by | ARTICLES, FREEDOM, GOVERNMENT, OBAMA, TAXES

Obama signed the Farm Bill into law.

This $956 billion bill will set the course of U.S. food policy for the next half-decade. The old farm bill expired in 2012, and its replacement is 959 pages long, costing some $956.4 billion over 10 years.

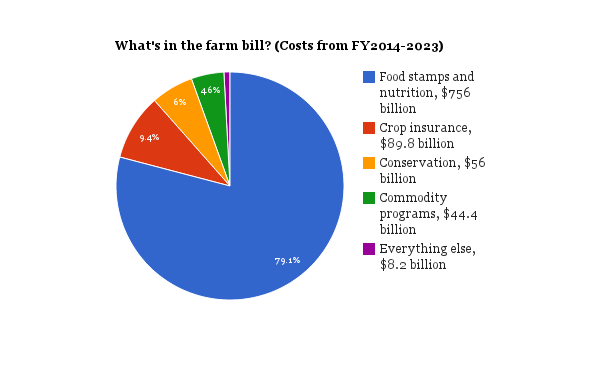

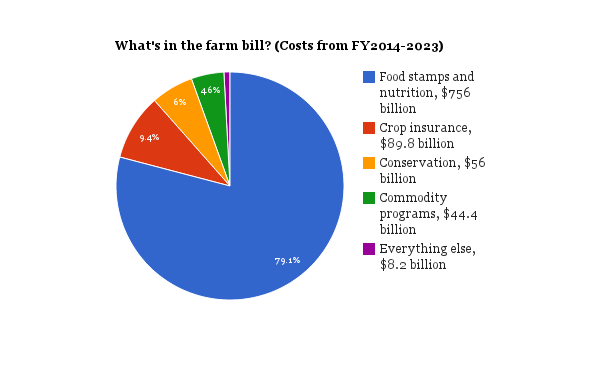

The chart below is courtesy of the WaPo.

This bill includes such goodies as:

— $3 million plan for Christmas tree taxes (15 cent levy per tree)

–$100 million will go to study how to get Americans to buy more maple syrup

–$1 million will buy weather radios for rural Americans

–$15 million ‘wool trust fund’

–$170 million program to protect catfish growers from overseas competition

But most of that money goes to food-stamp and nutrition programs, which are administered by the U.S. Department of Agriculture. The 10-year spending total for those entitlements will hit $756 billion under the new law.

Your tax dollars at work.

by | ARTICLES, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT

The story of “I, Pencil” is rightfully regarded as one of the most important economic essays of the 20th century. Known for both its brevity and simplicity, “I, Pencil” conveys the truth about the correlation between free people and economic freedom.

The brilliance of “I, Pencil” is that the lesson is told from the most unexpected perspective — that of the lowly pencil. Yet the very humbleness of the pencil is perfectly juxtaposed by the complexity through which the pencil itself comes into being.

Told through the eyes of the pencil, the pencil delightfully describes human ingenuity, cooperation, and connectedness — all necessary parts to bring the pencil to fruition. The pencil explains that it is a people free and unfettered, who have each learned and exchanged a skill, that ultimately will create a good — be it a pencil like him, or otherwise.

Ultimately, using the perspective of the pencil is a metaphor for Read’s salient point: for us all to look introspectively and understand ourselves, our potential, and the world in which we live and can contribute. That it is ultimately people, not some government, who can organize, work, and create a thing of beauty and of necessity.

In that regard, the recent movie adaptation of “I, Pencil”, produced by Competitive Enterprise Institute, fell short of its potential. To be sure, the film most certainly has beautiful and simple graphics to convey the story and show the complexity of markets. However, the message itself is narrated from an outside perspective explaining the process of creative industry using a pencil as an example, which is not how “I, Pencil” is written.

By choosing to retell “I, Pencil”, with a replacement narrator looking in instead of the pencil looking out, the film loses the charm of the story and the central message about individuals, their potential, and freedom to create. The story needs that foundation in order to powerfully and properly explain that people, not government, are the true source of economic freedom.

Though the film is good, it is not great, and misses a wonderful opportunity to really bring to life the message of “I Pencil”, and convey its truths about individual freedom and free markets. Start with the essay and then watch the movie — and be uplifted about the ingenuity of free people.

by | ARTICLES, BUSINESS, FREEDOM, GOVERNMENT, POLITICS

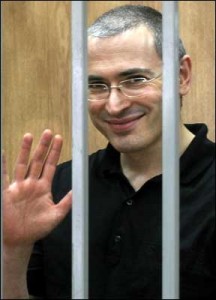

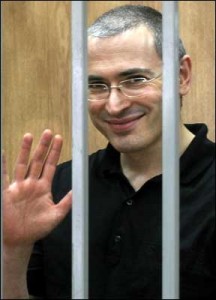

Mikhail Khodorkovsky, the former Yukos CEO and Russian billionaire, has just recently been released from jail. If I were him, my first act of new-found freedom would be to sue Goldman Sachs for billions of dollars. Watch out, Goldman Sachs investors!

I am a liberty-loving free market individual, which means I am generally pro-business. But as I have indicated so many times before, crony-capitalism is not free market, and thus it should be called out. Unfortunately, that cronyism does not entirely escape the upper echelons of the finance world and a horrific lack of integrity sometimes seeps into Wall Street. The story of Mikhail Khordorkovsky and Goldman Sachs is such an example.

First, a parallel story: in the late 1980’s, the State of Washington issued Washington Power Public Service bonds (commonly called “WPPSS”) to finance a number of nuclear power plants. The bonds were considered very high quality as they were guaranteed 1) not only by the project, but 2) also unconditionally by the State of Washington, and 3) even regardless of whether the plants ever actually got constructed.

First Boston was a lead underwriter of this issue.

When oil and gas prices dropped sharply a few years later, the State of Washington decided to renege on its guarantee and default to the tune of $2.25 billion. It argued (incredibly) that they didn’t have the right to make such a guarantee. The Washington Courts upheld this point of view (naturally), and the Supreme Court (ridiculously) claimed that it was a state matter, despite the fact that many little old ladies — like my mother — pension funds, and other investors from all around the country were devastated by this “fraud”. This was undeniably gross negligence.

The most frustrating part of the matter, however, happened after the decision was issued. The State of Washington needed to raise money by issuing new bonds. And who do you think was the lead underwriter this time around, despite the scam that had cost their customers hundreds of millions of dollars….

You guessed it — First Boston again, a stunning lack of integrity from world of government and finance. But this fraud pales in comparison to that of Mikhail Kordorkovsky and Vladmir Putin.

I was reminded of the WPPSS affair (also known as “Whoops”) when in 2003, in a brazen act of thievery, Vladimir Putin “confiscated” the controlling interest in shares of the Yukos Oil Company held by Mikhail Khodorkovsky.

Khordorkovsky built a company that grew in wealth and stature upon the collapse of the Soviet Union. Shortly after Kordorkovsky was named “Person of the Year” by the Russian business magazine “Expert”, he was arrested.

There were laughable “criminal” and “tax cheating” charges leveled against Khodorkovsky, for which he has been in jail for a decade until just last month.

As Khordorkovsky’s popularity grew while in prison, Putin suddenly and obviously made a public relations decision in connection with the Olympics to release the famed Khordorkovsky. (Indeed, just in the last week, Khordorkovsky’s business partner was also released from his prison sentence.)

Everyone knew that the criminal charges were just a very thinly veiled justification for President (Dictator) Putin to steal the company for himself and the Russian people. I get it – that is his nature. But what has this to do with integrity, finance, or even WPPSS?

Underwriters.

Just as First Boston underwrote the first WPPSS project that fraudulently defaulted and was able to (incredibly) underwrite for the State of Washington again, Putin was able to perform his grand confiscation with the help of a major underwriter.

Upon restructuring the oil company following the arrest of Khodorkovsky, that fact that Vladmir Putin could then go to Goldman Sachs, who would gladly orchestrate the largest underwriting of stolen goods and fraud the world has ever seen, is utterly staggering.

Just as incredible, First Boston — later known as Credit Suisse during the time of the confiscating and beyond — also got in on the action (among others).

But the coziness between Putin and Goldman doesn’t end there. Just last winter, Goldman Sachs renewed its relationship with Putin by signing a three-year agreement with Russia’s Economy Ministry and the Russian Direct Investment Fund.

During that time, Goldman Sachs will be paid $500,000 to help Putin attract foreign investors. This latest partnership has been slammed by the Human Rights Foundation.

Now that Khodorkovsky is a free man once again, it wouldn’t take much for him to highlight the close relationship between Vladmir Putin and Goldman Sachs. I’m not a lawyer, but one would think that Goldman might have reason to be concerned about a potential lawsuit from Mr. Khodorkovsky for aiding and abetting the confiscation of his company.

by | ARTICLES, CONSTITUTION, FREEDOM, OBAMA, POLITICS

Errors and omissions (E&O) is the coverage that protects you from another individual or company that wants to hold you responsible for something that you provided which does not give expected results. Does the President have coverage?

There were many statements made last night during the State of the Union that didn’t seem to match up with reality for many Americans. Going through the transcript of the State of the Union, it was easy to point out problems in Obama’s address. Below, I’ve gone through the speech, and outlined in italics the exact words he said used.

Looks like Obama needs insurance! I’m providing the errors and omissions coverage for Obama for the State of the Union he gave to everyday America.

____________

Tonight, this chamber speaks with one voice to the people we represent: it is you, our citizens, who make the state of our union strong.

>>> This chamber speaks with one voice because of the growing (mis)use of Executive Action used, and threatened to be used, by Obama during his Presidency.

Here are the results of your efforts: The lowest unemployment rate in over five years.

>>> It’s the lowest unemployment rate in over 5 years because of the amount of people who have stopped looking for a job. Obama fails to mention that this is also the lowest number of workers in the workforce since the early 1960s.

Our deficits – cut by more than half

>> Deficits have been cut only this year because of non-policy reasons (Large Fannie/Freddie payments to the Treasury in 2012 and accelerated tax transactions at the end of 2012 that count on this fiscal year). Also, we still have had yearly $1 trillion deficits, which was never seen before Obama became president.

And for the first time in over a decade, business leaders around the world have declared that China is no longer the world’s number one place to invest; America is.

>> No, actually this year, America fell out of the top ten list for the first time in twenty years on the Index of Economic Freedom.

In the coming months, let’s see where else we can make progress together. Let’s make this a year of action. That’s what most Americans want – for all of us in this chamber to focus on their lives, their hopes, their aspirations.

>>> Most Americans don’t want Congress to take action for the sake of action. Most people want Congress to get out of the way so that they can make their own destiny.

Today, after four years of economic growth

>>> Economic growth has slowed to a crawl

and those at the top have never done better

>> Those at the top have lost more wealth than any other income bracket and have also seen their taxes rise due to legislation passed during Obama’s presidency

But average wages have barely budged.

>>> Businesses can’t afford to pay their workers more due to excessive regulations, higher taxes, and Obamacare changes — all which have hindered their ability to operate day-to-day and more importantly, plan long-term.

And too many still aren’t working at all.

>>> This is first true statement of the night<<<

So wherever and whenever I can take steps without legislation to expand opportunity for more American families, that’s what I’m going to do.

>>> Bypassing the Constitution is not how American families elected the President to operate.

Opportunity is who we are. And the defining project of our generation is to restore that promise.

>>> Debt is who we are. We can’t restore opportunity with this generation or the next because of the staggering amount of debt — more than $50,000 per man, woman, and child

So let’s make that decision easier for more companies. Both Democrats and Republicans have argued that our tax code is riddled with wasteful, complicated loopholes that punish businesses investing here, and reward companies that keep profits abroad.

>>> Please cite the loophole. American businesses are actually punished with the highest corporate tax rate in the world. They move businesses abroad so that they can keep more of their hard earned money themselves.

But I will act on my own to slash bureaucracy and streamline the permitting process for key projects, so we can get more construction workers on the job as fast as possible.

>>>Is this before or after we start the “Shovel-Ready” projects?

Federally-funded research helped lead to the ideas and inventions behind Google and smartphones. That’s why Congress should undo the damage done by last year’s cuts to basic research.

>>> Federally funded research — like Green Energy companies or NIH “studies”?

Now, one of the biggest factors in bringing more jobs back is our commitment to American energy. The all-of-the-above energy strategy I announced a few years ago is working, and today, America is closer to energy independence than we’ve been in decades.

>> That strategy of subsidizing companies like Solyndra, Satcon Technology, and A123 systems?

One of the reasons why is natural gas – if extracted safely, it’s the bridge fuel that can power our economy with less of the carbon pollution that causes climate change. Businesses plan to invest almost $100 billion in new factories that use natural gas.

>>>While shuttering the coal industry by imposing overreaching and impossible regulations to run them out of business.

Let’s continue that progress with a smarter tax policy that stops giving $4 billion a year to fossil fuel industries that don’t need it, so that we can invest more in fuels of the future that do.

>> Lets continue with a smarter tax policy that stops giving billions of our taxpayer money to subsidize companies that still manage to go bankrupt

And even as we’ve increased energy production, we’ve partnered with businesses, builders, and local communities to reduce the energy we consume.

>>> By taking away our regular lightbulbs

When we rescued our automakers, for example, we worked with them to set higher fuel efficiency standards for our cars. In the coming months, I’ll build on that success by setting new standards for our trucks, so we can keep driving down oil imports and what we pay at the pump.

>>> So that the price of cars goes up for consumers, and so that state legislatures can imposes fees on hybrids and electric cars because they are not bringing in as much revenue from fuel-efficient cars via the gas tax.

But the debate is settled. Climate change is a fact.

>>> It’s Global Warming when it is warm, and Climate Change when it is cold. It must be a polar vortex out there

So let’s get immigration reform done this year.

>>> If you want immigration reform done, try doing it through Congress, not by Executive Fiat.

Two years ago, as the auto industry came roaring back

>>> How did it come “roaring back” again? Cash for Clunkers cost taxpayers money, taxpayers had to bail out the auto industry, and production of the “new” electric cars is sluggish or has stopped altogether

And if Congress wants to help, you can concentrate funding on proven programs that connect more ready-to-work Americans with ready-to-be-filled jobs.

>>>What are these ambiguous and undetailed “programs”, and if they are so “proven”, why are record numbers of Americans still not working?

I’m also convinced we can help Americans return to the workforce faster by reforming unemployment insurance so that it’s more effective in today’s economy. But first, this Congress needs to restore the unemployment insurance you just let expire for 1.6 million people.

>>>99 weeks of unemployment isn’t enough?

Five years ago, we set out to change the odds for all our kids. We worked with lenders to reform student loans, and today, more young people are earning college degrees than ever before.

>>Obama’s reform was that the rates on federal student loans just doubled. And more young people are in debt than ever before just out of college with dismal job prospects — thanks to Obama’s economy.

And as Congress decides what it’s going to do, I’m going to pull together a coalition of elected officials, business leaders, and philanthropists willing to help more kids access the high-quality pre-K they need.

>>> Because or current K-12 education system is already leading the world in education, right, so we can focus on pre-K?

Today, women make up about half our workforce. But they still make 77 cents for every dollar a man earns. That is wrong, and in 2014, it’s an embarrassment. A woman deserves equal pay for equal work.

>>> Unless you work for the White House. Obama’s own White House staff still underpays its women compared to men.

In the coming weeks, I will issue an Executive Order requiring federal contractors to pay their federally-funded employees a fair wage of at least $10.10 an hour – because if you cook our troops’ meals or wash their dishes, you shouldn’t have to live in poverty.

>>> That’s giving Federal Workers a 42% pay raise unilaterally with my tax dollars.

Tom Harkin and George Miller have a bill to fix that by lifting the minimum wage to $10.10. This will help families. It will give businesses customers with more money to spend. It doesn’t involve any new bureaucratic program. So join the rest of the country. Say yes. Give America a raise.

>>> Businesses will not be able to absorb a minimum wage hike of up to 42% without cutting jobs to make up the balance sheet. That will give Americans more unemployment.

And if this Congress wants to help, work with me to fix an upside-down tax code that gives big tax breaks to help the wealthy save, but does little to nothing for middle-class Americans.

>>> Please state the big tax breaks to save? The wealthy pay a 39.6% of their income to the government (not counting state and local taxes) plus the Obamacare surtaxes that started this year, also only for the wealthy. That means they save less of their money because more gets taken in taxes to fund the government.

Send me legislation that protects taxpayers from footing the bill for a housing crisis ever again, and keeps the dream of homeownership alive for future generations of Americans.

>>> Americans footed the bill for the housing crisis in the form of TARP (which Obama voted for as Senator) and ARRA (which Obama signed as President). Obama could have paid the mortgage off for every homeowner in America and still have spent less taxpayer money overall. Talk about economic stimulus and the dream of homeownership!

One last point on financial security. For decades, few things exposed hard-working families to economic hardship more than a broken healthcare system. And in case you haven’t heard, we’re in the process of fixing that.

>>> After we fix the website, the application process, the security holes, and the healthplans…

That’s what health insurance reform is all about – the peace of mind that if misfortune strikes, you don’t have to lose everything.

>>> Not everything. But you can lose your health plan, and you can lose your doctor

Already, because of the Affordable Care Act, more than three million Americans under age 26 have gained coverage under their parents’ plans. More than nine million Americans have signed up for private health insurance or Medicaid coverage.

>>> Signed up means “Placed in the shopping cart”. And millions more have lost their plans and haven’t signed up with Obamacare

And here’s another number: zero. We did all this while adding years to Medicare’s finances, keeping Medicare premiums flat, and lowering prescription costs for millions of seniors.

>>> Here’s another number: Trillions. Obama added trillions to Medicare’s entitlement deficit and trillions to our deficit to pay for Obamacare

So again, if you have specific plans to cut costs, cover more people, and increase choice – tell America what you’d do differently. Let’s see if the numbers add up. But let’s not have another forty-something votes to repeal a law that’s already helping millions of Americans like Amanda. The first forty were plenty. We got it. We all owe it to the American people to say what we’re for, not just what we’re against.

>>> We’ve polled the American people and the majority of the American people are for repealing Obamacare.

That’s why, tonight, I ask every American who knows someone without health insurance to help them get covered by March 31st. Moms, get on your kids to sign up. Kids, call your mom and walk her through the application.

>>> Because the enrollment numbers are so low, the President has to actually beg the American people to sign up, use millions in taxpayer money to run ads, and use Hollywood to promote Obamacare

It should be the power of our vote, not the size of our bank account, that drives our democracy.

>>> We are a Republic, not a democracy, Mr. President

And I know this chamber agrees that few Americans give more to their country than our diplomats and the men and women of the United States Armed Forces.

>>> Obama cares so much for the military that he just announced a 42% pay increase for federal workers, after just making cuts to military pensions.

But I will not send our troops into harm’s way unless truly necessary

>>> Yes, we saw that policy with Benghazi

That’s why I’ve imposed prudent limits on the use of drones – for we will not be safer if people abroad believe we strike within their countries without regard for the consequence.

>>> What about being safer domestically? Obama fails to mention that the first US citizen was killed yesterday via drones because of a dispute over 3 cows that belonged to a neighbor.

That’s why, working with this Congress, I will reform our surveillance programs – because the vital work of our intelligence community depends on public confidence, here and abroad, that the privacy of ordinary people is not being violated.

>>> Translation: If you like your privacy, you can keep your privacy, just like your health plan and doctor.

And it is American diplomacy, backed by pressure, that has halted the progress of Iran’s nuclear program – and rolled parts of that program back – for the very first time in a decade. As we gather here tonight, Iran has begun to eliminate its stockpile of higher levels of enriched uranium. It is not installing advanced centrifuges. Unprecedented inspections help the world verify, every day, that Iran is not building a bomb. And with our allies and partners, we’re engaged in negotiations to see if we can peacefully achieve a goal we all share: preventing Iran from obtaining a nuclear weapon.

>> That’s not what Iran says. Please show us the agreement signed between our two nations. Obama has yet to do that.

And we all continue to join forces to honor and support our remarkable military families.

>>> Obama honors them by making reductions to their pensions and going after military chaplains’ ability to minister to troops

The America we want for our kids – a rising America where honest work is plentiful and communities are strong; where prosperity is widely shared and opportunity for all lets us go as far as our dreams and toil will take us – none of it is easy. But if we work together; if we summon what is best in us, with our feet planted firmly in today but our eyes cast towards tomorrow – I know it’s within our reach.

>>> As Obama reaches for his pen — not to work together under the Constitution, but unilaterally by Executive Order like he stated repeatedly during this address.

Believe it.

>>> As Obama asked us to believe him on Benghazi, the IRS, Fast and Furious, Obamacare, our doctors, and our health plans, to name a few.

God bless you, and God bless the United States of America.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, TAXES

It seems like the White House and media these days are spending a lot of their energy discussing disparity between the haves- and have-nots. The phrase “income inequality” is especially being used more frequently as a means to continue the class warfare rhetoric and is absolutely certain to be a major theme of Obama’s State of the Union Address this month.

Many explanations are bandied about in an attempt to show that “devious policies” are causing the wide gulf between higher and lower income earners. They include the vague and general terms such as “special tax benefits for the wealthy”, “corporate welfare”, and a “tax system that favors those with higher incomes”. Though these targets are great for talking points, they fail solidly on substance.

There are no virtually no special benefits for the wealthy — only higher tax rates, phased out tax deductions, and added surtaxes that lower income earners do not have to contend with. As for corporate welfare, though it does exist, it only affects a few crony capitalist-type industries and companies out of the millions of small businesses which form the backbone of our economy (think: GE, green energy, electric cars). What’s more, the tax system clearly favors those with lower incomes, not higher, with lesser rates and more deductions and tax credits available. It has been shown clearly and indisputably that the US has – by a large margin – the most progressive taxes in the world (yes, far more progressive than even Europe and the Scandinavian countries). Though there is income inequality in America, why it exists is not what you think.

The simple reason is this: unlike people in the fastest growing countries, and unlike our own citizens in prior generations, the current middle and lower income classes in America have lost their inclination to personally invest in their future. I would argue that much of this is because the growing government welfare system is stripping individuals of their need to prepare and plan ahead, and a wide safety net also exists. For the most part, it is only the upper middle and higher income individuals — those who are not the beneficiaries of government welfare and those with more entrepreneurial orientation — that are forcing themselves to save and put this money at risk into investments for their future.

Much of China’s current economic success can be directly attributed to the financial attitude of their citizens with regard to investing. Almost all earners, including and especially the middle and lower income ones, keep a certain amount of income each month and invest it in both entrepreneurial endeavors and the existing equity markets. It is common for even the minimum wage earners to save at least 10% of their income! Large or small sum, they regard investment as a priority and a path to prosperity.

I have a close relative who is an owner and executive of a substantial manufacturing operation that he started in Shenzhen, China because of its business friendly environment. I’ve heard from him many times that he went into business, not to comply with government regulations, but to make things. And part of that business friendly environment is the people. He has been pleasantly surprised by the careful frugality of the owners and their passion to invest and grow– a sentiment extends to, and is practiced by, even their lowest paid workers.

Contrast this to the present state of affairs in our country. We have not been saving– we have been borrowing for more than a generation now. Citizens have mortgaged their future by consuming continuously — while investing nothing — and passing on that example to the next generation. We are turning into a country where people will begin to wonder why they should invest, if it’s just going to be taken away from them in the long run by those who do not, or go into a market that is wholly unstable.

People are encouraged to spend as if consumption is a good thing , but truly, it is investing that is far better for individuals and for the economy as a whole. When our government pushes measures such as extending unemployment benefits, food stamps and other welfare programs, it reinforces prolonged financial dependency. It is government policy aimed in the wrong direction as recipients have harder, not easier, obstacles to overcome.

The biggest problem that this country has to deal with regard to moving people away from a culture of dependency is that it continues to be demagogued by the Left for the precise reason that it easily mischaracterizes those who might being against such policies as “insensitive” and as being against the “less well off”. But many who are opposed to such policies merely recognize that success of investment, independence, and upward mobility are making other countries greater while we persist our slide into wider dependencies and economic decline.

In order to get the middle class back on track, we must focus our efforts and rhetoric on reminding ourselves that this country was built upon those who were willing to invest their time and money to become great. It is the true source of upward mobility – and those that do not do their fair share will be left behind by those who do. This is what truly drives at the heart of income inequality in our country.

Investment is what made our country thrive and it is the only thing that will properly sustain our country’s financial future.

_________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ECONOMY, FREEDOM, QUICKLY NOTED, TAXES

“We must make our election between economy and liberty, or profusion and servitude. If we run into such debts as that we must be taxed in our meat and in our drink, in our necessities and our comforts, in our labors and our amusements,… our people … must come to labor sixteen hours in the twenty-four, give our earnings of fifteen of these to the government,… have no time to think, no means of calling our mis-managers to account; but be glad to obtain sustenance by hiring ourselves out to rivet their chains on the necks of our fellow-sufferers…. And this is the tendency of all human governments … till the bulk of society is reduced to be mere automatons of misery…. And the forehorse of this frightful team is public debt. Taxation follows that, and in its train wretchedness and oppression”.

Thomas Jefferson, 1816

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ECONOMY, FREEDOM, POLITICS

As a Jewish guy, I hardly pay attention to the leaders of other religions, but Pope Francis has won my admiration since his election this past spring. So it was somewhat dismayed when I read his recent Papal Exhortation published last month. In one section, Pope Francis seems to very nearly reject the idea of “trickle down economics”, a position that, if indeed true, would be devastating to the world.

Being in finance and business for decades, it has become abundantly clear that free markets are the best path to prosperity. So what to make of Francis’s thoughts?

My Catholic friends tell me that Francis’s discussion follows the the same path of Catholic Social Teaching — under which economics loosely falls — from the last several Popes, and therefore he hasn’t said anything new or different on the topic. This sentiment was echoed in Peggy Noonan’s piece published in the WSJ regarding Francis’s publication. Noonan was cautiously optimistic that Francis wasn’t rejecting free markets and she welcomed the conversation he has created.

On the other side of the aisle, Francis was blasted by some fiscal conservatives over a particularly thorny paragraph:

“In this context, some people continue to defend trickle-down theories which assume that economic growth, encouraged by a free market, will inevitably succeed in bringing about greater justice and inclusiveness in the world. This opinion, which has never been confirmed by the facts, expresses a crude and naïve trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system. Meanwhile, the excluded are still waiting. To sustain a lifestyle which excludes others, or to sustain enthusiasm for that selfish ideal, a globalization of indifference has developed. Almost without being aware of it, we end up being incapable of feeling compassion at the outcry of the poor, weeping for other people’s pain, and feeling a need to help them, as though all this were someone else’s responsibility and not our own. The culture of prosperity deadens us; we are thrilled if the market offers us something new to purchase; and in the meantime all those lives stunted for lack of opportunity seem a mere spectacle; they fail to move us.”

Here, it’s easy to see on the surface that the language Pope Francis employs — that trickle-down theories “have never been confirmed by the facts” of being successful — can be confusing. This is a very valid criticism. Certainly, the world has seen economic gains in numerous places where trickle-down economics has been practiced, including Pope Francis’s Argentina, but he seems not to discuss them.

A second reading suggests that “Free markets aren’t what Francis is criticizing here, but rather the lazy idea that “trickle down” economics somehow lifts people from poverty by its own volition, much as a sale at Wal-Mart somehow lifts people from poverty. Does it?

Francis — as well as any causal observer of any video showing Wal-Mart shoppers fight over $500 televisions — would disagree. Francis condemns a consumerist culture that is merely keeping up with the Joneses as it were (or in Francis’ words, “ we are thrilled if the market offers us something new to purchase; and in the meantime all those lives stunted for lack of opportunity seem a mere spectacle”) and simply views human beings as participants in the spectacle of consumerism as something abhorrent… “they fail to move us” as Pope Francis rightly mentions.

So what do the leaders of conservative finance and economics do about Pope Francis? Obviously he will be writing more during his pontificate. Clearly, the world is watching and his remarks and actions speak volumes not just to Catholics any more.

It’s worth it to remember that Pope Francis is not an economist first and foremost. That being said the sweeping generalities seen in his exhortation were ripe for wide interpretation. Don’t forget, the liberal media is always waiting in the wings for a statement or a sentence (this time paragraph 54) that “shows” the Pope is on their (liberal) side — in this case the issue was economics.

Pope Francis is a speaker of freedom, and in that should be included economic freedom. We have a potential opportunity to educate the Pope and ally with him about the truth about economics and the free market. Will the world listen?

by | FREEDOM, HYPOCRISY, OBAMA, OBAMACARE, POLITICS

The great bait-and-switch of Obamacare (“you can keep your plan and your doctor”) was intentionally orchestrated by the architects of the legislation. There were thousands of policies offered nationwide that were good and even very good but now they can’t be sustained under the new Obamacare policy requirements. These regulations are so narrow that it intentionally made obsolete or non-compliant the vast majority of health care policies in that were currently in existence, thereby requiring the insurers to cancel those offerings.

There are 10 essential benefits to Obamacare that every policy now must have. Most of them are routine and were likely found in some form on the vast majority of plans pre-Obamacare. Forbes recently compiled a list of these required items:

1) Ambulatory patient services – Care you receive without being admitted to a hospital, such as at a doctor’s office, clinic or same-day (“outpatient”) surgery center. Also included in this category are home health services and hospice care (note: some plans may limit coverage to no more than 45 days).

2) Emergency services – Care you receive for conditions that could lead to serious disability or death if not immediately treated, such as accidents or sudden illness. Typically, this is a trip to the emergency room, and includes transport by ambulance. You cannot be penalized for going out-of-network or for not having prior authorization.

3) Hospitalization – Care you receive as a hospital patient, including care from doctors, nurses and other hospital staff, laboratory and other tests, medications you receive during your hospital stay, and room and board. Hospitalization coverage also includes surgeries, transplants and care received in a skilled nursing facility, such as a nursing home that specializes in the care of the elderly (note: some plans may limit skilled nursing facility coverage to no more than 45 days).

4) Laboratory services – Testing provided to help a doctor diagnose an injury, illness or condition, or to monitor the effectiveness of a particular treatment. Some preventive screenings, such as breast cancer screenings and prostrate exams, are provided free of charge.

5) Maternity and newborn care – Care that women receive during pregnancy (prenatal care), throughout labor, delivery and post-delivery, and care for newborn babies.

6) Mental health services and addiction treatment – Inpatient and outpatient care provided to evaluate, diagnose and treat a mental health condition or substance abuse disorder (note: some plans may limit coverage to 20 days each year).

7) Rehabilitative Services and devices – Rehabilitative and habilitative services and devices to help you gain or recover mental and physical skills lost to injury, disability or a chronic condition. Plans have to provide 30 visits each year for either physical or occupational therapy, or visits to the chiropractor. Plans must also cover 30 visits for speech therapy as well as 30 visits for cardiac or pulmonary rehab.

8) Pediatric Services – Care provided to infants and children, including well-child visits and recommended vaccines and immunizations. Dental and vision care must be offered to children younger than 19. This includes two routine dental exams, an eye exam and corrective lenses each year.

9) Prescription drugs – Medications that are prescribed by a doctor to treat an illness or condition. Examples include prescription antibiotics to treat an infection or medication used to treat an ongoing condition, such as high cholesterol. At least one prescription drug must be covered for each category and classification of federally approved drugs.

10) Preventive and wellness services and chronic disease treatment – Preventive care, such as physicals, immunizations and cancer screenings designed to prevent or detect certain medical conditions. Also, care for chronic conditions, such as asthma and diabetes.

The bulk of this list consists of items that were not necessarily mandatory on any insurance plan, but were fairly common in some form or another. For instance, maternity care might have been an add-on some plans, included on others, but was relatively common in the industry. However, there are two items in particular on this list which are recent healthcare innovations not widely found. Therefore, their inclusion as criteria for assessing whether a health plan was “good” or “not good” rendered most current insurance plans incomplete — and therefore obsolete — for Obamacare. They are 1) “rehabilitative and habilitative care” and 2) “pediatric services”.

On the matter of rehabilitative and habilitative services, the new Obamacare essential makes a distinction between Rehabilitative Services (which help to recover lost capacities) and Habilitative Services (which “help people acquire, maintain, or improve skills and functioning for daily living”). Statereforum.org, a site devoted to health reform implementation, concurs that Habilitative services — a word not readily familiar to many people — are “a set of benefits not traditionally covered by private health insurance”.

When Health and Human Services made their final decisions this past November on the 10 Essentials for health plans, it “recognized that many health plans across the country do not recognize habilitative services as a distinct group of services. HHS proposed a flexible policy that allows states to define habilitative services if their benchmark plan fails to do so”. In the Federal Register published on November 26, 2013, it was specifically noted that this flexibility “will provide a valuable opportunity for states to lead the development of policy in this area and welcome comments on this proposed approach to providing habilitative services”. In other words, HHS created an benefit requirement that most insurance plans didn’t cover and isn’t even uniformly defined in the industry. Because nearly all plans lacked this “essential item”, most existing health insurance plans have been declared non-compliant.

With regard to pediatric services, it has typically been a matter in the healthcare industry that dental and vision coverage — particularly for children — are not to be included as part of a health insurance policy. Those that do have almost always have it as an add-on where you get services elsewhere, and only a few of the largest companies even bothered to offer it. This “must have” was never a part of a normal healthcare environment, and by making this one of the compliance items, it too has rendered nearly all plans incompatible with Obamacare regulations.

It has become clear that few existing health insurance policies pass the Obamacare litmus test. This carefully engineered attack on the “bad apple” health care industry was to induce a large-scale shift of citizens onto the exchanges (to pay for Obamacare) after their insurance was inevitably canceled. “If you like your plan you can keep it”, was a hollow promise all along. With the website calamity, Obamacare has utterly backfired — but the citizens are left holding the bag of higher costs, canceled plans, and an uncertain future. There is a sense of irony that the Obamacare “benefits” have done nothing to benefit anyone.

by | ARTICLES, BLOG, FREEDOM, HYPOCRISY, OBAMA

The idea of “disparate impact” is a poisonous cancer that has taken root as an important concept in the business world. If we do not end it soon, it will continue to grow, extorting huge sums from innocent companies, creating an enormous economic burden on society, and allowing the tort bar to run amok.

Under disparate impact, there are many areas in business where charges of “discrimination”, often regarding race, could and are being made every day. Employment and mortgage origination are two of the most prevalent. The law requires – as it should -that for a company to be guilty of such discrimination, there must be an intent to discriminate.But government agencies have found a way to overrule that requirement by developing the concept of “disparate impact”. Disparate impact is the concept that allows for a showing that if a protected class of citizens has a statistically lesser representation with respect to a business (hiring, mortgages originated, etc.) it may be implied that the business has intentionally discriminated. This is clearly irrational, since there may be many economic, societal, and local reasons for the statistic. But disparate impact puts the burden to show lack of discrimination on the employer – guilty until proven innocent. In fact, in order for an employer to defend himself against such a charge, he would have to show that the “offending rule or practice” was a “business necessity”.

Though I find this concept outrageous, the federal and state governments and their agencies seem to love it. I therefore believe that they should be equally adamant in applying the concept in the public sector.

The IRS scandal has shown the clear practice of targeting conservative groups applying for 501c4 status. Under disparate impact theory, the charge of intentional discrimination would apply because there is no “business necessity” in the clearly statistically significant discrimination policy the IRS has employed. The Obama administration, having complete control and responsibility for the Department of the Treasury and its Internal Revenue Service.is therefore guilty of intentional discrimination. In particular, President Obama’s specific response, that there has been no evidence that anyone directed anyone to intentionally target conservatives, does not insulate him from being actually guilty.

The current administration has been keen on applying disparate impact theory to a number of private companies, and appears intent on ramping up the practice. For example, Obama’s labor secretary nominee, Thomas Perez, has been particularly lucrative in this regard. In June, National Review Online (NRO) covered some of Perez’s more recent cases, noting that Perez “has applied that theory vigorously to force large settlements from financial companies even in cases where there was no evidence of actual racial discrimination”. In other words, employers can be sought after for violating the law whether or not they intended to do wrong.

The White House in general, and Perez in particular, like disparate impact theory because it, as NRO notes, it “sets a very low bar for proving discrimination. Under it, prosecutors need not prove intent, merely that minorities have suffered a disparate impact from some action”. And this is a person Obama intends to add to his Presidential Cabinet.

If disparate impact can be applied to the private sector, it should also — in the spirit of fairness and equality, of course — be applied to the IRS. Numbers have been abused, and particular groups have been adversely singled out and subject to excessive, burdensome, and overreaching scrutiny; of this we are certain. The targeting of conservatives was a concerted effort to slow down or dissuade the creation of their tax-exempt groups. Even if the White House did not give a direct order (which remains to be seen), it doesn’t really matter anyway under disparate impact theory. Intent needs not to be proved in court; merely the act of discrimination is enough.

Based on the White House’s unmitigated belief of their ability to use disparate impact against companies for questionable practices, the rule should be applied to the IRS for its questionable practices as well. Since the IRS falls directly under the purview of the Executive Branch, why is the President of the United States therefore not directly responsible and culpable for the IRS abuse?

by | FREEDOM, GOVERNMENT, OBAMA, OBAMACARE

Obamacare was sold to the public as universal health insurance. Insurance, in and of itself, is an exchange of a premium payment in return for a guarantee against specific loss criteria — such as damage or death. Prime examples of this are home and life insurance. And yet, health insurance in our country is not merely a guarantee against loss due to ill health; it encompasses much, much more. In this way, health insurance doesn’t follow the examples of other insurance industries, and therein lies a major reason for Obamacare’s growing economic difficulties ($1.85 trillion) and growing opposition.

Typical health insurance plans nowadays function by providing both insurance and coverage of certain medical costs. With ObamaCare comes the individual mandate, which most people understand the meaning to be that everyone is required to purchase for themselves a health insurance policy (hence the idea of “universal coverage”). The rationale in favor of the individual mandate is to safeguard against societal calamity — that if someone doesn’t have health insurance and they get into an accident or get sick, he doesn’t become a burden on society.

A mandate to buy health insurance might not sound so terrible on the surface to some, because it dictates the purchase of something that just about everyone wants to buy anyway since it is sensible to do so. But what makes Obamacare’s individual mandate so odious is that it it forces people to buy a product comprised of both insurance and a slew of pre-selected, prepaid medical care – which includes paying for stuff they don’t need. This intentionally misuses people’s ability to buy their own reasonably priced insurance. And because the mandate requires coverage to be universal, you have to include everything and everyone, such as preexisting conditions, high risk, etc. Therefore, the individual mandate requires an-insurance-that-is-not really-just-insurance, making reality very different than what it is thought to be.

From an economic standpoint, the individual mandate is a terrible idea because its sole purpose is to obfuscate the true cost of caring for those persons whose circumstances or risk, such as preexisting conditions or age, would result in paying more for health insurance. By controlling the prices through artificial means instead of private competition, the individual mandate creates a misallocation of resources, which is a failure of the fundamental principles of Economics 101.

A second major problem with the individual mandate as it is written is that you can forgo coverage in lieu of paying a penalty and then if you develop a condition, you can still get coverage without being denied due to a pre-existing condition. Unfortunately, this only serves to make prices more expensive for those who are healthy because there must be funds to cover those who are not.

I would argue that having health insurance coverage should not be a mandate in the strict sense of the word; i.e, one should not be required to purchase it. That being said, I also think that people should regard the ownership of a health insurance policy (a “true insurance”) as a basic necessity for proper living. The attitude toward health insurance coverage –- by citizens, legislators, and insurance companies alike —- truly needs a paradigm shift if health care is to be reformed for the better. The health insurance sector must be restructured to resemble other insurance industries such as life, fire, and home; in doing so, they will create a more competitive and dignified system as well as fulfill the purpose of safeguarding against an unforeseen disaster. Therefore, the actual components of what comprises “health insurance” (currently insurance and pre-paid medical care) must change.

The idea of helping everyone to carry health insurance sounds like a lofty goal. However, the individual mandate is the wrong way to attain this. From human point of view, the idea that all persons have coverage may be good, but imposing the mandate is bad for liberty. Turning basic economics on its head, it incentivizes the wrong things and creates most expensive health care possible.

The government has never been efficient with other people’s money. The economics of the current health care law will only serve to reduce the quality of health care for our citizens because it lacks free market competition. A health care reform solution could be focusing on providing a ” true insurance” product that everyone could have – one that protects against having an extraordinary event happen whose economics is more than can be afforded. Obamacare is not an insurance; it is pre-paid medical care system whose product provides for all at all costs. Imposing an individual mandate for such a program is ultimately economically unsustainable. The current health care law should be overturned for the sake of the economic health of this country.