Tax season has begun. Normally, the deadline for filing your federal tax return is April 15. But because the Washington D.C. Emancipation Day holiday falls on April 15 this year, Tax Day is the Monday after, April 18th.

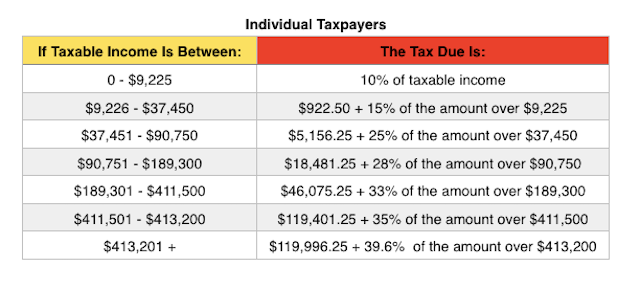

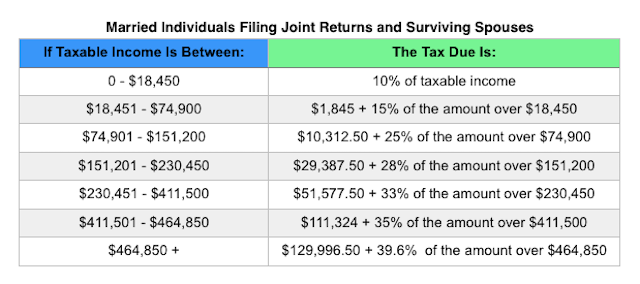

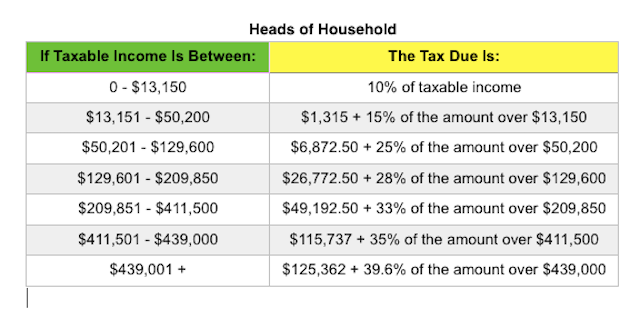

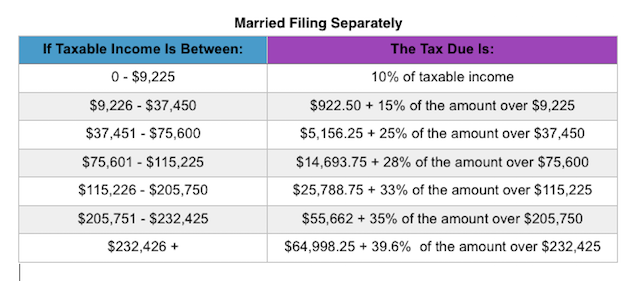

Last spring, Forbes put together a nice, extensive list of all the tax rates and adjustments for 2015. I have posted below some of the most pertinent information. For an all-inclusive list, you should check out the article in its entirety.

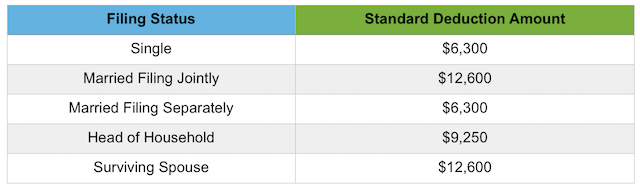

The standard deduction amounts are:

Some tax credits are also adjusted for 2015. Some of the most common tax credits are:

Earned Income Tax Credit (EITC). For 2015, the maximum EITC amount available is $3,359 for taxpayers filing jointly with one child; $5,548 for two children; $6,242 for three or more children (up from $6,143 in 2014) and $503 for no children. Phaseouts are based on filing status and number of children and begin at $8,240 for single taxpayers with no children and $18,110 for single taxpayers with one or more children.

Child & Dependent Care Credit. For 2015, the value used to determine the amount of credit that may be refundable is $3,000 (the credit amount has not changed). Keep in mind that this is the value of the expenses used to determine the credit and not the actual amount of the credit.

Hope Scholarship Credit. The Hope Scholarship Credit for 2015 is an amount equal to 100% of qualified tuition and related expenses not in excess of $2,000 plus 25% of those expenses in excess of $2,000 but not in excess of $4,000. That means that the maximum Hope Scholarship Credit allowable for 2015 is $2,500. Income restrictions do apply and for 2015, those kick in for taxpayers with modified adjusted gross income (MAGI) in excess of $80,000 ($160,000 for a joint return).

Lifetime Learning Credit. As with the Hope Scholarship Credit, income restrictions apply to the Lifetime Learning Credit. For 2015, those restrictions begin with taxpayers with modified adjusted gross income (MAGI) in excess of $55,000 ($110,000 for a joint return).

Changes were also made to certain tax Deductions, deferrals & exclusions for 2015. You’ll find some of the most common here:

Student Loan Interest Deduction. For 2015, the maximum amount that you can take as a deduction for interest paid on student loans remains at $2,500. Phaseouts apply for taxpayers with modified adjusted gross income (MAGI) in excess of $65,000 ($130,000 for joint returns), and is completely phased out for taxpayers with modified adjusted gross income (MAGI) of $80,000 or more ($160,000 or more for joint returns).

Flexible Spending Accounts. The annual dollar limit on employee contributions to employer-sponsored healthcare flexible spending accounts (FSA) edges up to $2,550 for 2015 (up from $2,500).

IRA Contributions. The limit on annual contributions to an Individual Retirement Arrangement (IRA) remains unchanged at $5,500. The additional catch-up contribution limit for individuals aged 50 and over remains at $1,000.

Also note that the floor for medical expenses remains 10% of adjusted gross incocome (AGI) for most taxpayers. Taxpayers over the age of 65 may still use the 7.5% through 2016.

For a more complete list of tables and rates, check out the Forbes article or visit the official IRS website.