by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

A short but informative article by the Washington Free Beacon describes how the Government Accountability Office (GAO) has calculated that within a few years, the federal government will owe more money that the sum of what is produced by the economy. That, my friends, is an egregious amount of debt.

“Gene Dodaro, the comptroller general for the Government Accountability Office, testified at the Senate Budget Committee to provide the results of its audit on the government’s financial books.

“We’re very heavily leveraged in debt,” Dodaro said. “The historical average post-World War II of how much debt we held as a percent of gross domestic product was 43 percent on average; right now we’re at 74 percent.”

Dodaro says that under current law, debt held by the public will hit a historic high.

“The highest in the United States government’s history of debt held by the public as a percent of gross domestic product was 1946, right after World War II,” he said. “We’re on mark to hit that in the next 15 to 25 years.”

Another economic projection which assumes that cost controls for Medicare don’t hold and that healthcare costs continue to increase, shows debt rising even further.

“These projections go to 200, 300 percent, and even higher of debt held by the public as a percent of gross domestic product,” said Dodaro. “We’re going to owe more than our entire economy is producing and by definition this is not sustainable.”

Additionally, the audit found fault with the number of improper payments that should not have been made or were the incorrect amount. The audit found that in fiscal year 2015 there were $136.7 billion improper payments, which was up by $12 billion from the year prior.

The audit also called into question the reliability of the government’s financial statements. According to the report, if a federal entity purchases a good or service, that cost should match the revenue recorded by the federal entity that sold the good or service. The report found that this was not always the case and found hundreds of billions of dollars in differences between transactions between federal entities.

“The government-wide financial statements that the GAO audits tell us what came into the government’s coffers and what went out, what the government owns and what it owes, and if the operations are financially sustainable,” said Sen. Mike Enzi (R., Wyo.). “But can we trust the information in the statements?”

“GAO’s audit calls into question the reliability of the underlying financial data,” he said. “The sketchiness is such that GAO remains unable to even issue an audit opinion on the government’s books.”

According to the audit, these weaknesses will eventually harm the government’s ability to reliably report their assets, liabilities, and costs, and this will prevent the government from having the information to operate in an efficient and effective manner.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, RETIREMENT, TAXES

The Financial Times reviewed data recently that suggested that the US public pension system is in dire straits; the funding shortage is likely 3 times as large as what is being reported. The estimated deficit is $3.4 trillion.

The solutions for the funding shortfalls are grim: either raise taxes or cut spending; unfortunately the “cut spending” approach always goes to the essential services first, so that taxpayers feel the heat and will consider a tax hike instead.

US Congressman Devin Nunes recently noted that, “It has been clear for years that many cities and states are critically underfunding their pension programmes and hiding the fiscal holes with accounting tricks.” Nunes has “put forward a bill to the House of Representatives last month to overhaul how public pension plans report their figures.” He added: “When these pension funds go insolvent, they will create problems so disastrous that the fund officials assume the federal government will have to bail them out.”

Insolvency has already been observed in San Bernardino, California and Detroit, Michigan, largely due to mismanagement of pension funding and budget shortfalls. The Financial Times noted that “Chicago, Dallas, Houston and El Paso have the largest pension holes compared with their own revenues”, as well as the states of Illinois, Arizona, Ohio, and Nevada.

Research done by Stanford paints a difficult future: “Currently, states and local governments contribute 7.3 per cent of revenues to public pension plans, but this would need to increase to an average of 17.5 per cent of revenues to stop any further rises in the funding gap.”

And more: “Several cities and states, including California, Illinois, New Jersey, Chicago and Austin, would need to put at least 20 per cent of their revenues into their pension plans to prevent a rise in their deficits, while Nevada would have to contribute almost 40 per cent.”

Much of the problem lies in the fact that retirement costs and liabilities have consistently been calculated on a 7%-8% return , which is not particularly realistic, as has been demonstrated in recent years during the economic downturn.

There is no way this silent funding crisis will get any better — and until localities recognize and admit their crisis and make ardent changes to their pension systems, it will only continue to worsen egregiously.

by | ARTICLES, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

The Fix the Debt Campaign Steering Committee is a bipartisan group of prominent leaders and experts, including luminaries such as Erskine Bowles and Alan Simpson, the co-chairs of the White House Fiscal Commission. The Fix the Debt group put together some decent graphics regarding federal spending.

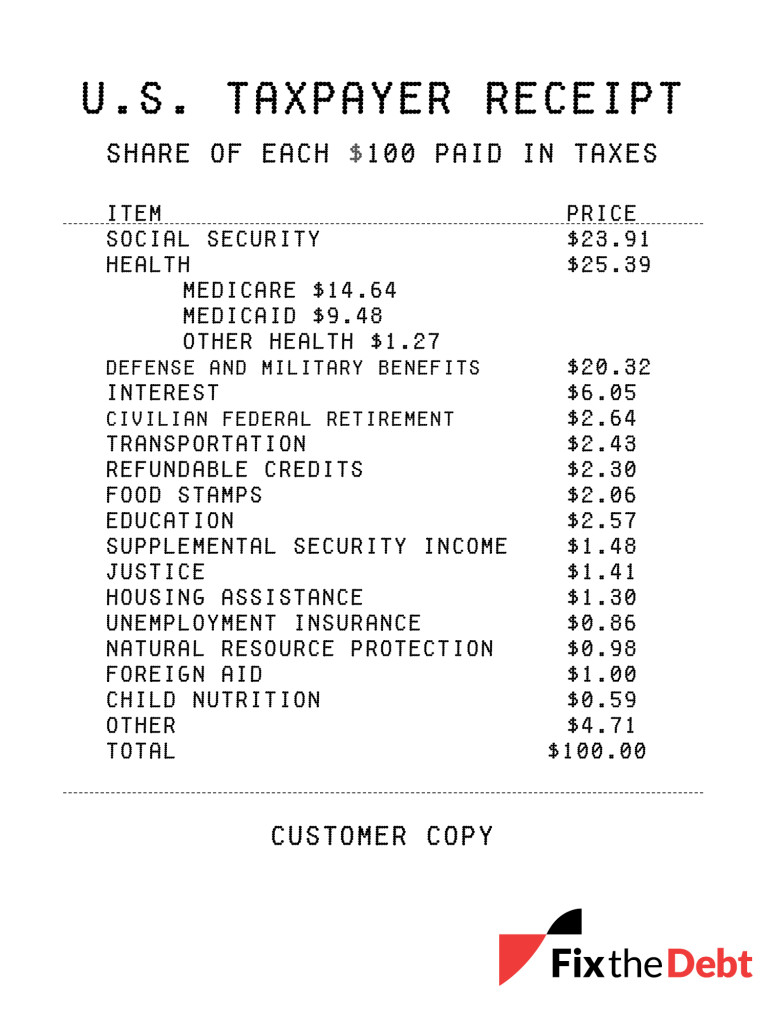

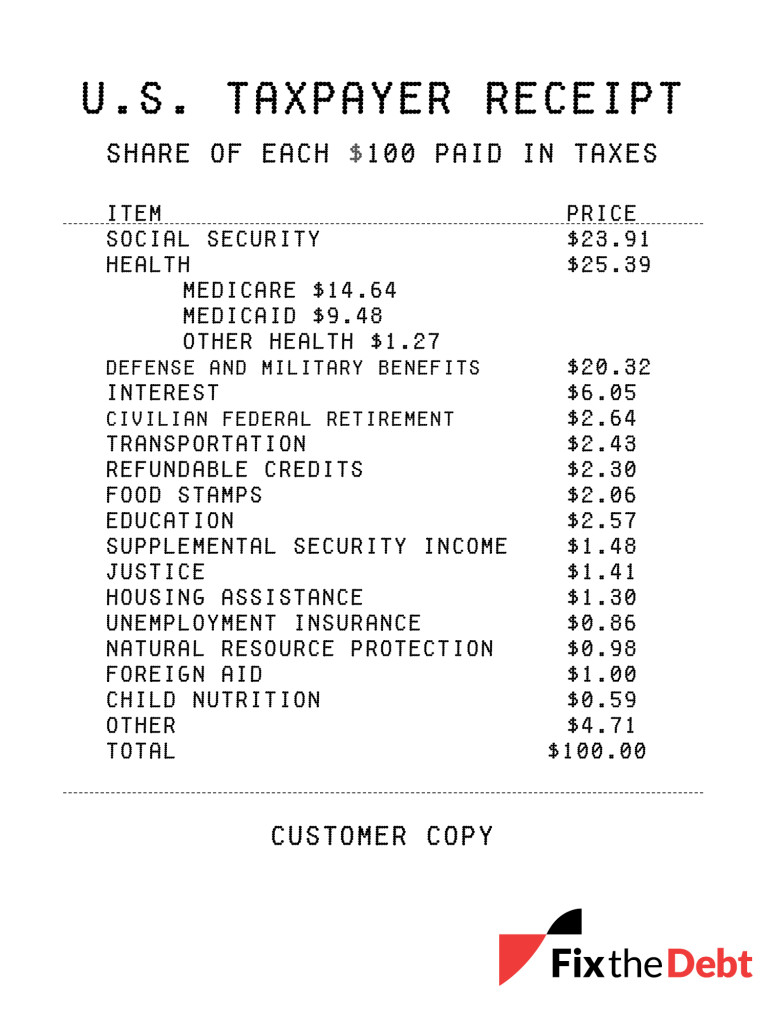

This is a “taxpayer receipt” highlighting where the money goes and highlight where it comes from in the first place.

How are our federal tax dollars spent? As the taxpayer receipt illustrates, more than $75 of every $100 paid in federal taxes goes to Social Security, federal health care, defense, and interest on the debt. And the amounts for Social Security, health care, and interest are forecast to grow considerably in the years to come.

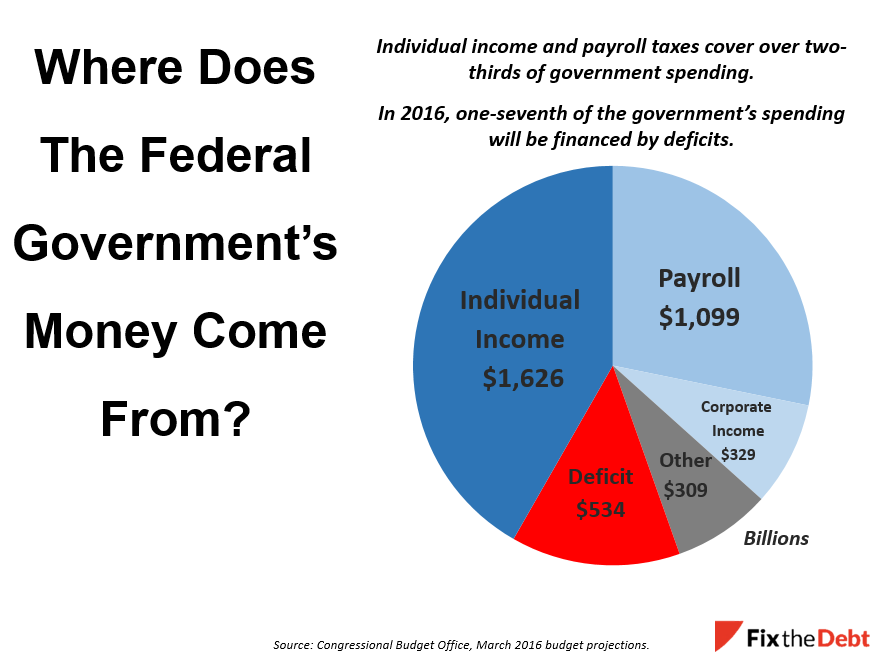

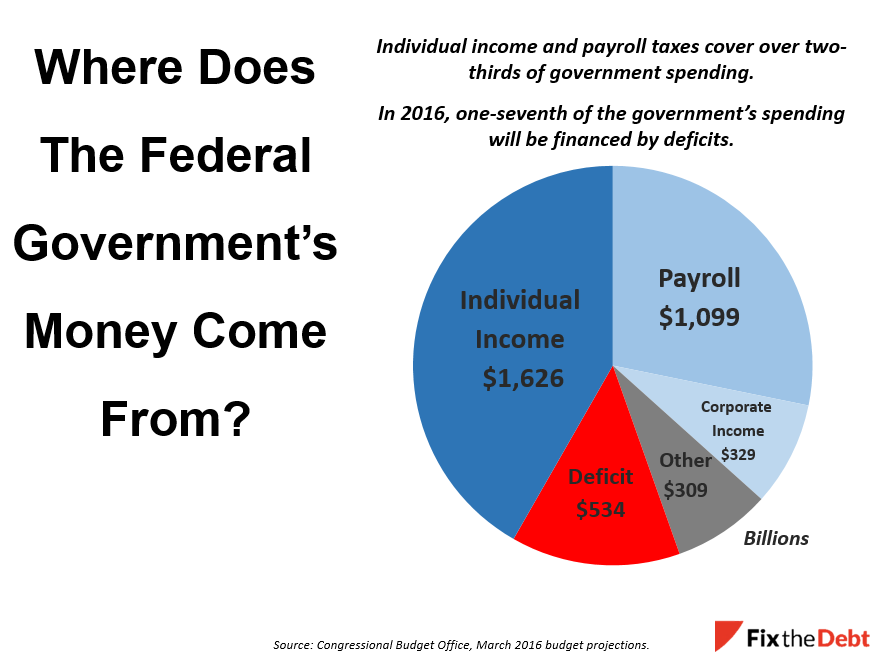

Where does the money come from? Much of the revenue for the federal government comes from the individual income tax that many of us are rushing to complete. Another major source is the payroll tax, which is the “FICA” tax that is withheld from your paycheck. It is used to fund Social Security benefits and parts of Medicare.

But a significant part of the government is deficit financed because spending exceeds revenue. That share is expected to grow substantially in the years ahead.

Check out their blog for more information.

by | ARTICLES, BLOG, BUSINESS, CONSTITUTION, FREEDOM, OBAMA, OBAMACARE, TAX TIPS, TAXES

Find Out How ACA affects Employers with 50 or More Employees

Some of the provisions of the health care law apply only to large employers, which are generally those with 50 or more full-time equivalent employees. These employers are applicable large employers – also known as ALEs – and are subject to the employer shared responsibility provisions.

Information Reporting

Applicable large employers have annual reporting responsibilities concerning whether and what health insurance they offered to their full-time employees during the prior year. In 2016, the deadline to provide Forms 1095-C to full-time employees is March 31. The deadline by which ALEs must file information returns with the IRS is no later than May 31 or June 30 if filed electronically.

All employers, regardless of size, that provide self-insured health coverage must file an annual return reporting certain information for individuals they cover. In 2016, the deadline by which self-insured ALEs must provide Forms 1095-C to responsible individuals is March 31. The returns with 2015 information are due no later than May 31 or June 30 if filed electronically.

Employer Shared Responsibility Payment

ALEs are subject to the employer shared responsibility payment if at least one full-time employee receives the premium tax credit and any one these conditions apply. The ALE:

- failed to offer coverage to full-time employees and their dependents

- offered coverage that was not affordable

- offered coverage that did not provide a minimum level of coverage

SHOP Marketplace

Employers with more than 50 cannot purchase health insurance coverage for its employees through the Small Business Health Options Program – better known as the SHOP Marketplace. However, Employers that have exactly 50 employees can purchase coverage for their employees through the SHOP.

For more information, visit the Determining if an Employer is an Applicable Large Employer page on IRS.gov/aca.

by | ARTICLES, BLOG, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Everything we were promised with Obamacare has yet to come to fruition: keep your plan! lower prices! tens of millions insured! and a litany of other broken promises and predictions.

Obamacare was signed into law on March 23, 2010. The Weekly Standard took the time to perform a thorough examination on the current state of Obamacare, an audit perhaps, comparing what was promised and what has been delivered. Their findings are sobering. It also offers some remedies of the most egregious maladies plaguing this particular legislation. I have reprinted the article in its entirety below, because it is chock-full of good information:

Three years ago, on the eve of Obamacare’s implementation, the Congressional Budget Office (CBO) projected that President Obama’s centerpiece legislation would result in an average of 201 million people having private health insurance in any given month of 2016. Now that 2016 is here, the CBO says that just 177 million people, on average, will have private health insurance in any given month of this year—a shortfall of 24 million people.

Indeed, based on the CBO’s own numbers, it seems possible that Obamacare has actually reduced the number of people with private health insurance. In 2013, the CBO projected that, without Obamacare, 186 million people would be covered by private health insurance in 2016—160 million on employer-based plans, 26 million on individually purchased plans. The CBO now says that, with Obamacare, 177 million people will be covered by private health insurance in 2016—155 million on employer-based plans, 12 million on plans bought through Obamacare’s government-run exchanges, and 9 million on other individually purchased plans (plus a rounding error of 1 million).

In other words, it would appear that a net 9 million people have lost their private health plans, thanks to Obamacare—with a net 5 million people having lost employer-based plans and a net 4 million people having lost individually purchased plans.

None of this is to say that fewer people have “coverage” under Obamacare—it’s just not private coverage. In 2013, the CBO projected that 34 million people would be on Medicaid or CHIP (the Children’s Health Insurance Program) in 2016. The CBO now says that 68 million people will be on Medicaid or CHIP in 2016—double its earlier estimate. It turns out that Obamacare is pretty much a giant Medicaid expansion.

To be clear, the CBO—which has very generously labeled Obamacare’s direct subsidies to insurance companies as “tax credits,” even though sending money to insurers doesn’t lower anyone’s taxes—isn’t openly declaring that Obamacare has reduced the number of people with private health insurance or that it has doubled the number of people on Medicaid or CHIP. Rather, the CBO maintains that Obamacare has actually increased the number of people with private health insurance by 9 million and has increased the number of people on Medicaid or CHIP by (just) 13 million. But it would seem that the only reason the CBO can make these claims is that it has moved the goalposts.

That is, the CBO has significantly altered its estimates for what 2016 would have looked like if Obamacare had never been passed. In 2013, the CBO projected that, in the absence of Obamacare, 186 million people would have had private health insurance in 2016, and 34 million people would have been on Medicaid or CHIP. The CBO now maintains that, in the absence of Obamacare, only 168 million people would have had private health insurance in 2016 (a reduction of 18 million people from its 2013 projection), while 55 million people would have been on Medicaid or CHIP (an increase of 21 million people from its 2013 projection). Somehow the hypothetical non-Obamacare world has changed a lot in the past three years. (The CBO doesn’t explain how this could have happened.)

Even the CBO’s revised figures for a non-Obamacare world, however, can’t gloss over the fact that Obamacare has failed to hit its target for private health insurance by 24 million people. To see that, one must simply compare Obamacare’s new tally of 177 million to its 2013 target of 201 million.

The CBO doesn’t release retroactive scoring of Obamacare. Try finding, for example, tallies from the federal government (whether from the CBO or otherwise) on what Obamacare has actually cost so far. Rather, the CBO is like a handicapper who predicts the results of horseraces, but then never bothers to publish the races’ actual results.

Now that it’s clear enough, however, that Obamacare is basically an expensive Medicaid expansion coupled with 2,400 pages of liberty-sapping mandates, it’s time for a winning Obamacare alternativeto emerge, one along the lines of what Ed Gillespie almost rode to victory in the Virginia Senate race. Such an alternative should address the longstanding inequity in the tax code—between employer-based and individually purchased insurance—while adhering to four basic notions:

1. It shouldn’t touch the tax treatment of the typical American’s employer-based plan.

2. It should close the tax loophole on the employer side—which says that the more you spend (on insurance), the more you save (in taxes)—by capping the tax exclusion at $20,000 for a family plan (while letting anyone with a more expensive plan still get the full tax break on that first $20,000).

3. It should offer a simple tax break for individually purchased insurance that isn’t income-tested and thus doesn’t pick winners and losers (in marked contrast with Obamacare, which is all about picking winners and losers.)

4. It shouldn’t provide direct subsidies to insurance companies like Obamacare does. (The federal government provides a tax break for mortgage interest paid—it doesn’t directly pay a portion of people’s mortgage bills. Likewise, it shouldn’t directly pay people’s health insurance bills as if it were some kind of “single payer.”)

In addition, anyone crafting an Obamacare alternative should keep this important point in mind and express it publicly: Far from being the gospel truth, the CBO’s scoring is more like a wild guess that will never be checked against future reality.

by | ARTICLES, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Earlier this month, the Wall Street Journal noted an incredible sequence of events brought to light through judicial process and undercover emails. Obama meddled in the net-neutrality process, violating standards of conduct. I have reproduced the article in its entirety, as the contents contained therein are rather incredulous:

Congressional committees rarely re-report journalistic exposés, but it’s amazing what information subpoenas can pry loose. A Senate committee has exposed new details on how the White House broke the law to get the Internet regulated as an old-fashioned utility, including emails that show how shocked regulators at the Federal Communications Commission were at the violation of their agency’s independence.

A page-one article in The Wall Street Journal last year detailed an “unusual, secretive effort inside the White House” led by a small group “acting like a parallel version of the FCC itself.” President Obama’s aides thought net neutrality “would help define the president’s legacy” and that along with immigration could be handled by unilateral presidential action. The courts have blocked Mr. Obama’s executive order on immigration, and the Internet regulations should be next to go.

The report, from Republicans on the Senate Committee on Homeland Security and Governmental Affairs, finds that FCC staff worked through a weekend in November 2014 to finalize a plan backed by Chairman Tom Wheeler for light regulation of the Internet. They were shocked on Monday, Nov. 10, when an agency official forwarded a news alert, which she summarized as follows: “Obama says to make it Title II”—the heavy-handed law regulating railroads and the old monopoly phone system.

Staffers then shared a flurry of emails: “Not sure how this will affect the current draft and schedule—but I suspect substantially.” “This might explain our delay.” “It might indeed.” “Will try to get to the bottom of this this morning.” “At least the delays in edits from above now makes [sic] sense.”

Panic struck when it became clear the chairman would cave in to Mr. Obama’s demand and surrender the FCC’s independence. This is a verbatim quote from a draft media Q&A prepared for Mr. Wheeler:

“Q. Has there been discussions between the WH and the FCC leading up to this rollout?

“A. The FCC kept the WH apprised of the process thus far, but there have not been substantive discussions [IS THIS RIGHT?].”

FCC staffers cited nine areas in which the last-minute change violated the Administrative Procedure Act, which requires advance public notice of significant regulatory changes. Agency staffers noted “substantial litigation risk.” A media aide warned: “Need more on why we no longer think record is thin in some places.”

These emails are a step-by-step display of the destruction of the independence of a regulatory agency. The Senate report should make fascinating reading for the federal appellate judges considering whether to invalidate the regulations.

Mr. Obama’s edict resulted in 400 pages of slapdash regulations that the agency’s own chief economist has dismissed as an “economics-free zone.” In the year since Obamanet has been in effect, regulatory uncertainty has led to a collapse in investment in broadband.

Independent regulatory agencies operate in a constitutional gray area, separate from the executive and legislative branches. They have the power to issue broad rules but are unaccountable to voters. The rationale is that agency staffers are experts in the fields they regulate. That justification collapses if they’re subject to political pressure.

In 1983, Ronald Reagan held a single meeting with his FCC chairman on the issue of regulating television rerun revenues. Unlike Mr. Obama, Reagan didn’t have his own staff working on the regulations. And Reagan didn’t express any opinion on the rules—also unlike Mr. Obama, who issued a video promoting utility regulation for the Internet.

Yet Reagan’s modest involvement was headline news. A congressional committee declared he “acted improperly and undermined the fairness and integrity” of the FCC. Sen. Daniel Patrick Moynihan said: “It is imperative for the integrity of all regulatory processes that the president unequivocally declare that he will express no view on the matter.” The Washington Post editorialized: “The danger lies in the kind of chilling signal a certain kind of presidential participation might send to all regulatory agencies about the possible fragility of their independence.”

A 1991 opinion from the Justice Department’s Office of Legal Counsel warns: “White House staff members should avoid even the mere appearance of interest or influence—and the easiest way to do so is to avoid discussing matters pending before the independent regulatory agencies with interested parties and avoid making ex parte contacts with agency personnel.”

The appeals court has plenty of evidence proving White House meddling with a supposedly independent agency. Voters have more reason for outrage at an administration that ignores limits on its power. The Internet is too important to be left to politicians, especially ones who violate the law.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

According to an economist at the Congressional Budget Office (CBO), the federal government should examine the question of taxing drivers by the mile as a means of raising higher revenue for highway programs.

According to the Washington Examiner, “Chad Shirley, CBO’s deputy assistant director for microeconomic studies, gave a presentation that says federal gas tax revenues are falling short of federal spending on highway programs. But to resolve that problem, Shirley didn’t propose less federal spending, and instead offered three suggestions.”

1) Charge drivers more through the implementation of a “vehicle-miles traveled charges.”

2) Charging them more when traffic is bad. Shirley calls that “congestion pricing.”

3) Charging tolls on “additional existing interstates.”

The idea of a “vehicle miles traveled tax,” or a “VMT” tax, was considered in 2011 in a bill that never came to fruition. That plan “foresaw the installation of equipment on people’s cars and trucks that would measure how far they drive, and the collection of taxes electronically through a reading of those devices at gas stations.”

Whether or not these new suggestions will be considered again remains to be seen. The CBO says that its three suggestions are not higher taxes or fees, but as an attempt to “make federal highway spending more productive for the economy.”

Such proposals are invasive of people’s privacy, and represent another ridiculous attempt at trying to regulate the behaviors of people.

by | ARTICLES, BLOG, CONSTITUTION, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Obama weighed in on the current Apple-government dispute, saying that access should be made necessary.

From Reuters:

U.S. President Barack Obama on Friday made a passionate case for mobile devices to be built in such a way as to allow government to gain access to personal data if needed to prevent a terrorist attack or enforce tax laws.

Speaking at the South by Southwest festival in Texas, Obama said he could not comment on the legal case in which the FBI is trying to force Apple Inc. to allow access to an iPhone linked to San Bernardino, California, shooter Rizwan Farook.

But he made clear that, despite his commitment to Americans’ privacy and civil liberties, a balance was needed to allow some intrusion when needed.

“The question we now have to ask is: If technologically it is possible to make an impenetrable device or system where the encryption is so strong that there is no key, there’s no door at all, then how do we apprehend the child pornographer, how do we solve or disrupt a terrorist plot?” he said.

“What mechanisms do we have available to even do simple things like tax enforcement because if in fact you can’t crack that at all, government can’t get in, then everybody is walking around with a Swiss bank account in their pocket.”

The Justice Department has sought to frame the Apple case as one not about undermining encryption. A U.S. Federal Bureau of Investigation court order issued to Apple targets a non-encryption barrier on one iPhone.

The FBI says Farook and his wife were inspired by Islamist militants when they shot and killed 14 people on Dec. 2 at a holiday party in California. The couple later died in a shootout with police.

“Setting aside the specific case between the FBI and Apple, … we’re going to have to make some decisions about how do we balance these respective risks,” Obama said.

“My conclusion so far is you cannot take an absolutist view.”

Obama was speaking at the South by Southwest festival in Austin about how government and technology companies can work together to solve problems including making it easier for people to vote.

by | ARTICLES, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

CNSNews remains a go-to source for analyzing information on the U.S. Treasury, tax revenue, and such. Here they are again, scrutinizing tax receipts for FY2016 through the end of February. In a nutshell, the U.S. government continues to run a deficit, and the amount of taxpayer responsibility continues to increase. From CNSNEWS:

The U.S. Treasury hauled in a record of approximately $1,248,371,000,000 in tax revenues in the first five months of fiscal 2016 (Oct. 1, 2015 through Feb. 29, 2016), according to the Monthly Treasury Statement released today.

Despite these record tax revenues in the first five months of the fiscal year, the federal government nonetheless ran a deficit of approximately $353,005,000,000 during the same period.

In February alone, the Treasury ran a deficit of $192,614,000,000.

The record five-month tax haul of $1,248,371,000,000 equaled approximately $8,263 for each of the 151,074,000 people in the country who had either a full or part-time job in February.

The record taxes in the first five months of this fiscal year exceed by about $63,263,220,000 in constant 2016 dollars the then-record $1,185,107,780,000 in tax revenues (in constant 2016 dollars) that the Treasury took in during the first five months of fiscal 2015.

However, even while taking in a record $1,248,371,000,000 in tax revenues from October through February, the Treasury was spending $1,601,375,000,000, according to the Monthly Treasury Statement. Thus, so far this fiscal year, the Treasury has run a deficit of $353,005,000,000.

The largest source of revenue in the first five months of this fiscal year was the individual income tax, which brought the Treasury $597,524,000,000. The second largest source was Social Security and other payroll taxes, which brought in $428,181,000,000.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Based on data from H&R Block as we are halfway through filing season, it is apparent that compliance with the Obamacare penalty is still a difficult task.

This is the second year that the penalty has been levied; for 2014 taxes, the fee was $95 or 1 percent of qualified income — whichever was greater — and for 2015 taxes it is $325 or 2 percent of income, whichever is greater. The average penalty is $383, while last year it was $172, which corresponds roughly to the rise in penalty costs.

However, about 3/5, or 60% of filers “who received advanced tax credits to help them buy private plans on Obamacare’s web-based exchanges must pay a portion back to the IRS because they underestimated their actual income for 2015.” Interestingly, this is an increase from last year’s figure of 52% who had to repay a portion of their advanced subsidy. Thus, compliance and income estimation is getting worse, not better, after two tax seasons.

The average subsidy amount of that Obamacare enrollees must pay back has also increased slightly this year — $579, up from $530 last year.

In contrast, about 33% of taxpayers overstated their income and received additional subsidy funds from the IRS; the average amount was $450. Those that got the number correct and saw no adjustments was a paltry 3%.

The confusion is sure to continue with next year’s filing season. The minimum penalty for no insurance will double again to $695 or 2.5% of income, whichever is higher. H&R Block calculations show that for an average family of four earning $60,000 would pay $975 this tax season (2015), compared to about $400 last year (2014), while next year the penalty would rise to $2,000 (2016).