Each year, the Tax Foundation releases its annual report measuring Tax Freedom Day, “the day when the nation as a whole has earned enough money to pay its total tax bill for the year.” Tax Freedom Day is today. April 24th. It takes 114 days of working to pay the country’s tax bill.

Some important findings:

“Americans will pay $3.3 trillion in federal taxes and $1.5 trillion in state and local taxes, for a total bill of more than $4.8 trillion, or 31 percent of the nation’s income.

Tax Freedom Day is one day later than last year due mainly to the country’s continued steady economic growth, which is expected to boost tax revenue especially from the corporate, payroll, and individual income tax.

Americans will collectively spend more on taxes in 2015 than they will on food, clothing, and housing combined.

If you include annual federal borrowing, which represents future taxes owed, Tax Freedom Day would occur 14 days later on May 8.

Tax Freedom Day is a significant date for taxpayers and lawmakers because it represents how long Americans as a whole have to work in order to pay the nation’s tax burden.”

According to the Tax Foundation, the farthest Tax Freedom Day in the calendar year was in 2000, when Tax Freedom Day was May 1. That year, “Americans paid 33 percent of their total income in taxes that year. A century earlier, in 1900, Americans paid only 5.9 percent of their income in taxes, meaning Tax Freedom Day came on January 22. The last time Tax Freedom Day was this late in the year was 2007 (April 25).”

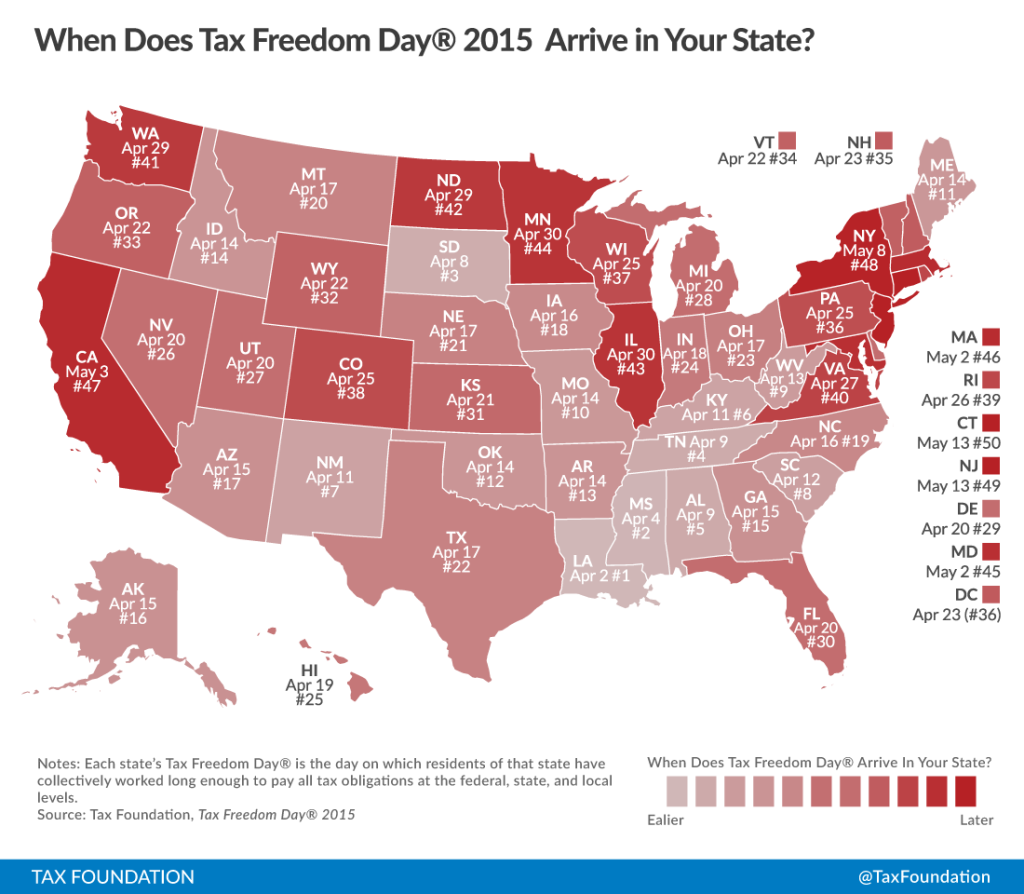

Additionally, Tax Freedom Day is calculated state-by-state. Some states have a more progressive tax system and higher taxes, and some have a lower tax burden. The latest Tax Freedom Day is found in New Jersey and Connecticut, whose Tax Freedom Days fall on May 13th. A few states have Tax Freedom Days earlier than the national Tax Freedom Day; Louisiana is the earliest on April 2nd. You can see how your state fares:

In case you are interested in the methodology of the Tax Foundation, they issues the following description: “In the denominator, we count every dollar that is officially part of national income according to the Department of Commerce’s Bureau of Economic Analysis. In the numerator, we count every payment to the government that is officially considered a tax. Taxes at all levels of government—federal, state, and local—are included in the calculation. In calculating Tax Freedom Day for each state, we look at taxes borne by residents of that state, whether paid to the federal government, their own state or local governments, or governments of other states. Where possible, we allocate tax burdens to the taxpayer’s state of residence. Leap days are excluded to allow comparison across years, and any fraction of a day is rounded up to the next calendar day.”

Most Americans understand that the governments collecting of taxes is a NECESSARY EVIL and accept it. It is the price one pays for various essential services that are necessary and demanded from our government i.e. national security , defense and a host of social programs. What is most disturbing and galling to taxpayers is the lavish and wasteful expenditures ($600 hammers ) that a bloated and ever expanding government craves. Unless our ever growing government run by the Progressive wing of the Democratic Party shows some restraint in its consumption of our tax dollars then Tax Freedom Day will be extended beyond the current date.