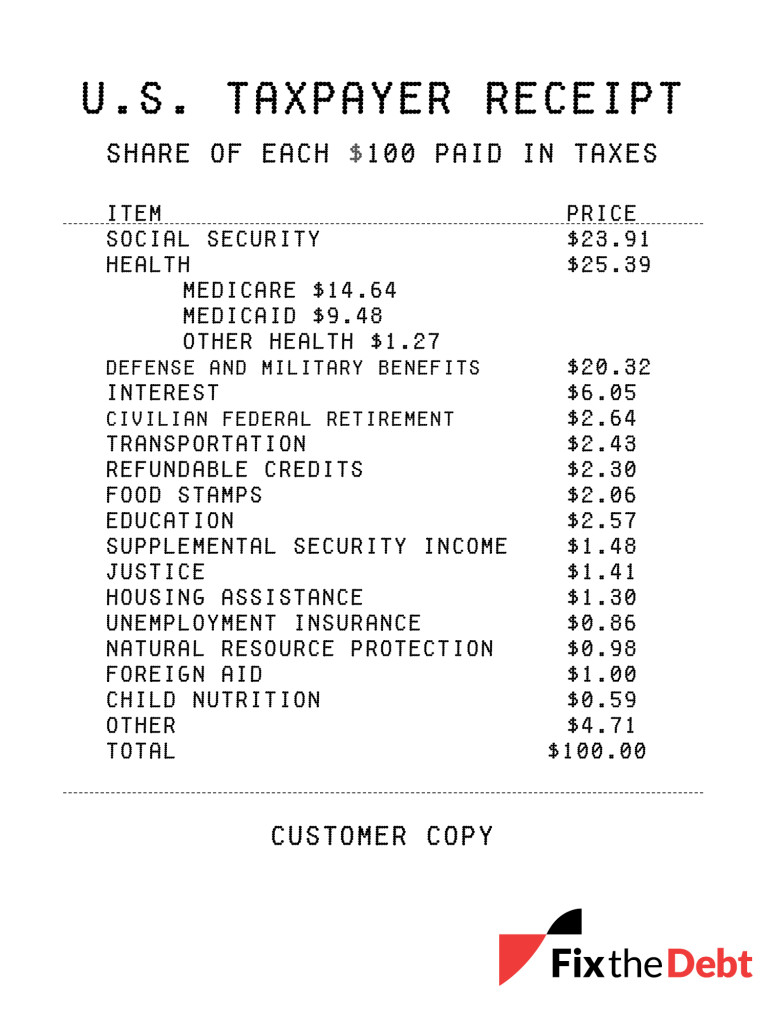

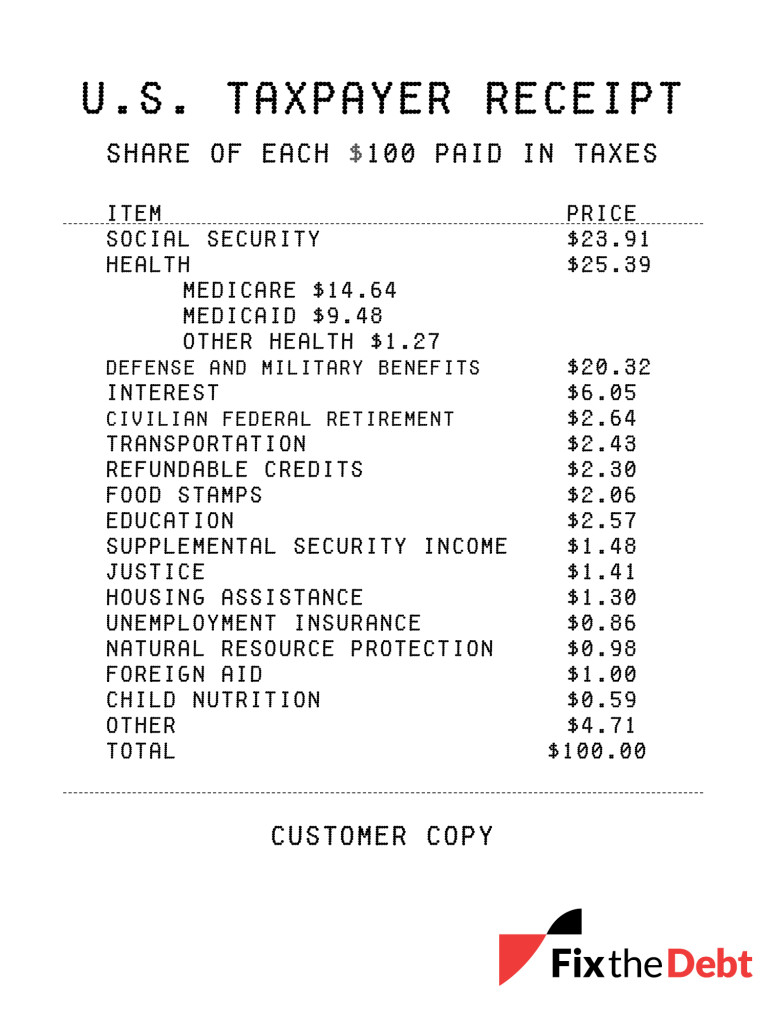

This is a “taxpayer receipt” highlighting where the money goes and highlight where it comes from in the first place.

How are our federal tax dollars spent? As the taxpayer receipt illustrates, more than $75 of every $100 paid in federal taxes goes to Social Security, federal health care, defense, and interest on the debt. And the amounts for Social Security, health care, and interest are forecast to grow considerably in the years to come.

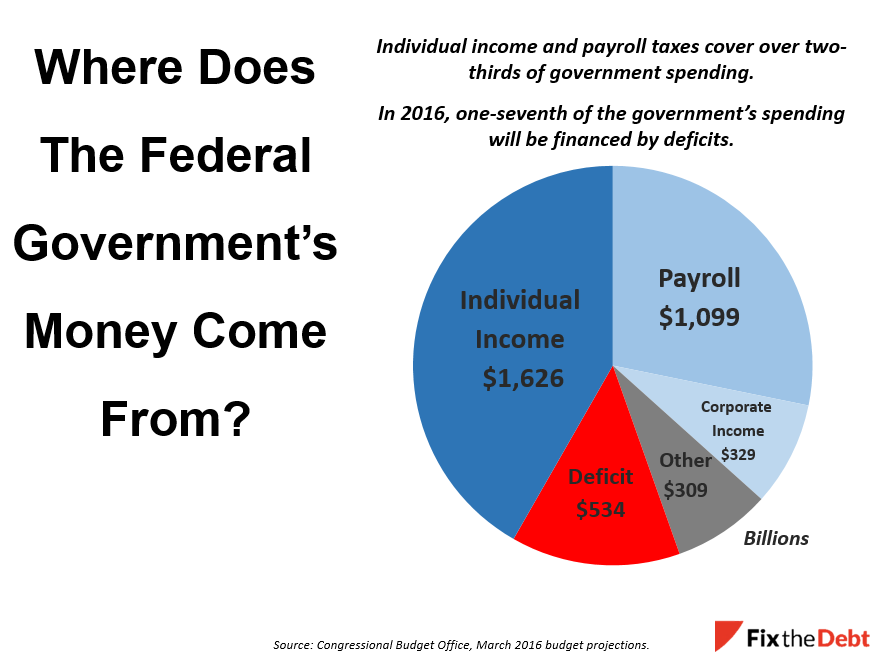

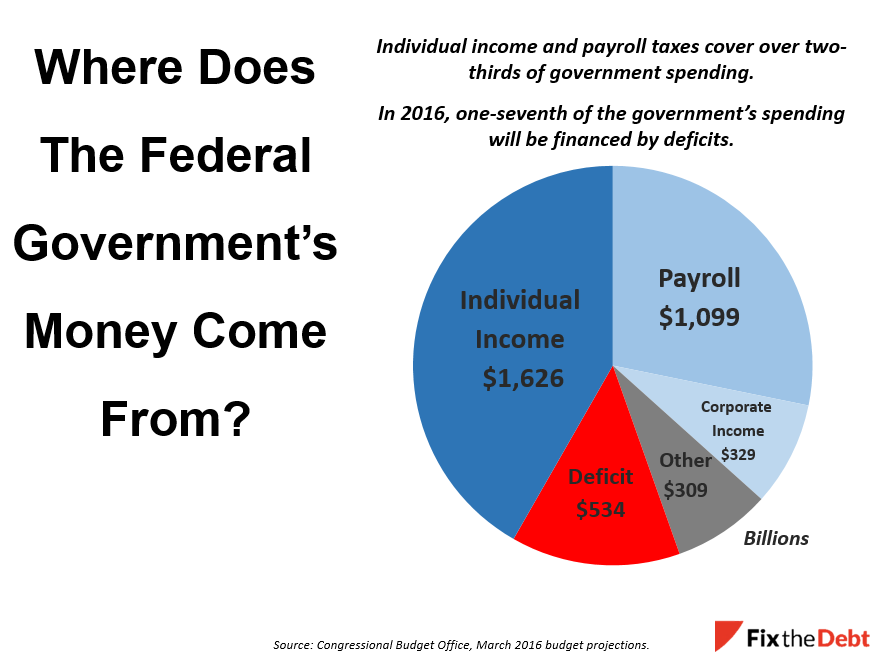

Where does the money come from? Much of the revenue for the federal government comes from the individual income tax that many of us are rushing to complete. Another major source is the payroll tax, which is the “FICA” tax that is withheld from your paycheck. It is used to fund Social Security benefits and parts of Medicare.

But a significant part of the government is deficit financed because spending exceeds revenue. That share is expected to grow substantially in the years ahead.

Check out their blog for more information.

by | ARTICLES, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, HYPOCRISY, POLITICS, TAXES

Yesterday, The Treasury Department made more changes to rules with regard to inversions. The driving force behind the constant meddling into this legal practice is the retention of tax revenue.

“Under the new rules, there will be a three-year limit on foreign companies bulking up on U.S. assets to avoid ownership requirements for a later inversions deal, Treasury said in a statement.”

In an inversion, a U.S. company typically buys a smaller foreign rival and reincorporates to the rival’s home country, which moves the company’s tax domicile, though core management usually stays in the United States.

The Treasury, which had last introduced new rules in November to curb inversions, also is proposing tackling the practice of post-inversion earnings stripping with new limits on related-party debt for U.S. subsidiaries.”

This continued attack on inversions is ridiculous and companies are being targeted unfairly because they represent a possible loss of revenue for the government. Inversions are legal, and sometimes necessary. They are a way for U.S. companies to change their HQ from the U.S. to a foreign country, for the sole purpose of allowing themselves the express privilege of being on par with foreign companies and eliminate the severe disadvantage that the U.S. puts on its own businesses via excessive taxes!

It is outrageous that the government applies such discrimination. It is outrageous that American companies have to chose to move their headquarters elsewhere simply to survive and compete globally, because they are taxed on their profits in two jurisdictions — both domestic and foreign.

by | ARTICLES, BLOG, BUSINESS, CONSTITUTION, FREEDOM, OBAMA, OBAMACARE, TAX TIPS, TAXES

Find Out How ACA affects Employers with 50 or More Employees

Some of the provisions of the health care law apply only to large employers, which are generally those with 50 or more full-time equivalent employees. These employers are applicable large employers – also known as ALEs – and are subject to the employer shared responsibility provisions.

Information Reporting

Applicable large employers have annual reporting responsibilities concerning whether and what health insurance they offered to their full-time employees during the prior year. In 2016, the deadline to provide Forms 1095-C to full-time employees is March 31. The deadline by which ALEs must file information returns with the IRS is no later than May 31 or June 30 if filed electronically.

All employers, regardless of size, that provide self-insured health coverage must file an annual return reporting certain information for individuals they cover. In 2016, the deadline by which self-insured ALEs must provide Forms 1095-C to responsible individuals is March 31. The returns with 2015 information are due no later than May 31 or June 30 if filed electronically.

Employer Shared Responsibility Payment

ALEs are subject to the employer shared responsibility payment if at least one full-time employee receives the premium tax credit and any one these conditions apply. The ALE:

- failed to offer coverage to full-time employees and their dependents

- offered coverage that was not affordable

- offered coverage that did not provide a minimum level of coverage

SHOP Marketplace

Employers with more than 50 cannot purchase health insurance coverage for its employees through the Small Business Health Options Program – better known as the SHOP Marketplace. However, Employers that have exactly 50 employees can purchase coverage for their employees through the SHOP.

For more information, visit the Determining if an Employer is an Applicable Large Employer page on IRS.gov/aca.

by | ARTICLES, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, POLITICS, TAXES

Dustin Howard over at Americans for Limited Government tackles one of the key factors contributing to the rise of corporate inversions: high corporate taxes. I would also argue that another mitigating factor is foreign-earned income, which the United States government lays claim to — and is the only major country to do so. Under U.S. tax law, U.S. companies are forced to pay both foreign- and domestic-earned income, putting them at a global disadvantage.

At any rate, Howard’s piece is a worthwhile read on the equally detrimental effect of high corporate tax rates. I have shared it in its entirety below.

“How should policymakers stop the bleeding of American jobs overseas? There’s one easy answer among many harder ones, and that is to stop making it so expensive to do business in the United States.

Many things price American workers out of competition, whether it be the current mix of trade rules, currency manipulation and other unfair labor practices but the easiest to address domestically is the corporate tax rate. Government’s unwillingness to do with less is making it considerably harder for Americans to even work.

Seriously, why should American corporations pay a 39 percent rate, among the world’s highest, to headquarter here when they can “invert” to Ireland and pay 12.5 percent, less than one third the domestic rate?

If the corporation can keep most of their American workforce and keep 26.5 percent more of their money as an alternative by cutting the corporate tax rate, wouldn’t that a good thing?

Why would the U.S. maintain a policy that discourages business from even being on American soil?

Democrats propose a solution to this phenomenon: punish the innovating refugees that refuse to pay into their racket. They believe in taxing the profits of inverted firms. One problem: extrapolating from a recent study by economist Wayne Winegarden for the Pacific Research Institute, this actually further discourages firms from even retaining their American workforce, and encourages them to simply export their products outright from their new foreign addresses.

Call it a lose-lose proposition, where American workers lose jobs, American businesses leave and revenues drop while the deficit increases; Ireland should chip in and send Democrats a fruit basket.

If taxing inverted companies suddenly sounds unappealing, here’s an alternative: make inversions less attractive as a means of generating profit. The U.S. is a free country, so it looks bad when it punishes corporations for acting in their best interest. Instead, why not lower the tax rate to a more competitive, attractive rate, and then focus rolling back the regulatory state that is literally paid by taxpayers to make businesses less productive?

The first step on this path would be to begin reducing the cost of business with a comprehensive set of tax reforms that clean up our messy corporate tax code, and give businesses a sense of calm when planning for the future.

Besides it’s not like the corporate tax generates that much revenue anyway, at just 10.6 percent of $3.2 trillion of total receipts in 2015, according to the Office of Management and Budget. By far the most revenue comes from individual and payroll taxes.

As things stand, corporations are seeking foreign shores to chart out profitable futures, mainly because the business climate in the U.S. has made itself so volatile that it cannot accomplish that at home. The data supports the notion that punishing corporations that choose foreign domiciles will hurt working Americans more than it will avenge or protect them. The limited government solution is to let individuals choose what works for them, and to tax them at a reasonable rate so they do not move out of necessity.

As stated above, lowering the corporate tax rate is just one part of the solution. America has fundamental problems across the board that put us at a global disadvantage that should also be addressed.

The corporate tax rate is a necessary first step to signal to the world that we are restructuring the policies to make the U.S. more attractive among competitors. Creating jobs in America begins with keeping the economy free and competitive, and that cannot happen without fiscal restraint and limiting government, but also cannot happen if we’re taxing ourselves to the stone age.

by | ARTICLES, BUSINESS, GOVERNMENT, TAX TIPS, TAXES

Tax Refund Offsets Pay Unpaid Debts

If you can’t pay your taxes in full, the IRS will work with you. Past due debts like taxes owed, however, can reduce your federal tax refund. The Treasury Offset Program can use all or part of your federal refund to settle certain unpaid federal or state debts, to include unpaid individual shared responsibility payments. Here are five facts to know about tax refund offsets.

1. Bureau of the Fiscal Service. The Department of Treasury’s Bureau of the Fiscal Service, or BFS, runs the Treasury Offset Program.

2. Offsets to Pay Certain Debts. The BFS may also use part or all of your tax refund to pay certain other debts such as:

Federal tax debts.

Federal agency debts like a delinquent student loan.

State income tax obligations.

Past-due child and spousal support.

Certain unemployment compensation debts owed to a state.

3. Notify by Mail. The BFS will mail you a notice if it offsets any part of your refund to pay your debt. The notice will list the original refund and offset amount. It will also include the agency that received the offset payment. It will also give the agency’s contact information.

4. How to Dispute Offset. If you wish to dispute the offset, you should contact the agency that received the offset payment. Only contact the IRS is your offset payment was applied to a federal tax debt.

5. Injured Spouse Allocation. You may be entitled to part or the entire offset if you filed a joint tax return with your spouse. This rule applies if your spouse is solely responsible for the debt. To get your part of the refund, file Form 8379, Injured Spouse Allocation. If you need to prepare a Form 8379, you can prepare and e-file your tax return for free using IRS Free File.

Health Care Law: Refund Offsets and the Individual Shared Responsibility Payment

While the law prohibits the IRS from using liens or levies to collect any individual shared responsibility payment, if you owe a shared responsibility payment, the IRS may offset your refund against that liability.

Each and every taxpayer has a set of fundamental rights they should be aware of when dealing with the IRS. These are your Taxpayer Bill of Rights. Explore your rights and our obligations to protect them on IRS.gov.

Additional IRS Resources:

Tax Topic 203 – Refund Offsets

by | ARTICLES, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

CNSNews remains a go-to source for analyzing information on the U.S. Treasury, tax revenue, and such. Here they are again, scrutinizing tax receipts for FY2016 through the end of February. In a nutshell, the U.S. government continues to run a deficit, and the amount of taxpayer responsibility continues to increase. From CNSNEWS:

The U.S. Treasury hauled in a record of approximately $1,248,371,000,000 in tax revenues in the first five months of fiscal 2016 (Oct. 1, 2015 through Feb. 29, 2016), according to the Monthly Treasury Statement released today.

Despite these record tax revenues in the first five months of the fiscal year, the federal government nonetheless ran a deficit of approximately $353,005,000,000 during the same period.

In February alone, the Treasury ran a deficit of $192,614,000,000.

The record five-month tax haul of $1,248,371,000,000 equaled approximately $8,263 for each of the 151,074,000 people in the country who had either a full or part-time job in February.

The record taxes in the first five months of this fiscal year exceed by about $63,263,220,000 in constant 2016 dollars the then-record $1,185,107,780,000 in tax revenues (in constant 2016 dollars) that the Treasury took in during the first five months of fiscal 2015.

However, even while taking in a record $1,248,371,000,000 in tax revenues from October through February, the Treasury was spending $1,601,375,000,000, according to the Monthly Treasury Statement. Thus, so far this fiscal year, the Treasury has run a deficit of $353,005,000,000.

The largest source of revenue in the first five months of this fiscal year was the individual income tax, which brought the Treasury $597,524,000,000. The second largest source was Social Security and other payroll taxes, which brought in $428,181,000,000.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Based on data from H&R Block as we are halfway through filing season, it is apparent that compliance with the Obamacare penalty is still a difficult task.

This is the second year that the penalty has been levied; for 2014 taxes, the fee was $95 or 1 percent of qualified income — whichever was greater — and for 2015 taxes it is $325 or 2 percent of income, whichever is greater. The average penalty is $383, while last year it was $172, which corresponds roughly to the rise in penalty costs.

However, about 3/5, or 60% of filers “who received advanced tax credits to help them buy private plans on Obamacare’s web-based exchanges must pay a portion back to the IRS because they underestimated their actual income for 2015.” Interestingly, this is an increase from last year’s figure of 52% who had to repay a portion of their advanced subsidy. Thus, compliance and income estimation is getting worse, not better, after two tax seasons.

The average subsidy amount of that Obamacare enrollees must pay back has also increased slightly this year — $579, up from $530 last year.

In contrast, about 33% of taxpayers overstated their income and received additional subsidy funds from the IRS; the average amount was $450. Those that got the number correct and saw no adjustments was a paltry 3%.

The confusion is sure to continue with next year’s filing season. The minimum penalty for no insurance will double again to $695 or 2.5% of income, whichever is higher. H&R Block calculations show that for an average family of four earning $60,000 would pay $975 this tax season (2015), compared to about $400 last year (2014), while next year the penalty would rise to $2,000 (2016).

by | ARTICLES, BLOG, BUSINESS, ECONOMY, GOVERNMENT, POLITICS, TAX TIPS, TAXES

Every year, the various tax agencies calculate how many Americans do not pay a federal income tax. The 2015 tax year number estimates that 77.5 million households, which is 45.3%, according to the research Tax Policy Center. This number is only for federal taxes and does not include state income taxes.

There are two main reasons for the lack of federal taxes: either the household has no taxable income, or their tax liability is reduced and offset by tax breaks.

The research also calculated the various income levels from the richest and the poorest.

“The top 1 percent of taxpayers pay a higher effective income tax rate than any other group (around 23 percent, according to a report released by the Tax Policy Center in 2014) — nearly seven times higher than those in the bottom 50 percent.

On average, those in the bottom 40 percent of the income spectrum end up getting money from the government. Meanwhile, the richest 20 percent of Americans, by far, pay the most in income taxes, forking over nearly 87 percent of all the income tax collected by Uncle Sam.

The top 1 percent of Americans, who have an average income of more than $2.1 million, pay 43.6 percent of all the federal individual income tax in the US; the top 0.1 percent — just 115,000 households, whose average income is more than $9.4 million — pay more than 20 percent of it.”

Federal taxes are not the only taxes that Americans pay. Income, payroll, corporate income, state, local, property taxes, estate taxes, and excise taxes (which include taxes on gasoline, alcohol and cigarettes), are all various forms of taxation that are spread out and paid by households daily.