by | ARTICLES, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

The nomination of Loretta Lynch to the position of Attorney General is before you. Although her intelligence, experience, and poise may appear to make her a superb candidate, it is clear now that she would be an extremely poor – even dangerous — choice due to her strong position on civil asset forfeiture.

The need to safeguard civil liberties and individual rights is a priority for all Americans. Do you really want to consider confirming a person who has been exceedingly proud of her record of taking property without due process…of practicing guilty until proven innocent? This is a very serious issue, not to be taken lightly.

Civil asset forfeiture is a particularly egregious abuse of power, allowing the government to seize property and cash if it merely suspects wrongdoing, even with no evidence and no charging of a crime.

Loretta Lynch was particularly lucrative in this regard as the U.S. attorney for the Eastern District of New York. Between 2011 and 2013, the forfeiture operations under her management netted more than $113 million in civil actions. Lynch’s division was among the top in the country for its collections. But this is not something to be proud of.

In one particularly appalling case, Loretta Lynch’s office seized nearly a half-million dollars from two businessman in 2012 and sat on it for more than two years without a court hearing or appearance before a judge. In fact, no crime had been committed. These men were denied due process and deprived of their assets without warning or criminal charges. Lynch suddenly returned the money just weeks ago on January 20, 2015 — on the eve of her confirmation hearings, having found no wrongdoing by the men either.

During Lynch’s confirmation hearing testimony pertaining to civil asset forfeiture, Lynch stated that “civil and criminal forfeiture are very important tools of the Department of Justice as well as our state and local counterparts.” She further argued that forfeiture is “ done pursuant to court order, and I believe the protections are there.” This is, in fact, not true. In the case mentioned above, there was not only no court order, but also no hearing at any time in nearly three years. That is unconscionable. And this is only one of many similar, well-documented, incidents.

The problem of civil asset forfeiture is that the government can confiscate money or property under the mere suspicion of a crime without ever actually charging someone. The person must prove his innocence to reclaim what was seized, which is a burden of time and money and readily seems to go against our staunch American belief of “innocent until proven guilty.” What’s more, besides the obvious threat to civil liberties, those most likely to be victims are poor and minority citizens.

Thankfully, in recent months, individuals and organizations on both sides of the political aisle have come together to demand reform to this unjust practice. Bipartisan legislation has been proposed in Congress; groups ranging from the Heritage Foundation to the American Civil Liberties Union have been increasingly critical of civil asset forfeiture practices. Even Eric Holder has called for changes and the IRS has recently and publicly pledged to reduce its involvement as well.

Loretta Lynch and her record on civil asset forfeiture represents the worst of this “tool for law enforcement”. A vote for her confirmation is a vote you will never be able to walk back. Do you really want to confirm a person who is so deeply committed to civil asset forfeiture at the very same time in America that there is strong bipartisan support for protecting civil liberties and walking back the laws pertaining to this practice? It makes no sense to proceed down this path.

Loretta Lynch may arguably be the most successful forfeiture agent in government today. This is not a positive quality for an Attorney General. The practice is abusive and her tactics even more so. Voting to confirm a person with such an atrocious civil liberties record is certain to cause problems for you down the road when you have to answer for your support. Therefore, on behalf of all Americans, I urge you to vote no for her confirmation.

by | ARTICLES, BLOG, BUSINESS, OBAMA, POLITICS, TAXES

As I read this recent article in the Wall Street Journal, “Sluggish Productivity Hampers Wage Gains” I mulled as to whether or not the Wall Street Journal had started a new satire section — but then it occurred to me that the author’s analysis of the current market was completely serious. Is he so clueless that he actually does not understand why there is “tepid productivity”?

The author, Greg Ip, cites 1) Faulty data may be partly to blame, 2) the severity of the financial crisis and recession and 3) weak business investment, but completely misses the elephant in the room: the meddling, anti-business policies of the current administration.

This administration has been exceedingly heavy-handed in its efforts to demonize businesses, while promising that businesses will be highly taxed and regulated. Whether it is labor regulation by the NRLB or environmental regulation by the EPA, government interference has been overreaching and restrictive.

Additionally, there have been huge increases in both criminal rules and regulations about what businesses are allowed and not allowed to do — from nitpicky labor rules, to dictating employee minutiae, to minimum wage requirements, all which restrict business hiring.

More unfortunately, Obama has provided the background for a litigation-friendly environment. If a larger, more financially stable company wants to steal something from a smaller company, they can sue them or just threaten with a costly legal battle. Likewise, “disparate impact” and IRS asset forfeiture are two practices which demonize business owners by merely suggesting wrongdoing — and put the burden of the business owners to prove their innocence.

And recently, the Obama Administration has decided to wage war on business inversions, by declaring companies who wish to move their headquarters abroad in order to stay competitive, to be “unpatriotic”, and “tax dodgers”, calling the perfectly legal process of inversion to be a “loophole”. Couple that with the fact that we have the highest corporate tax rate in the world and it’s no wonder that businesses struggle to survive.

Usually the Wall Street Journal is fairly en pointe. It’s hard to believe any editor would have let this article be published while utterly ignoring Obama’s detrimental business policies that have plagued the economy over the last 6 years — which is why something needed to be said.

by | ECONOMY, TAXES

CPAs know all the good jokes…

by | ARTICLES, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

During oral arguments of the Burwell Obamacare case before the Supreme Court on Wednesday, a possible resolution seemed to rear its ugly head when Chief Justice Roberts questioned U.S. Solicitor General Donald Verrilli over the contested ambiguity of the application of Obamacare subsidies. Verrilli made the case that the “court should defer to the interpretation of the Internal Revenue Service, which said the tax credits apply nationwide.” This reasoning is absolutely the worst possible solution — but of course not entirely unexpected from the federal government.

The idea of “deference” refers “ to “Chevron deference,” “a doctrine mostly unknown beyond the halls of the Capitol and the corridors of the Supreme Court. It refers to a 1984 decision, Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc., and it is one of the most widely cited cases in law. Boiled down, it says that when a law is ambiguous, judges should defer to the agency designated to implement it so long as the agency’s decision is reasonable.”

Given the current catastrophic state of the Internal Revenue Service, the courts must run from this idea as quickly as possible. The IRS has proven overwhelmingly in the last few years that no decision it makes is “reasonable” and therefore cannot be trusted as an unbiased, independent agency capable of carrying out a professional opinion on this or virtually any manner. IRS officials engaged in targeting of conservatives, “lost” official emails, mislead Congress and investigators about their existence, and corresponded with agencies such as the FBI, the House Oversight Committee, the DoJ, and the White House in 2509 documents over a multi-year period.

No wonder the federal government requests deference to the IRS to sort out the language and spirit of Obamacare subsidies. It’s like the fox guarding the hen house!

The IRS is no more capable of making such a determination in the first place as the FCC was in implementing net neutrality or the EPA rules changes on limiting carbon dioxide emissions. Agencies have repeatedly exceeded their statutory jurisdiction. SCOTUS would be wise to ignore this suggestion to put the onus back on the IRS to sort out the mess. The IRS has never answered satisfactorily for its repeated scandals, and therefore cannot be considered non-partisan or capable of any prudent judgment, via “deference”, at this time.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, NEW YORK, OBAMA, POLITICS, TAXES

The Wall Street Journal had an excellent article a couple weeks ago calling out the egregious prosecutorial misconduct of New York Attorney General Eric Schneiderman. In this farce of a case, Schneiderman is hell bent on going after Hank Greenberg (formerly with AIG) in an attempt to discredit his name in a state civil lawsuit. The manner in which Schneiderman is conducting himself is a disgrace to his position as prosecutor and reflects a trend of prosecutorial abuses that has grown alarmingly in recent years.

In the Schneiderman-Greenberg case, Eric Schneiderman has been pursuing civil charges against Hank Greenberg related to an “allegedly fraudulent reinsurance transaction” some years ago while disgraced Eliot Spitzer was the Attorney General. Mr. Greenberg was the defendant in a prior, failed criminal prosecution involving this particular transaction several years ago; in preparation for this upcoming civil case, it came to light that the “federal government has been hiding potentially exculpatory evidence” from the prior trial of Mr. Greenberg. The key witness for the government in that case, a Mr. Napier, who never had any direct communication with Mr. Greenberg about the deal in question apparently provided such “compelling inconsistencies” that an Appeals judge wrote “Napier may well have testified falsely.” Yet, Napier’s testimony is the very piece of evidence upon which Schneiderman has built his civil case.

For several years, and as recently as January, the federal government continued to claim that the notes and evidence collected during the first case should be kept under seal. It was only recently, under pressure, that the prosecutors relented and provided that notes and memos which showed the blatant inconsistencies of Mr. Napier. Had that release not occurred, however, Mr. Schneiderman would have been allowed to pursue the civil case against Greenberg relying “on a Napier deposition conducted years before the appeals court cast doubt on his testimony and before Mr. Greenberg’s legal team uncovered the notes.” What’s more, Mr. Greenberg was denied a trial by jury, and because “it’s a civil case and Mr. Napier doesn’t live in New York, he cannot be compelled to appear.” Thankfully, in light of the new exculpatory evidence, the trial has been stayed to decide whether or not to continue with the farce.

It is clear that Schneiderman’s decision to doggedly pursue this case for years even in the face of tainted, unreliable evidence is abusive. Schneiderman himself should be under investigation for malicious prosecution, going after a “big name” for his own political and personal gain.

This unprofessional prosecutorial behavior is unfortunately not limited to Eric Schneiderman. The nominee for Attorney General, Loretta Lynch, who also hails from New York has an egregious record of abuse particularly relating to civil asset forfeiture while she was the U.S. Attorney for the Eastern District of New York. In the most outrageous case during her tenure, her offices colluded with the IRS to seize nearly $450,000 from the bank account of two businessmen known as the Hirsch Brothers in May 2012, for “suspicion”, not actual charges, of criminal activity.

For nearly 3 years, the brothers were never charged with any crime, and Lynch’s office wholy ignored stringent deadlines regarding forfeiture cases. Prosecutors were compelled by law to file a court complaint within a certain amount of days following the seizure, but that never actually happened at any time, and the Hirsch brothers never had the opportunity to appear before a judge. In fact, there was never any case presented against them at anytime; Lynch’s office just sat on the seized money, all while offering to cut a deal with the brothers to keep some of the funds in return for dropping the matter. The brothers turned down every offer made to them.

Suddenly, a week before the Lynch’s confirmation hearing, in late January 2015 — two years and eight months after the case began — Lynch’s office returned all the money to the brothers. Lynch’s office clearly violated the law in the manner by which her prosecutors ignored forfeiture rules and denied due process to the Hirschs while going after the “big money”.

In a similar manner, NBC has covered another practice of Lynch’s office: using the “John Doe” alias in an overwhelmingly high amount to keep witness and court information from becoming public information. “Federal prosecutors in New York’s Brooklyn-based Eastern District pursued cases against secret, unnamed “John Doe” defendants 58 times since Loretta Lynch became head prosecutor in May 2010.” In comparision to others, “none of the nation’s 93 other federal district courts has charged more than eight “Does” during the same time period, and the national average is under four.” National Review has also covered the specifics of some of these cases, calling out Lynch’s “secret docket”. The repeated use of such secrecy invites Lynch’s office to the criticism that such practice undermines the right to a public trial guaranteed by our Constitution.

The conduct of Schneiderman and Lynch is unacceptable. The fact that Schneiderman is and will remain the Attorney General for New York and Loretta Lynch is poised to become the next Attorney General for the United States is disconcerting. It is not the first and it certainly won’t be the last, but it is increasingly brazen. This type of behavior undermines the integrity of our justice system when the nations leading prosecutors can’t be bothered to follow the rules and conduct themselves in an unbiased, professional manner. How can citizens protect their liberties in the face of such prosecutorial abuse?

by | ARTICLES, BLOG, BUSINESS, CONSTITUTION, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, QUICKLY NOTED, TAXES

Bernie Sanders recently advocated for President Obama to raise $100 billion in taxes by the old “closing corporate loopholes” schtick. The difference this time, is that Obama is actively exploring his abilities to do so via Executive Order. Townhall has the scoop:

“White House Press Secretary Josh Earnest confirmed Monday that President Obama is “very interested” in the idea of raising taxes through unitlateral executive action.

“The president certainly has not indicated any reticence in using his executive authority to try and advance an agenda that benefits middle class Americans,” Earnest said in response to a question about Sen. Bernie Sanders (I-VT) calling on Obama to raise more than $100 billion in taxes through IRS executive action.

“Now I don’t want to leave you with the impression that there is some imminent announcement, there is not, at least that I know of,” Earnest continued. “But the president has asked his team to examine the array of executive authorities that are available to him to try to make progress on his goals. So I am not in a position to talk in any detail at this point, but the president is very interested in this avenue generally,” Earnest finished.

Sanders sent a letter to Treasury Secretary Jack Lew Friday identifying a number of executive actions he believes the IRS could take, without any input from Congress, that would close loopholes currently used by corporations. In the past, IRS lawyers have been hesitant to use executive actions to raise significant amounts of revenue, but that same calculation has change in other federal agencies since Obama became president.

Obama’s preferred option would be for Congress to pass a corporate tax hike that would fund liberal infrastructure projects like mass transit. But if Congress fails to do as Obama wishes, just as Congress has failed to pass the immigration reforms that Obama prefers, Obama could take actions unilaterally instead. This past November, for example, Obama gave work permits, Social Security Numbers, and drivers licenses to approximately 4 million illegal immigrants.

Those immigration actions, according to the Congressional Budget Office, will raise federal deficits by $8.8 billion over the next ten years.”

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Yesterday it was reported that the Treasury Department paid $3 billion to cover Obamacare cost-sharing subsidies without Congressional approval. The heart of the dispute appears to be whether or not these subsidies were supposed to be funded via yearly appropriations or not. The House Ways and Means Chair, Paul Ryan, argues the former. Health and Human Services, via the Department of Justice, argues the latter.

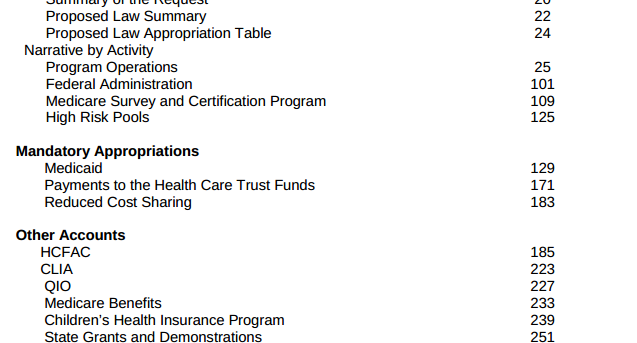

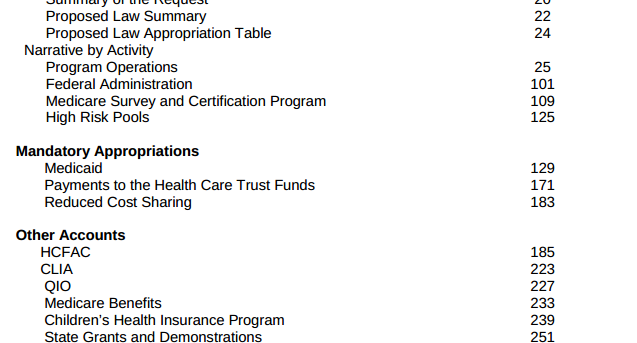

In order to make sense of the funding dispute, it seemed necessary to dig around in the agency budgets to see how cost sharing was accounted for. Cost-sharing falls under the purview of the “Centers for Medicare & Medicaid Services (CMS)”. Yet, while comparing the budget requests for 2014 (for which the Treasury covered costs) and the ones for 2015 (current) & 2016 (future), it became clear that CMS changed the way it accounted for cost-sharing funding after 2014.

Looking at the 2014 Budget request, CMS had section called “Mandatory Appropriations”, which listed three items: 1) Medicaid 2) Payments to the Health Care Trust Funds 3) Reduced Cost Sharing.

Further in that budget, CMS wrote, “The FY 2014 request for Reduced Cost Sharing for Individuals Enrolled in Qualified Health Plans is $4.0 billion in the first year of operations for Health Insurance Marketplaces, also known as Exchanges. CMS also requests a $1.4 billion advance appropriation for the first quarter of FY 2015 in this budget to permit CMS to reimburse issuers who provided reduced cost-sharing in excess of the monthly advanced payments received in FY 2014 through the cost-sharing reduction reconciliation process.”

This position — that Obamacare cost-savings was to be funded by yearly appropriations– was reiterated by a “July 2013 letter to then Sen. Tom Coburn, Congressional Research Service wrote that, “unlike the refundable tax credits, these [cost-sharing] payments to the health plans do not appear to be funded through a permanent appropriation. Instead, it appears from the President’s FY2014 budget that funds for these payments are intended to be made available through annual appropriations.” (Remember, a 2014 budget would have been written also in 2013)

You can see a picture of the 2014 budget here:

However, Congress rejected those requested appropriations at the time so “the administration went ahead and made the payments anyway.” That is the mystery $3 billion paid for by the Treasury.

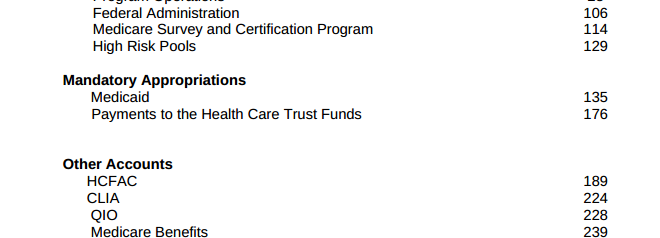

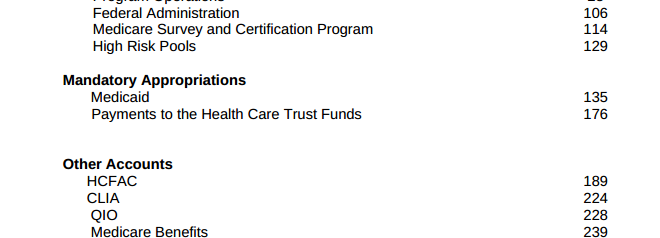

There is a noticeable change, however, with the CMS budget for 2015. The cost-sharing portion, which was originally listed as “Mandatory Payments” in 2014, is not listed at a “Mandatory Payment” anymore. Nor is it for 2016 either.

2015 Budget request:

CMS Budget 2015

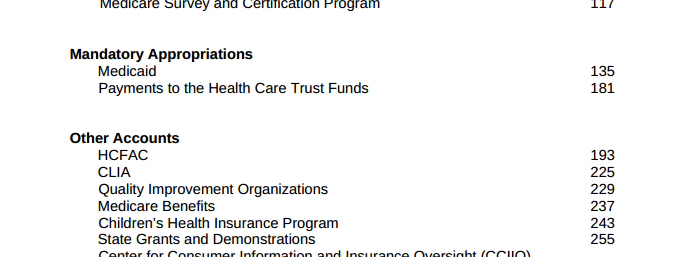

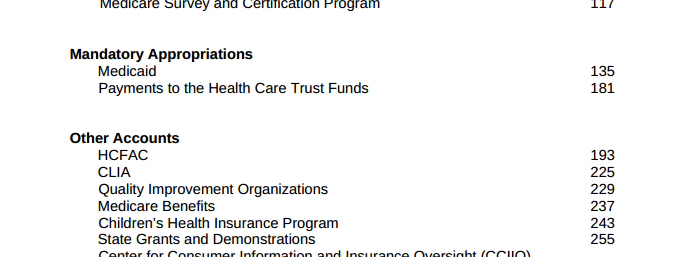

2016 Budget request:

CMS Budget 2016

Reading through the 2015 and 2016 budget documents, “cost sharing” appears in various areas, usually related to Medicaid, but not in one specific section — contrary to how it was accounted for in 2014, as a specific appropriation from the agency.

What’s equally interesting is that the DoJ argued about this specific matter in their recent brief dated January 26, 2015, saying that, “The House’s statutory arguments are incorrect. The cost sharing reduction payments are being made as part of a mandatory payment program that Congress has fully appropriated. See 42 U.S.C. § 18082. With respect to Section 4980H, Treasury exercised its rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute. See 26 U.S.C. § 7805(a).”

Yet, as shown above, the “mandatory program for cost-sharing”, that was submitted for funding (and rejected) in 2014, was removed entirely from the 2015 and 2016 budget requests. Now there is no way to even see the “cost-sharing” portion of the budget at all. And this appears to contract the statement by the DoJ that there is a “mandatory payment” program.

Cost sharing subsidies are an enormous part of Obamacare. “These payments come about because President Obama’s healthcare law forces insurers to limit out-of-pocket costs for certain low income individuals by capping consumer expenses, such as deductibles and co-payments, in insurance policies. In exchange for capping these charges, insurers are supposed to receive compensation.”

Cost sharing is expected to cost taxpayers roughly $150 billion over the next 10 years, according to estimates by the Congressional Budget Office.

But we now don’t know the specific funding amounts for the year 2015 or for 2016, and the costs for 2014 are in dispute, involving that $3 billion in funds from the Treasury (which came from somewhere and somehow).

The one thing we do know for certain: the Treasury Department is clearly exercising the power it perceives to have, as a “rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute.”

by | ARTICLES, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

A few weeks ago, I reported how Obama’s budget contained a $22 billion student loan bailout to cover a massive shortage of funds for the Department of Education Federal Student Loan program. Because the program is categorized as a “credit program”, due to a “quirk in the budget process for credit programs, the department can add the $21.8 billion to the deficit automatically, without seeking appropriations or even approval from Congress.”

Now it is being reported that the Treasury Department approved and paid for $3 billion in Obamacare costs without seeking Congressional approval. Have we uncovered another similar quirk in the federal budget process that allows for the Treasury to cover Obamacare costs that aren’t funded? We don’t actually know yet, because the letter from the Treasury which “revealed that $2.997 billion in such payments had been made in 2014”, “didn’t elaborate on where the money came from.”

Here’s what’s going on:

“At issue are payments to insurers known as cost-sharing subsidies. These payments come about because President Obama’s healthcare law forces insurers to limit out-of-pocket costs for certain low income individuals by capping consumer expenses, such as deductibles and co-payments, in insurance policies. In exchange for capping these charges, insurers are supposed to receive compensation.

What’s tricky is that Congress never authorized any money to make such payments to insurers in its annual appropriations, but the Department of Health and Human Services, with the cooperation of the U.S. Treasury, made them anyway.”

So here we have two agencies collaborating on funding for Obamacare without Congressional approval. When asked about the $3 billion by House Ways and Means Chairman Rep. Paul Ryan, he received a letter which merely described the what the cost-sharing program was, without explaining anything 1) regarding how the payments came to be made, or 2) where the money came from.

What’s more, because the cost-sharing payments from the Department of Homeland Security is part of a larger lawsuit against Obama’s Executive Actions, filed by John Boehner, the letter referred Rep. Ryan to the Department of Justice.

It turns out that Department of Justice recently argued this topic on January 26th. In this brief the Department of Justice argued that John Boehner’s position, that the cost-sharing program payments required annual appropriation, was incorrect, “The cost sharing reduction payments are being made as part of a mandatory payment program that Congress has fully appropriated.” So the Department of Justice and the Treasury Department and the Department of Health and Human Services maintain that the payment they made was licit and Congressionally approved as part of Congressional appropriations.

However, prior budget requests and negotiations tell a different story about how Obamacare cost-sharing is funded.

“For fiscal year 2014, the Centers for Medicare and Medicaid Services (the division of Health and Human Services that implements the program), asked Congress for an annual appropriation of $4 billion to finance the cost-sharing payments that year and another $1.4 billion “advance appropriation” for the first quarter of fiscal year 2015, “to permit CMS to reimburse issuers …”

In making the request, CMS was in effect acknowledging that it needed congressional appropriations to make the payments. But when Congress rejected the request, the administration went ahead and made the payments anyway.

The argument that annual appropriations are required to make payments is also backed up by a report from the Congressional Research Service, which has differentiated between the tax credit subsidies that Obamacare provides to individuals to help them purchase insurance, and the cost-sharing payments to insurers.

In a July 2013 letter to then Sen. Tom Coburn, Congressional Research Service wrote that, “unlike the refundable tax credits, these [cost-sharing] payments to the health plans do not appear to be funded through a permanent appropriation. Instead, it appears from the President’s FY2014 budget that funds for these payments are intended to be made available through annual appropriations.”

As we are likely to not receive any answers soon regarding the $3 billion in Obamacare funding, or the source, here are some things to think about and look for as we wait:

1) How will cost-sharing be funded in this year’s budget?

2) Where did the $3 billion come from? If the $3 billion came from another agency, does that mean we have agencies who have large enough slush funds to absorb a $3 billion transfer?

3) If the $3 billion was tacked onto the deficit (like the student loan “bailout”), what does this bode for future cost-sharing payments? The Congressional Budget Office has already estimated that cost-sharing payments to insurers are expected to cost about $150 billion over the next 10 years.

by | ARTICLES, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAX TIPS, TAXES

I’ve hinted that the Obama Administration and Democrats are now worrying about the backlash regarding the Obamacare penalty. This is the first year Americans who did not purchase health insurance will have to confront it on their tax bill. Byron York over at the Washington Examiner did a great job discussing the politics of the penalty as well as the new “special enrollment period” that will open up at tax-filing time.

“The Democrats who wrote and passed the Affordable Care Act were sure of two things: The law had to include a mandate requiring every American to purchase health insurance, and it had to have an enforcement mechanism to make the mandate work. Enforcement has always been at the heart of Obamacare.

Now, though, enforcement time has come, and some Democrats are shying away from the coercive measures they themselves wrote into law.

The Internal Revenue Service is the enforcement arm of Obamacare, and with tax forms due April 15, Americans who did not purchase coverage and who have not received one of the many exemptions already offered by the administration are discovering they will have to pay a substantial fine. For a household with, say, no kids and two earners making $35,000 a piece, the fine will be $500, paid at tax time.

That’s already a fact. What is particularly worrisome to Democrats now is that, as those taxpayers discover the penalty they owe, they will already be racking up a new, higher penalty for 2015. This year, the fine for not obeying Obamacare’s edict is $325 per adult, or two percent of income above the filing threshold, whichever is higher. So that couple making $35,000 a year each will have to pay $1,000.

There’s another problem. The administration’s enrollment period just ended on February 15. So if people haven’t signed up for Obamacare already, they’ll be stuck paying the higher penalty for 2015.

By the way, Democrats don’t like to call the Obamacare penalty a penalty; its official name is the Shared Responsibility Payment. But the fact is, the lawmakers’ intent in levying the fines was to make it so painful for the average American to ignore Obamacare that he or she will ultimately knuckle under and do as instructed.

Except that it’s easier to inflict theoretical pain than actual pain. Tax filing season is enlightening many Americans for the first time about the “mechanics involved” in Obamacare’s fee structure, Democratic Rep. Lloyd Doggett wrote to the Centers for Medicare and Medicaid Services on December 29. ‘Many taxpayers will see the financial consequences of their decision not to enroll in health insurance for the first time when they make the Shared Responsibility Payment.’

That is why Doggett, who has since been joined by fellow Democratic Reps. Sander Levin and Jim McDermott, asked the administration to create a new signup period for anyone who claims ignorance of the penalty. On Friday, the administration complied, creating a “special enrollment period” from March 15 to April 30.

To be eligible, according to an administration press release, people will have to “attest that they first became aware of, or understood the implications of, the Shared Responsibility Payment after the end of open enrollment … in connection with preparing their 2014 taxes.”

It’s not the most stringent standard: Just say you didn’t know. But even with that low bar, a significant number of Americans will decide not to enroll in Obamacare. For some, it’s the result of a financial calculation; paying the fine is cheaper than complying. Others are unaware. Maybe a few are just defiant.

Whatever the reasons, quite a few people will be hit with the penalty; Doggett and his Democratic colleagues subscribe to the Treasury Department’s estimate that somewhere between three million and six million Americans will have to pay the Obamacare penalty on the tax forms they’re filing now. Many will owe more next year, when the penalty goes even higher in 2016.

The individual mandate has always been extremely unpopular. In December 2014, just a couple of months ago, the Kaiser Family Foundation found that 64 percent of those surveyed don’t like the mandate. The level of disapproval has been pretty consistent since the law was passed.

And there’s very little chance the individual mandate’s approval numbers will improve, now that millions of Americans are getting a taste of what it really means. They’re learning an essential truth of Obamacare, which is that if you don’t sign up, the IRS will make you pay. No matter how much some Democrats would like to soften the blow they have delivered to the American people, that’s the truth about Obamacare.”

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

The nomination of Loretta Lynch to the position of Attorney General is before you. Although her intelligence, experience, and poise may appear to make her a superb candidate, it is clear now that she would be an extremely poor – even dangerous — choice due to her strong position on civil asset forfeiture.

Though I as a libertarian and you as a liberal may disagree on many things, the need to safeguard civil liberties and individual rights is a priority for both of us. Do you really want to consider confirming a person who has been proud of her record of taking property without due process…of guilty until proven innocent? She may very well bring down anyone who supports her candidacy.

Civil asset forfeiture is a particularly egregious abuse of power, allowing the government to seize property and cash if it merely suspects wrongdoing, even with no evidence and no charging of a crime.

Loretta Lynch was particularly lucrative in this regard as the U.S. attorney for the Eastern District of New York. Between 2011 and 2013, the forfeiture operations under her management netted more than $113 million in civil actions. Lynch’s division was among the top in the country for its collections. But this is not something to be proud of.

In one particularly appalling case, Loretta Lynch’s office seized nearly a half-million dollars from two businessman in 2012 and sat on it for more than two years without a court hearing or appearance before a judge. In fact, no crime had been committed. These men were denied due process and deprived of their assets without warning or criminal charges. Lynch suddenly returned the money just weeks ago on January 20, 2015 — on the eve of her confirmation hearings, having found no wrongdoing by the men either.

During Lynch’s confirmation hearing testimony pertaining to civil asset forfeiture, Lynch stated that “civil and criminal forfeiture are very important tools of the Department of Justice as well as our state and local counterparts.” She further argued that forfeiture is “ done pursuant to court order, and I believe the protections are there.” This is, in fact, not true. In the case mentioned above, there was not only no court order, but also no hearing at any time in nearly three years. That is unconscionable. And this is only one of many similar incidents.

The problem of civil asset forfeiture is that the government can confiscate money or property under the mere suspicion of a crime without ever actually charging someone. The person must prove his innocence to reclaim what was seized, which is a burden of time and money and readily seems to go against our notion of “innocent until proven guilty.”

In recent months, individuals and organizations on both sides of the political aisle have come together to demand reform to this unjust practice. Bipartisan legislation has been proposed in Congress; groups ranging from the Heritage Foundation to the American Civil Liberties Union have been increasingly critical of civil asset forfeiture practices. Even Eric Holder has called for changes and the IRS has pledged to reduce its involvement as well. What’s more, besides the obvious threat to civil liberties, those most likely to be victims are poor and minority citizens.

Loretta Lynch and her record on civil asset forfeiture represents the worst of this “tool for law enforcement”. A vote for her confirmation is a vote you will never be able to walk back. Do you really want to confirm a person who is so deeply committed to civil asset forfeiture at the very same time there is strong bipartisan support for protecting civil liberties and walking back the laws pertaining to this practice?

Loretta Lynch may arguably be the most successful forfeiture agent in government today. This is not a positive quality for an Attorney General. The practice is abusive and her tactics even more so. Voting to confirm a person with such an atrocious civil liberties record is certain to cause problems for you down the road. I urge you to vote no for her confirmation.