by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, QUICKLY NOTED, TAX TIPS, TAXES

Since there seems to be increased interest, and confusion, regarding tax filing and Obamacare this year, it is worth it add some more information to help navigate the process.

The IRS Tax Form 1095a is officially known as the “Health Insurance Marketplace Statement”. If a household member or members enrolled in a healthcare plan through a state or federal exchange, you will receive a 1095a in the mail by early February. You cannot file your taxes without it. It contains information regarding your coverage, such as the number of people enrolled in a marketplace plan, and the dates of effective coverage.

Please note: you will not receive a Form 1095a if you have health coverage through a job or through programs such as Medicaid, Medicare, or the Children’s Health Insurance Program (CHIP).

What you will see on a Form 1095a?

–The form will have information about every member of your household who received Obamacare coverage in 2014. Each person will be listed separately.

–The form will list month-by-month, the amount you paid for your health insurance premium. Each person will be listed separately.

–The form will provide the amount of the “premium tax credits” you received in 2014. They are also called “advanced payments”. This amount is what lowered your monthly premiums, and was calculated based upon income information you provided when you enrolled.

–The form will list the cost of a “benchmark” premium that your premium tax credit is based on. This was the second-lowest cost silver plan, and was considered the “benchmark” to determine subsidies for lower- and moderate-income earners who enrolled in Obamacare.

Why is the 1095a necessary?

The 1095a is your PROOF OF INSURANCE. It contains all the information you need to fill out your form 8965, which is the Premium Tax Credit form. The 8962 Form is a worksheet, whose calculation gets recorded on your 2014 Tax Return.

The main point of all of these forms is really the Premium Tax Credit portion. Remember, 85% of Obamacare enrollees received some sort of subsidy, which is properly known to the IRS as a “Premium Tax Credit”. But most people opted not to receive their tax credit at tax filing time (now). They received it in advance, during 2014, in the form of monthly amounts that were credited against the monthly healthcare premium costs. These advance payments lowered the monthly cost of insurance.

The credit was tabulated based on estimated income information furnished during the application process. But because income situations can change over the course of a year (remember you enrolled at the beginning of 2014), the IRS requires you to re-calculate your income again at tax time (now), and match it against the amount and information you provided when you enrolled.

Since your Premium Tax Credit was based upon estimated income amounts, the amount you were eligible to receive as a tax credit may be higher or lower than what you actually did receive. So, using the information you receive on your 1095a about your household and your payments and your subsidies, you then fill out the Form 8962 to calculate the ACTUAL amount of tax credit you were eligible for in 2014, and check it against what you received as an advance payment applied to your monthly premium costs. Any differences will be resolved either by either reducing or increasing your tax credit amount, which will then affect the final amount of taxes due or taxes returned to you.

Also note — if you enrolled in Obamacare, you must fill out Form 8925, which means you cannot file a 1040EZ. You must file a traditional 1040 tax return.

All the information listed above that you will see on the 1095a is important. If there are any errors, it is imperative that you contact the Obamacare marketplace immediately to resolve the inconsistencies before you file your taxes.

by | ARTICLES, ECONOMY, OBAMA, OBAMACARE, QUICKLY NOTED, TAXES

From Fox Business:

“The health insurance industry says companies will give consumers more time to pay January’s premiums under President Barack Obama’s health care law.

The move is an attempt to head off potential problems as the Obama administration renews millions of current customers, while trying to accommodate new ones as well.

Renewing coverage each year is standard operating procedure for private insurance plans.

But 2015 is the first renewal year for the health law, and the process involves a massive electronic data transfer from the government to insurers, happening right around the holidays. Last year, many files had errors.”

The grace period was just announced after health insurance enrollment ended Monday, December 15th. Insurers are also aware for the potential problem of “double billing” from a consumer who switched plans, and will work to rectify any issues in a swift manner. So, if you purchased an Obamacare plan this year, you’ll have a little extra time to be certain that you were billed correctly, and only once.

by | ARTICLES, FREEDOM, GOVERNMENT, OBAMA, QUICKLY NOTED, TAXES

A federal judge authorized two of three tea party complaints against the IRS to move ahead, despite a plea for dismissal from the accusations of discrimination.

“In her ruling Thursday, Judge Susan Dlott allowed two of the tea party groups’ claims — including that the IRS discriminated and retaliated against them based on their views in violation of their free speech rights — to survive to trial”

This will be interesting to watch, and marks several cases now pending against the IRS in court.

by | ARTICLES, FREEDOM, OBAMA, QUICKLY NOTED, TAXES

From National Review Online:

“The Internal Revenue Service may have been caught violating federal tax law: In October 2010, the agency sent a database on 501(c)(4) social-welfare groups containing confidential taxpayer information to the Federal Bureau of Investigation, according to documents obtained by a House panel.

The information was transmitted in advance of former IRS official Lois Lerner’s meeting the same month with Justice Department officials about the possibility of using campaign-finance laws to prosecute certain nonprofit groups. E-mails between Lerner and Richard Pilger, the director of the Justice Department’s election-crimes branch, obtained through a subpoena to Attorney General Eric Holder, show Lerner asking about the format in which the FBI preferred the data to be sent”.

More evidence that the 2013 IRS scandal targeting 501c4s is worse than we thought. Read the whole article here:

by | ARTICLES, QUICKLY NOTED

A nonprofit group, called The Voters Trust, “hopes to award a $1 million bounty to anyone who can provide “smoking gun” evidence to implicate IRS leadership or members of the Obama administration who purposefully targeted conservative and tea party-affiliated groups”

The Voters Trust is a 501c4, whose purpose is “to identify and mobilize Americans” and “that this is the people’s bounty to seek the truth.”

A press release from The Voters Trust says that, in order to be able to claim the prize, the seeker must be able to offer “relevant evidence including emails, eye-witness accounts, or testimony of political targeting of Americans by the IRS or the Obama administration that has not previously been reported”.

The person reporting is assured of anonymity and the evidence provided “must lead directly to the arrest and conviction those responsible”

by | ARTICLES, FREEDOM, GOVERNMENT, OBAMA, QUICKLY NOTED

From Katie Pavlich at Townhall.com

“According to new IRS emails obtained through a Freedom of Information Act request from Judicial Watch, former head of tax exempt groups at the IRS Lois Lerner was in contact with the Department of Justice in May 2013 about whether tax exempt groups could be criminally prosecuted for “lying” about political activity.

JW IRS doc

Read the full story here

by | ECONOMY, QUICKLY NOTED

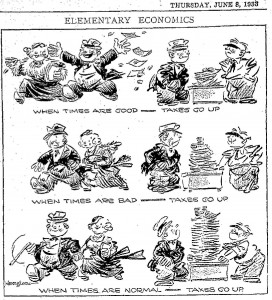

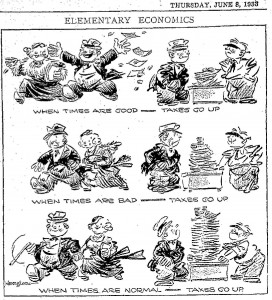

AEI posted two fantastic cartoons by Henry Payne, which demonstrates well how illogical minimum wage law really is.

Click on the link to see the cartoons (reprinted at AEI with the author’s permission)

by | ARTICLES, BUSINESS, ECONOMY, OBAMA, QUICKLY NOTED

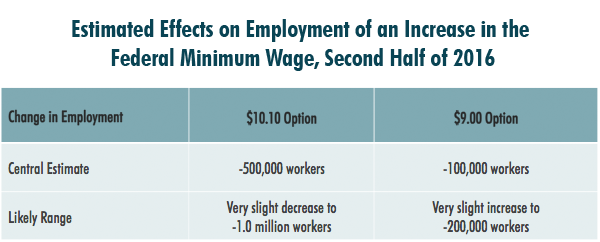

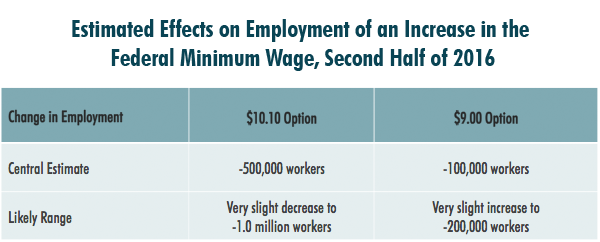

The CBO considered two different possibilities to raise the minimum wage, as a Democrat bill is set to be introduced in the Senate in a few weeks.

From the CBO report:

“Increasing the minimum wage would have two principal effects on low-wage workers. Most of them would receive higher pay that would increase their family’s income, and some of those families would see their income rise above the federal poverty threshold. But some jobs for low-wage workers would probably be eliminated, the income of most workers who became jobless would fall substantially, and the share of low-wage workers who were employed would probably fall slightly”

What Options for Increasing the Minimum Wage Did CBO Examine?

For this report, CBO examined the effects on employment and family income of two options for increasing the federal minimum wage:

1) A “$10.10 option”

A “$10.10 option would increase the federal minimum wage from its current rate of $7.25 per hour to $10.10 per hour in three steps—in 2014, 2015, and 2016. After reaching $10.10 in 2016, the minimum wage would be adjusted annually for inflation as measured by the consumer price index.

2) A “$9.00 option”

A “$9.00 option” would raise the federal minimum wage from $7.25 per hour to $9.00 per hour in two steps—in 2015 and 2016. After reaching $9.00 in 2016, the minimum wage would not be subsequently adjusted for inflation.

Read the full report here

by | ARTICLES, ECONOMY, QUICKLY NOTED

This was a great article from Forbes countering the misconception that generic drugs are better for price-cutting in the pharmaceutical world. I encourage you to read the piece in it’s entirety.

by | ARTICLES, POLITICS, QUICKLY NOTED

Sad but true: