by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, NEW YORK, OBAMA, POLITICS, TAXES

The Wall Street Journal had an excellent article a couple weeks ago calling out the egregious prosecutorial misconduct of New York Attorney General Eric Schneiderman. In this farce of a case, Schneiderman is hell bent on going after Hank Greenberg (formerly with AIG) in an attempt to discredit his name in a state civil lawsuit. The manner in which Schneiderman is conducting himself is a disgrace to his position as prosecutor and reflects a trend of prosecutorial abuses that has grown alarmingly in recent years.

In the Schneiderman-Greenberg case, Eric Schneiderman has been pursuing civil charges against Hank Greenberg related to an “allegedly fraudulent reinsurance transaction” some years ago while disgraced Eliot Spitzer was the Attorney General. Mr. Greenberg was the defendant in a prior, failed criminal prosecution involving this particular transaction several years ago; in preparation for this upcoming civil case, it came to light that the “federal government has been hiding potentially exculpatory evidence” from the prior trial of Mr. Greenberg. The key witness for the government in that case, a Mr. Napier, who never had any direct communication with Mr. Greenberg about the deal in question apparently provided such “compelling inconsistencies” that an Appeals judge wrote “Napier may well have testified falsely.” Yet, Napier’s testimony is the very piece of evidence upon which Schneiderman has built his civil case.

For several years, and as recently as January, the federal government continued to claim that the notes and evidence collected during the first case should be kept under seal. It was only recently, under pressure, that the prosecutors relented and provided that notes and memos which showed the blatant inconsistencies of Mr. Napier. Had that release not occurred, however, Mr. Schneiderman would have been allowed to pursue the civil case against Greenberg relying “on a Napier deposition conducted years before the appeals court cast doubt on his testimony and before Mr. Greenberg’s legal team uncovered the notes.” What’s more, Mr. Greenberg was denied a trial by jury, and because “it’s a civil case and Mr. Napier doesn’t live in New York, he cannot be compelled to appear.” Thankfully, in light of the new exculpatory evidence, the trial has been stayed to decide whether or not to continue with the farce.

It is clear that Schneiderman’s decision to doggedly pursue this case for years even in the face of tainted, unreliable evidence is abusive. Schneiderman himself should be under investigation for malicious prosecution, going after a “big name” for his own political and personal gain.

This unprofessional prosecutorial behavior is unfortunately not limited to Eric Schneiderman. The nominee for Attorney General, Loretta Lynch, who also hails from New York has an egregious record of abuse particularly relating to civil asset forfeiture while she was the U.S. Attorney for the Eastern District of New York. In the most outrageous case during her tenure, her offices colluded with the IRS to seize nearly $450,000 from the bank account of two businessmen known as the Hirsch Brothers in May 2012, for “suspicion”, not actual charges, of criminal activity.

For nearly 3 years, the brothers were never charged with any crime, and Lynch’s office wholy ignored stringent deadlines regarding forfeiture cases. Prosecutors were compelled by law to file a court complaint within a certain amount of days following the seizure, but that never actually happened at any time, and the Hirsch brothers never had the opportunity to appear before a judge. In fact, there was never any case presented against them at anytime; Lynch’s office just sat on the seized money, all while offering to cut a deal with the brothers to keep some of the funds in return for dropping the matter. The brothers turned down every offer made to them.

Suddenly, a week before the Lynch’s confirmation hearing, in late January 2015 — two years and eight months after the case began — Lynch’s office returned all the money to the brothers. Lynch’s office clearly violated the law in the manner by which her prosecutors ignored forfeiture rules and denied due process to the Hirschs while going after the “big money”.

In a similar manner, NBC has covered another practice of Lynch’s office: using the “John Doe” alias in an overwhelmingly high amount to keep witness and court information from becoming public information. “Federal prosecutors in New York’s Brooklyn-based Eastern District pursued cases against secret, unnamed “John Doe” defendants 58 times since Loretta Lynch became head prosecutor in May 2010.” In comparision to others, “none of the nation’s 93 other federal district courts has charged more than eight “Does” during the same time period, and the national average is under four.” National Review has also covered the specifics of some of these cases, calling out Lynch’s “secret docket”. The repeated use of such secrecy invites Lynch’s office to the criticism that such practice undermines the right to a public trial guaranteed by our Constitution.

The conduct of Schneiderman and Lynch is unacceptable. The fact that Schneiderman is and will remain the Attorney General for New York and Loretta Lynch is poised to become the next Attorney General for the United States is disconcerting. It is not the first and it certainly won’t be the last, but it is increasingly brazen. This type of behavior undermines the integrity of our justice system when the nations leading prosecutors can’t be bothered to follow the rules and conduct themselves in an unbiased, professional manner. How can citizens protect their liberties in the face of such prosecutorial abuse?

by | ARTICLES, BLOG, BUSINESS, CONSTITUTION, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, QUICKLY NOTED, TAXES

Bernie Sanders recently advocated for President Obama to raise $100 billion in taxes by the old “closing corporate loopholes” schtick. The difference this time, is that Obama is actively exploring his abilities to do so via Executive Order. Townhall has the scoop:

“White House Press Secretary Josh Earnest confirmed Monday that President Obama is “very interested” in the idea of raising taxes through unitlateral executive action.

“The president certainly has not indicated any reticence in using his executive authority to try and advance an agenda that benefits middle class Americans,” Earnest said in response to a question about Sen. Bernie Sanders (I-VT) calling on Obama to raise more than $100 billion in taxes through IRS executive action.

“Now I don’t want to leave you with the impression that there is some imminent announcement, there is not, at least that I know of,” Earnest continued. “But the president has asked his team to examine the array of executive authorities that are available to him to try to make progress on his goals. So I am not in a position to talk in any detail at this point, but the president is very interested in this avenue generally,” Earnest finished.

Sanders sent a letter to Treasury Secretary Jack Lew Friday identifying a number of executive actions he believes the IRS could take, without any input from Congress, that would close loopholes currently used by corporations. In the past, IRS lawyers have been hesitant to use executive actions to raise significant amounts of revenue, but that same calculation has change in other federal agencies since Obama became president.

Obama’s preferred option would be for Congress to pass a corporate tax hike that would fund liberal infrastructure projects like mass transit. But if Congress fails to do as Obama wishes, just as Congress has failed to pass the immigration reforms that Obama prefers, Obama could take actions unilaterally instead. This past November, for example, Obama gave work permits, Social Security Numbers, and drivers licenses to approximately 4 million illegal immigrants.

Those immigration actions, according to the Congressional Budget Office, will raise federal deficits by $8.8 billion over the next ten years.”

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Yesterday it was reported that the Treasury Department paid $3 billion to cover Obamacare cost-sharing subsidies without Congressional approval. The heart of the dispute appears to be whether or not these subsidies were supposed to be funded via yearly appropriations or not. The House Ways and Means Chair, Paul Ryan, argues the former. Health and Human Services, via the Department of Justice, argues the latter.

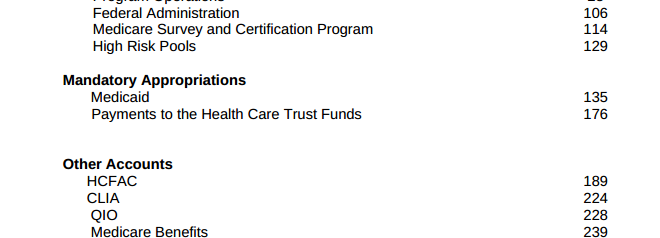

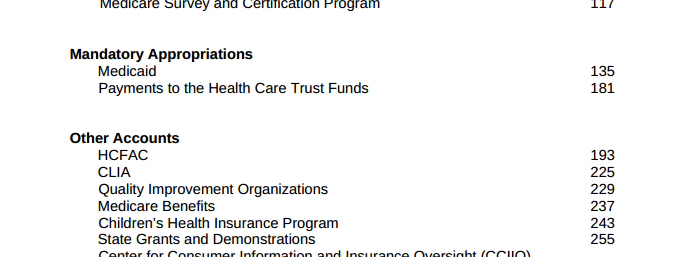

In order to make sense of the funding dispute, it seemed necessary to dig around in the agency budgets to see how cost sharing was accounted for. Cost-sharing falls under the purview of the “Centers for Medicare & Medicaid Services (CMS)”. Yet, while comparing the budget requests for 2014 (for which the Treasury covered costs) and the ones for 2015 (current) & 2016 (future), it became clear that CMS changed the way it accounted for cost-sharing funding after 2014.

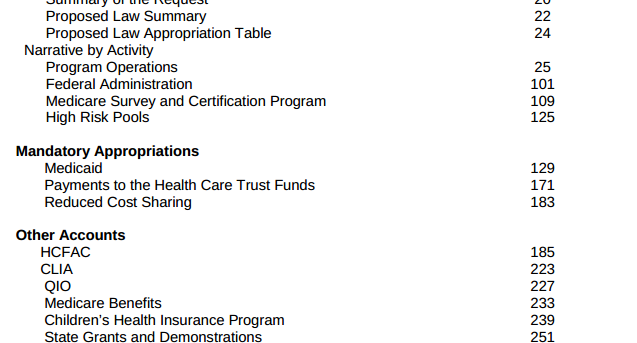

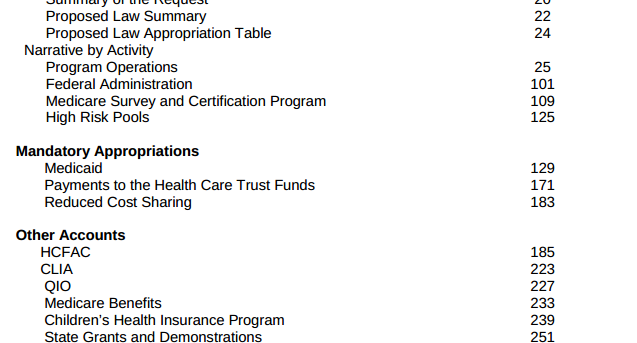

Looking at the 2014 Budget request, CMS had section called “Mandatory Appropriations”, which listed three items: 1) Medicaid 2) Payments to the Health Care Trust Funds 3) Reduced Cost Sharing.

Further in that budget, CMS wrote, “The FY 2014 request for Reduced Cost Sharing for Individuals Enrolled in Qualified Health Plans is $4.0 billion in the first year of operations for Health Insurance Marketplaces, also known as Exchanges. CMS also requests a $1.4 billion advance appropriation for the first quarter of FY 2015 in this budget to permit CMS to reimburse issuers who provided reduced cost-sharing in excess of the monthly advanced payments received in FY 2014 through the cost-sharing reduction reconciliation process.”

This position — that Obamacare cost-savings was to be funded by yearly appropriations– was reiterated by a “July 2013 letter to then Sen. Tom Coburn, Congressional Research Service wrote that, “unlike the refundable tax credits, these [cost-sharing] payments to the health plans do not appear to be funded through a permanent appropriation. Instead, it appears from the President’s FY2014 budget that funds for these payments are intended to be made available through annual appropriations.” (Remember, a 2014 budget would have been written also in 2013)

You can see a picture of the 2014 budget here:

However, Congress rejected those requested appropriations at the time so “the administration went ahead and made the payments anyway.” That is the mystery $3 billion paid for by the Treasury.

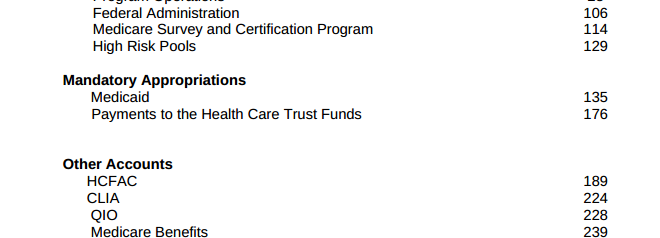

There is a noticeable change, however, with the CMS budget for 2015. The cost-sharing portion, which was originally listed as “Mandatory Payments” in 2014, is not listed at a “Mandatory Payment” anymore. Nor is it for 2016 either.

2015 Budget request:

CMS Budget 2015

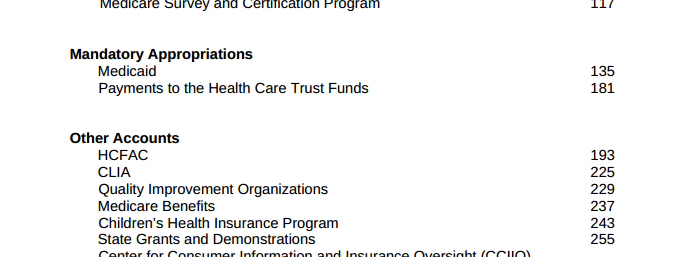

2016 Budget request:

CMS Budget 2016

Reading through the 2015 and 2016 budget documents, “cost sharing” appears in various areas, usually related to Medicaid, but not in one specific section — contrary to how it was accounted for in 2014, as a specific appropriation from the agency.

What’s equally interesting is that the DoJ argued about this specific matter in their recent brief dated January 26, 2015, saying that, “The House’s statutory arguments are incorrect. The cost sharing reduction payments are being made as part of a mandatory payment program that Congress has fully appropriated. See 42 U.S.C. § 18082. With respect to Section 4980H, Treasury exercised its rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute. See 26 U.S.C. § 7805(a).”

Yet, as shown above, the “mandatory program for cost-sharing”, that was submitted for funding (and rejected) in 2014, was removed entirely from the 2015 and 2016 budget requests. Now there is no way to even see the “cost-sharing” portion of the budget at all. And this appears to contract the statement by the DoJ that there is a “mandatory payment” program.

Cost sharing subsidies are an enormous part of Obamacare. “These payments come about because President Obama’s healthcare law forces insurers to limit out-of-pocket costs for certain low income individuals by capping consumer expenses, such as deductibles and co-payments, in insurance policies. In exchange for capping these charges, insurers are supposed to receive compensation.”

Cost sharing is expected to cost taxpayers roughly $150 billion over the next 10 years, according to estimates by the Congressional Budget Office.

But we now don’t know the specific funding amounts for the year 2015 or for 2016, and the costs for 2014 are in dispute, involving that $3 billion in funds from the Treasury (which came from somewhere and somehow).

The one thing we do know for certain: the Treasury Department is clearly exercising the power it perceives to have, as a “rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute.”

by | ARTICLES, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

A few weeks ago, I reported how Obama’s budget contained a $22 billion student loan bailout to cover a massive shortage of funds for the Department of Education Federal Student Loan program. Because the program is categorized as a “credit program”, due to a “quirk in the budget process for credit programs, the department can add the $21.8 billion to the deficit automatically, without seeking appropriations or even approval from Congress.”

Now it is being reported that the Treasury Department approved and paid for $3 billion in Obamacare costs without seeking Congressional approval. Have we uncovered another similar quirk in the federal budget process that allows for the Treasury to cover Obamacare costs that aren’t funded? We don’t actually know yet, because the letter from the Treasury which “revealed that $2.997 billion in such payments had been made in 2014”, “didn’t elaborate on where the money came from.”

Here’s what’s going on:

“At issue are payments to insurers known as cost-sharing subsidies. These payments come about because President Obama’s healthcare law forces insurers to limit out-of-pocket costs for certain low income individuals by capping consumer expenses, such as deductibles and co-payments, in insurance policies. In exchange for capping these charges, insurers are supposed to receive compensation.

What’s tricky is that Congress never authorized any money to make such payments to insurers in its annual appropriations, but the Department of Health and Human Services, with the cooperation of the U.S. Treasury, made them anyway.”

So here we have two agencies collaborating on funding for Obamacare without Congressional approval. When asked about the $3 billion by House Ways and Means Chairman Rep. Paul Ryan, he received a letter which merely described the what the cost-sharing program was, without explaining anything 1) regarding how the payments came to be made, or 2) where the money came from.

What’s more, because the cost-sharing payments from the Department of Homeland Security is part of a larger lawsuit against Obama’s Executive Actions, filed by John Boehner, the letter referred Rep. Ryan to the Department of Justice.

It turns out that Department of Justice recently argued this topic on January 26th. In this brief the Department of Justice argued that John Boehner’s position, that the cost-sharing program payments required annual appropriation, was incorrect, “The cost sharing reduction payments are being made as part of a mandatory payment program that Congress has fully appropriated.” So the Department of Justice and the Treasury Department and the Department of Health and Human Services maintain that the payment they made was licit and Congressionally approved as part of Congressional appropriations.

However, prior budget requests and negotiations tell a different story about how Obamacare cost-sharing is funded.

“For fiscal year 2014, the Centers for Medicare and Medicaid Services (the division of Health and Human Services that implements the program), asked Congress for an annual appropriation of $4 billion to finance the cost-sharing payments that year and another $1.4 billion “advance appropriation” for the first quarter of fiscal year 2015, “to permit CMS to reimburse issuers …”

In making the request, CMS was in effect acknowledging that it needed congressional appropriations to make the payments. But when Congress rejected the request, the administration went ahead and made the payments anyway.

The argument that annual appropriations are required to make payments is also backed up by a report from the Congressional Research Service, which has differentiated between the tax credit subsidies that Obamacare provides to individuals to help them purchase insurance, and the cost-sharing payments to insurers.

In a July 2013 letter to then Sen. Tom Coburn, Congressional Research Service wrote that, “unlike the refundable tax credits, these [cost-sharing] payments to the health plans do not appear to be funded through a permanent appropriation. Instead, it appears from the President’s FY2014 budget that funds for these payments are intended to be made available through annual appropriations.”

As we are likely to not receive any answers soon regarding the $3 billion in Obamacare funding, or the source, here are some things to think about and look for as we wait:

1) How will cost-sharing be funded in this year’s budget?

2) Where did the $3 billion come from? If the $3 billion came from another agency, does that mean we have agencies who have large enough slush funds to absorb a $3 billion transfer?

3) If the $3 billion was tacked onto the deficit (like the student loan “bailout”), what does this bode for future cost-sharing payments? The Congressional Budget Office has already estimated that cost-sharing payments to insurers are expected to cost about $150 billion over the next 10 years.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

The nomination of Loretta Lynch to the position of Attorney General is before you. Although her intelligence, experience, and poise may appear to make her a superb candidate, it is clear now that she would be an extremely poor – even dangerous — choice due to her strong position on civil asset forfeiture.

Though I as a libertarian and you as a liberal may disagree on many things, the need to safeguard civil liberties and individual rights is a priority for both of us. Do you really want to consider confirming a person who has been proud of her record of taking property without due process…of guilty until proven innocent? She may very well bring down anyone who supports her candidacy.

Civil asset forfeiture is a particularly egregious abuse of power, allowing the government to seize property and cash if it merely suspects wrongdoing, even with no evidence and no charging of a crime.

Loretta Lynch was particularly lucrative in this regard as the U.S. attorney for the Eastern District of New York. Between 2011 and 2013, the forfeiture operations under her management netted more than $113 million in civil actions. Lynch’s division was among the top in the country for its collections. But this is not something to be proud of.

In one particularly appalling case, Loretta Lynch’s office seized nearly a half-million dollars from two businessman in 2012 and sat on it for more than two years without a court hearing or appearance before a judge. In fact, no crime had been committed. These men were denied due process and deprived of their assets without warning or criminal charges. Lynch suddenly returned the money just weeks ago on January 20, 2015 — on the eve of her confirmation hearings, having found no wrongdoing by the men either.

During Lynch’s confirmation hearing testimony pertaining to civil asset forfeiture, Lynch stated that “civil and criminal forfeiture are very important tools of the Department of Justice as well as our state and local counterparts.” She further argued that forfeiture is “ done pursuant to court order, and I believe the protections are there.” This is, in fact, not true. In the case mentioned above, there was not only no court order, but also no hearing at any time in nearly three years. That is unconscionable. And this is only one of many similar incidents.

The problem of civil asset forfeiture is that the government can confiscate money or property under the mere suspicion of a crime without ever actually charging someone. The person must prove his innocence to reclaim what was seized, which is a burden of time and money and readily seems to go against our notion of “innocent until proven guilty.”

In recent months, individuals and organizations on both sides of the political aisle have come together to demand reform to this unjust practice. Bipartisan legislation has been proposed in Congress; groups ranging from the Heritage Foundation to the American Civil Liberties Union have been increasingly critical of civil asset forfeiture practices. Even Eric Holder has called for changes and the IRS has pledged to reduce its involvement as well. What’s more, besides the obvious threat to civil liberties, those most likely to be victims are poor and minority citizens.

Loretta Lynch and her record on civil asset forfeiture represents the worst of this “tool for law enforcement”. A vote for her confirmation is a vote you will never be able to walk back. Do you really want to confirm a person who is so deeply committed to civil asset forfeiture at the very same time there is strong bipartisan support for protecting civil liberties and walking back the laws pertaining to this practice?

Loretta Lynch may arguably be the most successful forfeiture agent in government today. This is not a positive quality for an Attorney General. The practice is abusive and her tactics even more so. Voting to confirm a person with such an atrocious civil liberties record is certain to cause problems for you down the road. I urge you to vote no for her confirmation.

by | BLOG, ECONOMY, FREEDOM, GOVERNMENT, POLITICS, TAXES

“But how is this legal plunder to be identified? Quite simply. See if the law takes from some persons what belongs to them, and gives it to other persons to whom it does not belong. See if the law benefits one citizen at the expense of another by doing what the citizen himself cannot do without committing a crime.” ~ Bastiat’s “The Law”

![bastiat-quote-picture_thumb[2]](https://taxpolitix.com/wp-content/uploads/2015/02/bastiat-quote-picture_thumb2.jpg)

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Though the confirmation process for the next Attorney General has been delayed for the next two weeks amid lack of Republican support for nominee Loretta Lynch, it is particularly troubling that the media coverage has failed to discuss Lynch’s position on civil asset forfeiture during this time. Civil asset forfeiture is a particularly egregious abuse of power, allowing the government to seize property and cash if it merely suspects wrongdoing, even with no evidence of or charges with a crime.

Lynch has been particularly lucrative as the U.S. attorney for the Eastern District of New York. The Wall Street Journal noted in November that “Ms. Lynch’s office is a major forfeiture operation, bringing in more than $113 million in civil actions from 123 cases between 2011 and 2013, according to the Justice Department.” Furthermore, Lynch herself boasted to the Brooklyn Daily Eagle last year that the “Eastern District of New York, working collaboratively with other offices as well as on its own, collected over $904 million in criminal and civil actions in Fiscal Year 2013.”

The Daily Eagle went on to describe how additionally, “working with partner agencies and divisions, the Eastern District forfeited another $1,319,038,046 in assets tainted by crime. Forfeited assets are deposited into the Department of Justice Assets Forfeiture Fund and the Treasury Forfeiture Fund and are used to restore funds to crime victims and for a variety of law enforcement purposes.”

One such forfeited case in which Lynch was directly involved was that of the Hirsch Brothers, going back to May 2012. Amazingly, this case was only recently resolved this past January once questions began to swirl after Lynch became the AG nominee. The facts surrounding the ordeal are despicable:

“In May of 2012 the Hirsch brothers, joint owners of Bi-County Distributors in Long Island, had their entire bank account drained by the Internal Revenue Service working in conjunction with Lynch’s office. Many of Bi-County’s customers paid in cash, and when the brothers made several deposits under $10,000, federal agents accused them of “structuring” their deposits in order to avoid the reporting requirements of the Bank Secrecy Act. Without so much as a criminal charge, the federal government emptied the account, totaling $446,651.11.

For more than two years, and in defiance of the 60-day deadline for the initiation of proceedings included in the Civil Asset Forfeiture Reform Act of 2000, Lynch’s office simply sat on the money while the Hirsch brothers survived off the goodwill their business had engendered with its vendors over the decades.”

It’s no coincidence that Lynch’s office suddenly returned the money on January 20, 2015 on the eve of the confirmation hearings, having found no wrongdoing or crime after nearly three years. The Hirsch Brothers were well represented by the Institute for Justice, who has helped other victims of asset forfeiture.

When asked about the “fairness” of civil asset forfeiture during her confirmation hearing by Senator Mike Lee, Lynch responded that “civil and criminal forfeiture are very important tools of the Department of Justice as well as our state and local counterparts.” Speaking directly about civil asset forfeiture, she claimed that such forfeiture is “done pursuant to supervision by a court, it is done pursuant to court order, and I believe the protections are there.” Unfortunately, this was patently untrue in the case of the Hirsch Brothers, who never had a court date or a hearing in front of a judge to plead their innocence during their entire 2+ year ordeal with Lynch’s office.

The problem of civil asset forfeiture is that “authorities can take money (or other property) and then dare the owner to battle through legal obstacles to get it back. To do that, the owner must prove innocence. Charge someone with a crime and the burden of proving guilt is on the government, but confiscate property under civil asset forfeiture and the government keeps the spoils unless the owner is able to prove his innocence. That is not the way our system of justice is supposed to work.”

Now we face the likelihood that the next Attorney General of the United States is one who has repeatedly and gleefully engaged in the process of civil asset forfeiture, putting fiscal gain above due process and civil liberties.

by | ARTICLES, BLOG, FREEDOM, OBAMA, OBAMACARE, POLITICS, TAX TIPS, TAXES

If you are one of the millions of Americans who declined health insurance and decided to pay the fee tax fine penalty, be aware that it will be a part of your 2014 tax calculations — and beyond.

The penalty is officially called the “shared responsibility payment”. This is on U.S. Individual Income Tax Return for 2014, Form 1040, line 61; OR Form 1040A, line 38; OR Form 1040EZ, line 11. The instructions to calculate that are here, on page 5.

The penalty for 2014 is relatively cheap in order to transition Obamacare into your life. Be aware, however, that next year and in subsequent years, the penalty goes up swiftly — pressuring you to get a health insurance plan or else pay the piper.

Here’s how it works:

“Beginning in 2014, absent a qualified exemption, you will be required to obtain health insurance. If you fail to comply, you will be subject to a penalty of 1.0% of your annual income or $95.00, whichever is greater.

In 2015, the penalty increases to the greater of 2.0% of annual income or $325 per person. The following year it becomes the greater of 2.5% of income or $695 per person. After 2016, it will be indexed to the cost of living.

It should also be noted that the maximum penalty is capped at three times the per person penalty. For example, if you earn $28,500 in 2014, 1.0% of your income would equal $285. Therefore, if you earn more than this, your maximum penalty would remain the same. All penalties will be due and payable with your annual federal income tax return. Hence, the penalty for 2014 would be due by April 15, 2015 and the IRS will be the collection agency used.”

The method of assessing and collection the fee is through the Internal Revenue Service (IRS). The fee will be collected by deducting its cost from a person’s tax refund. But for those who don’t get a refund, the IRS isn’t allowed to demand payment either, so it is unclear how those fees will be attained. This ambiguity also leads to further questions about how Obamacare is being actually being paid for (as the penalty is one of the revenues to help offset the costs).”

Not sure if you qualify for an exemption to maintain qualified coverage? The IRS rules allow an exemption if you:

–Have no affordable coverage options because the minimum amount you must pay for the annual premiums is more than eight percent of your household income, OR

–Have a gap in coverage for less than three consecutive months, OR

–Qualify for an exemption for one of several other reasons, including having a hardship that prevents you from obtaining coverage, or belonging to a group explicitly exempt from the requirement.

Interestingly, Sylvia Burwell, the Secretary of Health and Human Services, indicated today that “that the administration might offer some enrollment flexibility around the April 15 tax deadline, so that people who suddenly realize they face a penalty for remaining uninsured could have an opportunity to remedy that.” Burwell, however, did not offer any specifics of what that flexibility might look like.

Sunday, February 15 is the Obamacare enrollment deadline. The CBO lowered its target for this year, from 13 million paid enrollees, to 9.1 paid enrollees. According to the latest figures which combine “HHS data on enrollment through HealthCare.gov and the 14 state-run exchanges, more than 10 million people had signed up as of earlier this month. That means they’d selected a plan, but many still have to make their first premium payment to get covered. Inevitably, some won’t do that.” Also note, New York announced today that citizens have an extended enrollment deadline until February 28 to enroll in Obamacare coverage on the state exchange.

Last year, 6.7 million people paid for Obamacare coverage, a number far fewer than Administration officials predicted when Obamacare began in October 2013.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Obama proposed his FY2016 budget on Monday. The budget is filled tax hikes — more than 20 — which are expected to fund more spending schemes cooked up by the President. The tax hikes total about $2 trillion in additional revenue over the next decade. “The administration contends that various spending cuts and tax increases would trim the deficits by about $1.8 trillion over the next decade, leaving the red ink at manageable levels.”

So, just like his yearly spending, so to with his decade budget outlook: despite record tax revenue, Obama’s proposals still don’t balance out. We continue to have deficit spending.

What is in this budget proposal? It’s chock-full of ambitious taxes aimed mainly at the wealthy and businesses. Most of his budget items will likely not pass Congress — and he knows this. At this point in his Presidency, it doesn’t matter anyway what he proposes, or really, what actually passes. And Obama knows this. He’s not running again.

Obama has merely given the Democrats a list of initiatives for them to push, so that they can create anti-Republican narratives using his ideas for litmus tests and sound bytes over the next year to two years heading into the 2016 elections. It’s not about solutions; it’s about creating more divide. Charles Krauthammer got it right when he said, ““Look, I don’t mind if the President sends a budget which he knows is not going to achieve anything. But when he prefaces his remarks as we just saw by saying we have to put politics aside, posing again as the one person in the country who rises above partisanship and party, speaks for the national interest, it’s really grating.”

Here’s the rundown of the list of budget tax hikes. I’ll do some follow up posts about a couple of particularly odious policies contained therein, but for the time being, you can read the entire list of tax increases here. The amounts of revenue noted below are calculated to be collected from the tax increases over the next decade, from 2016 – 2025.

“Limit deductions for top earners to 28 percent rate, even if income is taxed at 39.6 percent: $603.2 billion

Impose a 14 percent one-time tax on previously untaxed foreign income: $268.1 billion

Impose a 19 percent minimum tax on foreign income: $206 billion

Modify estate and gift tax provisions: $214.4 billion

Change the taxation of capital income: $207.9 billion

Other increases from reform of U.S. international tax system: $135.8 billion

Impose a financial fee on large financial companies: $111.8 billion

Increase tobacco taxes and index for inflation: $95.1 billion

Repeal LIFO (Last In First Out) method of accounting for inventories: $76.1 billion

Conform SECA (Self Employed Contributions Act) taxes for professional service businesses: $74.6 billion

Other revenue changes and loophole closers: $47.9 billion

Eliminate oil and natural gas preferences: $45.5 billion

Implement the Buffett Rule by imposing a new “Fair Share Tax” (making millionaires pay at least 30 percent tax rate): $35.2 billion

Reform the treatment of financial and insurance industry products: $34.4 billion

Limit the total accrual of tax-favored retirement benefits: $26.0 billion

Other loophole closers: $24.3 billion

Reinstate Superfund taxes: $21.2 billion

Tax carried interests as ordinary income: $17.7 billion

Make unemployment insurance surtax permanent: $15.7 billion

Eliminate coal preferences: $4.3 billion

Reauthorize special assessment from domestic nuclear utilities: $2.3 billion

Increase and modify Oil Spill Liability Trust Fund financing: $1.6 billion

Repeal tax-exempt bond financing of professional sports facilities: $542.0 million”

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, QUICKLY NOTED, TAX TIPS, TAXES

Since there seems to be increased interest, and confusion, regarding tax filing and Obamacare this year, it is worth it add some more information to help navigate the process.

The IRS Tax Form 1095a is officially known as the “Health Insurance Marketplace Statement”. If a household member or members enrolled in a healthcare plan through a state or federal exchange, you will receive a 1095a in the mail by early February. You cannot file your taxes without it. It contains information regarding your coverage, such as the number of people enrolled in a marketplace plan, and the dates of effective coverage.

Please note: you will not receive a Form 1095a if you have health coverage through a job or through programs such as Medicaid, Medicare, or the Children’s Health Insurance Program (CHIP).

What you will see on a Form 1095a?

–The form will have information about every member of your household who received Obamacare coverage in 2014. Each person will be listed separately.

–The form will list month-by-month, the amount you paid for your health insurance premium. Each person will be listed separately.

–The form will provide the amount of the “premium tax credits” you received in 2014. They are also called “advanced payments”. This amount is what lowered your monthly premiums, and was calculated based upon income information you provided when you enrolled.

–The form will list the cost of a “benchmark” premium that your premium tax credit is based on. This was the second-lowest cost silver plan, and was considered the “benchmark” to determine subsidies for lower- and moderate-income earners who enrolled in Obamacare.

Why is the 1095a necessary?

The 1095a is your PROOF OF INSURANCE. It contains all the information you need to fill out your form 8965, which is the Premium Tax Credit form. The 8962 Form is a worksheet, whose calculation gets recorded on your 2014 Tax Return.

The main point of all of these forms is really the Premium Tax Credit portion. Remember, 85% of Obamacare enrollees received some sort of subsidy, which is properly known to the IRS as a “Premium Tax Credit”. But most people opted not to receive their tax credit at tax filing time (now). They received it in advance, during 2014, in the form of monthly amounts that were credited against the monthly healthcare premium costs. These advance payments lowered the monthly cost of insurance.

The credit was tabulated based on estimated income information furnished during the application process. But because income situations can change over the course of a year (remember you enrolled at the beginning of 2014), the IRS requires you to re-calculate your income again at tax time (now), and match it against the amount and information you provided when you enrolled.

Since your Premium Tax Credit was based upon estimated income amounts, the amount you were eligible to receive as a tax credit may be higher or lower than what you actually did receive. So, using the information you receive on your 1095a about your household and your payments and your subsidies, you then fill out the Form 8962 to calculate the ACTUAL amount of tax credit you were eligible for in 2014, and check it against what you received as an advance payment applied to your monthly premium costs. Any differences will be resolved either by either reducing or increasing your tax credit amount, which will then affect the final amount of taxes due or taxes returned to you.

Also note — if you enrolled in Obamacare, you must fill out Form 8925, which means you cannot file a 1040EZ. You must file a traditional 1040 tax return.

All the information listed above that you will see on the 1095a is important. If there are any errors, it is imperative that you contact the Obamacare marketplace immediately to resolve the inconsistencies before you file your taxes.

![bastiat-quote-picture_thumb[2]](https://taxpolitix.com/wp-content/uploads/2015/02/bastiat-quote-picture_thumb2.jpg)