A few days ago, Politico revealed a little gem hidden in the Obama budget:

“In obscure data tables buried deep in its 2016 budget proposal, the Obama administration revealed this week that its student loan program had a $21.8 billion shortfall last year, apparently the largest ever recorded for any government credit program.”

That’s a nearly $22 billion loss — for one program, for one year. Politico described how that the amount is greater than the budgets of the EPA and Interior Department combined, or the NASA program’s budget. But it will be covered entirely by the taxpayer anyway.

How did the federal student loan program rack up such massive debt so quickly? Let’s take a look at Obama’s recent reform efforts and programs to help provide relief to student borrowers.

A 2010 law allowed for repayment caps at 10% of a borrower’s income, though some loan holders were initially ineligible. This was called “Pay As You Earn” (PAYE). There were also some other portions of PAYE that were less talked about by the media, including:

1) If the payment doesn’t cover the accruing interest, the government pays your unpaid accruing interested for up to three years from when you begin paying back your loan under the PAYE program.

2) The balance of your loan can be forgiven after 20 years if you meet certain criteria

3) Your loan can be forgiven after 10 years if you go to work for a public service organization

Obama then expanded the PAYE program in June 2014 via Executive Order. The NYTimes reported that this “extend such relief to an estimated five million people with older loans who are currently ineligible — those who got loans before October 2007 or stopped borrowing by October 2011. But the relief would not be available until December 2015, officials said, given the time needed for the Education Department to propose and put new regulations into effect”.

That recent expansion helped to figure into the staggering re-estimation listed in Obama’s FY 2016 budget. As far as the terms of the costs for just the PAYE program, those have “ballooned from $1.7 billion in 2010 to $3.5 billion in 2013 to an estimated $7.6 billion for 2014.”

What’s more, last June, CNS News reported a huge increase in overall student loan debt by comparing the balanced owed when Obama took office to the balance owed in May 2014:

“Since President Barack Obama took office in January 2009, the cumulative outstanding balance on federal direct student loans has jumped 517.4 percent. The balance owed as of the end of May was $739,641,000,000.00. That is an increase of $619,838,000,000.00 from the balance that was owed as of the end of January 2009, when it was $119,803,000,000.00, according to the Monthly Treasury Statement.”

Comparing that amount to his predecessor, under George W. Bush, “the amount of outstanding loans increased from $67,979,000,000.00 in January of 2001 to $119,803,000,000 in January of 2009, an increase of 76.2%.” That was over 8 years. Obama’s jumped the 517.4% in 5.5 years.

So how does this particularly enormous budget shortfall get resolved? Why, it simply gets tacked directly onto the federal deficit. Since the federal student loan program is considered a credit program, “because of a quirk in the budget process for credit programs, the department can add the $21.8 billion to the deficit automatically, without seeking appropriations or even approval from Congress.” This whopper adds nearly 5% to the deficit itself.

Apparently, this sort of bailout is not entirely uncommon either. According to a report last month on the U.S. Government credit-loan system,

“these unregulated and virtually unsupervised federal credit programs are now the fastest-growing chunk of the United States government, ballooning over the past decade from about $1.3 trillion in outstanding loans to nearly $3.2 trillion today. That’s largely because the financial crisis sparked explosive growth of student loans and Federal Housing Administration mortgage guarantees, which together compose two-thirds.“

The FHA itself has added $75 billion to the deficit in this manner over the last twenty years. Though that is a ridiculous sum itself, it makes the one year, $21.8 billion chunk for the federal student loan program bailout contained in Obama’s FY2016 budget especially egregious and alarming.

Like the ballooning student loan debt, the act of loan forbearance, which is a temporary pause in repayment of your federal student loan, has also seen an upswing. Forbearance can be granted for up to three years. According to the Wall Street Journal, “loan balances in forbearance were about 12.5% of those in repayment in 2006. In 2013, they were 13.3%. Today they are 16%, or $125 billion of the $778 billion in repayment.”

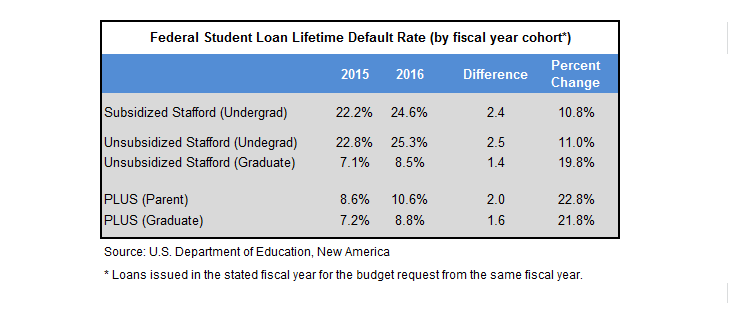

As for defaulting entirely, Forbes recently noted that, “the Department of Education’s budget documents project that 25.3 percent of undergraduate Stafford loans (measured by dollars, not numbers of loans) issued next year will default at some point during the borrower’s repayment term. That is up a full 2.5 percentage points from what the agency projected last year for the previous cohort of loans.” All categories of loans, according to the DoE projection, will see an increase in default.

These figures reinforce a WSJ opinion piece in late December covering the “student debt bomb”. The author, Jason Delisle, director of the Federal Education Budget Project at the New America Foundation, detailed how the current rate of default “now stands at 19.8% of borrowers whose loans have come due — some 7.1 million borrowers with $103 billion in outstanding balances.”

Trying to discern whether or not this $21.8 billion shortfall contained in Obama’s budget is a one-time anomaly or not remains to be seen. The sharp uptick of federal student loan debt and defaults in the past few years would suggest it is not. And there seems to be little incentive just yet to reign in Obama’s repayment reforms, since, at the end of the day, any loss will just be added onto the federal deficit for the taxpayer to pick up the tab — while the Feds continue to tout to young people how much Obama is helping them.