by | ARTICLES, BLOG, BUSINESS, ECONOMY, ELECTIONS, FREEDOM, OBAMA, POLITICS, TAXES

I like CNSNews, because they provide straightforward number-crunching on fiscal minutia that is tedious yet important data. This week as we enter the 8th year of Obama’s term, they have calculated that federal debt has increased more than $70,000 per household during the 7 years Obama has held office thus far.

From CSNNews:

“The debt of the federal government increased by $8,314,529,850,339.07 in President Barack Obama’s first seven years in office, according to official data published by the U.S. Treasury.

That equals $70,612.91 in net federal borrowing for each of the 117,480,000 households that the Census Bureau estimates were in the United States as of September.

During President George W. Bush’s eight years in office, the federal debt increased by $4,899,100,310,608.44, according to the Treasury. That equaled $44,104.65 in net federal borrowing for each of the 111,079,000 households that, according to the Census Bureau, were in the country as of Jan. 20, 2009, the day that Bush left office and Obama assumed it.

In the fifteen years from the beginning of Bush’s first term to the end of Obama’s seventh year in office, the federal debt increased $13,213,630,160,947.51.

That $13,213,630,160,947.51 increase in the debt during the Bush-Obama years equals $112,219.57 for each of the 117,748,000 households that were in the country as of September.

When Bush took office on Jan. 20, 2001, the federal debt was 5,727,776,738,304.64. When Obama took office eight years later, on Jan. 20, 2009, the federal debt was 10,626,877,048,913.08.

As of Jan. 20, 2016, when Obama completed his seventh year in office, the federal debt was $18,941,406,899,252.15.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, TAX TIPS, TAXES

Tax season has begun. Normally, the deadline for filing your federal tax return is April 15. But because the Washington D.C. Emancipation Day holiday falls on April 15 this year, Tax Day is the Monday after, April 18th.

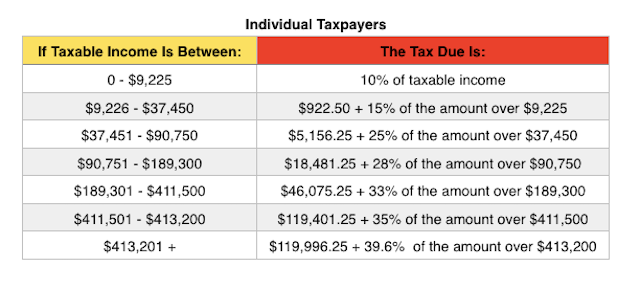

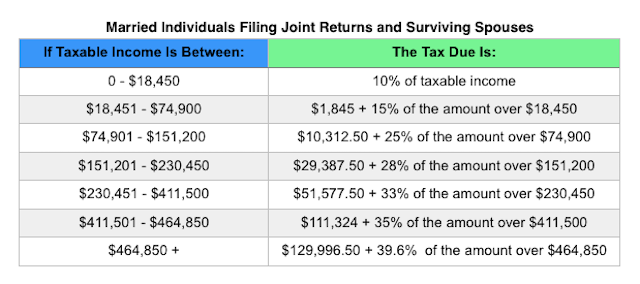

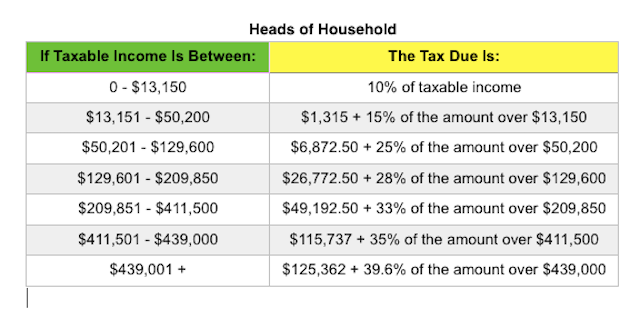

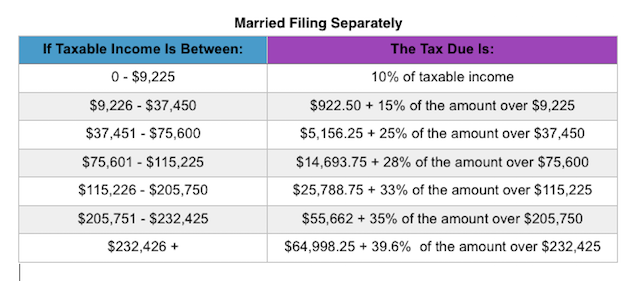

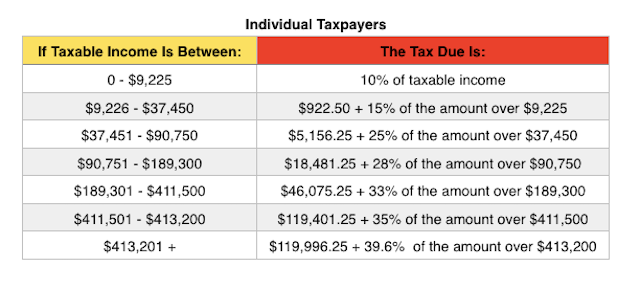

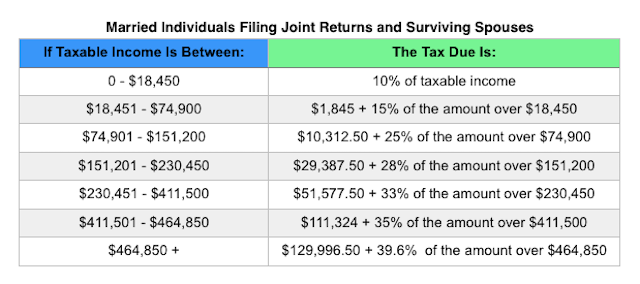

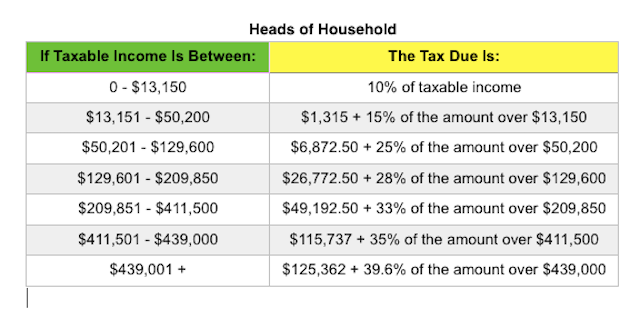

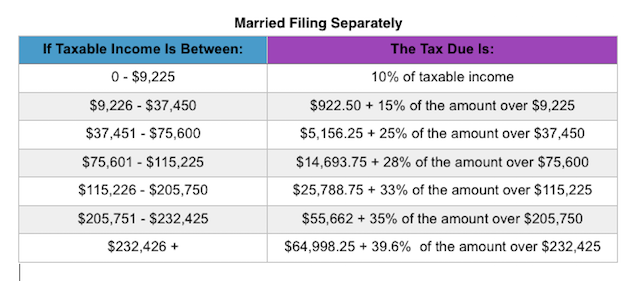

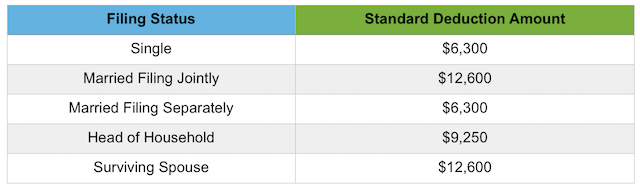

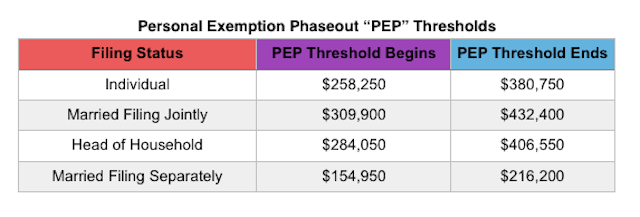

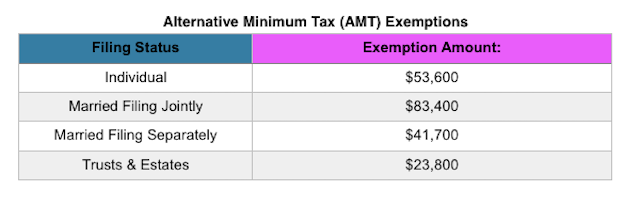

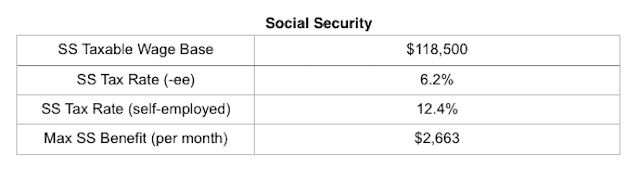

Last spring, Forbes put together a nice, extensive list of all the tax rates and adjustments for 2015. I have posted below some of the most pertinent information. For an all-inclusive list, you should check out the article in its entirety.

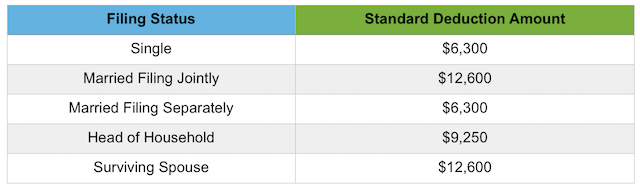

The standard deduction amounts are:

Some tax credits are also adjusted for 2015. Some of the most common tax credits are:

Earned Income Tax Credit (EITC). For 2015, the maximum EITC amount available is $3,359 for taxpayers filing jointly with one child; $5,548 for two children; $6,242 for three or more children (up from $6,143 in 2014) and $503 for no children. Phaseouts are based on filing status and number of children and begin at $8,240 for single taxpayers with no children and $18,110 for single taxpayers with one or more children.

Child & Dependent Care Credit. For 2015, the value used to determine the amount of credit that may be refundable is $3,000 (the credit amount has not changed). Keep in mind that this is the value of the expenses used to determine the credit and not the actual amount of the credit.

Hope Scholarship Credit. The Hope Scholarship Credit for 2015 is an amount equal to 100% of qualified tuition and related expenses not in excess of $2,000 plus 25% of those expenses in excess of $2,000 but not in excess of $4,000. That means that the maximum Hope Scholarship Credit allowable for 2015 is $2,500. Income restrictions do apply and for 2015, those kick in for taxpayers with modified adjusted gross income (MAGI) in excess of $80,000 ($160,000 for a joint return).

Lifetime Learning Credit. As with the Hope Scholarship Credit, income restrictions apply to the Lifetime Learning Credit. For 2015, those restrictions begin with taxpayers with modified adjusted gross income (MAGI) in excess of $55,000 ($110,000 for a joint return).

Changes were also made to certain tax Deductions, deferrals & exclusions for 2015. You’ll find some of the most common here:

Student Loan Interest Deduction. For 2015, the maximum amount that you can take as a deduction for interest paid on student loans remains at $2,500. Phaseouts apply for taxpayers with modified adjusted gross income (MAGI) in excess of $65,000 ($130,000 for joint returns), and is completely phased out for taxpayers with modified adjusted gross income (MAGI) of $80,000 or more ($160,000 or more for joint returns).

Flexible Spending Accounts. The annual dollar limit on employee contributions to employer-sponsored healthcare flexible spending accounts (FSA) edges up to $2,550 for 2015 (up from $2,500).

IRA Contributions. The limit on annual contributions to an Individual Retirement Arrangement (IRA) remains unchanged at $5,500. The additional catch-up contribution limit for individuals aged 50 and over remains at $1,000.

Also note that the floor for medical expenses remains 10% of adjusted gross incocome (AGI) for most taxpayers. Taxpayers over the age of 65 may still use the 7.5% through 2016.

For a more complete list of tables and rates, check out the Forbes article or visit the official IRS website.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, GOVERNMENT, NEW YORK, POLITICS, TAXES

On Wednesday, January 6, Mayor DeBlasio proclaimed a $15/hr minimum wage for the public workers in New York City. The cost for such a plan is expected to be more than $200 million over the next five years. Both De Blasio and Gov. Cuomo seem intent on playing the role of wage-crusader during their respective terms — but only for some New Yorkers.

Just like DeBlasio, Gov. Cuomo announced in early January that “he would provide a $15-an-hour minimum wage to some 28,000 state university workers.” And last November, “the governor made New York the first state to set a $15 minimum wage for public employees; he also took steps to secure $15 an hour for workers at fast-food chain restaurants.” DeBlasio, too, has sought other ways to provide more generous benefits. Late in December, he announced that NYC “would begin offering six weeks of paid parental leave to 20,000 city employees.”

The problem is that these minimum wage hikes not only add to the budget woes, it also creates inequalities between the public and private sector (except for fast-food workers). How is it good for New York that a McDonald’s open next door to a pizza shop with a $5 minimum wage difference? And how can Cuomo attract more businesses to New York state with costs that are already the highest in the entire country — when he is going to make them even higher?

Here in New York City, a minimum wage hike for public workers would mean that New York City will pay more for its labor than it currently has calculated to pay, in order to produce the exact same product or services. Looked at it another way, to then keep to the operating budget, NYC will get less goods and services for the taxes it receives. This would result in a bigger budget deficit — because of having to spend more overall to maintain the current goods and services.

Minimum wage hikes no one anyone except the pockets of the public sector workers, while pushing the budget on an even more unsustainable trajectory. The rest of the taxpayers will be expect to either 1) have yet another tax increase in the near future or 2) see diminished services. Neither of these scenarios benefits New Yorkers.

by | ARTICLES, BLOG, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

After nearly 8 years of listening to Obama talk incessantly about the need for the wealthy to “pay their fair share,” Hillary Clinton has picked up the mantle in her new tax proposal unveiled this week.

Clinton spoke about the need for “an additional 4 percent tax on people making more than $5 million per year, calling the tax a “fair share surcharge.” It is reminiscent of the failed “Buffet Rule” proposal put forth by Obama a few years back.

According to a Clinton staffer, “This surcharge is a direct way to ensure that effective rates rise for taxpayers who are avoiding paying their fair share, and that the richest Americans pay an effective rate higher than middle-class families.”

The tax proposal is calculated to bring in $150 billion on revenue over a ten-year span. Nowhere does it calculate the cost of implementing such a plan, additional paperwork, hours spent on compliance and enforcement, and so forth. As a revenue raiser, it amounts to $15 billion a year for the federal government, pocket change really — something that could be more easily attained by cutting the size and scope of many federal budgets.

It’s not really about revenue anyway. It’s more about pandering to a segment of voters, vilifying the high income earners and stirring up class warfare. It was the one message that resonated most with Obama supporters in 2012; he continuously and intentionally railed against “millionaires and billionaires”, and talked about “the wealthy paying their fair share” in order to create a divide and separate that particular fiscal population from the rest of “mainstream America”. Hillary is merely following the leftist playbook and recycling stale ideas as her candidacy flounders.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

Government wage increases vastly outpaced the public sector, and the number of government jobs have soared. For the federal government alone, there are 2.1 million workers, “costing over $260 billion in wages and benefits this year.” according to recent data analysed by the US Bureau of Economic Analysis (BEA).

There is no justification for government workers to earn more than the private sector. What was once a noble profession — the idea of ‘public service’ — has been replaced by as system that allows for and encourages the economic imbalance because the government is not market-driven. Structures such as arbitration and non-firing allow public service employees to continue to receive their benefits and artificial pay raises regardless of the outside economic conditions.

Because of this, public sector wages eventually exceed the normal market-based wages. Negotiations in the public sector should never be “how much of an increase will I receive from before”, but rather, “can we justify these wages and benefits at all?” We should not be paying more than the private sector, which responds and adjusts to the mitigating economic factors; the government does not, and the result is what we see today: sprawling wages, busted pensions, and bloated budgets.

In essence, government workers have stronger job security because they are not dependent on the economy to keep them going. What’s even more sobering is the fact that the private sector marketplace is beginning to lose the best and brightest people, because the government is paying more, and providing employment with better benefits. This will have long-lasting detrimental effects. It was never intended for the government to compete with the private sector. This phenomenon has turned the entire system on its head.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Today, Forbes did an updated analysis of the current state of Obamacare, as the enrollment numbers are trickling in. The news is rather poor:

“To briefly recap this year’s enrollment figures, late sign ups and automatic renewals pushed the number of people signing up for Obamacare through Healthcare.gov to 8.6 million through the end of 2015, before any attrition. Extrapolating from the current numbers implies that total Obamacare sign-ups will reach about 14 million (once the figures from state-run exchanges are baked in). The White House had previously lowered its 2016 goals, hoping to have 10 million people still enrolled and fully paid at the end of 2016 across the federally run healthcare.gov as well as state-run exchanges. The Obama Administration should hit, or slightly top these estimates, once totals from the state exchanges are factored into the final figures.

For comparison, last year, enrollment topped out at 11.5 million. Around 10 million followed through to purchase plans and 9 million ended up with coverage at year-end, after attrition. Applying the same proportions for this year, Wall Street analysts estimate that about 11 million to 12 million consumers will confirm enrollment by paying for their coverage. About 10 million to 11 million will remain enrolled by year-end 2016. This compares to the government’s revised goal of 10 million, (and an older projection from the Congressional Budget Office for 21 million).

Yet the federal numbers show that the rate of growth in the exchanges has declined year over year, and is mostly comprised of people who were previously covered by some kind of Obamacare plan (71% in 2016). Remember that at the end of the 2015 open enrollment period, the total enrollment across both state-based and the federal healthcare.gov marketplace was up 46% from the 2014 open-enrollment period. That was before any attrition. This year, it looks like the year-over-year growth in the exchanges will come in at about half of that figure.

The age mix of those who are signing up also looks to be tracking, at best, on par with prior years and perhaps a little worse. Remember, Obamacare was always dependent upon more young and presumably healthier consumers signing up for the inefficient plans to help subsidize older and costlier beneficiaries. But many young consumers are choosing to forgo the exchange’s high premiums, even as the government’s penalties for remaining uncovered by a “qualified” plan start to rise. For many of the young, and healthy, Obamacare’s overpriced plans are a bad deal.

Data that HHS released yesterday on the federal and state-based exchanges shows that 35% of total federal and state-based selections were by people younger than 35 thus far for 2016. This compares to 33% during the similar time frame during the 2015 open enrollment period and 29% during the 2014 open enrollment period. For health insurers, the slight improvement in the age mix isn’t expected to be material.

Obamacare’s acolytes are casting the tepid growth as success. Under their calculus, any expansion is a measure of progress. This math largely draws from how one charts achievement–whether it’s drawn from considerations of economics, or derived mostly from politics. If the goal is merely expanding Obamacare’s footprint, then each enrollee adds to the political enterprise. But Obamacare was supposed to be affordable, and self-sustaining. It was supposed to replace the individual and small group markets and the health plans people liked, and couldn’t keep.”

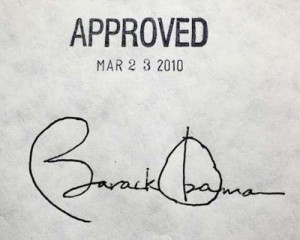

The government is willing to do anything to cast Obamacare in a positive light. But nothing can save it from the fact that the enrollment at this point in 2016 will only be half of what was projected when the legislation was voted on in 2010. If anyone thought that Obamacare would only have covered 10 million persons at this point — instead of the 21 million — there is little doubt that it would not have been passed.

Even today, the Obama voted to veto the bill that would have repealed Obamacare (the Restoring Americans’ Healthcare Freedom Reconciliation Act of 2015). Unfortunately for millions of Americans, Obamacare has proven to be yet another bungled, failed, government pipe-dream.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, POLITICS, TAXES

In 2015, the federal government’s published 82,036 pages of rules, proposed rules and notices. It surpassed last year’s 77,687 pages broke the previous record of 81,405 pages in 2010. Competitive Enterprise Institute issued their yearly survey of the federal regulatory state. Among them are some of their findings:

*3,378 final rules and regulations were created

*2,334 proposed rules were issued in 2015 and are at various stages of consideration.

*29 executive orders and 31 executive memorandums were issued

Regulation functions as a hidden tax. Last year’s report calculated that, “based on the best available federal government data, past reports, and contemporary studies, regulatory compliance costs $1.88 trillion annually.”

Recommendations for reigning in regulation include repealing “certain statutes, require congressional approval for big rules and enforce maximum requirements set forth in the Administrative Procedure Act.” 2015 saw major final rules from the EPA — the Clean Power Plan and its Waters of the Unites States rule — as well as the FCC’s net neutrality order.

You can follow updates on federal regulation on CEI’s “Ten Thousand Commandments” page here

by | ARTICLES, BLOG, ECONOMY, NEW YORK, OBAMA, POLITICS, TAXES

Recently, Gene Epstein of Barron’s made a fascinating observation about Paul Krugman, the New York Times’ darling of economics. On December 18th in the NYTimes, Krugman wrote about the film, “The Big Short”, which was about the “housing bubbles and retold lies.” In his article, Krugman stated that the housing bubble “was largely inflated via opaque financial schemes that in many cases amounted to outfight fraud.”

Unfortunately for Krugman, some folks like Gene Epstein have long memories and short tolerance. Epstein noted that, “This causal analysis is directly contradicted by an alternative view previously expressed in the New York Times: that the housing bubble was largely inflated by policies of the Federal Reserve.

First, Epstein went back to August 2, 2002, when a columnist in the pages of the New York Times, wrote that, “To fight this recession, the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.”

Nearly seven years later on June 17, 2009, a few months after the crisis of 2008, the same columnist wrote for the New York Times that “What I said was that the only way the Fed could get traction would be if it could inflate a housing bubble. And that’s just what happened.”

Can anyone guess who this columnist is? Gene Epstein knew: Paul Krugman.

Of course, Krugman is counting on his readers to be either a) financial morons like he is; b) short on memory; or c) both. This kind of incompetency from Mr. Krugman is a consummate example of why he should not be the time of day on economic matters.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, OBAMA, OBAMACARE, POLITICS, TAXES

With the insurance enrollment period ending in mid-December, Healthcare.gov announced that 8.2 million Americans selected plans for 2016 in 38 states. The Administration is touting the 8.2 figure as a “success” by comparing it to the 6 million plan selections by the same time last year. There was no mention, however, of how the 8.2 million number falls exceedingly short of the 21 million projected to be Obamacare users.

One amusing point is how the Administration parsed its words. “Plan selection” is an important phrase in Obamacare-speak. It means that many people chose these plans, filled out the forms, and submitted them — but did not necessarily pay for them. This is why they didn’t use the term “enroll” when describing the Obamacare figures. In order to be considered to be actually enrolled, one must pay the first month’s premium. Not everyone will actually go ahead and pay their premium, and the federal Obamacare numbers will inevitably be even smaller because of it.

The current figure excludes the state insurance exchanges. When these are added to the federal numbers, the Obama Administration is hoping that will get them over the 10 million mark for this year — half of what was touted when Obamacare was passed. If they do hit that number, it still means that only about a million people were added to Obamacare this year, as last year’s enrollment ended up being about 9.1 million users.

In the debates leading up to Obamacare, it was argued that Obamacare should be voted for because it would get eventually get 28 million of the uninsured 45 million Americans (15% of the 315 million population). At that projected target, the 28 million would only be covering 70% of the then-uninsured, which is decent but not excellent. It is clear now that NOBODY would have voted for Obamacare if they only expected to cover 10 million (or barely more than 20%) of the then-uninsured, which is where we currently are. That is the key, salient point that is now being lost in the discussions.

The ACA continues to be a disaster for all taxpayers.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

On a recent post over at Cafe Hayek, my friend Don Boudreaux discusses the merits of minimum wage policy. A gentleman, Mr. Hutcheson, wrote in to chide the writers, saying that Boudreaux and others “who argue that the minimum wage destroys some jobs miss the point.” Mr. Hutchinson insisted that the real point is “the amount of harm to low income workers compared to the benefits of going to other low-income workers.”

Boudreaux correctly responded that minimum wage legislation is unethical because the government strips “some people of economic opportunity in order to artificially enhance the opportunities available to other people.”

Although Don’s response is certainly correct, I do not believe arguments of fairness, morals, or constitutionality carry much weight with the standard liberal position espoused by Mr. Hutcheson. I believe that he needs to understand that raising the minimum wage hurts everyone, as other individuals and the economy as a whole are outright harmed by such policy by much more than than those who are helped. This can be seen by realizing that the money that is now going to a higher minimum wage WILL NECESSARILY cause one or a combination of the following:

1) In an attempt to offset the higher minimum wage, the business will fire or refuse to hire other employees. Especially from the poorest among us, many individuals. will either lose their job or not be able to get jobs at all moving forward. The cost of raising the minimum wage is just like the cost of raising a commodity. For instance, consider the scenario where the price of apples — a basic pantry item for most everybody — goes from $1.50/pound to $2.00/pound. Fewer people will buy the apples, or people will buy fewer apples overall. So it is also with a higher minimum wage; if a unit of labor costs more,fewer units of labor will be purchased overall. As a result, the economy will likely contract because of the loss of jobs resulting from a wage hike.

2) The business can simply earn less profit. If more of the earnings must go to the cost of labor, the business earns less profit overall. For some minimum wage advocates, perhaps that is the actual goal — to keep businesses from earning too much at the top. But in reality, the loss of business capital (from both large corporations to small mom and pops) means there is less money to grow the existing business, or for future business endeavors. Whether it is reinvested directly back into the business with equipment upgrades or growing the business through new employees or expansion, earning less money for the company creates a ripple effect. The less a company can earn, the less it can help grow the economy. Impeding its ability to do so, through the imposition of mandated wage increases, is harmful.

3) In order to offset the increased wage cost, a business, if possible, can choose to raise its prices. This will attempt to ensure that the company earns the same amount as before. But the effect of the price increase is negative. As prices increase, supply and demand dictates that some customers will simply not buy (reducing GDP) and the rest will have their standard of living go down (because they are paying more just to have the same product as before).

Every one of these responses — cutting jobs, loss of business capital, and raising prices — are bad for the employees and the economy as a whole. Though the minimum wage hikes sound good in theory, in reality, economies don’t exist in a vacuum. These types of policies hurt more than help. The three aforementioned points overwhelm anything positive going to minimum wage recipients; in reality, it is a bigger net cost to the system.

Would ⅔ of the population still support the minimum wage it if they understood how devastating it would be both to the most economically disadvantaged people and to the economy as a whole? People have continuously been pitched the false idea that the economy improves because minimum wage recipients will spend their extra money. Minimum wage policy is an impediment. Economics 101 reminds us that in fact, it is more stimulative for the economy that the employer keep the money and reinvest it than for the worker to merely spend it. That is how you grow the economy.