by | ARTICLES, GOVERNMENT, TAX TIPS, TAXES

Most people like receiving a tax refund – it’s kind of like a windfall for many people, especially those for whom saving is a difficult discipline. However, getting a big tax refund from the IRS may not necessarily be the best thing for you in certain situations.

Try to think about your refund in a different way. Essentially, you are giving the government an interest-free loan, which they give back to you when you file your taxes. There’s really no reason to do that, other than you like the surprise surplus.

A lot of people don’t like the idea of owing the government, or are afraid they will not have the money available at tax time to pay the bill. That is a valid concern. However, if you adjust your withholding enough so that you owe on April 15th, that also means you have more money in your paycheck each month.

In reality, whether you owe the government or they owe you, the amount of tax collected is virtually the same. The difference is whether you have your taxes paid for you via your paycheck, and have a smaller paycheck because of it (and a refund in the spring), or whether you set the money aside on your own and have a little bit more to take home from work every pay period.

If you set your withholding so that you’ll owe at tax time, you are in essence holding your own money longer. This can be helpful in situations such as being in debt, where payments are due every month. By having extra in your paycheck due to having less money deducted for taxes, you could use the extra money to pay a little more on your debt, thereby reducing the amount of interest you pay in the long run. Some people prefer this approach.

One potential thing to worry about with regard to waiting on federal tax returns. We have seen situations where state governments have delayed issuing refunds in the recent past due to staffing, fiscal woes, and other such problems. Even the federal government last year delayed receiving returns until Jan 31st last year (and therefore remitting refunds) — though that was due to the Fiscal Cliff. However, since the example has been seen in some states, and since the IRS apparently understaffed, it is not an unlikely possible scenario that the federal government might also delay issuing refunds on a larger scale in the future.

At the end of the day, whether you like to keep your own money until tax time or whether you prefer the windfall method, you can achieve this your preference by going to visit your Human Resources administrator. If you want more money in your paycheck – and possibly owing the IRS, claim more dependents. If you prefer a refund, claim fewer dependents. The form to make changes on is called a W-4.

It’s always good practice once a year to review your tax and financial situation and make adjustments as necessary.

______________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, BLOG, OBAMACARE, TAX TIPS, TAXES

New Changes to the Itemized Medical Deduction

For years, taxpayers have been able to claim an itemized deduction on their taxes for medical expenses. That deduction still exists, but the threshold has been increased starting this years, as part of the implemenation of Obamacare taxes.

When a taxpayer, spouse, and/or dependents accumulate large medical bills in a given year, the ability to deduct them comes as a welcome relief to many family. The rule-of-thumb was that the sum of medical expenses totalled 7.5% or more of the Adjusted Gross Income (AGI). So for instance, if a family’s AGI was $50,000, they could claim an itemized deduction of medical expenses if it was at least $3,500 (not including insurance premiums, etc).

Now beginning this year and beyond, the threshold has been raised to 10% AGI. That same family making $50,000 AGI needs to have accumulated $5,000 worth of qualifying medical expenses before they can claim that deduction on their tax return.

There is one group for which the floor is still 7.5%; that is persons who are age 65 and above. The 7.5% AGI calculation will remain as such for another 4 years until 2017.

For data through 2009 from the IRS, 10 million families used this tax deduction. Raising the threshold was a means to limit the amount of deductions taxpayers would claim starting this year, thereby raising more tax revenue to pay for Obamacare.

This change is found of found on pages 1,994-1,995 of the PPACA.

——————————-

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, TAX TIPS, TAXES

Most items on this year’s 1040 are the same for last year. However, a few changes should be noted — mainly related to adjustments for inflation.

The new Standard Deduction amounts are as follows:

Single: $6,100

Married Filing Separate: $6,100

Married Filing Joint: $12,200

Head of Household: $8,950

Dependent: the greater value of either 1) earned income plus $350 or 2) $1,000. This cannot exceed $6,100

There are additional Standard Deduction amounts for filers with special status: 1) age 65 and older or 2) blind. These amounts are as follows:

Single or Head of Household: $1,500

Married, Joint: $1,200

Married, Separate: $1,200

Look for Part II on IRS 1040 Changes coming up soon.

_________________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ECONOMY, FREEDOM, QUICKLY NOTED, TAXES

“We must make our election between economy and liberty, or profusion and servitude. If we run into such debts as that we must be taxed in our meat and in our drink, in our necessities and our comforts, in our labors and our amusements,… our people … must come to labor sixteen hours in the twenty-four, give our earnings of fifteen of these to the government,… have no time to think, no means of calling our mis-managers to account; but be glad to obtain sustenance by hiring ourselves out to rivet their chains on the necks of our fellow-sufferers…. And this is the tendency of all human governments … till the bulk of society is reduced to be mere automatons of misery…. And the forehorse of this frightful team is public debt. Taxation follows that, and in its train wretchedness and oppression”.

Thomas Jefferson, 1816

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ECONOMY, NEW YORK, TAXES

The NYTimes ran an article yesterday talking about the curious population shift from NY to FL. The biggest thing missing from the article’s conclusions, however, is the affect of taxes on New York’s population (re)location.

A CNSnews report last year discussed a study by the Tax Foundation found a net loss of 1.3 million New Yorkers who left the state over the 10 year period from 2000-2010.

3.4 million total moved out of state, but another 2.1 moved in, so the change was -1.3 million — which totaled a loss of $45.6 billion in income.

Although many factors determine one’s decision to move to or from a locality, taxes are typically part of the process. As such, the Tax Foundation noted many high tax facts that are unique to New York:

According to the group, New York ranked second among the states for the highest state and local tax burden in 2009. The Empire State was ranked highest for tax burden every year from 1977 until 2006, except in 1984 when it was ranked second.

New York State has a progressive personal income tax rate ranging from 6.45 percent to 8.82 percent for those earning over $2 million. Sales varies by county, and is between seven and eight percent. In Manhattan, the sales tax is 8.875 percent.

According to the Retirement Living Center, which examines tax burdens by state for those nearing retirement, New York also levies a gasoline tax at 49.0 cents per gallon and a cigarette tax of $4.35 per pack, along with an additional $1.50 per pack in New York City.

New York is also one of 17 states plus the District of Columbia that collects an estate tax, with a $1 million exemption and a progressive rate from 0.8 percent to 16 percent.

In 2007, New York State collected $1.1 billion from its estate and gift taxes, the highest of any of the states, according to the Tax Foundation.

I have mentioned these points before. Back in 2009, Rush Limbaugh fled the state due to the crushing taxes. And an Op-Ed in the NY Post last year discussed the implications of a shrinking population — loss of revenue, House of Representative seats, and policy power.

High taxes have devastating consequences. Thomas Sowell once quipped, “Elections should be held on April 16th- the day after we pay our income taxes. That is one of the few things that might discourage politicians from being big spenders”.

With the recent election of De Blasio as Mayor of NYC, you can expect even more flight. De Blasio has vowed to raise taxes both as a means of pushing his economic equality agenda and rewarding the unions for the patience with contract negotiations over the last 4+ years.

The state of NY is on the brink of fiscal insolvency and more and more people are waking up to that reality — and leaving the state in droves.

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, HYPOCRISY, POLITICS, SOCIAL SECURITY, TAXES

Faithful devotees on the Left continue to peddle the notion that Social Security is not in crisis, that it doesn’t contribute to the deficit, and there is no need for reform. However, reading through this year’s just-released Social Security Trustees report, the annual “State of the SSA”, we find that the Trustees tell a different narrative — one that is grim indeed. The following primer pulls directly from the report and then explains the statement in layman’s terms. It is copied text from summary of the entire report.

What it actually says:

“Social Security’s total expenditures have exceeded non-interest income of its combined trust funds since 2010, and the Trustees estimate that Social Security cost will exceed non-interest income throughout the 75-year projection period”.

What it means:

Non-interest income includes payroll taxes, taxes on scheduled benefits, and general fund transfers. Expenditures (payouts to beneficiaries) have exceeded (been more than) income (taxes collected ) since 2010. Social Security has not been paying for itself for the last three years. Anyone telling you otherwise is patently false.

What it actually says:

“The deficit of non-interest income relative to cost was about $49 billion in 2010, $45 billion in 2011, and $55 billion in 2012”.

What it means:

Again, right here the report describes that there is a deficit occurring and provides a tangible figure for each year. It directly contradicts the notion the idea that Social Security is PAYGO. It is not.

What it actually says:

“The Trustees project that this cash-flow deficit will average about $75 billion between 2013 and 2018 before rising steeply as income growth slows to the sustainable trend rate after the economic recovery is complete and the number of beneficiaries continues to grow at a substantially faster rate than the number of covered workers”

What it means:

The deficit is only going to worsen by about 30% over the next 5 years to $75 billion a year. Then the deficit is going to RISE STEEPLY because even more people will be claiming benefits than those working and paying into the system.

What it actually says:

Redemption of trust fund asset reserves by the General Fund of the Treasury will provide the resources needed to offset Social Security’s annual aggregate cash-flow deficits.

What it means:

The Government is using Trust Fund Asset Reserves by the General Fund of the Treasury NOW — and has been for three years — to meet its Social Security obligations. What the Left fails to understand or deliberately doesn’t explain is that we are already borrowing from reserves (think using savings) just to meet basic program costs.

What it actually says:

“Since the cash-flow deficit will be less than interest earnings through 2020, reserves of the combined trust funds measured in current dollars will continue to grow, but not by enough to prevent the ratio of reserves to one year’s projected cost (the combined trust fund ratio) from declining. (This ratio peaked in 2008, declined through 2012, and is expected to decline steadily in future years.)”

What it means:

Remember, we are talking about the reserves now. The reserve amount (savings) will still grow slowly even after paying the Social Security deficit, until about 2020. This is how the Left claims that there is a Social Security “surplus”. They count the Social Security Trust Fund (deficit) + Trust Fund Asset Reserves (savings) = surplus. That is not a true surplus. That is fuzzy math.

What it actually says:

“After 2020, Treasury will redeem trust fund asset reserves to the extent that program cost exceeds tax revenue and interest earnings until depletion of total trust fund reserves in 2033, the same year projected in last year’s Trustees Report”.

What it means:

By 2020 (that’s 7 years from now) the Social Security Trust Fund deficit amount will grow and finally outpace any growth (surplus) in the Trust Fund Asset Reserves (savings). This outpacing will continue until 2033: that’s the year that the Social Security Trustees project a depletion of total trust fund reserves (the savings account runs out!). Yet because this projection date, 2033, was also in last year’s report, the Left can dismissively remark that there are “relatively few changes or surprises” in this year’s report — so that no one bothers to actually read it.

What it actually says:

“Thereafter, tax income would be sufficient to pay about three-quarters of scheduled benefits through 2087”.

What it means:

Even though you’ve faithfully paid in, you’ll only be able to get back 75% of the money. One-fourth of it gone. Poof. That means the Trust Fund Asset Reserves (savings) will have been propping up the Social Security Trust Fund a full 25% by 2033, and that Social Security will have been under-funded for 23 years by that time.

What to do about it?

Well, the very first paragraph of the Social Security Trustees report urges action:

‘Neither Medicare nor Social Security can sustain projected long-run programs in full under currently scheduled financing, and legislative changes are necessary to avoid disruptive consequences for beneficiaries and taxpayers. If lawmakers take action sooner rather than later, more options and more time will be available to phase in changes so that the public has adequate time to prepare. Earlier action will also help elected officials minimize adverse impacts on vulnerable populations, including lower-income workers and people already dependent on program benefits”

So, despite what the media and the Left tell you, Social Security is not fully funded. There is no surplus. Its current modus operandi takes the benefits being paid today and uses them to pay their current beneficiary obligations (instead of being held in trust like its original intent). It also borrows from reserves (savings) in order to meet just those basic current obligations.

The Trustee Summary concludes,

“Lawmakers should address the financial challenges facing Social Security and Medicare as soon as possible. Taking action sooner rather than later will leave more options and more time available to phase in changes so that the public has adequate time to prepare.”

It is signed by the Trustees:

Jacob J. Lew, Secretary of the Treasury, and Managing Trustee of the Trust Funds.

Kathleen Sebelius, Secretary of Health and Human Services, and Trustee.

Charles P. Blahous III, Trustee.

Seth D. Harris, Acting Secretary of Labor, and Trustee.

Carolyn W. Colvin, Acting Commissioner of Social Security, and Trustee.

Robert D. Reischauer, Trustee.

Therefore, the next time someone claims that Social Security is not in a crisis, is solvent, is able to meet all of its obligations, and/or is running a surplus, show them the Trustees report about the real situation — in the Trustees own words.

by | ARTICLES, CONSTITUTION, OBAMA, OBAMACARE, POLITICS, TAXES

As each day passes, the various facets of Obamacare are getting implemented in order to be fully operational by 2014. And we are beginning to hear about difficulties in the implementation caused primarily by either 1) people or companies trying to avoid the “penalties” or 2) people wanting to pay the penalties in order to avoid having to pay for intentionally overpriced health “insurance”.

In order to achieve adequate and targeted enrollment in Obamacare those representing the Government have begun to be aggressive. They are choosing to use all methods at their disposal to pressure, cajole, and otherwise push people to “do the right thing” and buy the mandated insurance product. Health and Human Services Secretary Kathleen Sebelius has millions now at her disposal to dispatch “navigators” and “in-person assisters” to help enroll more Americans into Obamacare. But the very act of doing so may be rendering Obamacare unconstitutional.

It is worthwhile to remember that the only way in which the law of Obamacare was saved from being declared unconstitutional was the that that there is no penalty associated with Obamacare. It was ruled to be a “tax” derived from not purchasing the mandated health coverage. In reaching his conclusion, Justice Roberts accepted the Administration’s position that there is absolutely no negative interference whatsoever on anyone opting to pay the “tax” rather than buy the product.

Therefore, any attempt by the administration or any of the implementing bodies to pressure, threaten or even imply some sort of wrongdoing by those choosing to not buy insurance would be clearly unconstitutional.

If those implementing Obamacare are properly following the Supreme Court’s mandate, they should be telling prospective insurance purchasers that they should be deciding for themselves whether they would be better off with the insurance or the penalty. We know this is not happening. At the macro level, governors have been hustled to implement the exchanges in their states. And at the individual level, Obamacare officials are pushing for more enrollees to ensure a steady flow of premiums paid by healthy patients in order to cover those who are high-risk and high-cost.

What can be done? If we are vigilant in not allowing individuals and businesses into being compelled to buy Obamacare, can we starve the beast? Are the tactics and funding unconstitutional? If so, Obamacare may just die of its own deficiencies.

by | ARTICLES, BUSINESS, ECONOMY, OBAMA, TAXES

There is an erroneous sentiment perpetuated by the media that our government gives corporate tax breaks for moving jobs overseas, implying that our tax laws favor countries like China and India over the United States. This is simply untrue. Expenses that companies and businesses incur while doing business are rightly deductible (“a tax break”) but no specific tax benefits exist in our tax code for companies who relocate outside of our country.

What you don’t hear in the media, however, is that the real reason jobs are moving overseas is because of terrible business policies here at home. Companies operating abroad can undersell us — not so much because wages and costs are lower, but more importantly because their ability to conduct day to day business is not burdened by a) government at all levels hampering their every move, b) very high tax rates, and c) courts that allow frivolous and anti-business litigation to become a significant cost of doing business. We are part of a global economy now, but the foreign countries are rapidly becoming more user friendly than our own.

We are overburdening our businesses with convoluted tax codes and paperwork. The host of local, state, and federal regulations and taxes becomes a cost of every product we make and every service we sell. Additionally, the costs of our legal system itself — not just the direct costs of dealing with frivolous lawsuits but also the need to defensively organize business records and processes — constitutes a large and growing tax on conducting business.The end result makes it more expensive to produce a job here and many companies must move overseas to a friendlier business environment in order to remain financially solvent.

I have a close relative who is an owner and executive of a substantial manufacturing operation that he started in Shenzhen, China because of its business friendly environment. I’ve heard from him many times that he went into business, not to comply with government regulations, but to make things. The wages he pays and his operating costs are much lower than they would be here in the US, but that is substantially offset by less skilled workers and high transportation costs. But his taxes are much less than what they would be in the US, and his total legal expenses would be at least 50 times higher here. And he has not suffered a single expensive lawsuit since he started business in China 25 years ago! Is there any wonder why China’s economy is thriving while ours is stagnating?

Simply put, due to government interference, if a company is going to lose money here, it is going to leave. The real reason for jobs moving overseas is that higher taxes, expensive and complex regulations, and stifling legal environment have rendered the United States less globally competitive. Without major changes, we are destined to become a declining force in the business world.

by | BLOG, OBAMA, OBAMACARE, POLITICS, TAXES

Back in 2009, Obama gave a speech at Arizona State University and joked about using the IRS to audit unsavory people. In a jolting forecast nearly four years ago, Glenn Reynolds wrote a response in the WSJ, saying,

“Should the IRS come to be seen as just a bunch of enforcers for whoever is in political power, the result would be an enormous loss of legitimacy for the tax system”.

As the IRS problems continue to unfold, it’s pretty clear that confidence from all sides is low right now.

With that in mind, one question should definitely be discussed: Should we delay the implementation of Obamacare? Obamacare is designed to be enforced by….the IRS.

Last week, CNBC explained how this will work:

“Get ready for the Internal Revenue Service to play a dominant role in health care. When Obamacare takes full effect next year, the agency will enforce most of the laws involved in the reform — even deciding who gets included in the health-care mandate.”

and further:

“In its 5-4 ruling last year, the Supreme Court upheld the law’s mandate that Americans have health insurance, saying that Congress can enforce the mandate under its taxing authority and through the IRS.

As a result, the agency has to administer 47 tax provisions under Obamacare. They include the right to levy a penalty against businesses and individuals who don’t provide or acquire insurance. Noting that the IRS will collect the penalties, the decision labeled them a tax.

The IRS also has to determine how to distribute annual subsidies to 18 million people who make less than $45,000 a year and thus qualify for subsidies in buying health coverage, as well as how to deliver tax credits to small businesses that buy coverage for workers”.

Obviously we currently have incompetency, partisanship, and trust issues in the IRS. And don’t forget about financial — IRS head Shulman asked for more money (prior to leaving in November 2012) in order to handle Obamacare in 2014. And on top of it all, the head of the IRS, Steven Miller, resigned yesterday.

At this point, the targeting has swelled to 500. Can the IRS be trusted anymore in implement Obamacare in a fair and just manner?

UPDATE:….and the concern is now very real, folks. The Internal Revenue Service official in charge of the tax-exempt organizations at the time when the unit targeted tea party groups now runs the IRS office responsible for the health care legislation.

Sarah Hall Ingram served as commissioner of the office responsible for tax-exempt organizations between 2009 and 2012. But Ingram has since left that part of the IRS and is now the director of the IRS’ Affordable Care Act office. This was confirmed today by the IRS.

by | ARTICLES, BLOG, HYPOCRISY, OBAMA, POLITICS, TAXES

A fresh Op-Ed this morning by IRS head Steven Miller reveals the lengths to which the IRS and the White House are going to spin the on-going scandal.

“The agency was simply trying to manage the explosive growth in applications for 501(c)(4) status that started pouring in to the IRS in 2010. The Internal Revenue Service recognizes that we should have done a better job of handling the influx of applications by advocacy groups,” Miller wrote.

We saw the shoots of this line of thinking yesterday both from David Plouffe and Nancy Pelosi. Trying to suggest that all these groups that have sprung from the Citizen’s United ruling clogged up the IRS, who was then somehow reduced to scrutinizing groups in order to manage this problem. If only Citizen’s United could be overturned!

David Plouffe, former WH Adviser observed on Twitter “What IRS did dumb and wrong. Impt to note GOP groups flourished last 2 elections, overwhelming Ds. And they will use this to raise more $.”

And Nancy Pelosi was a bit more to the point:

“We need accountability at the IRS, of course, as to how this happened. But we’ve really got to overturn Citizens United which has exacerbated the situation. So I’ve called for DISCLOSE, that’s a dare, disclose… I’ve been calling for it for over a year, disclose, who are these people? Transparency, amend the constitution to overturn Citizens United, reform the political system, let’s take money down as far as possible. Public financing of campaigns, clean campaigns and empowerment of people because people feel very left out of the loop“.

However, the organizations who were subject to additional scrutiny were applying for either 501(c)3 or 501(c)4 or others, as revealed in this timeline put out by the WSJ on May 13th. but the apologists are counting on citizens to not know the different. By focusing on the 501(c)4 side of it, they can focus on calling out and blaming Citizens United.

Now back to Steven Miller. Further down his Op-Ed, he writes

“Mistakes were made, but they were in no way due to any political or partisan motivation,” he wrote. “We are — and will continue to be — dedicated to reviewing all applications for tax-exempt status in an impartial manner.”

Except, of course, when it comes to the Barack H Obama Foundation.

I have not found this elsewhere, so you’re seeing it here first.

Let’s go back to May 8, 2011, right in the thick of the IRS targeting activity. The NY Post writes a revealing piece about the Barack H Obama Foundation, run by Obama’s half-brother Malik:

“President Obama’s half-brother runs an off-the-books American charity that claims to support poor Kenyans — but it lies about its federal status and no one knows how it spends its money.” … “Malik started his charity the year his brother ran for president. The foundation claims to be a tax-exempt, federally recognized nonprofit. It is not. Nor are there any filings of its expenditures, which the IRS requires of larger charities. Alton Ray Baysden, a former State Department employee at whose Virginia home the charity was founded in 2008, admitted the organization has not even applied for tax-exempt status”

Oh and incidentally, the National Legal and Policy Center, a Washington, DC, watchdog group, made a formal complaint to the IRS and US Post Office about the Foundation that prior week in the beginning of May 2011.

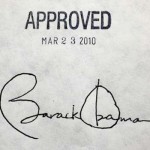

The result? This sunlight on the foundation means that the The Barack H Obama Foundation hurriedly applied for and received tax exempt status in an unprecedented 30 days. The letter of their approval is currently available on the foundations’ website.It was signed Lois Lerner, the senior IRS in the middle of this scandal, of all people. On top of it, the status was made retroactive to December 2008.

See here:

Barack H Foundation Letter For Tax Exempt Status in June 2011

The plot thickens, as the apologies ring hollow.

UPDATE: Thanks Daily Caller for “borrowing” from information regarding the Obama Foundation in my post this morning (written at 9:45 am) for your post at 5:00pm. It was also posted on Canada Free Press and Red State this morning before anyone else wrote on it. Glad I could help (without receiving credit).