by | BLOG, ECONOMY, FREEDOM, GOVERNMENT, POLITICS, TAXES

“But how is this legal plunder to be identified? Quite simply. See if the law takes from some persons what belongs to them, and gives it to other persons to whom it does not belong. See if the law benefits one citizen at the expense of another by doing what the citizen himself cannot do without committing a crime.” ~ Bastiat’s “The Law”

![bastiat-quote-picture_thumb[2]](https://taxpolitix.com/wp-content/uploads/2015/02/bastiat-quote-picture_thumb2.jpg)

by | ARTICLES, ECONOMY, OBAMA, OBAMACARE, POLITICS, TAXES

As the Obamacare sign up season ended, some Democrats are concerned that there might be a kerfuffle at tax time when taxpayers who opted not to have health insurance coverage last year learn they have to pay a penalty-tax-fee. The penalty is officially called the “shared responsibility payment”.

Three Democrat officials have appealed to the Obama Administration to offer a special enrollment period at tax filing time.

This is the first year the penalty is levied. The penalty for the 2014 tax year is relatively cheap in order to transition Obamacare into American life. However, next year and in subsequent years, the penalty goes up swiftly. This is why some lawmakers are concerned, because the open enrollment period has ended, and those who still don’t have insurance will face steeper fines.

For not having health insurance last year, the fine is $95 per person or 1 percent of household income above the threshold for filing taxes, whichever is greater. But the fine increase to $325 per person or 2 percent of household income to be collected next year, for those who opted not to enroll in Obamacare or have health insurance at all.

This of course would be one of many tweaks to the law since it was passed in 2010. What Democrats are particularly worried about is the fallout of a massive tax penalty in 2016 — when the Presidential election campaigns are in full swing. The backlash is certain to be harsher next year, and even more so beyond, and the health law will be harder to defend and justify. According to government estimates, the average fine will be about $1,100.”

The White House remains uncommitted as to whether it will enact a small filing season around April 15th or consider having open enrollment next year be shifted or extended to include some or all of the tax season. Of course they’ll do whatever it takes to mask the consequences of Obamacare’s policies, again and again and again. If it was such a great piece of legislation, it should be able to stand on its own merit. But it wasn’t — and more and more people finally realize it.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Though the confirmation process for the next Attorney General has been delayed for the next two weeks amid lack of Republican support for nominee Loretta Lynch, it is particularly troubling that the media coverage has failed to discuss Lynch’s position on civil asset forfeiture during this time. Civil asset forfeiture is a particularly egregious abuse of power, allowing the government to seize property and cash if it merely suspects wrongdoing, even with no evidence of or charges with a crime.

Lynch has been particularly lucrative as the U.S. attorney for the Eastern District of New York. The Wall Street Journal noted in November that “Ms. Lynch’s office is a major forfeiture operation, bringing in more than $113 million in civil actions from 123 cases between 2011 and 2013, according to the Justice Department.” Furthermore, Lynch herself boasted to the Brooklyn Daily Eagle last year that the “Eastern District of New York, working collaboratively with other offices as well as on its own, collected over $904 million in criminal and civil actions in Fiscal Year 2013.”

The Daily Eagle went on to describe how additionally, “working with partner agencies and divisions, the Eastern District forfeited another $1,319,038,046 in assets tainted by crime. Forfeited assets are deposited into the Department of Justice Assets Forfeiture Fund and the Treasury Forfeiture Fund and are used to restore funds to crime victims and for a variety of law enforcement purposes.”

One such forfeited case in which Lynch was directly involved was that of the Hirsch Brothers, going back to May 2012. Amazingly, this case was only recently resolved this past January once questions began to swirl after Lynch became the AG nominee. The facts surrounding the ordeal are despicable:

“In May of 2012 the Hirsch brothers, joint owners of Bi-County Distributors in Long Island, had their entire bank account drained by the Internal Revenue Service working in conjunction with Lynch’s office. Many of Bi-County’s customers paid in cash, and when the brothers made several deposits under $10,000, federal agents accused them of “structuring” their deposits in order to avoid the reporting requirements of the Bank Secrecy Act. Without so much as a criminal charge, the federal government emptied the account, totaling $446,651.11.

For more than two years, and in defiance of the 60-day deadline for the initiation of proceedings included in the Civil Asset Forfeiture Reform Act of 2000, Lynch’s office simply sat on the money while the Hirsch brothers survived off the goodwill their business had engendered with its vendors over the decades.”

It’s no coincidence that Lynch’s office suddenly returned the money on January 20, 2015 on the eve of the confirmation hearings, having found no wrongdoing or crime after nearly three years. The Hirsch Brothers were well represented by the Institute for Justice, who has helped other victims of asset forfeiture.

When asked about the “fairness” of civil asset forfeiture during her confirmation hearing by Senator Mike Lee, Lynch responded that “civil and criminal forfeiture are very important tools of the Department of Justice as well as our state and local counterparts.” Speaking directly about civil asset forfeiture, she claimed that such forfeiture is “done pursuant to supervision by a court, it is done pursuant to court order, and I believe the protections are there.” Unfortunately, this was patently untrue in the case of the Hirsch Brothers, who never had a court date or a hearing in front of a judge to plead their innocence during their entire 2+ year ordeal with Lynch’s office.

The problem of civil asset forfeiture is that “authorities can take money (or other property) and then dare the owner to battle through legal obstacles to get it back. To do that, the owner must prove innocence. Charge someone with a crime and the burden of proving guilt is on the government, but confiscate property under civil asset forfeiture and the government keeps the spoils unless the owner is able to prove his innocence. That is not the way our system of justice is supposed to work.”

Now we face the likelihood that the next Attorney General of the United States is one who has repeatedly and gleefully engaged in the process of civil asset forfeiture, putting fiscal gain above due process and civil liberties.

by | ARTICLES, BLOG, GOVERNMENT, OBAMA, POLITICS, TAXES

The recent article highlighting Connecticut’s “super rich” citizens and their effect on Connecticut’s income tax revenue was unwittingly a great example of how the state of Connecticut is unfairly grubbing more than its fair share of taxes — despite the author’s attempt to disparage the wealthy.

The AP writer, Stephen Singer, attempted to suggest how “the super-rich taxpayers in Connecticut and elsewhere shielded their income through charitable donations or other means to avoid a tax hit following the expiration of federal tax cuts” was somehow responsible for a decrease of income tax revenue in Connecticut.

Singer was incorrect when he declared his “result”: Connecticut income tax revenue plunged by nearly $281 million, more than 14 percent, compared with the same month a year before.

First, the author conflated federal tax revenue with state tax revenue, and therein lies his error. When high income earners make large charitable donations or create more capital gains from ordinary income tax to reduce their taxes, only the federal tax liability goes down. In Connecticut, like New Jersey, there is no deduction for charity, nor is there a reduced rate for capital gains either (the state taxes them as if they are ordinary). These tax policies actually translate into a windfall for state income tax revenue, because the deductions permissible at the federal level are not at the state level in Connecticut.

The only thing that could possibly explain Connecticut’s tax revenue loss would have been simply an overall reduction in income tax revenue by any and all taxpayers. Trying to suggest that the wealthiest taxpayers were somehow defrauding the state of Connecticut of potential tax income — when in essence their wealth provides an superabundance of revenue — shows both the ignorance and agenda of the author on tax policy.

What the author did properly reveal is that if the Connecticut state budget is so precariously dependent on the income tax revenue of less than 10 people — whom it must track and monitor to ensure it “gets” it income revenue — Connecticut certainly has its spending priorities severely out of whack.

by | ARTICLES, BLOG, FREEDOM, OBAMA, OBAMACARE, POLITICS, TAX TIPS, TAXES

If you are one of the millions of Americans who declined health insurance and decided to pay the fee tax fine penalty, be aware that it will be a part of your 2014 tax calculations — and beyond.

The penalty is officially called the “shared responsibility payment”. This is on U.S. Individual Income Tax Return for 2014, Form 1040, line 61; OR Form 1040A, line 38; OR Form 1040EZ, line 11. The instructions to calculate that are here, on page 5.

The penalty for 2014 is relatively cheap in order to transition Obamacare into your life. Be aware, however, that next year and in subsequent years, the penalty goes up swiftly — pressuring you to get a health insurance plan or else pay the piper.

Here’s how it works:

“Beginning in 2014, absent a qualified exemption, you will be required to obtain health insurance. If you fail to comply, you will be subject to a penalty of 1.0% of your annual income or $95.00, whichever is greater.

In 2015, the penalty increases to the greater of 2.0% of annual income or $325 per person. The following year it becomes the greater of 2.5% of income or $695 per person. After 2016, it will be indexed to the cost of living.

It should also be noted that the maximum penalty is capped at three times the per person penalty. For example, if you earn $28,500 in 2014, 1.0% of your income would equal $285. Therefore, if you earn more than this, your maximum penalty would remain the same. All penalties will be due and payable with your annual federal income tax return. Hence, the penalty for 2014 would be due by April 15, 2015 and the IRS will be the collection agency used.”

The method of assessing and collection the fee is through the Internal Revenue Service (IRS). The fee will be collected by deducting its cost from a person’s tax refund. But for those who don’t get a refund, the IRS isn’t allowed to demand payment either, so it is unclear how those fees will be attained. This ambiguity also leads to further questions about how Obamacare is being actually being paid for (as the penalty is one of the revenues to help offset the costs).”

Not sure if you qualify for an exemption to maintain qualified coverage? The IRS rules allow an exemption if you:

–Have no affordable coverage options because the minimum amount you must pay for the annual premiums is more than eight percent of your household income, OR

–Have a gap in coverage for less than three consecutive months, OR

–Qualify for an exemption for one of several other reasons, including having a hardship that prevents you from obtaining coverage, or belonging to a group explicitly exempt from the requirement.

Interestingly, Sylvia Burwell, the Secretary of Health and Human Services, indicated today that “that the administration might offer some enrollment flexibility around the April 15 tax deadline, so that people who suddenly realize they face a penalty for remaining uninsured could have an opportunity to remedy that.” Burwell, however, did not offer any specifics of what that flexibility might look like.

Sunday, February 15 is the Obamacare enrollment deadline. The CBO lowered its target for this year, from 13 million paid enrollees, to 9.1 paid enrollees. According to the latest figures which combine “HHS data on enrollment through HealthCare.gov and the 14 state-run exchanges, more than 10 million people had signed up as of earlier this month. That means they’d selected a plan, but many still have to make their first premium payment to get covered. Inevitably, some won’t do that.” Also note, New York announced today that citizens have an extended enrollment deadline until February 28 to enroll in Obamacare coverage on the state exchange.

Last year, 6.7 million people paid for Obamacare coverage, a number far fewer than Administration officials predicted when Obamacare began in October 2013.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

A few days ago, Politico revealed a little gem hidden in the Obama budget:

“In obscure data tables buried deep in its 2016 budget proposal, the Obama administration revealed this week that its student loan program had a $21.8 billion shortfall last year, apparently the largest ever recorded for any government credit program.”

That’s a nearly $22 billion loss — for one program, for one year. Politico described how that the amount is greater than the budgets of the EPA and Interior Department combined, or the NASA program’s budget. But it will be covered entirely by the taxpayer anyway.

How did the federal student loan program rack up such massive debt so quickly? Let’s take a look at Obama’s recent reform efforts and programs to help provide relief to student borrowers.

A 2010 law allowed for repayment caps at 10% of a borrower’s income, though some loan holders were initially ineligible. This was called “Pay As You Earn” (PAYE). There were also some other portions of PAYE that were less talked about by the media, including:

1) If the payment doesn’t cover the accruing interest, the government pays your unpaid accruing interested for up to three years from when you begin paying back your loan under the PAYE program.

2) The balance of your loan can be forgiven after 20 years if you meet certain criteria

3) Your loan can be forgiven after 10 years if you go to work for a public service organization

Obama then expanded the PAYE program in June 2014 via Executive Order. The NYTimes reported that this “extend such relief to an estimated five million people with older loans who are currently ineligible — those who got loans before October 2007 or stopped borrowing by October 2011. But the relief would not be available until December 2015, officials said, given the time needed for the Education Department to propose and put new regulations into effect”.

That recent expansion helped to figure into the staggering re-estimation listed in Obama’s FY 2016 budget. As far as the terms of the costs for just the PAYE program, those have “ballooned from $1.7 billion in 2010 to $3.5 billion in 2013 to an estimated $7.6 billion for 2014.”

What’s more, last June, CNS News reported a huge increase in overall student loan debt by comparing the balanced owed when Obama took office to the balance owed in May 2014:

“Since President Barack Obama took office in January 2009, the cumulative outstanding balance on federal direct student loans has jumped 517.4 percent. The balance owed as of the end of May was $739,641,000,000.00. That is an increase of $619,838,000,000.00 from the balance that was owed as of the end of January 2009, when it was $119,803,000,000.00, according to the Monthly Treasury Statement.”

Comparing that amount to his predecessor, under George W. Bush, “the amount of outstanding loans increased from $67,979,000,000.00 in January of 2001 to $119,803,000,000 in January of 2009, an increase of 76.2%.” That was over 8 years. Obama’s jumped the 517.4% in 5.5 years.

So how does this particularly enormous budget shortfall get resolved? Why, it simply gets tacked directly onto the federal deficit. Since the federal student loan program is considered a credit program, “because of a quirk in the budget process for credit programs, the department can add the $21.8 billion to the deficit automatically, without seeking appropriations or even approval from Congress.” This whopper adds nearly 5% to the deficit itself.

Apparently, this sort of bailout is not entirely uncommon either. According to a report last month on the U.S. Government credit-loan system,

“these unregulated and virtually unsupervised federal credit programs are now the fastest-growing chunk of the United States government, ballooning over the past decade from about $1.3 trillion in outstanding loans to nearly $3.2 trillion today. That’s largely because the financial crisis sparked explosive growth of student loans and Federal Housing Administration mortgage guarantees, which together compose two-thirds.“

The FHA itself has added $75 billion to the deficit in this manner over the last twenty years. Though that is a ridiculous sum itself, it makes the one year, $21.8 billion chunk for the federal student loan program bailout contained in Obama’s FY2016 budget especially egregious and alarming.

Like the ballooning student loan debt, the act of loan forbearance, which is a temporary pause in repayment of your federal student loan, has also seen an upswing. Forbearance can be granted for up to three years. According to the Wall Street Journal, “loan balances in forbearance were about 12.5% of those in repayment in 2006. In 2013, they were 13.3%. Today they are 16%, or $125 billion of the $778 billion in repayment.”

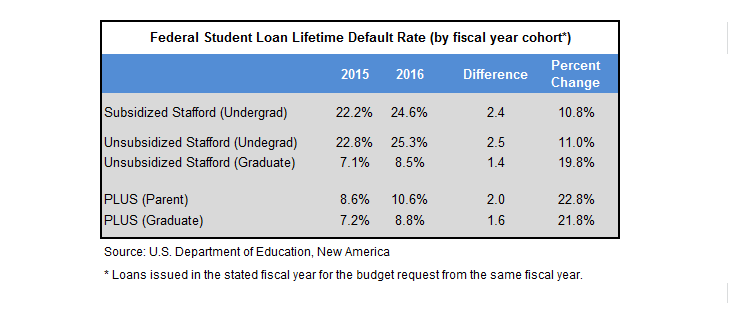

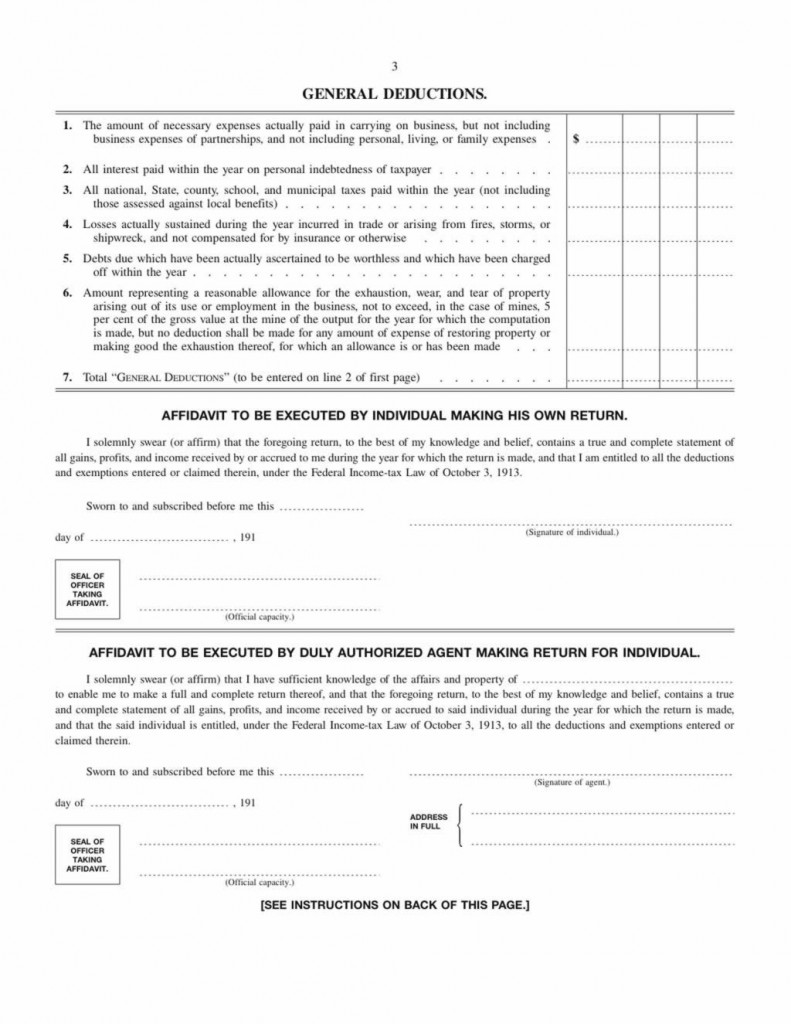

As for defaulting entirely, Forbes recently noted that, “the Department of Education’s budget documents project that 25.3 percent of undergraduate Stafford loans (measured by dollars, not numbers of loans) issued next year will default at some point during the borrower’s repayment term. That is up a full 2.5 percentage points from what the agency projected last year for the previous cohort of loans.” All categories of loans, according to the DoE projection, will see an increase in default.

These figures reinforce a WSJ opinion piece in late December covering the “student debt bomb”. The author, Jason Delisle, director of the Federal Education Budget Project at the New America Foundation, detailed how the current rate of default “now stands at 19.8% of borrowers whose loans have come due — some 7.1 million borrowers with $103 billion in outstanding balances.”

Trying to discern whether or not this $21.8 billion shortfall contained in Obama’s budget is a one-time anomaly or not remains to be seen. The sharp uptick of federal student loan debt and defaults in the past few years would suggest it is not. And there seems to be little incentive just yet to reign in Obama’s repayment reforms, since, at the end of the day, any loss will just be added onto the federal deficit for the taxpayer to pick up the tab — while the Feds continue to tout to young people how much Obama is helping them.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, TAX TIPS, TAXES

He’s a pretty smart guy….

by | ARTICLES, BLOG, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Obama’s budget for FY2016 claimed $1.8 trillion in deficit savings over a ten year period, 2016-2025. He used PAYGO (pay-as-you-go) rules to determine this figure, which basically means paring tax increases and spending reductions on one side to pay for new spending programs and tax credits on the other side, with anything left over going to the deficit.

However, his numbers for overall deficit reduction appear to be overstated, according to an analysis by the Committee For a Responsible Federal Budget (CRFB), by “using a baseline which effectively ignores the costs of extending or repealing certain policies and assuming a large increase in spending in the future to claim savings from extending spending limits after 2021.”

The Chicago Sun-Times did a decent summary of the CRFB report. Essentially, Obama makes a series of assumptions about future budget items to achieve his number for deficit reduction ($1.8 trillion), so that it comes close to the amount of tax hikes in the budget ($2 trillion), making it somewhat politically palatable — at least for his side. Here are the major points:

“MANDATORY AUTOMATIC CUTS

In the budget table summarizing the $1.8 trillion in deficit cuts, there’s a line that adds back funds to replace the automatic, across-the-board cuts to a variety of mandatory programs, including a 2 percentage point cut in payments to doctors who treat Medicare patients.

That’s a major assumption on Obama’s part about the fate of the automatic cuts, part of the deal he struck with Congress in August 2011.

Cost: $185 billion over 10 years.

MEDICARE FEES

There’s a proposal to permanently fix a flawed Medicare formula that threatens doctors with an even bigger 21 percent fee cut. Lawmakers typically “patch” the formula for a year or two but hope for a long-term solution this year.

Cost: $108 billion.

REFUNDABLE TAX CREDITS

A set of refundable tax credits — tax refunds that go out to low-income people who don’t owe federal income tax — expire in 2017. So does a maximum $2,500 tax credit for the cost of college. Obama’s budget simply assumes they get extended.

Cost: $166 billion.

INFLATED SPENDING BASELINE

This one’s tricky and requires background. Under budget rules, official scorekeepers at the Congressional Budget Office are supposed to set an arbitrary baseline for annual agency budgets passed by Congress each year that rises each year with inflation at a relatively generous pace.

The 2011 Budget Control Act slashed this spending increase by $900 billion by setting spending “caps” well below this baseline. Well, the caps are lifted after 2021, but Obama’s 10-year budget covers four more years. The White House assumes the baseline would jump to inflated levels that pretend the 2011 law never happened. Then it claims huge savings when cutting them back in 2022-25 to more realistic levels.

Questionable savings: about $310 billion.

DEBT SERVICE

Additional debt would have to be issued to cover the above policies, and interest costs on that debt are considerable. Cost: about $105 billion

GRAND TOTAL: $874 BILLION

In summary, Obama’s budget claims $1.809 trillion in deficit savings. Take away $874 billion accruing from accounting tricks and there’s about $935 billion left.”

There you have it. $935 billion is vastly different than $1.8 trillion — essentially saving only half of what Obama claims. For those who want to get into the nitty-gritty, you can read the full CRFB analysis here.

The government is always playing around with numbers and accounting tricks. Here are past examples of fuzzy math for Social Security gimmicks, Obamacare deficit scoring, and boosting Obamacare enrollment numbers. So this latest one is anything but surprising.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Obama proposed his FY2016 budget on Monday. The budget is filled tax hikes — more than 20 — which are expected to fund more spending schemes cooked up by the President. The tax hikes total about $2 trillion in additional revenue over the next decade. “The administration contends that various spending cuts and tax increases would trim the deficits by about $1.8 trillion over the next decade, leaving the red ink at manageable levels.”

So, just like his yearly spending, so to with his decade budget outlook: despite record tax revenue, Obama’s proposals still don’t balance out. We continue to have deficit spending.

What is in this budget proposal? It’s chock-full of ambitious taxes aimed mainly at the wealthy and businesses. Most of his budget items will likely not pass Congress — and he knows this. At this point in his Presidency, it doesn’t matter anyway what he proposes, or really, what actually passes. And Obama knows this. He’s not running again.

Obama has merely given the Democrats a list of initiatives for them to push, so that they can create anti-Republican narratives using his ideas for litmus tests and sound bytes over the next year to two years heading into the 2016 elections. It’s not about solutions; it’s about creating more divide. Charles Krauthammer got it right when he said, ““Look, I don’t mind if the President sends a budget which he knows is not going to achieve anything. But when he prefaces his remarks as we just saw by saying we have to put politics aside, posing again as the one person in the country who rises above partisanship and party, speaks for the national interest, it’s really grating.”

Here’s the rundown of the list of budget tax hikes. I’ll do some follow up posts about a couple of particularly odious policies contained therein, but for the time being, you can read the entire list of tax increases here. The amounts of revenue noted below are calculated to be collected from the tax increases over the next decade, from 2016 – 2025.

“Limit deductions for top earners to 28 percent rate, even if income is taxed at 39.6 percent: $603.2 billion

Impose a 14 percent one-time tax on previously untaxed foreign income: $268.1 billion

Impose a 19 percent minimum tax on foreign income: $206 billion

Modify estate and gift tax provisions: $214.4 billion

Change the taxation of capital income: $207.9 billion

Other increases from reform of U.S. international tax system: $135.8 billion

Impose a financial fee on large financial companies: $111.8 billion

Increase tobacco taxes and index for inflation: $95.1 billion

Repeal LIFO (Last In First Out) method of accounting for inventories: $76.1 billion

Conform SECA (Self Employed Contributions Act) taxes for professional service businesses: $74.6 billion

Other revenue changes and loophole closers: $47.9 billion

Eliminate oil and natural gas preferences: $45.5 billion

Implement the Buffett Rule by imposing a new “Fair Share Tax” (making millionaires pay at least 30 percent tax rate): $35.2 billion

Reform the treatment of financial and insurance industry products: $34.4 billion

Limit the total accrual of tax-favored retirement benefits: $26.0 billion

Other loophole closers: $24.3 billion

Reinstate Superfund taxes: $21.2 billion

Tax carried interests as ordinary income: $17.7 billion

Make unemployment insurance surtax permanent: $15.7 billion

Eliminate coal preferences: $4.3 billion

Reauthorize special assessment from domestic nuclear utilities: $2.3 billion

Increase and modify Oil Spill Liability Trust Fund financing: $1.6 billion

Repeal tax-exempt bond financing of professional sports facilities: $542.0 million”

by | BLOG, POLITICS, QUICKLY NOTED, TAXES

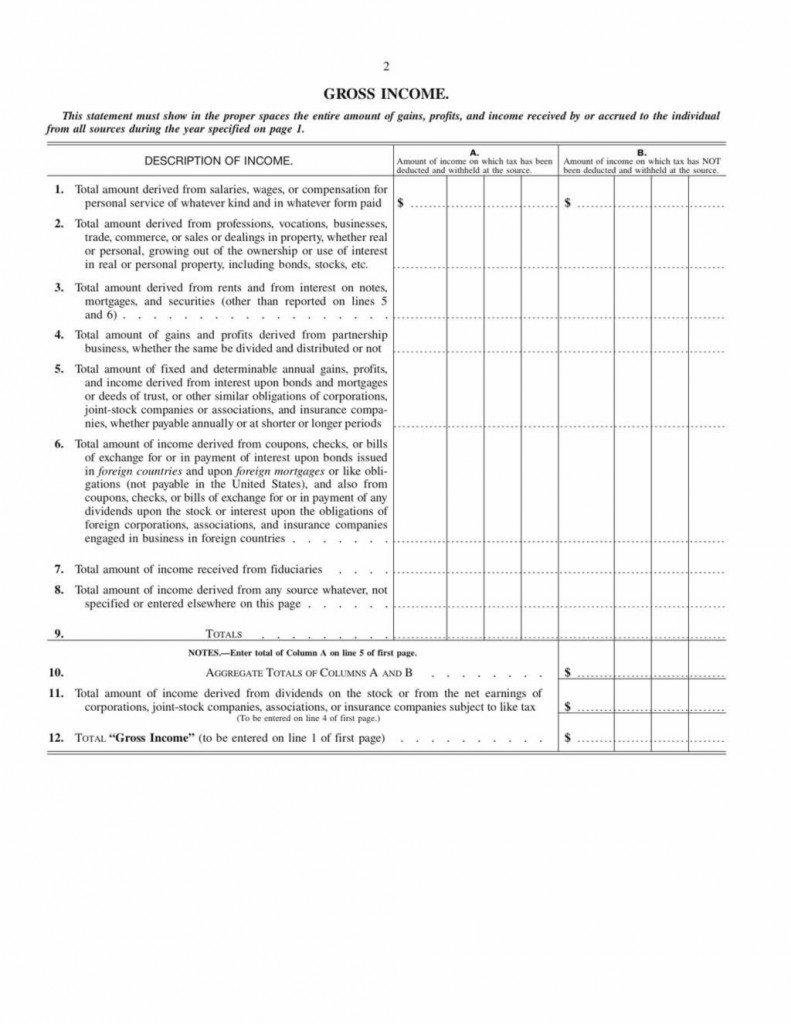

As we begin tax season, here’s something to ponder.

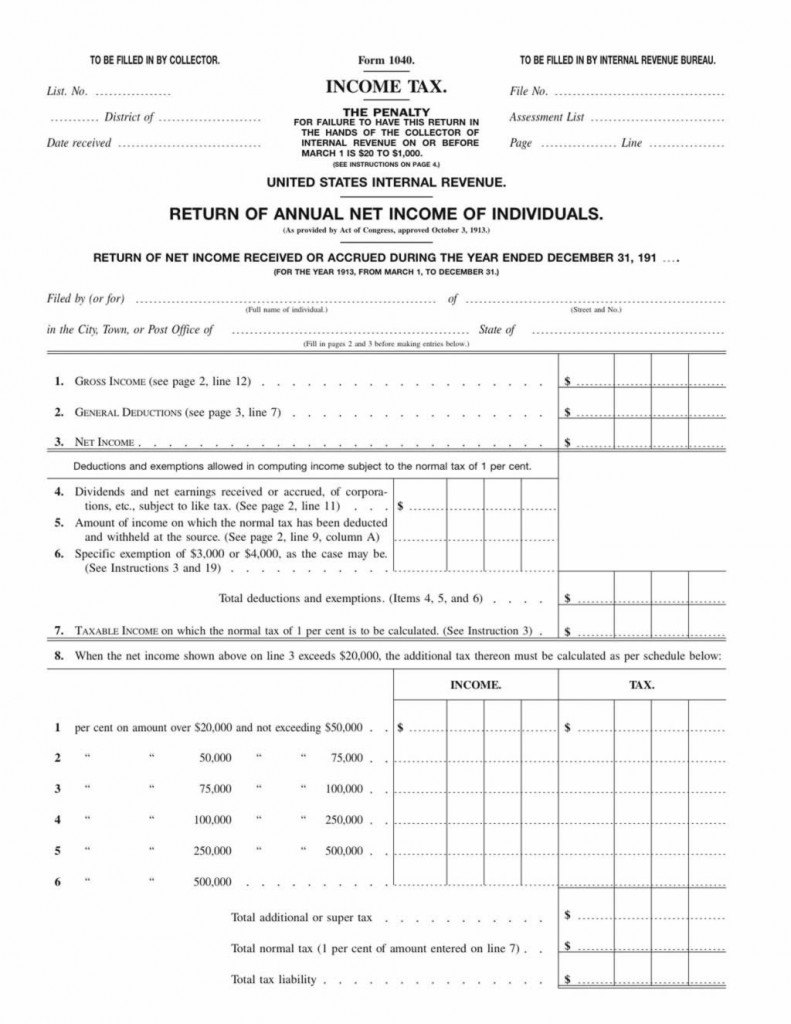

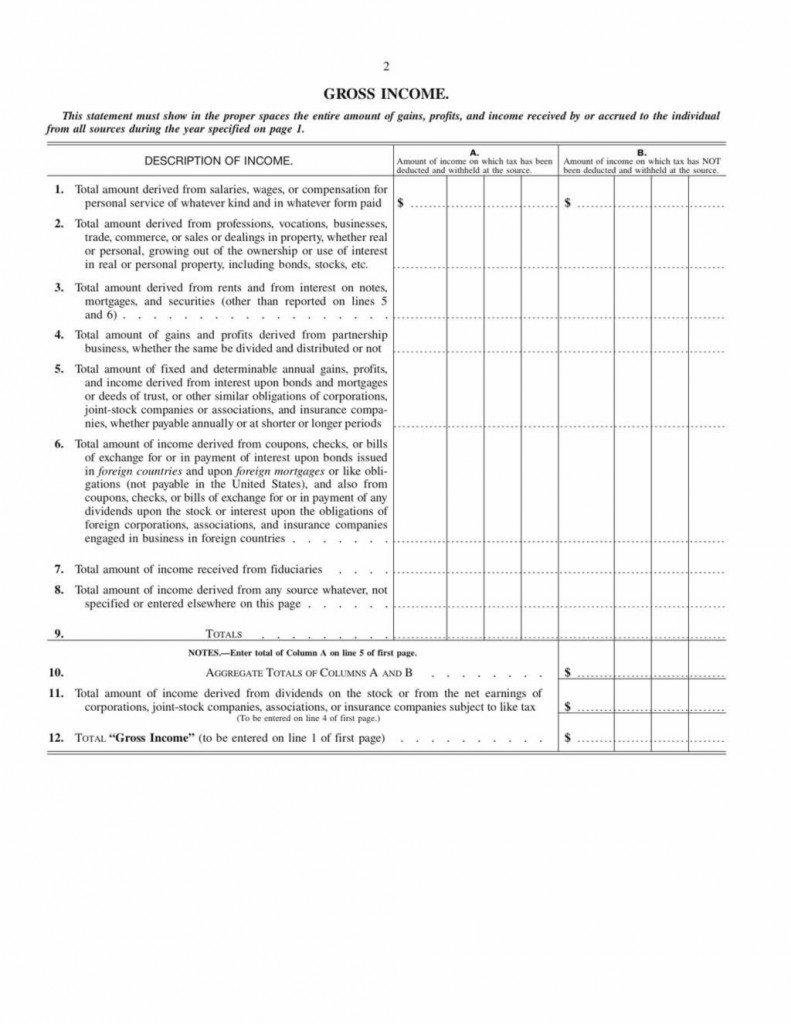

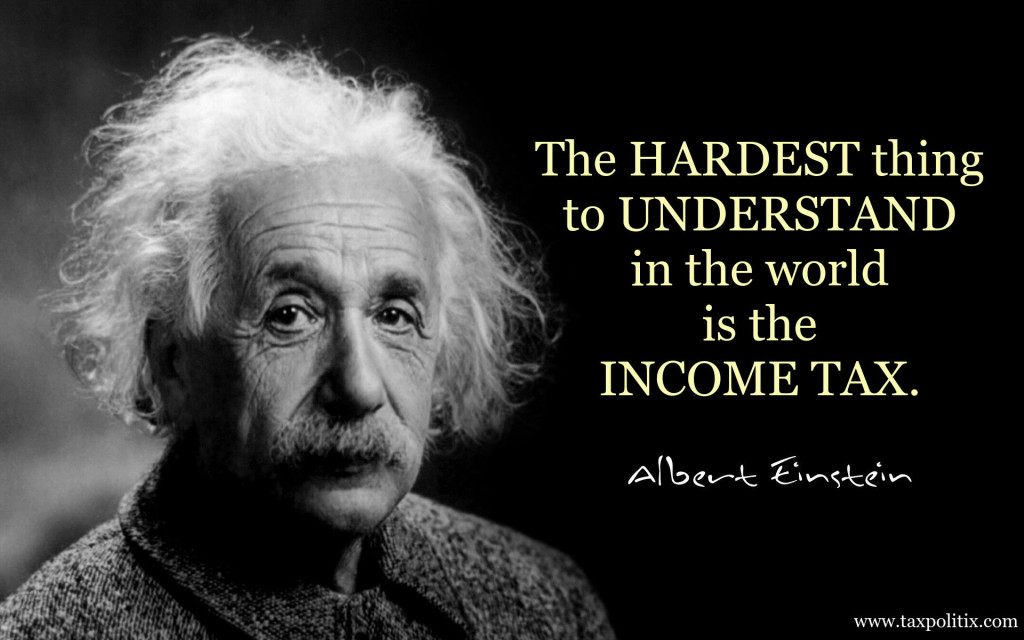

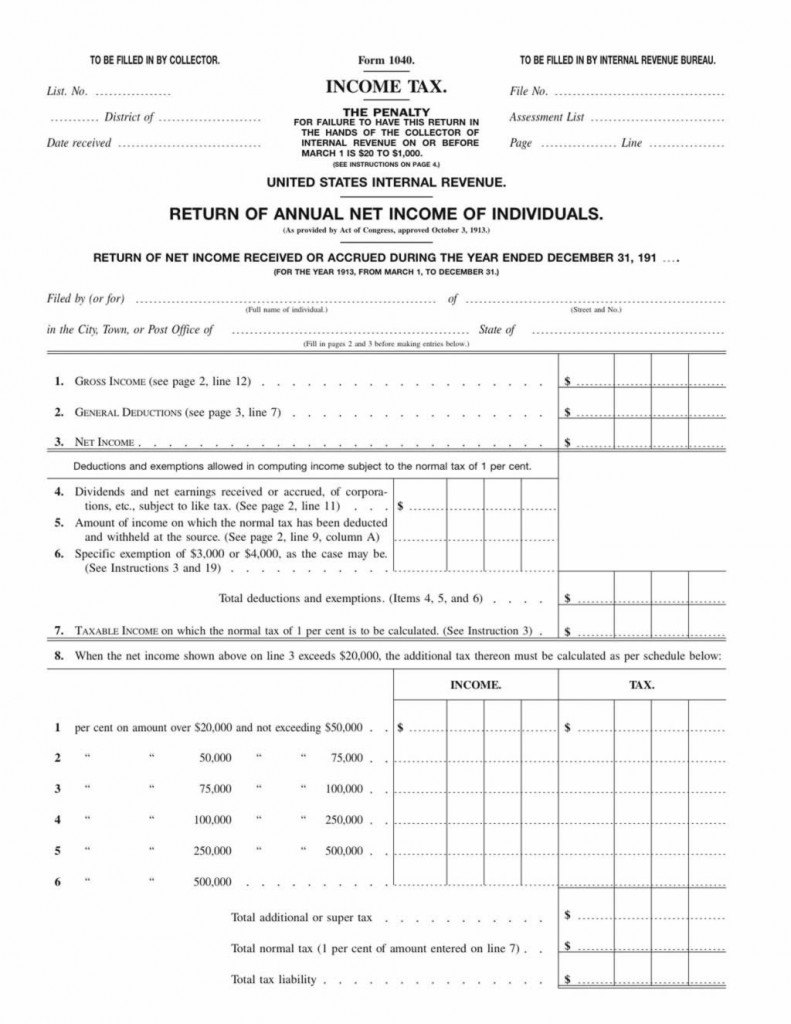

1n 1913, the 16th Amendment was ratified which granted Congress the ability to levy a personal income tax. Below is a scan of the tax form from 100 years ago:

That is the first page of the 1913 1040. It is FOUR pages in its entirety — 3 pages of calculations and 1 page of instructions. The rest of the pages are at the end.

The income tax for that year was a 1% tax on net income greater than $3,000. It also included a 6% surtax on incomes of more than $500,000.

There are some charming provisions on here, such as how farmers can calulate income on wool and hides of slaughtered animals, or how to deal with “losses occurred during shipwreck”.

What this document shows, however, is that it took merely 100 years to go from 4 pages to 1000s of pages just for Americans to calculate their tax burdens and tax compliance to the government.

There is something incredibly wrong with that. The 1913 tax form is a good argument for the need for comprehensive tax reform.

——————————-

![bastiat-quote-picture_thumb[2]](https://taxpolitix.com/wp-content/uploads/2015/02/bastiat-quote-picture_thumb2.jpg)