But we need more than just a “patch”. We need to eliminate the AMT from the tax code. Here’s why:

The Alternative Minimum Tax (“AMT”) presents hardships to the practitioner as well as the taxpayer who prepares his own return by, as its name implies, imposing a second tax calculation mechanism on taxpayers. It serves virtually no useful purpose, other than the raising of an ever-increasing amount of tax revenue. But it has become very clear in recent years that this AMT tax revenue is not coming from just the taxpayers who were the intended targets of this tax.

A very substantial majority of all AMT paid by taxpayers results from the following four factors:

- Treating state and local taxes as a preference

- Treating miscellaneous deductions as a preference

- Allowing lower exemptions than the regular tax.

Each of these, however, can be quickly shown as inappropriate factors with which to base a tax system intended to just make sure everyone pays a “fair share” of tax.

- State and local taxes are hardly a loophole. The taxes exacted by state and local governments are hardly “voluntarily” paid by taxpayers in an attempt to avoid paying federal taxes.

- Miscellaneous deductions is the category of deductions that consists primarily of expenses incurred to earn income that is subject to tax. It includes unreimbursed employee expenses, investment expenses, etc. This is the most basic and important deduction needed to have a truly fair income tax system. For example, if an individual pays a lawyer a fee for collecting back wages, the legal fee is a miscellaneous deduction. If an individual pays the lawyer $300 for collecting $1000 of back pay, netting $700, the AMT would tax the individual on the full $1000.

- The exemption available under the AMT tax system is a fixed dollar amount which, unlike exemptions and standard deductions under the regular tax system, is not indexed for inflation. Furthermore, it is phased out entirely over certain income levels. And each year Congress has to approve an annual “patch”, which raises the threshold for inflation, in order to raise the exemption limits of the tax so that less wealthy taxpayers won’t be subject to the AMT.

It must be noted that the annual AMT patch is not a tax cut at all, but merely the avoidance of a massive tax increase on millions of middle-income taxpayers’ families. Congress likes to point to the patch as some major revenue loss, had the AMT been applied to those families, as an excuse to raise to raise taxes in order to offset this “potential missing tax revenue”.

The AMT in its present form has no place in tax law. The AMT does not serve the purpose for which it was intended and functions in a most inequitable manner while adding enormous compliance burdens. It should therefore be changed to eliminate the adjustments for state and local taxes and miscellaneous deductions, update its rates, and modify its exemption — or else the AMT needs to be eliminated completely.

crossposted at redstate.com/alanjoelny

by | ECONOMY, FREEDOM, OBAMA, POLITICS, TAXES

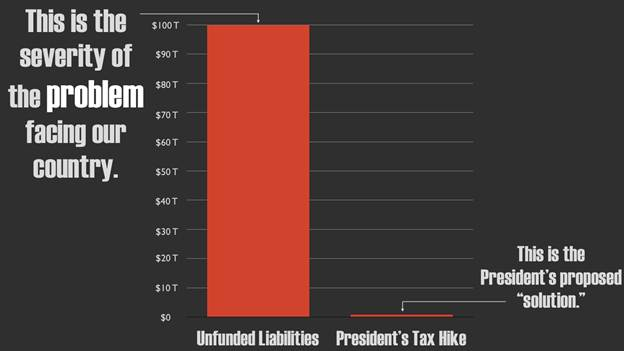

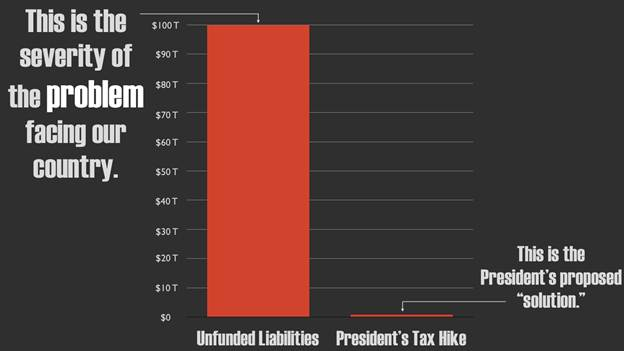

This is fairly self-explanatory

Obama’s plan to tax the rich would have very little impact on the crushing debt — even if you were to tax the top income-earners at 100%…but he doesn’t want to tell you that.

by | ECONOMY, FREEDOM, OBAMA, OBAMACARE, POLITICS, TAXES

I was talking to a small business owner the other day. He said it made more sense to “to pay a $2,000 fine than buy $6,000 insurance policy” (per employee, of course).

But there is no “fine”. It’s a “tax”. Employers who do not provide the one-size-fits-all, government-approved insurance demanded by Obamacare are taxed. And we know it’s a tax because the Supreme Court said so–in fact, if it isn’t a tax, if there is any hint that not purchasing insurance was bad behavior, Obamacare is unconstitutional.

Conservatives, people of integrity should take care to describe this payment to the government accurately: it is a tax on perfectly legal and moral behavior, not a fine for bad behavior. When you hear someone refer to the payment as a fine or hear them denigrate a business who opts to pay the tax rather than purchase insurance, be sure to remind them what the Supreme Court said.

by | CONSTITUTION, ECONOMY, FREEDOM, OBAMA, POLITICS, TAXES

Class warfare proved to be the winner in this election cycle as it was a key component of Obama’s policies and re-election rhetoric. The components of such a tactic were easily recognized: 1) the political opponent (Romney) will hurt those among us who are most vulnerable (elderly, poor, etc); 2) the political opponent (Romney) does not care about the “middle class”; 3) the political opponent (Romney) wants to benefit those most advantaged (the rich/elite).

The third point of this strategy was the one that resonated most with Obama supporters; he continuously and intentionally railed against “millionaires and billionaires”, and talked about “the wealthy paying their fair share” in order to create a divide and separate that particular fiscal population from the rest of “mainstream America”.

Besides the obvious baseness of such an argument coming from the President of the United States, it is critically important to note the amount of true millionaires and billionaires are so few in number, that taxing them more – as Obama plans to do – will not help with any significant deficit reduction. His assertion was pure dishonest political speech; you cannot possibly create enough revenue from the millionaire/billionaire population even if you were to tax them at 100%. Our fiscal situation is so dire in this country that an increased tax on this group in any large or small amount solves nothing in the long-term.

Unfortunately, none of this mattered to Obama. He intentionally threw the labels around so that they conveniently fit whatever emotive language would coerce voters and supporters to rally behind his outrageous monetary policies. It was classical class-warfare: antagonizing lower socio-economic groups against the “rich”. Simultaneously, he added record numbers of citizens to entitlement rolls, thereby creating a further divide. And it worked to win.

Obama has stated his intent to raise the marginal rates on the top income earners, (aka the “rich”, “wealthy”, or “top 2%”). Yet history shows us that higher tax rates results in less – not more – tax collections. Democrats like to wax poetic about the high rates of 70% and even 91%. What they fail to comprehend or deliberately don’t explain is that at those times, there were an enormous amount of tax shelters such as real estate, so that people could legally lower that taxable income and would not have to actually pay the outrageous tax rates.

With the IRC reforms of 1986, Reagan reduced the tax rates to 28% in exchange for getting rid of the tax shelters. As a result, the amount of federal income collected was more at 28% and a clean tax code than at 91% and tax shelters, because at 28%, it really wasn’t worth the time, cost, and effort to hide money. We need comprehensive tax reform, but not the type that Obama is pushing. His policies of more “tax credits” (which is government spending run through the tax code) and marginal rate increases hampers our recovery. If the federal tax rates are going to rise again – and they will – in addition to state and local tax hikes, the tax burden in this country will be staggering. People will do one of two things: 1) start finding ways not to pay it like they did when the rates were outrageous or 2) stop working and investing so much because it’s just going to get taken away from them. When that happens, the economy worsens — and it is already suffering enough.

Blindly vilifying the rich was simply a tactic Obama used to pit classes against one another for political gain. But putting it into practice? Imposing higher taxes on that segment of the population most able to invest in and aid our recovery is true economic ignorance. Why take additional money from those taxpayers who have been able to create wealth and employment successfully and give it to the government and politicians who have proven their ability to mismanage and squander income? What worked to win the White House, will not work to win the economy back.

(crossposted at redstate.com/alanjoelny)

by | FREEDOM, POLITICS, TAXES

That was the year the death tax was completely eliminated for one year. The families of philanthropist John Kluge, Texas oilman Dan Duncan, and Yankee’s mogul George Steinbrenner made out like bandits in 2010. Unfortunately, 2013 will see a crushing increase in the death tax.

In 2013, the death tax will revert to its antiquated, pre-2001 form. The applicable exclusion amount will plummet to $1,000,000, and the top marginal rate will leap twenty points to 55%. A 5% surtax will also return, to be levied on estates between $10 million and $17 million. This raises the top effective rate of the death tax to 60%.

Not only will the rate sharply increase, the amount of people estimated to be affected by the tax law changes will go up more than 13-fold. But truest and most invisible effects will be felt in the economy:

The economic incidence of the death tax is far broader, because it causes many wealthy individuals to save less, choosing instead to retire early or, as Milton Friedman put it, “dissipate their wealth on high living.” This reduction in savings means a concomitant reduction in investment, lessening the flow of capital to businesses and organizations where countless ordinary Americans are employed.

Additionally, a study done by the Tax Foundation when the death tax was 55% concluded that it “has roughly the same effect on entrepreneurial incentives as a doubling of income tax rates.”

The death tax rate change is only one of many, many tax increases scheduled for 2013, unless Congress makes changes to it at the last minute.

by | ARTICLES, ECONOMY, FREEDOM, TAXES

In a different article, I exposed the myth of income inequality, rhetoric that is constantly being repeated by the Obama administration and the media. Using data from the CBO and the IRS, Ron Schmidt of the University of Rochester School of Business was able to dissect and expose the inaccuracies being perpetuated. The Left frequently cited a CBO report that claimed to show income was at an all-time high, but it was revealed that reported only represented data until 2007 — right before the Great Recession began. The article is worth a two minute read.

Picking up where the CBO data left off, the newest CBO report confirms that that income gap is indeed shrinking — not expanding as we are constantly being told. According to CNBC,

Between 2007 and 2009, after-tax earnings by Americans in the top one percent for income fell 37 percent. On a pre-tax basis they fell 36 percent in the same period.

and at the same time,

when you take into account federal transfers, assistance and taxes paid, the incomes of the bottom 20 percent grew by 3 percent, while it fell a modest 2 percent for the middle 20 percent. In other words, the incomes of the top one percent fell 18 times more than the incomes for the middle class at the start of the recession.

The article goes on to show that the amount of taxes paid by upper-income earners is also higher now than before the Great Recession. Although the author was incorrect that the current highest level tax margin is the lowest rate ever (it was lowered in the 1986 IRC reforms to 28% ), he correctly concludes that the highest earners

paid an average effective tax rate of 28.9 percent on their income — far more than any other group, and more than twice the average effective rate of the middle class, who paid 11 percent on average.

Overall, a good analysis to help refute the continuous income inequality argument used as a justification to raise taxes on the wealthy in order to pay for the government’s overspending problem.