by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

Daniel Mitchell, a libertarian economist and Senior Fellow at the CATO Institute, offered an overall positive review of Rand Paul’s tax plan that was released today. He had three minor quibbles and one major concern with the proposal. It his his evaluation of Paul’s 14.5% business activity tax that is the interesting point for discussion — Mitchell asserts is a Value-Added Tax (VAT) for all intents and purposes.

Paul’s argues that he “would also apply this uniform 14.5% business-activity tax on all companies…. This tax would be levied on revenues minus allowable expenses, such as the purchase of parts, computers and office equipment. All capital purchases would be immediately expensed, ending complicated depreciation schedules.”

As Mitchell points out, the high corporate tax rate (35%) would be reduced down to 14.5% which is obviously a great thing. His bone of contention is the “business-activity tax doesn’t allow a deduction for wages and salaries” and therefore, “he is turning the corporate income tax into a value-added tax (VAT).” In theory, he argues, a VAT would not be a terrible thing because “is a consumption-based tax which does far less damage to the economy, on a per-dollar-collected basis, than the corporate income tax.”

However, the VAT’s place in other economies have proven to be, as Mitchell suggests, “a money machine for big government”, and therefore Mitchell cautions against its implementation in the United States.

Mitchell contends,

“The VAT helped finance the giant expansion of the welfare state in Europe. And the VAT is now being used to enable ever-bigger government in Japan. Heck, even the IMF has provided evidence (albeit inadvertently) that the VAT is a money machine. All of which helps to explain why it would be a big mistake to give politicians this new source of revenue.

Indeed, this is why I was critical of Herman Cain’s 9-9-9 plan four years ago. It’s why I’ve been leery of Congressman Ryan’s otherwise very admirable Roadmap plan. And it’s one of the reasons why I feared Mitt Romney’s policies would have facilitated a larger burden of government.

These politicians may have had their hearts in the right place and wanted to use the VAT to finance pro-growth tax reforms. But I can’t stop worrying about what happens when politicians with bad motives get control. Particularly when there are safer ways of achieving the same objectives.”

Mitchell gives an alternative suggestion for reforming the corporate part of the tax code. He calls for “an incremental reform”, consisting of the following:

–Lower the corporate tax rate

–Replace depreciation with expensing

–Replace worldwide taxation with territorial taxation

His suggestion is that if there is enough support within Congress to potentially reform the corporate income tax (and replace it with a VAT), there should also be support for an alternative reform done incrementally, which would be far better in the long run than introducing a VAT for good.

So are Mitchell’s concerns about Paul’s “business activity tax” valid? Is it essentially a VAT? Pretty much. The VAT gets added to products along the way in the process of production and distribution, and is ultimately passed on to the consumer in the form of the final price.

One could certainly argue that the VAT is not a positive solution for reasons such as the fact that European economies which have the VAT are also in shambles. Also, though many of the VATs started out small, most VATs average nearly 20%. That would likely happen here too — while we still continue to collect an income tax. What’s more, it also tends to disproportionately affect small businesses because they often can’t pass along the cost increases associated with the VAT, and compliance will be burdensome and expensive.

Overall, though, Mitchell was pleased with Rand Paul’s plan, which is to be expected from a fellow libertarian economist. His points about the business activity tax are fair, but Paul’s roadmap is overall a decent one. As more contenders for 2016 release their tax plans, we’ll evaluate them here. Thoughts?

by | ARTICLES, BLOG, ECONOMY, OBAMA, POLITICS, TAXES

Rand Paul blew up the pages of the Wall Street Journal this evening with his Op-Ed he released a few hours ago on his plan to reform the tax code. The formal announcement comes tomorrow, but his tax plan is what he calls “The Fair and Flat Tax”.

The basic tenets call for a 14.5% tax for both individuals and businesses, elimination of the payroll tax, gift tax, and estate tax, and more. He’ll keep mortgage and charitable deductions, as well as the Earned Income Tax Credit, and the first $50,000 of income of a family of four will not be taxed.

Rand Paul boosts working with Stephen Moore and Arthur Laffer and says his plan will jump start the economy. The only thing he didn’t really delve into was how much federal income his plan would bring.

You can read the entire proposal below, but I’ll give Rand Paul credit for talking about our byzantine, convoluted tax code and making it a focal point of his campaign. Let me know what you think in the comments below. Here it is:

Some of my fellow Republican candidates for the presidency have proposed plans to fix the tax system. These proposals are a step in the right direction, but the tax code has grown so corrupt, complicated, intrusive and antigrowth that I’ve concluded the system isn’t fixable.

So on Thursday I am announcing an over $2 trillion tax cut that would repeal the entire IRS tax code—more than 70,000 pages—and replace it with a low, broad-based tax of 14.5% on individuals and businesses. I would eliminate nearly every special-interest loophole. The plan also eliminates the payroll tax on workers and several federal taxes outright, including gift and estate taxes, telephone taxes, and all duties and tariffs. I call this “The Fair and Flat Tax.”

President Obama talks about “middle-class economics,” but his redistribution policies have led to rising income inequality and negative income gains for families. Here’s what I propose for the middle class: The Fair and Flat Tax eliminates payroll taxes, which are seized by the IRS from a worker’s paychecks before a family ever sees the money. This will boost the incentive for employers to hire more workers, and raise after-tax income by at least 15% over 10 years.

Here’s why we have to start over with the tax code. From 2001 until 2010, there were at least 4,430 changes to tax laws—an average of one “fix” a day—always promising more fairness, more simplicity or more growth stimulants. And every year the Internal Revenue Code grows absurdly more incomprehensible, as if it were designed as a jobs program for accountants, IRS agents and tax attorneys.

Polls show that “fairness” is a top goal for Americans in our tax system. I envision a traditionally All-American solution: Everyone plays by the same rules. This means no one of privilege, wealth or with an arsenal of lobbyists can game the system to pay a lower rate than working Americans.

Most important, a smart tax system must turbocharge the economy and pull America out of the slow-growth rut of the past decade. We are already at least $2 trillion behind where we should be with a normal recovery; the growth gap widens every month. Even Mr. Obama’s economic advisers tell him that the U.S. corporate tax code, which has the highest rates in the world (35%), is an economic drag. When an iconic American company like Burger King wants to renounce its citizenship for Canada because that country’s tax rates are so much lower, there’s a fundamental problem.

Another increasingly obvious danger of our current tax code is the empowerment of a rogue agency, the IRS, to examine the most private financial and lifestyle information of every American citizen. We now know that the IRS, through political hacks like former IRS official Lois Lerner, routinely abused its auditing power to build an enemies list and harass anyone who might be adversarial to President Obama’s policies. A convoluted tax code enables these corrupt tactics.

My tax plan would blow up the tax code and start over. In consultation with some of the top tax experts in the country, including the Heritage Foundation’s Stephen Moore, former presidential candidate Steve Forbes and Reagan economist Arthur Laffer, I devised a 21st-century tax code that would establish a 14.5% flat-rate tax applied equally to all personal income, including wages, salaries, dividends, capital gains, rents and interest. All deductions except for a mortgage and charities would be eliminated. The first $50,000 of income for a family of four would not be taxed. For low-income working families, the plan would retain the earned-income tax credit.

I would also apply this uniform 14.5% business-activity tax on all companies—down from as high as nearly 40% for small businesses and 35% for corporations. This tax would be levied on revenues minus allowable expenses, such as the purchase of parts, computers and office equipment. All capital purchases would be immediately expensed, ending complicated depreciation schedules.

The immediate question everyone asks is: Won’t this 14.5% tax plan blow a massive hole in the budget deficit? As a senator, I have proposed balanced budgets and I pledge to balance the budget as president.

Here’s why this plan would balance the budget: We asked the experts at the nonpartisan Tax Foundation to estimate what this plan would mean for jobs, and whether we are raising enough money to fund the government. The analysis is positive news: The plan is an economic steroid injection. Because the Fair and Flat Tax rewards work, saving, investment and small business creation, the Tax Foundation estimates that in 10 years it will increase gross domestic product by about 10%, and create at least 1.4 million new jobs.

And because the best way to balance the budget and pay down government debt is to put Americans back to work, my plan would actually reduce the national debt by trillions of dollars over time when combined with my package of spending cuts.

The left will argue that the plan is a tax cut for the wealthy. But most of the loopholes in the tax code were designed by the rich and politically connected. Though the rich will pay a lower rate along with everyone else, they won’t have special provisions to avoid paying lower than 14.5%.

The challenge to this plan will be to overcome special-interest groups in Washington who will muster all of their political muscle to save corporate welfare. That’s what happened to my friend Steve Forbes when he ran for president in 1996 on the idea of the flat tax. Though the flat tax was surprisingly popular with voters for its simplicity and its capacity to boost the economy, crony capitalists and lobbyists exploded his noble crusade.

Today, the American people see the rot in the system that is degrading our economy day after day and want it to end. That is exactly what the Fair and Flat Tax will do through a plan that’s the boldest restoration of fairness to American taxpayers in over a century.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

The number of new businesses has been on the decline since 2008, with more businesses closing than opening. The US Census Bureau confirmed the statistics, which was reported on by Gallup earlier this year. This startling trend also reaffirms a study released last year by the Brookings Institute, which noted that 2009, 2010, and 2011 saw the collapse of businesses faster than their creation.

The annoying thing about the Brookings Institute’s study is that they do not attribute the decline to anything in particular, saying that they need “a more complete knowledge about what drives dynamism, and especially entrepreneurship, than currently exists.” This is utter nonsense, and reinforces why I typically don’t pay attention to what the Brookings Institute says. They are providing political cover for the Obama Administration with their non-conclusive conclusion about the decline of new business.

The most suffocating factor is the sharp rise of federal regulations, which now cost the American economy nearly $1.9 trillion every year — more than 10% of our nation’s GDP. Add in state and local regulations, and that total is even higher.

Not surprisingly, the rates of business start-ups and deaths have changed for the worse as regulatory costs have grown. No wonder: Anyone who wants to stay in business has to keep finding more money to pay for higher costs, while anyone who wants to start a new business has to clear financial and legal barriers that get taller every year. The founder of Subway recently remarked that his company “would not exist” if today’s regulatory burden had existed when he started it in the 1960s.

Simply look at the past few years to see how the regulatory state has grown. Between 2009 and 2013, the federal government added $494 billion in regulatory costs to the American economy. The highlight was 2012, when President Obama and his executive agencies published over $236 billion in new costs. As for 2014, the federal government announced over 79,000 pages of new regulations, costing a total of $181.5 billion.

That’s equivalent to 3.5 million median family incomes. But it isn’t flowing to families through new jobs and higher wages — it’s lost on lawyers, paperwork and other compliance costs.

I was curious what some of the largest wealth managers had to say about the economy. Was anyone talking about the recovery (or lack thereof)? High taxes? Regulation? I took a sampling of the CEOs of Citigroup, JP Morgan Chase, Goldman Sachs, and Morgan Stanley to see what, if anything, they’ve publicly discussed in the last 6 months to a year. The only one that has spoken on the subject is Jamie Dimon of Chase, who stated earlier this year that “the U.S. economy is doing well” but he blamed poor government and regulatory policies for hurting growth. “We’re growing at 2.5 percent. We should be doing better. “I blame them all,” Dimon said of politicians. “To me, they waste a lot of time pointing fingers and not collaborating.”

But they do spend time regulating. This is the canary in the coalmine which impacts new and potential entrepreneurs. Many see the start up costs and the regulatory headaches as too burdensome a barrier to even begin, thus deciding it’s not worth it. Small businesses have been the backbone of America, the pathway to our greatness, and this recent, rapid decline in American business is most alarming.

by | ARTICLES, BLOG, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, RETIREMENT, SOCIAL SECURITY, TAXES

I recently read a letter to the editor about Social Security in the Wall Street Journal that irritated me. Not the letter writer per se, but more by the Wall Street Journal choosing to print a letter that perpetuates a widely perceived myth about Social Security.

The letter was simply this: “Oh, please don’t blame older Americans for “eating up the budget” through payments of Social Security and Medicare benefits. It is the federal government that raided the Social Security Trust Fund. Older Americans have contributed to this for years. Where is the money now?”

The problem with this letter writer is that they really just don’t understand the truth that people who have paid into Social Security are getting many, many more times the actuarial value than what they put into it. It’s not a simple misunderstanding on this. It really, truly is just a flat-out lie that people who put 30-40 years worth of payments are merely getting back just what they put in.

The politicians need this lie to survive because they risk alienating a large voting bloc of older Americans if they merely even suggest that Social Security needs reform. But it does; the egregious state that Social Security is hidden by the way the federal government accounts for it. They even have a special name for it. Social Security is repeatedly described as a pay-as-you-go (“PAYGO”) system, which gives credence to something that is terribly incorrect. PAYGO is not a system at all; rather it is a method of reporting that hides earned realities, making it totally unacceptable to accounting professions, the SEC, and virtually everybody outside the government.

Calling it PAYGO helps to perpetuate the fallacy that beneficiaries are merely receiving what they paid into to. I don’t want to pick on the poor letter writer, as she doesn’t seem to really know how Social Security works (or hasn’t worked). But the Wall Street Journal should know better.

I suppose it is fitting that the 1936 Bulletin announcing Social Security ends like this: “What you get from the Government plan will always be more than you have paid in taxes and usually more than you can get for yourself by putting away the same amount of money each week in some other way.”

This is why we have accrued trillions in unfunded liabilities such as Social Security. If it sounds too good to be true, it probably is.

by | ARTICLES, BLOG, BUSINESS, FREEDOM, GOVERNMENT, OBAMA, POLITICS

On Monday, the Department of Education announced student loan debt forgiveness for students at the now-closed Corinthian College system in California. At the end of April, the Department of Education slapped the for-profit college group with $30 million in fines for allegedly misrepresenting post-graduation job prospects and/or placement rates to some 900 students in 12 schools since 2007. Read the letter here.

Never mind that in 2010 (a year for which I have numbers), 110,000 students were enrolled in 100 schools in their system. That means the total transgressions represent less than 1% of the entire school population. And yet, the DoE decided that 40,000 students in the shuttered college system were eligible for immediate loan forgiveness for Corinthian’s misdeeds; all the students need to do is fill out a form, and their loan will be covered. By taxpayers, to the tune of an estimated $500 million dollars.

But why? That’s where it gets interesting.

Enter Kamala Harris. She’s the current Attorney General in California and she’s running for retiring Senator Barbara Boxer’s seat. Harris worked in conjunction with the Department of Education specifically targeting the Corinthian College system. According to the Wall Street Journal, “Last summer the Education Department began to drive Corinthian out of business by choking off federal student aid for supposedly stonewalling exhaustive document requests. The Department claimed to be investigating whether Corinthian misrepresented job placement rates as California Attorney General Kamala Harris alleged in a lawsuit.”

Corinthian agreed to turn over their education centers to other non-profits, but Kamala Harris refused to release any buyer of potential future liability, meaning anyone purchasing would be under constant threat of a lawsuit. Last November, “the nonprofit Education Credit Management Corporation (ECMC) “agreed to buy more than 50 Corinthian campuses for $24 million plus $17.25 million in protection money to the feds for a release from liability. But ECMC passed up Corinthian’s 23 schools in California because Ms. Harris wouldn’t quit.” The alternative to having no buyer for these particular schools would ultimately be to shut them down.

It was in April 2015 that Corinthian was slapped with the $30 million fine, which effectively drove the final nail in the coffin of the remaining schools because no one in their right mind would shoulder the liability. As for the hefty penalty, “The Department assessed the maximum fine of $35,000 per regulatory violation, which its bureaucrats count as each student that was improperly counted.” By the end of the month, all the rest of the schools indeed closed, throwing out of employment and school, thousands of people.

For those affected, “to mitigate the political damage, DoE [deputized] financial aid counselors to help Corinthian’s student refugees. Yet most community colleges don’t offer Corinthian’s vocational programs and flexible schedules, and many for-profits don’t accept Corinthian’s credits. Ms. Harris and the feds have also made clear they intend to continue their persecution of for-profits, so students could enroll in another political target.” How generous of them.

What makes this whole affair particularly odious is that that “the federal government doesn’t specify how for-profits calculate their job placement rates. States and accrediting agencies have disparate and often vague rules, which notably don’t apply to nonprofit and public colleges.” Thus, Corinthian Colleges was really just a part of the larger assault on for-profit colleges by the Obama Administration, all tied to his new “Gainful Employment” rules. You can read the regulations released last October.

Part of this new regulation change deals with colleges and federal aid. “In particular, Obama intends to change the parameters of what’s known as the “90-10 Rule”—a federal law that bars these schools from receiving more than 90 percent of their revenues through federal student aid, including loans and grants.” The affect of these changes on the for-profit college system has been noted by Forbes. Though the regulations don’t actually take affect until July 1, 2015, it appears Corinthian was a ripe target. What’s more, the Department of Education found a ready and willing partner in Kamala Harris, who just happens to be running for a very important Senate seat in California.

On can debate the merits of the for-profit college system, but that would be fodder for another post. The fact remains that certainly, the generous student loan forgiveness/bailout will resonate with these 40,000 young, impressionable voters who suddenly got their college costs covered by someone else, even if they weren’t an actual victim of alleged “misrepresentation”. Will there soon be another for-profit college chain shut down and subsequent loan bailout by the Feds in another important election state?

by | ARTICLES, BLOG, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

The upcoming Presidential Election Cycle is beginning to get crowded already. Since I’m undecided right now, I’ve chosen to do a scorecard of sorts of each of the major candidates in four policy areas:

*Taxes

*Immigration

*Free Trade

*Entitlement Reform

These issues are among the most crucial for me. Over the next couple of weeks, I’ll be posting about what I believe is the best, most optimal policy in each of these four areas, and then I’ll score the candidates on their positions.

I’ll also post when I have decided to eliminate a candidate, and why. I welcome your thoughts on these particular issues too. The scorecard will be up soon.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

In lieu of the recent news that the GDP actually contracted during the 1st Quarter, some folks at the White House seem fit to blame both the winter and the actual process and algorithms by which 1st Quarter numbers are analyzed.

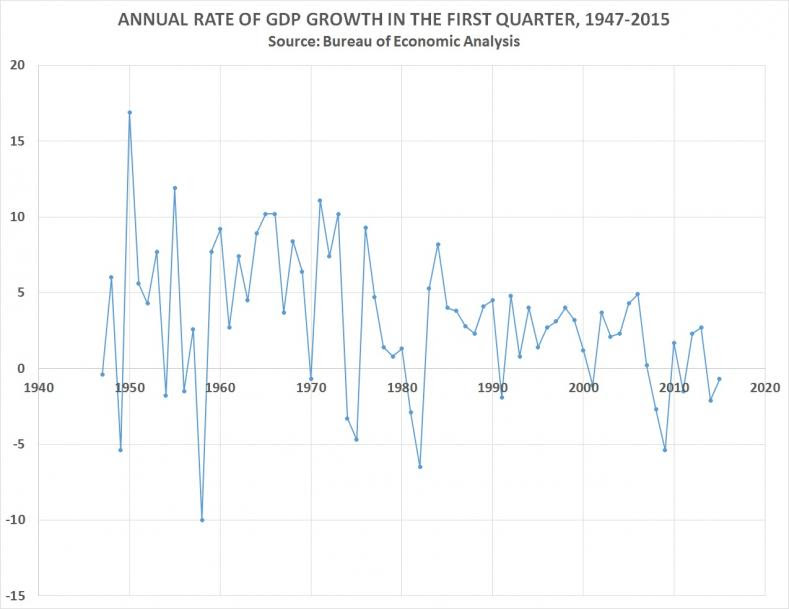

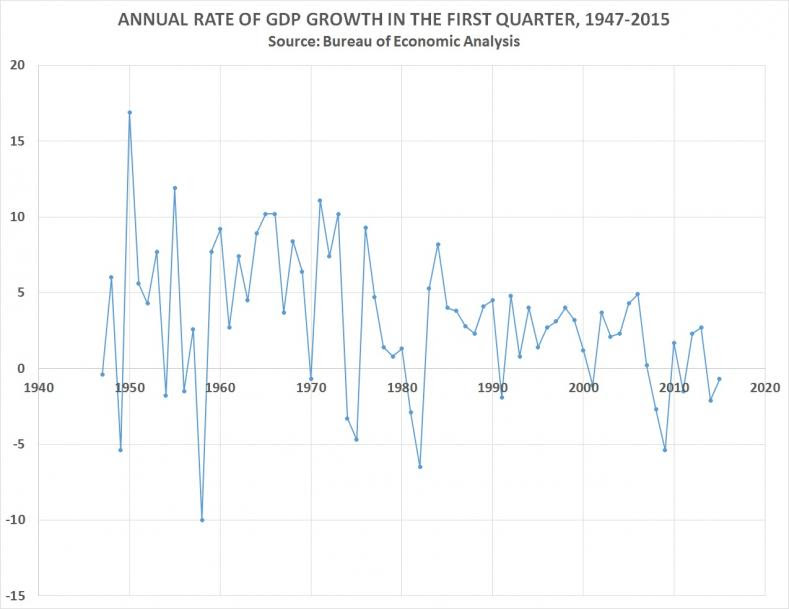

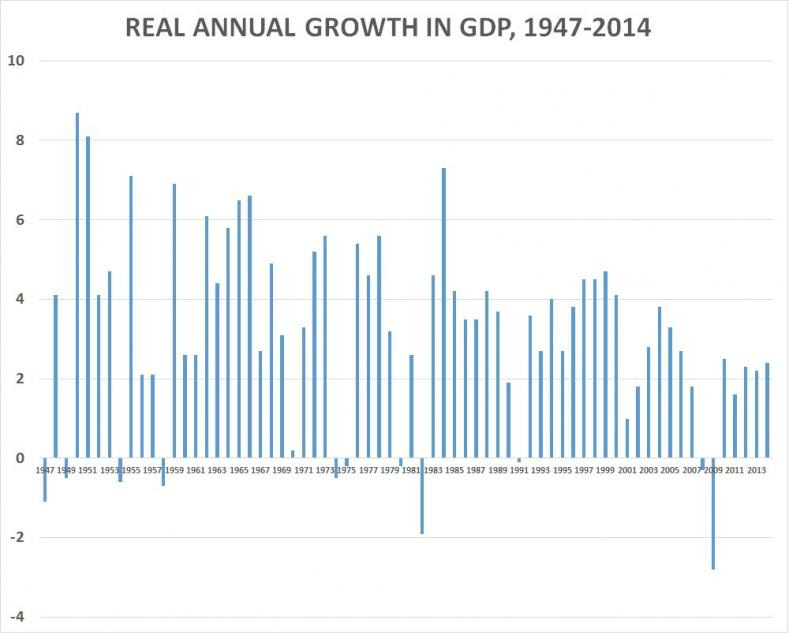

CNS News decided to take a look at Obama’s 1st Quarter numbers and compare them to previous presidents all the way back to 1947, which is the earliest data offered by the Bureau of Economic Analysis. The result shows that Obama has the lowest 1st Quarter numbers of all Presidents. I reproduced the article below, because it had some great graphs which shows the comparison data nicely. This just reaffirms what we know and what I wrote about the other day: the economy is still not that strong.

——–

Even if you leave out the first quarter of 2009—when the recession that started in December 2007 was still ongoing–President Barack Obama has presided over the lowest average first-quarter GDP growth of any president who has served since 1947, which is the earliest year for which the Bureau of Economic Analysis has calculated quarterly GDP growth.

In all first quarters since 1947, the real annual rate of growth of GDP has averaged 4.0 percent.

In the seven first quarters during Obama’s presidency, it has declined by an average of -0.43 percent. And if you leave out the first quarter of 2009 and look only at the first quarters of the six years since the recession ended, it has averaged only 0.4 percent.

In the six years of Harry Truman’s presidency for which the BEA has calculated quarterly GDP, the annual rate of growth in GDP in the first quarter averaged 4.5 percent.

During President Eisenhower’s eight years, it averaged 3.2 percent. During Kennedy’s three years, it averaged 4.9 percent. During Johnson’s five years, it averaged 8.3 percent. During Nixon’s six years, it averaged 5.3 percent. During Ford’s two years, it averaged 2.3 percent. During Carter’s four years, it average 2.4 percent. During Reagan’s eight years, it average 2.1 percent. During George H.W. Bush’s four years, it average 2.9 percent. During Clinton’s eight years, it averaged 2.6 percent. And during George W. Bush’s eight years, it averaged 1.7 percent.

President Obama took office on Jan. 20, 2009. In the first quarter of 2009, GDP declined at an annual rate of -5.4 percent. In the first quarter of 2010, it grew by 1.7 percent. In the first quarter of 2011, it declined -1.5 percent. In the first quarter of 2012, it grew 2.3 percent. In the first quarter of 2013, it grew 2.7 percent. In the first quarter of 2014, it declined -2.1 percent. And in the first quarter of 2015, it declined -0.7 percent.

In these seven first quarters that Obama has been president (2009 through 2015), the annual rate of growth in GDP has declined at an average rate of -0.43 percent.

But the National Bureau of Economic Research says the last recession, which began on December 2007 did not end until June 2009. If you leave out the first quarter of 2009, and only count the six years (2010-2015) since the recession ended in June 2009, real annual rate of growth of GDP in the post-recession first quarters of Obama’s presidency has averaged 0.4 percent.

When GDP declined at -1.5 percent in the first quarter of 2011—which was after the recession and two full years into Obama’s presidency—some blamed it at least partly on the weather.

“Some of the slowdown in growth was linked to bad weather in early 2011 and an 11.7 percent decline in defense spending,” said a Reuters story of May 27, 2011.

When real GDP declined at a rate of -2.1 percent in the first quarter of 2014, a May 30, 2014 New York Times story said: “Most economists on Wall Street and at the Federal Reserve blame a very cold winter for much of the slowdown.”

When real GDP declined at a rate of -0.7 percent in the first quarter of this year, the top paragraph of an Associated Press story said: “The U.S. economy shrank at a 0.7 percent annual rate in the first three months of the year, depressed by a severe winter and a widening trade deficit.”

But there seems something more at work here than climate patterns–or the Obama presidency.

Under previous presidents, real GDP sometimes grew massively during the first quarter. In 1950, under Truman, for example, GDP grew at an annual rate of 16.9 percent in the first quarter. In 1955, under Eisenhower, it grew at a rate of 11.9 percent.

Under Johnson, in the first quarters of both 1965 and 1966, it grew at a rate of 10.2 percent. Under Nixon, it grew at 11.1 percent in the first quarter of 1971, and 10.2 percent in the first quarter of 1973, it grew at 10.2 percent.

Under Ford, in the first quarter of 1976, it grew at 9.3 percent. Under Reagan, in the first quarter of 1984, real GDP grew at a rate of 8.2 percent.

But since 1984—more than three decades ago–there has been no first quarter, in any year, under any president, when real GDP grew even as fast as 5.0 percent. The closest it came was in the first quarter of 2006, when George W. Bush was president, and it hit 4.9 percent.

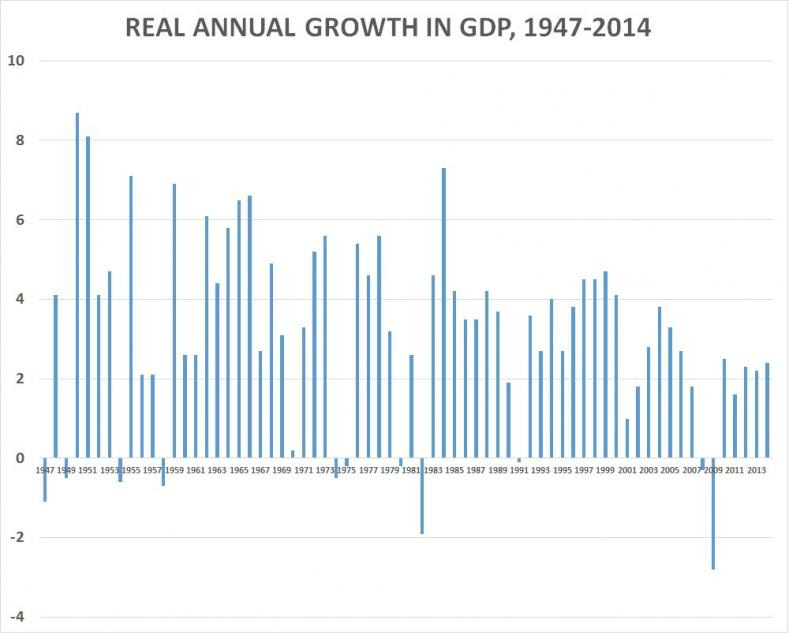

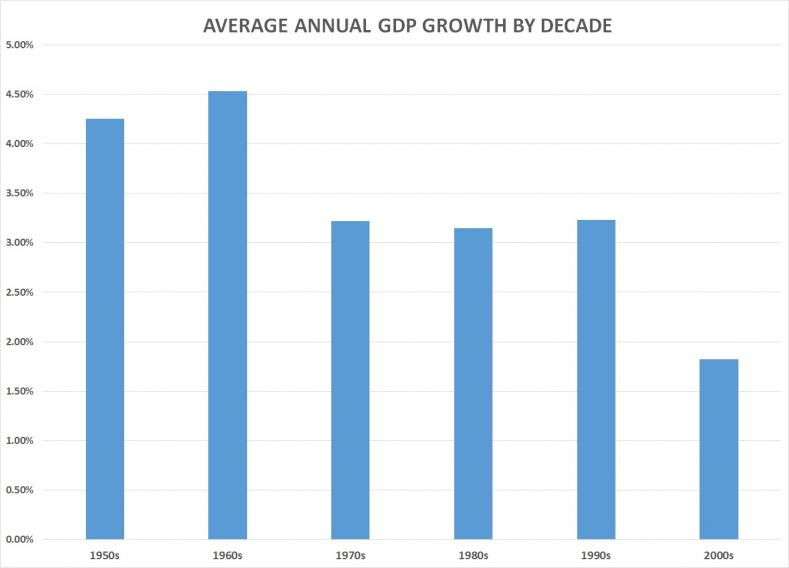

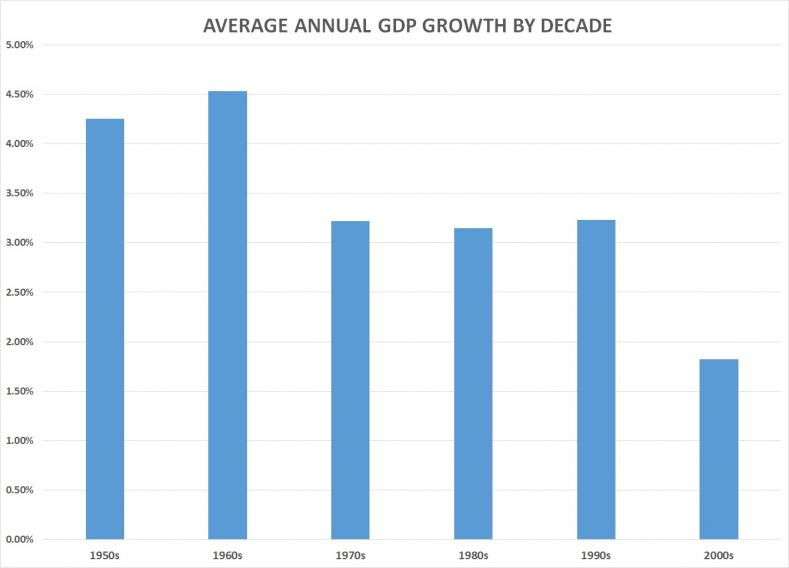

In the decades starting after World War II, average annual growth in GDP peaked in the 1960s.

In the 1950s, annual growth in GDP averaged 4.25 percent. In the 1960s, it climbed to 4.5 percent. But it dropped to 3.22 percent in the 1970s, then 3.15 percent in the 1980s, before ticking up to 3.23 percent in 1990s. In the 2000s, it averaged only 1.82 percent.

In the first five years of this decade (2010-2014), annual growth in GDP has averaged 2.2 percent. But that is less than the 2.7 percent it averaged in the first five years of the last decade (2000-2004) which was before the recession hit at the end of 2007 and brought the decade’s average down to 1.82 percent.

If it were to maintain an average annual rate of 2.2 percent for the next five years, the American economy of this decade would still be growing at less than half the rate of the 1960s.

Should the long-term decline in U.S. economic growth be attributed to cold weather? Or should people in Washington, D.C., start looking around them for an anthropogenic cause.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, OBAMA, POLITICS, TAXES

I came across this little piece in the NYPost discussing the sluggish economy and the arbitrary numbers that come out of the Labor Department. It starts off discussing the 1st Quarter GDP contraction, which stumped many “economists”, and even went so far as to possibly blame the algorithms themselves by which the government analyzes 1st Quarter numbers. Because it certainly couldn’t be domestic policies, could it?

This writer posits that we could indeed be on the bring of a recession, the definition of which is 2 straight quarters of economic contraction, and points out something fairly obvious. People just don’t have a lot of money to spend. I concur this is a major part of assessing the health of an economy, although I would argue that investment spending spurs economic growth even more than consumptive spending, which is this writers argument. Putting that aside, however, he does a decent job pointing out the concerns about the economy that we should all be paying attention to. Here’s the article and food for thought below:

“Anyone with even a quarter of a brain now understands that the US economy got off to a bad start this year.

There was an economic contraction in the first three months — when the nation’s gross domestic product fell at an annualized rate of 0.7 percent — that some quarter-brainers are still blaming on the cold weather, strikes at ports, the strong dollar, solar flares, Martian landings and (insert your own poor excuse here).

The truth: Most of these excuses are part of the problem, although I didn’t personally see or not see the Martians.

But the biggest part is that people don’t have enough money to spend. Interest from savings is down to zero, people don’t liquidate stock gains to make purchases, and job and income growth has been sketchy.

The economy isn’t doing much better in the current quarter either. The Federal Reserve Bank of Atlanta, an independent observer if ever there was one, measures growth so far in the second quarter at an annual rate of just 1.1 percent. That means growth — un-annualized — is a paltry 0.275 percent with less than four weeks left in the quarter.

It’s quite possible that we will eventually be told, after all revisions are made, that the economy met the official definition of a recession in the first half of 2015, which is two straight quarters of contractions.

But the quarter-brainers will probably get something to cheer about when Friday’s employment numbers come out. And, if they don’t strain their quarter-brains looking too deeply into the numbers, they could come away with a smile that can only happen because ignorance is bliss.

Wall Street expects the Labor Department to report that 235,000 new jobs were created in May. That would be higher than the 223,000 new jobs that — before any revisions are made — were created in April.

I’ve written before about the so-called birth/death model, which is the government’s fist-on-the-scale way of adding jobs they assume but can’t prove exist when new companies suddenly come into business in springtime.

The only problem is, entrepreneurs — especially those just starting out and risking their own capital — aren’t very daring when it’s clear to everyone that the economy isn’t doing well. So maybe, just maybe, there are more companies dying this spring than being born.

Labor must be having some second thoughts about the validity of that model since it guessed that only 213,000 phantom jobs were created by newly born companies in April. That’s way down from the 263,000-phantom-job guesstimate in April 2014.

The guesstimate for May should still be substantial. In May of 2014, Labor’s phantom jobs guesstimate added 204,000 jobs. Even if that’s been adjusted downward, this will still give a nice boost to the job growth that will be reported Friday.

There’s no guarantee, of course, that Friday’s number will be good. Any number of things could go wrong. Seasonal adjustments could hurt Friday’s number. And, of course, companies could have actually cut jobs in April. There were plenty of announcements of such cuts.

So, will Wall Street get the 235,000-job growth it expects? I say there’s a 60 percent chance Friday’s number meets or exceeds that guess.

But even if you guess right on Friday’s jobs figure, the prize could be elusive. Most folks don’t know how Wall Street will react to a better-than-expected number. If the figure is too strong, it’ll causes interest rates to rise and bond prices to fall in anticipation that the Federal Reserve’s interest rate hike is back on the table. If the number is weaker than expected, even the quarter-brainers will start worrying the economy is tanking.”

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS, TAXES

We have entered the Twilight Zone. Because there is virtually no other explanation of the latest crusade by labor leaders in Los Angeles. Union leaders are lobbying Los Angeles city council members to be EXEMPT from paying a $15 minimum wage in workplaces where unions exist. Tim Worstall from Forbes got it right in his opening salvo on the matter: “This is really quite glorious as a display of sheer naked chutzpah.”

The unions themselves have been some of the biggest supporters of the wage increase, not just in Los Angeles, but around the country. Now when it comes to actually paying that wage in Los Angeles, which is poised to be approved by city council, the unions want to retain their right to collective bargaining — which means paying a lower wage if they want. Here is the sheer hypocrisy:

“Rusty Hicks, who heads the county Federation of Labor and helps lead the Raise the Wage coalition, said Tuesday night that companies with workers represented by unions should have leeway to negotiate a wage below that mandated by the law.

“With a collective bargaining agreement, a business owner and the employees negotiate an agreement that works for them both. The agreement allows each party to prioritize what is important to them,” Hicks said in a statement. “This provision gives the parties the option, the freedom, to negotiate that agreement. And that is a good thing.”

You can’t make this up. Currently, businesses are not mandated to pay a $15/hour minimum wage and therefore really, truly, actually have, right now, what Mr. Union Rusty Hicks is asking for: “the option, the freedom, to negotiate” an agreement between a business owner and an employee for their wages, allowing “each party to prioritize what is important to them”. That’s what exists now. No mandated wage. Unions seem to be following the “Do as I say, not as I do” playbook.

What is really happening is that the unions want to be able to retain exclusivity on certain contracts. The exemption they are seeking is in places where unions exist in the workplace. By being exempt, this will give the unions the upper hand on contracts. If you were an employer who now will have to pay a $15/hour minimum wage, and the unions can come in and undercut that wage amount by negotiating $13/hour, which do you think an employer will pay? The $15/hour mandated wage for non unions, or the $13/hour union contract? The unions are fearful that leveling the playing field by mandating a $15/hour minimum wage for all will mean that they will lose some (or many) contract — meaning less money in the union’s pockets.

Now I’m not a fan of the proposed $15/hour minimum wage hike, ironically for some of the same reasons that the unions are pleading — a business owner and an employee ought to have the right to agree on wages without an artificial, arbitrary price floor. However, I’m even less of a fan of the idea that unions, or any other group, should be able to claim an exemption. If the city of Los Angeles is going to pass this legislation, then it should be binding for all. Either $15/hour is good for everyone, or no one. Shame on the unions for their brazen hypocrisy.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

As Chris Christie is still contemplating a 2016 presidential run, he recently posited a tax reform plan that differentiated himself from many of the other possible contenders. His platform was comprised of several points, such as: lower tax margins, reforming regulation,and eliminating payroll taxes for some earners. The last major tax code overhaul was the 1986 IRC reforms under President Reagan.

With regard to lowering tax margins, Christie proposed a true tax cut for both individual and corporate rates. Christie’s pan brings the top marginal rate to 28% from its current 39.6% for highest earners. His bottom rate would be less than 10% with just one more rate in the middle. Christie also proposes lowering the corporate tax rate from 35% to 25%. Currently, we have the highest corporate tax rate in the world. This would give businesses a much-needed boost.

Another part of this plan goes after regulation. Christie nails it when he stated, “Regulation must be rational, cost-based and used only to implement actions that are explicitly authorized by statute. This era in which an ideological administration tries to accomplish through the regulatory state what it didn’t have the votes to accomplish in the duly elected Congress must end.” The brutal, overbearing regulatory environment that currently exists is often overlooked, and I applaud Christie for bringing attention to it.

Christie also examines the payroll tax, calling for its elimination for those over 62 and under 21, which would “reduce the marginal cost to the employee of taking a job, and reduce the federally imposed cost to an employer of hiring someone.” It is an incentive for older workers to continue working and younger workers to start. With the workforce participation rates at all-time lows, this is a pro-growth approach.

Other tenets of his plan include increasing investment in R&D and developing a more sensible national energy plan, such as building the Keystone pipeline. It is revenue-neutral, meaning the tax cut side will be offset by modifying or eliminating many of the tax credits and deductions that riddle the tax code, making it much more simplified. Keenly aware of the cherished mortgage deduction and charitable contribution deduction, Christie makes those basically off-limits, but the rest of them could be fair game.

Christie has yet to decide and announce if he is actually running, but his ideas provide good fodder for, and comparison to, the other current candidates. Some have called for a Flat Tax, while others champion a national sales tax. Tax code reform is overdue and necessary, and should be a centerpiece of any serious candidate for 2016. Overall, Christie’s plan is fairly sensible and growth-oriented. Now if he would only fix his entitlement reform policies!