by | ARTICLES, BLOG, BUSINESS, ECONOMY, GOVERNMENT, HYPOCRISY

Right before the government shutdown, Detroit received a pledge for a $320 million federal “aid package”. The Obama Administration wants to make it perfectly clear: this is not a bailout. That word is too toxic during this time of fiscal instability in Washington. This is relief. A stimulus. It is a hand-up, not a hand-out, and, as the NY Times reports, this will not be the only federal infusion that Detroit receives to get back on its feet.

Some questions immediately come to mind:

1) Various news agencies reported that the funds are being scraped together mainly from agencies such as TARP, FEMA, Homeland Security, and HUD. Who authorized this aid package?

2) Much of the funds are for projects that are similar to projects already funded by alternative sources, such as the Ford, Kresge, and Knight Foundations. The funds will not be used in anyway with regard to debt structuring. Why are federal funds duplicating projects already in motion?

3) Detroit already receives 71 federal grants for operation and it still couldn’t manage to avoid bankruptcy. Clearly, Detroit has been malfunctioning for years even with government intervention, so Why are we propping up this city even more?

4) What is to prevent other cities who are struggling financially for reasons to call for aid? After the aid to Detroit was announced, at least one Congressman, Jerry McNerney, went on the offensive. He wrote to the White House asking why aid was not extended to Stockton, California, a city which declared bankruptcy last year, “and suffers from many of the same problems as Detroit”. Will this type of federal aid package for cities become a slippery slope? Will it be a pick-and-chose/reward scenario? How about a carrot dangled to cities?

A recent WSJ article on the aid noted that with federal money comes strings. “Grants from the Transportation and Housing and Urban Development Departments will require the city to pay prevailing union wages, which will jack up costs. Prevailing wage is an economic compensation theory that requires municipalities to pay more-than-market wages. The end result of paying prevailing wages means that Detroit will get less with their our money. Even now, prevailing wage theory is hotly contested in NYC, a form of unionism for those workers who are non-unionized. Isn’t this type of overpayment what helped get Detroit into the mess it is in in the first place?

Furthermore, this cash fund may impact pension reforms that city manager Kevyn Orr is trying to accomplish. The pension managers insist that pensions are only underfunded by $634 million, while Orr is arguing closer to $3 billion. Part of pension restructuring and cost savings proposed by Orr were expected to be re-diverted toward blight abatement. With the arrival of this federal aid package — much of which is supposedly for the blight problem — you can expect that pensioners will argue that their pensions do not need, or need less of, the chopping block. That is a pity, as it undermines real pension reform so badly needed in Detroit.

What Kevyn Orr really needs to do to forge a path of prosperity in Detroit is to completely fund the pension system according to what the pension managers say they need ($634 million vs $3 billion), in exchange for complete government removal from the pension system; Impose a switch from a defined benefit model to a defined contribution model and be done with it. Let the pension heads grapple and manage their own funds now. Such a bold fiscal move would give Detriot a much more solid path to economic revitalization than any aid package can do.

There was no emergency that necessitated the use of federal funds being injected into the city of Detroit. No Katrina. No Sandy — only decades of fiscal irresponsibility, corruption, mismanagement. This “non-bailout” only undermines the task of this city, and potentially others, to make hard decisions about money, taxes, pensions, and budgets. It is a band-aid where a tourniquet (or maybe an amputation?) is needed. In a city rife with every kind of unimaginable fiduciary irresponsibility, the idea that the city of Detroit should be entitled to receive any more federal tax dollars is wholeheartedly repugnant.

by | FREEDOM, GOVERNMENT, OBAMA, OBAMACARE

Obamacare was sold to the public as universal health insurance. Insurance, in and of itself, is an exchange of a premium payment in return for a guarantee against specific loss criteria — such as damage or death. Prime examples of this are home and life insurance. And yet, health insurance in our country is not merely a guarantee against loss due to ill health; it encompasses much, much more. In this way, health insurance doesn’t follow the examples of other insurance industries, and therein lies a major reason for Obamacare’s growing economic difficulties ($1.85 trillion) and growing opposition.

Typical health insurance plans nowadays function by providing both insurance and coverage of certain medical costs. With ObamaCare comes the individual mandate, which most people understand the meaning to be that everyone is required to purchase for themselves a health insurance policy (hence the idea of “universal coverage”). The rationale in favor of the individual mandate is to safeguard against societal calamity — that if someone doesn’t have health insurance and they get into an accident or get sick, he doesn’t become a burden on society.

A mandate to buy health insurance might not sound so terrible on the surface to some, because it dictates the purchase of something that just about everyone wants to buy anyway since it is sensible to do so. But what makes Obamacare’s individual mandate so odious is that it it forces people to buy a product comprised of both insurance and a slew of pre-selected, prepaid medical care – which includes paying for stuff they don’t need. This intentionally misuses people’s ability to buy their own reasonably priced insurance. And because the mandate requires coverage to be universal, you have to include everything and everyone, such as preexisting conditions, high risk, etc. Therefore, the individual mandate requires an-insurance-that-is-not really-just-insurance, making reality very different than what it is thought to be.

From an economic standpoint, the individual mandate is a terrible idea because its sole purpose is to obfuscate the true cost of caring for those persons whose circumstances or risk, such as preexisting conditions or age, would result in paying more for health insurance. By controlling the prices through artificial means instead of private competition, the individual mandate creates a misallocation of resources, which is a failure of the fundamental principles of Economics 101.

A second major problem with the individual mandate as it is written is that you can forgo coverage in lieu of paying a penalty and then if you develop a condition, you can still get coverage without being denied due to a pre-existing condition. Unfortunately, this only serves to make prices more expensive for those who are healthy because there must be funds to cover those who are not.

I would argue that having health insurance coverage should not be a mandate in the strict sense of the word; i.e, one should not be required to purchase it. That being said, I also think that people should regard the ownership of a health insurance policy (a “true insurance”) as a basic necessity for proper living. The attitude toward health insurance coverage –- by citizens, legislators, and insurance companies alike —- truly needs a paradigm shift if health care is to be reformed for the better. The health insurance sector must be restructured to resemble other insurance industries such as life, fire, and home; in doing so, they will create a more competitive and dignified system as well as fulfill the purpose of safeguarding against an unforeseen disaster. Therefore, the actual components of what comprises “health insurance” (currently insurance and pre-paid medical care) must change.

The idea of helping everyone to carry health insurance sounds like a lofty goal. However, the individual mandate is the wrong way to attain this. From human point of view, the idea that all persons have coverage may be good, but imposing the mandate is bad for liberty. Turning basic economics on its head, it incentivizes the wrong things and creates most expensive health care possible.

The government has never been efficient with other people’s money. The economics of the current health care law will only serve to reduce the quality of health care for our citizens because it lacks free market competition. A health care reform solution could be focusing on providing a ” true insurance” product that everyone could have – one that protects against having an extraordinary event happen whose economics is more than can be afforded. Obamacare is not an insurance; it is pre-paid medical care system whose product provides for all at all costs. Imposing an individual mandate for such a program is ultimately economically unsustainable. The current health care law should be overturned for the sake of the economic health of this country.

by | BLOG, ECONOMY, FREEDOM, GOVERNMENT, TAXES

The question of additional taxes on the wealthy is really a liberty and equity issue, impinging on the very entrepreneurial environment that made our country great. At the heart of any monetary decisions should be free will, not a free lunch.

Stop and think about it for a minute. In my adult life, in a free country such as ours, it is entirely my judgment as to whether or not I want to work hard and try to earn a lot of money, and/or risk my money via investments. Such choices are made only after careful deliberation. And one of the factors going into that decision is how much tax I will pay on my winnings, my successes. That is why it is unequivocally immoral that our government – or any government – should feel it has the place and authority to come along after I earned my success and basically declare that because I have done well for myself, I should have to pay more to that government. This is legal plunder.

I have right and the liberty to factor into my decision making process what the government states I must owe under law, and decide whether that amount and calculation would be amenable to my overall situation and goals. The government has no right to retroactively come along and declare that I must detract from my commitment to invest in my self, my education, my career, or anything else because it needs a greater revenue stream. Why should I, who have proven myself to be successful (according to the government) have to give my success over to people who have proven to grossly mismanage our country’s finances?

When people say things such as Exxon makes X so many billions of dollars a year and therefore they can afford to pay more, such a statement only reflects the gross naivete and ignorance of basic financial rules. Without a frame of reference, unless that number is coupled with how much money was invested or needed to be invested in order to earn that earnings figure, such a statement is worthless rhetoric. If a company makes $10 billion, but has $100 billion invested in the company (which is quite typical for major corporations), that would be a 10% return.

When put into that perspective of how much was invested to get that ROI, 10% isn’t quite so much. Would you invest millions or billions for the risk of a 10% return or the risk of losing it all? Most would not. If you have money invested in something like a bank that is a very safe investment, but you also get a pretty low return. If you are investing in something in which you have the chance of losing, you risk everything hoping to get that 10, 15, 20% return. With any investment, be it oil or a bowling alley business, you would not have access to that kind of risk capital unless it was strongly anticipated to get that larger-than-safe-return: you risk losing it all. And yet, many companies and individuals still make the investment. Good for them.

So then with those who were able to make a decent return on investment, Obama’s tax policies are simply a death wish for our country. If we go out in the free market looking at companies and individuals investing millions and billions a year, and the government leaves alone the ones who do poorly on their investments but leeches onto the winners, the successful ones, this is what it essentially tells them: you were so successful, we want and deserve a piece of your success. We are happy, though, to allow you to lose your money alone.

Doesn’t everyone see the lunacy and disingenuousness of going after the oil companies when oil is $100 a barrel but ignoring them when oil is $20 a barrel? Or screaming about their 4% profits yet say nothing about the government’s gas tax of about 18 cents per gallon? This type of targeted hypocrisy only supplies us with 1) more political posturing and talking points and 2) attempts at additional revenue streams.

Having a policy to target the winners with an additional tax after they become winners will eventually destroy those winners because no one will want to invest or earn over a certain threshold. This will stymie and financially ruin our country, founded upon the backs of small businesses, hard work, entrepreneurship, free minds, free society, and free economy.

Those who are prosperous should be given the same liberty to manage their success as any other citizen, not additional tax penalties. How can we honestly and morally take extra money from those taxpayers who have been able to create wealth and employment successfully and give it to the government and politicians who manage to continuously and egregiously squander income?

by | ECONOMY, GOVERNMENT, HYPOCRISY, POLITICS

The House passes the Senate bill

257-167 was the vote tally.

Here’s the official list of yeas and nays:

—- AYES 257 —

Ackerman

Alexander

Altmire

Andrews

Baca

Baldwin

Barber

Barletta

Bass (CA)

Bass (NH)

Benishek

Berkley

Berman

Biggert

Bilbray

Bishop (GA)

Bishop (NY)

Boehner

Bonamici

Bono Mack

Boren

Boswell

Brady (PA)

Brady (TX)

Braley (IA)

Brown (FL)

Buchanan

Butterfield

Calvert

Camp

Capps

Capuano

Carnahan

Carney

Carson (IN)

Castor (FL)

Chandler

Chu

Cicilline

Clarke (MI)

Clarke (NY)

Clay

Cleaver

Clyburn

Coble

Cohen

Cole

Connolly (VA)

Conyers

Costa

Costello

Courtney

Crenshaw

Critz

Crowley

Cuellar

Cummings

Curson (MI)

Davis (CA)

Davis (IL)

DeGette

DelBene

Denham

Dent

Deutch

Diaz-Balart

Dicks

Dingell

Doggett

Dold

Donnelly (IN)

Doyle

Dreier

Edwards

Ellison

Emerson

Engel

Eshoo

Farr

Fattah

Fitzpatrick

Fortenberry

Frank (MA)

Frelinghuysen

Fudge

Gallegly

Garamendi

Gerlach

Gibson

Gonzalez

Green, Al

Green, Gene

Grijalva

Grimm

Gutierrez

Hahn

Hanabusa

Hanna

Hastings (FL)

Hastings (WA)

Hayworth

Heck

Heinrich

Herger

Herrera Beutler

Higgins

Himes

Hinchey

Hinojosa

Hirono

Hochul

Holden

Holt

Honda

Hoyer

Israel

Jackson Lee (TX)

Johnson (GA)

Johnson (IL)

Johnson (OH)

Johnson, E. B.

Kaptur

Keating

Kelly

Kildee

Kind

King (NY)

Kinzinger (IL)

Kissell

Kline

Kucinich

Lance

Langevin

Larsen (WA)

Larson (CT)

LaTourette

Latta

Lee (CA)

Levin

Lipinski

LoBiondo

Loebsack

Lofgren, Zoe

Lowey

Lucas

Luetkemeyer

Luján

Lungren, Daniel E.

Lynch

Maloney

Manzullo

Marino

Markey

Matsui

McCarthy (NY)

McCollum

McGovern

McKeon

McMorris Rodgers

McNerney

Meehan

Meeks

Michaud

Miller (MI)

Miller, Gary

Miller, George

Moore

Murphy (CT)

Murphy (PA)

Nadler

Napolitano

Neal

Noem

Olver

Owens

Pallone

Pascrell

Pastor (AZ)

Payne

Pelosi

Perlmutter

Peters

Pingree (ME)

Pitts

Platts

Polis

Price (NC)

Quigley

Rahall

Rangel

Reed

Reichert

Reyes

Ribble

Richardson

Richmond

Rogers (KY)

Rogers (MI)

Ros-Lehtinen

Ross (AR)

Rothman (NJ)

Roybal-Allard

Royce

Runyan

Ruppersberger

Rush

Ryan (OH)

Ryan (WI)

Sánchez, Linda T.

Sanchez, Loretta

Sarbanes

Schakowsky

Schiff

Schock

Schwartz

Scott, David

Serrano

Sessions

Sewell

Sherman

Shimkus

Shuler

Shuster

Simpson

Sires

Slaughter

Smith (NJ)

Smith (TX)

Speier

Stivers

Sullivan

Sutton

Thompson (CA)

Thompson (MS)

Thompson (PA)

Thornberry

Tiberi

Tierney

Tonko

Towns

Tsongas

Turner (NY)

Upton

Van Hollen

Velázquez

Walden

Walz (MN)

Wasserman Schultz

Waters

Watt

Waxman

Welch

Wilson (FL)

Womack

Yarmuth

Young (AK)

Young (FL)

—- NOES 167 —

Adams

Aderholt

Akin

Amash

Amodei

Austria

Bachmann

Bachus

Barrow

Bartlett

Barton (TX)

Becerra

Berg

Bilirakis

Bishop (UT)

Black

Blackburn

Blumenauer

Bonner

Boustany

Brooks

Broun (GA)

Bucshon

Burgess

Campbell

Canseco

Cantor

Capito

Carter

Cassidy

Chabot

Chaffetz

Coffman (CO)

Conaway

Cooper

Cravaack

Crawford

Culberson

DeFazio

DeLauro

DesJarlais

Duffy

Duncan (SC)

Duncan (TN)

Ellmers

Farenthold

Fincher

Flake

Fleischmann

Fleming

Flores

Forbes

Foxx

Franks (AZ)

Gardner

Garrett

Gibbs

Gingrey (GA)

Gohmert

Goodlatte

Gosar

Gowdy

Granger

Graves (GA)

Griffin (AR)

Griffith (VA)

Guinta

Guthrie

Hall

Harper

Harris

Hartzler

Hensarling

Huelskamp

Huizenga (MI)

Hultgren

Hunter

Hurt

Issa

Jenkins

Johnson, Sam

Jones

Jordan

King (IA)

Kingston

Labrador

Lamborn

Landry

Lankford

Latham

Long

Lummis

Mack

Marchant

Massie

Matheson

McCarthy (CA)

McCaul

McClintock

McDermott

McHenry

McIntyre

McKinley

Mica

Miller (FL)

Miller (NC)

Moran

Mulvaney

Myrick

Neugebauer

Nugent

Nunes

Nunnelee

Olson

Palazzo

Paulsen

Pearce

Pence

Peterson

Petri

Poe (TX)

Pompeo

Posey

Price (GA)

Quayle

Rehberg

Renacci

Rigell

Rivera

Roby

Roe (TN)

Rogers (AL)

Rohrabacher

Rokita

Rooney

Roskam

Ross (FL)

Scalise

Schilling

Schmidt

Schrader

Schweikert

Scott (SC)

Scott (VA)

Scott, Austin

Sensenbrenner

Smith (NE)

Smith (WA)

Southerland

Stearns

Stutzman

Terry

Tipton

Turner (OH)

Visclosky

Walberg

Walsh (IL)

Webster

West

Westmoreland

Whitfield

Wilson (SC)

Wittman

Wolf

Woodall

Yoder

Young (IN)

—- NOT VOTING 8 —

Buerkle

Burton (IN)

Graves (MO)

Lewis (CA)

Lewis (GA)

Paul

Stark

Woolsey

Thoughts?

by | ECONOMY, GOVERNMENT, OBAMA, TAXES

Tomorrow is the first Friday of the month, when unemployment numbers get released. This morning, Gallup released the results of its survey. It announced that,

U.S. unemployment, as measured by Gallup without seasonal adjustment, was 7.8% for the month of November, up significantly from 7.0% for October. Gallup’s seasonally adjusted unemployment rate is 8.3%, nearly a one-point increase over October’s rate.

.

The article went on wonder how the unemployment rate could have possibly risen again in November, after dropping right before the November Election. It speculated “superstorm Sandy” or “lackluster holiday hiring is to blame”.

Of course, it certainly couldn’t be related to the re-election of President Obama or the fiscal cliff now, could it?

Update: Unemployment drops to 7.7% — specifically, and only, because more than 500,000 workers dropped out of the workforce entirely.

by | ECONOMY, FREEDOM, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS, TAXES

President Obama has all but admitted that raising the tax margin on the top 2%/”millionaires and billionaires”/the wealthy might, just might, affect the economy negatively. Anticipating increased economic decline when he pushes up the rate from 35% to 39.6%, Obama has proposed another successful round of stimulus.

What might this new stimulus look like?

Extending the 2 percentage point Social Security payroll tax cut, boosting a tax incentive to businesses, establishing a $50 billion bank for long-term infrastructure projects, and extending unemployment benefits.

And the cost to taxpayers?

An estimated $255 billion total — which the GOP would surely need to demand that it be matched dollar-for-dollar in extra spending cuts.

So, let’s recount the logic of the Left:

Raise taxes –> Economy falters due to less consumption spending —> Need to spend $255 billion in government money to prop up the economy.

How about some other logic?

Keep tax rates the same as they’ve been for 10 years —> Economy gets a chance to recover without government interference and economic uncertainty —> No need to spend another $255 billion of taxpayer money

Some have suggested these are merely bargaining chips for the budget discussions. However, if Obama was so sure about his economic policies, and if these policies were really so good, he wouldn’t need to “spend” more or bargain any.

by | ARTICLES, ECONOMY, GOVERNMENT, OBAMA, TAX TIPS, TAXES

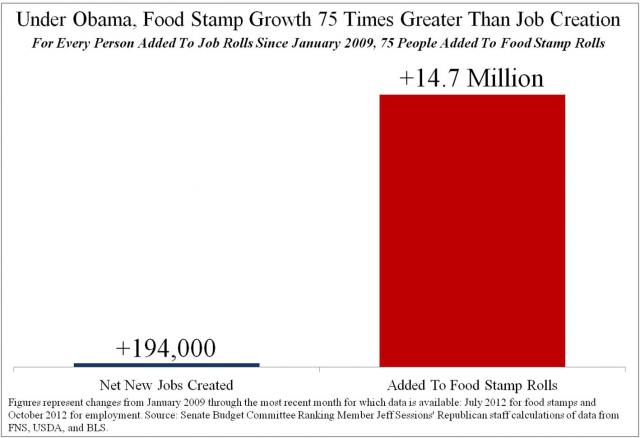

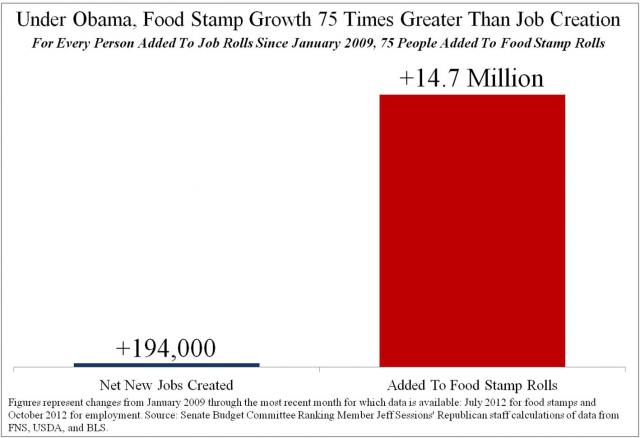

The Weekly Standard does a great analysis of the growth of food stamps in comparison to the growth of jobs during the Obama Administration. Using FNS, BLS and USDA data, they calculated that food stamp enrollment was 75 times faster than job creation. This visual puts it into perspective:

I have written on this trend before in the last few months; as unemployment has remained high, we recently passed the point where more people have been added to the dependency rolls than payrolls. This has a high impact on our crushing deficit and is directly attributable to Obama’s legacy. The article sums it up:

Welfare spending is projected to remain permanently elevated; for instance, at no point in the next 10 years will fewer than 1 in 9 Americans be on food stamps. In fact, the Administration has actively sought to boost food stamp spending and enrollment, including through a partnership with the Mexican government to advertise benefits to foreign nationals, as well as materials that teach outreach workers how to “overcome the word ‘No.’” USDA even goes so far as to argue that the program is “the most direct stimulus you can get.”

Overall, in the last four years, the United States’ gross federal debt has increased 53 percent, food stamp enrollment has increased 46 percent, and the number of employed persons has increased just 0.15 percent. This picture, however, is even more ominous than it looks. While only 194,000 net jobs have been created since 2009, the working age population has increased by approximately 5 million—almost 25 times that amount. In other words, a shrinking share of working age adults have or are even looking for a job. The real unemployment number (U-6), therefore, is 14.6 percent.

To put this month’s job creation in historical perspective, in October of 1984, 286,000 jobs were created—67 percent more—at a time when the U.S. working age population was 26 percent smaller than it is today.

Over time, these trends, if not reversed, spell economic disaster for the United States and its citizens.

Be sure to read the article in its entirety.

by | ECONOMY, GOVERNMENT, TAXES

One of the most commonly heard criticisms on the Ryan plan is that even though it will reduce the cost of Medicare to the government and move us more toward solvency, it will increase the amount of medical care that will have to be paid for by seniors.

The answer to this critique is not that they won’t be paying more, but rather, of course they will be paying more. Medicare is going broke, and the reason why is that it is unaffordable in its current form to the government. Paying more by seniors is certain – both by Ryan’s plan but also by doing nothing — because the system right now is almost bankrupt.

Ryan is trying to minimize the extra cost to those 55 and over by modifying how the system is subsidized by the government. The Ryan plan is the best one out there right now because it will allow the seniors to choose the kind of coverage options they want. Democrats try to say that the insurance companies will gouge seniors, but you simply can’t engage in price gouging when there are competing businesses. The people will select the health the coverage they want for their particular needs and ability.

The rational view for the future of health care is that the retiree will want to have choices for medical care, such as choosing a private room or shared, a hip replacement or hobbling a bit. It should be up to the individual if they want a procedure that is more or less invasive, standard or innovative. Having choices drive competition, which will in turn drive down the cost.

The hysteria that costs are going to rise is absurd because, although the Democrats won’t say so, costs will rise regardless of any plan because the system is broken. At least the Ryan plan is an alternative solution to Medicare, which, according the very trustees of Medicare, is completely unsustainable in its present form:

Medicare and Social Security “are on unsustainable paths” and will be insolvent within a few decades, according to the 2012 annual report of trustees of the funds. Since 1970, Medicare trustees have predicted the end is near and then nearer. The program must soon face up to demographic realities: Americans are living longer and fewer workers are paying Medicare and Social Security funds per retired citizen.

And in a letter to the Senate Budget Committee, in fact, the actuary at the Center for Medicare & Medicaid Services proffered a different set of more realistic circumstances—that the trustees themselves are being far too optimistic with their projections. In the actuary’s scenario, wherein we discount next year’s imaginary 30 percent rate cut to doctors and Obamacare’s supernatural ability to hold down costs, there will be an additional $10 trillion unfunded obligation over that 75 years.

Medicare trustees have warned that the program is facing more than $36 trillion in unfunded obligations. There needs to be a major change to the way it works but the Democrats are unwilling to acknowledge this fact or provide any solutions – only attacks. In doing so, the Democrats are really saying that they don’t care if they destroy Medicare.

It is imperative that the Republicans stand by Ryan and continue to hammer home the point that the Democrats have no Medicare plan, just like they have no budget plan (for 1200 days and counting). But by doing nothing and keeping Medicare the way it is, the Democrats will surely hasten the demise of the program within ten years. What will happen to the seniors then?

by | GOVERNMENT

Pension reform needs to begin in the public sector. it is clear that a wide gulf between funding and compensation exists. When pointing out the fact that the majority of federal and state public employees are overcompensated, the response is typically that “these amounts were promised”. But with most budgets now currently running severely in the red, addressing the compensation question is the key to solving major deficit dilemmas across the country. We need to analyze how we got here from two perspectives: 1) what was promised and 2) who promised it.

For localities that want to achieve solvency, it is essential to find out foremost exactly what was really and contractually promised to the public workers and for how long. An executive or union member works under a contract that exists for a specific time period. Their obligation is to provide their services in return for certain compensation and benefits during that time. But that’s it — they are only covered for the period of the current contract.

This point is important because there really can be no part of a negotiated contract that promises any compensation or benefits for services rendered after the end of the contract period; otherwise, the locality runs the risk of runaway financial obligations for which it cannot properly budget and it was not binding future governments not yet in office.

Therefore, if accruals to a defined benefit retirement program to a public service employee have been contracted for, the benefit accruals earned by that employee during the period of the contract can’t be taken away. However, unless a new contract specifically continues that same program into that next contract, the employee should not be entitled to any additional accruals.

Unfortunately, it is apparent that this simple concept has typically not been followed during the vast majority of contract negotiations in the public sector. If it had, negotiators for management would have long discontinued offering the out-of-control defined benefit plan.

Such dereliction is part of the reason that it’s necessary to examine the second point – “who promised it”. It is evident that serious research needs to be done in localities into who it was that negotiated such overgenerous contracts. Ultimately, negotiators have a fiduciary responsibility to the taxpayer not to pay more than fair compensation, thereby restricting compensation and benefits to amounts no greater than what those skills would command in the private sector. Valuable (and expensive) benefits such as job security must be factored in as an element of compensation paid to public sector employees.

Contrast how negotiations are performed in the private sector. The profit motive there keeps compensation at levels where economic forces show to be appropriate (i.e., the point where people generate results that justify its cost). This reflects economically rational “fair” compensation levels. But because the public sector does not have these economic forces to keep compensation levels in check, it is incumbent upon the public negotiators to do so properly. Failing to properly negotiate has created the soaring budget deficits we are experiencing.

There truly is a fundamental difference between private sector “management” and those doing the negotiating in the public sectors. In the private sector, the negotiator — either personally or the company who pays their merit based salary — will suffer serious financial damage if they offer their work force too much, because they will be unable to compete with their competitors in the marketplace.

On the other hand, there are no such competitive inhibitions in the public sector and therefore the negotiation routine lacks the incentive for restraint. Even worse, in most cases, the self-interest of the public sector negotiator is more directly aligned with the union that can get him elected rather than the taxpayer whom he is representing. This is a true case of the fox in charge of the hen house.

Examining the contract process in the public sector will provide an opportunity for fiscal reform. This will ensure that no public sector worker be paid more in any new contract then what those services warrant, without regard to what the prior contract provided. Most importantly, once a contract ends there is nothing on the table. There is nothing to prevent any new contract from offering less that the prior contract, especially where pay and benefits of the prior contract were out of line.

Even though it may be politically difficult and unpalatable, anybody representing the taxpayers has an obligation to those taxpayers. Those who breached the public trust with mismanagement should be held accountable. Budget reform and deficit reduction will naturally follow once compensation levels have been stabilized and brought in line with their private counterparts.

by | ECONOMY, GOVERNMENT, HYPOCRISY, TAXES

Over at Red State, Dan Spencer calls attention to the fact that today is a notable day:

“Deficit Day” is the date by which federal tax revenues run dry and the federal government begins adding even more debt on top of our exploding $16 Trillion national debt. This year Deficit Day falls on September 10th.

Two economists, James R. Harrigan & Antony Davies, stress the importance of this observance in their great article:

If lawmakers produced a balanced budget, Deficit Day would occur on December 31st, when the government spent the last dollar of its annual tax receipts at the stroke of midnight on New Year’s Eve. But we haven’t seen a balanced budget since the Eisenhower administration.

Conventional wisdom holds that the Clinton administration ran surpluses. But this is a twisting of the facts. It is true that the debt held by the public-which excludes money the government borrows from the Social Security trust fund-declined by $433 billion from 1997 to 2001. But, over those same years, the government borrowed $827 billion from the Social Security trust fund. In other words, the only way to claim that the Clinton administration ran surpluses is to admit that the government has no intention of paying back that $827 billion it borrowed from Social Security.

The latest that Deficit Day has fallen in the past 40-some years has been mid-December, at the end of the Clinton administration. The earliest was the beginning of July, during the Great Recession in 2009.

I particularly like the part about the Clinton surplus and Social Security. The logic of declaring Clinton surpluses is the same logic inherent in the idea that Social Security is Pay-as-you-go (PAYGO), about which I have written many times.

The gimmick accounting that our federal government employs would get you thrown in jail in the private sector. The gimmick borrowing-plus-money-printing that our government employs would make you ineligible to be credit-worthy for anything.

It’s Deficit Day!