by | ARTICLES, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

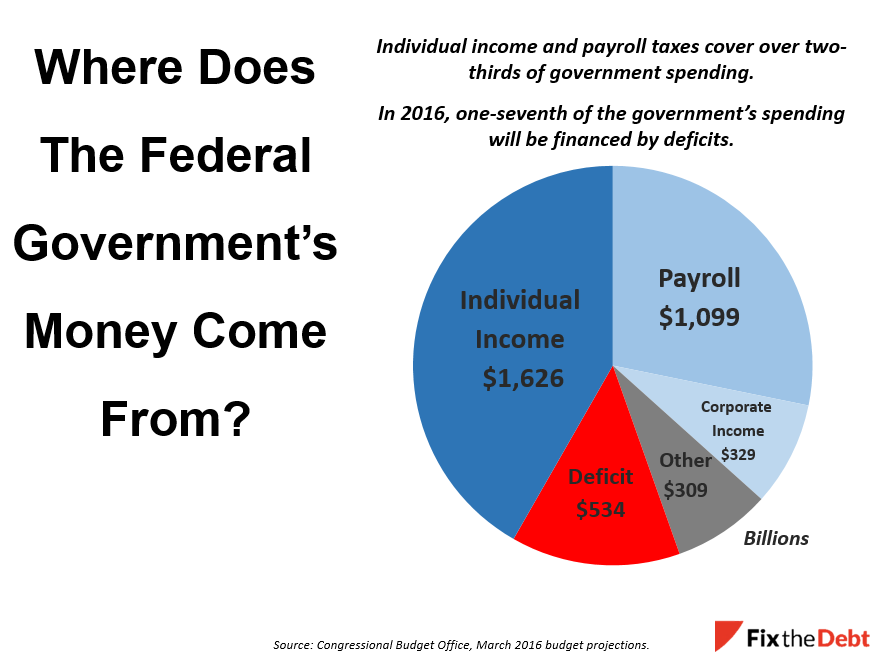

The Fix the Debt Campaign Steering Committee is a bipartisan group of prominent leaders and experts, including luminaries such as Erskine Bowles and Alan Simpson, the co-chairs of the White House Fiscal Commission. The Fix the Debt group put together some decent graphics regarding federal spending.

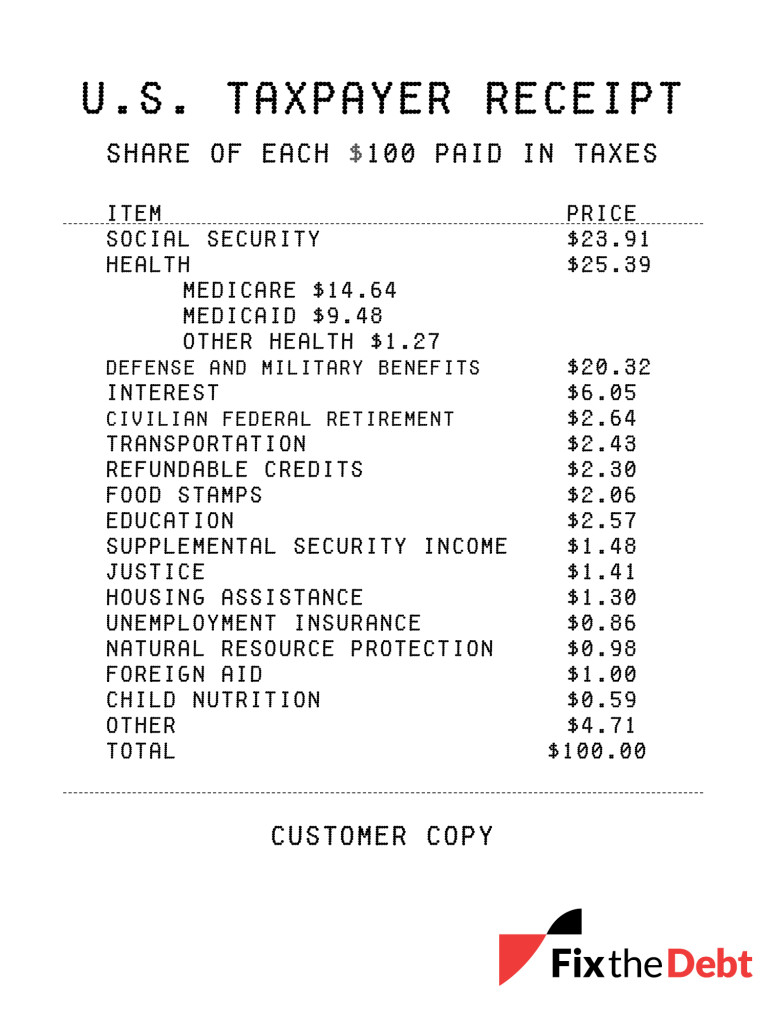

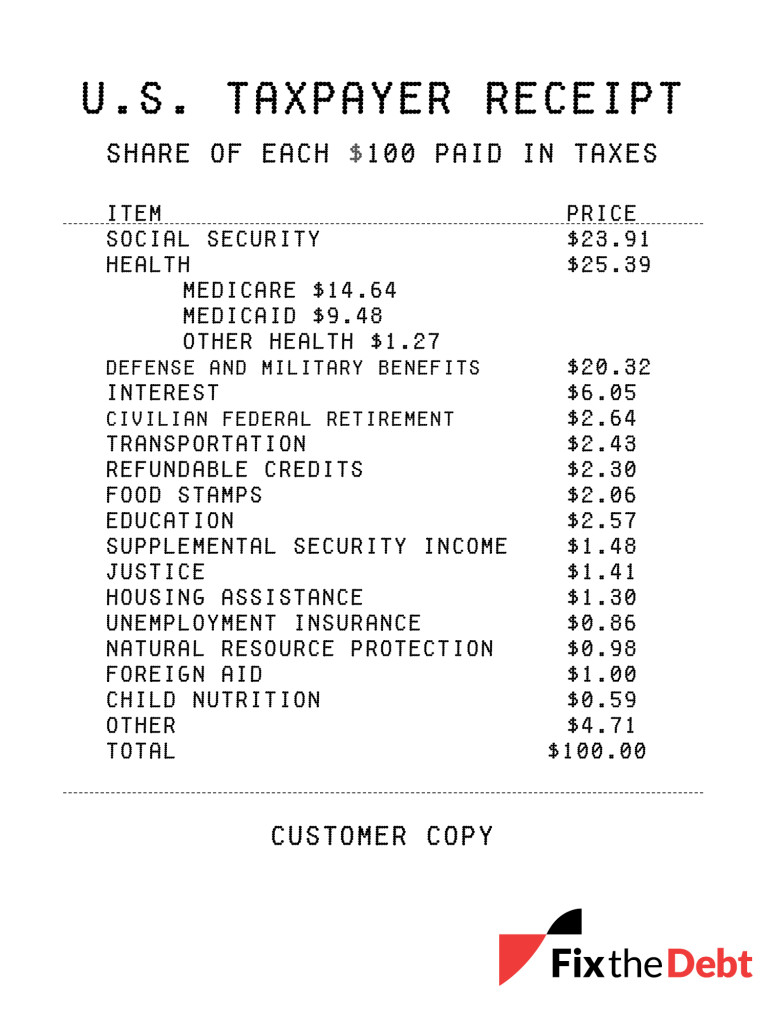

This is a “taxpayer receipt” highlighting where the money goes and highlight where it comes from in the first place.

How are our federal tax dollars spent? As the taxpayer receipt illustrates, more than $75 of every $100 paid in federal taxes goes to Social Security, federal health care, defense, and interest on the debt. And the amounts for Social Security, health care, and interest are forecast to grow considerably in the years to come.

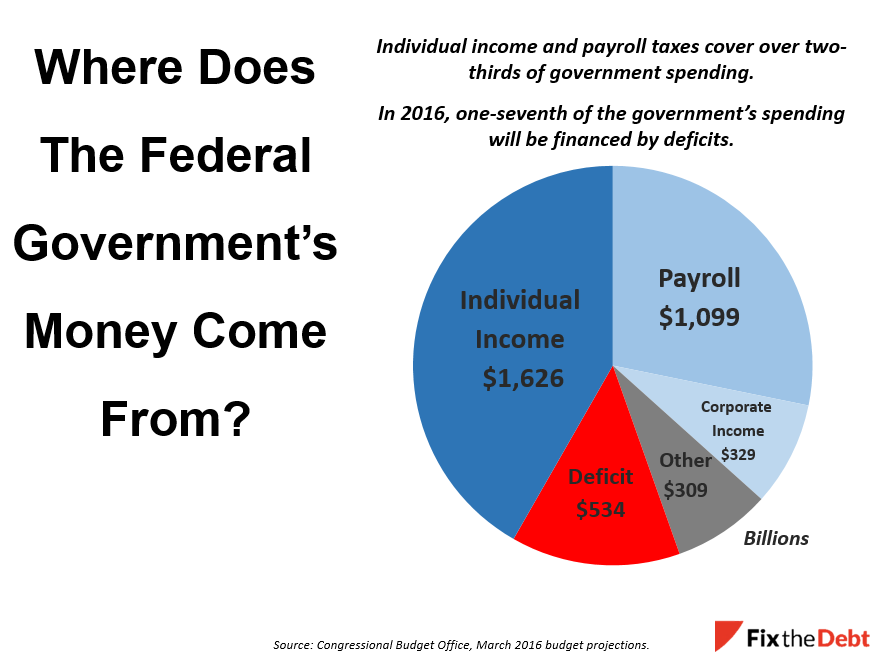

Where does the money come from? Much of the revenue for the federal government comes from the individual income tax that many of us are rushing to complete. Another major source is the payroll tax, which is the “FICA” tax that is withheld from your paycheck. It is used to fund Social Security benefits and parts of Medicare.

But a significant part of the government is deficit financed because spending exceeds revenue. That share is expected to grow substantially in the years ahead.

Check out their blog for more information.

by | ARTICLES, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, HYPOCRISY, POLITICS, TAXES

Yesterday, The Treasury Department made more changes to rules with regard to inversions. The driving force behind the constant meddling into this legal practice is the retention of tax revenue.

“Under the new rules, there will be a three-year limit on foreign companies bulking up on U.S. assets to avoid ownership requirements for a later inversions deal, Treasury said in a statement.”

In an inversion, a U.S. company typically buys a smaller foreign rival and reincorporates to the rival’s home country, which moves the company’s tax domicile, though core management usually stays in the United States.

The Treasury, which had last introduced new rules in November to curb inversions, also is proposing tackling the practice of post-inversion earnings stripping with new limits on related-party debt for U.S. subsidiaries.”

This continued attack on inversions is ridiculous and companies are being targeted unfairly because they represent a possible loss of revenue for the government. Inversions are legal, and sometimes necessary. They are a way for U.S. companies to change their HQ from the U.S. to a foreign country, for the sole purpose of allowing themselves the express privilege of being on par with foreign companies and eliminate the severe disadvantage that the U.S. puts on its own businesses via excessive taxes!

It is outrageous that the government applies such discrimination. It is outrageous that American companies have to chose to move their headquarters elsewhere simply to survive and compete globally, because they are taxed on their profits in two jurisdictions — both domestic and foreign.

by | ARTICLES, BLOG, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Everything we were promised with Obamacare has yet to come to fruition: keep your plan! lower prices! tens of millions insured! and a litany of other broken promises and predictions.

Obamacare was signed into law on March 23, 2010. The Weekly Standard took the time to perform a thorough examination on the current state of Obamacare, an audit perhaps, comparing what was promised and what has been delivered. Their findings are sobering. It also offers some remedies of the most egregious maladies plaguing this particular legislation. I have reprinted the article in its entirety below, because it is chock-full of good information:

Three years ago, on the eve of Obamacare’s implementation, the Congressional Budget Office (CBO) projected that President Obama’s centerpiece legislation would result in an average of 201 million people having private health insurance in any given month of 2016. Now that 2016 is here, the CBO says that just 177 million people, on average, will have private health insurance in any given month of this year—a shortfall of 24 million people.

Indeed, based on the CBO’s own numbers, it seems possible that Obamacare has actually reduced the number of people with private health insurance. In 2013, the CBO projected that, without Obamacare, 186 million people would be covered by private health insurance in 2016—160 million on employer-based plans, 26 million on individually purchased plans. The CBO now says that, with Obamacare, 177 million people will be covered by private health insurance in 2016—155 million on employer-based plans, 12 million on plans bought through Obamacare’s government-run exchanges, and 9 million on other individually purchased plans (plus a rounding error of 1 million).

In other words, it would appear that a net 9 million people have lost their private health plans, thanks to Obamacare—with a net 5 million people having lost employer-based plans and a net 4 million people having lost individually purchased plans.

None of this is to say that fewer people have “coverage” under Obamacare—it’s just not private coverage. In 2013, the CBO projected that 34 million people would be on Medicaid or CHIP (the Children’s Health Insurance Program) in 2016. The CBO now says that 68 million people will be on Medicaid or CHIP in 2016—double its earlier estimate. It turns out that Obamacare is pretty much a giant Medicaid expansion.

To be clear, the CBO—which has very generously labeled Obamacare’s direct subsidies to insurance companies as “tax credits,” even though sending money to insurers doesn’t lower anyone’s taxes—isn’t openly declaring that Obamacare has reduced the number of people with private health insurance or that it has doubled the number of people on Medicaid or CHIP. Rather, the CBO maintains that Obamacare has actually increased the number of people with private health insurance by 9 million and has increased the number of people on Medicaid or CHIP by (just) 13 million. But it would seem that the only reason the CBO can make these claims is that it has moved the goalposts.

That is, the CBO has significantly altered its estimates for what 2016 would have looked like if Obamacare had never been passed. In 2013, the CBO projected that, in the absence of Obamacare, 186 million people would have had private health insurance in 2016, and 34 million people would have been on Medicaid or CHIP. The CBO now maintains that, in the absence of Obamacare, only 168 million people would have had private health insurance in 2016 (a reduction of 18 million people from its 2013 projection), while 55 million people would have been on Medicaid or CHIP (an increase of 21 million people from its 2013 projection). Somehow the hypothetical non-Obamacare world has changed a lot in the past three years. (The CBO doesn’t explain how this could have happened.)

Even the CBO’s revised figures for a non-Obamacare world, however, can’t gloss over the fact that Obamacare has failed to hit its target for private health insurance by 24 million people. To see that, one must simply compare Obamacare’s new tally of 177 million to its 2013 target of 201 million.

The CBO doesn’t release retroactive scoring of Obamacare. Try finding, for example, tallies from the federal government (whether from the CBO or otherwise) on what Obamacare has actually cost so far. Rather, the CBO is like a handicapper who predicts the results of horseraces, but then never bothers to publish the races’ actual results.

Now that it’s clear enough, however, that Obamacare is basically an expensive Medicaid expansion coupled with 2,400 pages of liberty-sapping mandates, it’s time for a winning Obamacare alternativeto emerge, one along the lines of what Ed Gillespie almost rode to victory in the Virginia Senate race. Such an alternative should address the longstanding inequity in the tax code—between employer-based and individually purchased insurance—while adhering to four basic notions:

1. It shouldn’t touch the tax treatment of the typical American’s employer-based plan.

2. It should close the tax loophole on the employer side—which says that the more you spend (on insurance), the more you save (in taxes)—by capping the tax exclusion at $20,000 for a family plan (while letting anyone with a more expensive plan still get the full tax break on that first $20,000).

3. It should offer a simple tax break for individually purchased insurance that isn’t income-tested and thus doesn’t pick winners and losers (in marked contrast with Obamacare, which is all about picking winners and losers.)

4. It shouldn’t provide direct subsidies to insurance companies like Obamacare does. (The federal government provides a tax break for mortgage interest paid—it doesn’t directly pay a portion of people’s mortgage bills. Likewise, it shouldn’t directly pay people’s health insurance bills as if it were some kind of “single payer.”)

In addition, anyone crafting an Obamacare alternative should keep this important point in mind and express it publicly: Far from being the gospel truth, the CBO’s scoring is more like a wild guess that will never be checked against future reality.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, POLITICS, TAX TIPS, TAXES

We’re coming up on three years since the IRS scandal broke in May 2013. Most Americans have certainly forgotten about it, especially since the former head, Lois Lerner, went wholly unpunished. But some targeted groups have not forgotten about it, and continue to fight for transparency with the entire affair.

Earlier this week, a federal appeals court “ordered the IRS to quickly turn over the full list of groups it targeted so that a class-action lawsuit, filed by the NorCal Tea Party Patriots, can proceed. The judges also accused the Justice Department lawyers, who are representing the IRS in the case, of acting in bad faith — compounding the initial targeting — by fighting the disclosure.”

The IRS, of course, claimed that no targeting happened — that it was merely an issue of poorly trained employees. Of course, we all know better. A vast majority of the targets were conservative or tea-party groups, there were secret buzz words to identify them, and some of the groups still have not attained 501c3 status after 5 years!

According to the Washington Times, Tea Party groups have been trying for years to get a full list of nonprofit groups that were targeted by the IRS, but the IRS had refused, saying that even the names of those who applied or were approved are considered secret taxpayer information. The IRS said section 6103 of the tax code prevented it from releasing that information.

Judge Kethledge, however, said that turned the law on its head. ‘Section 6103 was enacted to protect taxpayers from the IRS, not the IRS from taxpayers,’ he wrote.”

This particular ruling certified the NorCal case as a class-action lawsuit. Others who were targeted may be permitted to join the case, but until that list is revealed, it is unknown who exactly among the 200 or so groups involved were actually targeted.

Now, “the case moves to the discovery stage, where the tea party groups’ lawyers will ask for all of the agency’s documents related to the targeting and will depose IRS employees about their actions.”

As a CPA intimately involved with the IRS for many years, I have been following this case since the beginning and have continued to report on updates. The actions of the IRS were particularly egregious and overreaching, and no one was appropriately punished for it. It’s good that some of the groups remain dedicated to getting more answers that what has been divulged by the Department of Justice to date.

by | ARTICLES, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Earlier this month, the Wall Street Journal noted an incredible sequence of events brought to light through judicial process and undercover emails. Obama meddled in the net-neutrality process, violating standards of conduct. I have reproduced the article in its entirety, as the contents contained therein are rather incredulous:

Congressional committees rarely re-report journalistic exposés, but it’s amazing what information subpoenas can pry loose. A Senate committee has exposed new details on how the White House broke the law to get the Internet regulated as an old-fashioned utility, including emails that show how shocked regulators at the Federal Communications Commission were at the violation of their agency’s independence.

A page-one article in The Wall Street Journal last year detailed an “unusual, secretive effort inside the White House” led by a small group “acting like a parallel version of the FCC itself.” President Obama’s aides thought net neutrality “would help define the president’s legacy” and that along with immigration could be handled by unilateral presidential action. The courts have blocked Mr. Obama’s executive order on immigration, and the Internet regulations should be next to go.

The report, from Republicans on the Senate Committee on Homeland Security and Governmental Affairs, finds that FCC staff worked through a weekend in November 2014 to finalize a plan backed by Chairman Tom Wheeler for light regulation of the Internet. They were shocked on Monday, Nov. 10, when an agency official forwarded a news alert, which she summarized as follows: “Obama says to make it Title II”—the heavy-handed law regulating railroads and the old monopoly phone system.

Staffers then shared a flurry of emails: “Not sure how this will affect the current draft and schedule—but I suspect substantially.” “This might explain our delay.” “It might indeed.” “Will try to get to the bottom of this this morning.” “At least the delays in edits from above now makes [sic] sense.”

Panic struck when it became clear the chairman would cave in to Mr. Obama’s demand and surrender the FCC’s independence. This is a verbatim quote from a draft media Q&A prepared for Mr. Wheeler:

“Q. Has there been discussions between the WH and the FCC leading up to this rollout?

“A. The FCC kept the WH apprised of the process thus far, but there have not been substantive discussions [IS THIS RIGHT?].”

FCC staffers cited nine areas in which the last-minute change violated the Administrative Procedure Act, which requires advance public notice of significant regulatory changes. Agency staffers noted “substantial litigation risk.” A media aide warned: “Need more on why we no longer think record is thin in some places.”

These emails are a step-by-step display of the destruction of the independence of a regulatory agency. The Senate report should make fascinating reading for the federal appellate judges considering whether to invalidate the regulations.

Mr. Obama’s edict resulted in 400 pages of slapdash regulations that the agency’s own chief economist has dismissed as an “economics-free zone.” In the year since Obamanet has been in effect, regulatory uncertainty has led to a collapse in investment in broadband.

Independent regulatory agencies operate in a constitutional gray area, separate from the executive and legislative branches. They have the power to issue broad rules but are unaccountable to voters. The rationale is that agency staffers are experts in the fields they regulate. That justification collapses if they’re subject to political pressure.

In 1983, Ronald Reagan held a single meeting with his FCC chairman on the issue of regulating television rerun revenues. Unlike Mr. Obama, Reagan didn’t have his own staff working on the regulations. And Reagan didn’t express any opinion on the rules—also unlike Mr. Obama, who issued a video promoting utility regulation for the Internet.

Yet Reagan’s modest involvement was headline news. A congressional committee declared he “acted improperly and undermined the fairness and integrity” of the FCC. Sen. Daniel Patrick Moynihan said: “It is imperative for the integrity of all regulatory processes that the president unequivocally declare that he will express no view on the matter.” The Washington Post editorialized: “The danger lies in the kind of chilling signal a certain kind of presidential participation might send to all regulatory agencies about the possible fragility of their independence.”

A 1991 opinion from the Justice Department’s Office of Legal Counsel warns: “White House staff members should avoid even the mere appearance of interest or influence—and the easiest way to do so is to avoid discussing matters pending before the independent regulatory agencies with interested parties and avoid making ex parte contacts with agency personnel.”

The appeals court has plenty of evidence proving White House meddling with a supposedly independent agency. Voters have more reason for outrage at an administration that ignores limits on its power. The Internet is too important to be left to politicians, especially ones who violate the law.

by | ARTICLES, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, POLITICS, TAXES

Dustin Howard over at Americans for Limited Government tackles one of the key factors contributing to the rise of corporate inversions: high corporate taxes. I would also argue that another mitigating factor is foreign-earned income, which the United States government lays claim to — and is the only major country to do so. Under U.S. tax law, U.S. companies are forced to pay both foreign- and domestic-earned income, putting them at a global disadvantage.

At any rate, Howard’s piece is a worthwhile read on the equally detrimental effect of high corporate tax rates. I have shared it in its entirety below.

“How should policymakers stop the bleeding of American jobs overseas? There’s one easy answer among many harder ones, and that is to stop making it so expensive to do business in the United States.

Many things price American workers out of competition, whether it be the current mix of trade rules, currency manipulation and other unfair labor practices but the easiest to address domestically is the corporate tax rate. Government’s unwillingness to do with less is making it considerably harder for Americans to even work.

Seriously, why should American corporations pay a 39 percent rate, among the world’s highest, to headquarter here when they can “invert” to Ireland and pay 12.5 percent, less than one third the domestic rate?

If the corporation can keep most of their American workforce and keep 26.5 percent more of their money as an alternative by cutting the corporate tax rate, wouldn’t that a good thing?

Why would the U.S. maintain a policy that discourages business from even being on American soil?

Democrats propose a solution to this phenomenon: punish the innovating refugees that refuse to pay into their racket. They believe in taxing the profits of inverted firms. One problem: extrapolating from a recent study by economist Wayne Winegarden for the Pacific Research Institute, this actually further discourages firms from even retaining their American workforce, and encourages them to simply export their products outright from their new foreign addresses.

Call it a lose-lose proposition, where American workers lose jobs, American businesses leave and revenues drop while the deficit increases; Ireland should chip in and send Democrats a fruit basket.

If taxing inverted companies suddenly sounds unappealing, here’s an alternative: make inversions less attractive as a means of generating profit. The U.S. is a free country, so it looks bad when it punishes corporations for acting in their best interest. Instead, why not lower the tax rate to a more competitive, attractive rate, and then focus rolling back the regulatory state that is literally paid by taxpayers to make businesses less productive?

The first step on this path would be to begin reducing the cost of business with a comprehensive set of tax reforms that clean up our messy corporate tax code, and give businesses a sense of calm when planning for the future.

Besides it’s not like the corporate tax generates that much revenue anyway, at just 10.6 percent of $3.2 trillion of total receipts in 2015, according to the Office of Management and Budget. By far the most revenue comes from individual and payroll taxes.

As things stand, corporations are seeking foreign shores to chart out profitable futures, mainly because the business climate in the U.S. has made itself so volatile that it cannot accomplish that at home. The data supports the notion that punishing corporations that choose foreign domiciles will hurt working Americans more than it will avenge or protect them. The limited government solution is to let individuals choose what works for them, and to tax them at a reasonable rate so they do not move out of necessity.

As stated above, lowering the corporate tax rate is just one part of the solution. America has fundamental problems across the board that put us at a global disadvantage that should also be addressed.

The corporate tax rate is a necessary first step to signal to the world that we are restructuring the policies to make the U.S. more attractive among competitors. Creating jobs in America begins with keeping the economy free and competitive, and that cannot happen without fiscal restraint and limiting government, but also cannot happen if we’re taxing ourselves to the stone age.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, POLITICS, TAXES

The following is a short version of a recent talk by Ben Eisen regarding the minimum wage issue as a poverty-fighting tool. It is undeniable that the percentage of full-time workers in poverty is much less than part-time workers. “He explained – using sound economic theory and admirable coverage of empirical findings – that the minimum wage is as effective a tool for fighting poverty as is gasoline as a tool for fighting fires.

One of the stats that Ben cited is that only three percent of workers who work full-time year ’round live below the poverty line, while sixteen percent of workers who work only part-time live below the poverty line. (I can’t recall if Ben’s stats are for Canada or the U.S., but because the general trend no doubt holds in nearly all countries, whether Ben’s specific stats are for Canada or the U.S. doesn’t matter for purposes of my post here.)

Here’s a mental experiment (one that I might have offered, in some form, in the past): suppose that Pres. Hillary Clinton or Pres. Bernie Sanders – displaying to the public her or his courageous opposition to poverty – cites the stat that Ben mentioned and then proposes that government outlaw part-time work. “Because every worker should be able to live decently upon his or her earnings,” proclaims the president, “and because working full-time enables a worker to earn more income than that worker earns when working only part-time, it shall hereby be the law of the land that every worker must be employed full-time.”

I’m pretty sure even the most ardent supporter of the minimum wage would balk at such a proposal. But why? What’s the difference between minimum-hour legislation and minimum-wage legislation? If government dictates that each worker shall be paid no less than $X per hour, and if this diktat has no effect on workers other than ensuring that no worker is paid less than $X per hour, what reason is there to suppose that if government dictates that all jobs shall be full-time jobs that this diktat have any effect on workers other than ensuring that all workers will now be employed full-time – and, hence, that the number of people living in poverty will fall?

Put differently, if government can work miracles when it dictates hourly wages, why can’t it work miracles when it dictates hours of work?”

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

According to an economist at the Congressional Budget Office (CBO), the federal government should examine the question of taxing drivers by the mile as a means of raising higher revenue for highway programs.

According to the Washington Examiner, “Chad Shirley, CBO’s deputy assistant director for microeconomic studies, gave a presentation that says federal gas tax revenues are falling short of federal spending on highway programs. But to resolve that problem, Shirley didn’t propose less federal spending, and instead offered three suggestions.”

1) Charge drivers more through the implementation of a “vehicle-miles traveled charges.”

2) Charging them more when traffic is bad. Shirley calls that “congestion pricing.”

3) Charging tolls on “additional existing interstates.”

The idea of a “vehicle miles traveled tax,” or a “VMT” tax, was considered in 2011 in a bill that never came to fruition. That plan “foresaw the installation of equipment on people’s cars and trucks that would measure how far they drive, and the collection of taxes electronically through a reading of those devices at gas stations.”

Whether or not these new suggestions will be considered again remains to be seen. The CBO says that its three suggestions are not higher taxes or fees, but as an attempt to “make federal highway spending more productive for the economy.”

Such proposals are invasive of people’s privacy, and represent another ridiculous attempt at trying to regulate the behaviors of people.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, POLITICS, TAXES

The great Don Boudreaux a friend of mine, made mention of this picture last week over on his superb blog, Cafe Hayek. The picture is apparently a favorite among Trump supporters.

“What to say? Perry Potts Eidelbus, a Facebook friend, describes it as “a distillation of economic ignorance into pure form.” Indeed. It’s much like Trump himself: the very image of economic ignorance.

Trump is doing now from the political right what Paul Krugman has done so successfully over the past decade and a half from the political left, which is the following: boisterously assuring people that their untutored instincts about the economy are indeed accurate – telling people that what they immediately see in economic affairs and policies is all that there is to see in economic affairs and policies (that is, that there is no ‘unseen’ whose reality can be perceived and understood only by looking beyond that which is immediately obvious). According to this bastardized, pandering version of economics, actual consumable goods (such as are pictured here) are reckoned to be costs, while toil is reckoned to be a benefit. The economic problem is not rooted in scarcity, it is rooted in abundance. Social benefactors, therefore, are those who promise to deny to us the fruits of the economy’s abundance (along with, by the way, our economic freedoms) as they bestow upon us ever-greater scarcity that will bless us with the need for more toil.

The photo shown here is, in short, itself an intellectual cargo ship loaded down with countless tons of economic ignorance.”

by | ARTICLES, BLOG, CONSTITUTION, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Obama weighed in on the current Apple-government dispute, saying that access should be made necessary.

From Reuters:

U.S. President Barack Obama on Friday made a passionate case for mobile devices to be built in such a way as to allow government to gain access to personal data if needed to prevent a terrorist attack or enforce tax laws.

Speaking at the South by Southwest festival in Texas, Obama said he could not comment on the legal case in which the FBI is trying to force Apple Inc. to allow access to an iPhone linked to San Bernardino, California, shooter Rizwan Farook.

But he made clear that, despite his commitment to Americans’ privacy and civil liberties, a balance was needed to allow some intrusion when needed.

“The question we now have to ask is: If technologically it is possible to make an impenetrable device or system where the encryption is so strong that there is no key, there’s no door at all, then how do we apprehend the child pornographer, how do we solve or disrupt a terrorist plot?” he said.

“What mechanisms do we have available to even do simple things like tax enforcement because if in fact you can’t crack that at all, government can’t get in, then everybody is walking around with a Swiss bank account in their pocket.”

The Justice Department has sought to frame the Apple case as one not about undermining encryption. A U.S. Federal Bureau of Investigation court order issued to Apple targets a non-encryption barrier on one iPhone.

The FBI says Farook and his wife were inspired by Islamist militants when they shot and killed 14 people on Dec. 2 at a holiday party in California. The couple later died in a shootout with police.

“Setting aside the specific case between the FBI and Apple, … we’re going to have to make some decisions about how do we balance these respective risks,” Obama said.

“My conclusion so far is you cannot take an absolutist view.”

Obama was speaking at the South by Southwest festival in Austin about how government and technology companies can work together to solve problems including making it easier for people to vote.