by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

I’ve written several times over the years about Obama’s economic policies and anti-business climate as factors that have hampered this country’s growth and recovery. Phil Gramm has a good piece in the WSJ recently that gave a succinct overview of all that is still wrong with the economy. Obama continues to insist that either a) the economy is good or b) any problems are someone else’s fault. Do yourself a favor and read this piece which is sobering, but accurate, about the state of our economy today.

What’s Wrong With the Golden Goose?

Since the Obama recovery began in the second quarter of 2009, public and private projections of economic growth have consistently overestimated actual performance. Six years later, projections of prosperity being just around the corner have given way to a debate over whether the U.S. has fallen into “secular stagnation,” a fancy phrase for the chronic low growth seen in much of Europe.

This is just another in a long line of excuses. America’s historic ability to outperform Europe is well documented; we call it American exceptionalism. It has always been based on the fact that the U.S has had better, more market-driven economic policies and our economy therefore worked better. But, as the U.S. economy is Europeanized through higher taxes and greater regulatory burdens, American exceptionalism is fading away, taking economic growth with it.

How bad is the Obama recovery? Compared with the average postwar recovery, the economy in the past six years has created 12.1 million fewer jobs and $6,175 less income on average for every man, woman and child in the country. Had this recovery been as strong as previous postwar recoveries, some 1.6 million more Americans would have been lifted out of poverty and middle-income families would have a stunning $11,629 more annual income. At the present rate of growth in per capita GDP, it will take another 31 years for this recovery to match the per capita income growth already achieved at this point in previous postwar recoveries.

When the recession ended, the Federal Reserve projected future real GDP growth would average between 3.8% and 5% in 2011-14. Based on America’s past economic resilience, these projections were well within the norm for a postwar recovery. Even though the economy never came close to those projections in 2011-13, the Fed continued to predict a strong recovery, projecting a 2014 growth rate in excess of 4%. Yet the economy underperformed for the sixth year in a row, growing at only 2.4%.

Implicit in these projections and in the headlines of most economic news stories—which to this day blame cold winters, wet springs, strikes, hiccups and blips for America’s failed recovery—is the belief that there has been no fundamental change in the U.S. economy. Underlying this belief is the assumption that either the economic policies of the Obama administration are not fundamentally different from the policies America has followed in the postwar period or that economic policy doesn’t really matter.

And yet we know that the Obama program represents the most dramatic change in U.S. economic policy in over three-quarters of a century. We also know from the experience of our individual states and the historic performance of other nations that policy choices have profound effects on economic outcomes.

The literature on economic development shows that U.S. states and nations tend to prosper when tax rates are low, regulatory burden is restrained by the rule of law, government debt is limited, labor markets are flexible and capital markets are dominated by private decision making. While many other factors are important, economists generally agree on these fundamental conditions.

As measured by virtually every economic policy known historically to promote growth, the structure of the U.S. economy is less conducive to growth today than it was when Mr. Obama became president in 2009.

Marginal tax rates on ordinary income are up 24%, a burden that falls directly on small businesses. Tax rates on capital gains and dividends are up 59%, and the estate-tax rate is up 14%. While tax reform has languished in the U.S., other nations have cut corporate tax rates. The U.S. now has the highest corporate rate in the world and the most punitive treatment of foreign earnings.

Meanwhile, federal debt held by the public has doubled, so a return of interest rates to their postwar norms, roughly 5% on a five-year Treasury note, will send the cost of servicing the debt up by $439 billion, almost doubling the current deficit.

Large banks, under aggressive interpretation of the 2010 Dodd-Frank financial law, are regulated as if they were public utilities. Federal bureaucrats are embedded in their executive offices like political officers in the old Soviet Union. Across the financial sector the rule of law is in tatters as tens of billions of dollars are extorted from large banks in legal settlements; insurance companies and money managers are subject to regulations set by international bodies; and the Consumer Financial Protection Bureau, formed in 2011, faces few checks, balances or restraints.

With ObamaCare the government now effectively controls the health-care market—one seventh of the economy. The administration’s anti-carbon policies hamstring the energy market, distort investment and lower efficiency. Despite the extraordinary bounty that has flowed to America from an unfettered Internet, Mr. Obama has dictated that the Web be regulated as a 1930s monopoly, bringing the cold dead hand of government down on what was once called the “new economy.”

During Mr. Obama’s presidency, the number of Americans receiving food stamps has risen by two-thirds and the number of people drawing disability insurance is up more than 20%. Not surprisingly, labor-force participation has plummeted. Crony capitalism and artificially low interest rates have distorted the capital markets, misallocating capital, overpricing assets and underpricing debt.

Despite the largest fiscal stimulus program in history and the most expansive monetary policy in more than 150 years, the U.S. economy is underperforming today because we have bad economic policies. America succeeded in the Reagan and post-Reagan era because of good economic policies. Economic policies have consequences.

With better economic policies America was like the fabled farmer with the goose that laid golden eggs. He kept the pond clean and full, he erected a nice coop, threw out corn for the goose and every day the goose laid a golden egg. Mr. Obama has drained the pond, burned down the coop and let the dogs loose to chase the goose around the barnyard. Now that the goose has stopped laying golden eggs, the administration’s apologists—arguing that we are now in “secular stagnation”—add insult to injury by suggesting that something is wrong with the goose.

by | ARTICLES, BLOG, POLITICS, TAXES

Possibly one of the biggest property-rights case since Kelo has recently been argued before the Supreme Court. The property in question this time is not land, but raisins. A couple, the Hornes, who were raisin farmers in California were fined for declining to participate in a government sponsored raisin regulatory group. The raisin growers sued the government under the 5th Amendment with regard to their raisin property, asking “whether the government’s chosen compensation is “just compensation” within the meaning of the Takings Clause”. They also sued as well under the 8th Amendment with regard to excessive fines. Hopefully, SCOTUS will rule this case in favor of the raisin growers and gain back some ground for property rights that was lost with Kelo.

A little background:

“Like much government mischief, Horne v. USDA has its roots in the Great Depression and federal programs to prop up the price of goods by controlling supply. To create raisin scarcity, the government established a Raisin Administrative Committee that manages the supply of raisins through annual marketing orders. Raisin handlers must set aside a portion of their annual crop, which the feds may then give away, sell on the open market, or send overseas.

Among the targets were Fresno, California raisin farmers Marvin and Laura Horne, who have been in the business for decades. In 2003-2004 the family farm was required to give some 30% of its raisin crop to the government—some 306 tons—without compensation. The previous year they had to hand over 47%, and they were paid less than the raisins cost to produce.

The Hornes refused to participate, and in a letter to the Agriculture Department they called the program “a tool for grower bankruptcy, poverty, and involuntary servitude.” The raisin police were not amused. The Raisin Administrative Committee sent a truck to seize raisins off their farm and, when that failed, it demanded that the family pay the government the dollar value of the raisins instead.”

The question at hand is really one of liberty and property — whether or not the government can seize a business product in order to regulate prices of that product in the market.

One of the more disturbing aspects of this case is the fact that the case was already once argued before the Supreme Court, and returned to the Ninth Circuit Court for clarification; SCOTUS “remanded for a determination of the merits of the takings claim”. Instead, the Ninth Circuit essentially doubled down on their ruling and suggested that their property — raisins that they farmed — was not considered personal property enough to merit the 5th amendment invocation because “the Takings Clause affords less protection to personal property than to real property, and that the Hornes’ did not lose all economically valuable use of their property.”

This logic is ridiculous. The Ninth Circuit had the audacity to suggest that the raisin growers actually benefited from the attempted seizure and subsequent fines — in the form of higher prices in the market for the raisins the growers had left to sell — and could therefore potentially recoup the cost of the fines incurred.

Here then we have a case of American business owners who fail to participate in a government sponsored, price-controlling committee, who then face suffering loss of property or fines because the government prefers the business owners to participate in the regulatory group in order to keep the market prices stabilized.

.

As the Heritage Foundation notes, “the egregiousness of this conduct is amplified when the government penalizes a business for refusing to transfer some of its property to a third party (here, the Raisin Administrative Committee), without assurance of being compensated. Whether the business chooses to incur the penalty or instead accedes to the transfer, basic logic demonstrates that its property is being taken.”

The Supreme Court has the ability to bring clarity with this case that the Takings Clause protects personal property on the same level as with real property. As Kelo was 10 years ago, it’s about time that property rights were affirmed strongly once again.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

From the Hill:

Exactly two years after the IRS first admitted improperly scrutinizing Tea Party groups, congressional investigations into the tax agency show no sign of drawing to a close anytime soon.

Congressional Republicans say they are deeply irritated that they haven’t finished off the investigations launched after Lois Lerner apologized for the IRS on May 10, 2013, and insist that President Obama’s Justice Department has stonewalled their efforts.

Top lawmakers like Senate Finance Chairman Orrin Hatch (R-Utah) note that they’ve only just received thousands of emails to and from Lerner that the IRS said were unrecoverable close to a year ago.

Hatch recently said he hoped a bipartisan Finance report, which members once thought could be released more than a year ago, could come out by the end of June. But congressional investigators maintain that they’ll need to make sure they have a fuller accounting of Lerner’s email trail before any reports are circulated.

Asked about the repeated delays, Hatch said simply: “Every time we turn around we get more emails.”

Congressional committees have received about 5,000 of the roughly 6,400 newly recovered Lerner emails they expect from Treasury’s inspector general for tax administration, a GOP aide said Friday. The aide said that there appears to be little new in the emails, and that the inspector general is expected to issue a broader report on the emails in the coming weeks.

Hatch is far from the only GOP lawmakers fuming about the status of the IRS investigation.

“That’s so egregious, for the tax collection agency of the United States to be in that kind of shape,” said Sen. Pat Roberts (R-Kan.). “They have nobody to blame but themselves. I’d just like to see some accountability, you know?”

But even some Republicans acknowledge that the IRS controversy wasn’t quite the slam dunk case they thought it was two years ago, and House Republicans at least have seemed to put more emphasis on their investigation into the Benghazi attacks over the last year.

Still, Republicans aren’t the only group frustrated by the IRS investigations – underscoring that the partisan divisions marking the inquiries aren’t going away, and that controversy will linger long after any reports are issued.

Tea Party groups say some organizations are still facing delays from the IRS, and that they believe Lerner and other agency officials are getting off easy.

“It’s clear the IRS would like this scandal to disappear,” Jordan Sekulow, whose American Center for Law and Justice represents dozens of groups challenging the IRS in court, said recently.

Congressional Democrats, though, say that two years’ worth of investigations, costing millions of taxpayer dollars, have found what they long suspected – that the IRS’s scrutiny of Tea Party groups was caused not by political bias, but by bureaucratic mismanagement.

The IRS itself says it took pride in a recent inspector general report that found the agency had cleaned up its act when processing tax-exempt applications. But the IRS, and their Democratic supporters, are also facing down budget cuts from Republicans who have shown no signs that they’ll forgive an agency which was unpopular even before Lerner’s apology two years ago.

John Koskinen, the IRS commissioner, has said that the roughly 10 percent budget cut – from $12.1 billion to $10.9 billion – the agency has absorbed in recent years has only hurt its ability to help taxpayers.

Koskinen said in a March speech that the improper scrutiny of Tea Party groups was “from a prior era,” and has urged Congress to allow the IRS to put that era to rest and provide more funding. “It’s not the IRS of 2010, 2011 or even 2012,” Koskinen said in the March speech.

Republicans themselves, frustrated especially by the Justice Department’s investigation into the IRS, have started focusing more heavily on preventing a “Lois Lerner 2.0” situation, as Rep. Peter Roskam (R-Ill.) calls it.

“Of course there’s not targeting going on right now, when the entire world is watching. It’s no surprise that they stopped the targeting for the time being,” said Roskam, the chairman of the House Ways and Means subcommittee overseeing the IRS. “But moving forward, the IRS hasn’t been able to demonstrate anything that it’s done to prevent the targeting from happening again.”

The Senate’s permanent subcommittee on investigations is the only panel to have rolled out a final report on the IRS’s handling of 501(c)(4) applications – and even that was notable largely for the split findings from former Sen. Carl Levin (D-Mich.) and Sen. John McCain (R-Ariz.).

Roskam said he didn’t know whether Ways and Means Chairman Paul Ryan (R-Wis.), who has made trade deals and tax reform his top priorities, would be interested in releasing a broad report on the committee’s IRS findings.

Rep. Jim Jordan (Ohio), a senior member of the House Oversight Committee, said much the same thing about his panel’s chairman, Rep. Jason Chaffetz (R-Utah).

Jordan did note that the committee’s previous chairman, Rep. Darrell Issa (R-Calif.), released periodic reports on the IRS, including a broad final report in his last days atop the Oversight panel.

The Ohio Republican was far more confident that Justice Department investigators have never been serious about pressing criminal charges against anyone connected to the IRS, and knocked former Attorney General Eric Holder for declining to appoint a special prosecutor to look into the case.

Justice officials have said they want to complete their investigation “as expeditiously as possible.” But Republicans were also enraged last month when an outgoing U.S. attorney decided not to bring their contempt charges against Lerner to a grand jury.

“You’ve got all this history, and you’ve got the fundamental nature of the violation,” Jordan said. “I think it’s kind of natural to be skeptical about, well, ‘everything’s fine now.’ I do think there’s more to look into here.”

Republicans add that they’ll have to keep their focus on the IRS as long as it’s still working on new rules governing 501(c)(4) groups, after groups ranging from the Tea Party to the American Civil Liberties Union ripped the Obama administration’s first effort.

And while Republicans don’t want to speculate on when their IRS efforts might come to a close, Roskam dropped some hints that their interest in both the agency and Lerner won’t fade anytime soon.

“The statute of limitations doesn’t lapse until after the new administration comes in, so you could very easily see a newly constituted Justice Department having a new attitude about Lerner,” Roskam said.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, RETIREMENT, SOCIAL SECURITY, TAXES

Chris Christie recently unveiled a plan to overhaul Social Security. This is his Hail Mary to get back in the game of running for President. Though I applaud his decision to make entitlement reform a major portion of his platform, his proposal is merely another veiled tax increase on the wealthy.

There are two portions to his reform plan. The first is to raise the retirement age from 67 to 69 over a phased in length of time. That is not such a bad idea. It is the second portion, related to reducing and even eliminating entirely the ability for a taxpayer to receive Social Security, into which he has paid during his working career, that is particularly heinous.

Chris Christie’s proposal to reduce and eliminate Social Security benefits for wealthier people is just a capitulation to the Left. He advocates reducing benefits for retired persons if they earn more than $80,000 and calls for eliminating outright Social Security benefits for retirees who earn $200,000 or more a year. This is basically another massive tax increase on the wealthy disguised as entitlement reform.

For many upper income earners, their income tax rates are already over 50%, especially when local and state taxes are factored in. Yet when one calculates that income tax rate, not included in that amount is Social Security (though Social Security is a separate tax). As reference, for those who are self-employed, one pays 15.3% to Social Security, but if someone is employed, the employer pays 7.65% while the employee pays the other 7.65%. The reason why this tax is not considered in the tax rate calculation is because it is considered to be “retirement pay”, something paid into “the system”, based upon the “promise” that it will be returned as benefits at a point in the future.

But now Christie proposes to change the game in a nearly fraudulent way. Social Security taxes would still be collected from taxpayers, but for upper income earners, you won’t get your benefits back in entirety or even at all after a certain income level when you are of retirement age. That’s practically criminal. It’s raising taxes on the wealthy yet again, because the Social Security tax would still be collected over the years, but you don’t receive the promised benefits anymore past certain income levels during your retirement years. Looked at it another way, if you are successful, if you do well and are able to retire with a decent income stream, you are now punished for that success and lose the funds you faithfully paid in over the years because the government now deems you to have too much money. It is wealth confiscation to cover decades of mismanaged funds that now need massive reform to be solvent.

I think Chris Christie’s heart is in the right place, but he really hasn’t thought his plan through. It plays directly to the Left playbook on class warfare, implying that the wealthy need to “pay their fair share” by now forfeiting their Social Security funds past a certain income threshold in order to help pay for government fiduciary malfeasance. That concept is repugnant and Social Security reform needs a better plan than what Chris Christie has to offer.

by | ARTICLES, OBAMA, POLITICS, SOCIAL SECURITY, TAXES

The federal government set an all-time record for monthly tax receipts this past April. The Congressional Budget Office (CBO) reported that nearly a half-trillion dollars was received — $472 billion to be exact. April is typically a high revenue month because yearly taxes are due on April 15th, but this April was the largest tax receipt in history. It beat the last year’s April tax haul –which was the prior record– by $58 billion ($414B).

With such a large amount of revenue, spending was below tax intake — meaning the government ran a surplus, and a record one at that as well. It was a $155 billion surplus for one month. That will help reduce the overall deficit expected for the year. According to the CBO, “the government has taken in $1.89 trillion in revenue, and spent $2.18 trillion through the first seven months of the fiscal year.” The fiscal year runs October 1 – September 30.

The most interesting part of the CBO report, however, was the portion on entitlement spending:

“The biggest spending increases are in Medicare, Medicaid and Social Security — the big entitlement programs that are essentially on autopilot, with costs increasing as more poor, disabled and elderly people become eligible. Combined, they are up some $81 billion compared to the same time period from fiscal year 2014.”

And more:

“Social Security has risen 4 percent this year, and Medicare has risen 8 percent, after unanticipated spending increases in 2014 left the government with a big bill at the beginning of this fiscal year.

But the biggest leap has been in Medicaid, the federal-state partnership that provides health care to the poor, and which is up 22 percent, or $36 billion, over the previous year. CBO analysts said the increase was chiefly due to Obamacare, which has pushed millions of new customers into the program, drawing ever-more resources.”

This is the elephant in the room. Entitlement spending is not even “counted”, so to speak, when discussing the $18 trillion federal debt. But until we agree to start recording Social Security, Medicare, and Medicaid in their budgets in actuarially sound way, we will never be able to honestly and effectively deal with their fiscal crises. All of these programs needs massive reform instead of incrementally kicking the can further down the road to avoid making difficult, but necessary changes for the long haul. Until then, deficit spending will only continue to worsen and revenue taken from the taxpayer to cover the government’s spending habits.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

A recent article by the National Review brought to light how the IRS has taken on the role of “rules interpretation” in recent years, which is beyond its scope as the nation’s tax collecting agency. The most notorious example of this new role is highlighted in the King vs Burwell case before the Supreme Court — where the IRS interpreted the language of Obamacare other than what was expressly written down as law. However, as the National Review discusses, the IRS has grown accustomed to interpreting law as it sees fit, without the oversight of Congress. Therein lies the problem.

With Burwell, the question being debated is over the letter of the law vs the spirit of the law. As Obamacare was written, tax subsidies were available for federal exchanges (letter of the law). As the IRS is the administrator, so to speak, of the subsidies, it interpreted that line of law to apply to all healthcare exchanges (spirit of the law) and ruled that subsidies were available for both federal and state exchanges, even though Obamacare never specified state exchanges, only federal. The federal government was sued, claiming that the IRS had not the power to administer subsidies beyond what was written, passed, and voted into law. SCOTUS will issue its ruling on the matter later this summer.

The question of rules interpretation is an interesting one. How much power, if any, does the IRS have in sorting out the minutiae of detail in the myriad of tax credits and subsidies that the tax code is riddled with?

The potential for abuse is certainly there. The National Review article focused on just one type of tax credit, the “production tax credit” (PTC) which applied to wind-energy producers, and all the changes the IRS made to the rules regarding this tax credit over the past few years:

*“In December 2012, Congress extended the production tax credit (PTC) to cover wind-energy producers who were in the beginning stages of construction by the subsidy’s cutoff date. The IRS clarified shortly thereafter that wind-farm projects would be able to receive the special tax giveaway if they spent as little as 5 percent of the construction costs.”

*“In April 2013, the IRS apparently decided the tax credit wasn’t large enough. So it simply raised the value of the PTC from $22 per megawatt-hour of electricity produced to $23 per megawatt-hour. Voilà — more federal spending courtesy of you, the taxpayer.”

*“In September 2013, the IRS went a step further. It expanded the PTC to cover wind-farm projects that generate power before the end of 2015, despite the fact that the PTC for all projects was set to expire at the end of 2013. The IRS also said in the notice that even projects that come online after that might still qualify; the agency intends to make decisions on a project-by-project basis.”

*“In August 2014, the IRS decided it would not only pay wind-energy developers for each megawatt-hour they produce. It would also allow them to sell a project — regardless of whether it was completed — and use the selling costs they incur to count toward qualifying for the PTC.”

*“The IRS also loosened its requirement that companies need to spend only 5 percent of construction costs to qualify. The agency said it would consider only the nature of the work (such as digging foundations, installing transformers, building roads), not the extent or the cost of the overall project. This more subjective standard gave the IRS even more leeway in doling out government subsidies.”

*In March 2015, the IRS loosened the PTC eligibility requirements yet again. The agency clarified what “begin construction” means. Under the new guidance, if a wind-project developer began construction on a new facility prior to January 1, 2015, and places the project in service before January 1, 2017, then the facility will be considered to be in progress for the purposes of receiving the PTC. This is regardless of the amount of physical work performed or the amount of costs paid or incurred within that amount of time.”

The PTC tax credit, between December 2012 and March 2015, had its rules significantly altered by the IRS. The crux of the issue, however, is the fact that this happened without any congressional oversight. The IRS workers, the ones making the decisions on these rules, are unelected, and accountable to no one. And yet, the changing of the tax credit affects the taxpayer. National Review notes, “While the PTC has historically averaged roughly $5 billion per year, the most recent one-year extension will cost taxpayers $13 billion.” That is an alarming expansion of taxpayer money just in this particular credit instance, without the approval of Congress.

This is also an effect of the larger problem of Congress using the tax code to pick winners and losers. Here, we have special tax credits to companies in order to push “green energy”. It is the essence of crony capitalism, where politicians trade favors and barters to support certain initiatives or restrict others via new taxes or credits. They’re basically all gimmicks to aid in reelection or pander to a portion of the electorate — and then we never get rid of all the tacked-on programs and policies because no one wants to give up their special initiatives.

The code has grown immensely complex. And now we have the IRS regularly going beyond its authority as well. The IRS must be reigned in from interpreter of law back to mere enforcer, as it goes about its business of tax collection. As such, Congress would also do well to reduce the amount of crony capitalism it engages in and stop playing games with our tax code.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

The Treasury Inspector General for Tax Administration (TIGTA) found even more missing emails from Lois Lerner among the recycled back-up tapes, which has provided now about 35,000 emails that were deemed lost and destroyed.

This new batch of roughly 6,400 emails is particularly interesting, because it spans 2004- 2013, so it covers the time frame both before and after Lerner’s hard drive crashed in 2011. About 650 emails appear to be from 2010-2011, which is the crucial time during which Lerner’s IRS targeted conservatives groups by denying or prolonging their 501c4 application process.

The bulk of the emails, however, are from 2012. 2012 was the presidential election year. However, by early 2012, we already know that Lerner was instructing her workers to be careful about what they put into writing.

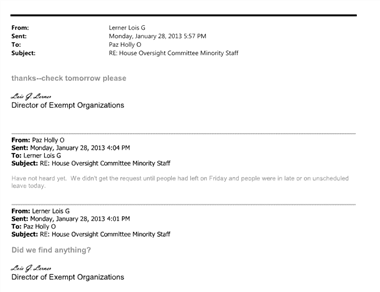

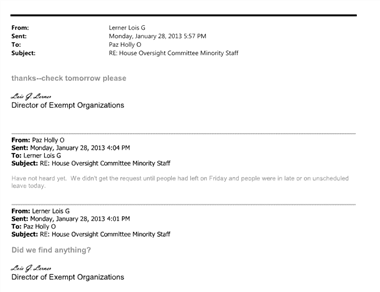

An email written in February 2012 — which was released by Judicial Watch and not part of the newly found emails — reveals a conversation between Lois Lerner and Holly Paz, one of her employees who served as the former Director of the Office of Rulings and Agreements. Paz’s position as Director of the Office of Rulings and Agreements meant that she “oversaw the tax law specialists who provided guidance to the agents in Cincinnati reviewing “tea party” and other applicants, as well as the department involved with processing the applications.” In Lerner’s email to Paz, she discusses training her employees to be mindful of what they write down:

“We are all a bit concerned about the mention of specific Congress people, practitioners and political parties. Our filed folks are not as sensitive as we are to the fact that anything we write can be public–or at least be seen by Congress. We talked with Nan [Downing – Director of EO Examinations] and she thought it would be great if R & A [Rulings and Agreements] could put together some training points to help them understand the potential pitfalls…

I realize everyone is very busy, but I’d like you and Tom [Miller EO adviser] to get together to work out a reasonable plan for completing the review and reporting back on some of the issues he thinks we’d need to cover. If you need more info, we can talk. Thanks”

If Lerner was mindful by then of written records, what the new Lerner emails could reveal might depend on who they were going to. However, Lerner was apparently not entirely so concerned about covering up everything, because other separate FOIA records have revealed emails between Lerner’s office and other government groups and officials.

For instance that in 2012 and 2013, Elijah Cummings and the IRS were in communication. In April 2014, it was reported that the “House Oversight Committee show staff working for Democratic Ranking Member Elijah Cummings communicated with the IRS multiple times between 2012 and 2013 about voter fraud prevention group True the Vote. True the Vote was targeted by the IRS after applying for tax exempt status more than two years ago. Further, information shows the IRS and Cummings’ staff asked for nearly identical information from True the Vote President Catherine Engelbrecht about her organization, indicating coordination and improper sharing of confidential taxpayer information.”

What’s more, the same Holly Paz mentioned earlier colluded with Lerner to provide True the Vote’s 990’s to Cumming’s staff in early 2013: “On January 28, three days after staffers requested more information, Lerner wrote an email to her deputy Holly Paz, who has since been put on administrative leave, asking, “Did we find anything?” Paz responded immediately by saying information had not been found yet, to which Lerner replied, “Thanks, check tomorrow please.” The 990’s were sent three days later.

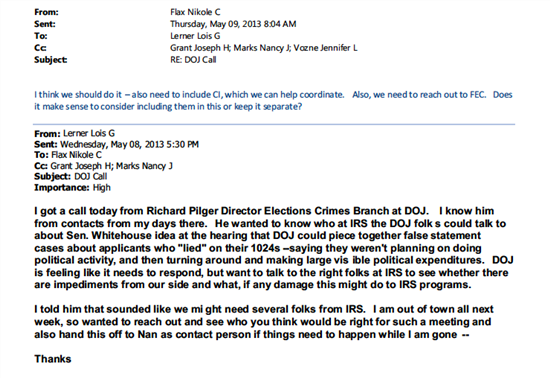

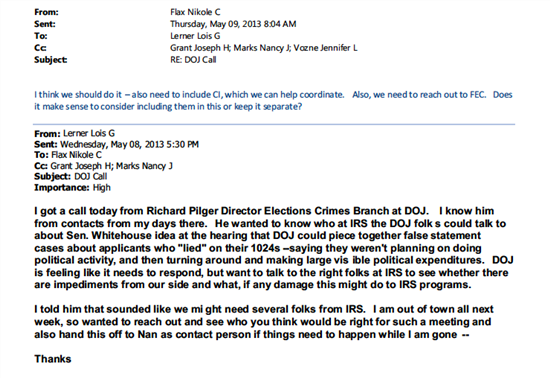

Similarly, in 2013, it has been noted that Lerner was in communication with the Department of Justice regarding prosecuting tax exempt groups. A email obtained by a FOIA request, written by Lerner just two days before the IRS scandal broke in May 2013, stated,

“I got a call today from Richard Pilger Director Elections Crimes Branch at DOJ … He wanted to know who at IRS the DOJ folk s [sic] could talk to about Sen. Whitehouse idea at the hearing that DOJ could piece together false statement cases about applicants who “lied” on their 1024s –saying they weren’t planning on doing political activity, and then turning around and making large visible political expenditures. DOJ is feeling like it needs to respond, but want to talk to the right folks at IRS to see whether there are impediments from our side and what, if any damage this might do to IRS programs. I told him that sounded like we might need several folks from IRS,” Lerner wrote in a May 8, 2013 email to former Nikole C. Flax, who was former-Acting IRS Commissioner Steven T. Miller’s chief of staff.

“I think we should do it – also need to include CI [Criminal Investigation Division], which we can help coordinate. Also, we need to reach out to FEC. Does it make sense to consider including them in this or keep it separate?” Flax responded on May 9, 2013.”

Incidentally, that wouldn’t be the first time Lerner explored such a scenario with the DoJ, and Pilger in particular; she did so even way back in 2010. National Review reported last June that “The Internal Revenue Service may have been caught violating federal tax law. In October 2010, the agency sent a database on 501(c)(4) social-welfare groups containing confidential taxpayer information to the Federal Bureau of Investigation, according to documents obtained by a House panel.

The information was transmitted in advance of former IRS official Lois Lerner’s meeting the same month with Justice Department officials about the possibility of using campaign-finance laws to prosecute certain nonprofit groups. E-mails between Lerner and Richard Pilger, the director of the Justice Department’s election-crimes branch, obtained through a subpoena to Attorney General Eric Holder, show Lerner asking about the format in which the FBI preferred the data to be sent”.

The Department of Justice never formally did anything to the social welfare groups, but it was shortly thereafter that targeting was begun by Lerner — not to current 501c4s, but new groups applying for status. “E-mails cited in a committee report released in March [2014] show that the [Citizen’s United] decision caused a lot of angst for Lerner and her colleagues in the IRS’s Exempt Organizations division, and she noted in public remarks that the agency was under pressure to “fix the problem” created by the decision.”

TIGTA is expected to release its report later this year on all the missing 35,000 emails, which will include this new-found batch. After TIGTA’s report comes out, a second report by a bipartisan Congressional committee will also be released, and the public will be able to see more clearly what Lerner was trying to hide when she discarded her computer hard drives.

.

by | BLOG, ECONOMY, TAXES

People have traditionally measured wealth by the amount of tangible assets they have. Viewed from this perspective, many people who have saved substantially for their retirement through an IRA, a 401K, or other profit sharing plans, (all in the category known as defined contribution plans) are well up in the highest percentile of people with wealth. Other people have retirement plans that provide only income streams for their (and often their spouse’s) lives. These are known as defined benefit pension plans. But since they do not have a pool of assets in a separately owned account, having rights only to the income stream – they are not viewed as having actual assets.

Therefore, these people are very often at the low end of the “asset” wealth scale. But the income stream is certainly an asset, a quite valuable one. And because of government policy and other economic factors in the last few years, the value of the defined benefit plans has exploded compared to the value of defined contribution plans. This has created a massive wealth switch to public service employees from private sector employees.

Given what the federal government’s policy has been with interest rates and fiscal policy, and given the much lower rate of return we have had to endure these last 6 years, the value of the retirement income stream has grown enormously, while the value of the retirement “nest egg” has diminished correspondingly. In this way, there has been a real conversion of income and assets such that people with continual income streams from defined benefit plans can now be looked at as having substantial “assets” while the retirement portfolio earning very little interest is less desirable. Being considered “wealthy” has become more about with having financial security than assets. The main reason for this switch can be found by examining the state of the pension system.

Say you have two people — one person in private industry, and one in the public sector, both making say $70K/year and hoping and expecting that they could retire on, say, $50K per year for all their years of good service and hard work.

It used to be, up until about 6 years ago, that a private industry person retiring with that $50K/year plan in mind could actually retire on that. The sum of his portfolio that would enable him to retire with that much per year would be around $1 million .That person could reasonably have concluded that he is set pretty well for life; if his portfolio earns 5% a year, he could pull out that $50k a year (5-% on a $1 million ) and still have the principal ($1 million ) left to pass on to the kids.

In a similar way, a public service worker or union making the roughly the same money would have roughly similar expectations — a $50K yearly pension. You could put a value on it ($1 million) but there is a large difference between the public pension and private pension. When the public pensioner dies, that pension ends; the money is gone. That is, there is no principal because there is no personal “investment portfolio” in the same manner that a private sector pensioner has. The public pension is funded from the larger investment pool within the public service industry.

Now, the last six years has made the pension and investment situation for retirees quite untenable. Interest rates remain sluggish, yielding only around 2% a year. That becomes only about $20K in returns for the private industry person. Now the pensioner can’t live off of the returns from the million in his portfolio. It’s not going to give him the retirement he planned or the inheritance he thought he could pass on. He needs more.

The situation is different for the public service person. He still gets his $50k a year, regardless of whether the return is actually 2% or 5%. His defined benefit plan promised to pay him a set amount every year until he passes away. When these plans were funded, and interest rates were a reliable 5%, the public service employers were only putting away enough to have $1 million worth per person, counting on yearly investment returns of 5%.

In order for the public service pension to get funded as promised , (at $50K/yr) the public service pension pool must pay it. Though the plan may have been “worth” a $1 million, now that the pool has to cough up the difference in funds due to low investment performance (2% in reality when 5% was necessary). That pension now becomes the valued at $2.5 million, ($2.5million x 2% = $50,000) because more funds are needed to supplement it in order to maintain the promised payments.

The government must come up with that extra $1.5 million supplement to sustain the promised benefits to the public service person. Multiply that by for every person for which there is not enough money set aside in these pooled retirement funds to pay for them. Where does that money come from? The employer? No, the taxpayer.

Here’s the kicker. When the public sector and unions earmarked that million for the employee, they hoped it would be enough to cover it. Within the private sector, over time business owners began to understand the fiscal instability and risk inherent in such defined benefit plans. Refusing to make such a commitment, most private sector employers have abandoned such plans completely.

When the public service sector started seeing the fissures in the system, they started to negotiate to keep their benefits as good as possible. But they didn’t, and still don’t, negotiate with the taxpayer. They negotiate with politicians, not the people who fund the retirement pool.

So what has really happened with these public and private retirement plans? Those public service persons with the $50K retirement plan saw the value of their retirement jump from $1 million to $2.5 million. From an accounting point of view, it’s money going into the assets of the public service employees, while the other side is a debt born to all the taxpayers for the benefit of a few.

This is nothing more than a huge wealth transfer. When the public sector and unions made deals with municipalities, these were cozy sweetheart deals, a trojan horse, a poison pill. There were no provisions made to handle the possibility of a low-interest rate society; they took their chances and their fallback was to suck money from the taxpayer by raising taxes to cover budgeting shortfalls.

Now the private sector pensioners are bearing the brunt on two fronts — their own retirement plans are performing poorly and their portfolios are dwindling while their taxes help to fund the gross negligence of the public sector. All taxpayers are feeling the pinch. The failure of the public service groups to be responsible in their fiduciary responsibility to the taxpayer means that now more than ever, vast amounts of wealth are being given over merely to band-aid this broken system, mask the true debt, and avoid real reform. This is politician/public service union cronyism for all to see.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, OBAMA, POLITICS, TAX TIPS, TAXES

Forbes recently had a very good article which explores the US Federal Debt and how it affects economic growth. It also reviews government debt for the future, and its affect on the private sector and the debt-to-GDP ratio. Unfortunately, it doesn’t cover the entirety of US debt, which includes substantial entitlement obligations, but that’s probably fodder for another article entirely. If you want a decent primer on our federal debt — which translates into $154,161 each taxpayer owes towards it — read the article below.

The availability of credit in the U.S. was a major catalyst in the economic boom of the twentieth century. However, too much of a good thing can also be a problem. Is the U.S. too reliant on debt? Is the federal government mortgaging the future earnings of an entire generation? In this article, we’ll explore these and other issues as we take a look at the debt cycle in America.

The Impact of Debt on Economic Growth

In the early part of the twentieth century, if people didn’t have the money to purchase an item, they would save for it. With the introduction of credit terms, high-dollar items became much more affordable. It also changed the way we view debt. For example, rather than think of a new car in terms of its total price, we began to focus on the amount of the monthly payment. And, as the use of debt increased, the American standard of living rose with it. Excessive debt was also one of the primary catalysts for the economic boom of the 1980s, 1990s, and part of the 2000s. However, when debt is used in excess, it steals from the future since it must be repaid. This is because a dollar borrowed today necessitates that a dollar plus interest be repaid in the future. This reduces the amount of money available for future spending. If the amount of debt accumulated is significant and the period of accumulation is long, the required debt payments will negatively impact economic growth. What about government debt? How does it impact the future and the economy?

Government Debt and the Future

As I write this article, the federal government has accumulated $18.2 trillion of debt. In 2004, the federal debt was $7.3 trillion. This rose to $10 trillion when the housing bubble burst four years later. Today it exceeds $18 trillion and is projected to approach $21 trillion by 2019. When you break this down to an amount per taxpayer, the numbers are substantial. It has more than doubled over the past 11 years, rising from $72,051 per taxpayer in 2004 to $154,161 today. As the debt continues higher, the liability of every taxpayer is also rising. The change in the amount of the federal debt per taxpayer from 2004 to 2015 represents an average annual increase of 7.16%. This is much more than the average annual wage increase during the same period.

The Great Private Sector Extortion?

What problems might result from our fiscal failure? With the debt per taxpayer as high as it is, if the government continues to raise taxes on middle income earners and above, it will become increasingly difficult for many of these individuals to preserve their standard of living. This will result in a reduction of wealth that spans the entire income spectrum, excluding perhaps the super-rich. The difficulty will begin in the middle class and eventually creep toward the higher income earners if the debt problem persists. Why will this create difficulty? Because these individuals will be asked to pay higher taxes so the federal debt can be retired. It may be framed under a pretense of patriotism but will really be just another excuse to extract money from the private sector. As the private sector shrinks, economic activity will slow which will result in smaller wage increases. Therefore, these individuals will be squeezed from both ends (taxes and wages). This is one of the key reasons why the middle class is shrinking. It’s as if we’re all on the Titanic and people are continuing to sing and dance while the ship slowly sinks. Does the federal government have the ability to repay its debt? And, if it does today, what about in five or ten years? How difficult will it be then? Let’s address this question now.

The U.S. Debt-to-GDP Ratio

The debt-to GDP ratio compares the amount of the public debt to the size of the economy. For example, if GDP – which is the total of all goods and services produced in the U.S. – is $17.0 trillion and the debt is the same amount, the ratio would be 100%. As the debt rises beyond GDP, the ratio will exceed 100%. This indicates that the debt is greater than the total of what we produce. You might equate it to an individual’s debt-to-income ratio which helps lenders assess an individual’s ability to repay a loan. America’s debt-to-GDP ratio in 1980 was only 35.4%. Ten years later it was 57.7%. As you can see from the chart below, America’s debt-to-GDP ratio has continued to rise and today stands at 102.6%. Although this is not a staggering percentage, as an absolute number, $18.2 trillion in debt is very formidable.

Is the federal government getting in over its head? Will the mounting debt cause a financial hardship on Americans? As the debt continues to expand, the economy will continue to be sluggish, the tax burden will continue to grow, and the middle class will continue to shrink. If Washington doesn’t act soon, will the debt become an unmanageable burden? I believe the answer to this questions lies somewhere between “absolutely” and “very likely.” How bad could it get? It’s difficult to say. To change direction, however, we will need elected officials who are willing to put the needs of the country ahead of their own agenda. In other words, politics will have to take a back seat. You can be sure of this: You cannot circumvent the laws of economics. If we continue to accumulate debt, if we ignore the warning signs, if our officials maintain the status quo, there will be consequences. I only hope America realizes it before it’s too late.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

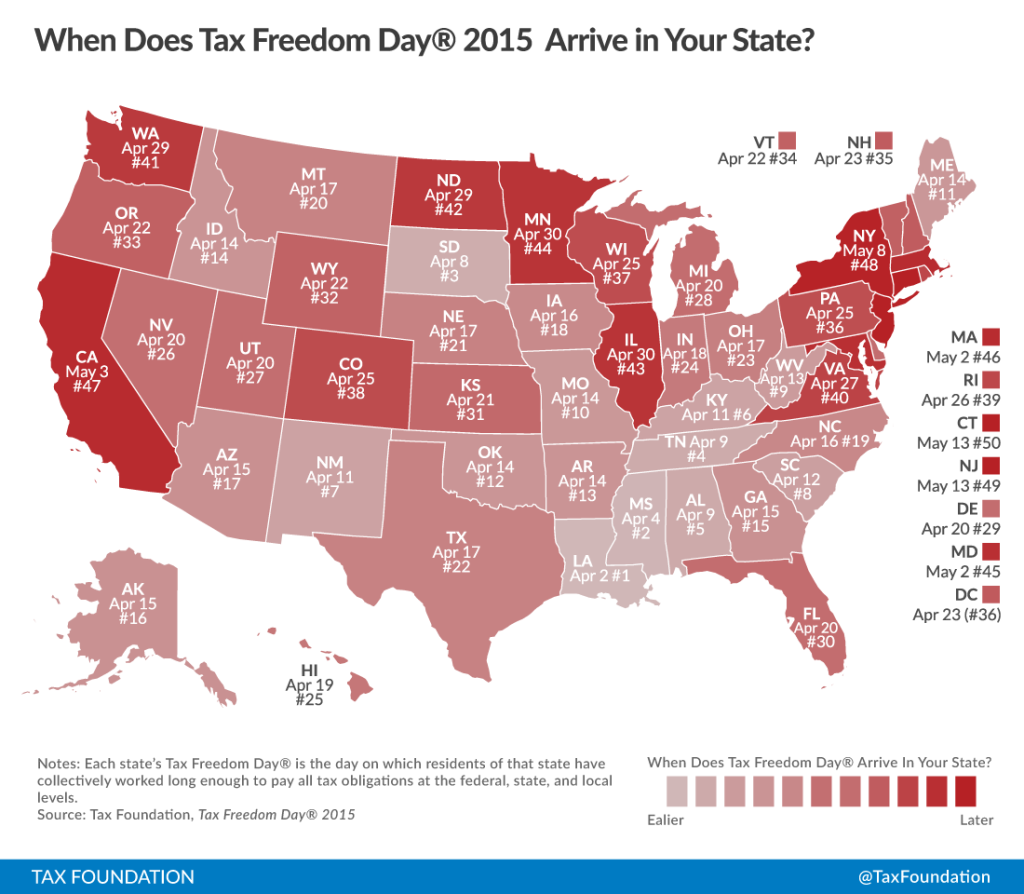

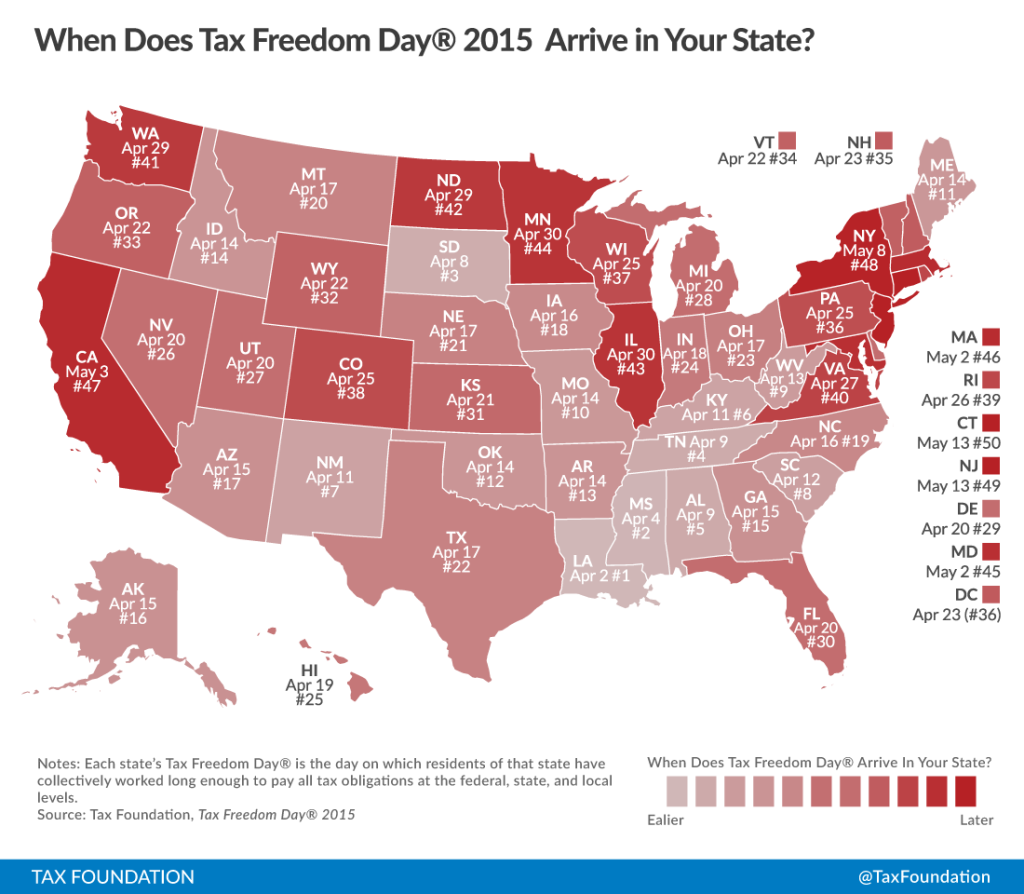

Each year, the Tax Foundation releases its annual report measuring Tax Freedom Day, “the day when the nation as a whole has earned enough money to pay its total tax bill for the year.” Tax Freedom Day is today. April 24th. It takes 114 days of working to pay the country’s tax bill.

Some important findings:

“Americans will pay $3.3 trillion in federal taxes and $1.5 trillion in state and local taxes, for a total bill of more than $4.8 trillion, or 31 percent of the nation’s income.

Tax Freedom Day is one day later than last year due mainly to the country’s continued steady economic growth, which is expected to boost tax revenue especially from the corporate, payroll, and individual income tax.

Americans will collectively spend more on taxes in 2015 than they will on food, clothing, and housing combined.

If you include annual federal borrowing, which represents future taxes owed, Tax Freedom Day would occur 14 days later on May 8.

Tax Freedom Day is a significant date for taxpayers and lawmakers because it represents how long Americans as a whole have to work in order to pay the nation’s tax burden.”

According to the Tax Foundation, the farthest Tax Freedom Day in the calendar year was in 2000, when Tax Freedom Day was May 1. That year, “Americans paid 33 percent of their total income in taxes that year. A century earlier, in 1900, Americans paid only 5.9 percent of their income in taxes, meaning Tax Freedom Day came on January 22. The last time Tax Freedom Day was this late in the year was 2007 (April 25).”

Additionally, Tax Freedom Day is calculated state-by-state. Some states have a more progressive tax system and higher taxes, and some have a lower tax burden. The latest Tax Freedom Day is found in New Jersey and Connecticut, whose Tax Freedom Days fall on May 13th. A few states have Tax Freedom Days earlier than the national Tax Freedom Day; Louisiana is the earliest on April 2nd. You can see how your state fares:

In case you are interested in the methodology of the Tax Foundation, they issues the following description: “In the denominator, we count every dollar that is officially part of national income according to the Department of Commerce’s Bureau of Economic Analysis. In the numerator, we count every payment to the government that is officially considered a tax. Taxes at all levels of government—federal, state, and local—are included in the calculation. In calculating Tax Freedom Day for each state, we look at taxes borne by residents of that state, whether paid to the federal government, their own state or local governments, or governments of other states. Where possible, we allocate tax burdens to the taxpayer’s state of residence. Leap days are excluded to allow comparison across years, and any fraction of a day is rounded up to the next calendar day.”