by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

The number of new businesses has been on the decline since 2008, with more businesses closing than opening. The US Census Bureau confirmed the statistics, which was reported on by Gallup earlier this year. This startling trend also reaffirms a study released last year by the Brookings Institute, which noted that 2009, 2010, and 2011 saw the collapse of businesses faster than their creation.

The annoying thing about the Brookings Institute’s study is that they do not attribute the decline to anything in particular, saying that they need “a more complete knowledge about what drives dynamism, and especially entrepreneurship, than currently exists.” This is utter nonsense, and reinforces why I typically don’t pay attention to what the Brookings Institute says. They are providing political cover for the Obama Administration with their non-conclusive conclusion about the decline of new business.

The most suffocating factor is the sharp rise of federal regulations, which now cost the American economy nearly $1.9 trillion every year — more than 10% of our nation’s GDP. Add in state and local regulations, and that total is even higher.

Not surprisingly, the rates of business start-ups and deaths have changed for the worse as regulatory costs have grown. No wonder: Anyone who wants to stay in business has to keep finding more money to pay for higher costs, while anyone who wants to start a new business has to clear financial and legal barriers that get taller every year. The founder of Subway recently remarked that his company “would not exist” if today’s regulatory burden had existed when he started it in the 1960s.

Simply look at the past few years to see how the regulatory state has grown. Between 2009 and 2013, the federal government added $494 billion in regulatory costs to the American economy. The highlight was 2012, when President Obama and his executive agencies published over $236 billion in new costs. As for 2014, the federal government announced over 79,000 pages of new regulations, costing a total of $181.5 billion.

That’s equivalent to 3.5 million median family incomes. But it isn’t flowing to families through new jobs and higher wages — it’s lost on lawyers, paperwork and other compliance costs.

I was curious what some of the largest wealth managers had to say about the economy. Was anyone talking about the recovery (or lack thereof)? High taxes? Regulation? I took a sampling of the CEOs of Citigroup, JP Morgan Chase, Goldman Sachs, and Morgan Stanley to see what, if anything, they’ve publicly discussed in the last 6 months to a year. The only one that has spoken on the subject is Jamie Dimon of Chase, who stated earlier this year that “the U.S. economy is doing well” but he blamed poor government and regulatory policies for hurting growth. “We’re growing at 2.5 percent. We should be doing better. “I blame them all,” Dimon said of politicians. “To me, they waste a lot of time pointing fingers and not collaborating.”

But they do spend time regulating. This is the canary in the coalmine which impacts new and potential entrepreneurs. Many see the start up costs and the regulatory headaches as too burdensome a barrier to even begin, thus deciding it’s not worth it. Small businesses have been the backbone of America, the pathway to our greatness, and this recent, rapid decline in American business is most alarming.

by | ARTICLES, BLOG, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, RETIREMENT, SOCIAL SECURITY, TAXES

I recently read a letter to the editor about Social Security in the Wall Street Journal that irritated me. Not the letter writer per se, but more by the Wall Street Journal choosing to print a letter that perpetuates a widely perceived myth about Social Security.

The letter was simply this: “Oh, please don’t blame older Americans for “eating up the budget” through payments of Social Security and Medicare benefits. It is the federal government that raided the Social Security Trust Fund. Older Americans have contributed to this for years. Where is the money now?”

The problem with this letter writer is that they really just don’t understand the truth that people who have paid into Social Security are getting many, many more times the actuarial value than what they put into it. It’s not a simple misunderstanding on this. It really, truly is just a flat-out lie that people who put 30-40 years worth of payments are merely getting back just what they put in.

The politicians need this lie to survive because they risk alienating a large voting bloc of older Americans if they merely even suggest that Social Security needs reform. But it does; the egregious state that Social Security is hidden by the way the federal government accounts for it. They even have a special name for it. Social Security is repeatedly described as a pay-as-you-go (“PAYGO”) system, which gives credence to something that is terribly incorrect. PAYGO is not a system at all; rather it is a method of reporting that hides earned realities, making it totally unacceptable to accounting professions, the SEC, and virtually everybody outside the government.

Calling it PAYGO helps to perpetuate the fallacy that beneficiaries are merely receiving what they paid into to. I don’t want to pick on the poor letter writer, as she doesn’t seem to really know how Social Security works (or hasn’t worked). But the Wall Street Journal should know better.

I suppose it is fitting that the 1936 Bulletin announcing Social Security ends like this: “What you get from the Government plan will always be more than you have paid in taxes and usually more than you can get for yourself by putting away the same amount of money each week in some other way.”

This is why we have accrued trillions in unfunded liabilities such as Social Security. If it sounds too good to be true, it probably is.

by | ARTICLES, BLOG, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

The upcoming Presidential Election Cycle is beginning to get crowded already. Since I’m undecided right now, I’ve chosen to do a scorecard of sorts of each of the major candidates in four policy areas:

*Taxes

*Immigration

*Free Trade

*Entitlement Reform

These issues are among the most crucial for me. Over the next couple of weeks, I’ll be posting about what I believe is the best, most optimal policy in each of these four areas, and then I’ll score the candidates on their positions.

I’ll also post when I have decided to eliminate a candidate, and why. I welcome your thoughts on these particular issues too. The scorecard will be up soon.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

In lieu of the recent news that the GDP actually contracted during the 1st Quarter, some folks at the White House seem fit to blame both the winter and the actual process and algorithms by which 1st Quarter numbers are analyzed.

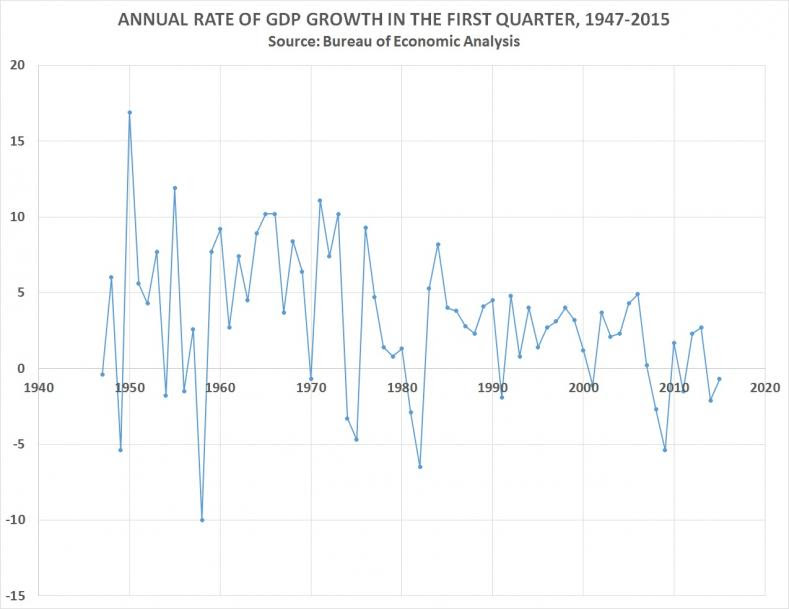

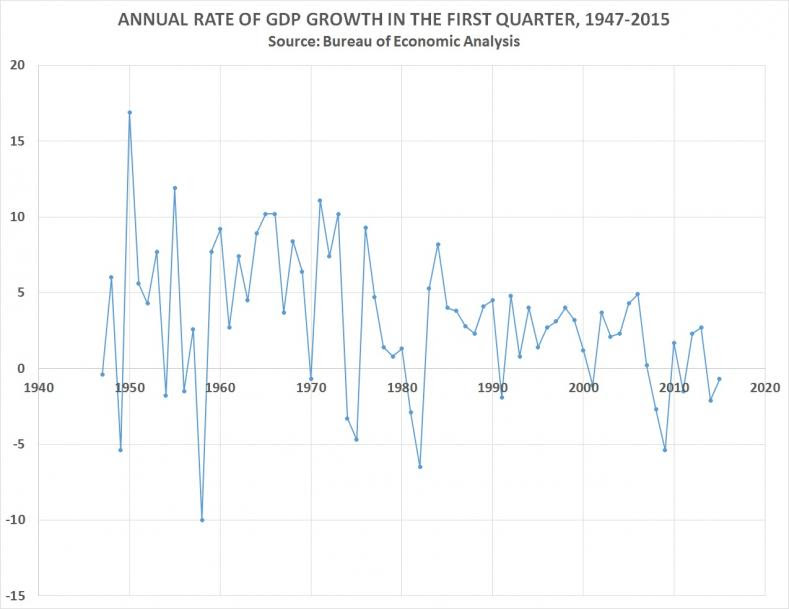

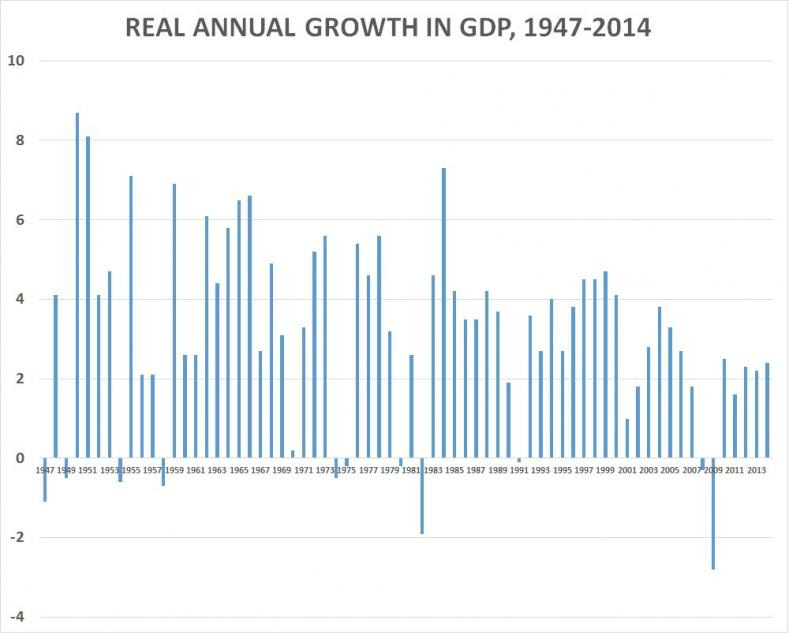

CNS News decided to take a look at Obama’s 1st Quarter numbers and compare them to previous presidents all the way back to 1947, which is the earliest data offered by the Bureau of Economic Analysis. The result shows that Obama has the lowest 1st Quarter numbers of all Presidents. I reproduced the article below, because it had some great graphs which shows the comparison data nicely. This just reaffirms what we know and what I wrote about the other day: the economy is still not that strong.

——–

Even if you leave out the first quarter of 2009—when the recession that started in December 2007 was still ongoing–President Barack Obama has presided over the lowest average first-quarter GDP growth of any president who has served since 1947, which is the earliest year for which the Bureau of Economic Analysis has calculated quarterly GDP growth.

In all first quarters since 1947, the real annual rate of growth of GDP has averaged 4.0 percent.

In the seven first quarters during Obama’s presidency, it has declined by an average of -0.43 percent. And if you leave out the first quarter of 2009 and look only at the first quarters of the six years since the recession ended, it has averaged only 0.4 percent.

In the six years of Harry Truman’s presidency for which the BEA has calculated quarterly GDP, the annual rate of growth in GDP in the first quarter averaged 4.5 percent.

During President Eisenhower’s eight years, it averaged 3.2 percent. During Kennedy’s three years, it averaged 4.9 percent. During Johnson’s five years, it averaged 8.3 percent. During Nixon’s six years, it averaged 5.3 percent. During Ford’s two years, it averaged 2.3 percent. During Carter’s four years, it average 2.4 percent. During Reagan’s eight years, it average 2.1 percent. During George H.W. Bush’s four years, it average 2.9 percent. During Clinton’s eight years, it averaged 2.6 percent. And during George W. Bush’s eight years, it averaged 1.7 percent.

President Obama took office on Jan. 20, 2009. In the first quarter of 2009, GDP declined at an annual rate of -5.4 percent. In the first quarter of 2010, it grew by 1.7 percent. In the first quarter of 2011, it declined -1.5 percent. In the first quarter of 2012, it grew 2.3 percent. In the first quarter of 2013, it grew 2.7 percent. In the first quarter of 2014, it declined -2.1 percent. And in the first quarter of 2015, it declined -0.7 percent.

In these seven first quarters that Obama has been president (2009 through 2015), the annual rate of growth in GDP has declined at an average rate of -0.43 percent.

But the National Bureau of Economic Research says the last recession, which began on December 2007 did not end until June 2009. If you leave out the first quarter of 2009, and only count the six years (2010-2015) since the recession ended in June 2009, real annual rate of growth of GDP in the post-recession first quarters of Obama’s presidency has averaged 0.4 percent.

When GDP declined at -1.5 percent in the first quarter of 2011—which was after the recession and two full years into Obama’s presidency—some blamed it at least partly on the weather.

“Some of the slowdown in growth was linked to bad weather in early 2011 and an 11.7 percent decline in defense spending,” said a Reuters story of May 27, 2011.

When real GDP declined at a rate of -2.1 percent in the first quarter of 2014, a May 30, 2014 New York Times story said: “Most economists on Wall Street and at the Federal Reserve blame a very cold winter for much of the slowdown.”

When real GDP declined at a rate of -0.7 percent in the first quarter of this year, the top paragraph of an Associated Press story said: “The U.S. economy shrank at a 0.7 percent annual rate in the first three months of the year, depressed by a severe winter and a widening trade deficit.”

But there seems something more at work here than climate patterns–or the Obama presidency.

Under previous presidents, real GDP sometimes grew massively during the first quarter. In 1950, under Truman, for example, GDP grew at an annual rate of 16.9 percent in the first quarter. In 1955, under Eisenhower, it grew at a rate of 11.9 percent.

Under Johnson, in the first quarters of both 1965 and 1966, it grew at a rate of 10.2 percent. Under Nixon, it grew at 11.1 percent in the first quarter of 1971, and 10.2 percent in the first quarter of 1973, it grew at 10.2 percent.

Under Ford, in the first quarter of 1976, it grew at 9.3 percent. Under Reagan, in the first quarter of 1984, real GDP grew at a rate of 8.2 percent.

But since 1984—more than three decades ago–there has been no first quarter, in any year, under any president, when real GDP grew even as fast as 5.0 percent. The closest it came was in the first quarter of 2006, when George W. Bush was president, and it hit 4.9 percent.

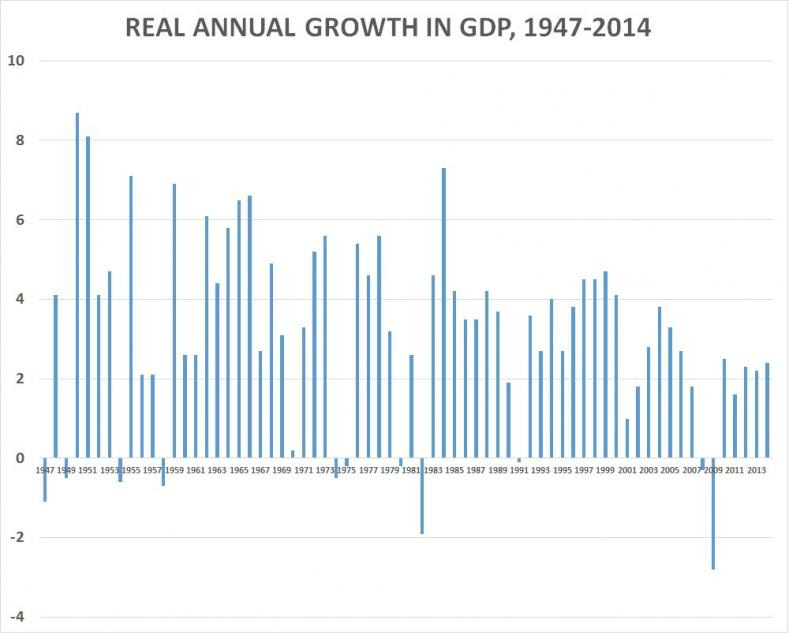

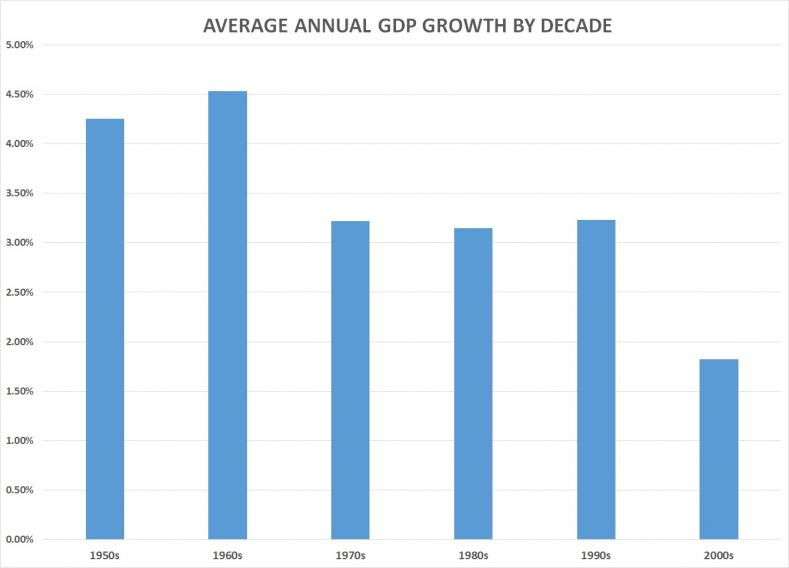

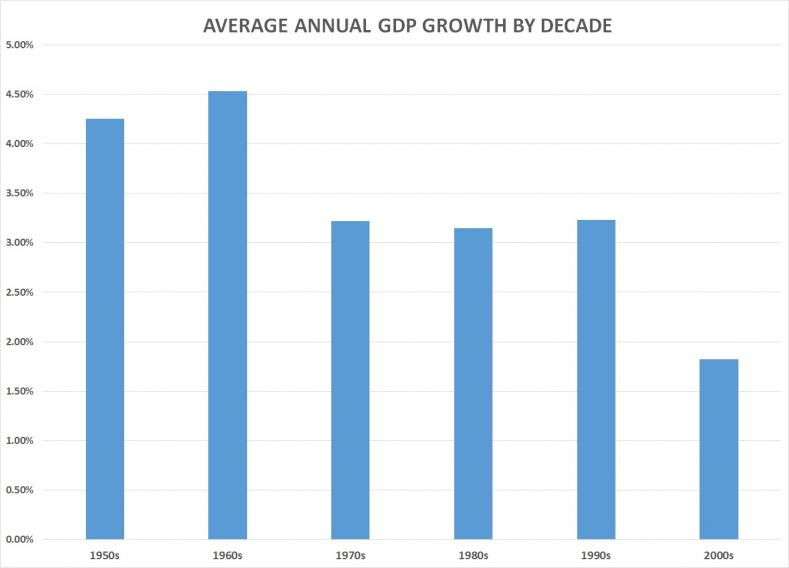

In the decades starting after World War II, average annual growth in GDP peaked in the 1960s.

In the 1950s, annual growth in GDP averaged 4.25 percent. In the 1960s, it climbed to 4.5 percent. But it dropped to 3.22 percent in the 1970s, then 3.15 percent in the 1980s, before ticking up to 3.23 percent in 1990s. In the 2000s, it averaged only 1.82 percent.

In the first five years of this decade (2010-2014), annual growth in GDP has averaged 2.2 percent. But that is less than the 2.7 percent it averaged in the first five years of the last decade (2000-2004) which was before the recession hit at the end of 2007 and brought the decade’s average down to 1.82 percent.

If it were to maintain an average annual rate of 2.2 percent for the next five years, the American economy of this decade would still be growing at less than half the rate of the 1960s.

Should the long-term decline in U.S. economic growth be attributed to cold weather? Or should people in Washington, D.C., start looking around them for an anthropogenic cause.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, OBAMA, POLITICS, TAXES

I came across this little piece in the NYPost discussing the sluggish economy and the arbitrary numbers that come out of the Labor Department. It starts off discussing the 1st Quarter GDP contraction, which stumped many “economists”, and even went so far as to possibly blame the algorithms themselves by which the government analyzes 1st Quarter numbers. Because it certainly couldn’t be domestic policies, could it?

This writer posits that we could indeed be on the bring of a recession, the definition of which is 2 straight quarters of economic contraction, and points out something fairly obvious. People just don’t have a lot of money to spend. I concur this is a major part of assessing the health of an economy, although I would argue that investment spending spurs economic growth even more than consumptive spending, which is this writers argument. Putting that aside, however, he does a decent job pointing out the concerns about the economy that we should all be paying attention to. Here’s the article and food for thought below:

“Anyone with even a quarter of a brain now understands that the US economy got off to a bad start this year.

There was an economic contraction in the first three months — when the nation’s gross domestic product fell at an annualized rate of 0.7 percent — that some quarter-brainers are still blaming on the cold weather, strikes at ports, the strong dollar, solar flares, Martian landings and (insert your own poor excuse here).

The truth: Most of these excuses are part of the problem, although I didn’t personally see or not see the Martians.

But the biggest part is that people don’t have enough money to spend. Interest from savings is down to zero, people don’t liquidate stock gains to make purchases, and job and income growth has been sketchy.

The economy isn’t doing much better in the current quarter either. The Federal Reserve Bank of Atlanta, an independent observer if ever there was one, measures growth so far in the second quarter at an annual rate of just 1.1 percent. That means growth — un-annualized — is a paltry 0.275 percent with less than four weeks left in the quarter.

It’s quite possible that we will eventually be told, after all revisions are made, that the economy met the official definition of a recession in the first half of 2015, which is two straight quarters of contractions.

But the quarter-brainers will probably get something to cheer about when Friday’s employment numbers come out. And, if they don’t strain their quarter-brains looking too deeply into the numbers, they could come away with a smile that can only happen because ignorance is bliss.

Wall Street expects the Labor Department to report that 235,000 new jobs were created in May. That would be higher than the 223,000 new jobs that — before any revisions are made — were created in April.

I’ve written before about the so-called birth/death model, which is the government’s fist-on-the-scale way of adding jobs they assume but can’t prove exist when new companies suddenly come into business in springtime.

The only problem is, entrepreneurs — especially those just starting out and risking their own capital — aren’t very daring when it’s clear to everyone that the economy isn’t doing well. So maybe, just maybe, there are more companies dying this spring than being born.

Labor must be having some second thoughts about the validity of that model since it guessed that only 213,000 phantom jobs were created by newly born companies in April. That’s way down from the 263,000-phantom-job guesstimate in April 2014.

The guesstimate for May should still be substantial. In May of 2014, Labor’s phantom jobs guesstimate added 204,000 jobs. Even if that’s been adjusted downward, this will still give a nice boost to the job growth that will be reported Friday.

There’s no guarantee, of course, that Friday’s number will be good. Any number of things could go wrong. Seasonal adjustments could hurt Friday’s number. And, of course, companies could have actually cut jobs in April. There were plenty of announcements of such cuts.

So, will Wall Street get the 235,000-job growth it expects? I say there’s a 60 percent chance Friday’s number meets or exceeds that guess.

But even if you guess right on Friday’s jobs figure, the prize could be elusive. Most folks don’t know how Wall Street will react to a better-than-expected number. If the figure is too strong, it’ll causes interest rates to rise and bond prices to fall in anticipation that the Federal Reserve’s interest rate hike is back on the table. If the number is weaker than expected, even the quarter-brainers will start worrying the economy is tanking.”

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS, TAXES

We have entered the Twilight Zone. Because there is virtually no other explanation of the latest crusade by labor leaders in Los Angeles. Union leaders are lobbying Los Angeles city council members to be EXEMPT from paying a $15 minimum wage in workplaces where unions exist. Tim Worstall from Forbes got it right in his opening salvo on the matter: “This is really quite glorious as a display of sheer naked chutzpah.”

The unions themselves have been some of the biggest supporters of the wage increase, not just in Los Angeles, but around the country. Now when it comes to actually paying that wage in Los Angeles, which is poised to be approved by city council, the unions want to retain their right to collective bargaining — which means paying a lower wage if they want. Here is the sheer hypocrisy:

“Rusty Hicks, who heads the county Federation of Labor and helps lead the Raise the Wage coalition, said Tuesday night that companies with workers represented by unions should have leeway to negotiate a wage below that mandated by the law.

“With a collective bargaining agreement, a business owner and the employees negotiate an agreement that works for them both. The agreement allows each party to prioritize what is important to them,” Hicks said in a statement. “This provision gives the parties the option, the freedom, to negotiate that agreement. And that is a good thing.”

You can’t make this up. Currently, businesses are not mandated to pay a $15/hour minimum wage and therefore really, truly, actually have, right now, what Mr. Union Rusty Hicks is asking for: “the option, the freedom, to negotiate” an agreement between a business owner and an employee for their wages, allowing “each party to prioritize what is important to them”. That’s what exists now. No mandated wage. Unions seem to be following the “Do as I say, not as I do” playbook.

What is really happening is that the unions want to be able to retain exclusivity on certain contracts. The exemption they are seeking is in places where unions exist in the workplace. By being exempt, this will give the unions the upper hand on contracts. If you were an employer who now will have to pay a $15/hour minimum wage, and the unions can come in and undercut that wage amount by negotiating $13/hour, which do you think an employer will pay? The $15/hour mandated wage for non unions, or the $13/hour union contract? The unions are fearful that leveling the playing field by mandating a $15/hour minimum wage for all will mean that they will lose some (or many) contract — meaning less money in the union’s pockets.

Now I’m not a fan of the proposed $15/hour minimum wage hike, ironically for some of the same reasons that the unions are pleading — a business owner and an employee ought to have the right to agree on wages without an artificial, arbitrary price floor. However, I’m even less of a fan of the idea that unions, or any other group, should be able to claim an exemption. If the city of Los Angeles is going to pass this legislation, then it should be binding for all. Either $15/hour is good for everyone, or no one. Shame on the unions for their brazen hypocrisy.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

As Chris Christie is still contemplating a 2016 presidential run, he recently posited a tax reform plan that differentiated himself from many of the other possible contenders. His platform was comprised of several points, such as: lower tax margins, reforming regulation,and eliminating payroll taxes for some earners. The last major tax code overhaul was the 1986 IRC reforms under President Reagan.

With regard to lowering tax margins, Christie proposed a true tax cut for both individual and corporate rates. Christie’s pan brings the top marginal rate to 28% from its current 39.6% for highest earners. His bottom rate would be less than 10% with just one more rate in the middle. Christie also proposes lowering the corporate tax rate from 35% to 25%. Currently, we have the highest corporate tax rate in the world. This would give businesses a much-needed boost.

Another part of this plan goes after regulation. Christie nails it when he stated, “Regulation must be rational, cost-based and used only to implement actions that are explicitly authorized by statute. This era in which an ideological administration tries to accomplish through the regulatory state what it didn’t have the votes to accomplish in the duly elected Congress must end.” The brutal, overbearing regulatory environment that currently exists is often overlooked, and I applaud Christie for bringing attention to it.

Christie also examines the payroll tax, calling for its elimination for those over 62 and under 21, which would “reduce the marginal cost to the employee of taking a job, and reduce the federally imposed cost to an employer of hiring someone.” It is an incentive for older workers to continue working and younger workers to start. With the workforce participation rates at all-time lows, this is a pro-growth approach.

Other tenets of his plan include increasing investment in R&D and developing a more sensible national energy plan, such as building the Keystone pipeline. It is revenue-neutral, meaning the tax cut side will be offset by modifying or eliminating many of the tax credits and deductions that riddle the tax code, making it much more simplified. Keenly aware of the cherished mortgage deduction and charitable contribution deduction, Christie makes those basically off-limits, but the rest of them could be fair game.

Christie has yet to decide and announce if he is actually running, but his ideas provide good fodder for, and comparison to, the other current candidates. Some have called for a Flat Tax, while others champion a national sales tax. Tax code reform is overdue and necessary, and should be a centerpiece of any serious candidate for 2016. Overall, Christie’s plan is fairly sensible and growth-oriented. Now if he would only fix his entitlement reform policies!

by | ARTICLES, BLOG, FREEDOM, OBAMA, POLITICS, TAXES

The media recently profiled another large civil asset forfeiture case, much like the Hirsch Brothers and the restaurant owner. This particular case involved a North Carolina man who has owned a convenience store since 2001. Last July, the IRS seized $107,000 from his bank account.

The owner, Lyndon McLellan, was visited by the FBI, who informed him that his habit of depositing less than $10,000 cash on repeated occasions drew suspicion by the government, also known as “structuring”. What started as a means to go after drug trafficking and money laundering has entangled many American citizens in recent years who have had their money seized under suspicion of criminal activity.

Recently, several cases have received substantial news coverage, resulting in the IRS, and then the Department of Justice changing their policy of asset forfeiture; now, no assets will be seized without an actual tie to a crime. Suspicion of activity is not enough anymore.

The plight of his latest victim of asset forfeiture was given several “opportunities” to settle with the government for a partial return of his money. The owner, who had done nothing wrong — since much of his business was run in cash — refused each offer. Three days after his story gained national coverage, the government dropped their case against him, citing the IRS and DoJ policy change. The owner had never been charged formally with anything. McLellan was fortunate; in such cases, the burden is on the victim to prove his innocence.

The Institute for Justice has been successfully representing many of these victims of civil asset forfeiture. However, “though the government will return all of the money it seized from McLellan, it dismissed the case without covering the store owner’s legal fees and expenses, as well as interest on the money.

In 2000, Congress passed a law that entitles McLellan to those fees and expenses, which total more than $20,000.

Additionally, government policies require the $107,702 seized is kept in an interest-bearing account. Though McLellan will receive the money, the government wants to keep the interest earned.”

Though the new policy reforms will hopefully keep from ensnaring more innocent Americans, others have not been so lucky.

In recent years, seizures executed because of structuring violations have increased dramatically. In 2005, the Internal Revenue Service made just 114 structuring seizures. By 2012, that number had risen to 639. During that same time period, the agency seized $242 million for structuring violations.

While banks must submit reports to the Department of the Treasury for cash deposits of more than $10,000, the government also receives “suspicious activity reports” on deposits below that threshold.

It’s likely the government received a suspicious activity report detailing McLellan’s deposits, which is how he “came onto the government’s radar.”

Also, “the IRS frequently teams up with local law enforcement to look through suspicious activity reports. By seizing property and money through the Department of Justice’s Equitable Sharing Program, law enforcement agencies share the proceeds of the forfeiture.”

Though Lyndon McLellan is supposed to receive his $107,000, he may still have to wait several more months. By July, the government will have held his money for a year. It’s amazing what a little sunlight and media coverage on these unconstitutional seizures can do for the government to come to its senses.

by | ARTICLES, BLOG, FREEDOM, OBAMA, POLITICS, TAXES

The recent Z Street Case against the IRS before the D.C. Court of Appeals is a notable example of egregious behavior by IRS employees.

Z Street is a group that was created in order to educate “the public about Zionism; about the facts relating to the Middle East and to the existence of Israel as a Jewish State; and about Israel’s right to refuse to negotiate with, make concessions to, or appease terrorists.”

In December 2009, the group submitted an application to the IRS in order to gain 501(c)(3) status. By July 2010, Z Street spoke to the IRS about the unusually lengthy process; the “IRS agent said that auditors had been instructed to give special attention to groups connected with Israel, and that they had sent some of those applications to a special IRS unit for additional review.”

The interesting thing about this case is that it hearkens back to the early years of the Obama Administration beginning in 2009. That’s more than three years before the IRS scandal blew wide open in 2013, which goes to show you just how deeply entrenched the culture was at the IRS — it seems no one considered actions against certain groups (but not others) to be discriminatory or punitive. Why did the IRS not recognize their own audacity?

Incidentally, according to documents, IRS inspectors were instructed to “be on the look out” (BOLO) for groups that would fit the description of “occupied territory advocacy”; that instruction was sent on August 6, 2010, merely a few days after the Z Street application file was examined. After the IRS scandal broke, and during subsequent investigations, it was revealed that the file containing “occupied territory advocacy” groups listed exactly one such group: Z Street.

The IRS manager involved with the Z Street case stated under oath by documents submitted during the initial court proceedings in 2013 that he concluded Z Street might be involved with terrorism funding because “there is a higher risk of terrorism in Israel.”

The Circuit Court was patently outraged at the IRS’s illegal actions on the matter, and further chastised the IRS and the DoJ for ridiculously implying that there can be a holding period of up to 270 days before a decision is made for a 501(c)(3) application. One judge remarked, “If I were you, I would go back and ask your superiors whether they want us to represent that the government’s position in this case is that the government is free to unconstitutionally discriminate against its citizens for 270 days.”

Why are heads still not rolling at the IRS? Why is the IRS defending this behavior? The tactic to appeal last year’s halted discovery that would potentially embarrass the IRS. This “would have allowed Z Street to examine IRS officials, under oath, and to receive internal communications from the agency regarding the special unit and special procedures for handling pro-Israel groups.”

In other words, the IRS and the government are more worried about protecting themselves than fixing the problems, thus continuing to clog up the court system until the waning days of the Obama Administration. This maneuver shows that corruption is evidently still alive and well at the IRS.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Recently, a business owner in the heart of Baltimore penned a piece describing some of the excessive and burdensome government policies business owner face. His piece gave an eye-opening view of the reality that is decades of fiscal and governmental mismanagement in the city.

For instance, he notes there a fee or fine for a ridiculous amount of infractions: “When the building alarm goes off, the police charge us a fee. If the graffiti isn’t removed in a certain amount of time, we are fined. This penalize-first approach is of a piece with Baltimore’s legendary tax and regulatory burden.”

As for taxes, “Baltimore fares even worse than other Maryland jurisdictions, having the highest individual income and property taxes at 3.2% and $2.25 for every $100 of assessed property value, respectively. New businesses organized as partnerships or limited-liability corporations are subject, unusually, to the local individual income tax, reducing startup activity.” This policy is especially anti-business; a company’s early make-or-break years are impeded by an excessive tax burden.

And regulations? “State and city regulations overlap in a number of areas, most notably employment and hiring practices, where litigious employees can game the system and easily find an attorney to represent them in court. Building-permit requirements, sales-tax collection procedures for our multistate clients, workers’ compensation and unemployment trust-fund hearings add to the expensive distractions that impede hiring.” People go into business to make things, to provide a product, a service, not to comply with government red tape.

So what is the solution? Typically more money is the stock answer from the Democrats but in the case of Baltimore, even that’s not true. They’ve already tried that. “The Maryland state and Baltimore city governments are leveraging funds to float a $1 billion bond issue to rebuild crumbling public schools. This is on top of the $1.2 billion in annual state aid Baltimore received in 2015, more than any other jurisdiction and eclipsing more populous suburban counties. The financial problem Baltimore does face is a declining tax base, the most pronounced in the state. According to the Internal Revenue Service, $125 million in taxable annual income in Baltimore vanished between 2009 and 2010.”

A declining tax base can be reversed once the climate for business growth and opportunity changes. Instead of approaching businesses merely as a source of revenue for a fiscally mismanaged city, give them breathing room. Loosen the regulations. Repeal fees and fines. Lower the tax burden. Give them the tools necessary to grow their companies and create more jobs.

Baltimore has suffocated under the failed progressive policies of the last few decades — the city and the state and local government all run by Democrats. What they’ve done is bad, but what they haven’t done for businesses is even worse.