by | ARTICLES, BLOG, ECONOMY, NEW YORK, OBAMA, POLITICS, TAXES

Recently, Gene Epstein of Barron’s made a fascinating observation about Paul Krugman, the New York Times’ darling of economics. On December 18th in the NYTimes, Krugman wrote about the film, “The Big Short”, which was about the “housing bubbles and retold lies.” In his article, Krugman stated that the housing bubble “was largely inflated via opaque financial schemes that in many cases amounted to outfight fraud.”

Unfortunately for Krugman, some folks like Gene Epstein have long memories and short tolerance. Epstein noted that, “This causal analysis is directly contradicted by an alternative view previously expressed in the New York Times: that the housing bubble was largely inflated by policies of the Federal Reserve.

First, Epstein went back to August 2, 2002, when a columnist in the pages of the New York Times, wrote that, “To fight this recession, the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.”

Nearly seven years later on June 17, 2009, a few months after the crisis of 2008, the same columnist wrote for the New York Times that “What I said was that the only way the Fed could get traction would be if it could inflate a housing bubble. And that’s just what happened.”

Can anyone guess who this columnist is? Gene Epstein knew: Paul Krugman.

Of course, Krugman is counting on his readers to be either a) financial morons like he is; b) short on memory; or c) both. This kind of incompetency from Mr. Krugman is a consummate example of why he should not be the time of day on economic matters.

by | ARTICLES, BLOG, ECONOMY, NEW YORK, POLITICS, TAXES

De Blasio recently announced the implementation of the NYC Commuter Benefits Law, which goes into effect on January 1, 2016. This law “requires for-profit and nonprofit employers with 20 or more full-time employees in New York City to offer commuter benefits. Employers can save by reducing payroll taxes and employees can lower their monthly expenses by using pre-tax income to pay for their commute.”

What De Blasio’s press release doesn’t say is that companies face costs associated with this new tax scheme. It doesn’t discuss the cost of implementation and the use of administrative resources. It doesn’t mention the constant upkeep, such as W2 adjustments or employee changes on and off the plan. All this adds more burden to small businesses.

This NY Commuter Benefits Law encapsulates De Blasio’s continued effort to destroy New York City growth and employment; it worsens the cost of being in business in New York. There is likely no net benefit to the employer for his forced participation.

It continues a longstanding situation where New York City mayors do what they think *is* good, but their schemes are really destructive. For instance, one of the most laughable programs in the world requires landlords in New York City to set up bank accounts for everyone who has a security account with their landlord; there are easily hundreds of thousands of such accounts in the city; virtually every New York City resident loses money, because the tax treatment of this at the state and federal level, so that it is a loss for everyone. It’s utterly ridiculous. For this particular law, however, I’ll give De Blasio the benefit of the doubt that he is just severely incompetent and economically clueless.

The continued assault on small businesses within the city make it harder for the economy to grow. The city needs less, not more, regulations for businesses to prosper.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, NEW YORK, POLITICS

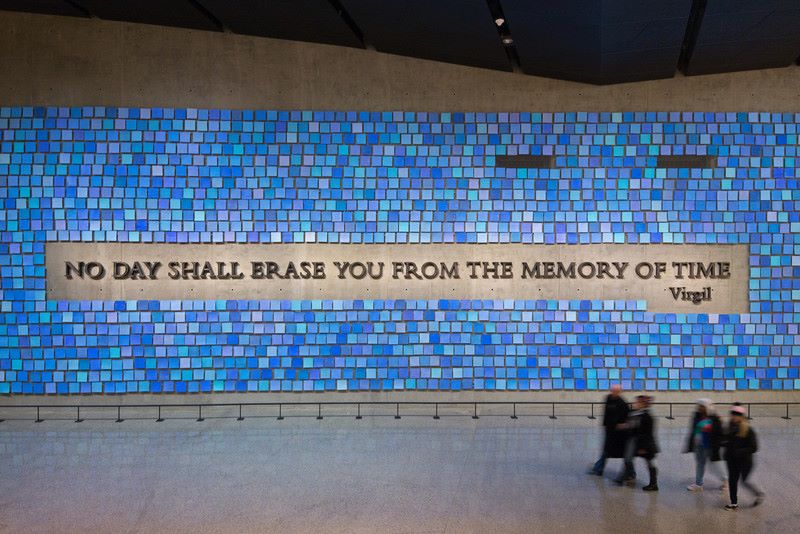

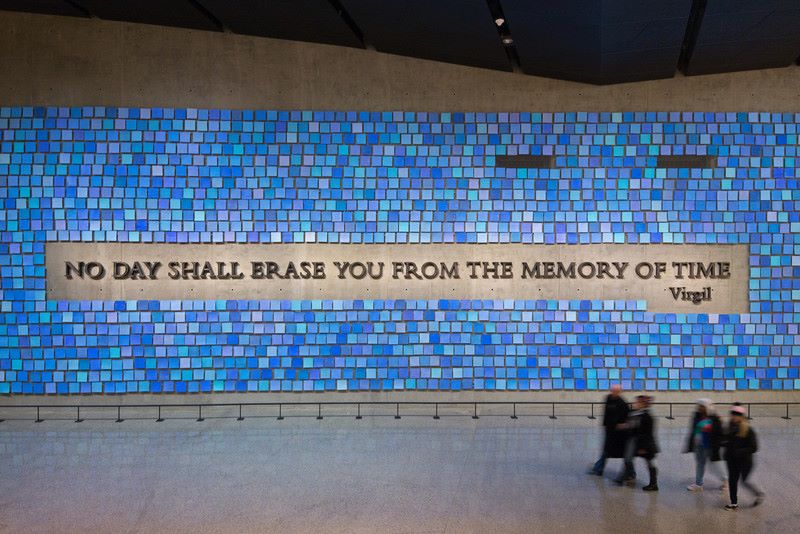

This quote from Virgil’s Aeneid sums it up:

God bless America.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, NEW YORK, OBAMA, POLITICS, TAXES

If NYC ever survives a mayor as economically ignorant as Bill de Blasio, it will be nothing short of a miracle. Not only has he been committed to “combating income inequality” by advocating raising taxes on the wealthy, now he also is pushing for a minimum wage hike to more than $13/hour as a means to bolster the economy.

De Blasio recently announced, “It’s time for New York City businesses to take bold action—not only because hardworking New Yorkers deserve a path to the middle class and an opportunity to stay in the middle class—but because giving them that opportunity would do so much to help our economy.”

His brilliant plan is to raise the wages past $13/hour in 2016, and then indexing it to inflation over the next 3 years so that the minimum wage will be $15/hour by 2019. The current wage is $8.75/hour, which will be $9.00 as of January 1, 2016. Where does de Blasio think that extra $4/hour is going to come from? He told the business owners that it’s time do “do your part”.

Unfortunately for the workers of NYC, they have a mayor who doesn’t understand that raising the minimum wage adversely affects those whom the wage hikes purport to help, especially the poorest in NYC. Less persons would be employed at $13/hour and $15/hour than if the minimum wage had not been hiked at all. Put it another way, many would see their hourly wages drop to $0/hour. That is not “opportunity”. That is unmitigated disaster.

by | ARTICLES, CONSTITUTION, FREEDOM, GOVERNMENT, HYPOCRISY, NEW YORK, OBAMA, POLITICS

According to the LA Times, Hillary Clinton has revealed that aides “deleted more than 30,000 emails that she deemed personal.”

In fact, Clinton herself breaks down the email numbers: there were 62,320 total messages. 30,490 of these were provided to the State Department, and 31,830 were private records that were destroyed.

That’s right, she wrote more personal emails than professional ones during her tenure as Secretary of State.

Hillary Clinton served as Secretary of State from March 2009 to February 2013. That’s four years minus one month. 4 years is 1460 days, plus minus 30 days, totaling 1430 days as Secretary of State. If she sent 31,830 private mails, that averages roughly 22.2 personal emails each day, 365 days a year, the entire time she was Secretary of State.

Does your employer tolerate that many personal emails a day?

It’s even worse if you don’t factor in weekends and federal holidays, just strict federal government working hours. The government calculates that federal employees work 2,087 hours a year. For Clinton’s term as Secretary of state, 2087 hours x 4 years is 8348 hours. Subtract a month (174 hours) and you get 8174 hours.

If she was able to delete 31,830 personal emails over her term, she sent 3.89 personal emails an hour, or one about every 15 minutes, racking up 31 personal emails over an 8 hour work day. On taxpayer money. On taxpayer time. Hillary Clinton was paid $186,600 a year as Secretary of State.

At least we now know what she was probably doing during Benghazi.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, NEW YORK, OBAMA, POLITICS, TAXES

The Wall Street Journal had an excellent article a couple weeks ago calling out the egregious prosecutorial misconduct of New York Attorney General Eric Schneiderman. In this farce of a case, Schneiderman is hell bent on going after Hank Greenberg (formerly with AIG) in an attempt to discredit his name in a state civil lawsuit. The manner in which Schneiderman is conducting himself is a disgrace to his position as prosecutor and reflects a trend of prosecutorial abuses that has grown alarmingly in recent years.

In the Schneiderman-Greenberg case, Eric Schneiderman has been pursuing civil charges against Hank Greenberg related to an “allegedly fraudulent reinsurance transaction” some years ago while disgraced Eliot Spitzer was the Attorney General. Mr. Greenberg was the defendant in a prior, failed criminal prosecution involving this particular transaction several years ago; in preparation for this upcoming civil case, it came to light that the “federal government has been hiding potentially exculpatory evidence” from the prior trial of Mr. Greenberg. The key witness for the government in that case, a Mr. Napier, who never had any direct communication with Mr. Greenberg about the deal in question apparently provided such “compelling inconsistencies” that an Appeals judge wrote “Napier may well have testified falsely.” Yet, Napier’s testimony is the very piece of evidence upon which Schneiderman has built his civil case.

For several years, and as recently as January, the federal government continued to claim that the notes and evidence collected during the first case should be kept under seal. It was only recently, under pressure, that the prosecutors relented and provided that notes and memos which showed the blatant inconsistencies of Mr. Napier. Had that release not occurred, however, Mr. Schneiderman would have been allowed to pursue the civil case against Greenberg relying “on a Napier deposition conducted years before the appeals court cast doubt on his testimony and before Mr. Greenberg’s legal team uncovered the notes.” What’s more, Mr. Greenberg was denied a trial by jury, and because “it’s a civil case and Mr. Napier doesn’t live in New York, he cannot be compelled to appear.” Thankfully, in light of the new exculpatory evidence, the trial has been stayed to decide whether or not to continue with the farce.

It is clear that Schneiderman’s decision to doggedly pursue this case for years even in the face of tainted, unreliable evidence is abusive. Schneiderman himself should be under investigation for malicious prosecution, going after a “big name” for his own political and personal gain.

This unprofessional prosecutorial behavior is unfortunately not limited to Eric Schneiderman. The nominee for Attorney General, Loretta Lynch, who also hails from New York has an egregious record of abuse particularly relating to civil asset forfeiture while she was the U.S. Attorney for the Eastern District of New York. In the most outrageous case during her tenure, her offices colluded with the IRS to seize nearly $450,000 from the bank account of two businessmen known as the Hirsch Brothers in May 2012, for “suspicion”, not actual charges, of criminal activity.

For nearly 3 years, the brothers were never charged with any crime, and Lynch’s office wholy ignored stringent deadlines regarding forfeiture cases. Prosecutors were compelled by law to file a court complaint within a certain amount of days following the seizure, but that never actually happened at any time, and the Hirsch brothers never had the opportunity to appear before a judge. In fact, there was never any case presented against them at anytime; Lynch’s office just sat on the seized money, all while offering to cut a deal with the brothers to keep some of the funds in return for dropping the matter. The brothers turned down every offer made to them.

Suddenly, a week before the Lynch’s confirmation hearing, in late January 2015 — two years and eight months after the case began — Lynch’s office returned all the money to the brothers. Lynch’s office clearly violated the law in the manner by which her prosecutors ignored forfeiture rules and denied due process to the Hirschs while going after the “big money”.

In a similar manner, NBC has covered another practice of Lynch’s office: using the “John Doe” alias in an overwhelmingly high amount to keep witness and court information from becoming public information. “Federal prosecutors in New York’s Brooklyn-based Eastern District pursued cases against secret, unnamed “John Doe” defendants 58 times since Loretta Lynch became head prosecutor in May 2010.” In comparision to others, “none of the nation’s 93 other federal district courts has charged more than eight “Does” during the same time period, and the national average is under four.” National Review has also covered the specifics of some of these cases, calling out Lynch’s “secret docket”. The repeated use of such secrecy invites Lynch’s office to the criticism that such practice undermines the right to a public trial guaranteed by our Constitution.

The conduct of Schneiderman and Lynch is unacceptable. The fact that Schneiderman is and will remain the Attorney General for New York and Loretta Lynch is poised to become the next Attorney General for the United States is disconcerting. It is not the first and it certainly won’t be the last, but it is increasingly brazen. This type of behavior undermines the integrity of our justice system when the nations leading prosecutors can’t be bothered to follow the rules and conduct themselves in an unbiased, professional manner. How can citizens protect their liberties in the face of such prosecutorial abuse?

by | ARTICLES, ECONOMY, FREEDOM, GOVERNMENT, NEW YORK, OBAMA, POLITICS

Is it any wonder why it’s so difficult to stay in business in New York? In exchange for eliminating one onerous compliance requirement with regard to wages, a new law simultaneously created more liability and penalties for businesses to actually stay in compliance with wage and labor law.

First, the positive. The new law terminates the yearly requirement for New York employers to provide annual wage notices to their employees each January. This burdensome paperwork is no longer a mandatory filing for all current employees; new employees, however, will still be expected to receive their notice.

The relaxation on the notice requirement, however, is in appearance only. The law sharply increases associated penalties for failing to provide the requisite wage notices to applicable employees. The penalty jump from a mere $50/week to $50 per day per employee and doubles the cap from $2500 to $5000. What’s more, for businesses failing to provide sufficient wage statements per law (different from wage notices), businesses will be docked $250/day, up from $100/per week, with the cap on that penalty also doubling to $5000 per employee.

The Department of Labor (DOL) certainly can’t be left out of their cut either. The new law allows the DOL to issue excessive civil penalties for wage and hour violations — doubling the amount from $10,000 to $20,000. The penalty increases help fund a new honey pot for the DOL called the “Wage Theft Prevention Enforcement Account”, created to help the DOL examine a full 6 years worth of time prior to the alleged violation.

However, the most egregious portion of the new law is the concept of ‘successor liability”, which essentially allows the possibility of a business being held liable for the wage of hour violations of its business predecessor. The law describes a business successor to be the “same employee” under these conditions: “if the employees of the new employer are engaged in substantially the same work in substantially the same working conditions under substantially the same supervisors” of the previous employer and has “substantially the same production process, produces substantially the same products and has substantially the same body of customers.” Thus, a business faces being penalized for violations committed by a prior business entity.

Finally, the law extends the scope of culpability for wage and hour violations. Previously, the top ten shareholders of corporations faced liability; now the top ten members of ownership (percentage-wise) in an LLC can also be found in violation.

In sum, while the new law reduced one burdensome regulation for business owners, it was replaced with more stringent rules of compliance, coupled with stiffer penalties to be meted out to violators of wage and labor laws. The increased threat of non-compliance and fines is just another example of the suffocating, anti-business environment that plagues New York.

For more details on the law and its affects, go here.

by | ARTICLES, ECONOMY, FREEDOM, GOVERNMENT, NEW YORK, OBAMA, POLITICS, TAXES

I have written on this subject before, and now the effects of high taxes and population migration are playing out in a substantial, political way: the decline of about 40% of Congressional seats in the northeast.

According to the Census Bureau, high taxpayers are moving south. It notes that in the 11 states that comprise the Northeast, population grew at a rate of only 15% over the thirty year span from 1983-2013, while the rest of the nation grew at roughly 41%. The key factor is high taxes. The result is a loss of Congressional seats there.

The American Legislative Exchange Council recently did a comprehensive study on House representation in 1950 from Maine to Pennsylvania, and compared it to current House seats. In 1950, there were 141 House members, but today there are only 85. Remember House seats are based on population — so this change is a 40% loss of power.

Need a dramatic comparison? Texas and California combined together now have more House seats than the Northeast conglomerate. For an area that used to be a political powerhouse, it is becoming increasingly marginalized due to excessive taxes and the ensuing population shift.

In 2011, Reuters had a lengthy article detailing how northern residents were fleeing massive state and local tax hikes. I wrote about the impact of high taxes on New York population loss here in 2012. And the NYTimes reported in December 2013 that Florida was soon to pass New York in population.

High taxes are a major factor in this population and political change, and it will be interesting to watch in the next few election cycles. As the report notes above, “This result is one of the most dramatic demographic shifts in American history. This migration is shifting the power center of America right before our very eyes. The movement isn’t random or even about weather or resources. Economic freedom is the magnet and states ignore this force at their own peril.”

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, NEW YORK, OBAMACARE

Would any consumer-driven industry be able to get away with this?

“Surprise medical bills occur when a consumer does everything possible to use hospitals and doctors that are in the consumer’s insurance plan, but nonetheless receives a bill from a specialist or other medical provider by whom the consumer did not know he or she would be treated, and who was outside his or her plan’s network of providers.

Worse, a relatively small but significant number of out-of-network specialists appear to take advantage in emergency care situations in particular, where the consumer has little choice or ability to “shop” for an appropriate provider. Too frequently, out-of-network specialists charge excessive fees — many times larger than what private or public insurers typically allow. In one example, a New Yorker who severed his finger in an accident went to participating hospital and ultimately received an $83,000 bill from a plastic surgeon who reattached the finger but – unbeknownst to the patient — was outside the insured’s network of providers.

The problem of surprise bills is not limited to emergency situations. They also can occur when a consumer schedules health care services in advance and an in-network provider, such as an anesthesiologist, is not available. In these instances, consumers are not told that the provider is out-of-network, not informed about how much the provider will charge, or not advised how much the insurer will cover. This lack of disclosure not only ill serves the consumer, but also undermines the efficiency of the health insurance market because consumers cannot effectively comparison shop for benefits or services”

This except from is part of a larger letter from Benjamin M. Lawsky, Superintendent of Financial Services for New York State, written to members of the New York State Legislature. You can read the letter here.

In any other industry, this would ALL be considered fraud.

by | ARTICLES, BUSINESS, ECONOMY, GOVERNMENT, NEW YORK

The newest calls to raise the minimum wage in NYC to $11/hour are a frustrating reminder that the city’s own Comptroller, Scott Stringer, has a total lack of understanding about how economics work.

Scott Stringer makes the argument that raising the minimum wage to $11/hour would provide an additional $2 billion in annual income to working families. While that might sound good to taxpayers — to get more money in their pockets — he completely fails to explain the other side of the equation: from where does that $2 billion come?

Stringer seemingly takes that $2 billion figure out of thin air, as there is no documented basis from which he arrived at this number. If Stringer is not utterly incompetent, then he should certainly have available his complete analysis of the financial pluses and minuses that are likely to occur as the result of the minimum wage hike; after all, that is his job.

Here’s the problem. Minimum wage hikes mean that all employers in New York City – both in the government and in the private sector – will pay more for its labor than it currently does pay, in order to produce the exact same product or services. Looked at it another way, in order to keep to the operating budget, NYC will get less goods and services than it now receives. Or, to keep its present level of operations would result in a budget deficit — because of having to spend more overall to maintain the current goods and services.

Therefore, the thought that minimum wage increases — especially a substantial one — will not have a negative effect on the city economy, is ludicrous.

The standard justification goes that the higher minimum wage puts more money into needy families and therefore strengthens the economy. This argument just happens to have a wonderful political effect for Democrats: it makes them seem sensitive to the plight of the needy, while making Republicans look like shills for those greedy Republican businessmen who are only trying to squeeze every last dollar out of their poor employees.

Just one problem —the Democratic position is nonsense, and economists know it, because of simple Economics 101: no businessman would be willing to pay an employee more than the economic value of the employee for him to perform his work.

Let’s assume that the rise in the minimum wage puts the cost of employee in excess of the value of that employee. The employer may then 1) terminate the employee (saving the excess of cost over productivity) or 2) buy equipment which, at that price, becomes cheaper than the employee.

But let’s say the employer keeps the employee, just paying him more for the same work he did before. The employer will then either a) earn a smaller return on his investment, reducing the amount he will be able to invest in the business in the future; b) he will raise his prices, which will maintain his profit margin, but will reduce his sales via you, or c) some combination of a) and b). In either case, growth of the NY economy will be hurt.

Here in New York City, a minimum wage hike would mean that New York City will pay more for its labor than it currently has calculated to pay, in order to produce the exact same product or services. Looked at it another way, to then keep to the operating budget, NYC will get less goods and services for the taxes it receives. This would result in a budget deficit — because of having to spend more overall to maintain the current goods and services.

Therefore, the thought that minimum wage increases — especially a substantial one — will not have a negative effect on the city economy, is ludicrous.

What the city is demanding with the minimum wage increase will have two effects. First, businesses in the city will have to pay their labor more, thereby raising the price of their goods to cover the wage increase. This ultimately will render New York City businesses less competitive than other businesses not located in the city. The result? Our businesses will lose business to those outside of New York City. That is not positive for the economy.

Secondly, New York City is often required to buy from the lowest bidder for many of its goods and services. Therefore, the city would likely have end up buying from outside of the city in order to get those cheaper prices — thereby not supporting the city’s own businesses.

The net effect of a minimum wage hike from $8 to $11 (a 37.5% increase) will take its toll on businesses in New York City and the economy. Stringer has publicly admitted that “the budgetary path we are on is still not sustainable.” Instead of cutting spending, his solution is to make the businesses cough up extra funds via a wage increase so that those wages can subsequently be taxed for more revenue for the city and the city’s budget — even at the expense of NYC businesses. Taxpayers too, will be affected, because their tax dollars will have less purchasing power in the city.

The minimum wage is already set to rise incrementally through 2015 to $9.00 for New York. Pushing through a faster and higher minimum wage increase will handicap New York City businesses in an already sluggish economy, and punish those companies who already endure high taxes and unending bureaucracy under the heavy hand of government.